Market Overview

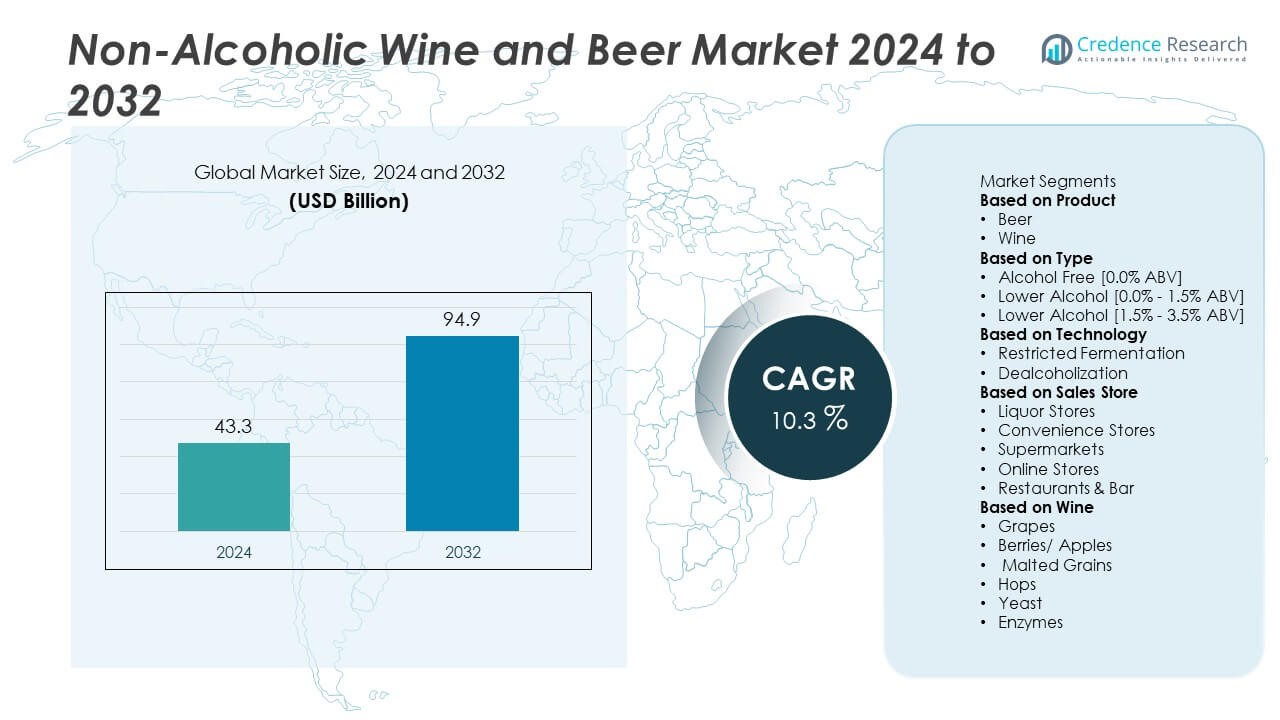

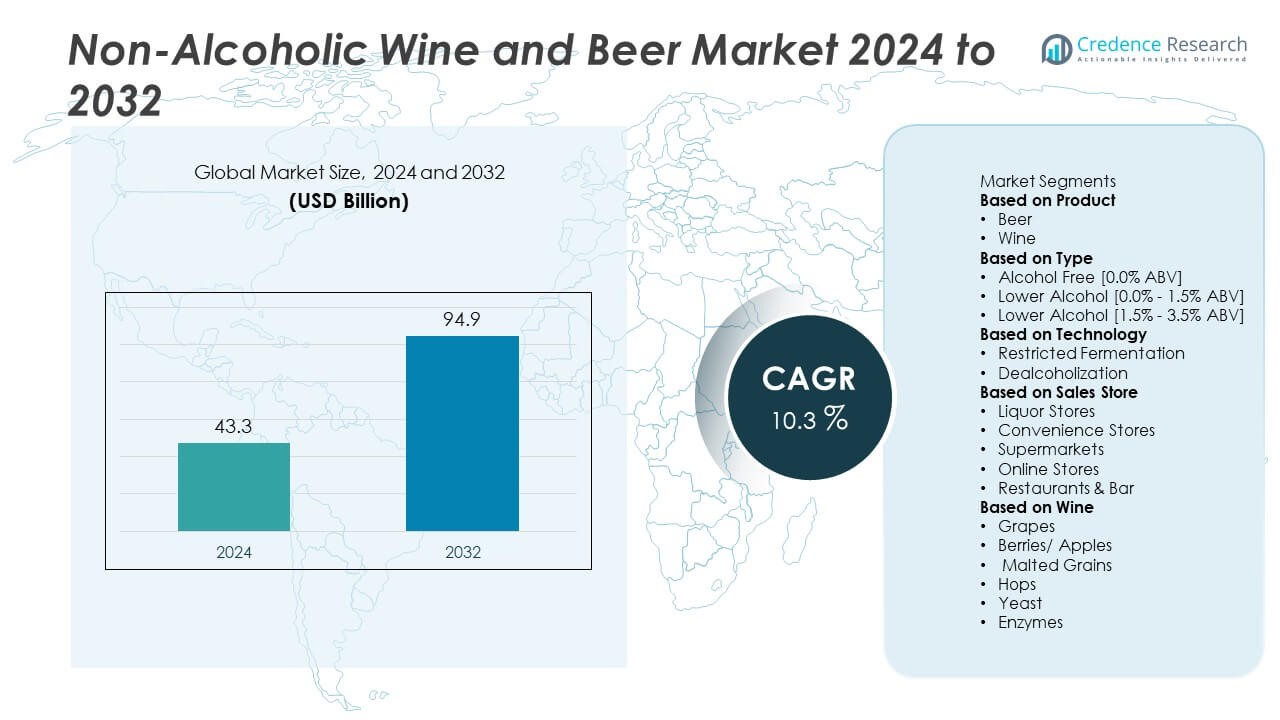

The Non-Alcoholic Wine and Beer Market size was valued at USD 43.3 billion in 2024 and is projected to reach USD 94.9 billion by 2032, growing at a CAGR of 10.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non-Alcoholic Wine and Beer Market Size 2024 |

USD 43.3 Billion |

| Non-Alcoholic Wine and Beer Market, CAGR |

10.3% |

| Non-Alcoholic Wine and Beer Market Size 2032 |

USD 94.9 Billion |

The Non-Alcoholic Wine and Beer Market grows steadily, driven by rising health awareness, stricter alcohol regulations, and increasing demand for mindful drinking alternatives. Consumers adopt alcohol-free beverages to maintain wellness while enjoying social experiences, boosting preference for low-calorie and natural formulations.

The Non-Alcoholic Wine and Beer Market demonstrates strong regional diversity, with Europe leading due to a long-standing culture of alcohol-free brewing and innovation, while North America shows rapid growth driven by health-conscious consumers and robust retail networks. Asia-Pacific emerges as a dynamic region, fueled by rising disposable incomes, urbanization, and younger demographics embracing mindful consumption. The Middle East & Africa also reflect significant potential, supported by cultural and religious acceptance of non-alcoholic beverages, while Latin America steadily expands through growing lifestyle awareness. Key players shape this global landscape by combining innovation, distribution, and branding. Heineken N.V. invests in premium alcohol-free variants with global reach, while Anheuser-Busch InBev leverages extensive brewing expertise to diversify product portfolios. Carlsberg expands its footprint through craft-inspired options, and Suntory Beer strengthens market penetration across Asia with tailored non-alcoholic solutions. Collectively, these players drive product quality, consumer trust, and widespread adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Non-Alcoholic Wine and Beer Market was valued at USD 43.3 billion in 2024 and is projected to reach USD 94.9 billion by 2032, expanding at a CAGR of 10.3% during the forecast period.

- Rising health awareness, stricter alcohol regulations, and shifting consumer behavior toward mindful drinking act as primary drivers that stimulate consistent demand for alcohol-free beverages.

- Key trends include the integration of functional ingredients, premiumization, and the use of advanced brewing technologies that improve taste profiles and expand product acceptance among health-conscious and younger demographics.

- Competitive intensity is high, with global leaders such as Heineken N.V., Anheuser-Busch InBev, Carlsberg, and Suntory Beer investing in innovation, premium variants, and distribution expansion, while niche players like Big Drop Brewing and Pierre Chavin focus on differentiation and craft-style offerings.

- Major restraints include high production costs, limited ability to fully replicate traditional taste, regulatory complexities across regions, and persistent consumer perceptions that alcohol-free products lack authenticity.

- Regional dynamics show Europe leading due to strong brewery traditions, North America advancing with retail and e-commerce adoption, Asia-Pacific emerging as the fastest-growing market, the Middle East & Africa benefiting from cultural acceptance, and Latin America expanding through urban demand.

- Strategic opportunities lie in innovation, partnerships with hospitality and retail networks, and expansion into emerging economies, where rising disposable incomes and changing lifestyles create a strong foundation for long-term market penetration and sustained growth.

Market Drivers

Rising Health Awareness and Shift Toward Low-Alcohol Alternatives

The Non-Alcoholic Wine and Beer Market benefits from rising global awareness about the negative health effects of alcohol consumption. Consumers seek alternatives that support wellness without sacrificing social experiences. The growing prevalence of lifestyle-related diseases such as liver disorders and obesity strengthens the demand for alcohol-free beverages. It addresses this trend by offering products that replicate traditional flavors while reducing health risks. Public health campaigns and stricter regulations on alcohol also reinforce this shift. A broader acceptance of mindful drinking practices creates a steady demand base across diverse demographics.

- For instance, in 2023, Heineken’s non-alcoholic portfolio showed mixed results, with some markets experiencing strong growth and others facing declines. While the exact total sales volume for Heineken 0.0 in 2023 was not publicly disclosed, Heineken 0.0 was distributed in over 110 global markets, continuing its expansion. This growth, seen in markets like Brazil and the USA, reflects a broader consumer trend toward low and no-alcohol options.

Expanding Product Innovation and Premiumization

Continuous advancements in brewing and fermentation techniques accelerate product adoption in the Non-Alcoholic Wine and Beer Market. Brands introduce beverages with improved taste profiles, natural ingredients, and enhanced aromas to attract quality-conscious buyers. It capitalizes on premium positioning by offering artisanal and craft-style options that appeal to urban and millennial consumers. Companies also expand their portfolios to cover varied consumer preferences, from traditional lagers to sparkling grape-based products. This innovation-driven environment elevates consumer satisfaction and increases brand loyalty. The combination of authenticity and variety sets a strong foundation for sustained growth.

Growing Influence of Younger Demographics and Lifestyle Changes

The Non-Alcoholic Wine and Beer Market experiences strong demand from younger consumers who prioritize wellness and balance. Gen Z and millennials are more inclined to experiment with alcohol-free options that fit social occasions without compromising health goals. It aligns with evolving preferences that emphasize social inclusion while reducing alcohol dependency. The market benefits from cultural shifts where celebrations no longer require high-alcohol beverages to retain significance. Increased participation in “dry months” such as Dry January illustrates this behavioral change. Strong engagement from younger audiences ensures long-term consumption growth.

- For instance, Heineken reported that its Heineken 0.0 product grew by a low-teens percentage in the first half of 2022, with sales expanding in key markets like Brazil and Spain, underscoring the adoption of alcohol-free options.

Expanding Global Distribution Channels and Accessibility

The Non-Alcoholic Wine and Beer Market gains momentum through wider availability across retail, online, and hospitality platforms. Supermarkets, specialty stores, and e-commerce platforms enhance consumer access and visibility. It benefits from partnerships with restaurants, bars, and hotels that integrate alcohol-free beverages into their menus. The convenience of digital platforms also supports direct-to-consumer sales, reaching health-conscious buyers worldwide. Strong marketing strategies and branding campaigns increase awareness and trial rates. A diverse distribution network ensures consistent penetration into both developed and emerging regions, reinforcing market growth.

Market Trends

Rising Popularity of Functional and Wellness-Oriented Beverages

The Non-Alcoholic Wine and Beer Market embraces the trend of functional ingredients that extend beyond refreshment. Consumers increasingly prefer products infused with botanicals, vitamins, and adaptogens that align with wellness-focused lifestyles. It leverages this shift by offering beverages that combine taste with health benefits, appealing to fitness-conscious individuals. The rise of low-sugar and low-calorie formulations further drives product acceptance. Brands highlight clean labels and natural sourcing to strengthen credibility among discerning buyers. The integration of wellness attributes ensures broader appeal across global markets.

- For instance, Suntory launched its All-Free beer-like beverage in Japan in 2010. Since its launch, All-Free has gained significant popularity and is marketed as containing zero calories and zero sugar. The product helped establish Suntory as a leader in Japan’s expanding market for non-alcoholic and health-oriented beverages, which is growing due to rising health consciousness and demographic shifts.

Technological Advancements in Brewing and Flavor Enhancement

The Non-Alcoholic Wine and Beer Market benefits from innovations that improve the sensory quality of alcohol-free products. Advanced dealcoholization processes allow beverages to retain authentic aromas and full-bodied taste. It gains traction through micro-brewing techniques and high-pressure fermentation methods that deliver consistency and flavor depth. Companies invest in research to replicate the complexity of traditional alcoholic beverages without compromising health standards. Such advancements increase consumer satisfaction and reduce barriers to adoption. The emphasis on technology-driven product development supports long-term competitiveness.

- For instance, For instance, Erdinger Weißbräu uses vacuum distillation technology in its Erdinger Weissbier Alkoholfrei. This process gently removes the alcohol while preserving the beer’s traditional wheat flavor. The resulting beverage also has isotonic properties, meaning it allows for the rapid absorption of nutrients. Due to these characteristics, Erdinger Alkoholfrei is a popular recovery drink among athletes.

Sustainability and Eco-Friendly Packaging Solutions

The Non-Alcoholic Wine and Beer Market aligns with global sustainability initiatives by adopting environmentally responsible practices. Brands increasingly use recyclable materials, lightweight glass, and biodegradable packaging to reduce carbon footprints. It attracts eco-conscious consumers who prioritize sustainability in purchasing decisions. The shift toward renewable energy and water-efficient brewing processes reinforces brand reputation. Companies integrate ethical sourcing of ingredients to strengthen transparency and trust. Commitment to sustainability enhances both brand differentiation and market credibility.

Growing Acceptance Across Social and Cultural Platforms

The Non-Alcoholic Wine and Beer Market gains visibility in cultural and social settings that traditionally favored alcoholic beverages. Restaurants, bars, and event organizers integrate alcohol-free options into menus and celebrations. It benefits from rising popularity of mindful drinking movements that redefine social norms. Celebrity endorsements and marketing campaigns normalize alcohol-free consumption among wider audiences. Seasonal campaigns such as Dry January or Sober October reinforce market growth. Broader cultural acceptance ensures these beverages remain integral to lifestyle and social identity.

Market Challenges Analysis

High Production Costs and Limited Taste Replication

The Non-Alcoholic Wine and Beer Market faces significant challenges in maintaining authentic flavor profiles while removing alcohol. Advanced processes such as vacuum distillation and reverse osmosis increase production costs and limit scalability for smaller producers. It often struggles to match the sensory depth of traditional alcoholic beverages, leading to consumer hesitation in repeat purchases. The requirement for premium raw materials further raises expenses and narrows affordability in price-sensitive markets. Limited success in replicating aroma and texture can also reduce competitiveness against alcoholic alternatives. Brands continue to invest in innovation, yet consistent quality remains a pressing challenge.

Regulatory Barriers and Market Perception Issues

The Non-Alcoholic Wine and Beer Market must navigate complex regulations that vary across countries, creating barriers for global expansion. Labeling rules and alcohol thresholds often differ, complicating distribution and compliance. It also faces the challenge of changing consumer perceptions that link alcohol-free options with inferior taste or limited authenticity. Marketing campaigns need to educate buyers and reposition these beverages as premium lifestyle products. Strong competition from traditional alcoholic beverages further intensifies the struggle for visibility. Overcoming cultural bias and regulatory inconsistencies remains critical for broader market acceptance and long-term growth.

Market Opportunities

Expansion into Emerging Economies and Untapped Consumer Segments

The Non-Alcoholic Wine and Beer Market holds strong opportunities in emerging regions where rising disposable incomes and growing health awareness reshape consumption patterns. Rapid urbanization and expanding middle-class populations in Asia-Pacific, Latin America, and the Middle East create fertile ground for alcohol-free beverages. It benefits from governments promoting healthier lifestyles and regulating alcohol consumption more strictly. Untapped demographics, including younger consumers and women, represent a significant growth avenue. Cultural acceptance of non-alcoholic options also supports broader integration into traditional celebrations. Strategic entry into these markets ensures sustained global presence and revenue diversification.

Innovation in Product Diversification and Strategic Collaborations

The Non-Alcoholic Wine and Beer Market can strengthen its position by introducing diversified flavors, functional ingredients, and premium variants. Companies have the chance to differentiate through wellness-focused formulations that combine low-calorie content with natural additives. It can also leverage collaborations with hospitality, retail, and e-commerce platforms to increase visibility and accessibility. Partnerships with global food chains, sports events, and lifestyle brands open new channels for consumer engagement. Growing digital influence offers further opportunities through targeted online marketing and direct-to-consumer sales. Innovation-driven expansion creates long-term value and establishes stronger brand loyalty across regions.

Market Segmentation Analysis:

By Product

The Non-Alcoholic Wine and Beer Market is segmented into non-alcoholic wine and non-alcoholic beer, with beer accounting for a larger share due to its widespread cultural acceptance and established global demand. Non-alcoholic beer dominates consumption in Europe, North America, and Asia-Pacific, where breweries expand their portfolios with lagers, ales, and craft-inspired options. It appeals to younger consumers who seek healthier alternatives while maintaining the social aspects of drinking. Non-alcoholic wine shows strong growth potential as innovations improve taste and aroma retention, appealing to premium-oriented buyers. Sparkling variants also gain traction for their positioning in celebratory occasions. Both categories continue to evolve, driven by innovation and rising consumer awareness.

- For instance, In Germany, consumers drank 10.4 million hectoliters of alcohol-free beer in 2023, confirming a strong, growing market and significant brewery investment. The consumption figure is a key indicator of the industry’s focus on this segment.

By Type

The market by type includes alcohol-free and low-alcohol variants, each catering to distinct consumer needs. Alcohol-free products with 0.0% ABV remain popular among health-conscious buyers and those avoiding alcohol for religious or lifestyle reasons. It benefits from stricter government regulations that promote safer consumption. Low-alcohol beverages, generally below 1.2% ABV, attract consumers who prefer reduced alcohol levels without fully eliminating it. These variants replicate traditional taste while offering a balanced choice for social occasions. The diversity within this segment ensures inclusivity for varied consumer groups. Strong demand from both categories drives steady market expansion.

By Technology

The Non-Alcoholic Wine and Beer Market leverages different production technologies, including dealcoholization and restricted fermentation. Dealcoholization techniques such as vacuum distillation, reverse osmosis, and membrane filtration dominate due to their ability to retain authentic flavors. It ensures higher product quality and supports premium positioning across developed markets. Restricted fermentation emerges as a cost-efficient method suitable for mass-market production, especially in emerging economies. Hybrid technologies that combine brewing precision with advanced filtration also expand adoption by addressing both taste and affordability. Continuous innovation in technology enhances product consistency and creates opportunities for global scalability.

- For instance, In July 2023, Anheuser-Busch InBev (AB InBev) announced a €31 million investment to upgrade its breweries in Belgium. This investment was aimed at expanding its non-alcoholic brewing and bottling capabilities and optimizing a new dealcoholization system. De-alcoholization is a primary method used to produce low- and no-alcohol beer.

Segments:

Based on Product

Based on Type

- Alcohol Free [0.0% ABV]

- Lower Alcohol [0.0% – 1.5% ABV]

- Lower Alcohol [1.5% – 3.5% ABV]

Based on Technology

- Restricted Fermentation

- Dealcoholization

Based on Sales Store

- Liquor Stores

- Convenience Stores

- Supermarkets

- Online Stores

- Restaurants & Bar

Based on Wine

- Grapes

- Berries/ Apples

- Malted Grains

- Hops

- Yeast

- Enzymes

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share of the Non-Alcoholic Wine and Beer Market, accounting for around 32% of global revenue in 2024. The region benefits from rising health consciousness, growing popularity of mindful drinking, and strong marketing campaigns by established beverage companies. The United States leads the market with its robust demand for craft-style non-alcoholic beer and premium alcohol-free wines. Canada also contributes meaningfully, driven by government-led awareness programs on alcohol-related health risks. It thrives in North America due to the integration of non-alcoholic offerings in restaurants, bars, and social events, where inclusivity has become a key trend. Strong retail networks, e-commerce growth, and continuous product launches reinforce the region’s dominance.

Europe

Europe represents the largest share of the Non-Alcoholic Wine and Beer Market, contributing about 38% in 2024, supported by cultural acceptance of non-alcoholic beverages and strong brewery traditions. Germany leads with a long-standing history of alcohol-free beer production, followed by Spain, the United Kingdom, and France. The region benefits from consumers embracing low- or no-alcohol beverages as part of balanced lifestyles. It also receives support from strict regulations limiting alcohol marketing, which encourages consumers to explore safer alternatives. The demand for premium non-alcoholic wines has surged, particularly in France and Italy, where traditional wine consumption is deeply rooted. Continuous innovation by European brewers and winemakers secures the region’s leadership.

Asia-Pacific

Asia-Pacific emerges as the fastest-growing region, holding around 20% market share in 2024 and expected to expand rapidly during the forecast period. Rising disposable incomes, rapid urbanization, and cultural shifts toward healthier consumption patterns drive growth across China, Japan, India, and Australia. Japan leads with its established market for low- and no-alcohol beverages, while China shows increasing demand due to lifestyle changes among urban youth. It benefits from the strong presence of global breweries investing in local production facilities to tap into the expanding consumer base. E-commerce platforms and retail innovation enhance product accessibility, while growing social campaigns on health and fitness further stimulate adoption. Asia-Pacific is positioned to close the gap with Western markets over the coming years.

Middle East & Africa

The Middle East & Africa accounts for nearly 6% of the global Non-Alcoholic Wine and Beer Market in 2024, supported by cultural and religious factors that encourage alcohol-free consumption. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa emerge as key markets with rising demand for premium alcohol-free beverages. It thrives in this region due to favorable acceptance in hospitality, tourism, and retail sectors, especially in the Gulf Cooperation Council (GCC) states. The growing expatriate population also boosts demand for diverse beverage options. However, limited local production and high import dependence remain challenges that shape pricing strategies. Expanding partnerships with international beverage companies are expected to enhance future market share.

Latin America

Latin America holds approximately 4% of the Non-Alcoholic Wine and Beer Market in 2024, with growth driven by urban centers in Brazil, Mexico, and Argentina. Rising awareness of health and wellness supports adoption, particularly among younger consumers seeking alternatives to traditional alcoholic beverages. It benefits from promotional campaigns linked to international lifestyle trends such as Dry January and sober living movements. Market penetration remains concentrated in urban areas due to limited distribution networks in rural zones. Partnerships between regional breweries and global players are expanding product availability. Although the market share is smaller compared to other regions, Latin America presents strong potential for long-term growth as consumer habits evolve.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bernard Brewery

- Suntory Beer

- Big Drop Brewing

- Pierre Chavin

- Carlsberg

- Behnoush Iran

- Heineken N.V.

- Moscow Brewing Company

- Erdinger Weibbrau

- Anheuser-Bush InBev

Competitive Analysis

The competitive landscape of the Non-Alcoholic Wine and Beer Market is shaped by leading players including Heineken N.V., Anheuser-Busch InBev, Carlsberg, Suntory Beer, Bernard Brewery, Erdinger Weibbrau, Big Drop Brewing, Pierre Chavin, Moscow Brewing Company, and Behnoush Iran. These companies drive market momentum by focusing on innovation, product diversification, and premium positioning to meet the evolving preferences of health-conscious consumers. Global giants leverage their strong distribution networks, advanced brewing technologies, and extensive brand portfolios to maintain dominance, while regional and niche players differentiate through craft-inspired products, functional ingredients, and targeted consumer engagement. Strategic investments in dealcoholization processes and flavor enhancement technologies allow the market leaders to replicate authentic taste, improving adoption among traditional alcohol consumers. Sustainability practices such as eco-friendly packaging and responsible sourcing further enhance brand reputation and consumer trust. Collaborations with hospitality, e-commerce, and retail sectors expand visibility, while competitive intensity remains high with continuous product launches, aggressive marketing strategies, and expansion into emerging markets. This dynamic environment reinforces innovation-driven growth and positions established players to capture long-term opportunities in both developed and developing regions.

Recent Developments

- In April 2025, Heineken introduced The Heineken Studio in Amsterdam to showcase innovative beer-serving technology, including the ability to blend alcoholic and non-alcoholic Heineken.

- In April 2025, Carlsberg Britvic launched 1664 Bière 0.0% (Off Trade), following its early 2025 release in On Trade. The alcohol-free variant hit major UK retailers like ASDA, Tesco, and Waitrose, supported by a multimillion-pound campaign.

- In February 2025, AB InBev reaffirmed its ambition to have no‑ or low‑alcohol beer products represent at least 20% of its global beer volume by the end of 2025, noting that in FY2023, these variants accounted for 6.8%.

- In February 2025, Carlsberg (Germany) introduced Somersby Zero an alcohol-free cider with apple and yuzu & lemon flavors. The launch targets Germany first, with expansion planned for Poland and Sweden in 2026, backed by the brand’s largest-ever German marketing campaign.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Technology, Sales Store, Wine and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with strong adoption across health-conscious consumer groups.

- Demand will rise for premium non-alcoholic variants with authentic taste and aroma.

- Younger demographics will drive long-term growth through lifestyle shifts toward mindful drinking.

- Technological advancements in brewing and dealcoholization will enhance product quality.

- E-commerce and direct-to-consumer platforms will strengthen global accessibility.

- Sustainability in packaging and production will become a core competitive differentiator.

- Partnerships with hospitality, retail, and entertainment sectors will boost visibility.

- Emerging economies will create new opportunities through rising disposable incomes.

- Innovation in functional ingredients and wellness-focused beverages will diversify product offerings.

- Global players and niche breweries will intensify competition through continuous product launches.