| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Healthcare Supply Chain Management Market Size 2023 |

USD 870.80 Million |

| North America Healthcare Supply Chain Management Market, CAGR |

12.1% |

| North America Healthcare Supply Chain Management Market Size 2032 |

USD 2,438.15 Million |

Market Overview

North America Healthcare Supply Chain Management Market size was valued at USD 870.80 million in 2023 and is anticipated to reach USD 2,438.15 million by 2032, at a CAGR of 12.1% during the forecast period (2023-2032).

The North America healthcare supply chain management market is primarily driven by the growing demand for enhanced operational efficiency, cost reduction, and real-time data visibility across healthcare systems. Rising pressure on hospitals and healthcare providers to minimize waste and ensure timely delivery of medical supplies has accelerated the adoption of advanced supply chain solutions. The integration of technologies such as cloud computing, artificial intelligence (AI), and blockchain is further transforming supply chain operations, enabling greater transparency, automation, and predictive analytics. In addition, increasing regulatory requirements and the need for compliance with standards such as the Drug Supply Chain Security Act (DSCSA) are compelling organizations to modernize their logistics and inventory management practices. A notable trend is the shift toward value-based care, which emphasizes outcome-driven supply chain decisions. Moreover, the post-pandemic focus on resilient and agile supply chains has led to greater investments in digital infrastructure across healthcare facilities in the region.

The North America healthcare supply chain management market is driven by robust technological adoption across the United States, Canada, and Mexico, with the U.S. leading in terms of digital transformation and infrastructure modernization. The region benefits from the presence of well-established healthcare networks, growing investments in cloud-based platforms, and increasing regulatory requirements for supply chain transparency and efficiency. Canada is rapidly enhancing its digital healthcare ecosystem, while Mexico is gradually modernizing its infrastructure through public-private partnerships. Key players operating in the regional market include IBM Corporation, SAP SE, Oracle Corporation, McKesson Corporation, Tecsys Inc., Cardinal Health, Infor, Epicor Software Corporation, and Blue Yonder Group, Inc., among others. These companies are actively investing in advanced technologies such as AI, blockchain, and IoT to offer comprehensive and scalable supply chain solutions tailored to healthcare needs. Strategic collaborations, product innovation, and regional expansion remain central to their competitive positioning across North America.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America healthcare supply chain management market was valued at USD 870.80 million in 2023 and is projected to reach USD 2,438.15 million by 2032, growing at a CAGR of 12.1% from 2023 to 2032.

- The global healthcare supply chain management market was valued at USD 2,480.91 million in 2023 and is projected to reach USD 6,991.12 million by 2032, growing at a CAGR of 12.2% during the forecast period.

- Increasing demand for cost efficiency, inventory optimization, and real-time tracking is driving market growth across the region.

- The adoption of cloud-based solutions and AI-driven analytics is reshaping supply chain operations in healthcare facilities.

- Leading players like IBM, SAP, Oracle, and McKesson are investing in advanced technologies to maintain competitive edge.

- High implementation costs and data integration challenges are limiting the adoption among small and mid-sized healthcare providers.

- The United States dominates the market due to its advanced healthcare infrastructure and strong regulatory frameworks.

- Canada and Mexico are witnessing growing adoption through public-private collaborations and digital transformation initiatives.

Report Scope

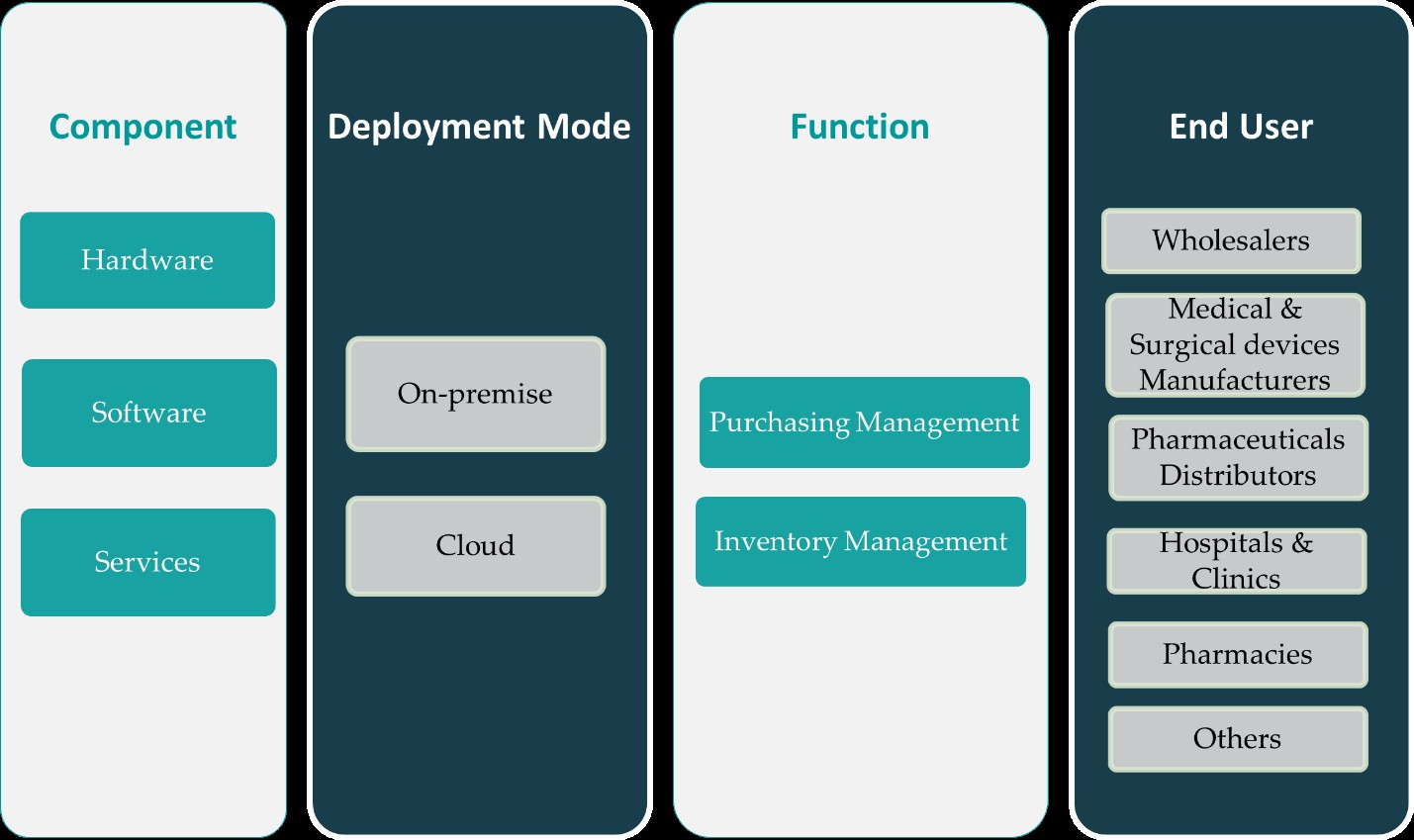

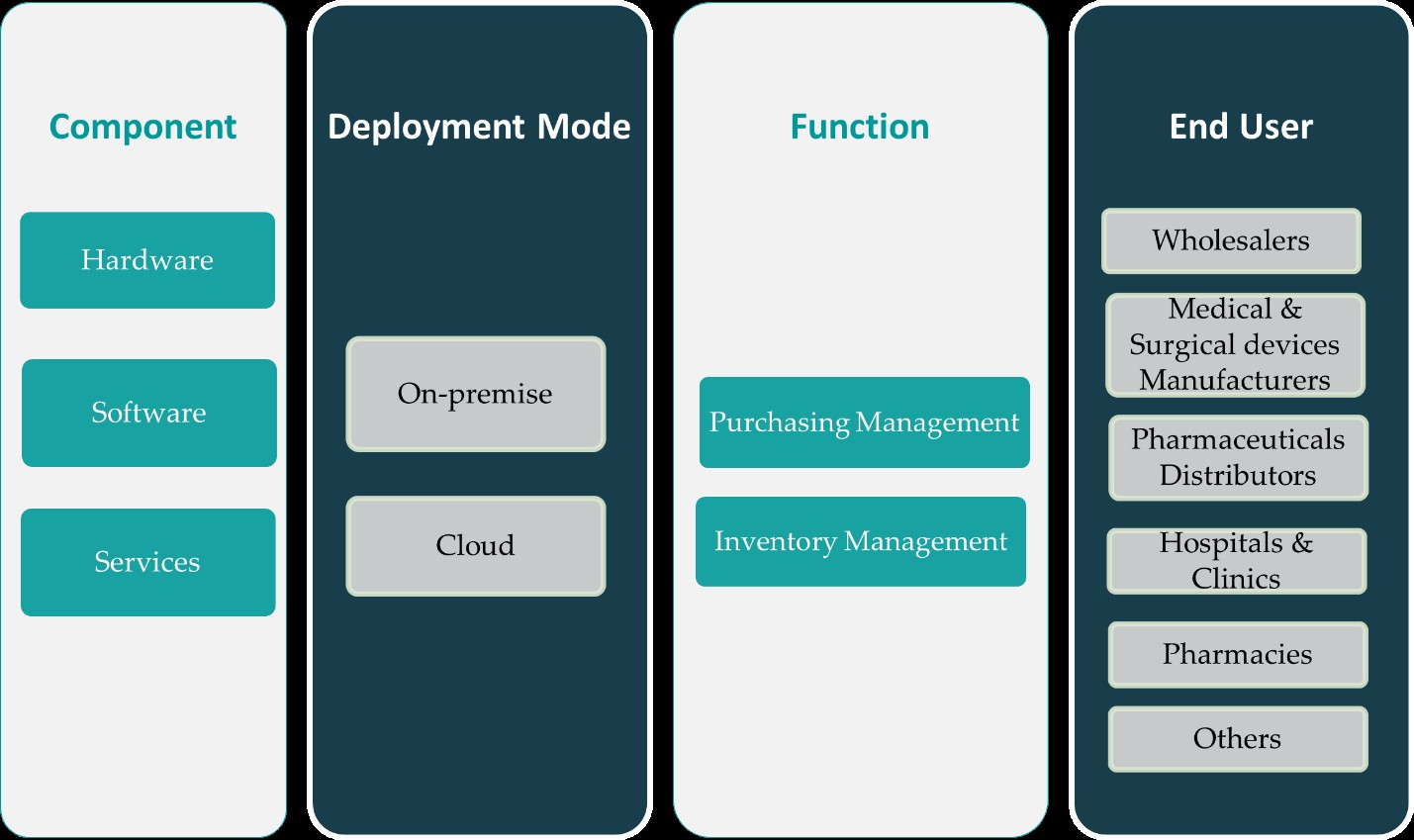

This report segments the North America Healthcare Supply Chain Management Market as follows:

Market Drivers

Increasing Demand for Operational Efficiency and Cost Reduction

One of the primary drivers of the North America healthcare supply chain management market is the rising need to enhance operational efficiency and reduce costs across healthcare systems. Healthcare providers are under constant pressure to optimize resources, minimize waste, and deliver high-quality patient care within constrained budgets. For instance, a survey conducted by the American Hospital Association revealed that hospitals implementing automated inventory management systems reduced stockouts and minimized waste, leading to improved patient care. Additionally, healthcare facilities in Texas have adopted AI-driven procurement tools to streamline purchasing processes, ensuring timely delivery of medical products and reducing operational expenses.

Adoption of Advanced Technologies and Digital Transformation

The rapid adoption of technologies such as artificial intelligence (AI), blockchain, machine learning, and the Internet of Things (IoT) is reshaping the healthcare supply chain landscape in North America. For instance, hospitals in California have deployed IoT-enabled devices to monitor the real-time location and condition of medical supplies, ensuring the integrity of temperature-sensitive products. Additionally, a government-backed initiative in Canada has introduced blockchain technology to enhance transparency and traceability in the pharmaceutical supply chain, reducing the risk of counterfeit drugs. Cloud-based platforms are also being widely adopted, with healthcare providers in New York leveraging these systems to improve coordination among suppliers and enhance supply chain agility.

Regulatory Compliance and Patient Safety Requirements

Regulatory frameworks such as the Drug Supply Chain Security Act (DSCSA) and other regional compliance mandates are playing a crucial role in shaping the North America healthcare supply chain management market. These regulations require end-to-end traceability, verification of product authenticity, and stringent reporting standards to safeguard public health. In response, healthcare organizations are deploying robust supply chain management systems that ensure compliance with these evolving standards while improving patient safety. These systems also help in mitigating the risks associated with counterfeit or expired products by offering real-time monitoring and alert mechanisms. As regulatory oversight continues to expand, organizations are prioritizing investments in solutions that enable seamless documentation, compliance tracking, and risk mitigation.

Growing Emphasis on Resilient and Agile Supply Chains

The COVID-19 pandemic exposed significant vulnerabilities in global and regional supply chains, prompting healthcare organizations across North America to re-evaluate and reinforce their supply chain strategies. As a result, there is now a growing emphasis on building resilient, flexible, and agile supply chains capable of responding to emergencies, fluctuating demand, and geopolitical disruptions. Healthcare providers are increasingly focusing on local sourcing, diversified supplier networks, and contingency planning to mitigate risks and maintain uninterrupted supply. This renewed focus is also driving the implementation of collaborative platforms that enhance communication and coordination among supply chain stakeholders. In the long term, such strategies are expected to improve operational continuity and patient care during both routine and crisis situations.

Market Trends

Shift Toward Cloud-Based and SaaS Supply Chain Platforms

A notable trend shaping the North America healthcare supply chain management market is the accelerated shift toward cloud-based and Software-as-a-Service (SaaS) platforms. These solutions offer healthcare providers scalable, cost-effective, and easily accessible tools for managing procurement, inventory, logistics, and supplier relations. For instance, hospitals in New York have adopted cloud-based platforms to enable seamless data integration across multiple departments, improving collaboration and decision-making. Additionally, a survey conducted by the American Hospital Association highlighted the use of SaaS platforms by clinics in California to track inventory levels and monitor shipment status in real-time, ensuring swift responses to supply chain disruptions.

Integration of Artificial Intelligence and Predictive Analytics

The adoption of artificial intelligence (AI) and predictive analytics is transforming how healthcare supply chains operate in North America. For instance, healthcare providers in Texas have implemented AI-powered demand forecasting tools to anticipate fluctuations in medical supply needs, reducing waste and enhancing resilience. Additionally, a government-backed initiative in Canada has introduced predictive analytics models to optimize logistics routes, ensuring timely delivery of critical healthcare products and minimizing operational inefficiencies. These technologies also aid in optimizing inventory levels and reducing reliance on manual processes, which are prone to human error. By leveraging AI and analytics, healthcare providers are making more informed, proactive decisions that enhance both operational efficiency and patient care outcomes.

Focus on End-to-End Visibility and Traceability

There is a growing emphasis on achieving end-to-end visibility and traceability across the healthcare supply chain. With increasing regulatory pressure and heightened concerns over counterfeit products, healthcare organizations are implementing systems that allow for full transparency from manufacturer to patient. Advanced tracking technologies such as RFID, barcoding, and blockchain are being integrated into supply chain operations to ensure product authenticity, monitor storage conditions, and trace the entire journey of pharmaceuticals and medical devices. This trend not only ensures compliance with regulations like the Drug Supply Chain Security Act (DSCSA) but also boosts stakeholder confidence in product integrity and supply reliability.

Emphasis on Supplier Diversification and Risk Management

In response to recent global supply chain disruptions, healthcare organizations in North America are placing greater emphasis on supplier diversification and strategic risk management. Rather than relying on a single source or region, companies are building networks of local and regional suppliers to increase supply chain resilience. This shift is also encouraging partnerships with third-party logistics providers (3PLs) and contract manufacturers who offer specialized expertise and flexibility. Additionally, organizations are adopting scenario planning and risk assessment tools to identify vulnerabilities and develop contingency strategies. This proactive approach is helping healthcare systems ensure uninterrupted access to critical supplies during emergencies or unexpected disruptions.

Market Challenges Analysis

Data Fragmentation and Integration Complexities

One of the significant challenges facing the North America healthcare supply chain management market is data fragmentation and the complexity of integrating diverse systems. Many healthcare organizations operate with legacy IT infrastructures, siloed departments, and disparate data sources that lack interoperability. For instance, a study by the U.S. Department of Health and Human Services highlighted that hospitals in Texas face delays in decision-making due to incompatibility between electronic health records (EHRs) and procurement systems. Additionally, healthcare providers in California have implemented cloud-based platforms to address integration challenges, enabling better coordination across departments and improving real-time visibility. Efforts to integrate AI and blockchain technologies into legacy systems have been supported by government-funded programs aimed at reducing operational inefficiencies.

High Implementation Costs and Cybersecurity Risks

Another critical challenge in the region is the high cost associated with implementing advanced healthcare supply chain solutions, particularly for small and mid-sized healthcare providers. While technologies such as AI, IoT, and predictive analytics offer considerable benefits, they require significant upfront capital, ongoing maintenance, and staff training. For many institutions, budget constraints limit the adoption of comprehensive solutions, thereby widening the digital gap between large health systems and smaller facilities. Additionally, the increasing digitization of supply chain data raises serious concerns regarding cybersecurity. Healthcare supply chains are frequent targets of cyberattacks due to the sensitive nature of patient and vendor data. A single breach can disrupt operations, lead to regulatory penalties, and erode patient trust. As cyber threats become more sophisticated, organizations must invest in robust cybersecurity frameworks alongside supply chain upgrades—further driving up overall costs and implementation complexity.

Market Opportunities

The North America healthcare supply chain management market presents significant growth opportunities driven by the increasing adoption of value-based care models and the rising focus on patient-centric healthcare delivery. As providers shift from volume-based to outcome-driven approaches, there is a growing demand for supply chain systems that can support data-driven decision-making, optimize resource allocation, and improve clinical outcomes. This transition creates a favorable environment for the development of integrated platforms that link supply chain processes with patient care pathways. Moreover, advancements in cloud computing and AI-powered analytics provide opportunities for vendors to offer scalable, customizable solutions tailored to the specific needs of hospitals, ambulatory care centers, and long-term care facilities. These technologies can help reduce waste, manage inventories more effectively, and ensure the timely availability of essential medical supplies—all of which contribute to better patient outcomes and cost efficiency.

In addition, the growing emphasis on sustainability and environmental stewardship within the healthcare sector is creating new avenues for innovation in supply chain management. Organizations are increasingly looking to adopt green logistics, energy-efficient warehousing, and eco-friendly packaging solutions. This shift opens up opportunities for supply chain providers that offer sustainable and ethically sourced materials, reverse logistics capabilities, and carbon footprint monitoring tools. Furthermore, the rapid expansion of telehealth and home-based care services has introduced new distribution models that require flexible and responsive supply chain systems. Companies that can support last-mile delivery, remote inventory tracking, and patient-level supply visibility stand to gain a competitive advantage. As regulatory bodies continue to encourage greater transparency, traceability, and risk mitigation in supply chain practices, there is a growing opportunity for solution providers to differentiate themselves through innovation, compliance readiness, and strategic partnerships across the healthcare ecosystem.

Market Segmentation Analysis:

By Component:

The component segment of the North America healthcare supply chain management market is categorized into hardware, software, and services. Among these, the software segment holds a dominant share due to the growing adoption of advanced platforms for real-time inventory tracking, procurement automation, and data analytics. These solutions are designed to optimize operational efficiency, enhance decision-making, and reduce waste. The increasing reliance on software tools integrated with technologies like AI, blockchain, and IoT is further fueling segment growth. Meanwhile, the services segment is also witnessing strong demand, driven by the need for system integration, consulting, and maintenance support. As healthcare facilities transition to digital platforms, the demand for professional services that ensure seamless deployment and training continues to rise. While hardware remains essential for tracking and monitoring equipment—such as RFID tags and barcode scanners—its share is comparatively smaller due to limited scalability and higher maintenance costs. Overall, the shift toward digital and service-oriented supply chain ecosystems is reshaping component preferences in the regional market.

By Deployment Mode:

Based on deployment mode, the North America healthcare supply chain management market is segmented into on-premise and cloud-based solutions. On-premise systems have traditionally held a significant share, particularly among large hospitals and health networks that prioritize in-house data control and customization. These solutions are valued for their robust security and direct integration with existing enterprise systems. However, cloud-based deployment is gaining rapid momentum due to its scalability, cost-effectiveness, and ease of access. Cloud platforms support real-time updates, remote monitoring, and streamlined collaboration across geographically dispersed healthcare facilities. In addition, cloud solutions significantly reduce the need for heavy IT infrastructure and lower upfront capital investment, making them especially attractive to small and mid-sized healthcare providers. With the growing emphasis on agility, data interoperability, and digital transformation, cloud deployment is expected to outpace traditional on-premise systems over the forecast period. Vendors offering secure, HIPAA-compliant cloud platforms with AI and analytics capabilities are likely to see strong adoption across the regional healthcare ecosystem.

Segments:

Based on Component:

- Hardware

- Software

- Services

Based on Deployment Mode:

Based on Function:

- Purchasing Management

- Inventory Management

Based on End User:

- Medical & Surgical Device Manufacturers

- Pharmaceutical Distributors

- Wholesalers

- Hospital & Clinics

- Pharmacies

- Others

Based on the Geography:

Regional Analysis

United States

United States accounted for the largest share of the North America healthcare supply chain management market, contributing approximately 83% of the regional revenue. The dominance of the U.S. market can be attributed to its advanced healthcare infrastructure, high adoption of digital technologies, and strong presence of leading software vendors and service providers. Major hospitals and healthcare networks across the country are increasingly investing in integrated supply chain solutions to improve operational efficiency and meet evolving regulatory standards such as the Drug Supply Chain Security Act (DSCSA). Moreover, initiatives aimed at enhancing value-based care and minimizing costs are driving the demand for real-time inventory tracking, predictive analytics, and supplier relationship management systems. The strong emphasis on innovation, along with a well-established ecosystem of technology partners, positions the U.S. as a key growth driver within the North American market.

Canada

Canada held a market share of around 9% in the North America healthcare supply chain management market in 2023. The country is steadily embracing digital transformation across its public and private healthcare sectors. Canadian healthcare providers are focusing on reducing procurement inefficiencies and improving resource allocation to optimize patient care. The federal government’s commitment to health IT investments and interoperability across provinces is facilitating the adoption of advanced supply chain solutions. In addition, the rising demand for cloud-based platforms, particularly among small and mid-sized healthcare organizations, is contributing to market expansion. Collaborations between hospitals and technology vendors to streamline inventory and logistics management are further enhancing Canada’s position in the regional market. Continued emphasis on patient safety and regulatory compliance is expected to drive sustained demand for intelligent supply chain systems.

Mexico

Mexico accounted for approximately 6.1% of the North America healthcare supply chain management market in 2023. While the country’s healthcare system faces infrastructure and funding challenges, there is a growing focus on modernizing supply chain operations to improve efficiency and reduce costs. Both public and private hospitals are investing in automated inventory management and procurement solutions to better manage limited resources. International collaborations and partnerships with global technology providers are also playing a role in supporting the country’s digital health ambitions. Additionally, Mexico’s expanding pharmaceutical and medical device sectors create demand for transparent, traceable, and efficient supply chain systems. Though still emerging, the market is poised for moderate growth as stakeholders recognize the strategic value of supply chain modernization.

Key Player Analysis

- IBM Corporation

- SAP SE

- McKesson Corporation

- North America Healthcare Exchange, LLC

- Oracle Corporation

- Tecsys Inc.

- Infor

- Corcentric, Inc.

- Epicor Software Corporation

- Cardinal Health

- Blue Yonder Group, Inc.

- LogiTag Systems

- Coupa

- Medsphere Systems Corporation

- Manhattan Associates

- Others

Competitive Analysis

The North America healthcare supply chain management market features intense competition among prominent players that focus on technological innovation, strategic partnerships, and regional expansion. Leading companies such as IBM Corporation, SAP SE, Oracle Corporation, McKesson Corporation, Tecsys Inc., Cardinal Health, Infor, Epicor Software Corporation, Blue Yonder Group, Inc., and Coupa play a critical role in shaping the competitive landscape. These companies are investing heavily in advanced technologies including AI, machine learning, blockchain, and cloud-based platforms to enhance supply chain visibility, optimize inventory management, and ensure regulatory compliance. Vendors are offering customized and scalable solutions tailored to the unique needs of hospitals, clinics, and pharmaceutical distributors, enabling them to improve operational efficiency and reduce costs. Strategic collaborations with healthcare providers and technology firms are common approaches to broaden service portfolios and strengthen market presence. Additionally, mergers and acquisitions are being utilized to expand geographical reach and integrate complementary solutions. Despite growing competition, the market presents ample opportunities for differentiation through value-added services, cybersecurity features, and real-time analytics. As the demand for end-to-end supply chain transparency continues to rise, companies that can provide secure, integrated, and interoperable platforms are well-positioned to lead the market.

Recent Developments

- In March 2025, SAP unveiled its vision for autonomous supply chains embedded with AI-first strategies and launched SAP Business Data Cloud for enhanced operational visibility.

- In February 2025, GHX celebrated its Supply Chains of Distinction Award, recognizing top-performing hospitals that excelled in automation and clinical integration.

- In January 2025, McKesson’s Practice Insights was named a Qualified Clinical Data Registry by CMS, enabling oncology practices to streamline data reporting and improve patient care.

- In November 2024, IBM integrated generative AI into its cognitive control tower, enabling natural language queries for faster decision-making. This transformation saved $388 million in inventory and shipping costs.

- In September 2024, Oracle introduced RFID-powered replenishment solutions in its Cloud SCM platform to automate inventory management and improve visibility across healthcare supply chains.

Market Concentration & Characteristics

The North America healthcare supply chain management market exhibits moderate to high market concentration, characterized by the presence of a few dominant players with strong technological capabilities and extensive client networks. Companies such as IBM, SAP, Oracle, and McKesson maintain a significant share due to their comprehensive product offerings and established relationships with healthcare institutions. The market is defined by continuous innovation, with vendors increasingly integrating artificial intelligence, blockchain, and Internet of Things (IoT) technologies into their solutions to enhance real-time visibility, traceability, and compliance. The sector also reflects a strong inclination toward digital transformation and cloud-based deployment, driven by the demand for cost reduction and operational efficiency. While large enterprises dominate, there is room for emerging players offering niche and agile solutions. Regulatory compliance, cybersecurity, and interoperability are critical characteristics influencing vendor selection. As healthcare systems prioritize value-based care, the market continues to evolve with a focus on data-driven, patient-centric supply chain models.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Function, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of AI and predictive analytics will enhance decision-making and demand forecasting in healthcare supply chains.

- Cloud-based platforms will continue to replace traditional systems, offering scalability and improved collaboration.

- Healthcare providers will prioritize end-to-end supply chain visibility to support patient-centric care models.

- Integration of blockchain will strengthen data security and transparency across the supply chain.

- Interoperability and system integration will become essential for seamless data exchange among stakeholders.

- Government regulations will drive compliance-focused digital solutions in inventory and logistics management.

- Strategic partnerships between tech firms and healthcare providers will accelerate digital transformation.

- Automation and robotics will increasingly be used to streamline warehousing and distribution processes.

- Smaller healthcare facilities will adopt cost-effective supply chain solutions to enhance operational efficiency.

- Continued investments in innovation will support market expansion and create competitive differentiation.