| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Automotive Repair and Maintenance Services Market Size 2024 |

USD 226.85 Million |

| North America Automotive Repair and Maintenance Services Market, CAGR |

8.40% |

| North America Automotive Repair and Maintenance Services Market Size 2032 |

USD 452.67 Million |

Market Overview

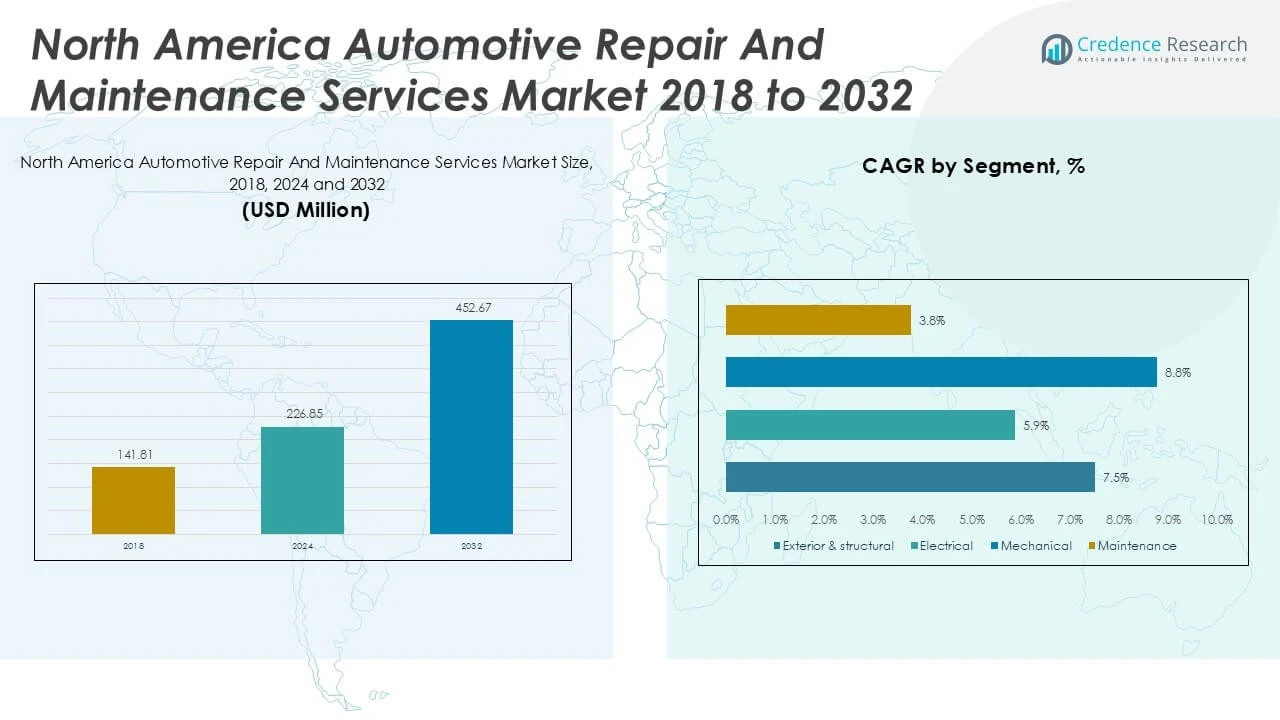

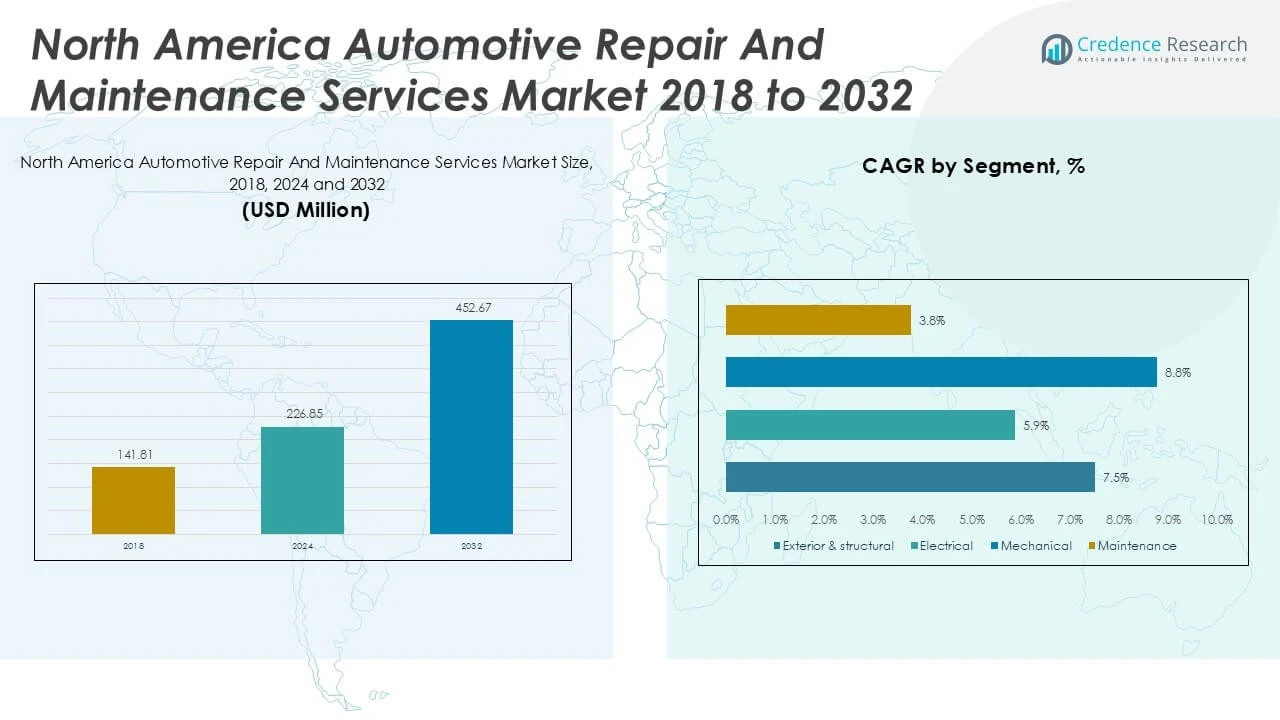

North America Automotive Repair and Maintenance Services Market size was valued at USD 141.81 million in 2018 to USD 226.85 million in 2024 and is anticipated to reach USD 452.67 million by 2032, at a CAGR of 8.40% during the forecast period.

The North American automotive repair and maintenance services market is experiencing significant growth, driven by several key factors. The increasing average age of vehicles, now at 13.6 years, necessitates more frequent maintenance and repairs. Advancements in vehicle technology, including electric vehicles and advanced driver-assistance systems, require specialized knowledge and equipment, prompting service providers to invest in training and tools. Digitalization is transforming the industry, with repair shops adopting advanced diagnostic tools and mobile apps to enhance efficiency and customer experience. However, the sector faces challenges such as a shortage of skilled technicians and economic pressures leading consumers to defer maintenance. Despite these hurdles, the market is projected to grow, with North America commanding a significant share due to its large vehicle population and technological advancements.

The North America Automotive Repair and Maintenance Services Market features a well-developed landscape, with the United States, Canada, and Mexico each contributing to the region’s robust service network. The U.S. leads in technological adoption, digital service offerings, and extensive vehicle ownership, while Canada emphasizes routine maintenance and compliance with regulatory standards across diverse climates. Mexico is emerging rapidly, supported by increasing urbanization and investment in formal service centers. The market is highly competitive, with prominent players such as AAMCO Transmissions and Total Car Care, AutoNation, Inc., and Firestone Complete Auto Care setting industry standards through their comprehensive service portfolios and nationwide reach. These companies leverage strong brand recognition, advanced diagnostic tools, and customer-focused digital solutions to capture a broad customer base and drive continued growth across North America.

Market Insights

- The North America Automotive Repair and Maintenance Services Market reached USD 226.85 million in 2024 and is projected to grow to USD 452.67 million by 2032, reflecting a CAGR of 8.40%.

- The market is supported by an aging vehicle fleet, increasing vehicle ownership, and a growing focus on preventive maintenance among consumers.

- Digital transformation is reshaping the sector, with workshops adopting advanced diagnostic tools, online booking systems, and contactless services to enhance customer experience.

- Leading companies such as AAMCO Transmissions and Total Car Care, AutoNation, Inc., and Firestone Complete Auto Care maintain a competitive edge through broad service portfolios and investments in technology and technician training.

- Skilled technician shortages, supply chain disruptions, and rising costs for parts and labor challenge operational efficiency and profitability for service providers across the region.

- The United States dominates the market with extensive infrastructure and rapid technology adoption, while Canada’s market growth is driven by regulatory compliance and Mexico is emerging with increased urbanization and formalization of service centers.

- Strong demand for electric and hybrid vehicle maintenance, rising adoption of digital platforms, and expansion of value-added services continue to create new growth opportunities in the regional market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Aging Vehicle Fleet and Rising Vehicle Ownership Fueling Demand for Maintenance Services

The North America Automotive Repair and Maintenance Services Market is benefiting from a steadily aging vehicle fleet across the region. The average age of vehicles on the road continues to rise, prompting consumers to seek more frequent repair and maintenance services to ensure reliability and safety. Higher vehicle ownership rates, combined with growing demand for used cars, have contributed to a larger pool of vehicles requiring ongoing service. Consumers now view regular maintenance as a necessity to preserve vehicle performance and value. The trend toward longer vehicle retention directly increases the need for both routine maintenance and complex repairs. Service providers report stronger business volumes as owners prioritize extending vehicle lifespans rather than replacing their vehicles quickly. It has made the market an essential part of the North American automotive ecosystem.

For instance, the average age of light vehicles in the U.S. reached 12.2 years in 2023, reflecting a growing need for maintenance and repair services.

Technological Advancements in Vehicles Requiring Specialized Services

Modern vehicles equipped with advanced driver-assistance systems, electric powertrains, and sophisticated onboard electronics have raised the bar for service expertise in the North America Automotive Repair and Maintenance Services Market. The growing complexity of automotive technologies has encouraged workshops to invest in advanced diagnostic tools and staff training. Specialized repair and calibration services are now critical for both independent and branded workshops to remain competitive. Customers expect service providers to handle a wide range of technical challenges, from battery systems in electric vehicles to sensor alignment in ADAS-equipped models. The integration of smart technologies and connectivity features has heightened consumer expectations for precision and quality. It is driving the need for continuous upskilling within the industry workforce.

For instance, the increasing adoption of connected car technologies and self-driving capabilities has driven demand for specialized repair services.

Digitalization and Convenience Driving Service Adoption

The North America Automotive Repair and Maintenance Services Market has experienced a surge in digitalization, with service centers introducing online booking, contactless payments, and real-time service tracking. Consumers appreciate seamless, transparent interactions that offer flexibility and control over their service appointments. Many workshops now use customer relationship management software to offer personalized reminders and updates, strengthening customer loyalty. The adoption of mobile apps and digital communication channels has made it easier for customers to schedule repairs and monitor progress. Service providers use digital tools to streamline inventory management and reduce service turnaround times. It has created a more efficient, customer-focused service environment.

Workforce Shortages and Economic Pressures Shaping Market Dynamics

The North America Automotive Repair and Maintenance Services Market continues to navigate persistent workforce shortages and economic challenges. A limited supply of skilled technicians restricts capacity, prompting workshops to increase investments in training and recruitment initiatives. Economic fluctuations influence consumer spending behavior, with some vehicle owners postponing non-essential repairs or opting for lower-cost services. Rising costs for parts and labor place pressure on both service providers and customers, impacting overall profitability. Competition from dealerships and quick-service chains drives innovation in pricing and value-added services. It forces market participants to differentiate through quality and customer experience. The market’s response to these challenges shapes its ongoing growth trajectory.

Market Trends

Adoption of Advanced Diagnostic Tools and Telematics Accelerates Service Precision

The North America Automotive Repair and Maintenance Services Market has experienced rapid integration of advanced diagnostic technologies and telematics solutions. Service providers rely on sophisticated diagnostic tools to identify and resolve complex issues in modern vehicles, including electric and hybrid models. The use of telematics enables remote vehicle monitoring and predictive maintenance, helping workshops proactively address faults before breakdowns occur. This technological evolution increases operational efficiency and minimizes downtime for vehicle owners. It has improved transparency for customers, who now expect digital records and real-time status updates. The market continues to shift toward data-driven diagnostics, which is redefining service quality standards across the region.

For instance, AI-based automated vehicle inspection technology has significantly improved efficiency, reducing inspection times to less than five minutes while cutting costs by 50%.

Expansion of Digital Platforms and Contactless Services Enhances Customer Engagement

The North America Automotive Repair and Maintenance Services Market has witnessed a surge in digital platform adoption, with many workshops offering online booking, contactless payment, and live service tracking. These innovations cater to consumer demand for convenience and safety, especially in urban and suburban markets. Workshops use mobile apps and integrated CRM systems to streamline communications and personalize service reminders. Customers value the ability to manage appointments, access service histories, and receive updates without visiting the workshop in person. It has driven higher retention rates and increased satisfaction among tech-savvy customers. Digital engagement is reshaping how repair businesses interact with their clientele.

For instance, 40-50% of customers now prefer scheduling repairs or maintenance services digitally, reflecting a shift toward online booking platforms.

Sustainability Initiatives and Shift to Electric Vehicles Influence Service Offerings

Sustainability concerns are prompting the North America Automotive Repair and Maintenance Services Market to adapt its service portfolio, with a stronger focus on electric vehicles and environmentally friendly practices. Workshops invest in specialized equipment for battery diagnostics, charging infrastructure, and eco-friendly parts. The transition to electric vehicles is reshaping demand for certain repair services, with more emphasis on software updates and less on traditional engine maintenance. It encourages service providers to pursue green certifications and implement waste reduction strategies. The focus on sustainability appeals to environmentally conscious customers. This trend positions the market to align with broader environmental goals and regulatory standards.

Growth of Franchise Networks and Industry Consolidation Improves Service Consistency

The North America Automotive Repair and Maintenance Services Market has seen significant growth in franchise networks and consolidation among industry players. Large chains acquire independent garages to expand service reach and ensure uniform standards. Franchise operations benefit from centralized procurement, consistent training, and branded customer experiences. The consolidation trend boosts operational efficiencies and allows for better adoption of best practices across multiple locations. It helps businesses maintain quality while expanding rapidly into new markets. This evolution supports the delivery of standardized, reliable service across the region.

Market Challenges Analysis

Shortage of Skilled Technicians and Rapid Technological Change Impact Service Capabilities

The North America Automotive Repair and Maintenance Services Market faces a persistent shortage of skilled technicians, which restricts growth and service quality across the region. Many workshops struggle to recruit and retain qualified professionals capable of handling advanced vehicle systems and diagnostic technologies. Rapid technological advancements in electric vehicles, ADAS, and onboard electronics require continual investment in training and specialized tools. Smaller businesses find it difficult to keep pace with these demands, resulting in service delays and lost business opportunities. The skills gap limits the ability of the industry to meet evolving customer expectations and complex repair requirements. It creates a competitive environment where talent acquisition and retention become critical priorities.

For instance, the growing complexity of modern vehicles has increased demand for specialized technicians, with service centers investing in advanced training programs.

Economic Volatility and Parts Supply Disruptions Pressure Market Profitability

The North America Automotive Repair and Maintenance Services Market contends with economic volatility and supply chain disruptions that affect both operating costs and customer demand. Fluctuating economic conditions influence consumers to defer non-essential repairs or choose lower-cost service alternatives. Supply shortages and rising prices for parts and materials disrupt workshop operations and erode profit margins. Service providers must navigate changing regulatory requirements and adapt to variable inventory availability. It places strain on business planning and long-term growth strategies. These challenges require continuous adaptation to sustain profitability and ensure consistent service delivery in a highly competitive market.

Market Opportunities

Expansion of Electric and Hybrid Vehicle Services Creates New Revenue Streams

The North America Automotive Repair and Maintenance Services Market offers substantial opportunities through the growing adoption of electric and hybrid vehicles. Rising consumer interest and government incentives for cleaner transportation increase demand for specialized maintenance, battery diagnostics, and repair solutions. Service centers that invest in EV-specific equipment and technician training can capture a new segment of customers requiring expertise in advanced propulsion systems and software updates. Workshops equipped to handle both conventional and electric vehicles position themselves as trusted service partners for a broader clientele. It creates potential for long-term contracts and recurring service agreements with fleet operators and eco-conscious consumers. The shift toward sustainable mobility expands business prospects for forward-thinking service providers.

Digital Platforms and Value-Added Services Enhance Customer Engagement

The North America Automotive Repair and Maintenance Services Market benefits from the rapid evolution of digital service platforms and customer-centric innovations. Online booking, automated reminders, and personalized maintenance plans drive higher retention and improve service efficiency. Service providers using mobile apps, telematics, and digital payment solutions offer a seamless, transparent experience that meets modern consumer expectations. Value-added offerings such as pick-up and drop-off, loyalty programs, and subscription-based maintenance packages foster long-term relationships and differentiate businesses from competitors. It empowers workshops to build brand loyalty and increase revenue per customer. These digital advancements open new avenues for growth across both urban and rural markets.

Market Segmentation Analysis:

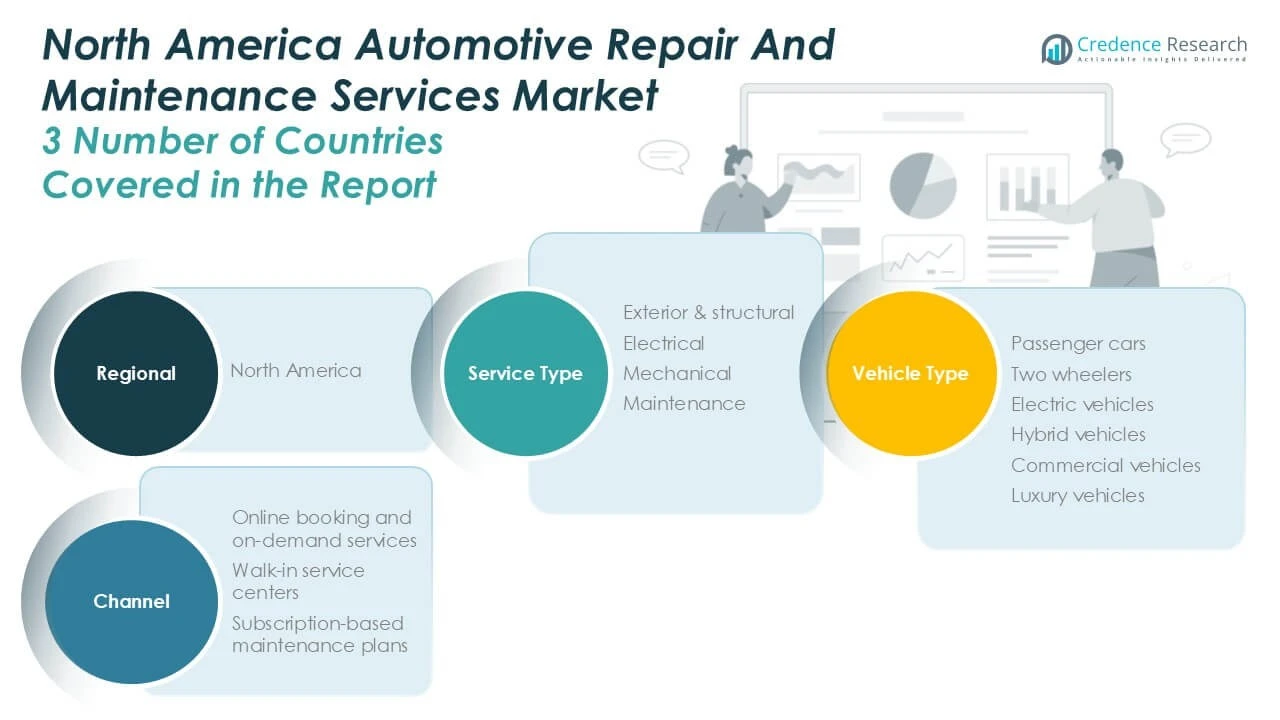

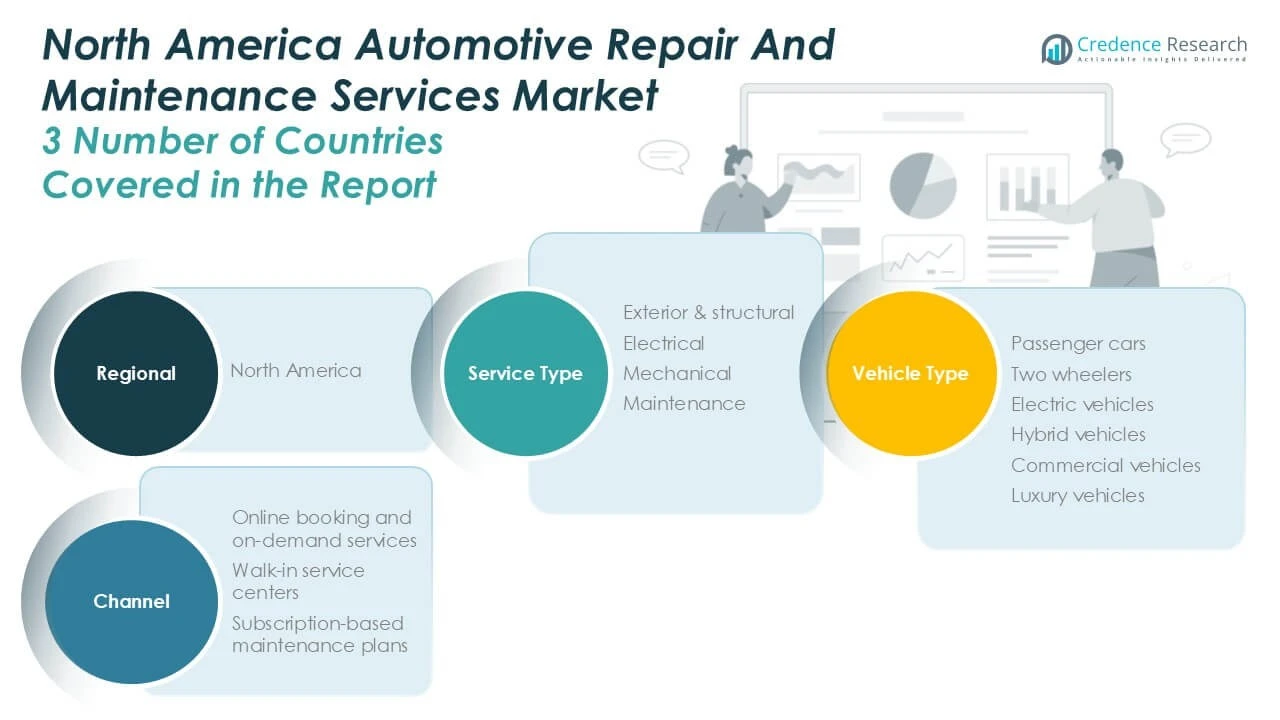

By Service Type:

The North America Automotive Repair and Maintenance Services Market comprises several key service segments: exterior & structural, electrical, mechanical, and maintenance services. Exterior & structural repairs address issues such as body damage, paint restoration, and structural realignment. Electrical services cover battery replacements, wiring, lighting, and advanced diagnostic services for modern vehicle electronics. Mechanical services focus on engine, transmission, suspension, and brake repairs, meeting the core operational needs of all vehicle types. Maintenance services, which include oil changes, filter replacements, tire rotation, and fluid checks, remain a routine requirement for vehicle owners seeking longevity and optimal performance. It is clear that service diversification helps providers address evolving consumer and vehicle technology demands.

By Vehicle Type:

The market’s vehicle type segmentation includes passenger cars, two wheelers, electric vehicles, hybrid vehicles, commercial vehicles, and luxury vehicles. Passenger cars constitute the largest segment, driven by the extensive private vehicle ownership base in North America. Commercial vehicles require specialized repair and maintenance schedules due to heavy usage and regulatory compliance standards. The growing adoption of electric and hybrid vehicles opens new opportunities for providers with expertise in battery systems, power electronics, and software-driven diagnostics. Luxury vehicles create demand for premium services, precision repairs, and genuine parts, supporting higher revenue per service engagement. It is essential for workshops to adapt their service portfolios and invest in training to meet diverse requirements across vehicle types.

By Channel:

Channel segmentation in the North America Automotive Repair and Maintenance Services Market consists of online booking and on-demand services, walk-in service centers, and subscription-based maintenance plans. Online booking and on-demand platforms enhance convenience, enabling customers to schedule repairs and maintenance remotely, while tracking progress through digital interfaces. Walk-in service centers remain popular for their accessibility and immediate assistance, especially for urgent repairs or routine maintenance needs. Subscription-based maintenance plans attract consumers with predictable costs and bundled services, encouraging regular vehicle upkeep. It is evident that the shift toward digital and value-added channels supports greater customer engagement and drives recurring revenue for service providers across the region.

Segments:

Based on Service Type:

- Exterior & structural

- Electrical

- Mechanical

- Maintenance

Based on Vehicle Type:

- Passenger cars

- Two wheelers

- Electric vehicles

- Hybrid vehicles

- Commercial vehicles

- Luxury vehicles

Based on Channel:

- Online booking and on-demand services

- Walk-in service centers

- Subscription-based maintenance plans

Based on the Geography:

Regional Analysis

United States

The United States commands the largest share of the North America Automotive Repair and Maintenance Services Market, accounting for approximately 78% of the regional market value in 2024. The country’s dominant position stems from its expansive vehicle parc, advanced automotive infrastructure, and widespread adoption of new vehicle technologies. Urbanization, higher rates of vehicle ownership, and consumer preference for regular preventive maintenance have driven consistent demand for repair and maintenance services nationwide. Service centers in the U.S. have rapidly embraced technological advancements, including advanced diagnostics, telematics integration, and digital service platforms, to enhance operational efficiency and customer experience. The proliferation of electric and hybrid vehicles has encouraged workshops to upskill technicians and invest in EV-specific equipment, supporting evolving mobility trends. Franchised and independent service networks maintain a highly competitive landscape, leading to continuous innovation in customer engagement, loyalty programs, and subscription-based service models. The U.S. market is also characterized by robust partnerships between OEMs, fleet operators, and independent service providers, which further reinforce market stability and growth. It benefits from established supply chains, enabling timely access to quality parts and materials, which is critical in supporting high service volumes across both urban and rural regions.

Canada

Canada holds a market share of around 13% in the North America Automotive Repair and Maintenance Services Market, positioning it as the second-largest regional contributor. The Canadian market is driven by a steadily aging vehicle fleet, with average vehicle age consistently increasing, prompting higher maintenance and repair frequency. Seasonal climate extremes—ranging from harsh winters to warm summers—create unique demands for exterior, structural, and mechanical maintenance. Regulatory standards concerning emissions and vehicle safety also drive service activity, requiring regular inspections and repairs for compliance. Canadian service centers have adopted digital booking and CRM systems, making the customer experience more efficient and transparent. The rise in electric and hybrid vehicle adoption, while not as rapid as in the U.S., continues to open new service segments for shops equipped with advanced diagnostic and battery repair capabilities. Franchise networks and large chains dominate the urban markets, whereas smaller independent operators serve remote and rural areas. Canada’s market benefits from a high level of consumer trust in branded service providers, reinforcing stable demand across the country. It faces challenges such as technician shortages and fluctuating parts costs, yet continues to post steady year-over-year growth in revenue.

Mexico

Mexico contributes approximately 9% of the North America Automotive Repair and Maintenance Services Market, reflecting its status as an emerging and rapidly growing market within the region. The expansion of Mexico’s vehicle parc, driven by rising economic prosperity and urbanization, has led to increased demand for both repair and routine maintenance services. The country’s automotive aftermarket is characterized by a blend of formal service centers and a large informal repair sector, especially prevalent in smaller cities and rural communities. Growth in the commercial vehicle segment, alongside the gradual adoption of modern diagnostic and digital booking tools, is encouraging formalization and investment from both domestic and international service providers. Mexico’s market is also witnessing a gradual increase in electric and hybrid vehicle adoption, though this segment remains nascent compared to the U.S. and Canada. Service providers are responding by expanding their service portfolios and investing in technician training to cater to new vehicle technologies. Supply chain complexities and cost sensitivity present ongoing challenges, but government initiatives supporting skills development and infrastructure improvements provide long-term growth prospects. It stands poised for higher growth rates, given ongoing investment, rising vehicle ownership, and a strengthening middle class.

Key Player Analysis

- AAMCO Transmissions and Total Car Care

- AutoNation, Inc.

- Clyde’s Car Care

- Driven Brands Holding Ltd.

- Firestone Complete Auto Care

- Goodyear Auto Service

- Jiffy Lube International, Inc.

- Les Schwab Tire Centers

- Meineke Car Care Centers, Inc.

- Midas, Inc.

- Monro, Inc.

Competitive Analysis

The North America Automotive Repair and Maintenance Services Market features a competitive landscape dominated by several leading players, including AAMCO Transmissions and Total Car Care, AutoNation, Inc., Firestone Complete Auto Care, Driven Brands Holding Ltd., and Goodyear Auto Service. These companies have established extensive service networks across urban and suburban areas, leveraging strong brand recognition and broad service portfolios to capture significant market share. They prioritize investments in advanced diagnostic tools, digital booking platforms, and technician training to address evolving vehicle technologies and changing customer preferences. Strategic partnerships with OEMs, fleet operators, and insurance providers further enhance their service capabilities and market presence. Franchise models and branded service centers allow these key players to ensure consistency, high-quality standards, and customer loyalty across multiple locations. The competitive environment encourages continuous innovation, including the introduction of subscription-based maintenance plans, value-added services, and loyalty programs. Leading companies actively pursue growth through mergers, acquisitions, and expansion into electric and hybrid vehicle servicing. Their ability to quickly adapt to industry trends, such as digitalization and sustainability, gives them a distinct advantage over smaller independent operators. The market’s top players remain focused on operational efficiency, customer satisfaction, and long-term brand strength to maintain their leadership positions.

Recent Developments

- In January, 2023, the company AutoNation, Inc. the largest auto retailer in the US, has revealed that it has successfully acquired RepairSmith, a full-service mobile solution for auto repair and maintenance with a notable operational footprint in the western and southern United States. RepairSmith is based in Los Angeles.

- In June 2022, A wholly owned subsidiary of TVS Automobile Solutions Pvt. Ltd., MyTVS Accessoriesis a brand of car accessories. Ltd. launched its “Life360” digital platform to provide its clients with a selection of auto repair services. A three-year subscription cost $60 (INR 5,000) thanks to the adoption of a subscription-based business model. In addition to mechanical, collision and maintenance, diagnostic, roadside assistance, accessories, and vehicle services, it offered comprehensive repair services.

- In June 2022, The American business YourMechanic, which offers mobile automotive repair and maintenance services to vehicle owners on-site, has been acquired by Wrench, a mobile vehicle services and technology marketplace. More than 35,000 zip codes will be serviced by the combined company’s more than 20,000 monthly private and fleet vehicle customers.

- In October 2022, A company devoted to auto repair, Caliber, announced that during the fourth quarter of 2021, it would purchase up to 17 collision repair facilities from American auto retailer AutoNation.

Market Concentration & Characteristics

The North America Automotive Repair and Maintenance Services Market demonstrates a moderately high level of market concentration, with several large branded players and franchise networks accounting for a significant portion of industry revenue. It features a blend of established corporate chains, independent garages, and specialized service centers, creating a dynamic environment where both scale and niche expertise play critical roles. Large service providers use extensive branch networks and standardized processes to deliver consistent quality, while independent operators differentiate through personalized service and local relationships. The market is characterized by rapid technological adoption, frequent integration of digital platforms, and a strong focus on technician training to address the increasing complexity of modern vehicles. It adapts to changing consumer expectations with subscription models, on-demand services, and tailored maintenance solutions. This competitive and innovative landscape ensures customers have access to a wide range of service options, supporting both convenience and quality across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, Vehicle Type, Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The North America Automotive Repair and Maintenance Services Market is projected to grow steadily through 2032, driven by an aging vehicle fleet and increasing demand for preventive maintenance.

- The rising adoption of electric and hybrid vehicles is creating new service opportunities, prompting workshops to invest in specialized training and equipment.

- Digital transformation is reshaping the industry, with service providers implementing advanced diagnostic tools, online booking systems, and customer relationship management platforms.

- Subscription-based maintenance plans and on-demand mobile services are gaining popularity, offering consumers convenience and predictable service costs.

- The shortage of skilled technicians remains a significant challenge, leading to increased investment in workforce development and training programs.

- Regulatory initiatives, including right-to-repair laws, are influencing market dynamics by promoting transparency and accessibility in vehicle maintenance.

- The integration of telematics and predictive analytics is enabling proactive maintenance strategies, reducing downtime and enhancing customer satisfaction.

- Consolidation among service providers is intensifying competition, with larger chains expanding their market presence through acquisitions and franchising.

- Environmental concerns are driving the adoption of eco-friendly practices, such as recycling programs and the use of sustainable materials in repair processes.

- Consumer expectations for seamless, technology-driven experiences are pushing service providers to innovate and enhance their service offerings continually.