| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Hub Motors Market Size 2024 |

USD 8,615.96 Million |

| Automotive Hub Motors Market , CAGR |

5.37 % |

| Automotive Hub Motors Market Size 2032 |

USD 13,067.57Million |

Market Overview

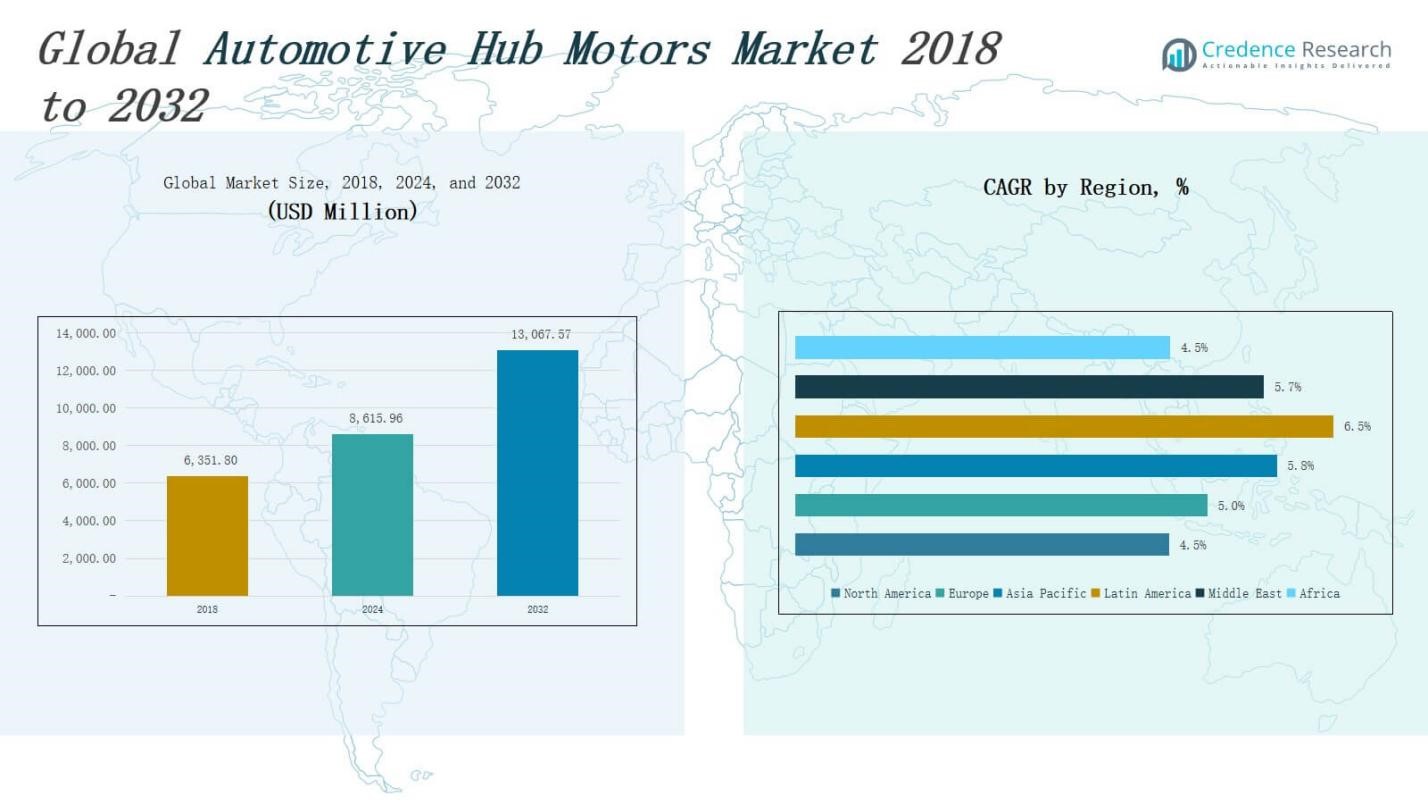

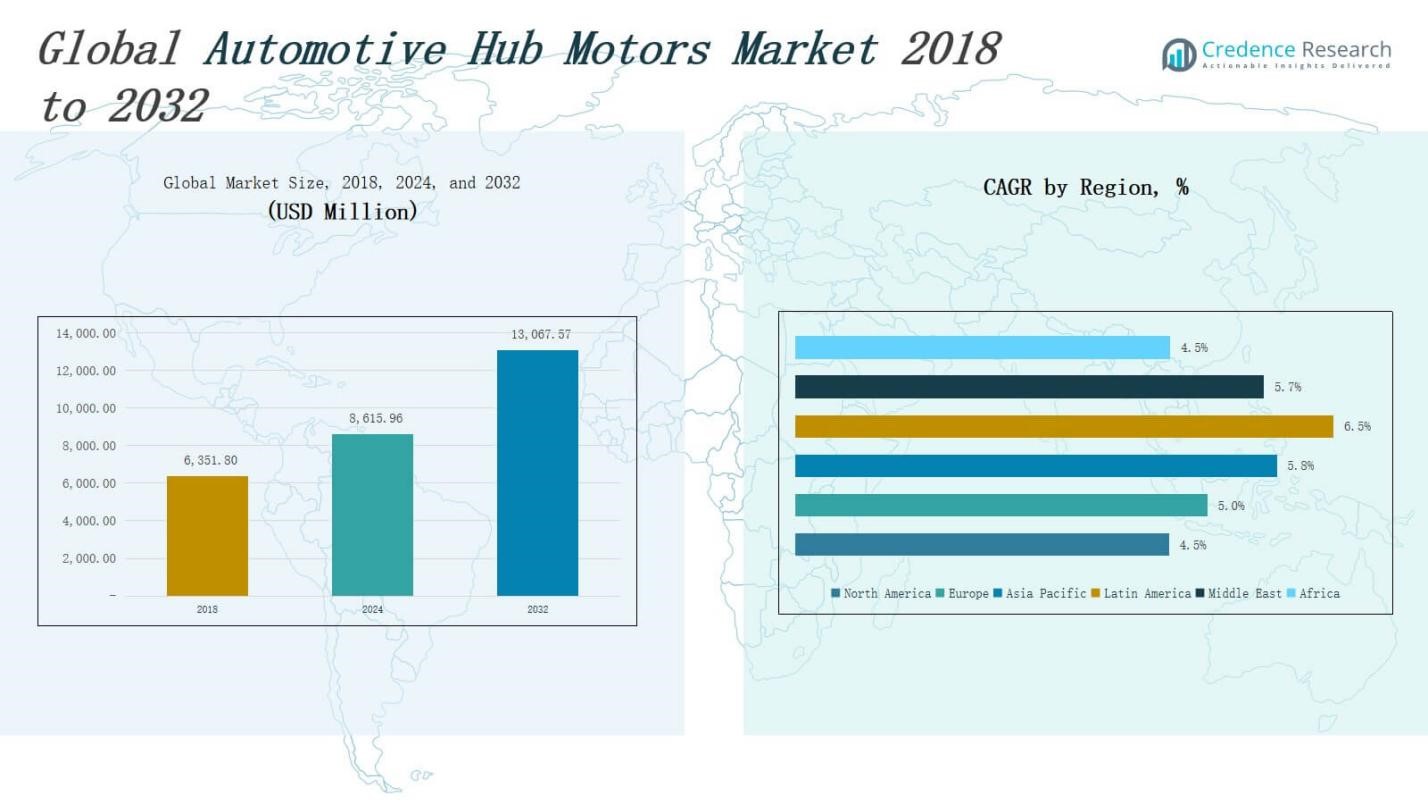

The Automotive Hub Motors Market size was valued at USD 6,351.80 million in 2018 to USD 8,615.96 million in 2024 and is anticipated to reach USD 13,067.57 million by 2032, at a CAGR of 5.37 % during the forecast period.

The Automotive Hub Motors Market is driven by the accelerating demand for electric vehicles, rising fuel efficiency concerns, and stringent global emission regulations. Hub motors offer a compact, efficient drivetrain solution by integrating the motor directly into the wheel hub, eliminating the need for conventional transmission systems and enhancing design flexibility. Automakers are increasingly adopting hub motors in urban electric mobility solutions, including e-bikes, electric scooters, and light electric vehicles, due to their reduced maintenance, high torque output, and improved space utilization. The growing emphasis on vehicle electrification and the expansion of smart city infrastructure further support market growth. Technological advancements in power electronics, lightweight materials, and integrated control systems are improving hub motor performance, efficiency, and durability. Trends include the integration of regenerative braking systems, wireless connectivity, and modular motor designs. Strategic collaborations between OEMs and motor manufacturers are facilitating large-scale commercialization and innovation, positioning hub motors as a key enabler of next-generation electric mobility.

The Automotive Hub Motors Market spans key regions including North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Asia Pacific leads in revenue share, driven by large-scale EV adoption in China, India, and Japan. Europe follows with strong regulatory support and advanced automotive infrastructure, while North America benefits from urban micromobility demand and fleet electrification. Latin America shows growth potential in Brazil and Mexico due to rising fuel costs and urbanization. The Middle East and Africa are emerging markets with supportive government initiatives and early adoption of compact EVs. Key players in the Automotive Hub Motors Market include Schaeffler Technologies AG & Co. KG, Michelin Group, Protean Electric Ltd., Elaphe Ltd., Heinzmann GmbH & Co. KG, Mitsubishi Motors Corporation, Taizhou Quanshun Motor Co., Ltd., TDCM Corporation Ltd., Magnetic Systems Technology Ltd., and other regional participants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Hub Motors Market was valued at USD 6,351.80 million in 2018 and is expected to reach USD 13,067.57 million by 2032, growing at a CAGR of 5.37%.

- Growth is driven by rising electric vehicle demand, fuel efficiency targets, and global emission mandates encouraging compact, low-maintenance drivetrain solutions.

- Hub motors eliminate the need for conventional transmissions, allowing for simplified vehicle architecture, better space utilization, and improved performance.

- Integration of regenerative braking, smart control systems, and modular motor designs enhances functionality, energy recovery, and compatibility with urban EV platforms.

- Asia Pacific dominates the market, led by China, India, and Japan, while Europe and North America follow with strong regulatory support and advanced EV infrastructure.

- Key players include Schaeffler Technologies, Michelin Group, Protean Electric, Elaphe, Heinzmann, TDCM Corporation, Mitsubishi Motors, and Magnetic Systems Technology.

- Challenges include thermal management in high-load conditions and increased unsprung mass affecting vehicle dynamics, especially in performance and off-road applications.

Market Drivers

Rising Demand for Electric Vehicles Across Urban and Suburban Landscapes

The Automotive Hub Motors Market is gaining traction due to the growing shift toward electric mobility driven by climate regulations and rising fuel prices. Governments are offering subsidies, tax benefits, and regulatory support to accelerate EV adoption, which boosts demand for compact and efficient hub motors. Urban populations prefer electric two-wheelers and compact vehicles for last-mile transport, making hub motors a practical solution. It supports space optimization and enhances vehicle agility. OEMs are focusing on lightweight, cost-effective electric drivetrains. Hub motors align with this shift, providing manufacturers a path to reduce complexity and improve efficiency.

- For instance, ZOE by Renault has integrated compact drivetrain technologies to maintain a flat floor and optimize cabin space, highlighting the utility of space-saving designs like hub motors.

- Design Flexibility and Elimination of Traditional Drivetrain Components

The Automotive Hub Motors Market benefits from the structural advantages of in-wheel motor technology. By eliminating axles, transmissions, and differentials, hub motors reduce overall vehicle weight and increase energy efficiency. It simplifies mechanical design, reduces maintenance, and lowers manufacturing costs. Engineers gain flexibility to reconfigure vehicle architecture for better space utilization. Compact integration of power and control systems improves overall vehicle performance. Automakers leverage these benefits to create innovative, scalable EV platforms across multiple vehicle categories.

- For instance, the Lightyear 0, a solar-assisted production car, utilized Elaphe in-wheel motors in 2022, allowing for a flat floor and flexible cabin design by freeing up space usually dedicated to traditional drivetrain components. This enabled Lightyear to enhance seating and cargo layouts significantly

Technological Advancements Enhancing Power and Durability

The Automotive Hub Motors Market is advancing due to innovations in materials, thermal management, and electronic control systems. High-performance magnets, efficient cooling solutions, and advanced insulation techniques enable hub motors to deliver higher torque without overheating. Integration of smart sensors and digital controllers improves precision, responsiveness, and safety. It enhances energy efficiency while supporting regenerative braking. These technological upgrades improve the lifespan and reliability of hub motors, making them suitable for both light-duty and high-performance applications. Manufacturers are investing heavily in R&D to improve scalability.

Supportive Regulatory Framework and Clean Mobility Targets

The Automotive Hub Motors Market is supported by global regulatory frameworks promoting sustainable transportation. Policies targeting zero-emission vehicle mandates, carbon neutrality goals, and air quality improvement drive adoption of electric mobility technologies. Hub motors help manufacturers meet compliance targets without compromising vehicle performance. It aligns with city-level mandates for noise and emission reduction in public and personal transportation. Incentives for electric mobility infrastructure further accelerate demand. Strategic government initiatives fuel innovation and large-scale hub motor deployments across regions.

Market Trends

Integration of Regenerative Braking Systems with Hub Motors

The Automotive Hub Motors Market is witnessing increased integration of regenerative braking systems to enhance energy efficiency. Regenerative braking allows the motor to convert kinetic energy into electrical energy during deceleration, extending battery range and reducing wear on traditional braking systems. It improves overall vehicle performance while supporting sustainability goals. Manufacturers are embedding this functionality into hub motors to deliver seamless energy recovery. It enables compact electric vehicles to operate more efficiently in stop-and-go urban conditions, increasing adoption in e-mobility platforms.

- For instance, Hyundai’s Kona Electric features a smart regenerative braking system that automatically adjusts braking based on real-time road conditions, allowing captured kinetic energy to recharge the battery and extend range.

Growth of Lightweight and Modular Motor Designs

The Automotive Hub Motors Market is experiencing a shift toward lightweight and modular designs that support scalable vehicle development. Automakers aim to reduce vehicle mass to improve energy consumption and handling. Modular hub motors allow easy integration across multiple platforms, including e-bikes, scooters, and compact EVs. It provides manufacturers with production flexibility while reducing time-to-market. Composite materials, compact configurations, and fewer moving parts also lower maintenance costs. This trend aligns with the industry’s pursuit of streamlined manufacturing and cost efficiency in electric drivetrains.

- For instance, Donut Labs developed an in-wheel motor system for the Verge electric motorcycle platform, delivering 4,300 Nm torque and 630 kW power at just 40 kg, demonstrating unprecedented power-to-weight ratios and easy integration across vehicles—from bikes to commercial trucks.

Increasing Adoption in Commercial and Last-Mile Delivery Vehicles

The Automotive Hub Motors Market is expanding into commercial transport, particularly in last-mile delivery applications. Fleet operators seek efficient, low-maintenance solutions for urban logistics. Hub motors enable compact powertrains with fewer mechanical losses and better maneuverability. It allows for easier vehicle customization and helps meet noise and emission regulations in dense city zones. Rising e-commerce demand is driving deployment of electric delivery vans and tricycles equipped with hub motors. Companies value the technology’s ease of integration and operational cost savings.

Advancement in Smart Connectivity and Control Systems

The Automotive Hub Motors Market is evolving with smart control technologies that enhance motor responsiveness and safety. Embedded sensors and electronic control units (ECUs) manage torque distribution, wheel slip, and braking coordination in real time. It improves vehicle handling, especially in autonomous and driver-assist platforms. The rise of connected vehicles supports integration with telematics for performance monitoring and diagnostics. These digital enhancements make hub motors a strategic fit for intelligent mobility ecosystems and future-ready EV architectures.

Market Challenges Analysis

Thermal Management and Durability Issues in High-Load Conditions

The Automotive Hub Motors Market faces significant challenges related to thermal management and long-term durability. Hub motors are directly exposed to road debris, heat, and mechanical stress, which can reduce lifespan and performance. Managing excess heat in compact in-wheel units remains complex, especially during sustained high-speed operation or in heavy vehicles. It limits their deployment in larger EVs and high-performance segments. Manufacturers are under pressure to develop advanced cooling systems without increasing weight or cost. Failures in insulation or bearing wear can lead to reliability concerns and higher maintenance frequency.

Complexity in Suspension and Unsprung Mass Impact on Ride Quality

The Automotive Hub Motors Market must address the impact of increased unsprung mass on vehicle dynamics. Placing the motor within the wheel hub increases the weight of suspension components, affecting handling, ride comfort, and overall stability. It can reduce efficiency on rough terrains and limit performance in premium or high-speed vehicles. Engineers must redesign suspension systems to compensate, increasing development time and cost. It also poses challenges for integration into existing vehicle platforms. Automakers may hesitate to adopt the technology without proven solutions for managing ride quality and control.

Market Opportunities

Expansion of Urban E-Mobility and Last-Mile Transport Solutions

The Automotive Hub Motors Market presents strong opportunities in the expanding urban e-mobility and last-mile delivery sectors. Demand for compact, energy-efficient transport options is growing across dense metropolitan areas. Hub motors support low-emission vehicles such as electric scooters, e-bikes, and three-wheelers by offering compact design and direct drive capability. It enables better maneuverability and reduces maintenance for urban fleet operators. Governments are promoting micro-mobility adoption through subsidies and infrastructure development. Startups and established OEMs are actively exploring hub motor integration in light commercial and passenger mobility solutions.

Adoption in Autonomous and Digitally Connected Vehicle Platforms

The Automotive Hub Motors Market is well-positioned to benefit from the growing shift toward autonomous and digitally controlled vehicles. Hub motors allow precise torque distribution to individual wheels, which supports advanced control algorithms in autonomous navigation. It enables vehicle designers to build flexible platforms without traditional drivetrain constraints. Integration with telematics, IoT, and vehicle-to-everything (V2X) systems enhances functionality and diagnostics. This creates opportunities for smart fleets and shared mobility services. Manufacturers can tap into future-ready applications where compact, software-defined drivetrains offer competitive advantages.

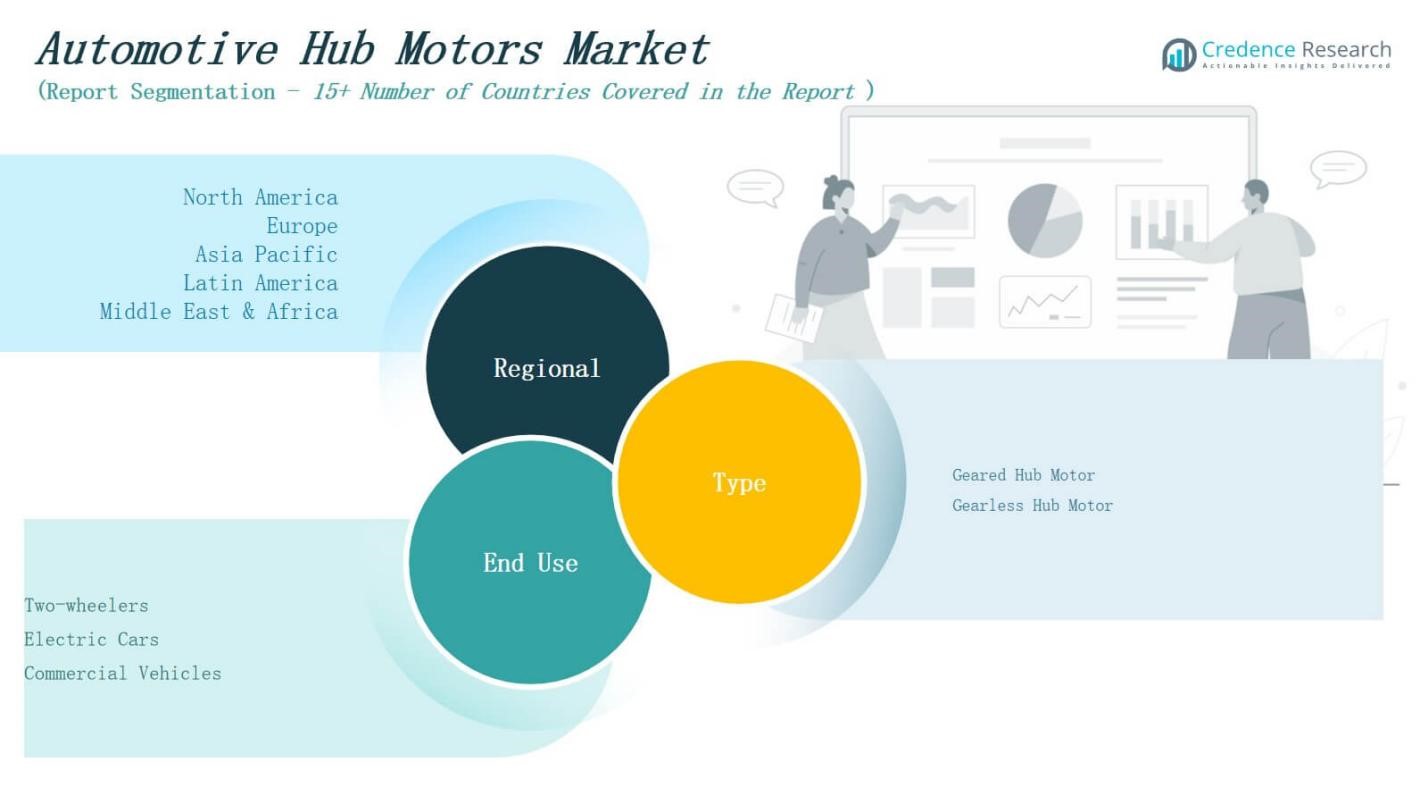

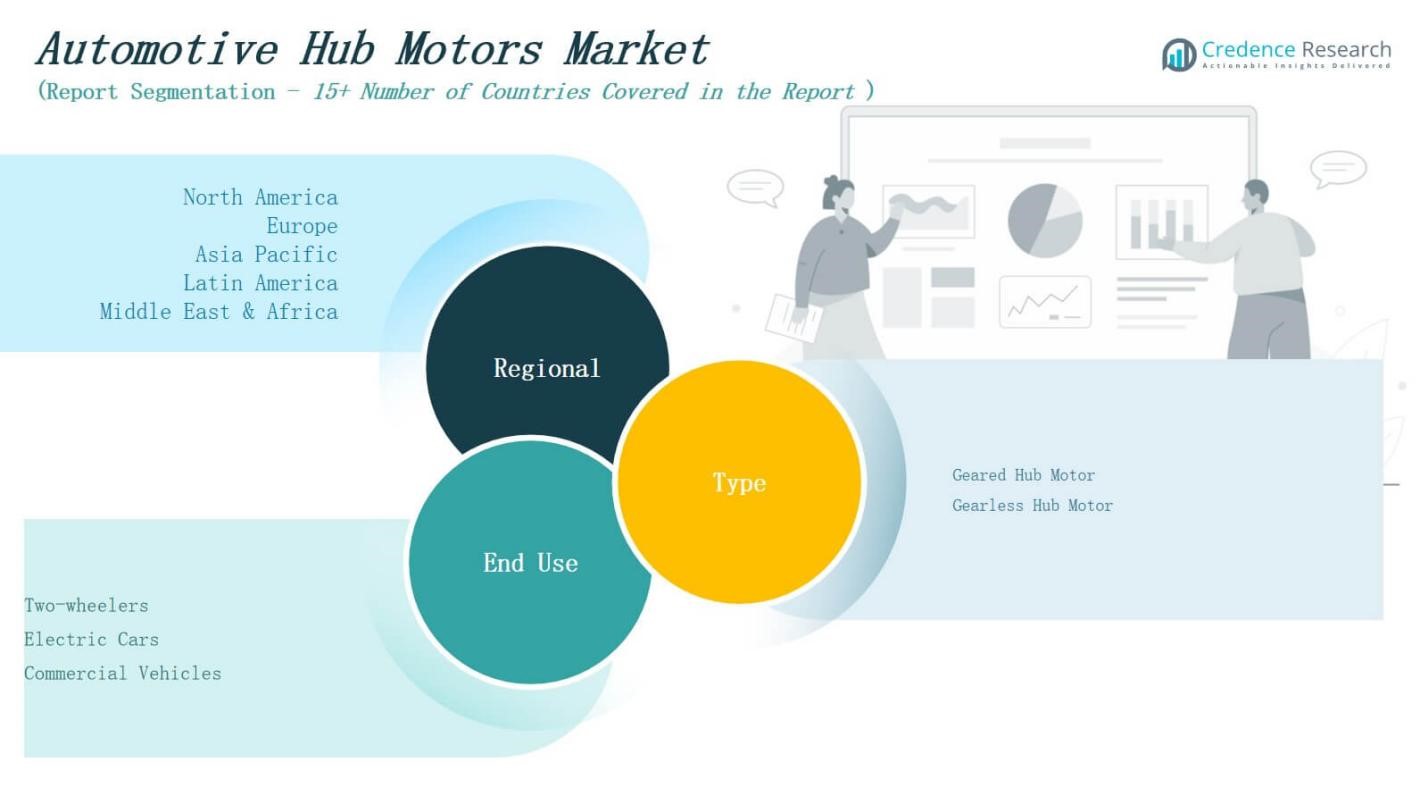

Market Segmentation Analysis:

By Type

The Automotive Hub Motors Market, based on type, is segmented into geared hub motors and gearless hub motors. Geared hub motors offer better torque output and are widely used in two-wheelers and light commercial vehicles that operate on inclined or uneven terrains. Their mechanical complexity increases maintenance requirements but provides better low-speed control. Gearless hub motors are gaining popularity in electric cars and scooters due to their quiet operation, low maintenance, and high efficiency. It allows for a simpler structure and supports longer lifecycle performance. Market growth is strong for gearless variants in urban applications where smooth acceleration and minimal mechanical wear are preferred.

- For instance, QS Motor supplies geared hub motors widely used in electric motorcycles and e-scooters around the globe, with products that offer up to 13kW of power and have been integrated by OEMs for demanding applications requiring high torque on inclines.

By End Use

The Automotive Hub Motors Market, by end use, includes two-wheelers, electric cars, and commercial vehicles. Two-wheelers hold a major share due to the rapid adoption of electric scooters and motorcycles in densely populated regions. It supports compact design and cost-effective mobility solutions. Electric cars are increasingly integrating hub motors to optimize space and reduce drivetrain losses, especially in small to mid-size EVs. Commercial vehicles are adopting hub motors in last-mile delivery applications to meet efficiency and sustainability goals. It enhances vehicle control and lowers fuel and maintenance costs for fleet operators.

- For instance, QS Motor supplies hub motors for leading two-wheeler EV manufacturers, enabling enhanced torque and reduced maintenance, which supports the high demand for electric two-wheelers in densely populated Asian cities.

Segments:

Based on Type

- Geared Hub Motor

- Gearless Hub Motor

Based on End Use

- Two-wheelers

- Electric Cars

- Commercial Vehicles

Based on Region

North America:

Europe:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific:

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America:

- Brazil

- Argentina

- Rest of Latin America

Middle East:

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa:

- South Africa

- Egypt

- Rest of Africa

Regional Analysis

North America

The North America Automotive Hub Motors Market size was valued at USD 1,191.60 million in 2018 to USD 1,543.24 million in 2024 and is anticipated to reach USD 2,192.74 million by 2032, at a CAGR of 4.5% during the forecast period. North America holds a significant share in the Automotive Hub Motors Market due to rising adoption of electric two-wheelers and last-mile delivery vehicles. It benefits from a strong presence of mobility startups and favorable state-level incentives for electric mobility. The U.S. leads regional demand with initiatives focused on decarbonization and fleet electrification. Canada is witnessing moderate growth with urban micromobility pilots. Local OEMs are integrating hub motors into low-emission vehicles to comply with federal regulations. The market is further supported by infrastructure development and strong consumer awareness.

Europe

The Europe Automotive Hub Motors Market size was valued at USD 1,740.39 million in 2018 to USD 2,309.08 million in 2024 and is anticipated to reach USD 3,397.57 million by 2032, at a CAGR of 5.0% during the forecast period. Europe commands a strong share in the Automotive Hub Motors Market with high EV penetration and supportive regulatory frameworks. It is driven by carbon neutrality goals, strict emission standards, and incentives for zero-emission vehicles. Countries like Germany, France, and the UK are major contributors, with widespread integration of hub motors in electric cars and two-wheelers. The market benefits from innovation by automotive OEMs and tier-1 suppliers. Urban logistics and shared mobility sectors are boosting demand for compact hub motor-powered vehicles. Strong R&D ecosystems accelerate product development and efficiency improvements.

Asia Pacific

The Asia Pacific Automotive Hub Motors Market size was valued at USD 2,202.17 million in 2018 to USD 3,065.06 million in 2024 and is anticipated to reach USD 4,806.25 million by 2032, at a CAGR of 5.8% during the forecast period. Asia Pacific dominates the global Automotive Hub Motors Market by revenue share, led by China, India, Japan, and South Korea. It benefits from large-scale production, cost-efficient supply chains, and aggressive government targets for electrification. China leads adoption with widespread use of electric scooters, motorcycles, and compact EVs. India is scaling up electric two-wheeler and rickshaw segments supported by subsidies. Japanese and Korean manufacturers are advancing lightweight, efficient hub motors. The region’s dense urban population and focus on clean transport drive sustained growth.

Latin America

The Latin America Automotive Hub Motors Market size was valued at USD 635.18 million in 2018 to USD 923.26 million in 2024 and is anticipated to reach USD 1,524.99 million by 2032, at a CAGR of 6.5% during the forecast period. Latin America shows rising potential in the Automotive Hub Motors Market due to increasing urbanization and policy shifts toward sustainable transport. Brazil and Mexico lead demand, with growing use of electric two-wheelers and shared mobility services. It is driven by high fuel costs, poor air quality in cities, and public sector investment in clean mobility. Regional players are exploring hub motors for low-maintenance fleet operations. Lightweight electric vehicles for delivery and personal use support growth. Consumer awareness and import regulations may impact market expansion speed.

Middle East

The Middle East Automotive Hub Motors Market size was valued at USD 245.81 million in 2018 to USD 338.98 million in 2024 and is anticipated to reach USD 525.32 million by 2032, at a CAGR of 5.7% during the forecast period. The Middle East Automotive Hub Motors Market is evolving with early adoption of electric vehicles in the UAE, Israel, and Saudi Arabia. It is gaining interest through government sustainability plans and urban mobility programs. Electric two-wheelers and compact utility EVs are entering the market, creating opportunities for hub motor applications. Strategic partnerships with global OEMs support technology transfer and localized solutions. It faces challenges in battery infrastructure but benefits from favorable policy momentum. High per capita income and smart city initiatives boost regional prospects.

Africa

The Africa Automotive Hub Motors Market size was valued at USD 336.65 million in 2018 to USD 436.34 million in 2024 and is anticipated to reach USD 620.71 million by 2032, at a CAGR of 4.5% during the forecast period. Africa is an emerging region in the Automotive Hub Motors Market, driven by growing demand for cost-effective electric mobility. It shows traction in countries like South Africa, Egypt, and Kenya where e-mobility startups are piloting electric two-wheelers and three-wheelers. Hub motors offer an affordable, low-maintenance alternative to traditional systems in informal transport sectors. It aligns with energy access and sustainability goals across urban centers. Limited charging infrastructure and import dependency remain barriers. Market participants are exploring local assembly and financing models to scale adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schaeffler Technologies AG & Co. KG

- Magnetic Systems Technology Ltd.

- Taizhou Quanshun Motor Co., Ltd.

- Protean Electric Ltd.

- TDCM Corporation Ltd.

- Heinzmann GmbH & Co. KG

- Michelin Group

- Mitsubishi Motors Corporation

- Elaphe Ltd.

- Other Key Players

Competitive Analysis

The Automotive Hub Motors Market features a competitive landscape marked by innovation, partnerships, and technological differentiation. Leading companies such as Schaeffler Technologies, Michelin Group, and Protean Electric focus on high-efficiency motor designs and compact architectures to gain market share. Startups like Elaphe Ltd. and TDCM Corporation Ltd. are expanding their presence through lightweight, modular hub motor systems tailored for two-wheelers and urban EVs. Established players such as Mitsubishi Motors and Heinzmann GmbH invest in R&D to enhance power density and thermal management. The Automotive Hub Motors Market rewards companies that offer scalable solutions, cost efficiency, and seamless integration with electric drivetrains. It attracts collaborations between OEMs and component manufacturers aiming to accelerate product deployment. Competitive advantage depends on motor performance, customization capability, and compatibility with smart vehicle platforms. Companies also pursue geographic expansion and joint ventures to strengthen supply chains and enter high-growth regions such as Asia Pacific and Latin America.

Recent Developments

- On May 16, 2025, Belrise announced entry into the electric vehicle hub motor segment through a partnership with a Chinese manufacturer. They plan to set up three new plants, expanding their integration within the EV supply chain, including chassis, chargers, and now hub motors.

- On January 18, 2025, Hyundai and TVS unveiled concept models of advanced electric three-wheeler and micro four-wheeler vehicles at the Bharat Mobility Global Expo 2025.

- In September 2023, Bajaj launched a new electric scooter version featuring a cost-effective hub motor, shifting from their previous mid-mounted motor design. This move aims to target a broader customer base via improved cost and simplicity.

- In February 2023, Flash (a component manufacturer) partnered with GEM Motors to manufacture hub motors, aiming to strengthen supply for the growing European e-bike and EV market.

Market Concentration & Characteristics

The Automotive Hub Motors Market shows moderate market concentration with a mix of established automotive suppliers and specialized motor manufacturers competing across global and regional levels. It features a blend of large players such as Schaeffler Technologies, Michelin Group, and Mitsubishi Motors alongside innovative firms like Protean Electric, Elaphe, and TDCM Corporation. The market favors companies that offer compact, high-torque, and energy-efficient motor systems compatible with electric two-wheelers, compact EVs, and last-mile delivery vehicles. The Automotive Hub Motors Market is characterized by a strong focus on R&D, modular designs, and ease of integration with lightweight electric platforms. It attracts new entrants in Asia and Europe where demand for electric micromobility is accelerating. Companies differentiate through performance optimization, digital integration, and partnerships with OEMs to secure scalable production contracts. Product standardization remains limited, creating space for customization and technical specialization in urban and low-speed applications. The pace of innovation and policy shifts influence competitive positioning.

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electric two-wheelers and compact EVs will continue to drive hub motor adoption in urban areas.

- Automakers will integrate hub motors into next-generation vehicle platforms to simplify drivetrain architecture.

- Technological improvements will enhance torque density, energy efficiency, and thermal management in hub motors.

- OEMs will expand partnerships with motor manufacturers to accelerate time-to-market and production scalability.

- Governments will increase incentives and infrastructure support for vehicles using hub motor systems.

- Emerging markets in Latin America, the Middle East, and Africa will present new growth opportunities.

- Lightweight materials and modular motor designs will gain traction in product development.

- Integration of smart sensors and control systems will improve performance and diagnostics.

- Adoption in last-mile delivery fleets will grow due to operational cost savings and low maintenance.

- R&D investments will focus on durability, waterproofing, and ride comfort in high-load applications.