Market Overview

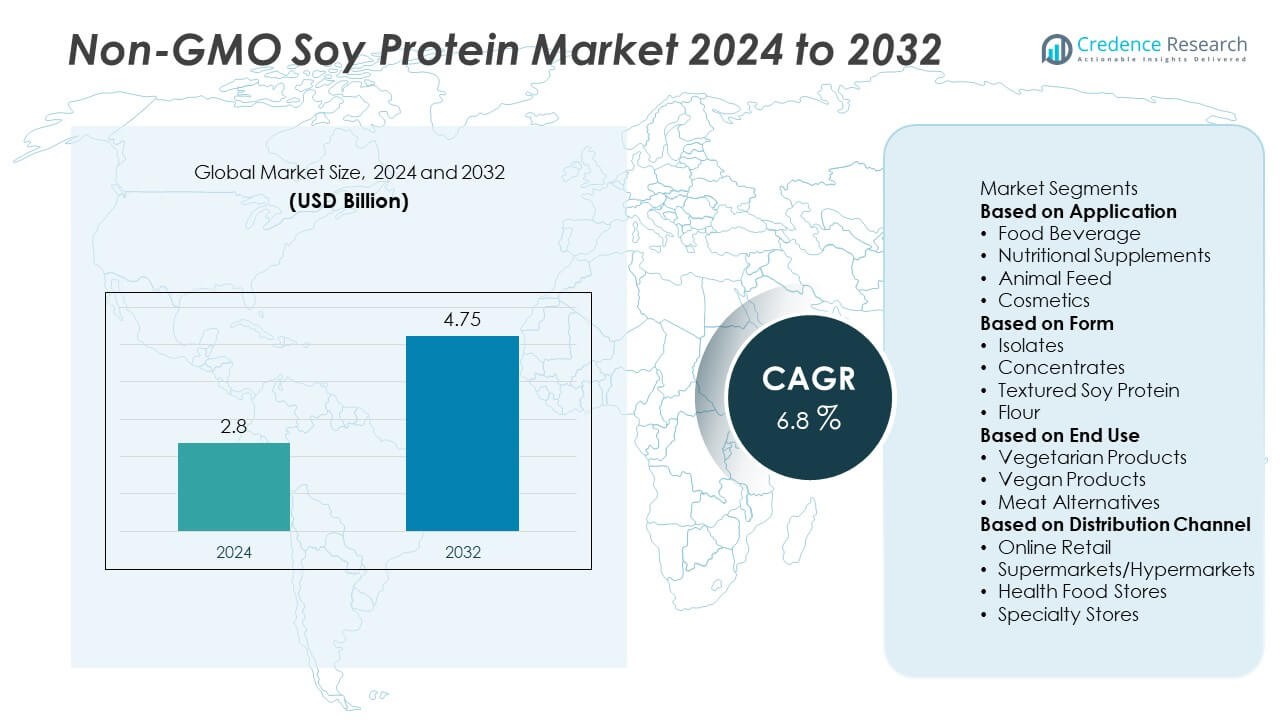

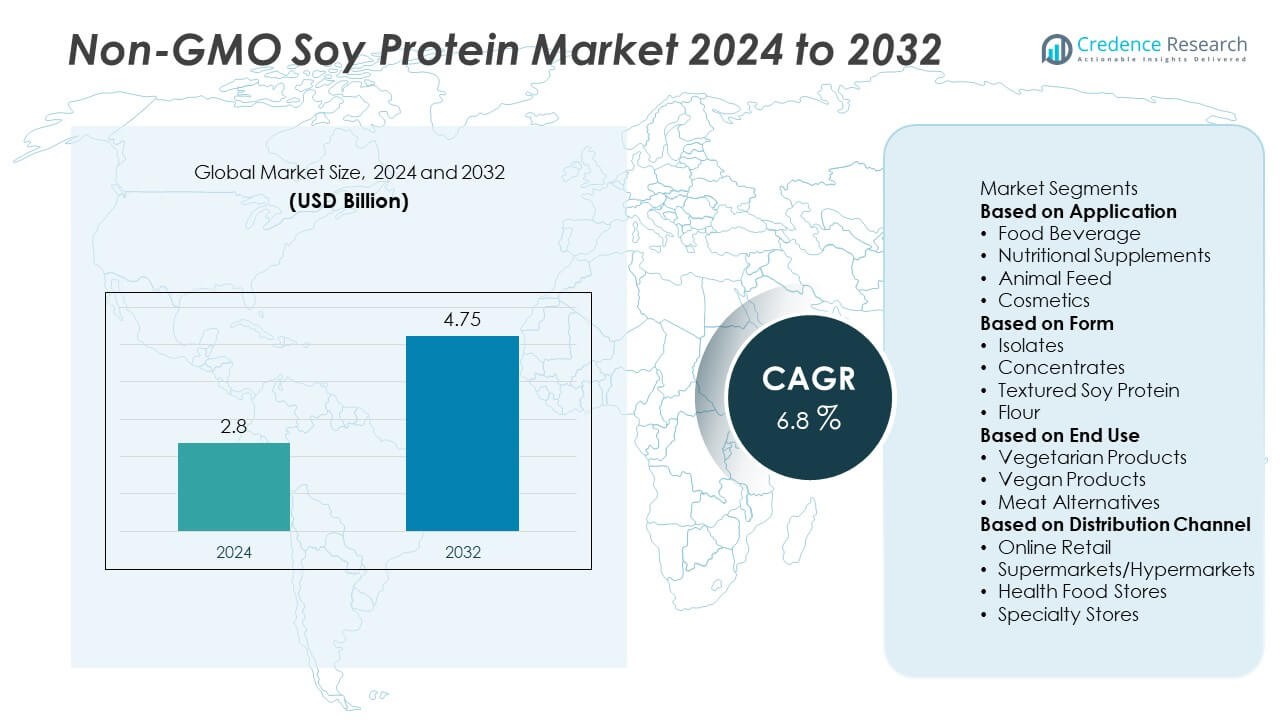

Non-GMO Soy Protein market size was valued at USD 2.8 billion in 2024 and is projected to reach USD 4.75 billion by 2032, growing at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non-GMO Soy Protein Market Size 2024 |

USD 2.8 Billion |

| Non-GMO Soy Protein Market, CAGR |

6.8% |

| Non-GMO Soy Protein Market Size 2032 |

USD 4.75 Billion |

Top players in the Non-GMO Soy Protein market include Nutritional Supplement Company, Eden Foods, DuPont, NutraBio, Wilson Sonsini Goodrich and Rosati, AGT Food and Ingredients, Thai Vegetable Oil Public Company Limited, Pure Foods, SOYUZ Agrar AG, and Ingredion. These companies focus on delivering high-purity protein isolates, concentrates, and textured soy products to serve food, beverage, and nutritional supplement markets. Asia-Pacific leads the market with 34% share, driven by strong demand for plant-based foods and expanding soy production capacity. North America follows with 33% share, supported by high adoption of clean-label products and regulatory emphasis on non-GMO certification, while Europe holds 28% share, driven by consumer preference for sustainable and traceable protein sources.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Non-GMO Soy Protein market was valued at USD 2.8 billion in 2024 and is projected to reach USD 4.75 billion by 2032, growing at a CAGR of 6.8% during the forecast period.

- Rising demand for plant-based diets and clean-label protein sources drives market growth, with food and beverage applications holding the largest share and soy protein isolates leading in form.

- Trends include expansion of plant-based meat and dairy alternatives, innovation in textured soy protein, and growing adoption of sustainable and traceable sourcing practices.

- The market is competitive with key players such as DuPont, Eden Foods, AGT Food and Ingredients, and Ingredion focusing on supply chain transparency, certification programs, and capacity expansion.

- Asia-Pacific leads with 34% share, followed by North America at 33% and Europe at 28%, supported by strong demand for plant-based products, rising health awareness, and growing investments in soy protein processing facilities.

Market Segmentation Analysis:

By Application

Food and beverage applications dominate the Non-GMO Soy Protein market with over 50% share due to rising demand for plant-based protein in bakery, dairy alternatives, snacks, and beverages. Manufacturers use soy protein for its high nutritional value, functional properties, and ability to improve texture and shelf life in processed foods. Nutritional supplements are also growing rapidly, fueled by fitness trends and consumer preference for clean-label protein powders. Animal feed remains an important segment, supporting livestock health with high-quality protein sources, while cosmetics use is expanding in personal care formulations due to soy protein’s moisturizing benefits.

- For instance, ADM’s PurelyNature™ Soy Protein Isolate has a minimum protein content of 90% on a moisture-free basis, making it suitable for food and beverage applications requiring high nutritional and functional quality.

By Form

Soy protein isolates lead the market with nearly 55% share, thanks to their superior protein concentration and versatile functionality in food and beverage formulations. They are widely used in protein bars, shakes, and meat substitutes for their neutral flavor and solubility. Concentrates follow, favored in bakery and feed applications for their cost-effectiveness and balanced nutritional profile. Textured soy protein is gaining popularity in plant-based meat products due to its meat-like texture, while soy flour is used in bakery and snack products to enhance protein content and improve dough properties.

- For instance, ADM offers soy protein isolate products with protein content levels of 90% or higher, in clean-label, non-GMO powder form, demonstrating isolate’s high purity and functionality.

By End Use

Meat alternatives represent the dominant end-use segment with more than 45% share, driven by the rising popularity of plant-based diets and growing adoption of flexitarian lifestyles. Non-GMO soy protein serves as a key ingredient in burgers, sausages, and nuggets, providing a desirable texture and protein level similar to meat. Vegan products are also experiencing strong growth, as consumers seek ethical and sustainable protein sources. Vegetarian products maintain steady demand, particularly in regions with a high proportion of vegetarian populations. The overall market growth is fueled by health consciousness and the shift toward sustainable food production.

Key Growth Drivers

Rising Demand for Plant-Based Protein

The growing preference for plant-based diets is a major driver for the Non-GMO Soy Protein market. Consumers are increasingly seeking clean-label and sustainable protein options to support health, ethical, and environmental concerns. Non-GMO soy protein offers a complete amino acid profile, making it a preferred alternative to animal protein. Food manufacturers are incorporating soy protein into dairy alternatives, snacks, and ready-to-eat meals. The rising adoption of flexitarian and vegan lifestyles globally continues to expand demand, boosting production and innovation in the non-GMO soy protein segment.

- For instance, Bunge’s new soy protein concentrates produced at its Morristown, Indiana facility feature about 70% protein content and 17% fiber on a dry basis.

Expansion of Functional Foods and Nutritional Supplements

Functional foods and nutritional supplements are seeing rapid growth, creating strong demand for non-GMO soy protein. Health-conscious consumers are choosing protein-enriched products for muscle development, weight management, and overall wellness. Soy protein’s ability to support heart health and cholesterol reduction adds to its appeal. Manufacturers are developing protein powders, shakes, and bars targeting athletes and fitness enthusiasts. The clean-label trend and preference for transparent ingredient sourcing encourage brands to offer non-GMO verified products, further accelerating the segment’s growth across global markets.

- For instance, NOW® Sports Soy Protein Isolate provides 20 grams of soy protein per serving in its 1.2-lb unflavoured, non-GMO powder form.

Government Support and Regulatory Approvals

Regulatory initiatives supporting non-GMO and sustainable food production are positively impacting market growth. Governments and certification bodies encourage labeling transparency, which builds consumer confidence in non-GMO protein products. Favorable policies promoting plant-based diets as part of climate action strategies are increasing adoption across food industries. Trade agreements and certifications like Non-GMO Project Verified help manufacturers expand into international markets. These regulations also encourage investment in supply chain traceability, ensuring consistent quality and compliance, which further strengthens the market’s credibility and expansion potential.

Key Trends & Opportunities

Growth of Plant-Based Meat and Dairy Alternatives

The surge in demand for plant-based meat and dairy alternatives creates a major growth opportunity for non-GMO soy protein. Manufacturers are using textured soy protein to mimic the taste and texture of meat, catering to flexitarian consumers. Non-GMO sourcing appeals to health-conscious and environmentally aware buyers, boosting product acceptance. Innovations in formulations are improving flavor and reducing allergen concerns, encouraging broader adoption. This trend is expected to expand significantly as global food companies and startups invest heavily in developing next-generation plant-based products with enhanced nutritional value and functionality.

- For instance, Cargill introduced its TEX PW80 M plant-protein blend in Europe designed to replicate the texture, juiciness, and bite of ground meat.

Adoption of Sustainable and Clean-Label Ingredients

Consumers increasingly favor sustainable and traceable food sources, driving demand for non-GMO soy protein. Brands are focusing on transparent labeling and eco-friendly sourcing to build trust and differentiate products in competitive markets. This trend is particularly strong in North America and Europe, where clean-label movements are well-established. Opportunities exist for producers to highlight low-carbon footprints and ethical sourcing practices. This shift toward sustainability aligns with corporate ESG goals and regulatory pushes, presenting a long-term growth avenue for manufacturers offering certified non-GMO soy protein solutions.

- For instance, soy protein concentrate in North America is known to typically contain around 70% protein content on a dry basis, making it usable in food & feed applications that demand both functionality and nutrition.

Key Challenges

Price Volatility and Supply Chain Constraints

The Non-GMO Soy Protein market faces challenges due to fluctuating prices of non-GMO soybeans and limited supply availability. Non-GMO crops require dedicated farming practices and segregation from GMO crops, increasing production and logistics costs. Seasonal variations and adverse weather conditions can impact yields, further affecting pricing stability. These factors make it difficult for manufacturers to maintain competitive pricing. Developing resilient supply chains and diversifying sourcing regions will be crucial to overcome this challenge and ensure a stable, cost-effective supply of raw materials.

Allergen Concerns and Competition from Other Proteins

Soy is one of the top allergens globally, which limits its acceptance among certain consumer groups and regions. This creates a barrier to wider adoption of soy protein in food and beverage applications. Additionally, the market faces strong competition from other plant-based proteins such as pea, rice, and hemp, which are perceived as hypoallergenic and cleaner alternatives. Manufacturers must innovate with improved processing techniques to minimize allergenic compounds and develop blended protein solutions to maintain competitiveness in the growing plant-based protein market.

Regional Analysis

North America

North America holds 33% market share, driven by strong demand for clean-label and plant-based protein products. The United States leads consumption, with food manufacturers focusing on non-GMO verified labeling to meet consumer expectations. The popularity of plant-based meat, dairy alternatives, and protein supplements supports steady growth. Investments in supply chain traceability and non-GMO soybean production further strengthen market availability. Canada also contributes with rising adoption of vegetarian diets and government initiatives encouraging sustainable agriculture. The region’s well-developed food processing industry and high consumer awareness continue to drive innovation and product development in non-GMO soy protein applications.

Europe

Europe accounts for 28% market share, supported by stringent regulations favoring non-GMO food products and strong consumer preference for transparency. Germany, France, and the U.K. lead demand, with high adoption in plant-based meat and dairy alternatives. European consumers prioritize sustainability and traceability, encouraging producers to invest in certified non-GMO sourcing. The region’s robust retail infrastructure and emphasis on organic and clean-label products support continued market expansion. Innovation in functional foods, sports nutrition, and bakery products further boosts demand, making Europe a key market for premium non-GMO soy protein products with clear labeling and environmental credentials.

Asia-Pacific

Asia-Pacific leads with 34% market share, making it the largest and fastest-growing regional market. China and India are major contributors, driven by rising health awareness, urbanization, and increasing demand for plant-based diets. Soy protein is widely used in traditional foods as well as modern meat alternatives, creating a strong growth base. Japan and South Korea favor high-quality, traceable non-GMO protein for health-conscious consumers. Expanding food manufacturing capacity and e-commerce penetration boost accessibility across emerging markets. Government initiatives promoting healthy eating habits and growing vegetarian and vegan populations continue to drive strong adoption of non-GMO soy protein products.

Latin America

Latin America holds 3% market share, with Brazil and Argentina leading production and consumption due to abundant soybean cultivation. Non-GMO soy protein demand is rising as food manufacturers target export markets requiring GMO-free certification. Growth is supported by increasing adoption of plant-based products in urban centers and rising awareness of sustainable food choices. Brazil’s strong position as a major supplier of non-GMO soybeans offers competitive advantages to local manufacturers. Market expansion is expected as regional players invest in processing facilities and retail distribution to meet growing demand for clean-label protein products domestically and internationally.

Middle East & Africa

Middle East & Africa represent 2% market share, showing gradual growth as awareness of plant-based nutrition spreads. Demand is concentrated in the GCC countries, where rising disposable incomes and health-conscious consumers are driving adoption of non-GMO soy protein in dietary supplements and functional foods. South Africa shows potential growth due to increasing vegetarian and vegan populations. Limited production capacity and reliance on imports present challenges, but improving logistics and distribution networks are expanding market access. Growth opportunities lie in introducing affordable, fortified soy protein products to address nutritional gaps and cater to rising demand for sustainable food sources.

Market Segmentations:

By Application

- Food Beverage

- Nutritional Supplements

- Animal Feed

- Cosmetics

By Form

- Isolates

- Concentrates

- Textured Soy Protein

- Flour

By End Use

- Vegetarian Products

- Vegan Products

- Meat Alternatives

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Health Food Stores

- Specialty Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Non-GMO Soy Protein market includes key players such as Nutritional Supplement Company, Eden Foods, DuPont, NutraBio, Wilson Sonsini Goodrich and Rosati, AGT Food and Ingredients, Thai Vegetable Oil Public Company Limited, Pure Foods, SOYUZ Agrar AG, and Ingredion. These companies focus on producing high-quality, traceable non-GMO soy protein products to meet the rising demand for clean-label and sustainable ingredients. Leading players invest in supply chain transparency, certification programs, and technological advancements to ensure consistent product quality and regulatory compliance. Strategic initiatives include partnerships with farmers, product innovation in protein isolates and concentrates, and expansion into plant-based meat and beverage applications. Companies are also increasing their presence in high-growth regions like Asia-Pacific through capacity expansion and e-commerce distribution channels. Competitive differentiation relies on sustainability credentials, pricing strategies, and the ability to cater to diverse end-use industries, including food, beverages, animal feed, and nutritional supplements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nutritional Supplement Company

- Eden Foods

- DuPont

- NutraBio

- Wilson Sonsini Goodrich and Rosati

- AGT Food and Ingredients

- Thai Vegetable Oil Public Company Limited

- Pure Foods

- SOYUZ Agrar AG

- Ingredion

Recent Developments

- In September 2025, Nutritional Supplement Company announced the launch of a new line of Non-GMO soy protein isolates with enhanced solubility and digestibility, achieving a protein concentration of 90% and particle size optimized for beverage applications.

- In July 2025, Thai Vegetable Oil Public Company Limited won the “Best Public Company of the Year” in Thailand’s food sector.

- In July 2025, AGT Food and Ingredients announced enhancements to its Non-GMO soy protein ingredient portfolio, increasing processing capacity dedicated to Non-GMO sources by 8,000 metric tons annually.

- In November 2024, Ingredion announced a strategic partnership with Lantmännen to advance plant-based proteins.

Report Coverage

The research report offers an in-depth analysis based on Application, Form, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for non-GMO soy protein will grow with rising adoption of plant-based diets worldwide.

- Soy protein isolates and concentrates will see higher use in functional foods and beverages.

- Expansion of plant-based meat production will boost demand for textured soy protein.

- Clean-label and traceability requirements will drive investment in certified non-GMO supply chains.

- Asia-Pacific will remain the largest market with strong growth in China and India.

- Europe will see demand driven by sustainability regulations and preference for organic products.

- North America will expand due to increasing use in protein powders and supplements.

- Technological innovations will improve protein quality, solubility, and flavor profiles.

- Companies will invest in local sourcing and processing to reduce supply chain risks.

- Competition will intensify as alternative plant proteins enter the market, pushing product innovation.