Market Overview:

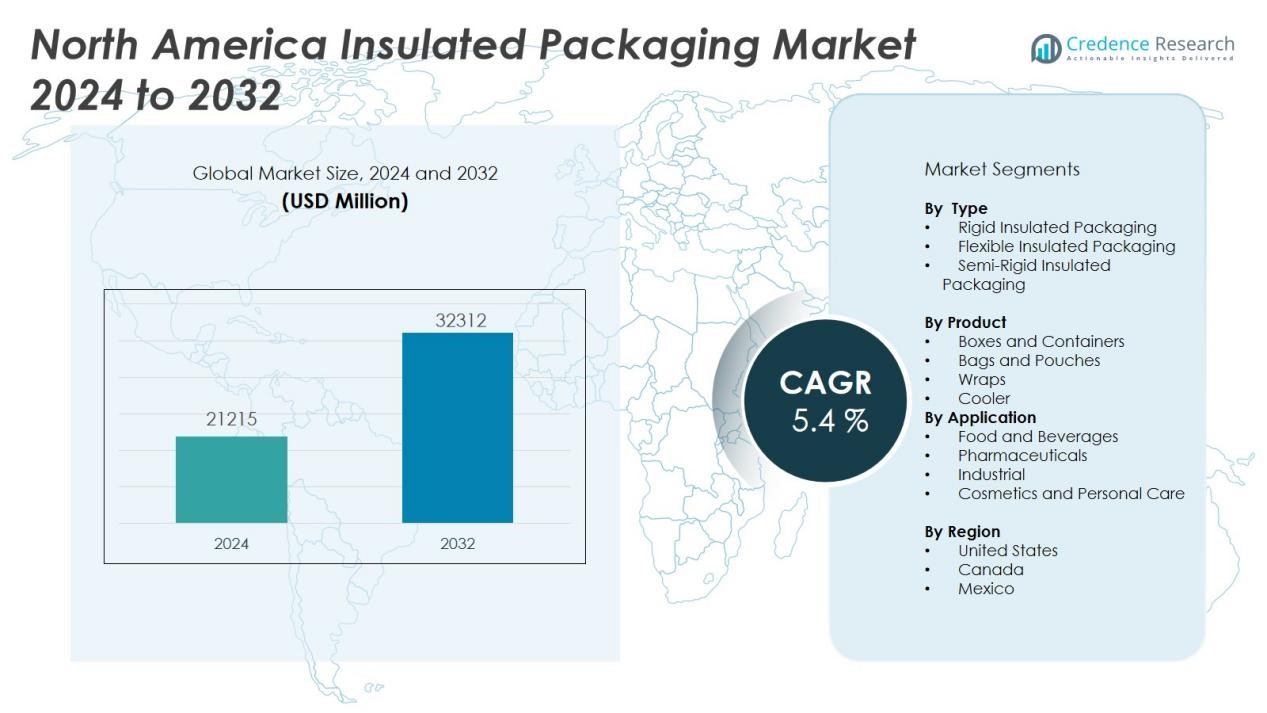

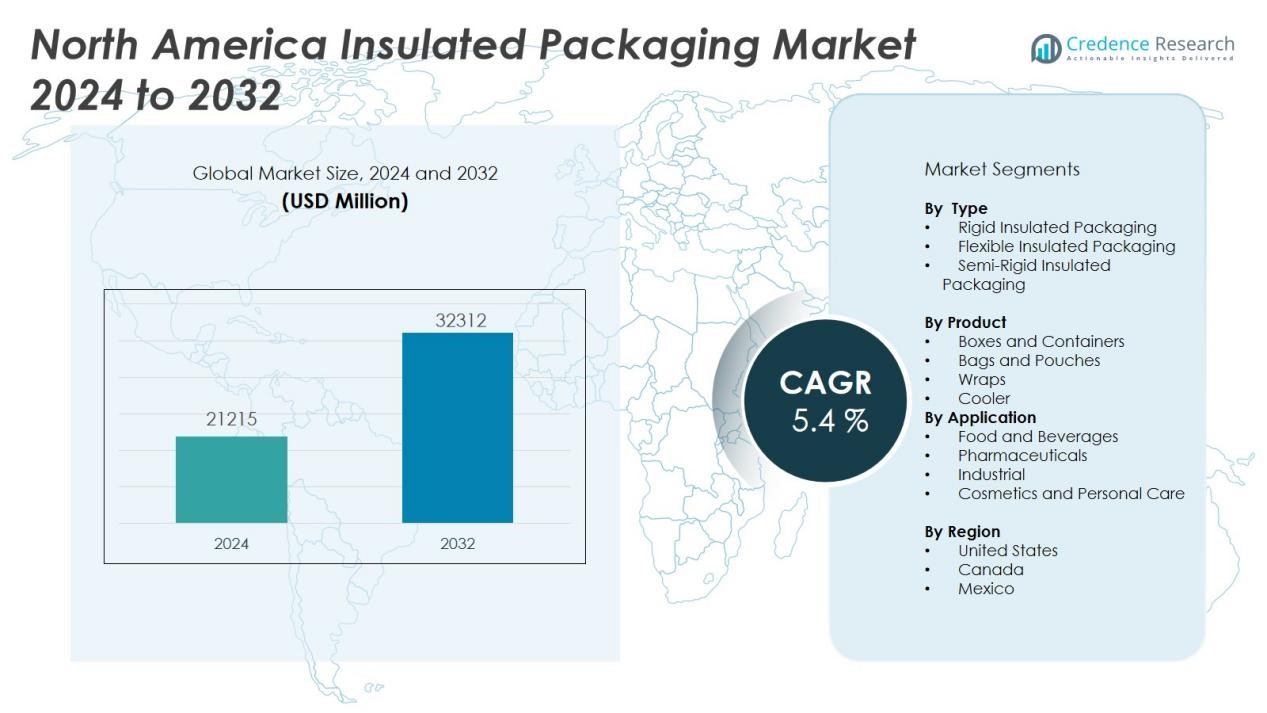

The North America Insulated Packaging Market size was valued at USD 21215 million in 2024 and is anticipated to reach USD 32312 million by 2032, at a CAGR of 5.4 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Insulated Packaging Market Size 2024 |

USD 21215 Million |

| North America Insulated Packaging Market, CAGR |

5.4 % |

| North America Insulated Packaging Market Size 2032 |

USD 32312 Million |

Key drivers shaping the market include stricter regulations on food safety and pharmaceutical integrity, which increase the adoption of advanced insulated packaging solutions. The growth of online grocery platforms and pharmaceutical distribution channels fuels investment in packaging formats that preserve product freshness and potency. Companies are developing eco-friendly, recyclable insulation materials to meet consumer preferences for sustainability and comply with environmental mandates.

Regionally, the United States dominates the North America Insulated Packaging Market, supported by robust cold chain infrastructure, advanced packaging innovation, and significant investments in supply chain modernization from key players such as Sonoco Products Company, Cold Ice Inc., Ecovative LLC., Amcor plc, Huhtamaki Oyj, Innovative Energy Inc., and DuPont. Canada follows, benefiting from a strong food export sector and expanding pharmaceutical manufacturing base, also driven by initiatives from major insulated packaging suppliers. Both countries see rising adoption of insulated packaging in meal kits, biologics, and specialty foods, reflecting evolving consumption patterns and heightened focus on product quality assurance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Insulated Packaging Market reached USD 21,215 million in 2024 and will grow to USD 32,312 million by 2032.

- Investments in cold chain infrastructure and temperature-controlled logistics drive demand for high-performance insulated packaging.

- E-commerce expansion and direct-to-consumer meal kit and pharmaceutical services increase the need for innovative, reliable packaging.

- Regulatory focus on food safety and pharmaceutical integrity accelerates adoption of certified insulation solutions.

- Rising raw material costs and supply chain disruptions pressure profitability and complicate procurement strategies for manufacturers.

- The United States leads with 78% share, followed by Canada at 19% and Mexico at 3%, each driven by unique market forces.

- Sustainability and compliance trends push manufacturers to develop recyclable, bio-based, and reusable insulation materials.

Market Drivers:

Expanding Cold Chain Infrastructure Fuels Market Demand:

The rapid expansion of cold chain infrastructure serves as a primary driver in the North America Insulated Packaging Market. Investments in advanced warehousing, refrigerated transport, and temperature-monitoring systems support the need for reliable packaging that ensures product quality. It addresses the growing movement of perishable goods across longer distances while minimizing spoilage risks. Food and pharmaceutical supply chains depend on these systems to meet safety and regulatory standards.

- For instance, Lineage, Inc. acquired four cold storage warehouses from Tyson Foods in 2025, adding approximately 49million cubic feet and 160,000 pallet positions to its North American network.

Growth of E-Commerce and Direct-to-Consumer Channels Increases Adoption:

The surge in e-commerce platforms and direct-to-consumer channels amplifies the need for insulated packaging across North America. Online grocery delivery, meal kits, and pharmaceutical shipments require packaging that protects products against temperature fluctuations during transit. It drives manufacturers to introduce innovative insulation materials and designs tailored to small-parcel distribution. This trend supports brand reputation and customer satisfaction.

Stringent Regulatory Environment Enhances Demand for Quality Solutions:

Regulatory agencies in North America enforce strict guidelines for the handling and transportation of temperature-sensitive products. The North America Insulated Packaging Market benefits from robust oversight, which compels stakeholders to invest in certified, high-performance insulation materials. It helps companies ensure compliance with food safety and pharmaceutical integrity requirements. Regulatory focus on health and safety standards underpins the market’s upward trajectory.

- For instance, Woolcool® supplies packaging systems that have been independently proven to maintain pharmaceuticals within the critical 2°C–8°C range for more than 120 hours, ensuring compliance with stringent pharmaceutical delivery regulations for clients like Baxter Healthcare and Oxford Nanopore Technologies.

Sustainability Initiatives and Consumer Preferences Shape Material Choices:

Rising consumer demand for sustainable packaging prompts manufacturers to develop recyclable, reusable, and bio-based insulated solutions. Companies in the North America Insulated Packaging Market respond by investing in eco-friendly materials that meet both environmental mandates and market expectations. It enhances brand value and supports regulatory compliance. This shift aligns with broader trends in corporate responsibility and green supply chains.

Market Trends:

Adoption of Advanced and Eco-Friendly Insulation Materials Gains Momentum:

A significant trend in the North America Insulated Packaging Market involves the rapid adoption of advanced insulation materials that balance performance with environmental responsibility. Manufacturers introduce bio-based foams, recyclable liners, and phase-change materials that improve thermal efficiency and reduce the environmental footprint. It accelerates the development of packaging that satisfies both stringent regulatory requirements and consumer sustainability preferences. Many companies explore plant-based insulation, compostable wraps, and reusable shipping containers to address shifting market dynamics. These innovations allow brands to position themselves as environmentally conscious without compromising on product safety. Demand for high-performance, lightweight materials also supports supply chain efficiency and reduces costs for end users.

- For instance, Nature-Pack’s Fibrease® wood foam, a partnership with Stora Enso, achieves an R-value of R-4.1/inch and can be curbside-recycled with the paper stream while offering superior thermal protection for cold chain applications.

Digitalization and Customization Drive Packaging Innovation:

Digitalization and the push for customization reshape the landscape of the North America Insulated Packaging Market. Companies adopt IoT-enabled sensors, smart tags, and real-time tracking systems to monitor temperature and ensure compliance throughout the logistics process. It empowers brands and logistics providers to enhance traceability and transparency for temperature-sensitive shipments. Demand for tailored packaging solutions grows, with brands seeking insulation designs that fit specific products, reduce waste, and streamline packaging operations. Automation in production lines and the use of data analytics further optimize material selection and inventory management. These technological advancements enable companies to respond swiftly to changing market needs and regulatory updates.

- For instance, DHL Supply Chain has deployed over 5,000 Locus Robotics autonomous mobile robots at more than 35 locations globally, reaching an unprecedented milestone of 500 million robotic picks and significantly reducing manual labor demands and error rates in packaging for pharmaceutical and e-commerce clients.

Market Challenges Analysis:

Rising Material Costs and Supply Chain Volatility Impact Profitability:

Escalating raw material costs present a significant challenge for the North America Insulated Packaging Market. Price fluctuations in polymers, specialty foams, and bio-based materials strain profit margins for manufacturers and converters. It complicates long-term procurement strategies and can delay the adoption of innovative, sustainable insulation solutions. Supply chain disruptions, transportation delays, and import restrictions further heighten operational risks. These issues force companies to reevaluate sourcing practices and maintain higher inventory levels, increasing costs across the value chain.

Regulatory Compliance and Waste Management Hurdles Intensify:

Strict regulations on packaging waste, recycling, and food contact safety create compliance challenges for market participants. The North America Insulated Packaging Market must address evolving mandates related to extended producer responsibility and landfill diversion targets. It demands significant investment in new materials, labeling, and take-back programs to meet legislative requirements. Complexities around multi-material packaging recycling slow the transition to circular supply chains. Companies face pressure to balance performance, cost, and sustainability in a changing regulatory environment.

Market Opportunities:

Emergence of High-Growth Sectors Expands Revenue Streams:

The rapid growth of pharmaceuticals, biologics, and specialty foods opens new avenues for the North America Insulated Packaging Market. Precision medicine, vaccine distribution, and meal kit services create demand for specialized temperature-controlled packaging. It enables manufacturers to diversify their product portfolios and address evolving customer needs. Opportunities exist in serving niche markets that require strict temperature compliance and premium product protection. Companies can leverage expertise in insulation technology to build long-term partnerships with these high-growth sectors. This strategy supports sustained revenue generation and market differentiation.

Innovation in Sustainable Packaging Drives Competitive Advantage:

Rising focus on eco-friendly solutions presents significant opportunities for innovation in the North America Insulated Packaging Market. Companies that invest in recyclable, compostable, and reusable insulation materials can capture environmentally conscious consumers and comply with new regulatory mandates. It supports brand reputation and aligns with the sustainability priorities of major clients in retail, healthcare, and logistics. The ability to deliver cost-effective, high-performance sustainable solutions positions suppliers for future growth. Emphasis on lifecycle analysis, closed-loop systems, and collaboration with recyclers enhances value creation across the market.

Market Segmentation Analysis:

By Type:

The North America Insulated Packaging Market covers various insulation types, with rigid, flexible, and semi-rigid solutions leading adoption. Rigid insulated packaging holds a strong position due to its durability and superior thermal protection, serving pharmaceuticals, food, and specialty chemicals. Flexible insulation, favored for lightweight and space-saving properties, meets the needs of e-commerce and direct-to-consumer deliveries. Semi-rigid formats offer a balance of structure and adaptability for diverse product applications.

- For instance, Sonoco ThermoSafe’s ChillTech® reusable shippers offer 2°C to 8°C protection with single-stage conditioning, supporting shipment durations from 2 days up to 6 days—enabling payloads up to 40L to be delivered with validated temperature control across North America as of 2025.

By Product:

Major product segments in the North America Insulated Packaging Market include boxes and containers, bags and pouches, wraps, and coolers. Boxes and containers dominate market share, offering robust protection for temperature-sensitive shipments. Bags and pouches cater to meal kits, seafood, and fresh produce, supporting the trend toward smaller, customized deliveries. Wraps and coolers extend shelf life for pharmaceuticals and specialty foods during transit, enhancing supply chain reliability.

- For instance, Sealed Air Cryovac® Modified Atmosphere Packaging (MAP) technology extends the shelf life of specialty breads and baked goods to over 40 days—over 75% longer than traditional packaging—substantially reducing waste and enabling broader product distribution.

By Application:

Food and beverages lead in application share, with strong demand for insulated packaging in frozen foods, dairy, and ready-to-eat meals. The pharmaceutical sector relies on advanced insulation to maintain product efficacy across biologics, vaccines, and specialty drugs. It extends to industrial applications, where specialty chemicals and electronics require thermal protection. Each segment drives ongoing innovation in materials and design to meet strict regulatory and quality standards.

Segmentations:

By Type:

- Rigid Insulated Packaging

- Flexible Insulated Packaging

- Semi-Rigid Insulated Packaging

By Product:

- Boxes and Containers

- Bags and Pouches

- Wraps

- Coolers

By Application:

- Food and Beverages

- Pharmaceuticals

- Industrial

- Cosmetics and Personal Care

By Region:

- United States

- Canada

- Mexico

Regional Analysis:

United States :

The United States holds 78% share of the North America Insulated Packaging Market, driven by extensive cold chain networks and advanced logistics capabilities. It benefits from significant investment in food safety, pharmaceutical distribution, and temperature-sensitive e-commerce. Major industry players focus on developing high-performance packaging for sectors such as meal kits, biologics, and specialty foods. Strong demand from healthcare and retail further accelerates product innovation and adoption. The U.S. regulatory landscape promotes the use of certified, sustainable materials, encouraging ongoing advancements in eco-friendly insulation. Strong partnerships with global supply chain operators position the country as a leading exporter of temperature-controlled goods.

Canada :

Canada captures 19% share of the North America Insulated Packaging Market, supported by its expanding food export industry and increasing pharmaceutical manufacturing activity. It emphasizes compliance with strict packaging standards to preserve product integrity across long-haul distribution routes. Canadian manufacturers invest in recyclable, lightweight insulated solutions that address the nation’s environmental priorities. Demand for packaging that supports seafood, produce, and meat exports remains high. Collaboration with technology partners accelerates the adoption of smart, sensor-enabled packaging formats. Canada’s focus on R&D and advanced automation ensures steady gains in market competitiveness.

Mexico :

Mexico holds 3% share of the North America Insulated Packaging Market, leveraging its role as a key participant in cross-border supply chains. It supplies insulated packaging solutions for temperature-sensitive shipments in produce, seafood, and pharmaceuticals. Domestic demand rises in response to evolving retail formats and fresh food delivery services. Mexican companies invest in cost-effective packaging that meets both U.S. and Canadian regulatory requirements. Strategic partnerships with North American distributors and logistics providers strengthen Mexico’s market presence. Opportunities exist for local manufacturers to expand in emerging applications and export-driven segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sonoco Products Company

- Cold Ice Inc.

- Ecovative LLC.

- Amcor plc

- Huhtamaki Oyj

- Innovative Energy Inc.

- DuPont

- Deutsche Post AG

- TP Solutions GMBH

- MARKO FOAM PRODUCTS

Competitive Analysis:

The North America Insulated Packaging Market features strong competition among leading players such as Sonoco Products Company, Cold Ice Inc., Ecovative LLC, Amcor plc, Huhtamaki Oyj, Innovative Energy Inc., and DuPont. It benefits from continuous investment in research and development, with each company focusing on advanced insulation materials, enhanced temperature-control technologies, and sustainable packaging solutions. Companies differentiate themselves through proprietary product lines, supply chain integration, and customization capabilities tailored to end-user requirements. Strategic partnerships and acquisitions shape the competitive landscape, enabling market leaders to strengthen their distribution networks and expand regional footprints. It also sees rising emphasis on eco-friendly packaging and compliance with strict regulatory standards, further elevating the level of innovation and quality assurance across the market.

Recent Developments:

- In July 2025, Sonoco Products Company achieved accreditation with the Pet Sustainability Coalition, highlighting its ongoing sustainability efforts in pet food packaging.

- In June 2025, Amcor launched a first-of-its-kind more sustainable shrink bag for turkey packaging.

- In February 2025, Huhtamaki launched recyclable single coated paper cups for yogurt and dairy under the brand “ProDairy

Market Concentration & Characteristics:

The North America Insulated Packaging Market demonstrates moderate to high concentration, with leading multinational players controlling a significant portion of industry revenue. It features strong competition among established firms focused on proprietary insulation materials, temperature-control technologies, and supply chain integration. The market is characterized by continuous innovation in sustainable solutions and investments in advanced manufacturing automation. Strategic partnerships and mergers shape competitive dynamics, while barriers to entry remain high due to regulatory requirements and specialized technology needs. Market participants emphasize product certification, quality assurance, and rapid response to evolving end-user demands. This environment fosters a blend of scale-driven efficiency and ongoing R&D in thermal packaging.

Report Coverage:

The research report offers an in-depth analysis based on Type, Product, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Industry leaders will expand offerings of recyclable and compostable insulation materials.

- Companies will adopt smart packaging with built‑in sensors to monitor temperature and trace shipments.

- Service providers will integrate real‑time data analytics into cold chain logistics for improved visibility.

- Brands will design custom-fit insulation solutions for diverse product formats, reducing waste and transit damage.

- Investment in automation and robotics will increase efficiency in packaging production and material handling.

- Collaboration with recyclers and circular economy partners will strengthen closed‑loop packaging systems.

- Stakeholders will develop hybrid systems combining passive insulation and active cooling units for long‑distance shipments.

- Providers will target niche verticals like personalized biologics and direct‑to‑consumer meal kits.

- Regulatory focus on sustainability will prompt rapid innovation in eco‑friendly packaging solutions.

- Companies will enhance modular insulated containers that support scalable, repeatable use across multiple shipments.