Market Overview

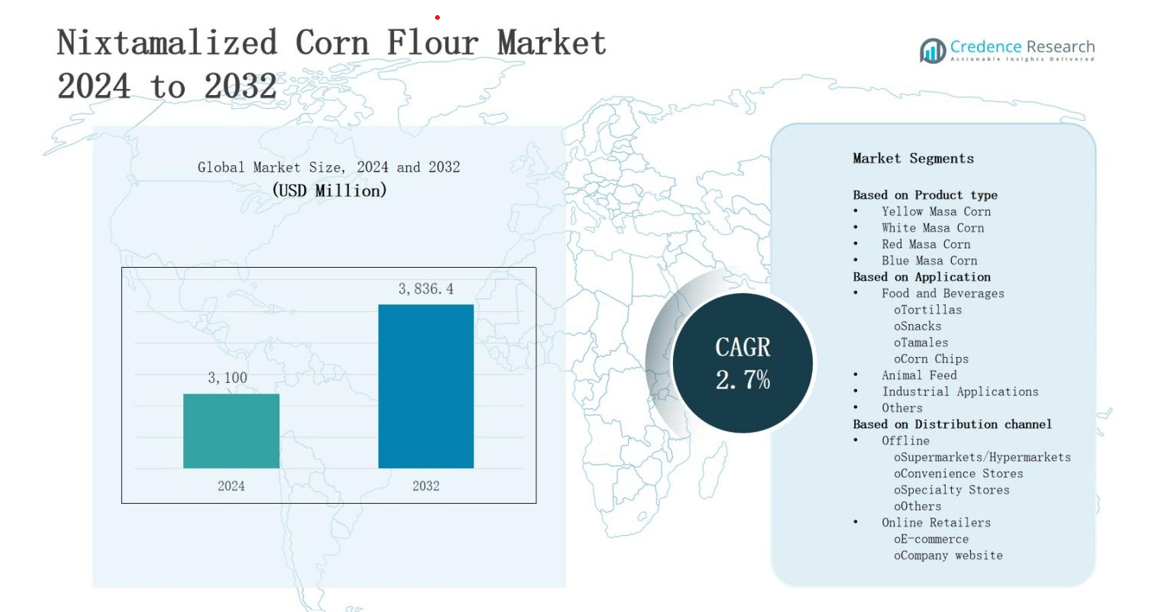

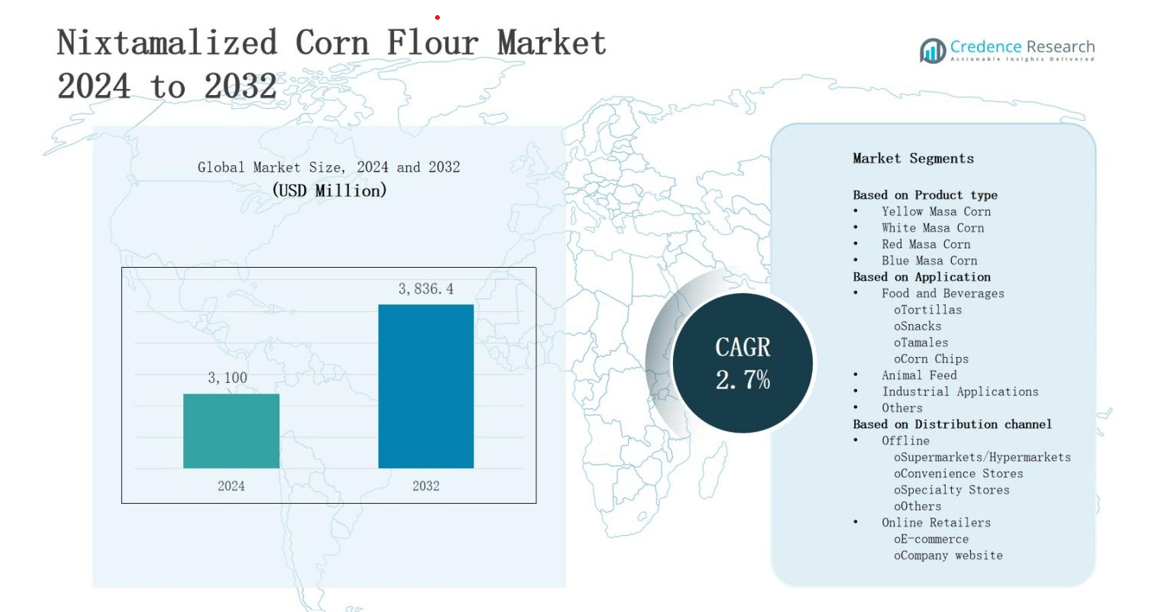

The nixtamalized corn flour market is projected to grow from USD 3,100 million in 2024 to USD 3,836.4 million by 2032, registering a CAGR of 2.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nitrile Butadiene Rubber (NBR) Latex Market Size 2024 |

USD 3,100 million |

| Nitrile Butadiene Rubber (NBR) Latex Market, CAGR |

2.7% |

| Nitrile Butadiene Rubber (NBR) Latex Market Size 2032 |

USD 3,836.4 million |

The nixtamalized corn flour market is driven by rising consumer demand for healthier and nutrient-rich alternatives to conventional flours. Growing awareness of its benefits, including enhanced digestibility, improved calcium content, and authentic flavor, supports adoption in both household and commercial food applications. Expanding use in tortillas, tamales, and gluten-free products further boosts demand, particularly in regions with strong cultural ties to traditional corn-based foods. Trends highlight increasing product innovations, organic and non-GMO offerings, and wider retail penetration through supermarkets and online platforms, reflecting a shift toward convenient, sustainable, and culturally significant food choices.

The nixtamalized corn flour market shows strong geographical diversity, with North America leading, followed by Latin America, Europe, Asia-Pacific, and the Middle East & Africa. North America holds dominance due to cultural consumption and advanced retail, while Latin America drives growth with traditional culinary reliance. Europe emphasizes gluten-free and premium variants, and Asia-Pacific expands with rising urban demand. The Middle East & Africa create emerging opportunities through growing food diversity. Key players include Cargill, Bunge, AZTECA MILLING L.P, Masienda, Woodland Foods, Grain Millers, Inc., King Arthur Baking Company, Gold Mine Natural Foods, Chenab Impex, and Molino Campo Noble.

Market Insights

- The nixtamalized corn flour market is projected to grow from USD 3,100 million in 2024 to USD 3,836.4 million by 2032, registering a CAGR of 2.7% during the forecast period.

- Yellow masa corn dominates with 45% share, followed by white masa corn at 30%, while red and blue masa corn collectively hold 25%, supported by growing demand for specialty and premium variants.

- Food and beverages lead with 65% share, with tortillas alone contributing over 30%, while snacks, tamales, and corn chips drive convenience-focused consumption, supported by animal feed and industrial applications.

- Offline distribution dominates with 70% share, led by supermarkets and hypermarkets at 35%, while online retailing with 30% share grows rapidly through e-commerce platforms and company-owned websites.

- North America holds 38% share, Latin America 25%, Europe 15%, Asia-Pacific 12%, and Middle East & Africa 10%, reflecting strong cultural ties, health trends, and global culinary adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Nutrient-Rich and Functional Foods

The nixtamalized corn flour market is expanding due to growing consumer interest in nutrient-rich and functional foods. Nixtamalization enhances calcium, amino acids, and overall digestibility, making it a healthier choice compared to conventional flours. It appeals to health-conscious consumers seeking clean-label and fortified ingredients. Food manufacturers adopt it to meet rising demand for nutritional alternatives. Increased awareness about gut health and sustainable diets also contributes. It strengthens consumer trust and supports repeat purchases.

- For instance, Gruma S.A.B. de C.V., a leading producer with its Maseca brand, offers nixtamalized corn flour used widely in nutritious tortillas and tamales, meeting demand for enriched and digestible corn products.

Expansion of Gluten-Free and Specialty Diet Applications

The nixtamalized corn flour market benefits from rising demand for gluten-free products. Nixtamalized flour serves as a safe alternative for consumers with gluten intolerance or celiac disease. Its application in tortillas, tamales, baked snacks, and ready-to-eat meals creates consistent growth. It aligns with keto, paleo, and plant-based diets, widening consumer reach. Foodservice operators also integrate it into menus. Growing awareness of diet-related health concerns enhances acceptance in global markets.

- For instance, companies like Bob’s Red Mill and Masienda include heirloom nixtamalized corn flour in their product lines, sourcing non-GMO stone-ground corn directly from Mexican farms to cater to gluten-intolerant consumers.

Cultural Relevance and Increasing Culinary Applications

The nixtamalized corn flour market thrives on cultural significance, especially in Latin American cuisines. Its use in staple products such as tortillas, enchiladas, and pupusas ensures steady demand. It preserves authentic flavors while meeting modern dietary preferences. Chefs and restaurants expand its use in fusion dishes, boosting visibility. Consumers value authenticity, linking it with tradition and heritage. It creates strong brand loyalty for producers and supports wider culinary experimentation in international markets.

Rising Distribution and Retail Penetration

The nixtamalized corn flour market gains momentum from expanded retail presence across supermarkets, specialty stores, and e-commerce platforms. Online sales provide convenience and reach for global consumers seeking authentic ingredients. Food brands highlight non-GMO and organic labels to attract premium buyers. It benefits from direct-to-consumer marketing strategies and regional branding. Retailers also leverage cultural demand to diversify product offerings. Broader accessibility strengthens market competitiveness and increases consumer adoption across multiple demographic groups.

Market Trends

Growing Popularity of Organic and Non-GMO Offerings

The nixtamalized corn flour market is witnessing strong demand for organic and non-GMO variants. Consumers prioritize transparency and clean-label products, driving brands to certify authenticity. It aligns with broader health-conscious purchasing behavior and rising distrust of chemically processed foods. Food producers promote non-GMO claims to differentiate in competitive retail. Organic nixtamalized flour also appeals to premium buyers seeking sustainable farming practices. This trend positions it as a key ingredient in natural food categories.

Increasing Adoption in Packaged and Convenience Foods

The nixtamalized corn flour market benefits from its integration into packaged and convenience food products. Food manufacturers use it in snacks, tortillas, bakery mixes, and ready-to-cook meals. It provides authentic flavor while meeting consumer expectations for quick meal preparation. Convenience-driven lifestyles push demand for such versatile ingredients. Global foodservice and retail sectors leverage its adaptability. This expansion highlights its potential to capture mainstream packaged food segments across both developed and emerging regions.

- For instance, companies like FreshDirect and Walmart Great Value have launched ready-to-cook tamale and tortilla kits featuring nixtamalized corn flour, combining tradition with convenience for busy consumers.

Integration into Plant-Based and Functional Diets

The nixtamalized corn flour market gains traction through its compatibility with plant-based and functional diets. It appeals to consumers avoiding gluten, wheat, or heavily processed alternatives. Nutritional advantages, including higher calcium and improved digestibility, position it as a better-for-you choice. Food innovators highlight these properties to develop healthier product lines. It fits into growing trends of personalized nutrition and diet-specific foods. Such positioning enhances long-term growth prospects across global health-conscious demographics.

- For instance, Gruma, the world’s largest nixtamalized corn flour producer, markets its Maseca brand masa flours as non-GMO, organic, and gluten-free, catering to wellness-focused consumers and athletes.

Widening Reach Through E-Commerce and Global Distribution

The nixtamalized corn flour market benefits from rapid digital adoption and global retail expansion. E-commerce platforms create access to authentic cultural ingredients for international buyers. It allows small and regional producers to expand visibility and consumer reach. Retailers also highlight nixtamalized flour in ethnic and specialty sections to cater to diverse markets. Direct-to-consumer models enhance brand loyalty and product storytelling. This trend ensures broader penetration and stronger presence across international food markets.

Market Challenges Analysis

High Production Costs and Limited Technological Advancements

The nixtamalized corn flour market faces challenges due to high production costs linked with nixtamalization processes. Specialized equipment, water, and lime requirements increase operational expenses for manufacturers. Small-scale producers often struggle to adopt modern technologies, limiting their competitiveness against large players. It also encounters hurdles in scaling production while maintaining quality standards. The lack of automation and process optimization in some regions creates inefficiencies. These cost barriers restrict broader adoption and affect pricing strategies across global markets.

Supply Chain Limitations and Intense Market Competition

The nixtamalized corn flour market experiences supply chain challenges due to reliance on high-quality maize and consistent raw material availability. Weather fluctuations, trade restrictions, and rising demand for alternative corn uses create risks in procurement. It also competes with conventional wheat and corn flours that dominate mainstream food markets due to lower costs. Intense competition pressures brands to differentiate through certifications and innovation. Limited awareness in non-traditional markets further restrains global expansion opportunities. This combination of challenges impacts long-term growth potential.

Market Opportunities

Expansion into Health-Conscious and Specialty Food Segments

The nixtamalized corn flour market presents strong opportunities in health-conscious and specialty food categories. Rising demand for gluten-free, non-GMO, and clean-label products supports its wider adoption. It offers nutritional benefits such as improved calcium levels and better digestibility, appealing to wellness-driven consumers. Food manufacturers can integrate it into bakery products, snacks, and ready-to-cook meals to address lifestyle needs. Premium buyers also seek organic-certified options, creating higher-value opportunities. This positioning allows producers to target niche but expanding consumer groups.

Global Penetration Through E-Commerce and Ethnic Food Demand

The nixtamalized corn flour market can grow significantly by leveraging e-commerce platforms and global ethnic food demand. Online channels create accessibility for international consumers seeking authentic ingredients. It enables smaller producers to market directly to buyers, enhancing brand visibility. Rising interest in Latin American cuisine worldwide supports consistent growth in restaurants and retail outlets. Expanding distribution networks in Asia-Pacific and Europe also strengthens reach. This opportunity aligns with cultural diversification and growing consumer interest in traditional flavors.

Market Segmentation Analysis:

By Product Type

The nixtamalized corn flour market by product type is dominated by yellow masa corn, holding nearly 45% share in 2024. Its popularity stems from widespread use in tortillas, snacks, and corn chips due to balanced flavor and versatility. White masa corn follows with about 30% share, supported by demand in authentic cuisines and bakery items. Red and blue masa corn together account for nearly 25% share, driven by rising preference for specialty, premium, and health-focused food products.

- For instance, Gruma’s Maseca brand one of the largest tortilla flour producers globally relies heavily on yellow masa corn for products distributed across the U.S. and Mexico.

By Application

The food and beverages segment leads the nixtamalized corn flour market with around 65% share in 2024. Tortillas represent the largest sub-segment, accounting for over 30% share of total application, reflecting cultural significance and daily consumption in Latin America and growing adoption globally. Snacks and corn chips together hold nearly 20% share, driven by convenience food demand. Tamales contribute about 10% share, while animal feed, industrial applications, and others collectively account for the remaining 35% share.

By Distribution Channel

Offline distribution dominates the nixtamalized corn flour market with close to 70% share in 2024. Supermarkets and hypermarkets hold the largest portion, around 35% share, supported by wide accessibility and consumer preference for bulk purchases. Convenience stores account for about 20% share, while specialty stores and other offline outlets contribute nearly 15%. Online retailers capture around 30% share, with e-commerce platforms driving faster growth through direct-to-consumer channels and increasing availability via company-owned websites.

- For example, PepsiCo’s Frito-Lay division produces leading corn chip brands like Doritos using nixtamalized corn flour, contributing billions in annual revenue.

Segments:

Based on Product type

- Yellow Masa Corn

- White Masa Corn

- Red Masa Corn

- Blue Masa Corn

Based on Application

-

- Tortillas

- Snacks

- Tamales

- Corn Chips

- Animal Feed

- Industrial Applications

- Others

Based on Distribution channel

-

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Others

- Online Retailers

- E-commerce

- Company website

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the nixtamalized corn flour market with a 38% share in 2024. Strong cultural ties to Mexican cuisine and the widespread consumption of tortillas, tamales, and corn chips sustain demand. It benefits from established production facilities, advanced distribution networks, and increasing consumer interest in gluten-free and non-GMO products. Food manufacturers in the United States and Mexico drive innovation through fortified and organic variants. The region’s robust retail sector also supports broader accessibility. This leadership reflects both cultural heritage and modern health-driven consumption trends.

Latin America

Latin America holds a 25% share of the nixtamalized corn flour market, driven by its deep-rooted presence in local diets. Countries such as Mexico, Guatemala, and Colombia dominate consumption due to traditional recipes. It remains a staple ingredient in tortillas, pupusas, and tamales, ensuring steady market growth. Strong domestic production supports local supply chains, while exports also strengthen global presence. Increasing awareness of health benefits further expands its use. The region’s cultural reliance on corn flour secures consistent demand across households and foodservice.

Europe

Europe accounts for 15% share in the nixtamalized corn flour market. Rising popularity of Latin American cuisine in urban centers creates opportunities for growth. It is supported by the demand for gluten-free and plant-based alternatives, appealing to health-conscious consumers. Specialty stores and restaurants drive adoption across key markets such as the United Kingdom, Germany, and Spain. Growth in e-commerce accelerates access to authentic imported products. The region also sees higher traction in premium categories, such as organic and non-GMO variants.

Asia-Pacific

Asia-Pacific secures a 12% share of the nixtamalized corn flour market in 2024. Rising urbanization and growing interest in international cuisines drive its adoption in countries like Japan, China, and India. It benefits from expanding retail penetration and increasing use in snacks and convenience foods. Local manufacturers and importers highlight health and cultural appeal to attract diverse consumers. E-commerce growth accelerates visibility and access. The region is positioned for faster growth due to evolving consumer preferences and rising disposable incomes.

Middle East & Africa

The Middle East & Africa represent 10% share of the nixtamalized corn flour market. Growing migration and exposure to Latin American cuisines contribute to rising demand. Foodservice outlets introduce tortillas, chips, and related foods, broadening market presence. It also benefits from increasing health awareness and preference for gluten-free diets. Distribution expansion in supermarkets and specialty stores supports product reach. The region presents emerging opportunities as consumer lifestyles shift toward global food diversity and healthier alternatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Woodland Foods

- Masienda

- Cargill

- Molino Campo Noble

- Gold Mine Natural Foods

- AZTECA MILLING L.P

- Chenab Impex

- Bunge

- King Arthur Baking Company

- Grain Millers, Inc.

Competitive Analysis

The nixtamalized corn flour market is highly competitive with a mix of global corporations and regional producers shaping industry dynamics. Key players such as Cargill, Bunge, AZTECA MILLING L.P, and Grain Millers, Inc. dominate through large-scale production capacity, strong distribution networks, and partnerships with foodservice providers. Companies like King Arthur Baking Company, Woodland Foods, and Gold Mine Natural Foods strengthen their position by focusing on specialty and organic offerings tailored for health-conscious consumers. Masienda and Molino Campo Noble emphasize authentic sourcing and traditional processing methods to attract premium buyers seeking cultural authenticity. Chenab Impex expands global reach through diversified export channels and product innovation. It is defined by ongoing product differentiation, certification strategies such as organic and non-GMO labeling, and strategic collaborations to meet rising demand for clean-label and gluten-free food products. Competitive intensity continues to rise as established players leverage technology to improve efficiency while smaller brands carve niches with regional flavors, sustainable sourcing practices, and direct-to-consumer sales strategies across offline and online channels.

Recent Developments

- In August 2025, AgEagle Aerial Systems launched the RedEdge-P™ Green, an NDAA-compliant multispectral drone camera offering up to 15 spectral bands to support precision agriculture, smart farming, and environmental monitoring.

- In August 2025, Interlune announced its multispectral camera payload will fly aboard Astrolab’s FLEX Lunar Innovation Platform rover, developed with NASA Ames to analyze lunar regolith and estimate helium-3 concentrations.

- In August 2025, EUMETSAT and the German Space Agency (DLR) successfully launched the Metop-SG A1 satellite carrying the METimage multispectral radiometer, designed to enhance global weather forecasting by capturing detailed atmospheric and surface data.

- In October 2024, Konica Minolta’s Specim introduced the FX50 hyperspectral camera designed to efficiently identify and sort black plastics using mid-wave infrared (MWIR) hyperspectral imaging technology

Maret Concentration & Characteristics

The nixtamalized corn flour market demonstrates moderate concentration, with a blend of multinational corporations and regional producers shaping competition. Large players such as Cargill, Bunge, and AZTECA MILLING L.P dominate through scale, distribution strength, and strong partnerships with foodservice providers. Mid-sized firms and niche brands like Masienda, Woodland Foods, and Molino Campo Noble compete by emphasizing authenticity, specialty variants, and organic or non-GMO certifications. It reflects characteristics of both cultural reliance and modern health-driven demand, where tortillas, snacks, and gluten-free products fuel consistent growth. The market shows steady regional diversity, with North America and Latin America holding significant shares while Europe, Asia-Pacific, and the Middle East & Africa emerge as expanding markets. It also displays resilience due to cultural integration and increasing adoption across packaged foods and retail channels. Competitive intensity remains high as established brands focus on innovation, quality improvements, and retail penetration, while smaller firms gain traction through e-commerce and direct consumer engagement.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for gluten-free and nutrient-rich products will strengthen global consumer adoption.

- Expansion of organic and non-GMO certified variants will create premium growth opportunities worldwide.

- Wider retail penetration across supermarkets and online platforms will increase accessibility and market visibility.

- Foodservice adoption in restaurants and quick-service chains will support consistent demand for authentic recipes.

- Growth in Latin American cuisines globally will expand usage in tortillas, tamales, and traditional dishes.

- Product innovation with fortified and functional flours will attract health-conscious and wellness-driven consumers.

- E-commerce platforms will accelerate distribution and enhance direct-to-consumer brand-building strategies internationally.

- Rising disposable incomes in Asia-Pacific will boost consumption of specialty and convenience-based corn flour.

- Strategic partnerships between global and regional producers will improve supply stability and product diversification.

- Increased consumer preference for sustainable and culturally significant foods will sustain long-term market growth.