Market Overview

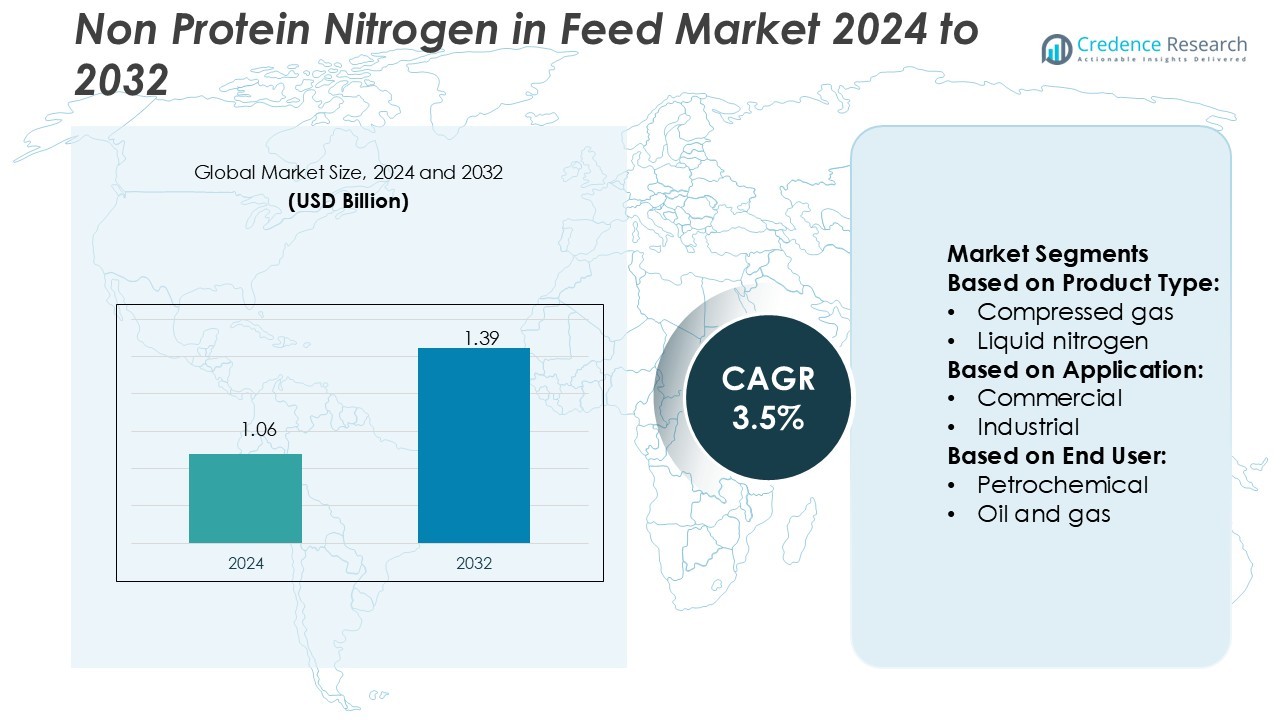

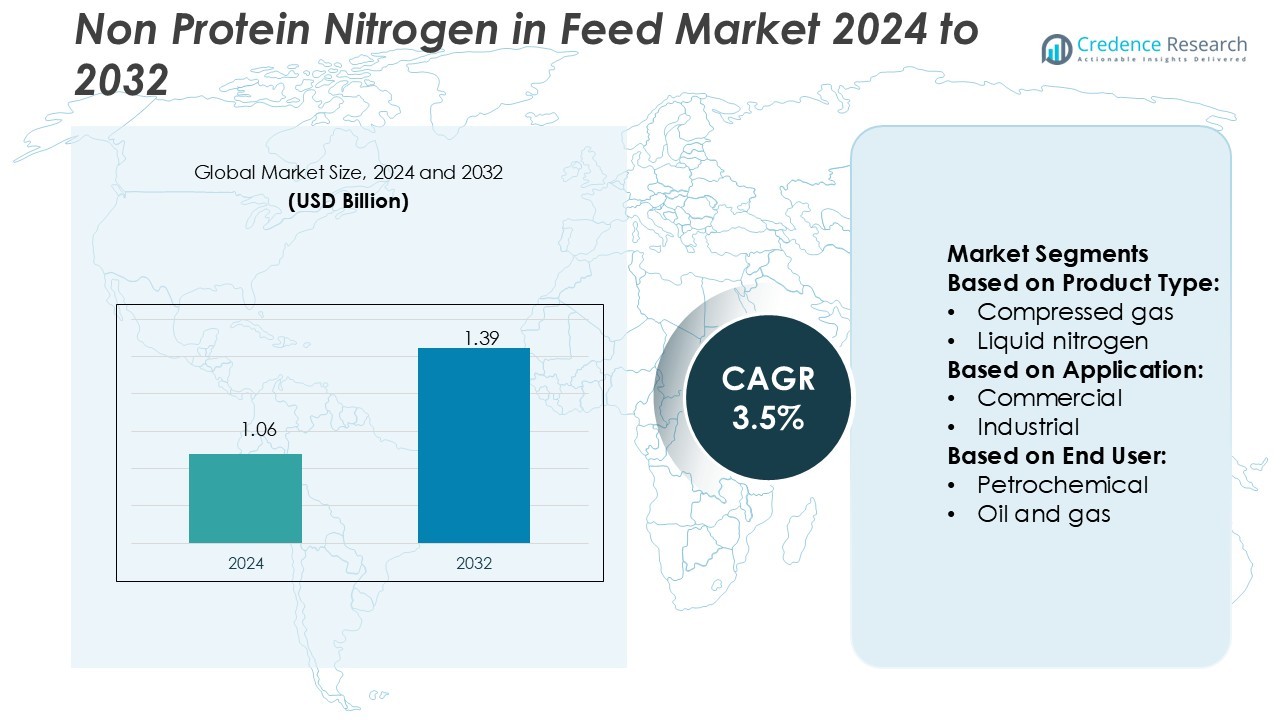

Non Protein Nitrogen in Feed Market size was valued USD 1.06 billion in 2024 and is anticipated to reach USD 1.39 billion by 2032, at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non Protein Nitrogen in Feed Market Size 2024 |

USD 1.06 Billion |

| Non Protein Nitrogen in Feed Market, CAGR |

3.5% |

| Non Protein Nitrogen in Feed Market Size 2032 |

USD 1.39 Billion |

The Non Protein Nitrogen in Feed Market is highly competitive, with key players such as Nutrien Limited, Alltech Inc., Incitec Pivot Limited, Fertiberia S.A, Antonio Tarazona, PetroLeo Brasileiro S.A, Borealis Ag, Nutri Feeds, Kay Dee Feed Company, and Meadow Feeds actively shaping the industry. These companies emphasize innovation, product diversification, and sustainable feed solutions to strengthen their market presence across global livestock sectors. North America emerges as the leading region, accounting for 32% of the total market share, supported by advanced livestock farming practices, strong adoption of protein-efficient feed additives, and well-established regulatory frameworks that ensure consistent demand for nitrogen-based feed solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Non Protein Nitrogen in Feed Market was valued at USD 1.06 billion in 2024 and is projected to reach USD 1.39 billion by 2032, registering a CAGR of 3.5%.

- Rising demand for cost-effective protein alternatives in livestock feed and the need to enhance feed conversion efficiency are key drivers supporting market growth across global farming sectors.

- The market is competitive with companies like Nutrien Limited, Alltech Inc., Incitec Pivot Limited, Fertiberia S.A, and others focusing on innovation, sustainable feed formulations, and regional expansion to maintain strong positions.

- Regulatory compliance challenges and risks of toxicity in livestock when nitrogen is not dosed properly remain restraints that hinder wider adoption among small-scale farmers.

- North America leads with a 32% share, while liquid nitrogen dominates the product segment with 62% share, reflecting its ease of handling and efficiency; Asia Pacific follows closely with the fastest growth driven by expanding livestock and dairy sectors.

Market Segmentation Analysis:

By Product Type

Within the Non Protein Nitrogen in Feed Market, liquid nitrogen holds the dominant share of 62%. Its wide adoption stems from ease of storage, efficient blending, and cost-effectiveness compared to compressed gas. Feed producers prefer liquid nitrogen for consistent nutritional quality and reduced handling complexities. The growing use of nitrogen-based feed additives in livestock farming continues to support this dominance. Demand is also reinforced by advanced preservation methods that maintain nutrient stability and reduce feed losses, ensuring reliable application across large-scale feed production facilities.

- For instance, Nutrien Limited supplies over 11 million tonnes of nitrogen products annually through a diverse distribution network that includes dozens of terminals and over 2,000 retail locations worldwide.

By Application

The commercial segment accounts for 55% of the application share, making it the leading sub-segment. This dominance is driven by the rising need for nitrogen-based feed formulations in large-scale livestock and poultry operations. Commercial farms use nitrogen additives to enhance protein synthesis, improve animal growth, and increase overall productivity. Industrial use follows, supported by automation in feed manufacturing. Science and research applications continue to expand as R&D teams explore more efficient nitrogen utilization in animal nutrition. Regulatory backing for optimized livestock feed further strengthens commercial adoption.

- For instance, ICL introduced eqo.x, a biodegradable controlled-release coating for urea that boosts nutrient use efficiency by up to 80%, degrades faster, and provides predictable nutrient release for open-field applications.

By End-User

The petrochemical sector leads the end-user segment with a 34% share, reflecting its central role in supplying nitrogen derivatives used in feed manufacturing. Strong integration with chemical processing and ammonia production secures its position. Oil and gas industries also contribute through nitrogen-based compounds, but their share is smaller. Food and beverage companies utilize nitrogen for preservation and quality control, while electronics and pharmaceutical sectors rely on nitrogen for specialized feed research and additive refinement. The healthcare and chemical industries support growth through innovations in nitrogen formulations for sustainable livestock nutrition.

Key Growth Drivers

Rising Demand for High-Performance Livestock Feed

The Non Protein Nitrogen in Feed Market benefits from the rising demand for efficient feed solutions that enhance animal productivity. Farmers increasingly use nitrogen-based additives to improve protein synthesis and accelerate growth in livestock. This adoption supports higher milk yield, better weight gain, and improved feed conversion ratios. Expanding dairy and meat consumption across developing regions reinforces this trend. The cost-effectiveness of non-protein nitrogen compared to conventional protein sources further drives adoption, creating sustained growth opportunities across both small-scale and industrial farming operations.

- For instance, AmeriGas a part of UGI Corporation, AmeriGas indeed operates a vast network. Recent UGI financial filings confirm a network of approximately 1,380 propane distribution locations serving customers across the United States.

Expansion of Commercial Livestock Farming

Commercial livestock farms dominate feed consumption, fueling demand for nitrogen-based supplements. Large-scale operations require consistent and economical feed inputs to maintain profitability and productivity. Non protein nitrogen additives support nutritional uniformity and optimize protein intake for herds and poultry flocks. The trend of intensive farming across Asia Pacific, Latin America, and Africa continues to expand market adoption. Government initiatives promoting livestock sector growth, along with rising urban meat and dairy consumption, strengthen demand from commercial farms. This factor positions the market for long-term growth momentum.

- For instance, Compo Expert began sourcing 25 % of its ammonia demand in low-carbon form from Q2 2024, a measure projected to avoid 15,000 tonnes CO₂ emissions annually.

Technological Advancements in Feed Processing

Advancements in feed manufacturing technologies have improved the efficiency and safety of non-protein nitrogen integration. Enhanced mixing systems and precision feeding equipment ensure optimal nitrogen distribution, reducing risks of toxicity. Innovations in encapsulation and controlled-release formulations further increase the nutritional effectiveness of nitrogen additives. These improvements encourage adoption among feed manufacturers focused on quality and safety standards. Research-driven developments support customized feed solutions for specific livestock categories. The combination of technology adoption and evolving feed formulations continues to create value, strengthening the role of non-protein nitrogen in modern animal nutrition.

Key Trends & Opportunities

Shift Toward Sustainable Feed Practices

Sustainability is emerging as a major trend, with non-protein nitrogen being recognized for its role in reducing reliance on traditional protein sources like soybean meal. This shift addresses environmental concerns linked to deforestation and overuse of land for protein crop cultivation. Non-protein nitrogen offers a resource-efficient alternative while supporting balanced nutrition for livestock. Opportunities lie in expanding eco-friendly feed formulations that align with global sustainability goals. Regulatory bodies promoting sustainable farming practices are also expected to encourage broader market adoption of nitrogen-based feed inputs.

- For instance, IFFCO’s cloud-based IFFCO Kisan Uday platform now manages data for 2,500 IFFCO Kisan drones, enabling farmers to book, view, and control nano-fertilizer spraying operations in real time.

Growing Focus on Research and Innovation

The market is experiencing opportunities through ongoing research in animal nutrition and feed chemistry. Scientists and feed manufacturers are collaborating to explore more effective nitrogen utilization pathways in ruminants. These studies aim to improve digestibility, maximize conversion efficiency, and minimize waste emissions like ammonia. Innovation in controlled-release technologies presents an opportunity to reduce health risks while enhancing productivity. As investment in feed R&D expands, the market is expected to benefit from novel product offerings tailored to diverse livestock categories, boosting long-term market expansion prospects.

- For instance, HeatGen’s self-heating can warms a beverage in just 2 minutes, with its heater weighing about 3 ounces and displacing only 10% of the can’s volume, offering compact and dependable portability.

Key Challenges

Risk of Toxicity in Livestock

The use of non-protein nitrogen poses a risk of toxicity if not administered carefully. Overconsumption can lead to elevated ammonia levels in the rumen, causing metabolic disorders or even fatalities in livestock. This challenge requires precision in dosage and effective farmer education on safe use. Lack of proper monitoring systems in developing markets makes the issue more severe. The need for specialized knowledge to ensure correct application limits adoption among small-scale farmers, restraining growth potential in certain regions despite rising demand.

Regulatory and Quality Compliance Issues

Stringent regulations governing feed safety and quality standards present challenges for the market. Variations in regulatory frameworks across regions create barriers for international trade of nitrogen-based feed additives. Compliance with these standards increases operational costs for manufacturers, particularly in developing economies. Companies must invest in advanced testing and quality assurance mechanisms to meet requirements, which can reduce profit margins. The risk of non-compliance further impacts brand reputation. These regulatory pressures remain a significant hurdle, affecting the pace of market expansion across global livestock industries.

Regional Analysis

North America

North America holds 32% share of the Non Protein Nitrogen in Feed Market, driven by advanced livestock farming practices and high meat and dairy consumption. The U.S. leads regional demand due to large-scale commercial cattle farms and strong adoption of protein-efficient feed additives. Supportive regulatory frameworks for feed safety and quality further encourage market penetration. Canada contributes steadily with emphasis on sustainable feed formulations and dairy sector growth. Rising investment in feed technologies, coupled with established industry players, reinforces the region’s leadership position, ensuring continued dominance in both innovation and consumption of non-protein nitrogen additives.

Europe

Europe accounts for 27% of the Non Protein Nitrogen in Feed Market, supported by strict regulatory standards and a strong focus on sustainable livestock production. Countries such as Germany, France, and the Netherlands drive adoption through advanced feed manufacturing facilities and dairy-intensive operations. Growing awareness of reducing dependence on traditional protein sources, alongside eco-friendly feed initiatives, supports steady growth. Demand is also shaped by consumer preferences for high-quality meat and dairy products. Innovation in precision feeding systems and adherence to EU environmental directives strengthen the market position, ensuring Europe remains a major hub for nitrogen-based feed solutions.

Asia Pacific

Asia Pacific dominates growth momentum with a 29% share, fueled by rapid livestock farming expansion and rising protein consumption in countries such as China, India, and Australia. Increasing demand for cost-effective feed inputs in developing economies drives the adoption of non-protein nitrogen. The region benefits from government-backed initiatives to modernize dairy and poultry sectors. Feed manufacturers are actively investing in production technologies to meet surging requirements. Expanding meat and dairy exports further elevate market opportunities. Asia Pacific’s population growth and dietary shifts continue to make it the fastest-growing market, offering significant potential for nitrogen-based feed applications.

Latin America

Latin America captures 7% market share, with Brazil and Argentina leading regional growth due to their strong beef and dairy industries. Expanding commercial farming operations and rising exports of animal protein products create consistent demand for nitrogen-based feed inputs. Adoption is supported by cost-sensitive livestock producers seeking affordable protein alternatives. Government efforts to strengthen agricultural productivity provide additional support. However, limited access to advanced feed technologies and regulatory inconsistencies restrain faster expansion. Despite these challenges, Latin America remains a key growth region, with increasing modernization in feed processing and export-oriented livestock production fueling steady demand.

Middle East & Africa

The Middle East & Africa region holds a 5% share of the Non Protein Nitrogen in Feed Market, supported by rising livestock farming in countries such as Saudi Arabia, South Africa, and Egypt. The region’s dependence on cost-effective feed alternatives drives adoption, particularly in the dairy and poultry sectors. Market growth is reinforced by government programs promoting food security and self-sufficiency. However, infrastructural gaps and limited awareness among small-scale farmers pose challenges. International players are expanding distribution networks to strengthen market presence. As livestock demand rises with population growth, the region shows potential for gradual but steady adoption.

Market Segmentations:

By Product Type:

- Compressed gas

- Liquid nitrogen

By Application:

By End User:

- Petrochemical

- Oil and gas

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Non Protein Nitrogen in Feed Market players such as Nutrien Limited, Nutri Feeds, Alltech Inc., Kay Dee Feed Company, PetroLeo Brasileiro S.A, Fertiberia S.A, Antonio Tarazona, Borealis Ag, Meadow Feeds, and Incitec Pivot Limited. The Non Protein Nitrogen in Feed Market is shaped by innovation, sustainability, and regional expansion strategies. Companies in this space focus on developing advanced nitrogen-based feed solutions that enhance livestock productivity while meeting strict regulatory standards. Emphasis is placed on research-driven formulations, precision feeding technologies, and sustainable alternatives to conventional protein sources. Market participants also invest in expanding production capacities and strengthening distribution networks to capture growing demand in emerging economies. The competition remains intense, with players differentiating through product quality, cost efficiency, and alignment with global sustainability goals in livestock nutrition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Liquiadubos just announced the inauguration of its new liquid fertilizer plant in Ferreira do Alentejo, Portugal. It will be creating cutting-edge NPK-supported liquid fertilizers that aim to support olive and almond crops. The company will be investing heavily in environmental sustainability as well as focusing on reducing the import dependency. It will supply the Portuguese market with advanced fertilizers manufactured locally.

- In July 2024, Nano Fertilizer Usage Promotion Maha Abhiyan by selecting 200 model nano village clusters in Haryana was launched by the Indian Farmers Fertiliser Cooperative Limited (IFFCO).

- In September 2023, Hydrotechnik UK Ltd changed their corporate name to Hydrotechnik UK Test Engineering. The new name would give more detailed picture of the company’s product and service range.

- In May 2023, Air Products signed an investment agreement with the Government of the Republic of Uzbekistan and Uzbekneftegaz JSC to acquire, own, and operate a natural gas-to-syngas processing facility in Qashqadaryo Province, Uzbekistan.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for cost-effective protein alternatives in livestock feed.

- Adoption will increase as farmers seek to improve feed conversion efficiency and productivity.

- Controlled-release technologies will gain traction to ensure safer nitrogen utilization in ruminants.

- Sustainability goals will drive greater use of non-protein nitrogen as a substitute for soybean meal.

- Research investments will enhance nitrogen formulations tailored for dairy, beef, and poultry sectors.

- Regulatory frameworks will push manufacturers toward higher quality and safer nitrogen additives.

- Emerging economies will see rapid adoption supported by livestock sector modernization programs.

- Precision feeding systems will support accurate nitrogen dosing and reduce risks of toxicity.

- Strategic partnerships will strengthen global supply chains and improve access in developing markets.

- Focus on reducing environmental impact will create opportunities for eco-friendly nitrogen feed solutions.