Market Overview:

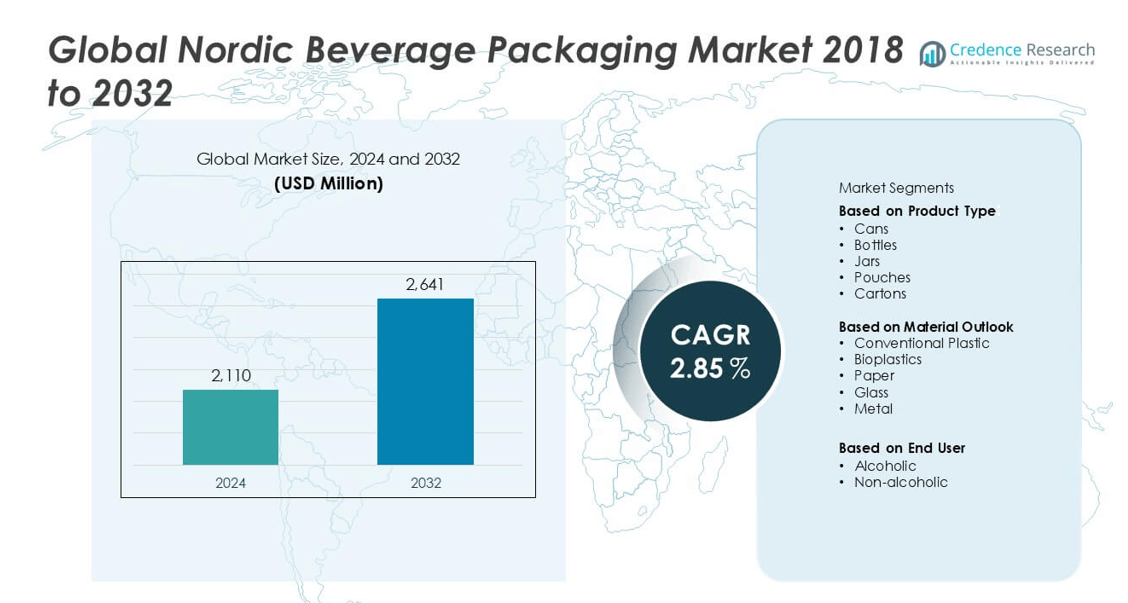

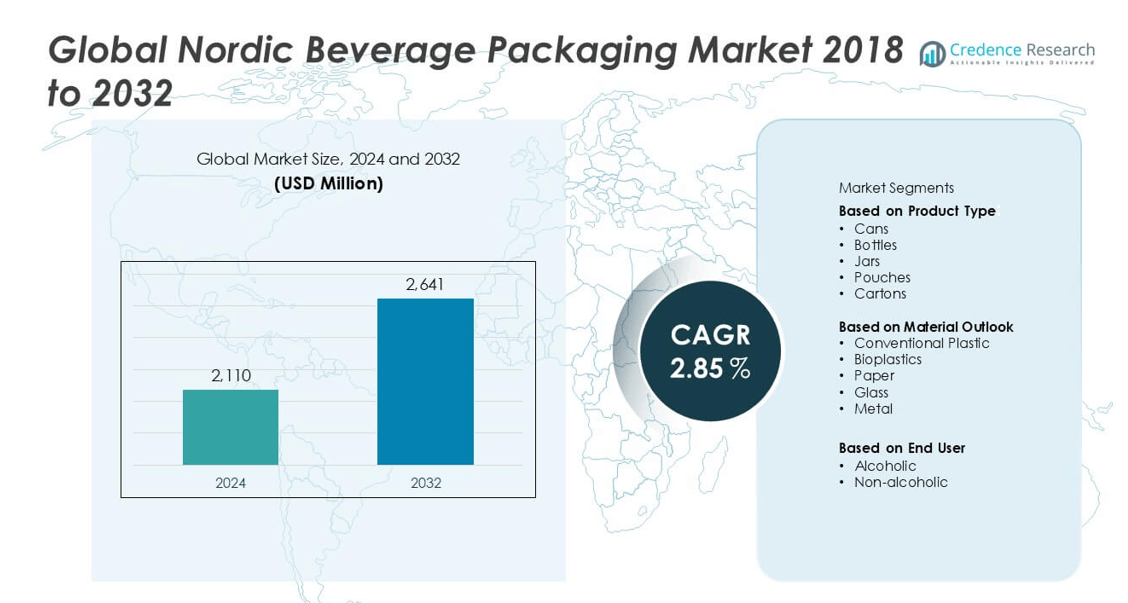

Nordic Beverage Packaging market size was valued at USD 2,110 million in 2024 and is anticipated to reach USD 2,641 million by 2032, at a CAGR of 2.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nordic Beverage Packaging Market Size 2024 |

USD 2,110 million |

| Nordic Beverage Packaging Market, CAGR |

2.85% |

| Nordic Beverage Packaging Market Size 2032 |

USD 2,641 million |

Top players in the Nordic beverage packaging market include Ball Corporation, Amcor, Mondi, Tetra Pak, Crown Holdings Inc, Ardagh Group, Billerud AB, Stora Enso, Sonoco Products Company, and Vidrala SA. These companies maintain a strong market presence through innovative, sustainable, and customizable packaging solutions. They focus on recyclable materials, lightweight formats, and smart packaging technologies to meet evolving consumer and regulatory demands. Among the Nordic countries, Sweden emerged as the leading region in 2024, commanding approximately 35% of the total market share. This dominance is attributed to its advanced recycling infrastructure, robust beverage sector, and consumer-driven demand for eco-friendly packaging.

Market Insights

- The Nordic beverage packaging market was valued at USD 2,110 million in 2024 and is projected to reach USD 2,641 million by 2032, growing at a CAGR of 2.85% during the forecast period.

- The market is driven by rising demand for sustainable and recyclable packaging solutions, supported by strict environmental regulations and consumer preference for eco-friendly materials such as bioplastics, paper, and metal.

- Increasing adoption of smart packaging, plant-based materials, and lightweight designs reflects current market trends, as manufacturers focus on enhancing functionality, shelf life, and product appeal.

- Key players such as Ball Corporation, Tetra Pak, Amcor, and Mondi dominate the market through innovations and strategic partnerships, while regional players like Billerud AB and Stora Enso are expanding with fiber-based packaging solutions.

- Sweden holds the largest regional share at 35%, followed by Denmark (25%) and Norway (20%), while bottles lead the product type segment due to their widespread use in both alcoholic and non-alcoholic beverages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Among product types, bottles held the dominant market share in 2024, driven by their wide usage in both alcoholic and non-alcoholic beverages. Their popularity stems from their durability, resealability, and compatibility with various materials including glass, PET, and bio-based plastics. Bottles are particularly preferred for water, soft drinks, juices, and spirits, owing to consumer familiarity and brand visibility. Meanwhile, cans are rapidly gaining traction, especially for carbonated drinks and beer, due to their recyclability and lightweight nature. Growth in ready-to-drink products has also increased demand for pouches and cartons, supporting market diversification.

- For instance, Coca-Cola HBC introduced 100% recycled PET bottles across its Nordic portfolio, eliminating over 4,000 tonnes of new plastic annually.

By Material Outlook

Conventional plastic remained the leading material segment in 2024, accounting for a substantial market share due to its cost-effectiveness, flexibility, and established supply chain. However, the segment is witnessing growing regulatory pressure and consumer pushback due to environmental concerns. In response, bioplastics and paper-based packaging are emerging as fast-growing alternatives, driven by sustainability initiatives and increased investments in eco-friendly solutions. Glass continues to dominate premium and alcoholic beverage packaging due to its perceived purity and recyclability, while metal, primarily used in cans, remains a reliable choice for beverages requiring longer shelf life.

- For instance, Billerud AB invested SEK 2.6 billion to convert its Gruvön mill to produce renewable fiber-based packaging as a substitute for plastic.

By End User

The non-alcoholic beverage segment dominated the market in 2024, holding the largest share due to the high and growing consumption of water, soft drinks, juices, and energy beverages across the Nordic countries. Rising health awareness and preference for functional and organic drinks have fueled packaging innovation in this segment, favoring convenient and sustainable formats. The alcoholic beverage segment also contributes significantly, especially with premiumization trends in wine, beer, and spirits. Demand for visually appealing and protective packaging solutions like glass bottles and aluminum cans continues to drive growth in alcoholic beverage packaging.

Market Overview

Rising Demand for Sustainable Packaging Solutions

The Nordic beverage packaging market is experiencing substantial growth due to increasing consumer awareness and regulatory support for sustainable packaging. Governments across the region are promoting circular economy principles and enforcing stringent plastic reduction policies. As a result, manufacturers are adopting recyclable, biodegradable, and compostable materials to align with environmental targets. The demand for paper-based cartons, plant-based plastics, and reusable containers has surged, especially among eco-conscious consumers. This trend is driving innovation and investment in sustainable packaging technologies, contributing to consistent market expansion.

- For instance, Tetra Pak processed over 46 billion paper-based beverage cartons globally in a year, of which 5.2 billion were collected and recycled in Europe, including contributions from Nordic facilities.

Growth in Non-Alcoholic Beverage Consumption

The rising health consciousness among Nordic consumers has led to increased consumption of non-alcoholic beverages such as bottled water, energy drinks, functional drinks, and ready-to-drink teas. This shift is fueling demand for innovative, convenient, and portable packaging formats. Manufacturers are investing in lightweight bottles, resealable cans, and ergonomic packaging to enhance consumer experience and brand appeal. Moreover, premiumization in non-alcoholic segments is encouraging the use of aesthetically appealing packaging, further boosting market growth across Denmark, Sweden, Norway, and Finland.

- For instance, Carlsberg launched Fibre Bottle prototypes for its alcohol-free beer line, with over 8,000 bio-based bottles tested in Denmark.

Technological Advancements in Packaging Materials

Innovations in packaging technology, such as active packaging, smart labeling, and barrier-enhanced materials, are propelling the Nordic beverage packaging market forward. These advancements help extend shelf life, improve product safety, and offer real-time tracking and traceability. Digital printing and customization also enable brands to create targeted marketing campaigns and connect with consumers. Adoption of automation and robotics in packaging lines further enhances production efficiency and consistency. As beverage producers modernize operations, the integration of high-performance and intelligent packaging solutions is accelerating across the region.

Key Trends & Opportunities

Emergence of Plant-Based and Bio-Based Packaging

The shift towards plant-based and bio-based packaging is a prominent trend in the Nordic beverage sector. Derived from renewable sources like sugarcane, corn starch, or cellulose, these materials offer a lower carbon footprint than traditional plastics. Beverage companies are increasingly adopting these alternatives to meet ESG goals and appeal to environmentally conscious consumers. The growing availability of composting and recycling infrastructure in the region supports this transition, opening up new opportunities for packaging companies to introduce innovative, low-impact solutions in the market.

- For instance, Coca-Cola Sweden transitioned to plant-based PlantBottle™ technology made with up to 30% bio-based material for all PET bottles sold locally.

Digital Transformation and Smart Packaging

Smart packaging is gaining traction as brands seek to enhance consumer interaction and supply chain transparency. QR codes, NFC tags, and RFID-enabled packaging are being adopted to provide product origin details, recycling instructions, and promotional content. This digital integration offers brands a competitive edge and enriches the customer experience. Additionally, data gathered through smart packaging solutions helps companies optimize logistics and inventory management. As digitization increases in the beverage industry, smart packaging is poised to become a key growth avenue in the Nordic market.

Key Challenges

High Cost of Sustainable and Advanced Packaging Materials

One of the major challenges in the Nordic beverage packaging market is the high cost associated with eco-friendly and technologically advanced materials. Biodegradable plastics, plant-based alternatives, and smart packaging components often carry a premium compared to conventional packaging options. These elevated costs can restrict adoption among small and mid-sized beverage producers, limiting the scale of sustainable packaging implementation. Cost pressures may also impact profit margins, particularly in competitive market segments with price-sensitive consumers.

- For instance, Stora Enso’s biodegradable biocomposite DuraSense® costs nearly 30% more than traditional polypropylene, posing a cost barrier to mass adoption.

Complex Regulatory Compliance Across Markets

Navigating the evolving and often complex regulatory landscape in Nordic countries presents another challenge. Each country has distinct packaging waste management regulations, deposit-return systems, and labeling requirements. Compliance with these varied policies demands significant administrative and operational effort, especially for multinational companies. Failure to meet regulations can lead to penalties and reputational damage. The need to frequently adapt packaging strategies to align with changing laws also increases operational costs and complicates long-term planning for businesses.

Supply Chain Disruptions and Material Shortages

The Nordic beverage packaging market remains vulnerable to supply chain disruptions, including raw material shortages, transportation delays, and geopolitical factors. Global instability, such as the ripple effects of conflicts or trade restrictions, has impacted the availability and pricing of key materials like aluminum, PET, and paperboard. Localized disruptions, including labor strikes or logistical bottlenecks, further hinder timely delivery and production continuity. These uncertainties challenge manufacturers’ ability to maintain stable output and meet fluctuating demand effectively.

Regional Analysis

Sweden

Sweden held the largest share in the Nordic beverage packaging market in 2024, accounting for approximately 35% of the regional revenue. The country’s strong emphasis on sustainability and well-established recycling infrastructure have driven demand for eco-friendly packaging solutions such as cartons, paper-based bottles, and bioplastics. Beverage producers in Sweden are actively adopting lightweight and recyclable materials to align with strict environmental regulations and shifting consumer preferences. Additionally, the country’s high consumption of bottled water, non-alcoholic beverages, and ready-to-drink products further supports consistent demand for innovative and functional packaging formats.

- For instance, Returpack Sweden’s reverse vending network collected over 2.2 billion beverage containers for recycling in a single year.

Denmark

Denmark accounted for nearly 25% of the Nordic beverage packaging market in 2024, supported by a growing preference for sustainable materials and a strong beverage manufacturing sector. The market is driven by increased demand for alcoholic beverages, particularly beer and wine, which boosts the use of glass bottles and aluminum cans. Denmark’s commitment to circular economy practices is also encouraging companies to invest in recyclable and compostable packaging. Moreover, innovation in functional drinks and plant-based beverages is contributing to demand for flexible and resealable formats like pouches and biodegradable containers across the country.

- For instance, Dansk Retursystem manages over 1.4 billion beverage packaging returns per year through its national deposit-return system.

Norway

Norway represented around 20% of the Nordic beverage packaging market share in 2024. The country’s packaging landscape is shaped by consumer emphasis on health, sustainability, and product quality. Demand for premium and eco-conscious packaging is high, especially in the non-alcoholic beverage segment. The government’s robust deposit-return system and plastic reduction policies have accelerated the adoption of recyclable cans, bioplastics, and glass packaging. Norway’s strong purchasing power and evolving taste for functional beverages, including energy drinks and organic juices, are further supporting the growth of high-performance and environmentally friendly packaging solutions.

Finland

Finland captured approximately 15% of the Nordic beverage packaging market in 2024. The market growth is supported by increased consumption of both non-alcoholic and alcoholic beverages, including bottled water, beer, and spirits. Finland’s advanced recycling system and government-backed environmental initiatives are fostering demand for sustainable materials such as paper, metal, and bioplastics. Beverage companies in Finland are also focusing on enhancing shelf life and visual appeal, leading to the adoption of advanced packaging technologies. The country’s innovation-friendly environment encourages continuous R&D in packaging, boosting demand for smart and functional formats.

Iceland

Iceland accounted for a smaller yet notable 5% share of the Nordic beverage packaging market in 2024. Despite its limited population size, the country exhibits growing demand for environmentally sustainable and premium packaging, especially in bottled water and alcoholic beverages. Iceland’s natural brand image supports the use of clean, recyclable, and locally sourced packaging materials. The tourism industry also plays a role in beverage consumption trends, influencing packaging preferences for portability and visual appeal. Continued investments in sustainable production and eco-labeling are expected to support moderate but steady growth in the Icelandic market.

Market Segmentations:

By Product Type

- Cans

- Bottles

- Jars

- Pouches

- Cartons

By Material Outlook

- Conventional Plastic

- Bioplastics

- Paper

- Glass

- Metal

By End User

By Geography

- Sweden

- Denmark

- Norway

- Finland

- Iceland

Competitive Landscape

The competitive landscape of the Nordic beverage packaging market is characterized by the presence of several global and regional players focusing on sustainability, innovation, and strategic partnerships. Key companies such as Ball Corporation, Amcor, Mondi, Tetra Pak, and Crown Holdings Inc are leading the market through advanced packaging solutions and strong distribution networks. These players are heavily investing in R&D to develop recyclable, biodegradable, and lightweight materials in response to increasing environmental regulations and consumer demand for eco-friendly packaging. Collaborations with beverage brands and retailers to introduce customized, functional, and smart packaging further intensify competition. Mergers, acquisitions, and capacity expansion are common strategies to gain regional foothold and expand product offerings. The market is expected to remain moderately consolidated, with sustainability leadership and material innovation serving as primary differentiators.

- For instance, Ball Corporation operates a high-capacity aluminum beverage can plant in Fosie, Sweden, capable of producing over 1.2 billion cans annually.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ball Corporation

- Mondi

- Amcor

- Crown Holdings Inc

- Tetra Pak

- Ardagh Group

- Billerud AB

- Sonoco Products Company

- Stora Enso

- Vidrala SA

Recent Developments

- In October 2024, Anheuser Busch InBev India (AB InBev) announced the launch of Budweiser Beats– marking its debut in the non-alcoholic energy drink category.

- In August 2024, Berry Global Group partnered with Aquafigure for a new line of reusable water bottles with an interchangeable 3D bottle card design. The collaboration is aimed at encouraging the young population to drink more water.

- In June 2024, Anora announced the launch of a new range of wine products containing 8% alcohol for grocery stores in Finland.

- In April 2024, Amcor announced the launch of a one-liter polyethylene terephthalate (PET) bottle for carbonated soft drink (CSD) use that is made from 100% post-consumer recycled (PCR) content.

Market Concentration & Characteristics

The Nordic Beverage Packaging Market demonstrates a moderately concentrated structure with a mix of global packaging leaders and established regional players competing across sustainability, innovation, and operational efficiency. Major firms such as Ball Corporation, Amcor, Tetra Pak, and Mondi maintain strong market positions by offering advanced, eco-friendly packaging solutions tailored to local regulatory standards and shifting consumer preferences. Regional players like Stora Enso and Billerud AB focus on fiber-based and recyclable materials, strengthening the sustainable packaging segment. It reflects high environmental consciousness, supported by government policies promoting circular economy models and deposit-return systems. The market prioritizes functionality, shelf life, and design aesthetics, especially in bottles and cans, which dominate the product landscape. Demand remains high for paper-based cartons and bioplastics, especially in the non-alcoholic beverage segment. Sweden leads in market share, driven by its advanced recycling infrastructure and strong consumer awareness. The market favors innovation and regulatory compliance, shaping its competitive and product development dynamics.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material Outlook, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily driven by rising demand for sustainable and recyclable beverage packaging.

- Government regulations across Nordic countries will push manufacturers to adopt eco-friendly and biodegradable materials.

- Paper-based and fiber-based packaging will gain more traction as alternatives to conventional plastic.

- Smart packaging technologies such as QR codes and RFID will become more common in premium and functional beverages.

- Bottles and cans will maintain dominance, supported by high demand in both alcoholic and non-alcoholic beverage segments.

- Bioplastics will witness strong adoption as brands seek low-carbon alternatives to fossil-based plastics.

- Sweden will remain the leading market, supported by consumer awareness and well-established recycling systems.

- Customization and digital printing will increase as brands aim to enhance consumer engagement and shelf appeal.

- Regional players will expand through innovation and partnerships to compete with global packaging giants.

- Supply chain optimization and investment in sustainable production processes will be key strategic priorities.