Market Overview:

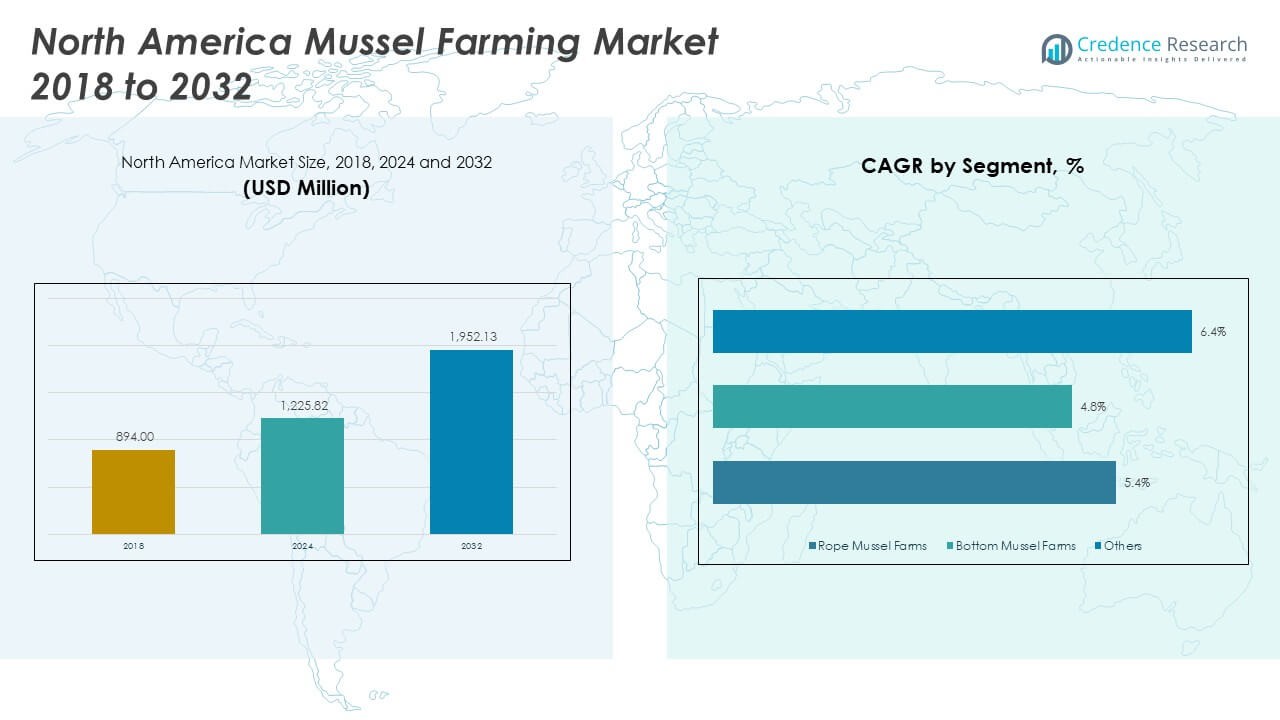

The North America Mussel Farming Market size was valued at USD 894.00 million in 2018 to USD 1,225.82 million in 2024 and is anticipated to reach USD 1,952.13 million by 2032, at a CAGR of 5.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Mussel Farming Market Size 2024 |

USD 1,225.82 Million |

| North America Mussel Farming Market, CAGR |

5.60% |

| North America Mussel Farming Market Size 2032 |

USD 1,952.13 Million |

The market is driven by consumer interest in healthy seafood options, supportive government policies, and growing aquaculture investment. Increasing awareness of mussels’ nutritional benefits strengthens demand in both domestic consumption and export markets. Rising investments in sustainable farming technologies, combined with the adaptability of mussels to various coastal conditions, continue to expand production potential. Partnerships between producers and distributors are also improving efficiency and distribution channels.

Geographically, the U.S. leads the market due to advanced aquaculture practices, higher seafood consumption, and strong export potential. Canada is emerging as a significant contributor with favorable coastal ecosystems and government support for shellfish aquaculture. Mexico shows growth potential as demand for affordable seafood options rises. Overall, regional dynamics reflect both mature and emerging opportunities for expansion in mussel farming.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Mussel Farming Market was valued at USD 894.00 million in 2018, reached USD 1,225.82 million in 2024, and is projected to grow to USD 1,952.13 million by 2032 at a CAGR of 5.60%.

- The U.S. accounted for the largest share at 48% in 2024, driven by advanced aquaculture practices and strong domestic seafood demand.

- Canada followed with a 34% share, supported by favorable coastal ecosystems and government-backed aquaculture programs, while Mexico held 18% due to rising consumer adoption.

- Mexico is the fastest-growing country, expanding its market presence with increasing seafood consumption and investments in low-cost aquaculture infrastructure.

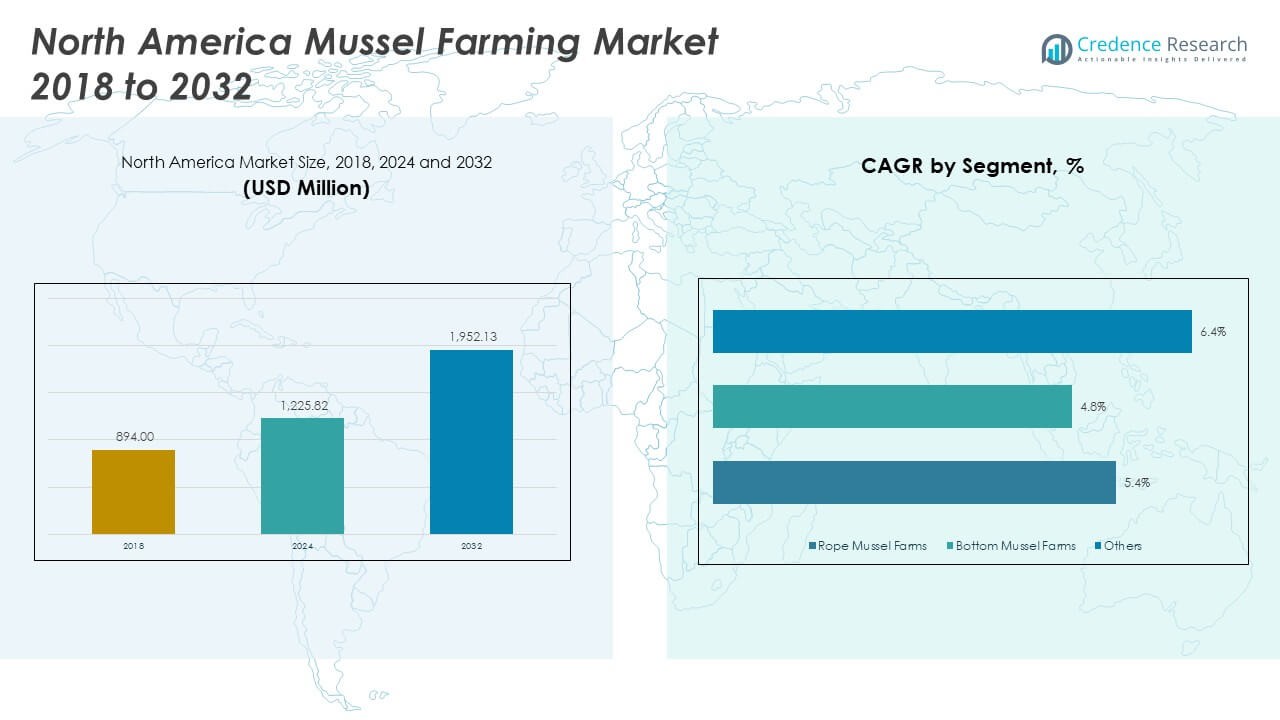

- Rope mussel farms dominated with 64% share in 2024, while bottom mussel farms contributed 28% and other methods accounted for 8%, reflecting diversification in farming techniques.

Market Drivers:

Rising Demand for Sustainable Protein Sources:

The North America Mussel Farming Market benefits from increasing demand for sustainable protein alternatives. Consumers prefer mussels because they are rich in protein, vitamins, and omega-3 fatty acids. The market gains momentum as dietary shifts focus on reducing reliance on land-based meat. Restaurants and retailers increasingly promote mussels as eco-friendly seafood. Farming mussels requires fewer resources, adding appeal for sustainability-focused buyers. Coastal farms are scaling operations to meet domestic demand. It supports growth by aligning with both nutrition and sustainability trends.

- For instance, mussel farming is a highly sustainable practice with minimal environmental impact—it requires no feed, uses no antibiotics or chemicals, and generates negligible greenhouse gas emissions. Mussels filter around 25 liters of seawater daily, improving water quality and coastal biodiversity, which adds to their appeal among eco-conscious consumers.

Government Support and Policy Initiatives:

The North America Mussel Farming Market experiences growth from government initiatives encouraging aquaculture. Policies focus on sustainable seafood supply, resource management, and coastal development. Subsidies and grants support farmers in expanding production capacity. Training programs enhance technical knowledge for sustainable practices. Governments in the U.S. and Canada emphasize aquaculture to reduce pressure on wild fish stocks. Regulatory frameworks promote water quality and ecosystem balance. This structured approach secures long-term growth in mussel farming. It enhances the sector’s role in regional food security.

- For instance, The recent U.S. federal Strategic Plan for Aquaculture Economic Development supports infrastructure development, technical training, and research to enhance production capacity and ensure environmental stewardship. Regulations emphasize water quality and ecosystem balance to secure long-term industry growth and bolster regional food security.

Expansion of Aquaculture Technology and Infrastructure:

Technology advancements drive efficiency in the North America Mussel Farming Market. Automation in seeding, harvesting, and monitoring reduces operational costs. Water quality monitoring systems support better yield management. Investments in hatcheries improve supply stability and scalability. Coastal aquaculture infrastructure is modernizing with innovative farming systems. Improved logistics support timely distribution to domestic and export markets. Producers adopt eco-friendly technologies to align with sustainability standards. The sector continues to expand production efficiency. It drives competitive advantage for regional mussel producers.

Growing Export Opportunities in Global Markets:

Export demand strengthens the North America Mussel Farming Market. International buyers prefer North American mussels for quality and sustainability certifications. Producers expand supply to European and Asian seafood markets. Export partnerships improve supply chain reach and efficiency. Rising demand for premium seafood in Asia-Pacific fuels growth opportunities. U.S. and Canadian mussel exporters secure strong footholds with sustainable branding. Trade agreements reduce barriers, enabling wider access to global markets. Mussel exports continue to grow as premium niche segments expand. It enhances profitability for regional players.

Market Trends:

Rising Popularity of Value-Added Mussel Products:

The North America Mussel Farming Market observes growth in value-added products. Pre-cooked, frozen, and flavored mussels gain traction in retail stores. Busy consumers demand convenience in seafood preparation. Value-added segments increase profit margins for producers. Foodservice operators expand menu options with easy-to-serve mussel dishes. Premium packaging enhances consumer appeal and extends shelf life. Demand for ready-to-cook mussel products grows in supermarkets. Expansion of this category strengthens revenue diversification. It creates new opportunities beyond traditional farming sales.

- For instance, Pre-cooked, frozen, and flavored mussels cater to consumer demand for convenient seafood options, expanding retail and foodservice offerings. This segment enhances profit margins and revenue diversification, as ready-to-cook mussel dishes become common in supermarkets and restaurant menus, supported by premium packaging that prolongs shelf life.

Adoption of Eco-Certifications and Labeling Standards:

Eco-certifications shape demand in the North America Mussel Farming Market. Consumers prefer products labeled as organic, sustainable, or certified by recognized agencies. Certification improves access to premium retail channels and export markets. Producers invest in compliance with eco-label standards. Retailers use certifications to strengthen seafood transparency. Awareness campaigns highlight the environmental benefits of mussel farming. Eco-certification adoption builds consumer trust and brand reputation. It boosts competitiveness of certified producers against imports. Certified products increasingly dominate seafood shelves.

- For instance, Consumers increasingly prefer mussels certified by recognized agencies like the Marine Stewardship Council (MSC) or Aquaculture Stewardship Council (ASC), associating these labels with sustainability and quality. Certification processes ensure sustainable fish stocks, minimize environmental impacts, and enforce effective management.

Integration of Smart Monitoring Technologies:

Digital monitoring advances influence the North America Mussel Farming Market. IoT-enabled sensors track water quality, nutrient levels, and farm productivity. Predictive analytics optimize harvest cycles and reduce waste. Farmers adopt automated feeding and seeding systems for efficiency. Technology lowers operational risks linked to environmental variability. Early adoption supports resilience against climate challenges. Integration of AI-driven platforms improves resource management. Smart systems reduce costs and improve yield quality. It reinforces competitiveness for innovative producers.

Rising Consumer Interest in Local and Fresh Seafood:

Local sourcing drives demand in the North America Mussel Farming Market. Consumers prefer traceable seafood sourced from nearby coasts. Freshness is a critical factor for restaurants and retailers. Regional farms strengthen supply chains by reducing transport time. Local mussels appeal to environmentally conscious buyers. Farmers markets and direct-to-consumer channels gain importance. Local branding increases consumer trust and loyalty. Fresh, traceable mussels enhance culinary appeal in domestic markets. It supports sustainable local economies.

Market Challenges Analysis:

Environmental and Climate-Related Constraints:

The North America Mussel Farming Market faces environmental challenges. Rising ocean temperatures impact mussel growth cycles. Pollution and nutrient runoff threaten water quality in coastal areas. Climate change increases vulnerability to harmful algal blooms. Coastal development pressures limit farming space availability. Producers must adapt farming systems to shifting conditions. Disease outbreaks also pose risk to production stability. Addressing these issues requires sustainable management practices. It limits scalability and raises operating costs for farmers.

Regulatory and Operational Barriers:

The North America Mussel Farming Market encounters regulatory hurdles. Permitting processes for aquaculture expansion remain lengthy and complex. Farmers face high compliance costs linked to water management standards. Trade restrictions can limit export opportunities. Access to capital investment is restricted for small-scale farms. Operational risks such as workforce shortages impact growth. Competition from imported seafood also challenges domestic producers. Strict regulations support sustainability but increase barriers to entry. It slows expansion for emerging market participants.

Market Opportunities:

Expansion into High-Value Export Markets:

The North America Mussel Farming Market holds strong opportunities in exports. Demand for sustainable seafood in Asia and Europe continues to rise. Producers with certifications gain premium access abroad. Global seafood shortages create favorable export conditions. Strengthened trade agreements expand market reach. Export opportunities provide revenue diversification for farmers. Growing niche markets for premium mussels enhance profitability. It secures long-term global positioning for North American producers.

Growth of Domestic Premium Seafood Consumption:

The North America Mussel Farming Market benefits from rising domestic demand. Consumers seek fresh, local, and premium seafood. High-end restaurants increasingly feature mussel-based dishes. Retailers expand seafood categories with packaged and branded mussel products. Marketing campaigns emphasize health and sustainability benefits. Increased awareness fuels consumer adoption. Strong domestic demand supports both small-scale and industrial farms. It encourages producers to invest in brand-building and quality assurance.

Market Segmentation Analysis:

By Type

The North America Mussel Farming Market shows dominance of rope mussel farms, driven by scalability and efficient yields. Bottom mussel farms maintain traditional relevance, catering to localized ecosystems and smaller-scale operations. Other methods remain niche but support innovation in farming approaches.

- For instance, Regarding farming methods, rope mussel farms dominate due to their scalability and efficiency, while bottom mussel farms preserve traditional approaches catering to local ecosystems.

By Product

Marine water farming holds the larger share due to favorable coastal conditions. Freshwater farming plays a smaller role but serves specific domestic markets with inland production. Both product categories highlight diverse approaches that cater to regional consumption and export demand.

- For instance, Marine water farming leads product share because of favorable coastal conditions, though freshwater farming serves specific inland markets, highlighting diverse production methods tailored to regional consumption needs.

Segmentation:

By Type

- Rope Mussel Farms

- Bottom Mussel Farms

- Others

By Product

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

United States

The U.S. holds the largest share of the North America Mussel Farming Market with 48% in 2024, supported by strong aquaculture infrastructure and high domestic seafood demand. The country benefits from advanced farming systems, certifications, and efficient supply chains that expand access to premium retail and foodservice channels. Consumer preferences for sustainable and protein-rich seafood continue to strengthen mussel adoption in domestic markets. Export opportunities to Europe and Asia further expand revenue streams for U.S. producers. The market also benefits from state-level support for aquaculture development. It demonstrates a clear leadership role in driving regional growth.

Canada

Canada follows with a 34% share of the North America Mussel Farming Market, driven by favorable coastal ecosystems and government support for sustainable aquaculture. Prince Edward Island and Atlantic provinces play a central role in production, ensuring consistent supply for both domestic and export markets. Certification programs strengthen the credibility of Canadian producers in international seafood trade. Investments in hatcheries and cold-chain logistics enhance industry competitiveness. Rising consumer awareness of mussels’ nutritional value fuels domestic consumption. Canada continues to expand production capacity while maintaining environmental balance. It remains a key contributor to the overall regional market.

Mexico

Mexico accounts for 18% of the North America Mussel Farming Market and represents the fastest-growing segment. Growth is supported by increasing seafood demand and investment in aquaculture as a low-cost protein source. Expansion of coastal farms and infrastructure improvements enhance production capacity. Rising domestic consumption is complemented by export opportunities in nearby markets. Government initiatives to support coastal communities strengthen industry participation. The market is still developing but shows strong upward potential. It demonstrates how emerging players contribute to the region’s long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Atlantic Aqua Farms

- American Mussel Harvesters, Inc.

- Andrews

- Penn Cove Shellfish

- Mussel King

- Blue Harvest Fisheries

- Pacific Seafood Group

- North Island Mussel Ltd

- Foveaux Seafood Ltd

- Prince Edward Aqua Farms

- Others

Competitive Analysis:

The North America Mussel Farming Market is moderately consolidated, with established players leading through scale, distribution, and product quality. It features companies such as Atlantic Aqua Farms, American Mussel Harvesters, and Penn Cove Shellfish that secure dominance by leveraging advanced aquaculture practices and strong supply chains. Smaller regional firms contribute by catering to niche demand and local markets. The industry is highly competitive, with firms focusing on sustainable certifications, eco-friendly branding, and export expansion. Technological innovation in farming methods enhances efficiency and yield, creating advantages for early adopters. Partnerships with retailers and restaurants strengthen consumer access, while export-focused producers target premium international markets. It remains competitive due to rising consumer demand, shifting regulatory standards, and the push toward sustainability-driven seafood production.

Recent Developments:

- In May 2025, St. Andrews entered a new partnership with Lonestar Soccer Club to secure access to high-quality natural grass fields for youth training programs, reflecting broader athletic infrastructure investments. While not directly linked to mussel farming, this partnership illustrates St. Andrews’ active engagement in community and development initiatives.

- In March 2025, Pacific Seafood unveiled a brand refresh across its retail portfolio to reinforce its commitment to innovation, sustainability, and premium quality products with modern packaging designed to engage consumers and support retail growth.

- In 2024, Pacific Seafood Group made a significant acquisition by purchasing Trident Seafoods’ large processing plant in Kodiak, Alaska, as part of a broader strategy to expand capacity amid industry consolidation.

Report Coverage:

The research report offers an in-depth analysis based on type, product, and regional segmentation. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for sustainable seafood will drive growth in the North America Mussel Farming Market.

- Expansion of aquaculture technologies will improve efficiency and productivity in farming operations.

- Export opportunities will grow as Europe and Asia seek premium mussel imports.

- Eco-certifications will strengthen consumer confidence and boost brand competitiveness.

- Value-added mussel products will gain traction in retail and foodservice sectors.

- Government policies will continue to support aquaculture expansion and sustainability compliance.

- Climate adaptation measures will become critical for long-term production stability.

- Local sourcing and fresh seafood demand will strengthen domestic market growth.

- Strategic partnerships with retailers and distributors will enhance market penetration.

- Innovation in packaging and preservation will increase shelf life and market reach.