Market Overview:

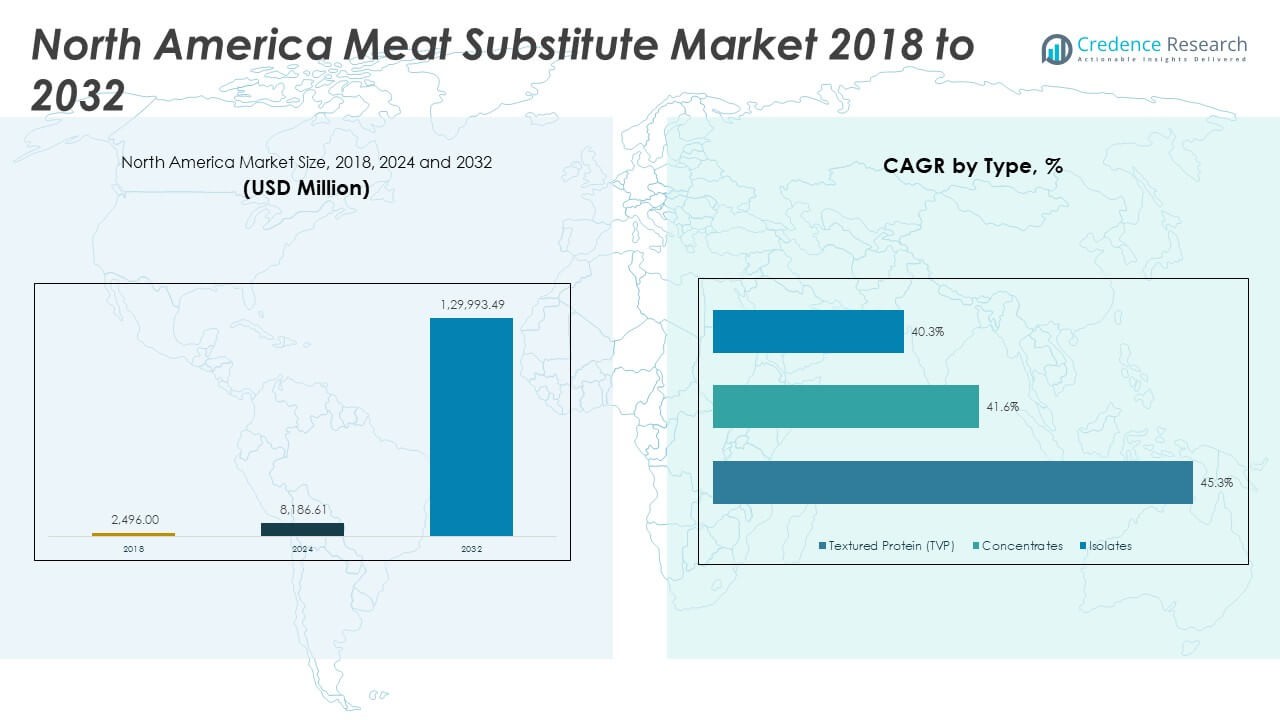

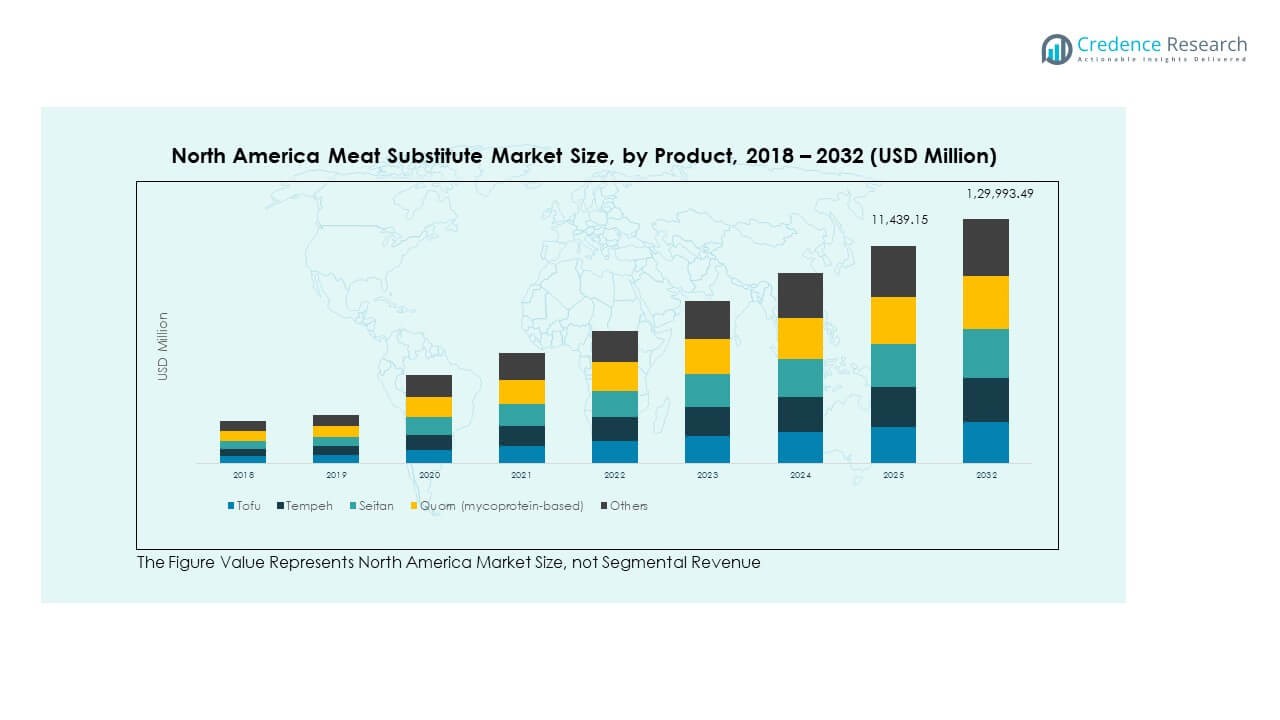

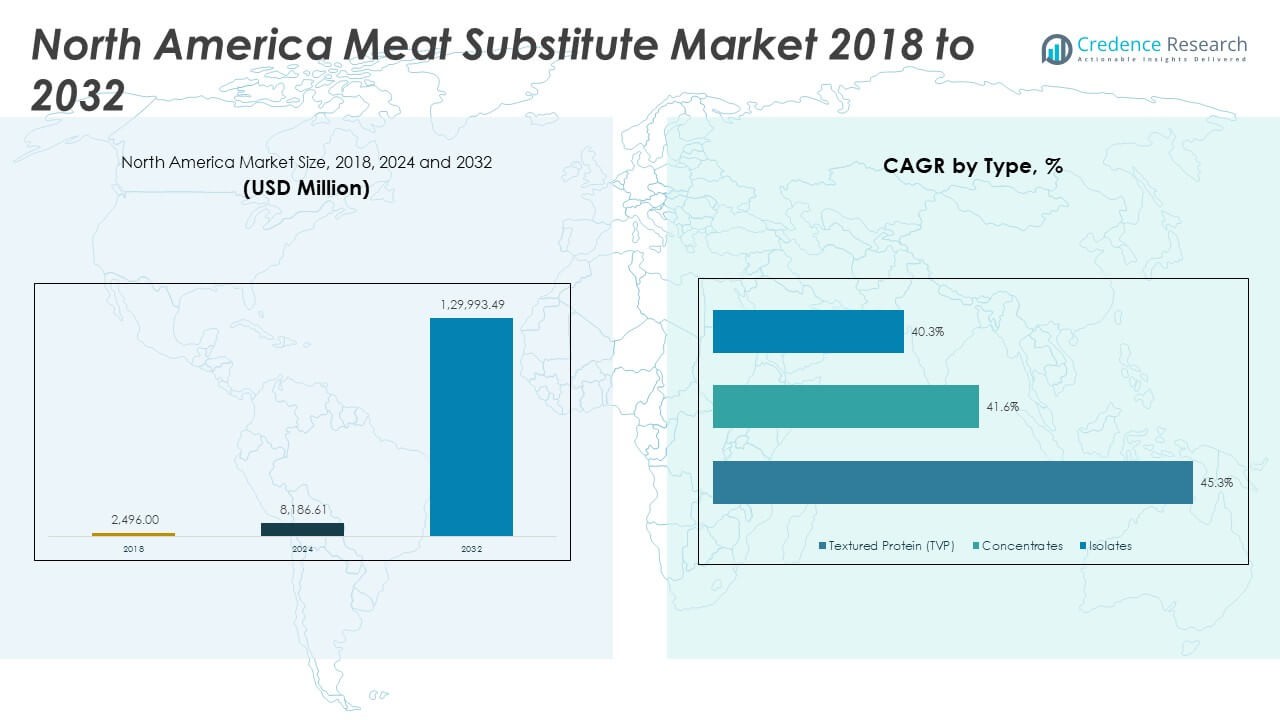

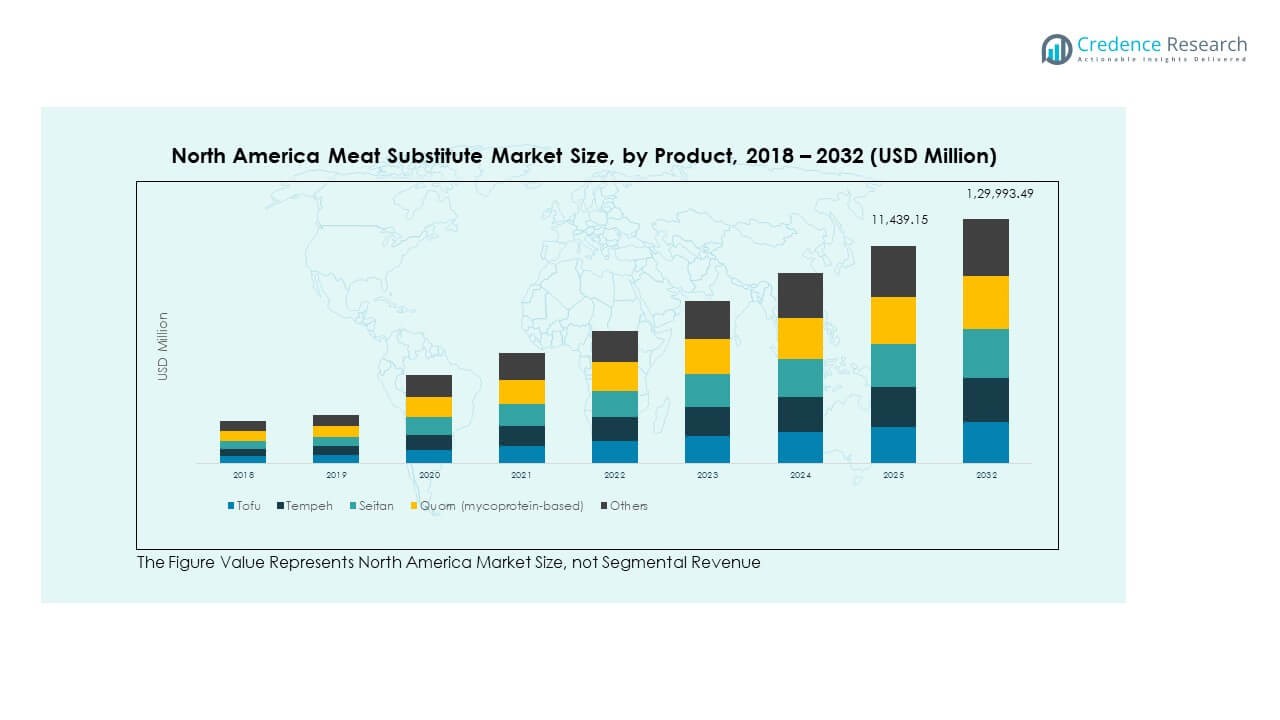

The North America Meat Substitute Market size was valued at USD 2,496.00 million in 2018 to USD 8,186.61 million in 2024 and is anticipated to reach USD 1,29,993.49 million by 2032, at a CAGR of 41.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Meat Substitute Market Size 2024 |

USD 8,186.61 Million |

| North America Meat Substitute Market, CAGR |

41.05% |

| North America Meat Substitute Market Size 2032 |

USD 1,29,993.49 Million |

The market growth is driven by rising consumer awareness of health, sustainability, and ethical food choices. Growing concerns about the environmental impact of animal farming have encouraged demand for plant-based proteins. Rising lactose intolerance and meat-related health risks are pushing consumers toward alternatives. Companies are innovating with advanced technologies to deliver products with better taste, texture, and nutritional profiles. Strong marketing campaigns and partnerships with foodservice outlets are further fueling adoption. Increased availability of meat substitutes across retail and online platforms has expanded consumer access, supporting widespread market acceptance.

The United States dominates the regional landscape due to strong investments in food technology, established retail networks, and consumer openness to sustainable products. Canada is emerging with increasing adoption driven by growing vegan and flexitarian populations. Mexico is showing potential as rising urbanization and awareness of health benefits expand demand. North America’s cultural diversity, combined with a strong focus on innovation, positions the region as a leader in global meat substitute trends, creating opportunities for both established companies and new entrants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Meat Substitute Market was valued at USD 2,496.00 million in 2018, increased to USD 8,186.61 million in 2024, and is projected to reach USD 1,29,993.49 million by 2032, growing at a CAGR of 41.05%.

- The United States held 68% share in 2024, supported by strong retail networks and food technology leadership, while Canada followed with 20% share driven by rising vegan and flexitarian populations, and Mexico accounted for 12% due to increasing urban demand.

- Mexico is the fastest-growing regional market with a 12% share, supported by its young population, urban expansion, and rising awareness of health and sustainability.

- Among products, tofu and tempeh together accounted for 38% share in 2024, highlighting their established cultural acceptance and versatility in consumer diets.

- Quorn and other innovative products showed steady expansion with a combined 27% share, reflecting rising interest in mycoprotein-based and diversified meat substitute offerings.

Market Drivers:

Rising Health Awareness and Changing Dietary Preferences

The North America Meat Substitute Market is driven by increasing awareness of health and nutrition among consumers. Shifting dietary preferences are encouraging individuals to explore plant-based proteins as alternatives to red and processed meats. Concerns over obesity, diabetes, and cardiovascular diseases are pushing people toward healthier food choices. Growing adoption of vegetarian, vegan, and flexitarian lifestyles reflects the region’s evolving consumption patterns. It is witnessing greater acceptance across younger demographics who are highly conscious of long-term well-being. Food producers are focusing on delivering substitutes with enhanced nutritional value. Consumers are prioritizing balanced diets that combine taste with health benefits.

- For instance, Maple Leaf Foods expanded its plant-based protein portfolio with an investment into new production facilities in Indiana, including a $310 million plant-based meat plant, showcasing commitment to serving health-conscious consumers with innovative plant proteins.

Environmental Concerns and Sustainability Goals

Growing concern about the environmental footprint of livestock production is strengthening demand for substitutes. Consumers are becoming more aware of greenhouse gas emissions, deforestation, and water use linked to animal farming. It is benefiting from sustainability-driven policies across the region. Governments and institutions are promoting eco-friendly diets to reduce climate change impact. Food companies are aligning their strategies with corporate sustainability goals to meet consumer expectations. Investments in renewable resources for plant-based products are increasing to support green objectives. Rising eco-conscious consumer behavior is reshaping food habits at scale. This trend positions meat substitutes as sustainable alternatives with long-term appeal.

- For instance, Tyson Foods invested in cultured meat and plant-based alternatives through Tyson Ventures, co-leading a seed funding round of $2.2 million in Future Meat Technologies, advancing affordable, non-GMO cultured meat production that reduces environmental impacts compared to conventional livestock.

Technological Advancements in Product Development

Innovation in food technology is a key driver behind market expansion. Companies are investing in advanced processing techniques that improve the taste and texture of substitutes. Consumers now expect plant-based foods to closely resemble meat in appearance and flavor. It is witnessing a surge in research to enhance protein extraction, fermentation, and cell-based alternatives. Product launches are increasingly highlighting innovation in nutritional composition and functionality. Collaborations with research institutes are enabling better development pipelines. Brands are competing by offering options that replicate traditional meats more authentically. Continuous progress in this space is reinforcing consumer trust and market growth.

Expansion of Distribution Networks and Foodservice Adoption

Distribution and accessibility play a vital role in market development. The North America Meat Substitute Market is expanding through supermarkets, specialty stores, and online channels. It is also gaining traction in restaurants, fast-food chains, and institutional foodservice. Partnerships with leading retail and quick-service outlets are increasing product availability. Consumers prefer convenient purchasing options, which boosts online retail penetration. Growing demand in both urban and suburban markets supports the expansion of distribution networks. Strategic promotions and in-store visibility are enhancing consumer engagement. The availability of substitutes across diverse channels strengthens adoption and sustains long-term growth.

Market Trends:

Shift Toward Clean Label and Natural Ingredients

The North America Meat Substitute Market is experiencing a strong shift toward clean-label products. Consumers prefer substitutes made from natural, non-GMO, and minimally processed ingredients. This trend reflects increasing skepticism toward artificial additives and preservatives in food. Brands are highlighting transparency in sourcing and labeling to gain trust. It is pushing producers to reformulate products with recognizable, simple ingredients. Plant proteins such as pea, soy, and lentils are becoming popular bases. Clean-label positioning appeals to health-conscious shoppers across demographics. This movement strengthens brand credibility and long-term consumer loyalty.

- For instance, in 2023, new plant-based protein powder SKUs globally featured clean-label formulations with five or fewer ingredients, and North American launches particularly emphasized organic and non-GMO claims, with pea protein leading product introductions.

Growth of Hybrid and Blended Product Categories

Hybrid products combining plant-based and traditional meat are creating new growth avenues. Consumers open to reducing meat intake without fully eliminating it find blended options appealing. It is encouraging brands to design products that deliver familiar taste with reduced environmental impact. Hybrid formats allow companies to reach flexitarian consumers who represent a large share of the market. Retailers are dedicating space to blended product launches. Innovation in this space demonstrates adaptability to varied consumer preferences. Blended proteins help balance affordability, nutrition, and flavor. This trend supports expansion beyond niche vegan and vegetarian segments.

- For instance, Tyson Foods launched its ‘Raised & Rooted’ brand in 2019, offering blended food products combining meat and plant ingredients. By 2020, the brand expanded into Europe’s foodservice sector, signaling increasing retailer support and consumer interest in hybrid meat products.

Premiumization and Diversification of Offerings

The market is witnessing rising interest in premium products with gourmet appeal. Consumers are seeking substitutes that deliver restaurant-quality taste and texture. The North America Meat Substitute Market is responding by diversifying offerings beyond burgers and sausages. Companies are introducing seafood analogs, poultry alternatives, and ethnic-inspired dishes. It is fueling demand for innovation in frozen, chilled, and ready-to-eat segments. Premiumization aligns with affluent consumers who prioritize taste and quality. Brand differentiation is increasingly tied to unique flavors, cooking versatility, and authenticity. This strategy enhances competitive positioning in a growing market.

Integration of Meat Substitutes in Mainstream Food Culture

The adoption of substitutes is extending into mainstream culture. Celebrity endorsements and social media campaigns are amplifying visibility. It is becoming more common to find meat substitutes in everyday meals across households. Foodservice chains are featuring plant-based dishes as core menu items. Retail promotions highlight substitutes as regular pantry essentials. Partnerships with schools, hospitals, and institutional cafeterias are widening exposure. Consumer familiarity has shifted substitutes from occasional novelty to routine food choice. This integration signals a long-term cultural shift toward sustainable dietary practices.

Market Challenges Analysis:

High Production Costs and Pricing Pressures

The North America Meat Substitute Market faces challenges linked to high production costs. Ingredients such as pea protein and soy isolates require advanced processing that adds expense. It is difficult for companies to match the price competitiveness of traditional meat. Consumers often view substitutes as premium items rather than affordable staples. Rising input costs linked to supply chain volatility intensify the challenge. Retailers face hurdles in balancing affordability with profitability. Achieving economies of scale remains a priority for producers. These financial pressures may limit adoption among price-sensitive segments in the region.

Consumer Perception and Taste Acceptance Barriers

Taste, texture, and cultural habits pose significant challenges to growth. Consumers who are used to traditional meat often find substitutes less satisfying. The North America Meat Substitute Market is addressing these issues through continuous innovation. It is investing in research to replicate authentic flavor and mouthfeel. Misconceptions around nutrition and processing methods also hinder adoption. Some consumers perceive substitutes as overly processed, reducing trust. Educational campaigns are necessary to bridge these perception gaps. Overcoming cultural resistance and taste barriers is critical for sustained market penetration.

Market Opportunities:

Rising Adoption of Flexitarian and Younger Consumer Segments

The North America Meat Substitute Market holds opportunities through growing flexitarian lifestyles. Younger consumers are particularly drawn to sustainable and ethical diets. It is benefiting from social influence, with plant-based eating linked to wellness and identity. Expanding product variety increases appeal across different meal occasions. Retailers and foodservice players are actively promoting these products to youth-driven markets. Investment in branding and digital campaigns enhances reach. The region offers significant room to convert occasional buyers into regular consumers.

Innovation in Alternative Protein Sources and Culinary Applications

Future opportunities lie in diversifying protein sources beyond soy and pea. Companies are exploring chickpea, fava bean, algae, and mycoprotein to expand offerings. The North America Meat Substitute Market is opening space for unique flavors and textures. It is also finding applications in baked goods, ready meals, and snacks. Culinary integration across diverse cuisines creates new appeal. Partnerships with chefs and restaurants encourage experimentation and acceptance. This innovation-driven expansion promises to create broader consumer engagement.

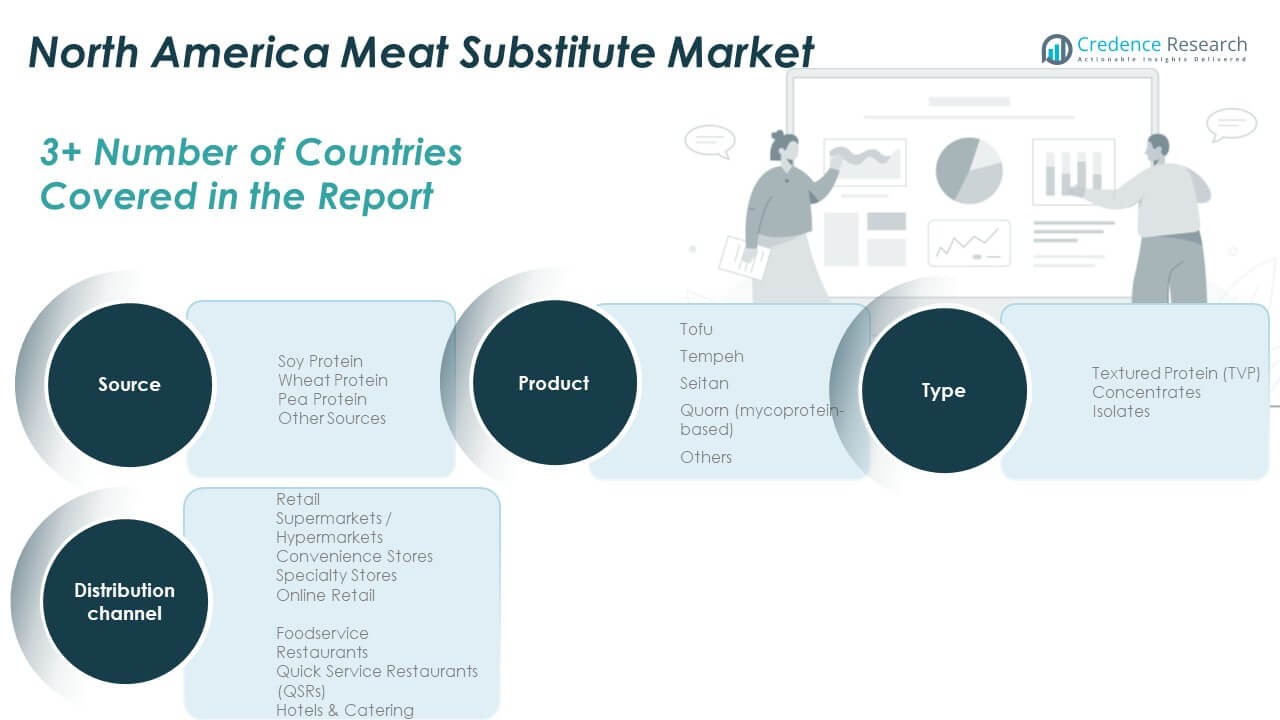

Market Segmentation Analysis:

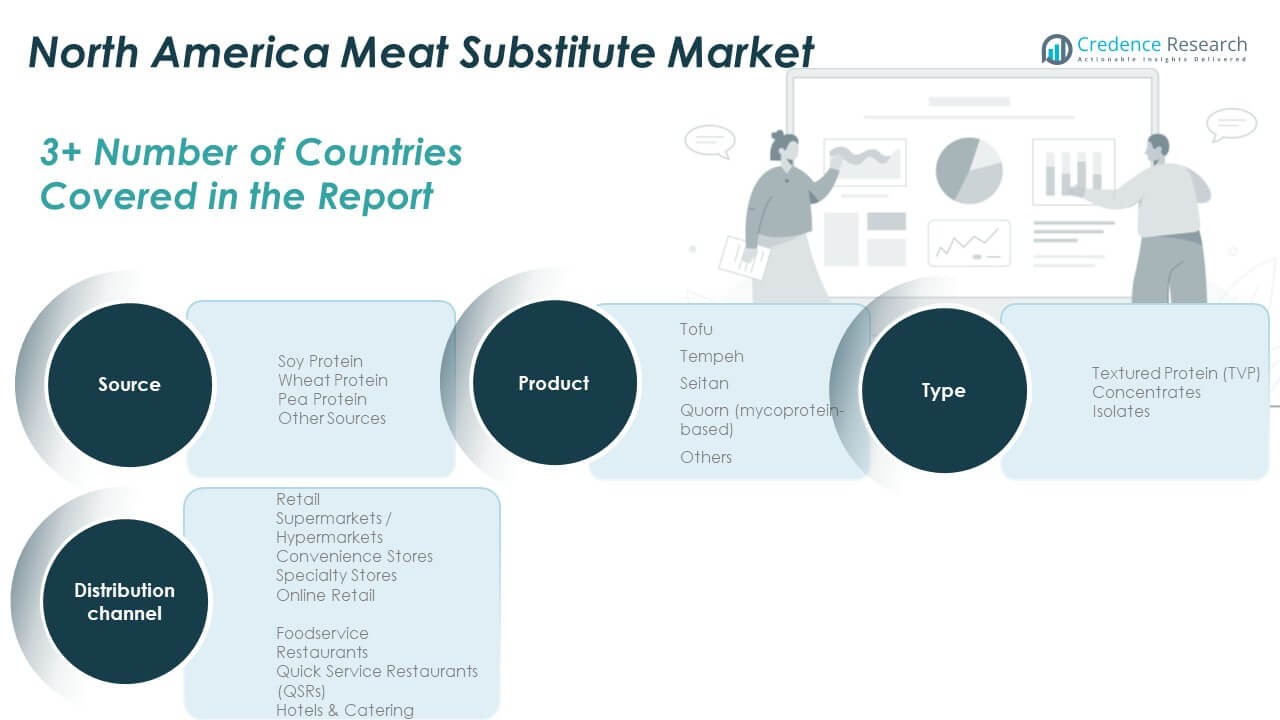

By Type

The North America Meat Substitute Market is segmented into textured protein (TVP), concentrates, and isolates. Textured protein dominates due to its wide use in processed foods and meat analogs. Concentrates are gaining traction in snacks and bakery applications. Isolates, known for high purity and protein content, are popular in functional food and beverages. It benefits from increasing demand for versatile protein formats.

- For instance, global production capacity for pea protein isolates reached around 200,000 metric tons in 2021, with North America playing a significant role, reflecting strong adoption of isolate protein formats in diverse food products.

By Source

Soy protein leads the segment because of its established supply base and affordability. Wheat protein attracts demand for its fibrous texture and suitability in bakery applications. Pea protein is expanding rapidly due to allergen-free appeal and sustainability benefits. Other sources, including chickpea and mycoprotein, are building niche opportunities in premium products. It reflects the region’s shift toward diverse protein bases.

By Product

Tofu and tempeh hold strong positions with their established cultural acceptance. Seitan appeals to consumers seeking high-protein, meat-like textures. Quorn, based on mycoprotein, is expanding through innovative launches. Other products, such as nuggets and patties, strengthen presence in mainstream retail and foodservice. It shows diversification beyond traditional soy-based items.

By Distribution Channel

Retail dominates with supermarkets, hypermarkets, and specialty stores offering extensive product ranges. Online retail is expanding quickly, driven by convenience and rising e-commerce adoption. Foodservice is a crucial growth engine, with restaurants and QSRs incorporating plant-based menu items. Hotels and catering are also introducing substitutes to align with consumer preferences. It demonstrates strong adoption across diverse purchasing channels.

Segmentation:

- By Type

- Textured Protein (TVP)

- Concentrates

- Isolates

- By Source

- Soy Protein

- Wheat Protein

- Pea Protein

- Other Sources

- By Product

- Tofu

- Tempeh

- Seitan

- Quorn (mycoprotein-based)

- Others

- By Distribution Channel

- Retail

- Supermarkets / Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Foodservice

- Restaurants

- Quick Service Restaurants (QSRs)

- Hotels & Catering

- By Country

- United States

- Canada

- Mexico

Regional Analysis:

United States: Market Leader with Strong Innovation Base

The United States holds the largest share of the North America Meat Substitute Market, accounting for nearly 68% in 2024. Its dominance is driven by advanced food technology, strong retail networks, and consumer openness to sustainable diets. The country has seen rapid product innovation, with startups and established companies investing heavily in R&D. It benefits from widespread adoption across supermarkets, hypermarkets, and foodservice outlets. Growing awareness of environmental sustainability and health-related concerns is fueling demand. Partnerships between leading QSR chains and plant-based brands strengthen consumer reach. The U.S. continues to lead the region’s growth trajectory.

Canada: Rising Adoption Across Retail and Foodservice Channels

Canada accounts for around 20% of the regional market share, supported by growing vegan and flexitarian populations. Canadian consumers are increasingly receptive to plant-based alternatives due to health consciousness and ethical considerations. The retail sector, particularly specialty stores and online platforms, plays a central role in distribution. It is also witnessing significant traction in foodservice, with restaurants and hotels offering diverse plant-based menus. Government support for sustainability and eco-friendly consumption further encourages adoption. Domestic players and international brands are expanding operations to capture growing demand. Canada is positioning itself as an attractive growth hub in the regional landscape.

Mexico: Emerging Market with Expanding Urban Demand

Mexico holds nearly 12% of the regional share and is emerging as a fast-growing market. Increasing urbanization and rising disposable incomes are influencing dietary habits toward healthier and modern food choices. The North America Meat Substitute Market in Mexico benefits from a young demographic keen to explore new diets. It is supported by growing retail infrastructure, including supermarkets and online channels. Foodservice operators are gradually introducing substitutes to align with evolving consumer preferences. Awareness campaigns about nutrition and environmental impact are boosting acceptance. Mexico’s growing demand underscores its potential as a strategic expansion destination.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ADM (US)

- Ingredion Incorporated

- DuPont

- PURIS

- Cargill

- Axiom Foods

- MGP Ingredients

- Garden Protein International

- Beyond Meat

Competitive Analysis:

The North America Meat Substitute Market is highly competitive, with global leaders and regional innovators driving expansion. Key companies include ADM, Beyond Meat, Cargill, Ingredion, DuPont, and PURIS, all focusing on diversified product portfolios. It is defined by constant innovation in taste, texture, and nutritional value to meet rising consumer expectations. Partnerships with retail chains and QSRs strengthen brand presence and improve consumer accessibility. Players are leveraging sustainability initiatives, clean-label strategies, and advanced processing technologies to capture market share. Competition is also shaped by mergers, acquisitions, and collaborations that expand distribution networks. The industry remains dynamic with both established firms and startups contributing to rapid growth.

Recent Developments:

- In May 2025, Ingredion emphasized innovations with pea protein and plant-based egg substitutes to address market demands around cost, taste, and nutrition in North America.

Report Coverage:

The research report offers an in-depth analysis based on type, source, product, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising health awareness will continue to boost adoption of substitutes.

- Sustainability goals will drive innovation in low-impact protein sources.

- Hybrid products will expand appeal to flexitarian consumers.

- Retail growth will accelerate through supermarkets and online platforms.

- Foodservice will integrate substitutes into core menu offerings.

- R&D will enhance authenticity in taste, texture, and nutrition.

- Pea protein and alternative sources will diversify market supply.

- Premiumization will attract affluent consumer groups.

- Mexico and Canada will emerge as secondary growth hubs.

- Strategic partnerships will reshape competitive dynamics across the region.