| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Digital Signature Market Size 2024 |

USD 3,120.52 million |

| North America Digital Signature Market CAGR |

32.67% |

| North America Digital Signature Market Size 2032 |

USD 29,943.17 million |

Market Overview:

The North America Digital Signature Market is projected to grow from USD 3,120.52 million in 2024 to an estimated USD 29,943.17 million by 2032, with a compound annual growth rate (CAGR) of 32.67% from 2024 to 2032.

Several factors are propelling the growth of the digital signature market in North America. The increasing incidence of digital fraud has heightened the demand for secure authentication methods, with digital signatures offering tamper-evident solutions that ensure document integrity and signer authenticity. Regulatory frameworks such as the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) in the U.S., along with Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA), have established legal validity for digital signatures, further encouraging their adoption. The shift towards remote work and digital transactions, accelerated by the COVID-19 pandemic, has also played a significant role in increasing the reliance on digital signature solutions. Enterprises are integrating digital signature platforms into broader document management systems to streamline workflows. Moreover, the rising demand for cost-effective and paperless operations continues to motivate businesses to adopt digital signature technologies.

Within North America, the United States dominates the digital signature market, accounting for a substantial share of the regional revenue. This growth is supported by the presence of key market players such as DocuSign Inc., Adobe Inc., and Entrust Corporation, as well as a strong emphasis on digital transformation across industries. Canada and Mexico are also experiencing significant growth in the digital signature market, driven by increasing digitalization efforts and supportive regulatory environments. Mexico, in particular, is projected to register the highest CAGR in the region from 2025 to 2030. The Canadian government’s initiatives to digitize public services are fostering demand for secure authentication technologies. Meanwhile, growing cross-border trade and legal harmonization within the region are further enhancing the use of standardized digital signature solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Digital Signature market is projected to surge from USD 3,120.52 million in 2024 to USD 29,943.17 million by 2032, registering a robust CAGR of 32.67%.

- The Global Digital Signature Marketis projected to grow significantly, from USD 7,885.08 million in 2024 to USD 76,046.14 million by 2032, reflecting a strong CAGR of 32.75% during the forecast period.

- Legal frameworks like the ESIGN Act, UETA, and PIPEDA have solidified the legitimacy of digital signatures, fostering wider adoption across North America.

- Digital transformation across BFSI, healthcare, and government sectors is accelerating the use of secure, legally binding electronic signature solutions.

- The rise of remote work and demand for paperless operations are embedding digital signatures into enterprise workflows and collaboration platforms.

- Heightened cybersecurity risks are compelling businesses to invest in tamper-proof, encrypted signature platforms that enhance document integrity.

- Regulatory fragmentation across U.S. states and Canadian provinces, along with legacy infrastructure, presents implementation and compliance challenges.

- The U.S. dominates the regional market, while Canada and Mexico show strong growth potential, supported by digitalization initiatives and evolving regulations.

Report Scope

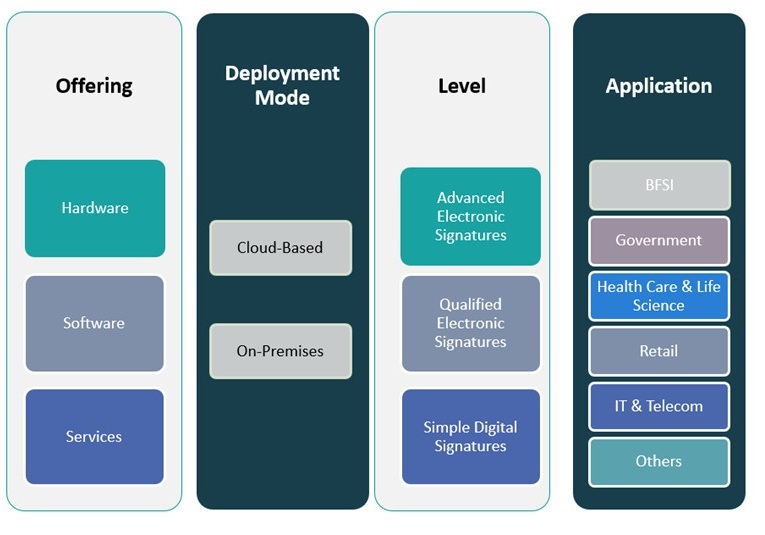

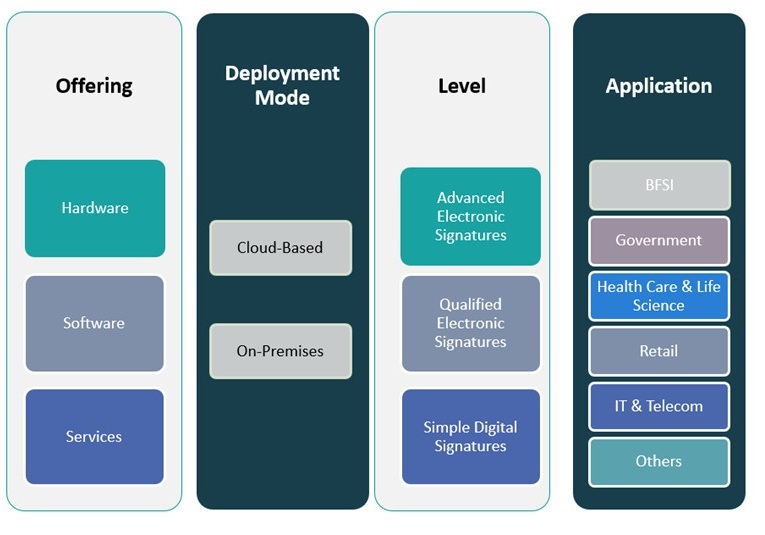

This report segments North America Digital Signature Market as follow

Market Drivers:

Regulatory Compliance and Legal Recognition

One of the primary drivers accelerating the adoption of digital signatures in North America is the presence of well-defined regulatory frameworks that ensure legal recognition of electronic signatures. For instance, in the United States, the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) provide a legal foundation for digital transactions, allowing businesses to securely validate contracts and other documents electronically. Similarly, Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA) offers guidelines for the secure and legal use of electronic signatures. These laws not only validate digital signatures in contractual and legal environments but also foster trust among organizations and individuals engaging in digital processes. The legal clarity encourages businesses to transition away from traditional paper-based documentation toward secure, verifiable, and efficient electronic solutions.

Digital Transformation Across Industries

The ongoing digital transformation across industries such as banking, financial services, insurance (BFSI), healthcare, real estate, and government is playing a crucial role in expanding the digital signature market. Organizations in these sectors are rapidly digitizing workflows to improve operational efficiency, reduce turnaround times, and enhance customer experiences. In the BFSI sector, for instance, financial institutions use digital signatures to streamline loan approvals, account openings, and insurance claims, significantly reducing paperwork and turnaround times while ensuring compliance with industry regulations. Digital signature solutions support these efforts by enabling seamless, secure, and legally binding transactions across various endpoints. In sectors like healthcare and finance, where data privacy and transaction accuracy are critical, digital signatures ensure both compliance and integrity. The increasing adoption of cloud-based platforms and enterprise resource planning (ERP) systems further integrates digital signature capabilities into broader enterprise ecosystems.

Remote Work and Paperless Workflows

The shift toward remote work models has significantly accelerated the demand for digital tools that enable business continuity without compromising security or compliance. Digital signatures have emerged as an essential component in supporting remote workflows, allowing employees to sign contracts, agreements, and legal documents without physical presence. Companies are embracing paperless operations to cut down on administrative costs and environmental impact. As a result, digital signatures are becoming embedded into document management systems, customer relationship platforms, and enterprise communication tools. This trend is particularly prominent among small and medium-sized enterprises (SMEs), which are leveraging digital signatures to streamline operations while remaining agile and competitive.

Growing Focus on Cybersecurity and Authentication

As cyber threats continue to evolve, businesses are placing a heightened focus on authentication and data security. Digital signatures offer strong encryption and identity verification features that help prevent document tampering, forgery, and unauthorized access. Advanced features such as audit trails, timestamps, and biometric verification contribute to increased transparency and accountability. With increasing concerns around fraud and data breaches, organizations are investing in secure digital signature platforms that comply with international security standards. These platforms not only mitigate risks but also reinforce customer confidence in digital interactions, ultimately driving wider adoption across the North American market.

Market Trends:

Integration with Emerging Technologies

One of the prominent trends shaping the North America digital signature market is the growing integration of digital signature solutions with emerging technologies such as artificial intelligence (AI), blockchain, and machine learning (ML). Organizations are adopting AI-powered document verification and fraud detection tools to complement digital signature platforms, enhancing overall security and reducing manual intervention. For example, DocuSign introduced an AI-powered identity verification feature in 2023 that uses biometric checks to authenticate signers, enhancing security and ensuring authenticity at both ends of a transaction. Blockchain is also gaining traction for enabling immutable audit trails, which ensure the integrity and non-repudiation of digitally signed documents. These integrations are elevating the reliability of digital signatures and are particularly appealing to sectors such as legal, finance, and public services that demand enhanced trust and transparency.

Expansion of Industry-Specific Applications

Digital signatures are increasingly tailored to meet the compliance needs of regulated industries such as pharmaceuticals and education. In the pharmaceutical sector, digital signatures authenticate clinical trial documents and regulatory filings, ensuring adherence to FDA and EMA standards. In education, institutions use electronic signatures to accelerate enrollment, verify degrees, and manage administrative tasks securely and remotely. For instance, educational organizations leverage digital signatures to facilitate consent forms for field trips, internship agreements, and graduation certificates, streamlining workflows and enhancing data security. These use cases demonstrate how digital signature solutions are expanding beyond traditional sectors to address unique industry requirements.

Mobile and Cloud-Based Signature Adoption

The rapid proliferation of mobile devices and cloud services has driven a significant shift toward mobile-friendly and cloud-based digital signature platforms. Businesses and consumers alike are prioritizing convenience and accessibility, and vendors are responding by offering cross-platform digital signature tools that can be used on smartphones, tablets, and web-based interfaces. Cloud-based deployment models, in particular, are gaining momentum due to their scalability, cost-effectiveness, and ease of integration with existing enterprise systems. This trend is particularly evident among startups and SMEs, which prefer subscription-based models that offer flexibility without significant upfront infrastructure investment.

Focus on User Experience and Interoperability

Vendors in the digital signature space are increasingly focusing on enhancing user experience through simplified interfaces, real-time notifications, and multi-language support. Solutions that provide seamless integration with popular productivity suites such as Microsoft 365, Google Workspace, and Salesforce are gaining preference among enterprises. Additionally, interoperability and compliance with international standards such as eIDAS, FIPS, and ISO 27001 are becoming vital differentiators. These advancements are not only improving the end-user journey but are also ensuring cross-border validity and wider adoption across multinational organizations operating in the North American region. The market is evolving toward solutions that combine ease of use with rigorous compliance and broad system compatibility.

Market Challenges Analysis:

Regulatory Fragmentation and Legal Ambiguities

Despite the presence of foundational laws such as the ESIGN Act and UETA in the United States and PIPEDA in Canada, varying interpretations and implementations across jurisdictions pose a challenge to seamless adoption of digital signatures. Some states and provinces maintain unique compliance requirements or impose additional verification protocols, which can hinder interoperability and increase complexity for multinational or cross-state operations. This regulatory fragmentation often requires businesses to adopt multiple standards or invest in additional legal consultations, slowing down implementation and increasing compliance costs. Additionally, sectors with limited digital readiness may remain hesitant to shift from traditional wet signatures due to legal uncertainty or industry-specific restrictions.

Security Concerns and Technological Barriers

While digital signatures are inherently more secure than traditional signatures, concerns over cybersecurity threats such as data breaches, identity theft, and unauthorized access persist. For instance, Incidents such as the compromise of D-Link’s digital certificates by the hacker group BlackTech highlight real-world risks: attackers used stolen private keys to sign malware, allowing it to bypass security filters and compromise user systems. The implementation of digital signature solutions often demands integration with encryption tools, certificate authorities, and secure key management systems, all of which require technical expertise and robust IT infrastructure. Smaller organizations may find it challenging to deploy and manage such systems without external support. Furthermore, user resistance due to lack of digital literacy or perceived complexity of the technology can act as a barrier to widespread acceptance. Legacy systems that do not support modern digital signature functionalities also create technical bottlenecks, especially in sectors still reliant on paper-intensive workflows. Overcoming these challenges requires targeted awareness campaigns, user training, and infrastructure upgrades, which can extend implementation timelines and increase upfront costs. These factors collectively restrain the pace of market expansion in certain segments of North America.

Market Opportunities:

The North America digital signature market presents substantial opportunities driven by the increasing digitization of public services and the growing emphasis on secure digital identities. Governments across the region are investing in e-governance platforms that require citizens and businesses to authenticate and authorize documents electronically. This transformation is expanding the use of digital signatures in sectors such as tax filing, licensing, voting, and healthcare services. The opportunity to integrate digital signatures into digital identity frameworks, including mobile ID and biometric authentication systems, is gaining traction as authorities seek to enhance security, efficiency, and citizen engagement. Moreover, the rising adoption of electronic health records and telemedicine is creating demand for compliant and tamper-proof signature solutions tailored for the healthcare ecosystem.

Another major growth opportunity lies in the increasing need for cross-border digital transactions and compliance with international standards. North American enterprises operating globally are actively seeking digital signature platforms that support interoperability with frameworks such as Europe’s eIDAS or Asia-Pacific’s evolving digital trust ecosystems. This demand is prompting vendors to innovate with scalable, multilingual, and cross-regulatory solutions. Additionally, the surge in mergers, acquisitions, and remote onboarding across various industries creates new use cases for secure, remote signing processes. Startups and mid-sized firms in particular are looking for cost-effective cloud-based signature solutions that offer rapid deployment and integration capabilities. As digital commerce continues to expand and trust becomes a strategic differentiator, digital signature providers in North America are well-positioned to capitalize on this growing landscape of opportunity.

Market Segmentation Analysis:

By Offering

The North America digital signature market is segmented into hardware, software, and services. Among these, the software segment holds a dominant position, driven by the widespread adoption of digital signature solutions across various industries. The demand for software solutions is bolstered by their ease of integration, scalability, and the increasing need for secure digital transactions. The services segment, encompassing managed and professional services, is also experiencing significant growth as organizations seek expert assistance for implementation and compliance with regulatory standards. Hardware components, while essential, constitute a smaller share, primarily serving niche applications requiring specialized security measures.

By Deployment Mode

Deployment modes in the North America digital signature market are categorized into cloud-based and on-premises solutions. Cloud-based deployment is gaining traction due to its cost-effectiveness, flexibility, and ease of access, especially among small and medium-sized enterprises (SMEs). The scalability and reduced infrastructure requirements of cloud solutions make them an attractive option for organizations aiming to streamline operations. Conversely, on-premises deployment remains preferred by large enterprises and government agencies that prioritize control over data and compliance with stringent security protocols. The choice between deployment modes often hinges on organizational size, regulatory requirements, and specific security considerations.

By Level

Digital signatures are classified into simple digital signatures, advanced electronic signatures (AES), and qualified electronic signatures (QES). AES is widely adopted across various sectors due to its balance between security and user convenience. QES, offering the highest level of security and legal assurance, is increasingly utilized in sectors with stringent compliance requirements, such as finance and healthcare. Simple digital signatures, while easier to implement, are generally employed in low-risk scenarios where legal enforceability is less critical. The selection of signature level is influenced by the sensitivity of transactions and the regulatory landscape governing electronic communications.

By Application

The application spectrum of digital signatures in North America encompasses BFSI, government, healthcare & life sciences, retail, IT & telecom, and others. The BFSI sector leads in adoption, driven by the imperative for secure and efficient transaction processing. Government agencies are increasingly implementing digital signatures to enhance service delivery and ensure document authenticity. In healthcare, the need for secure handling of patient records and compliance with health information regulations propels the adoption of digital signatures. Retail and IT & telecom sectors are also integrating digital signature solutions to streamline operations and enhance customer trust. The diverse application across these sectors underscores the versatility and critical role of digital signatures in facilitating secure digital interactions.

Segmentation:

By Offering Segment:

- Hardware

- Software

- Services

By Deployment Mode Segment:

By Level Segment:

- Advanced Electronic Signatures

- Qualified Electronic Signatures

- Simple Digital Signatures

By Application Segment:

- BFSI (Banking, Financial Services, and Insurance)

- Government

- Healthcare & Life Sciences

- Retail

- IT & Telecom

- Others

Regional Analysis:

North America remains a dominant force in the global digital signature market, accounting for approximately 46% of the global market share in 2023. This leadership is underpinned by a robust technological infrastructure, widespread digital literacy, and a favorable regulatory environment that encourages the adoption of electronic signature solutions. The region’s mature IT ecosystem and the presence of key market players contribute significantly to its market prominence.

Within North America, the United States holds the largest share of the digital signature market, driven by early adoption across various sectors including finance, healthcare, and government. The U.S. market benefits from comprehensive legislation such as the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA), which provide legal validity to electronic signatures. These regulatory frameworks have facilitated the integration of digital signatures into business processes, enhancing operational efficiency and security.

Canada represents a significant portion of the North American digital signature market, with a strong emphasis on secure digital transactions and data privacy. The country’s Personal Information Protection and Electronic Documents Act (PIPEDA) establishes the legal framework for electronic signatures, promoting their use in both public and private sectors. Canadian organizations are increasingly adopting digital signature solutions to streamline operations and comply with regulatory requirements, particularly in industries such as healthcare and finance.

Mexico, while currently holding a smaller share of the North American digital signature market, is experiencing rapid growth. The country’s efforts to modernize its digital infrastructure and implement supportive regulations are fostering increased adoption of electronic signature technologies. As Mexican businesses and government agencies seek to enhance efficiency and security in document handling, the demand for digital signature solutions is expected to rise, contributing to the overall expansion of the market in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- DocuSign

- Adobe Sign

- Notarius

- Signority

- eSignLive

Competitive Analysis:

The North America digital signature market is highly competitive, characterized by the presence of several established players and a growing number of innovative entrants. Key companies such as DocuSign Inc., Adobe Inc., Entrust Corporation, and OneSpan Inc. dominate the landscape, leveraging their advanced platforms, brand recognition, and broad customer bases. These firms continuously invest in research and development to enhance security features, user experience, and integration capabilities with enterprise applications. Additionally, strategic partnerships, mergers, and acquisitions are common as players aim to expand market reach and improve service portfolios. Startups and niche providers are also gaining traction by offering specialized solutions tailored to specific industries such as healthcare, legal, and real estate. The competition is further intensified by increasing demand for interoperable, scalable, and cloud-based digital signature solutions. Overall, companies compete on innovation, compliance, and service agility, striving to meet the region’s evolving security standards and user expectations.

Recent Developments:

- In April 2025, DocuSign announced an expanded partnership with Cognizant to enhance customer support and drive digital transformation. This multi-year agreement will see Cognizant providing customer support services for DocuSign, including eSignature, billing, and technical support, while also advancing DocuSign’s Intelligent Agreement Management (IAM) platform. Additionally, in April 2025, DocuSign partnered with LSEG Risk Intelligence to offer real-time bank account verification within its eSignature product, enhancing fraud prevention and transaction efficiency for US customers.

- In Nov 2024, Protean eGov Technologies made headlines by launching eSignPro, a comprehensive digital signing and stamping solution. This new product is designed to streamline business document workflows, offering features like automated processes, customizable templates, and enhanced security. The introduction of eSignPro reflects the ongoing trend of integrating advanced digital signature tools to boost efficiency and reduce reliance on physical paperwork.

Market Concentration & Characteristics:

The North America digital signature market exhibits moderate to high market concentration, with a few dominant players controlling a significant share of the revenue. Companies such as DocuSign, Adobe, and Entrust lead the space due to their strong technological capabilities, robust security frameworks, and established customer trust. The market is characterized by rapid innovation, driven by evolving cybersecurity requirements, digital transformation initiatives, and increasing demand for compliance-driven solutions. Vendors focus heavily on cloud-based platforms, API integration, and mobile compatibility to cater to diverse enterprise needs. The market also demonstrates high scalability and adaptability, with digital signature solutions being adopted across both large enterprises and small to mid-sized businesses. Regulatory alignment and interoperability are crucial characteristics, shaping product development and deployment. Furthermore, the presence of advanced IT infrastructure and high digital literacy across the region reinforces the market’s maturity, while emerging players continue to explore opportunities through niche, industry-specific offerings.

Report Coverage:

The research report offers an in-depth analysis based on Offering, Deployment Mode, Level and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to witness sustained growth driven by ongoing digital transformation across government and private sectors.

- Increasing adoption of remote and hybrid work models will further fuel demand for secure digital transaction solutions.

- Integration of blockchain and AI technologies will enhance authentication, transparency, and fraud prevention capabilities.

- Cloud-based digital signature platforms will dominate due to their scalability and cost-efficiency for businesses of all sizes.

- Regulatory enhancements will standardize compliance requirements, fostering broader enterprise and cross-border adoption.

- Demand for industry-specific solutions in healthcare, legal, and real estate sectors will create new market niches.

- Rising emphasis on environmental sustainability will accelerate the shift from paper-based workflows to digital alternatives.

- Small and medium-sized enterprises (SMEs) will emerge as key adopters, supported by affordable SaaS offerings.

- Strategic alliances and acquisitions among key players will drive innovation and expand market penetration.

- Growing cybersecurity awareness will increase investment in tamper-proof and legally binding signature technologies.