Market Overview:

The North America Asia Cuisine Market size was valued at USD 536.29 million in 2018, USD 568.00 million in 2024, and is anticipated to reach USD 899.36 million by 2032, at a CAGR of 5.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Asia Cuisine Market Size 2024 |

USD 568.00 Million |

| North America Asia Cuisine Market, CAGR |

5.91% |

| North America Asia Cuisine Market Size 2032 |

USD 899.36 Million |

The market is driven by growing consumer interest in authentic and diverse Asian dishes. As North American consumers seek new culinary experiences, Asian cuisine has gained significant traction, with Japanese, Chinese, and Korean food being the most popular choices. The increasing focus on health-conscious eating also contributes, as Asian cuisine typically includes lean proteins, vegetables, and rice. Additionally, the rise of online food delivery platforms further drives the demand for Asian food in North America.

Regionally, the United States leads the market due to its multicultural population and high demand for diverse cuisines, especially in cities with large Asian communities. Canada follows, with a growing preference for Japanese and Chinese food. Emerging markets in Mexico and Central America are beginning to see increased interest in Asian cuisine, driven by urbanization and shifting consumer tastes. These regions are likely to witness sustained growth as awareness of Asian culinary offerings increases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Asia Cuisine Market was valued at USD 536.29 million in 2018 and is expected to reach USD 899.36 million by 2032, growing at a CAGR of 5.91%.

- Rising consumer demand for authentic Asian flavors and diverse culinary experiences is driving market growth.

- Increasing health-consciousness among consumers has led to a higher preference for Asian cuisine, which often features lean proteins and vegetables.

- Supply chain challenges, including ingredient sourcing and import regulations, pose a restraint to the market’s growth.

- Cultural barriers and the balance between maintaining authenticity and catering to local tastes remain a challenge for market players.

- The United States holds the largest market share, driven by its diverse population and high demand for Asian cuisine.

- Canada, Mexico, and Central America are emerging markets, showing increasing interest in Asian food as urbanization and consumer awareness grow.

Market Drivers

Growing Demand for Authenticity and Diversity

The North America Asia Cuisine Market is driven by the increasing demand for authentic and diverse culinary experiences. North American consumers are eager to explore flavors beyond their traditional diet, and Asian cuisine offers a vast array of unique tastes and textures. Cultural exchange through travel, media, and immigration has led to greater exposure to Asian culinary traditions. This trend is driving a rise in restaurants, food delivery services, and grocery stores offering authentic Asian dishes.

Health Consciousness and Innovative Offerings

The growing focus on health and wellness among North American consumers has led to a surge in demand for healthier versions of Asian cuisine. It has become common to find dishes with reduced sodium, fat, and gluten-free alternatives. Asian food’s inherent focus on vegetables, rice, and lean proteins aligns with the growing preference for nutritious meals. The market continues to adapt by offering innovative, healthier options, appealing to a broad range of dietary preferences.

Increased Adoption of Convenience Foods

Convenience remains a key driver in the North America Asia Cuisine Market. Busy lifestyles and the desire for easy-to-prepare meals have propelled the growth of Asian convenience foods, including frozen meals and ready-to-eat products. It is increasingly popular to consume Asian cuisine at home, and meal kits and pre-packaged items are becoming common household staples. This demand for convenience aligns with the market’s expanding presence in supermarkets and e-commerce platforms.

- For instance, Laoban, a premium Asian frozen food brand specializing in dumplings and bao buns, doubled its retail distribution in September 2024 by adding 6,000 new distribution points and logged sales of nearly half a million bao buns in just three months following its May 2024 launch at Whole Foods Market.

Technological Integration in Food Production

The integration of advanced technologies into food production is another driver shaping the North America Asia Cuisine Market. Automation and digital platforms for online food delivery and ordering have streamlined the way consumers interact with the cuisine. Additionally, innovations in food preservation and packaging have extended the shelf life and quality of Asian food products. The growing role of these technologies in enhancing efficiency and accessibility contributes significantly to the market’s expansion.

- For instance, in 2024, Wingstop (a leading U.S. fast-casual chain known for Asian-inspired sauces) reported that digital ordering channels accounted for 68% of total orders in Q1, with over 40 million users in its digital database—the result of investing $50 million in proprietary technology and automation to streamline customer engagement and supply chain efficiency

Market Trends

Popularity of Fusion Cuisine

Fusion cuisine is a rising trend in the North America Asia Cuisine Market. Chefs are combining traditional Asian recipes with local flavors to create innovative dishes. This culinary cross-pollination is gaining traction, especially in urban areas where food enthusiasts seek new dining experiences. Fusion dishes not only make Asian cuisine more relatable but also introduce diverse flavor combinations that appeal to a broader audience. The market has adapted to this by offering fusion food in fast-casual restaurants and food trucks.

- For instance, Live Ocean launched its Pineapple Salsa Teriyaki Salmon in the US market in 2024, blending classic teriyaki flavors with pineapple salsa and introducing this fusion protein product through major retailers.

Focus on Sustainable and Eco-Friendly Practices

Sustainability continues to gain importance in the North America Asia Cuisine Market. Consumers are increasingly concerned with the environmental impact of their food choices, pushing restaurants and food producers to adopt more sustainable practices. This includes sourcing ingredients responsibly, reducing waste, and opting for eco-friendly packaging. Asian cuisine, with its emphasis on plant-based ingredients and lower environmental footprints, is well-positioned to capitalize on these sustainability-driven trends.

Growth in Online Food Delivery Services

The increasing reliance on online food delivery services is a prominent trend in the North America Asia Cuisine Market. As more consumers opt for food delivery, the demand for Asian cuisine delivered directly to their doorsteps has surged. Many restaurants now partner with platforms like Uber Eats, DoorDash, and Grubhub to expand their customer reach. Online food ordering has become a significant part of the market, helping to drive growth for Asian cuisine beyond traditional dining experiences.

Rise of Asian Street Food Culture

Asian street food is experiencing a revival in North America, influencing the market’s growth. Popular street foods from countries like Thailand, Vietnam, and South Korea are gaining popularity among foodies. The vibrant and flavorful nature of street food, combined with its affordability and convenience, makes it attractive to a wide range of consumers. It has created new opportunities for food trucks and pop-up restaurants, further increasing the market’s exposure and accessibility.

- For instance, the Dream Asia Food Fest held in New Jersey from March 2025, featured over 90 Asian food vendors and attracted thousands of customers daily, offering small plates priced under $6 and highlighting the mainstream popularity of Asian street food in the region.

Market Challenges Analysis

Supply Chain and Ingredient Availability

The North America Asia Cuisine Market faces challenges related to ingredient sourcing and supply chain disruptions. Many authentic Asian ingredients are imported, making them vulnerable to global supply chain issues such as shipping delays or geopolitical tensions. These disruptions can lead to higher prices or a shortage of key ingredients, affecting the consistency and availability of authentic dishes. Restaurants and suppliers need to develop alternative sourcing strategies to mitigate these risks.

Cultural Misunderstanding and Authenticity Challenges

Maintaining authenticity in Asian cuisine while adapting to local tastes is a challenge in the North America Asia Cuisine Market. Some consumers may prefer familiar flavors, while others desire more traditional, authentic Asian dishes. Striking the right balance between staying true to traditional recipes and meeting local preferences is a complex task for many restaurants and food brands. The market continues to navigate the delicate line between authenticity and innovation.

Market Opportunities

Expanding Health-Conscious Product Range

The increasing demand for health-conscious meals presents a significant opportunity in the North America Asia Cuisine Market. As consumers focus more on their health, the introduction of low-calorie, gluten-free, and organic options within Asian cuisine can attract a larger customer base. This shift opens doors for Asian food brands to develop and market healthier alternatives, tapping into the growing trend of wellness-focused eating.

Expansion into New Regional Markets

Emerging markets in North America, such as Mexico and Central America, present promising opportunities for growth in the North America Asia Cuisine Market. These regions are experiencing increasing exposure to Asian cuisine, driven by globalization and shifting consumer tastes. With the rise of urbanization and a growing middle class, the potential for expansion into these areas is substantial, offering a chance to reach new customers and increase market share.

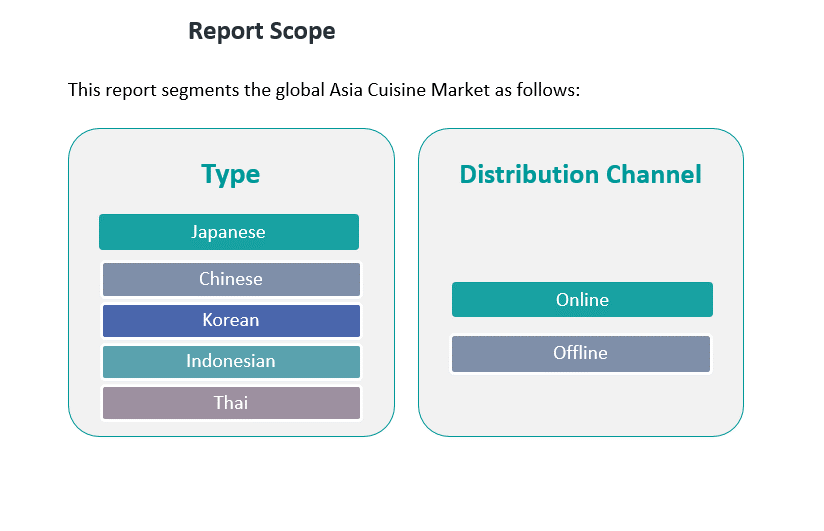

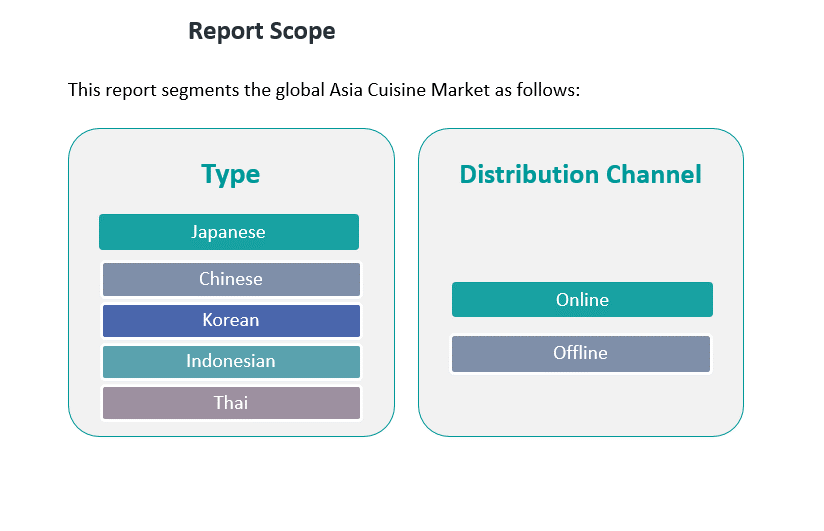

Market Segmentation Analysis

By Type

The Japanese segment leads the market due to its broad appeal, particularly in urban centers. Sushi, ramen, and tempura have gained widespread popularity, supported by growing consumer interest in Japanese culture. Chinese cuisine follows closely, with its rich variety of dishes like stir-fries and dumplings, which have become staples in North American households. Korean cuisine is rising in popularity, with dishes like Korean BBQ and bibimbap gaining traction, especially among younger consumers. Indonesian cuisine, while niche, is gradually growing as more consumers explore diverse Asian flavors. The “Others” segment includes various Asian cuisines that continue to gain interest as the market diversifies.

- For instance, Supreme Dumplings, a U.S.-based Chinese restaurant brand, introduced automated production lines that manufacture frozen dumplings, enabling the brand to efficiently serve both restaurants and supermarkets while addressing labor shortages and consistently producing thousands of dumplings daily through machine automation.

By Distribution Channel

The offline channel dominates the North America Asia Cuisine Market, driven by the high demand for dine-in restaurants, fast-casual dining, and food trucks. Consumers seek authentic dining experiences, often in major cities where Asian cuisine is a key attraction. Online channels, however, are expanding rapidly, supported by the growing preference for food delivery services and online ordering platforms. E-commerce and food delivery apps like Uber Eats and DoorDash provide convenience and enable consumers to enjoy Asian cuisine from the comfort of their homes. The online channel continues to show strong growth potential as it meets the needs of a busy, digitally connected population.

- For example, Panda Express remained the largest Asian restaurant chain in the U.S. in 2024, operating over 2,200 locations nationwide. The brand continued its dominance in the fast-casual American-Chinese cuisine market through its extensive footprint in major cities and varied locations across the country.

Segmentation

By Type

- Japanese

- Chinese

- Korean

- Indonesian

- Others

By Distribution Channel

Regional Analysis

United States

The United States dominates the North America Asia Cuisine Market, holding a significant market share of over 60%. The diverse population and a strong cultural inclination toward trying new flavors fuel the high demand for Asian cuisine in the region. Major cities like New York, Los Angeles, and San Francisco see substantial growth in Asian food offerings, particularly in restaurants and takeout services. Rising consumer interest in ethnic food has led to an increase in Asian food product availability in supermarkets, further expanding the market.

Canada

Canada contributes around 25% to the North America Asia Cuisine Market, with a growing appetite for authentic Asian dishes in major cities like Toronto and Vancouver. The multicultural demographic and increasing immigration from Asia have boosted the popularity of Asian cuisine. The demand for Japanese, Chinese, and Korean food is particularly high, with restaurants and supermarkets catering to a broad range of tastes. The rise in consumer interest for healthier and more sustainable eating habits also promotes the consumption of Asian cuisine, known for its use of fresh ingredients.

Mexico & Central America

Mexico and Central America represent the emerging subregion, with a market share of around 15%. While still smaller than the U.S. and Canada, the demand for Asian cuisine in Mexico has grown steadily, particularly in larger cities like Mexico City. The rising trend of fusion cuisine, combining Asian flavors with local ingredients, has fueled interest in restaurants offering Asian dishes. The growing middle class and increased awareness of global food trends are expected to drive further market growth in these regions, with more consumers looking to explore authentic Asian flavors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panda Express

- Noodles & Company

- Pei Wei Asian Diner

- The Cheesecake Factory

- Nestlé

- Conagra Brands

- Taco Bell

- McCormick & Company Inc.

- Moods Hospitality Pvt Ltd.

- JFC

Competitive Analysis

The competitive landscape of the North America Asia Cuisine Market is highly fragmented, with key players continually innovating to meet the increasing consumer demand. Major companies such as Panda Express, Noodles & Company, and Pei Wei Asian Diner lead the market, leveraging extensive networks of restaurants and strong brand recognition. These players dominate the market by offering a wide range of traditional and fusion Asian dishes that appeal to diverse consumer preferences. Other players like The Cheesecake Factory and Nestlé have also expanded their menu offerings to include Asian-inspired items, capitalizing on the growing trend of ethnic cuisine. Smaller yet competitive players such as McCormick & Company Inc. and JFC focus on product innovation and catering to niche segments, including health-conscious and sustainable food options. The North America Asia Cuisine Market sees intense competition among both large-scale chains and regional operators. Companies are focusing on improving customer experience through fast service, diverse menu options, and healthier alternatives. The competitive advantage lies in strategic expansions, innovative menu offerings, and catering to shifting consumer preferences, such as the increasing demand for plant-based options.

Recent Developments

- In July 2025, Panda Express launched a first-of-its-kind gaming activation in Fortnite Creative and Roblox to celebrate the summer return of their Hot Orange Chicken dish, marking a bold approach to engaging Gen Z consumers within the North American Asian cuisine market.

- In July 2025, Noodles & Company unveiled its new “Delicious Duos” combo offerings across North America, reinforcing its effort to create more value-packed meals that pair small entrées with a protein and a side, starting at $9.95.

- In June 2025, Fine Choice Foods, a North American company known for Asian-inspired cuisine, launched two new premium products under its SUMM! brand: Pork Gyoza Dumplings with Chili Crisp Oil and Spicy Sriracha Chicken Spring Rolls. These launches reinforce the company’s commitment to innovating with bold flavors and enhancing convenience for consumers seeking multicultural and restaurant-quality foods at home.

- In October 2024, Nestlé launched two new frozen brands Mings for Asian fare and Tapatío for Mexican cuisine targeting authentic flavors, with celebrity chef Ming Tsai leading development of the Mings line.

Report Coverage

The research report offers an in-depth analysis based on Type and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The North America Asia Cuisine Market will continue to expand as demand for authentic Asian food grows.

- Increasing urbanization and cultural diversity will boost the popularity of Asian cuisine in new regions.

- The market will see innovations in food delivery platforms, enhancing convenience for consumers.

- Health-conscious offerings, such as gluten-free and low-calorie Asian dishes, will become more prevalent.

- The rise of fusion cuisines will drive new menu developments and restaurant concepts.

- Increased focus on sustainability will encourage brands to adopt eco-friendly packaging and ingredient sourcing.

- Online distribution channels will grow, making Asian food more accessible through e-commerce and delivery apps.

- Fast-casual dining options will become more popular as consumers seek affordable Asian food.

- Rising disposable incomes will allow more people to explore diverse dining experiences, including Asian cuisine.

- Regional players will see expansion opportunities, especially in Central and South America, with increasing interest in Asian flavors.