Market Overview:

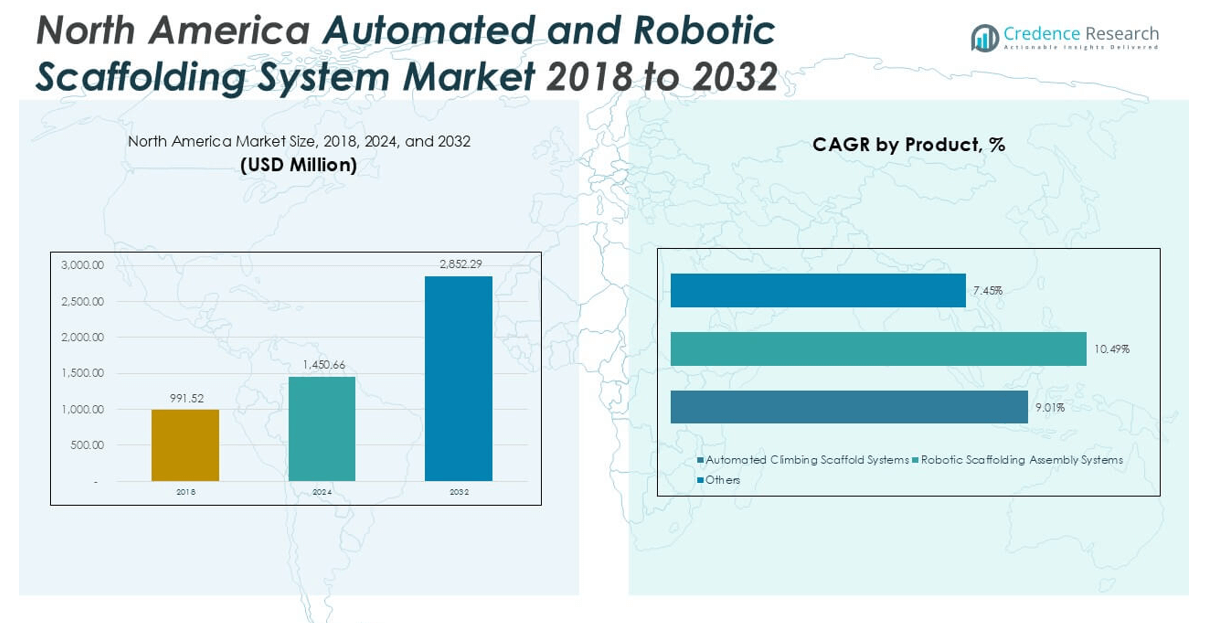

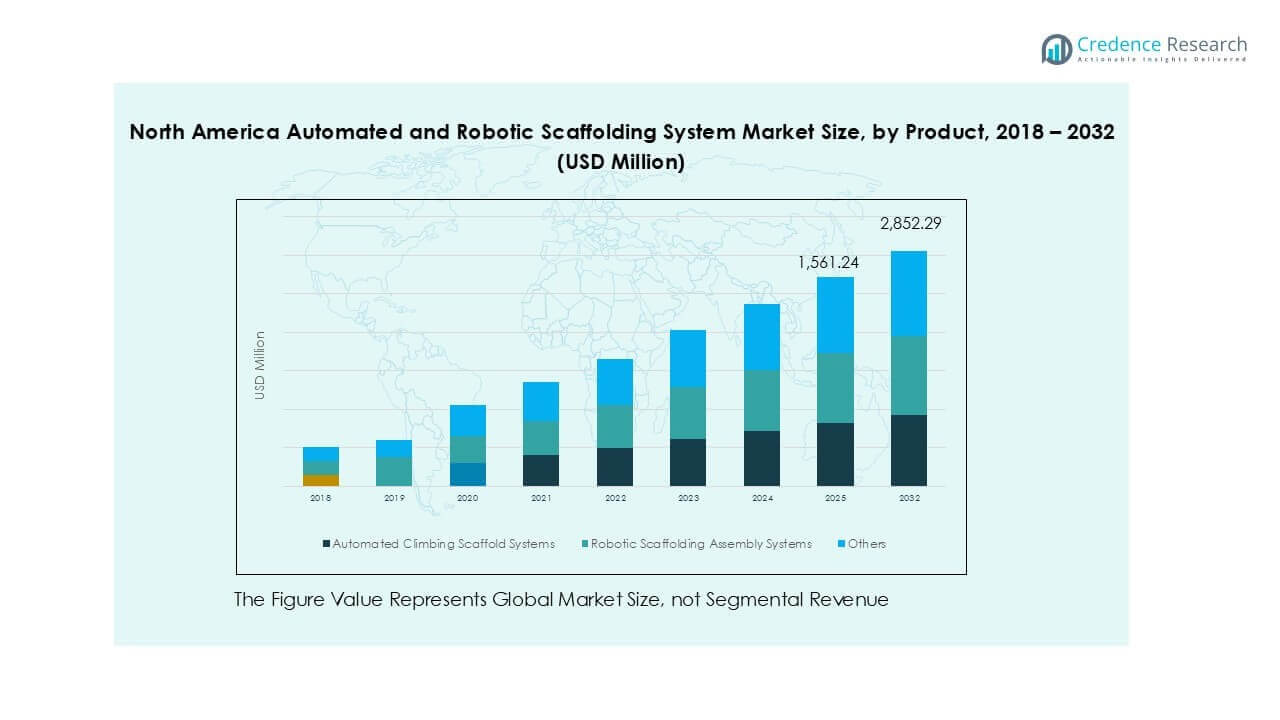

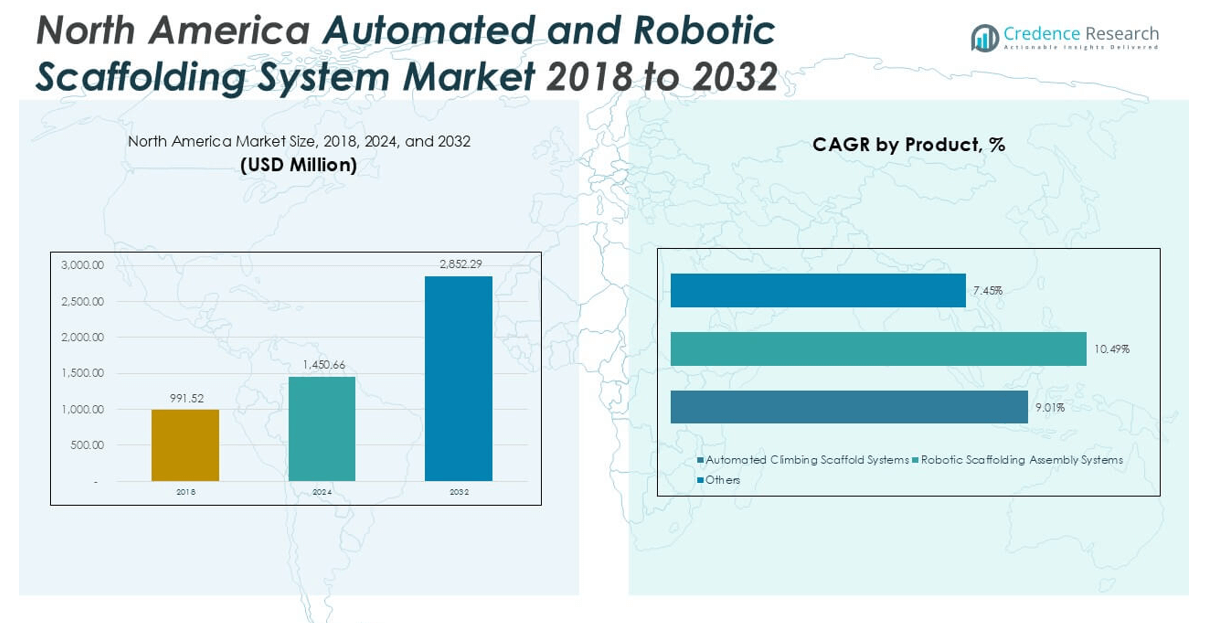

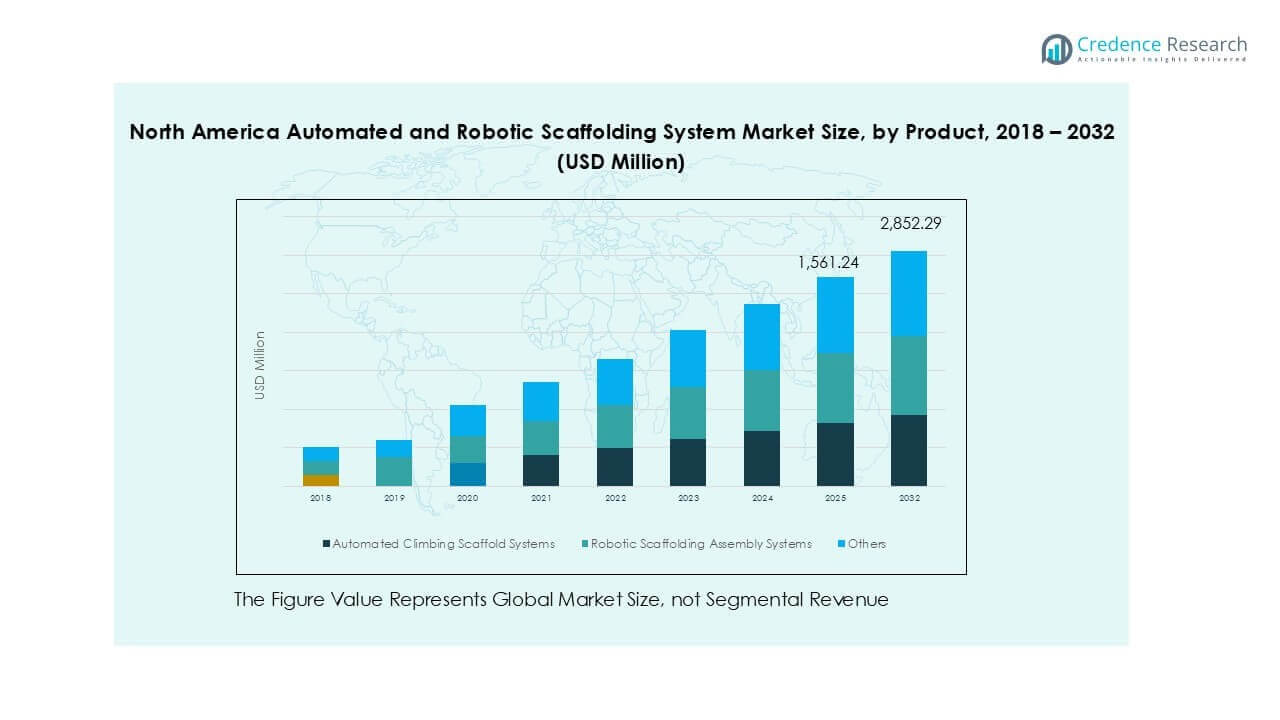

The North America automated and robotics scaffolding system market was valued at USD 991.52 million in 2018, reaching USD 1450.66 million in 2024, and is projected to attain USD 2852.29 million by 2032, growing at a CAGR of 9.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Automated and Robotics Scaffolding System Market Size 2024 |

USD 1450.66 million |

| North America Automated and Robotics Scaffolding System Market, CAGR |

9.01% |

| North America Automated and Robotics Scaffolding System Market Size 2032 |

USD 2852.29 million |

The North America Automated and Robotics Scaffolding System market is led by key players such as Layher, Inc., Kewazo, Reo Lift, MEVA, and KITSEN Scaffold & Formwork Technologies. These companies are driving innovation through advanced robotic assembly systems, automated climbing scaffolds, and integrated software platforms aimed at enhancing safety and efficiency in construction operations. Layher, Inc. holds a strong market position due to its extensive product portfolio and established customer base, while Kewazo is gaining momentum with its robotic solutions for material handling. The United States dominates the regional market with a 70% share in 2024, driven by high infrastructure spending, strict safety regulations, and early adoption of automation technologies across industrial and civil construction sectors.

Market Insights

- The North America automated and robotics scaffolding system market was valued at USD 991.52 million in 2018, reaching USD 1450.66 million in 2024, and is projected to attain USD 2852.29 million by 2032, growing at a CAGR of 9.01% during the forecast period.

- Market growth is primarily driven by the rising demand for automation in construction, increasing labor shortages, and strict workplace safety regulations encouraging the adoption of robotic systems.

- A key trend shaping the market is the integration of IoT and AI technologies into scaffolding systems, enabling real-time monitoring, predictive maintenance, and enhanced operational efficiency.

- The United States holds the dominant share of over 70%, followed by Canada with 22% and Mexico with 8%; among product segments, automated climbing scaffold systems account for the largest market share.

- High initial investment costs and lack of skilled operators for robotic systems are key restraints that may limit adoption among small to mid-sized contractors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

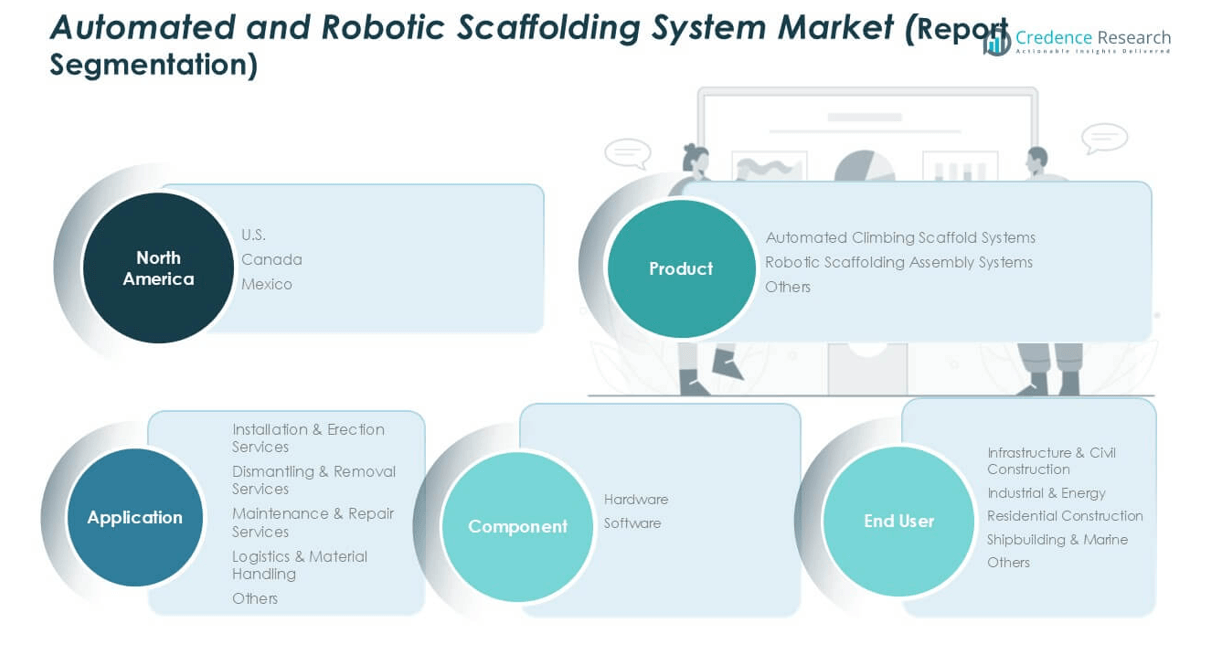

Market Segmentation Analysis:

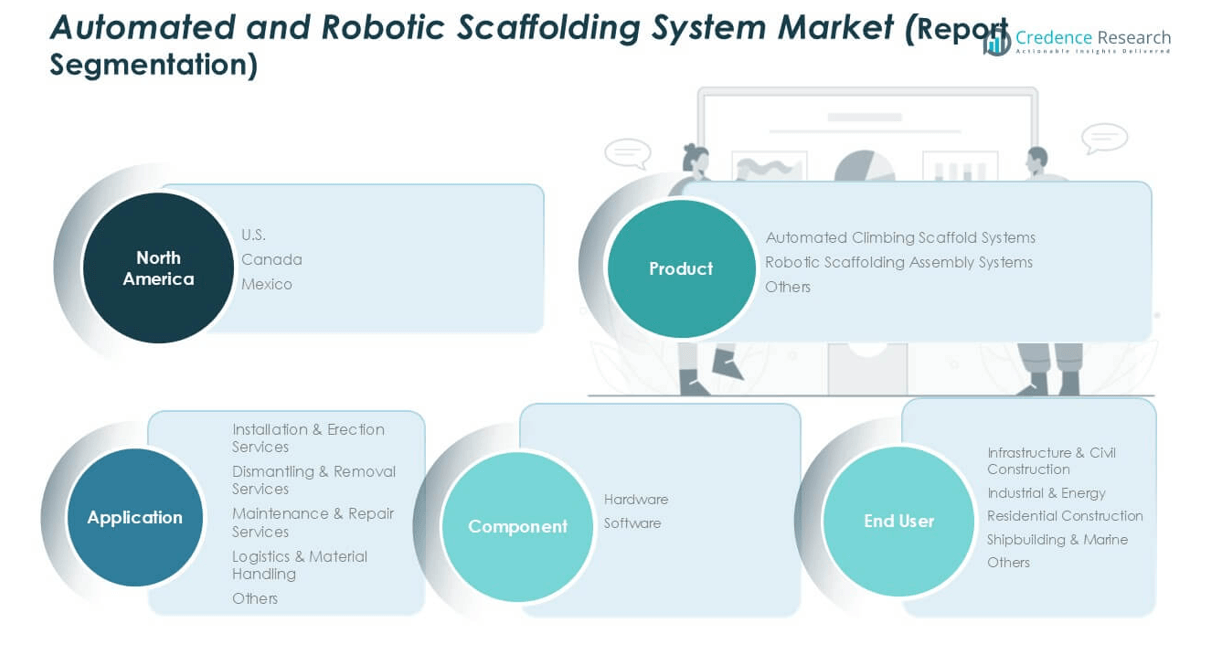

By Product

In the North America automated and robotics scaffolding system market, the automated climbing scaffold systems segment holds the dominant market share in 2024. This dominance is driven by its wide adoption in high-rise construction and infrastructure projects due to its efficiency in reducing manual labor and improving worker safety. The integration of sensors and IoT-enabled platforms in automated systems further enhances precision and operational control. Robotic scaffolding assembly systems are also gaining traction, particularly in projects requiring high customization and speed. The “Others” category, while smaller, includes modular and hybrid systems, seeing gradual uptake in niche applications.

- For instance, Kewazo’s LIFTBOT robotic system has demonstrated a 70% reduction in man-hours required for material transport during scaffolding assembly on-site and hasalready been deployed in over 50 industrial projects across Europe and North America.

By Application

Among application segments, installation & erection services accounted for the largest share of the North American market in 2024. The rising demand for efficient and safer scaffold setup procedures in large-scale construction and industrial maintenance projects fuels this segment’s growth. Automated and robotic systems significantly reduce human risk and labor time during scaffold erection. Dismantling & removal services and maintenance & repair services follow closely due to increasing lifecycle management needs of infrastructure assets. Logistics & material handling applications are emerging, propelled by the demand for automation in transporting heavy scaffold components.

- For instance, Layher Inc. implemented its Allround Scaffolding system in a New York City high-rise project, achieving a 30% reduction in installation time and enabling safe load-bearing capacity of up to 600 kg per working platform.

By Component

In terms of components, the hardware segment leads the North America automated and robotics scaffolding system market with the largest market share in 2024. This dominance stems from the high cost and critical role of physical equipment such as robotic arms, actuators, sensors, and scaffold frames integrated with automation features. The rising demand for durable and advanced hardware that ensures operational reliability and compliance with safety standards is a key driver. The software segment, though smaller, is growing steadily due to increased integration of real-time monitoring systems, predictive analytics, and cloud-based control platforms for better project efficiency.

Market Overview

Rising Demand for Construction Automation

The increasing demand for automation in construction is a primary growth driver in the North America automated and robotics scaffolding system market. Labor shortages, safety concerns, and pressure to improve productivity are encouraging contractors to adopt automated scaffolding solutions. These systems minimize manual labor, reduce setup time, and enhance on-site safety, making them an attractive investment in large-scale infrastructure and high-rise projects. The trend is particularly evident in urban developments and commercial construction, where timelines are tight and efficiency is paramount.

- For instance, MEVA’s automatic climbing system MAC was used in the construction of a 250-meter tower in Chicago, where it enabled a climb rate of one floor every three days, significantly improving project timelines.

Emphasis on Worker Safety and Compliance

Stricter safety regulations across North America are driving adoption of automated and robotic scaffolding systems. These systems reduce the need for human intervention in hazardous tasks such as elevated assembly, dismantling, and material handling. As occupational safety standards evolve, companies are compelled to integrate technologies that ensure worker protection and regulatory compliance. Robotic systems also offer consistent performance with fewer errors, contributing to reduced incidents and insurance liabilities, thereby supporting broader acceptance within industrial and civil construction sectors.

- For instance, Reo Lift’s semi-automated scaffold positioning system was deployed in an offshore platform project in Texas, reducing fall-risk incidents to zero and decreasing manual handling by over 60 scaffold repositioning operations per day.

Infrastructure Modernization Initiatives

Ongoing infrastructure modernization projects across the U.S. and Canada significantly contribute to market expansion. Government investments in transportation networks, bridges, commercial structures, and energy facilities demand efficient, scalable, and safe scaffolding solutions. Automated and robotics-based systems meet these requirements by enhancing operational efficiency and minimizing project delays. As legacy infrastructure is upgraded, these advanced systems are increasingly specified in project plans, reinforcing their market presence and long-term relevance in the region.

Key Trends & Opportunities

Integration of Smart Technologies and IoT

The integration of IoT-enabled sensors and smart technologies into scaffolding systems is a notable trend. These innovations allow real-time monitoring, predictive maintenance, and remote control, significantly improving project transparency and decision-making. IoT applications enable managers to track scaffold usage, detect structural issues, and ensure optimal performance, reducing downtime and operational risks. This shift toward data-driven scaffolding systems presents a strong opportunity for technology providers and construction firms seeking to optimize workflow and safety.

- For instance, KITSEN Scaffold & Formwork Technologies integrated over 400 IoT sensors across multiple construction sites in Ontario, enabling real-time diagnostics that led to a 22% drop in unplanned maintenance interventions.

Growing Adoption in Industrial and Energy Sectors

While construction remains the dominant sector, the adoption of automated scaffolding systems in industrial and energy settings is gaining momentum. Facilities like oil refineries, power plants, and chemical factories increasingly rely on automated solutions for maintenance and retrofitting tasks in hazardous environments. The need for minimal downtime and high precision in these sectors creates an ideal use case for robotic scaffolding. This trend opens new market avenues beyond traditional building projects, enhancing overall market diversification.

- For instance, during scheduled maintenance at a Chevron refinery in California, Layher’s scaffolding system enabled access setup in under 48 hours for a 60-meter-high column, compared to the usual 96-hour manual method

Key Challenges

High Initial Investment and ROI Concerns

Despite their long-term benefits, automated and robotic scaffolding systems require significant upfront investment, which may deter smaller contractors and firms. High costs related to hardware, software, training, and integration can impact adoption rates. Additionally, return on investment (ROI) may take time to materialize, especially in smaller-scale projects. This challenge is more pronounced in cost-sensitive sectors, where traditional scaffolding methods remain more financially accessible despite being labor-intensive and slower.

Limited Skilled Workforce for System Operation

The lack of skilled operators and technicians to manage and maintain automated systems poses a significant hurdle. Construction and industrial firms may struggle to find personnel with the technical expertise required to operate robotic components and interpret software analytics. This talent gap slows adoption and raises training costs, particularly in regions where workforce digital literacy is low. Without adequate upskilling initiatives, companies risk underutilizing advanced scaffolding solutions.

Regulatory Uncertainty and Approval Delays

Navigating regulatory landscapes can be a barrier for manufacturers and users of robotic scaffolding systems. Approval processes for new technologies can be lengthy, especially when they involve safety compliance for automated equipment. Differences in local and federal construction codes also create complexity, causing delays in project planning and execution. Regulatory ambiguity may further discourage early adoption, particularly among firms wary of compliance risks and unexpected legal hurdles.

Regional Analysis

United States

The United States holds the largest share of the North America automated and robotics scaffolding system market, accounting for over 70% of the regional revenue in 2024. The dominance is driven by strong demand from commercial, infrastructure, and industrial construction projects, particularly in metropolitan cities. Significant federal investments in transportation, energy, and urban redevelopment further support market growth. Adoption is also accelerated by strict occupational safety regulations and a growing emphasis on construction automation. Advanced technology infrastructure and early adoption of robotics contribute to the widespread implementation of intelligent scaffolding systems across various sectors.

Canada

Canada represents approximately 22% of the North American automated and robotics scaffolding system market in 2024. The country is witnessing steady growth due to infrastructure modernization, particularly in public transportation and energy sectors. Growing awareness around worker safety and government-led sustainability initiatives are encouraging construction firms to adopt automated scaffolding solutions. Additionally, the skilled labor shortage in remote and northern regions increases the reliance on robotic systems to reduce operational delays. Technological advancements and partnerships between local and global solution providers are further strengthening the Canadian market’s role in the regional ecosystem.

Mexico

Mexico contributes around 8% of the North American automated and robotics scaffolding system market. Although still emerging, the market is gaining traction due to the increasing number of industrial and energy projects, especially in oil and gas, automotive manufacturing, and export-oriented infrastructure. Government efforts to attract foreign direct investment (FDI) and improve workplace safety standards are prompting gradual adoption of automated construction technologies. However, limited access to high-end robotics and cost-sensitive construction practices remains challenges. Despite this, Mexico offers significant long-term potential as automation adoption expands beyond urban industrial hubs into broader construction applications.

Market Segmentations:

By Product

- Automated Climbing Scaffold Systems

- Robotic Scaffolding Assembly Systems

- Others

By Application

- Installation & Erection Services

- Dismantling & Removal Services

- Maintenance & Repair Services

- Logistics & Material Handling

- Others

By Component

By End User

- Infrastructure & Civil Construction

- Industrial & Energy

- Residential Construction

- Shipbuilding & Marine

- Others

By Geography

Competitive Landscape

The competitive landscape of the North America automated and robotics scaffolding system market is characterized by a mix of established players and innovative entrants driving technological advancement and market expansion. Key companies such as Layher, Inc., Kewazo, Reo Lift, MEVA, and KITSEN Scaffold & Formwork Technologies are actively investing in R&D to develop automated and intelligent scaffolding solutions tailored for construction, industrial, and infrastructure applications. These firms are focusing on modular system integration, safety enhancement, and operational efficiency to differentiate themselves in a rapidly evolving market. Strategic collaborations, product launches, and geographic expansions are common competitive strategies aimed at strengthening market presence. Additionally, startups like Kewazo are disrupting traditional approaches through robotics and AI-based systems, targeting labor efficiency and real-time monitoring. The market is increasingly influenced by customer demand for automation, compliance with safety regulations, and the need for scalability. As adoption accelerates, competitive intensity is expected to rise, fostering further innovation and consolidation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Layher, Inc.

- Kewazo

- Reo Lift

- MEVA

- KITSEN Scaffold & Formwork Technologies

Recent Developments

- In 2025, MEVA USA is actively promoting the MAC (MEVA Automatic Climbing) system in North America. This system is a hydraulically powered, crane-independent solution that allows entire scaffold assemblies to climb as a single unit. It enhances efficiency and safety in high-rise construction by reducing crane usage, minimizing material costs, and accelerating the overall construction timeline.

- In 2025, Kewazo’s LIFTBOT, a mobile, battery-powered robotic hoist, experienced increased deployment in North America. The LIFTBOT automates the vertical movement of scaffolding materials, potentially decreasing labor by 40-70% and improving jobsite safety. It also utilizes onboard analytics to provide data-driven insights for better project management and transparency.

- In April 2025, Layher opened a new distribution and support facility in Baltimore County, enhancing logistics and operational efficiency for North American projects.

- In April 2025, Layher commenced operations at a new automated and energy-efficient production facility supporting modular, integrated scaffolding systems. Advanced automation at this plant increases production speed and consistency and supports the rollout of their latest Allround Lightweight Scaffolding and Modular Access System (AGS).

Market Concentration & Characteristics

The North America Automated and Robotics Scaffolding System Market exhibits a moderately concentrated structure, with a few key players such as Layher, Inc., Kewazo, MEVA, Reo Lift, and KITSEN Scaffold & Formwork Technologies holding significant market shares. It is characterized by a strong focus on innovation, driven by rising demand for automation, safety compliance, and labor efficiency in construction and industrial sectors. The market favors companies with the capability to integrate hardware, software, and advanced robotics into turnkey scaffolding solutions. It is defined by a mix of established manufacturers with global reach and emerging technology firms offering specialized robotic systems. Competitive advantage depends on product reliability, deployment speed, and value-added services such as predictive analytics and remote monitoring. The United States dominates the regional market due to high infrastructure investments and faster technology adoption, while Canada and Mexico show steady growth supported by sector-specific applications and regulatory shifts. The market continues to evolve through strategic partnerships, investments in R&D, and expanding use cases across infrastructure, industrial maintenance, and shipbuilding.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Component, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by increased demand for construction automation across commercial and infrastructure projects.

- Robotic scaffolding systems will gain wider acceptance due to their ability to reduce labor costs and improve safety standards.

- Integration of IoT and AI will enhance real-time monitoring, predictive maintenance, and operational efficiency.

- The United States will remain the dominant regional market due to early technology adoption and regulatory support.

- Canada will see rising adoption in public infrastructure and industrial projects focused on safety and productivity.

- Mexico will offer long-term growth potential supported by industrial expansion and foreign investment.

- Hardware will continue to dominate component demand, while software adoption will rise with digitalization trends.

- Installation and erection services will remain the leading application segment due to consistent demand across sectors.

- Collaborations between construction firms and technology providers will accelerate product innovation and deployment.

- The market will face growing pressure to address cost barriers and upskill the workforce for system operation.