| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Cardiovascular Devices Market Size 2024 |

USD 25,312.58 million |

| North America Cardiovascular Devices Market, CAGR |

7.0% |

| North America Cardiovascular Devices Market Size 2032 |

USD 46,628.20 million |

Market Overview

The North America Cardiovascular Devices Market is projected to grow from USD 25,312.58 million in 2024 to an estimated USD 46,628.20 million by 2032, with a compound annual growth rate (CAGR) of 7.0% from 2025 to 2032. This robust growth reflects the region’s increasing reliance on advanced cardiovascular technologies to address rising incidences of heart-related ailments.

Key market drivers include the aging population, rising obesity rates, and the growing prevalence of hypertension and diabetes, all of which contribute to a surge in cardiovascular conditions. In addition, technological advancements such as minimally invasive procedures, wearable monitoring devices, and AI-powered diagnostic tools are reshaping treatment landscapes and improving early detection. Increasing awareness of preventive healthcare and favorable reimbursement policies are further accelerating adoption. Market trends also indicate a shift toward value-based care and outpatient cardiac interventions, which are expected to influence product innovation and service delivery models.

Geographically, the United States holds the dominant share of the North American cardiovascular devices market due to its advanced healthcare infrastructure, strong regulatory environment, and high healthcare expenditure. Canada is also showing notable growth, driven by public health initiatives and the rising demand for interventional cardiology devices. Key players include Medtronic, Abbott Laboratories, Boston Scientific Corporation, Edwards Lifesciences, and GE Healthcare, all of which are actively expanding their portfolios and geographic reach.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America cardiovascular devices market is projected to grow from USD 25,312.58 million in 2024 to USD 46,628.20 million by 2032, at a CAGR of 7.0% from 2025 to 2032.

- The global cardiovascular devices market is projected to grow from USD 72,115.60 million in 2024 to USD 133,700.94 million by 2032, with a CAGR of 7.1% from 2025 to 2032, driven by increasing cardiovascular diseases and advancements in medical technology.

- Cardiovascular diseases remain the leading cause of mortality in the region, driving strong demand for advanced diagnostic and surgical devices.

- Key market drivers include a rapidly aging population, increasing obesity rates, and the growing prevalence of hypertension and diabetes.

- Technological advancements such as AI-powered diagnostics, wearable monitors, and minimally invasive procedures are reshaping treatment approaches.

- High device costs and regulatory complexities remain key restraints, limiting adoption across smaller healthcare facilities and delaying product approvals.

- The United States dominates the regional market with over 80% share, supported by robust infrastructure, high healthcare spending, and strong industry presence.

- Canada is experiencing steady growth due to supportive public health programs, rising awareness, and growing adoption of interventional cardiology technologies.

Report Scope

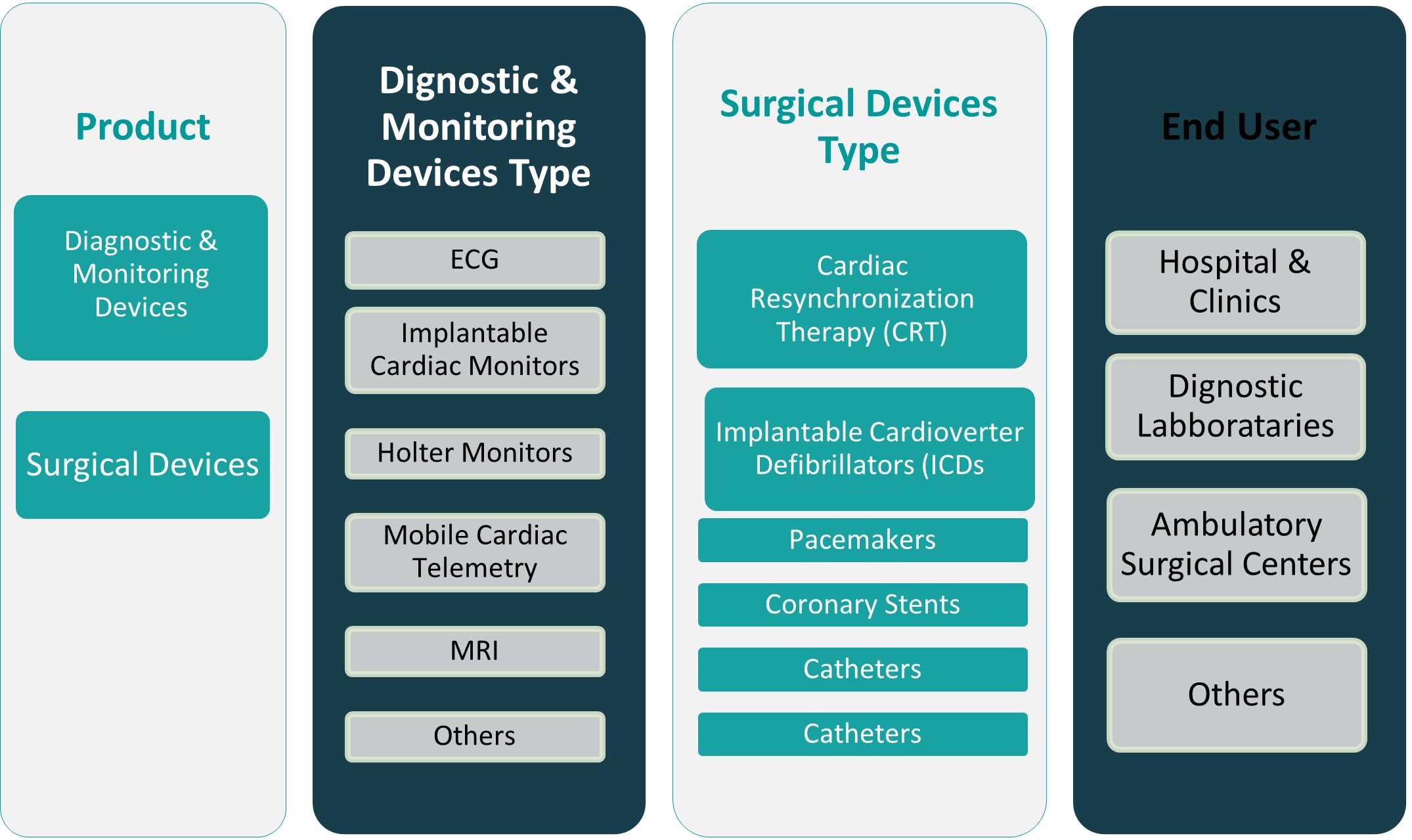

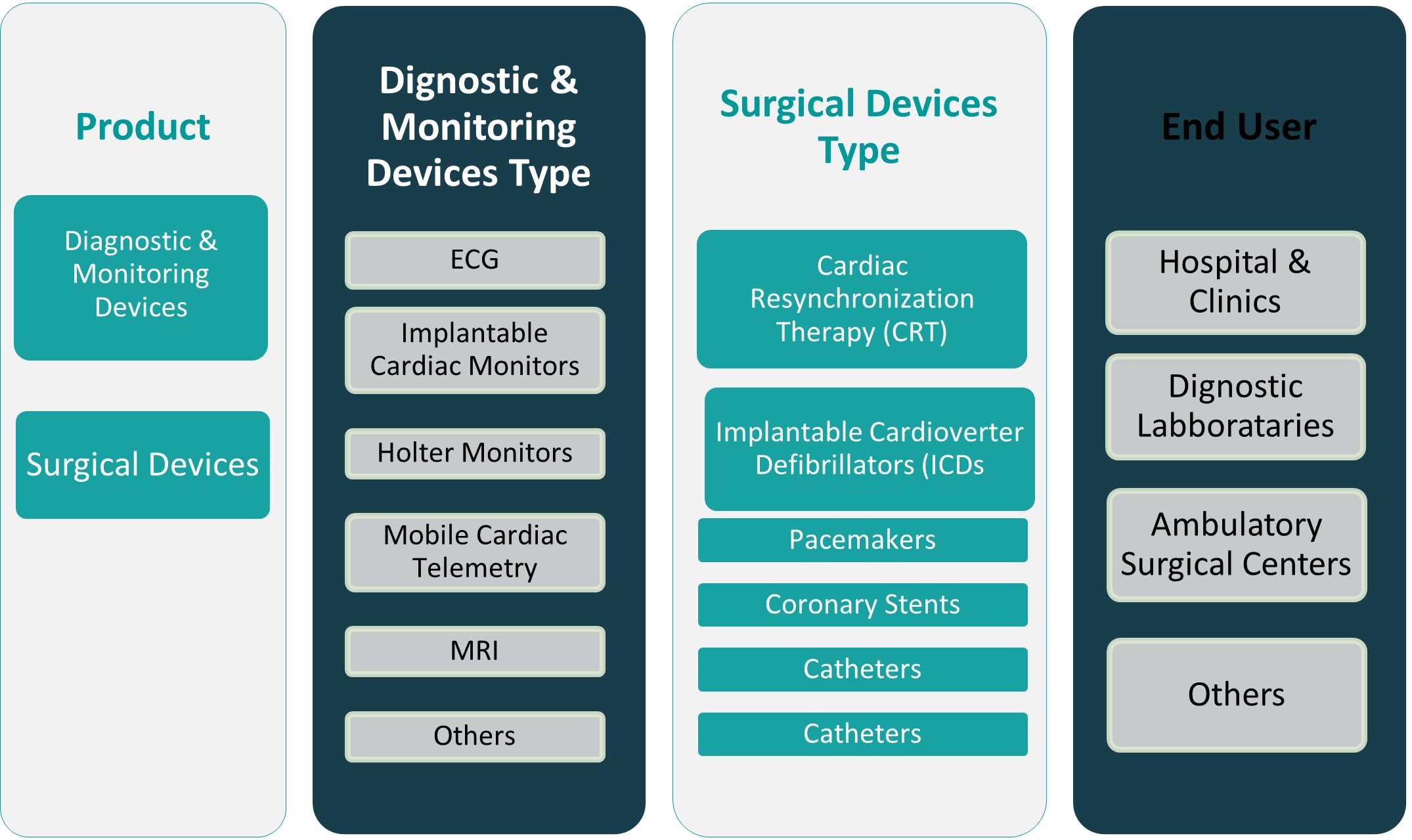

This report segments the North America Cardiovascular Devices Market as follows:

Market Drivers

Rising Prevalence of Cardiovascular Diseases and Aging Population

The growing burden of cardiovascular diseases (CVDs) in North America stands as one of the most significant drivers for the cardiovascular devices market. Conditions such as coronary artery disease, heart failure, stroke, and peripheral artery disease continue to affect a large segment of the population. For instance, according to the American Heart Association, 127.9 million U.S. adults had some form of cardiovascular disease in 2020. In 2022, cardiovascular disease accounted for 941,652 deaths in the United States, making it the leading cause of mortality. Coronary heart disease alone caused 371,506 deaths in the same year. Moreover, the region is experiencing a demographic shift marked by a rapidly aging population. In the United States, the number of people aged 65 years and above is steadily increasing, contributing to higher hospitalization rates and a greater demand for medical interventions. This demographic trend is fueling demand for advanced cardiovascular devices such as pacemakers, defibrillators, heart valves, and diagnostic imaging systems designed specifically for geriatric patients. Healthcare providers and policymakers are prioritizing early detection and timely intervention, creating sustained market opportunities for cardiovascular device manufacturers.

Technological Advancements in Minimally Invasive and Wearable Devices

Continuous innovation in cardiovascular technology is significantly transforming diagnostic and therapeutic strategies, thus fueling market expansion. Minimally invasive procedures are becoming the preferred choice for both physicians and patients due to shorter hospital stays, reduced post-operative complications, and faster recovery times. In North America, advancements in transcatheter heart valves, drug-eluting stents, and catheter-based ablation systems are now standard tools in cardiac care. The integration of AI-driven imaging, robotic-assisted surgery, and digital health platforms is enhancing procedural accuracy and safety. Simultaneously, the growing demand for wearable and remote monitoring devices is reshaping the landscape of chronic disease management. Smartwatches, biosensors, and portable ECG monitors enable real-time tracking of heart rate, blood pressure, and rhythm irregularities. These tools are particularly beneficial for patients with a history of arrhythmia or heart failure, as they provide timely alerts and support preventative care models. In North America, where telemedicine adoption has surged post-pandemic, the integration of cardiovascular wearables into digital health platforms is creating new avenues for continuous patient engagement and remote diagnostics. This shift is not only improving clinical outcomes but also reducing the burden on hospital infrastructure.

Favorable Reimbursement Policies and Healthcare Infrastructure

North America’s well-established healthcare infrastructure, coupled with favorable reimbursement frameworks, plays a crucial role in driving the cardiovascular devices market. In the United States, Medicare, Medicaid, and private insurers offer comprehensive coverage for a wide range of cardiovascular procedures and devices. This includes implantable cardioverter defibrillators (ICDs), cardiac resynchronization therapy (CRT) devices, and advanced imaging systems. These reimbursement structures significantly reduce out-of-pocket expenses for patients and encourage healthcare providers to adopt the latest technologies without financial constraints. Additionally, the presence of specialized cardiac centers, well-trained healthcare professionals, and a focus on evidence-based treatment further support the adoption of new devices and procedures. Hospitals and clinics are increasingly participating in value-based care models that emphasize outcomes, efficiency, and patient satisfaction. This approach incentivizes the use of technologies that contribute to early diagnosis, improved procedural success, and reduced readmission rates. Regulatory clarity provided by the U.S. Food and Drug Administration (FDA) and Health Canada also fosters a streamlined pathway for the approval and commercialization of new cardiovascular devices, thereby encouraging innovation and competition.

Strategic Collaborations, R\&D Investment, and Market Expansion Initiatives

The North American cardiovascular devices market is benefiting from strong industry investment in research and development (R\&D), as well as strategic partnerships between medical device companies, healthcare providers, and academic institutions. Leading players such as Medtronic, Abbott Laboratories, and Boston Scientific are allocating substantial budgets toward the development of next-generation devices that offer enhanced precision, durability, and patient compatibility. These include bioresorbable stents, wireless pacemakers, and AI-driven imaging systems. Strategic collaborations are enabling companies to expand their capabilities and market reach. Joint ventures and partnerships are being used to co-develop technologies, streamline distribution channels, and address specific regional healthcare needs. Additionally, many companies are expanding their presence in underserved regions within North America, particularly rural areas where access to specialized cardiac care has traditionally been limited. These initiatives are supported by government funding and public-private partnerships aimed at reducing healthcare disparities and improving cardiovascular outcomes. Furthermore, clinical trials and registries conducted across North America are generating valuable data that inform best practices and support regulatory approvals. These efforts are essential for building trust among clinicians and patients, ensuring that new cardiovascular devices are both safe and effective. The continuous pipeline of innovations, backed by robust R\&D and collaborative strategies, is expected to sustain long-term market growth.

Market Trends

Increased Adoption of Minimally Invasive Procedures

Minimally invasive cardiovascular procedures are rapidly gaining traction in North America due to their numerous benefits over traditional surgery. These procedures, including catheter-based interventions, transcatheter aortic valve replacement (TAVR), and percutaneous coronary interventions (PCI), are favored for their ability to reduce patient recovery times, minimize complications, and improve overall outcomes. With advancements in device technology such as drug-eluting stents and bioresorbable scaffolds, patients can experience enhanced procedural success rates and a faster recovery. For instance, the National Cardiac Registry reports that over 290,000 heart valve replacement procedures are expected to be performed annually in the United States by 2029, with TAVR procedures accounting for over 190,000. Furthermore, minimally invasive surgeries are becoming increasingly accessible as healthcare providers focus on improving the patient experience and optimizing resource utilization. As a result, the demand for specialized cardiovascular devices supporting these interventions continues to grow. This trend is particularly evident in the management of high-risk patients, such as the elderly or those with multiple comorbidities, for whom traditional open-heart surgery may be too risky. Additionally, the growing acceptance of minimally invasive procedures is supported by healthcare systems in North America, which are increasingly focused on reducing hospital stay lengths and enhancing procedural efficiency. This shift aligns with broader goals in healthcare, including cost containment, improved patient satisfaction, and higher throughput in hospitals, creating strong market opportunities for manufacturers of minimally invasive cardiovascular devices.

Integration of AI and Machine Learning in Cardiovascular Devices

The integration of artificial intelligence (AI) and machine learning (ML) into cardiovascular devices is transforming the landscape of diagnostics and treatment. These technologies are particularly useful in the analysis of cardiovascular imaging data, such as CT scans, MRIs, and echocardiograms, enabling more accurate and faster diagnoses. AI-driven algorithms are capable of identifying early signs of heart disease, arrhythmias, or blockages, often detecting conditions that might otherwise go unnoticed by human clinicians. Furthermore, AI is enhancing device functionality, improving the precision of surgical tools, and even enabling predictive analytics to anticipate complications during procedures. For instance, AI-powered cardiovascular monitoring systems are being used to predict heart failure risks and optimize treatment plans. Studies indicate that AI-driven models can improve early detection rates and enhance patient outcomes by leveraging real-time data. This trend is particularly evident in the rise of AI-powered catheter ablation systems and advanced cardiac monitoring devices that leverage real-time data for immediate decision-making. These innovations are not only improving patient outcomes but also driving the adoption of devices in a range of healthcare settings, from major hospitals to outpatient clinics. The growing focus on AI-enabled diagnostics and treatment options is expected to continue as the demand for personalized medicine increases. As AI and ML technologies evolve, their integration into cardiovascular devices will redefine the standard of care and contribute to more efficient, data-driven healthcare.

Shift Towards Remote Patient Monitoring and Wearables

The shift towards remote patient monitoring and the increasing popularity of wearable cardiovascular devices are key trends in North America. With the rise of chronic cardiovascular conditions and the need for continuous management, wearable devices such as smartwatches, ECG monitors, and blood pressure trackers are becoming essential tools for both patients and healthcare providers. These devices allow for the continuous tracking of vital signs, enabling early intervention and personalized care without the need for frequent hospital visits. This trend is supported by advancements in wireless communication technologies, which allow for the seamless transmission of real-time data from wearable devices to healthcare providers. Telehealth platforms are also growing in popularity, allowing doctors to remotely monitor patients’ health, make data-driven decisions, and adjust treatments as necessary. As more healthcare systems integrate digital health solutions, the adoption of wearable cardiovascular devices is expected to grow, particularly as consumers increasingly prioritize health and wellness monitoring. Furthermore, as these devices offer non-invasive and user-friendly solutions, they appeal to a wide range of demographics, including aging populations and tech-savvy millennials, thereby driving market expansion.

Rising Demand for Personalized and Precision Medicine

The growing demand for personalized and precision medicine is a significant trend in the North American cardiovascular devices market. Patients and healthcare providers are increasingly seeking tailored treatment plans that take into account genetic, lifestyle, and environmental factors. In response, the cardiovascular device industry is focusing on developing advanced technologies that can deliver personalized solutions, such as genetic testing, precision diagnostics, and customized implantable devices. These innovations are particularly valuable in the management of complex cardiovascular diseases, such as heart failure, arrhythmias, and atherosclerosis, where one-size-fits-all approaches are often insufficient. With the help of personalized medicine, clinicians can choose the most appropriate therapeutic device based on individual patient profiles, ensuring more effective treatment and reducing the risk of adverse outcomes. Moreover, the trend toward precision medicine is driving the development of devices that offer greater compatibility with individual patient needs, such as patient-specific stents and customized heart valves. As healthcare becomes more data-driven and patient-centric, the demand for personalized cardiovascular devices is expected to increase, leading to a more sophisticated and dynamic market landscape.

Market Challenges

High Cost of Advanced Cardiovascular Devices and Procedures

One of the most prominent challenges facing the North America cardiovascular devices market is the high cost associated with advanced cardiovascular devices and related procedures. Many next-generation technologies, including drug-eluting stents, transcatheter heart valves, implantable cardioverter-defibrillators (ICDs), and robotic-assisted surgical systems, come with substantial acquisition, maintenance, and operational costs. These expenses often result in financial strain for both healthcare institutions and patients, particularly those without comprehensive insurance coverage. While public and private insurers in North America do offer reimbursement for many cardiovascular procedures, the extent of coverage varies significantly, leading to uneven access to advanced care. In many cases, the out-of-pocket expenses for patients remain high, especially for elective procedures or when using newer, less-established technologies. Hospitals and clinics must also weigh the return on investment when deciding to adopt costly equipment, which may slow the overall rate of technological integration. Additionally, smaller or rural healthcare facilities may lack the capital or infrastructure to support such sophisticated technologies, contributing to geographic disparities in patient care. For instance, some hospitals in North America have reported difficulties in acquiring robotic-assisted surgical systems due to high initial costs and ongoing maintenance expenses. This financial barrier also impacts long-term patient adherence to treatment plans involving implantable devices or remote monitoring tools, which require ongoing follow-ups and maintenance. As a result, cost considerations continue to limit widespread adoption of state-of-the-art cardiovascular technologies, ultimately posing a challenge to achieving uniform, high-quality cardiac care across the region.

Regulatory Hurdles and Lengthy Approval Timelines

Despite North America’s reputation for innovation, stringent regulatory requirements and extended approval timelines remain key challenges for cardiovascular device manufacturers. The U.S. Food and Drug Administration (FDA) maintains rigorous standards to ensure the safety and efficacy of medical devices, particularly those used in high-risk cardiovascular interventions. While these protocols are critical for patient protection, the extensive clinical trial requirements, complex documentation processes, and prolonged review periods can significantly delay product launches. For many companies, especially small and mid-sized enterprises, navigating the regulatory landscape involves high upfront costs and considerable resource allocation. The need to conduct multiple phases of clinical trials, secure investigational device exemptions, and respond to regulatory queries adds layers of complexity and uncertainty. Furthermore, post-market surveillance obligations—such as ongoing reporting, risk assessments, and periodic audits—extend the regulatory burden even after product approval. These delays not only slow the pace of innovation but also affect the competitive dynamics of the market. Companies may deprioritize North American launches in favor of regions with faster approval pathways, such as the European Union, under its CE marking system. The regulatory environment can also hinder patient access to life-saving or life-improving technologies, particularly when newer devices that are already in use elsewhere face prolonged approval bottlenecks in North America. Overcoming this challenge requires ongoing collaboration between regulators, industry stakeholders, and clinical institutions to streamline processes without compromising safety.

Market Opportunities

Expansion of Preventive Cardiology and Outpatient Care Models

The shift toward preventive cardiology and outpatient care presents a significant opportunity for growth in the North America cardiovascular devices market. As healthcare systems emphasize early diagnosis and chronic disease management, the demand for devices that support preventive monitoring, risk assessment, and non-invasive diagnostics is accelerating. Wearable technologies, remote monitoring systems, and portable diagnostic tools are increasingly being used to detect early signs of cardiovascular issues, allowing for timely intervention and reducing hospital admissions. Simultaneously, the rise in outpatient cardiac procedures—enabled by minimally invasive devices—creates a lucrative avenue for device manufacturers to design compact, user-friendly technologies that align with ambulatory care settings. This shift is not only enhancing patient convenience but also reducing overall healthcare costs, making it a focal area for investment and innovation.

Integration of Digital Health and Personalized Medicine

The growing intersection of digital health and personalized medicine represents a transformative opportunity in the cardiovascular devices landscape. Advanced analytics, artificial intelligence (AI), and big data are enabling a new generation of smart cardiovascular devices capable of real-time monitoring, predictive diagnostics, and adaptive therapy. These technologies support personalized treatment plans tailored to individual patient profiles, improving outcomes and adherence. As North American healthcare systems increasingly adopt data-driven, value-based care models, manufacturers that integrate digital functionality into their cardiovascular solutions stand to gain competitive advantage. Moreover, strategic collaborations between medtech firms and digital health platforms can unlock new service-based revenue streams, further expanding market potential.

Market Segmentation Analysis

By Product

The North America cardiovascular devices market is broadly segmented into diagnostic & monitoring devices and surgical devices. Diagnostic and monitoring devices, including ECG systems, Holter monitors, cardiac event monitors, and wearable heart rate monitors, hold a substantial share due to rising demand for early detection and continuous monitoring of cardiovascular conditions. The prevalence of chronic heart diseases and the increasing shift toward remote patient monitoring have further driven the adoption of these non-invasive tools. Meanwhile, surgical devices such as stents, pacemakers, defibrillators, and heart valves are witnessing steady growth, supported by the increasing number of interventional and surgical procedures across the region. Technological advancements and the growing preference for minimally invasive surgeries continue to enhance procedural efficacy, resulting in greater demand for innovative surgical tools and implants.

By End User

By end user, the market is segmented into hospitals & clinics, diagnostic laboratories, ambulatory surgical centers, and others. Hospitals and clinics account for the largest share, given their comprehensive infrastructure, skilled personnel, and access to advanced cardiac care technologies. They serve as primary centers for diagnostics, surgeries, and post-operative care, making them critical demand drivers for a wide range of cardiovascular devices. Diagnostic laboratories are experiencing growth due to the rising demand for specialized testing and early-stage detection of cardiovascular anomalies. Ambulatory surgical centers are emerging as high-growth segments, offering cost-effective and efficient cardiac procedures with shorter recovery times, particularly for patients opting for minimally invasive interventions. The “others” category, which includes home healthcare settings and academic research institutions, is also expanding as wearable monitoring devices and remote diagnostic solutions gain prominence.

Segments

Based on Product

- Diagnostic & Monitoring Devices

- Surgical Devices

Based on End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Ambulatory Surgical Centers

- Others

Based on Diagnostic & Monitoring Devices Type

- ECG

- Implantable Cardiac Monitors

- Holter Monitors

- Mobile Cardiac Telemetry

- MRI

- Others

Based on Surgical Devices Type

- Cardiac Resynchronization Therapy (CRT)

- Implantable Cardioverter Defibrillators (ICDs

- Pacemakers

- Coronary Stents

- Catheters

Based on Region

Regional Analysis

United States (82.5%)

United States, holds the largest regional market share of 82.5%. This dominance is driven by the country’s advanced healthcare infrastructure, high per capita healthcare spending, and early adoption of cutting-edge medical technologies. The United States is home to some of the world’s leading cardiovascular device manufacturers, such as Medtronic, Abbott Laboratories, and Boston Scientific, which continuously invest in innovation and R&D. The high prevalence of cardiovascular diseases, coupled with an aging population and lifestyle-related health conditions like obesity and hypertension, contributes significantly to the demand for diagnostic, monitoring, and surgical cardiovascular devices. Additionally, favorable reimbursement structures, a strong regulatory framework under the U.S. Food and Drug Administration (FDA), and increased focus on minimally invasive and outpatient cardiac procedures are further propelling market growth.

Canada (17.5%)

Canada accounts for the remaining 17.5% of the North America cardiovascular devices market. Although smaller in scale compared to the U.S., Canada is experiencing steady growth driven by public health initiatives, increasing investments in healthcare modernization, and rising awareness of heart health. The Canadian government’s support for early disease detection and preventive care has led to the increased adoption of cardiovascular diagnostic tools and wearable monitoring devices. Furthermore, advancements in telehealth and remote monitoring, particularly post-COVID-19, are reshaping cardiac care delivery across the country. Canadian hospitals and ambulatory surgical centers are also embracing minimally invasive procedures, supported by enhanced training programs and procurement of advanced surgical equipment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Abbott

- GE HealthCare

- Edwards Lifesciences Corporation

- L. Gore & Associates, Inc.

- Siemens Healthcare GmbH

- BIOTRONIK SE & Co. KG

- Canon Medical Systems Asia Pte. Ltd.

- Braun SE

- LivaNova PLC

- Cardinal Health

- Medtronic

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- Johnson & Johnson Services, Inc.

- Baxter International Inc.

Competitive Analysis

The North America cardiovascular devices market is highly competitive, with global players like Abbott, Medtronic, and Boston Scientific Corporation leading in terms of innovation, product diversification, and geographic reach. These companies leverage strong R\&D capabilities and strategic acquisitions to expand their portfolios and maintain market dominance. Abbott and Medtronic, in particular, offer comprehensive device lines across diagnostics, monitoring, and surgical categories. Meanwhile, Edwards Lifesciences specializes in structural heart solutions, giving it a strong foothold in minimally invasive valve therapies. Philips and GE HealthCare focus on advanced imaging and diagnostic technologies, while newer players like LivaNova and BIOTRONIK are gaining traction through specialized cardiovascular implants and therapies. Intense competition is driving rapid technological advancements, collaborative partnerships, and a growing focus on digital health integration, shaping a dynamic and innovation-driven market landscape.

Recent Developments

- In February 2025, Abbott issued a safety notification for certain Assurity and Endurity pacemakers due to potential epoxy mixing issues during manufacturing, which could lead to device malfunction.

- In April 2025, GE HealthCare launched the Revolution™ Vibe CT system featuring Unlimited One-Beat Cardiac imaging and AI solutions, enhancing cardiac imaging capabilities.

- In April 2025, Medtronic reported promising evidence for its Affera™ pulsed field ablation technologies in treating atrial fibrillation patients.

- In May 2024, Siemens Healthineers announced new cardiology applications with artificial intelligence for the Acuson Sequoia ultrasound system, including a new 4D transesophageal (TEE) transducer for cardiology exams.

- In February 2025, Philips developed a miniaturized intracardiac transducer, enabling higher-resolution views of cardiac structures and functions, benefiting structural heart disease and electrophysiology procedures.

- In March 2025, Boston Scientific announced the acquisition of SoniVie Ltd. to expand its interventional cardiology therapies offerings with ultrasound-based renal denervation technology.

- In June 2024, Biovac Institute entered a partnership with Sanofi to locally manufacture inactivated polio vaccines in Africa, aiming to serve the potential needs of over 40 African countries.

Market Concentration and Characteristics

The North America cardiovascular devices market exhibits a moderately high market concentration, with a few dominant players such as Medtronic, Abbott, and Boston Scientific Corporation holding significant market shares due to their extensive product portfolios, strong distribution networks, and continuous investment in research and development. The market is characterized by rapid technological innovation, a growing emphasis on minimally invasive procedures, and increasing integration of digital health solutions such as remote monitoring and AI-driven diagnostics. Regulatory rigor, particularly from the U.S. FDA, shapes product development and commercialization timelines, while favorable reimbursement policies and high healthcare spending support sustained demand. Despite the dominance of established firms, the market remains dynamic, with opportunities for niche players and startups offering specialized or disruptive technologies. Overall, the market reflects a combination of mature infrastructure, evolving patient preferences, and innovation-driven competition.

Report Coverage

The research report offers an in-depth analysis based on Product, End User, Diagnostic & Monitoring Devices Type, Surgical Devices Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The integration of AI and machine learning will enhance diagnostic accuracy and personalize cardiovascular treatment pathways, transforming clinical decision-making.

- Remote monitoring and wearable cardiovascular devices will gain wider adoption as demand for home-based and preventive care continues to rise.

- Minimally invasive procedures will dominate treatment protocols due to reduced recovery time, lower complication risks, and growing patient preference.

- Ambulatory surgical centers and outpatient cardiology clinics will expand as healthcare systems prioritize cost-effective and efficient care delivery models.

- Future product development will focus on next-generation implants like bioresorbable stents and tissue-engineered heart valves for improved patient outcomes.

- Cardiovascular devices will increasingly connect with digital health platforms, enabling real-time data analysis and improved chronic disease management.

- Precision medicine will become more prevalent, with genetic profiling and patient-specific device customization enhancing therapeutic effectiveness.

- Major players will continue engaging in mergers, acquisitions, and partnerships to accelerate innovation and expand their market footprint.

- Regulatory bodies are expected to implement faster approval processes for breakthrough cardiovascular technologies, promoting quicker market entry.

- Efforts to improve access to cardiovascular care in underserved regions will drive the development and deployment of affordable and portable devices.