Market Overview

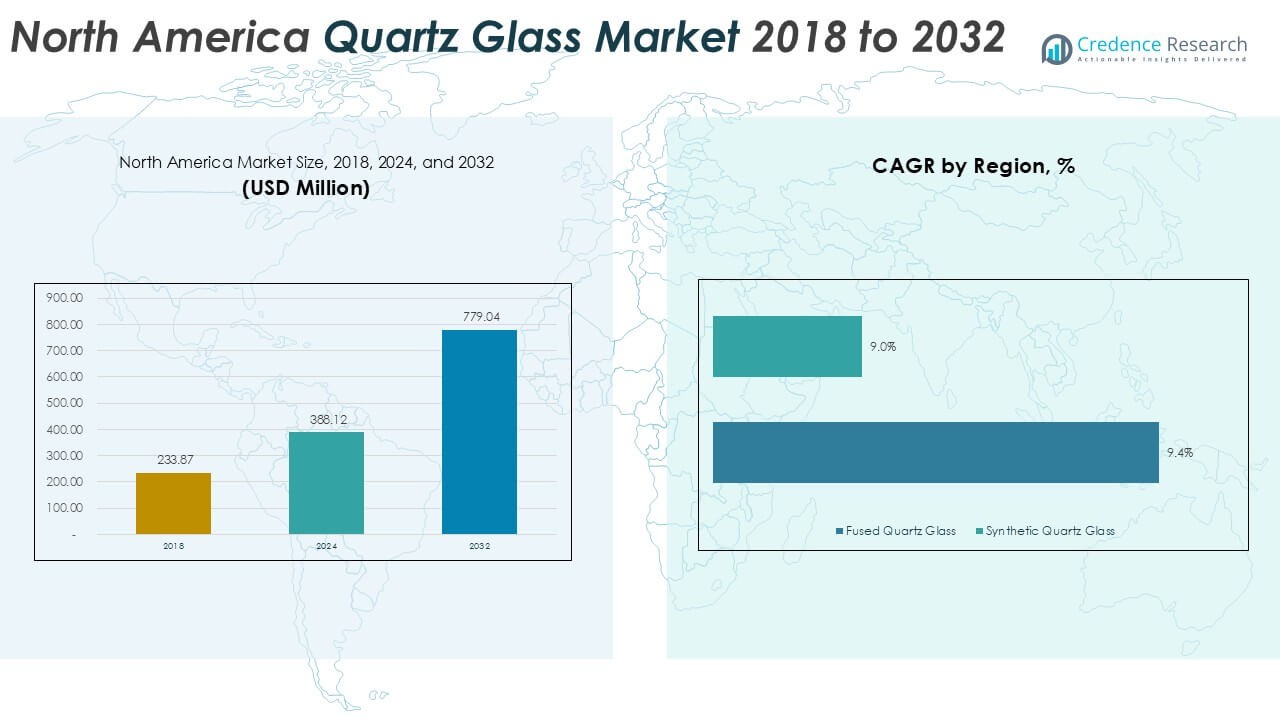

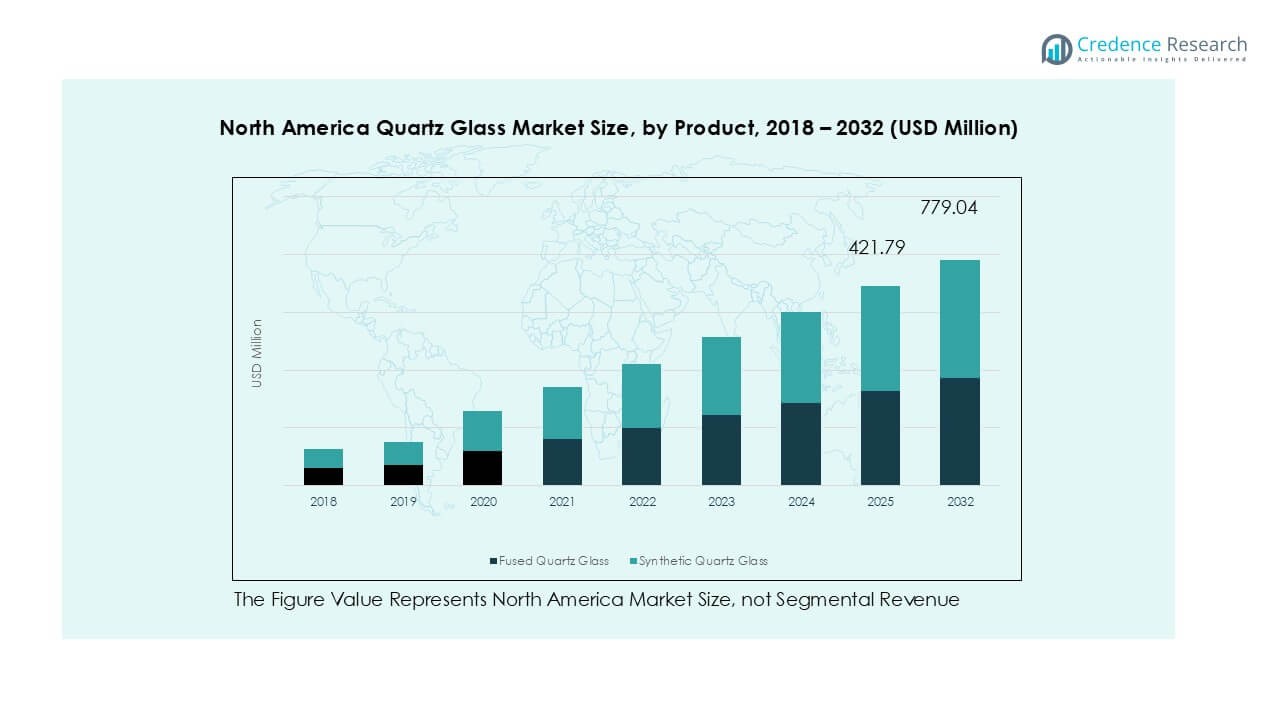

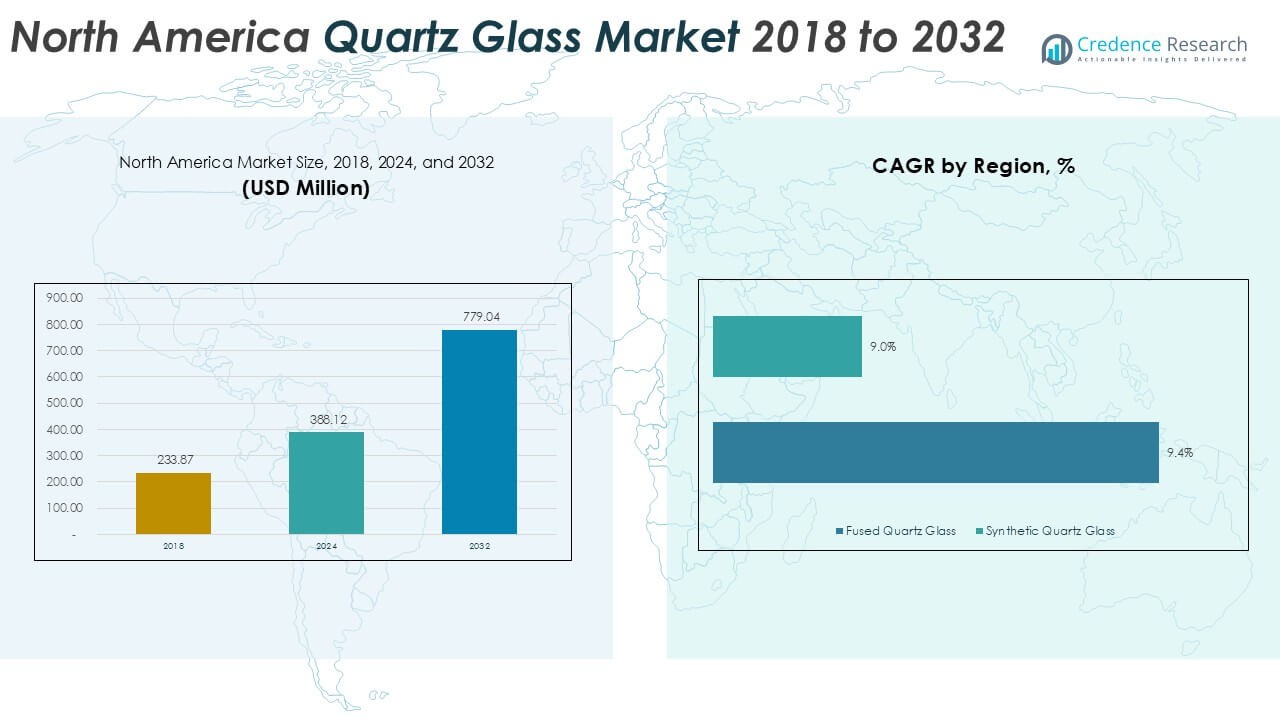

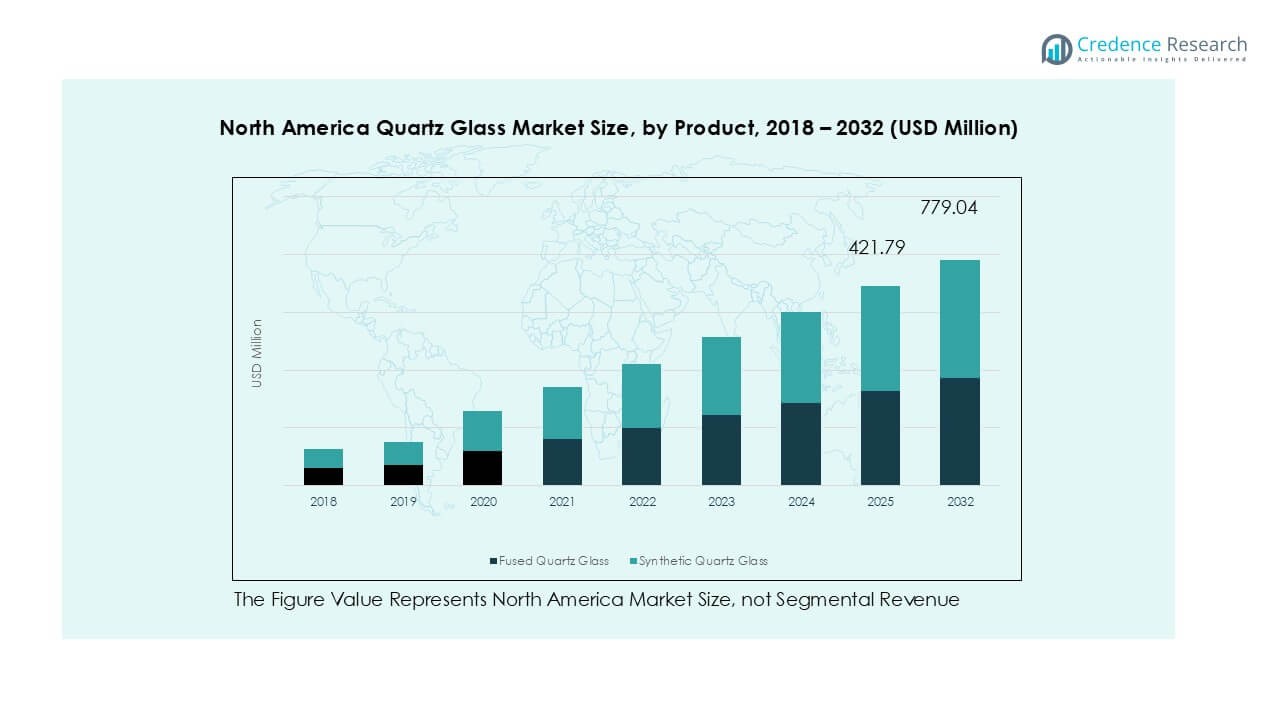

North America Quartz Glass market size was valued at USD 233.87 million in 2018, expanded to USD 388.12 million in 2024, and is anticipated to reach USD 779.04 million by 2032, at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Quartz Glass Market Size 2024 |

USD 388.12 Million |

| North America Quartz Glass Market, CAGR |

9.2% |

| North America Quartz Glass Market Size 2032 |

USD 779.04 Million |

The North America quartz glass market is led by established players such as Tosoh Quartz, Inc., Saint-Gobain S.A., Heraeus Holding, Precision Electronic Glass, and Swift Glass, which collectively dominate through advanced product portfolios and strong supply capabilities. These companies focus on high-purity fused and synthetic quartz glass to meet rising demand from semiconductors, solar, and medical sectors. The United States accounted for over 70% of the regional market share in 2024, driven by its robust semiconductor manufacturing base, extensive renewable energy projects, and leadership in photonics and medical research. Canada and Mexico follow with 18% and 12% shares, respectively, supported by growing solar investments, laboratory applications, and electronics assembly activities. This competitive environment underscores the importance of technological innovation, strategic partnerships, and regional supply chain strength in shaping market leadership across North America.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America quartz glass market was valued at USD 388.12 million in 2024 and is projected to reach USD 779.04 million by 2032, growing at a 9.2% CAGR during the forecast period.

- Strong demand from the semiconductors and electronics segment, holding 45% share in 2024, acts as a primary driver, supported by the expansion of chip fabrication and 5G device adoption.

- Key trends include the increasing use of quartz glass in solar energy and photonics applications, with innovations in fabrication enhancing product precision and purity.

- Leading players such as Tosoh Quartz, Saint-Gobain, Heraeus, and Swift Glass dominate through high-purity products, while regional firms strengthen niche supply capabilities; however, high production costs remain a restraint.

- The United States leads with over 70% market share, followed by Canada at 18% and Mexico at 12%, with quartz tubes maintaining dominance across forms due to versatile applications.

Market Segmentation Analysis:

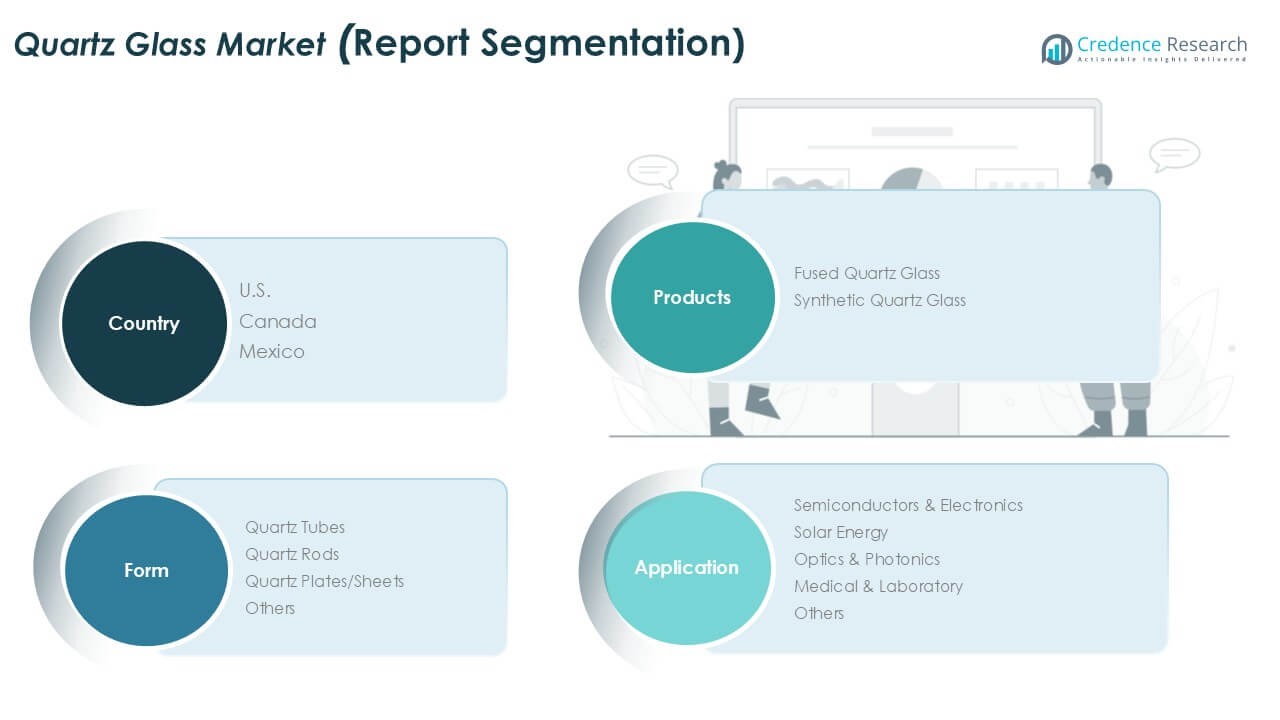

By Product

Fused quartz glass dominated the North America quartz glass market in 2024, holding over 60% share. Its dominance is driven by high thermal resistance, low expansion coefficient, and strong demand in semiconductor and optical applications. Industries rely on fused quartz glass for wafer processing, photomasks, and UV optics. Synthetic quartz glass is expanding at a steady pace due to its superior purity and low hydroxyl content, supporting photonics and medical uses. However, fused quartz glass remains the leading product due to its cost efficiency and established adoption across multiple industries.

- For instance, Yakult’s Yakult 1000 drink contains 100 billion CFU (1*1011) of the Lacticaseibacillus paracasei strain Shirota (updated from Lactobacillus casei strain Shirota) per 100ml bottle, and it is a popular and recognized probiotic beverage in Japan.

By Application

The semiconductors and electronics segment led the market in 2024 with around 45% share. Quartz glass plays a vital role in photolithography, diffusion, and etching processes due to its purity and thermal stability. The rise in chip fabrication, 5G expansion, and advanced consumer electronics boosts demand from this sub-segment. Solar energy applications also show significant growth, supported by rising photovoltaic cell installations across the U.S. and Canada. Optics, photonics, and medical applications follow, but semiconductors continue to dominate as a core driver of quartz glass consumption in the region.

- For instance, Yakult’s Shirota strain (Lactobacillus casei YIT 9029) is consumed in over 40 million bottles daily in Japan, highlighting mass adoption.

By Form

Quartz tubes held the largest share in 2024, accounting for over 40% of the market. Their wide use in semiconductor manufacturing, laboratory equipment, and UV lamps drives this leadership. High dimensional accuracy, chemical resistance, and optical transparency make tubes indispensable across multiple industries. Quartz rods and plates are also gaining traction, particularly in optical devices and high-temperature furnaces. However, tubes maintain dominance due to their versatility and established role in electronics and scientific research. Ongoing advancements in fabrication technology further strengthen the preference for quartz tubes in North America.

Key Growth Drivers

Rising Semiconductor Manufacturing Demand

The rapid growth of the semiconductor and electronics sector in North America is the primary driver of quartz glass consumption. Quartz glass is essential in wafer processing, diffusion, and photolithography due to its purity, heat resistance, and durability. The U.S. and Canada are investing heavily in domestic chip manufacturing, with the CHIPS and Science Act in the U.S. channeling billions into advanced fabs. These facilities require high-purity fused and synthetic quartz components, such as tubes, rods, and plates, for critical fabrication steps. The increasing demand for smartphones, 5G devices, and advanced computing accelerates quartz glass adoption. Continuous miniaturization of chips further raises the need for precision quartz glass. As North America seeks to reduce reliance on overseas suppliers, quartz glass will remain indispensable in strengthening the regional semiconductor ecosystem.

- For instance, Intel’s $20 billion fab project in Ohio will use high-purity fused quartz tubes for its diffusion furnaces, a standard requirement for 300 mm wafer production. These critical components must meet extremely strict dimensional tolerances, similar to the illustrative figure of ±0.02 mm, to ensure the necessary high performance and uniformity for advanced chipmaking.

Expansion of Solar Energy Installations

North America’s renewable energy transition significantly boosts demand for quartz glass in solar applications. Quartz glass is widely used in photovoltaic cells, crucibles for silicon production, and optical components for concentrated solar systems. The U.S. solar market surpassed 30 GW of new installations in recent years, supported by tax credits, state-level clean energy mandates, and decarbonization policies. Quartz’s ability to withstand extreme temperatures and transmit UV light makes it vital in solar panel manufacturing. Canada is also accelerating investments in solar farms, enhancing regional demand. As utility-scale projects expand, the need for quartz-based components grows steadily. The focus on reducing greenhouse gas emissions and meeting net-zero targets by 2050 ensures a stable long-term growth outlook. This clean energy shift positions quartz glass as a crucial material for enabling efficient solar technologies in North America.

- For instance, Heraeus supplies fused quartz crucibles capable of operating at 1420 °C for over 6000 hours during monocrystalline silicon ingot pulling, supporting U.S. PV manufacturers.

Growth in Medical and Laboratory Applications

The medical and laboratory sectors are emerging as strong growth areas for quartz glass demand. Its high purity, transparency, and resistance to chemical corrosion make it ideal for labware, cuvettes, and diagnostic instruments. North America’s healthcare industry, valued at trillions of dollars, continues to expand investment in advanced research and diagnostics. Quartz glass enables accurate optical measurements in spectroscopy, DNA analysis, and pharmaceutical development. The rising demand for precision instruments in life sciences and clinical testing fuels consumption. Recent emphasis on pandemic preparedness, molecular diagnostics, and personalized medicine strengthens reliance on quartz-based equipment. Additionally, quartz tubes and rods are key in sterilization systems using UV-C technology for infection control. As laboratories and research institutions scale up across the U.S. and Canada, quartz glass adoption in medical and analytical applications is expected to accelerate steadily.

Key Trends & Opportunities

Adoption of Photonics and Optics Applications

The growing role of photonics in communications, defense, and industrial applications creates major opportunities for quartz glass. Its optical transparency, durability, and stability make it vital in lasers, sensors, and fiber optics. North America leads in developing advanced photonics solutions, particularly in aerospace, telecommunications, and autonomous vehicle technologies. For instance, quartz plates and rods are essential in high-powered laser systems for precision manufacturing and defense programs. The surge in demand for data transmission capacity further drives quartz use in fiber optic networks. As Industry 4.0 advances, quartz glass becomes central to optical sensors and monitoring equipment. This expanding role of photonics positions quartz glass as a strategic material enabling innovations across multiple sectors, strengthening its market presence in the coming decade.

- For instance, Coherent’s high-power industrial lasers integrate fused quartz optics capable of transmitting laser power above 10 kW, essential for precision cutting and welding applications.

Technological Advancements in Manufacturing

Ongoing advancements in quartz glass processing and fabrication present opportunities for product innovation. Modern CNC machining, flame polishing, and advanced molding techniques are improving product precision, dimensional accuracy, and consistency. These innovations enhance the suitability of quartz glass for demanding applications in electronics, medical diagnostics, and renewable energy. Manufacturers are also investing in energy-efficient processes to reduce emissions and costs, aligning with sustainability goals. Customization capabilities are expanding, allowing tailored solutions for specific industry requirements, from semiconductor wafers to laboratory cuvettes. As clients demand higher performance and stricter purity levels, companies that leverage advanced manufacturing technologies can differentiate themselves and capture greater market share. These developments create growth opportunities for suppliers catering to North America’s high-tech industries.

Key Challenges

High Production and Processing Costs

One of the major challenges in the North America quartz glass market is its high production cost. Manufacturing fused and synthetic quartz glass requires energy-intensive processes, precision equipment, and strict quality control. Any contamination during production can compromise product quality, leading to waste and higher costs. These expenses limit the scalability of quartz glass manufacturing and often make products more expensive compared to alternatives. Small and mid-sized buyers may struggle with affordability, restricting market reach. Additionally, high costs impact competitiveness against global suppliers, particularly from regions with lower production expenses. Addressing cost challenges will require investment in automation, energy efficiency, and material recycling.

Supply Chain Vulnerabilities

The quartz glass industry depends heavily on the availability of high-purity raw materials, particularly silica sand. Supply chain disruptions, whether due to geopolitical tensions, trade restrictions, or environmental regulations, can affect raw material sourcing. North America relies on both domestic and imported silica, making the market sensitive to global shifts. Transportation delays and fluctuating energy prices further add risks. In addition, the increasing demand from semiconductors and solar energy puts pressure on limited supply chains. Any shortage can slow production cycles and increase costs. Companies must focus on building resilient supply chains, diversifying sourcing, and investing in local material production to mitigate these risks.

Regional Analysis

United States

United States held the dominant position in the North America quartz glass market in 2024, accounting for over 70% share. Strong demand comes from its established semiconductor and electronics sector, which heavily relies on quartz glass for wafer processing, diffusion, and photolithography. Expanding solar energy projects, supported by the Inflation Reduction Act, further enhance consumption. The country also leads in advanced photonics, defense, and medical research, where quartz glass plays a critical role. Continuous investment in domestic chip fabrication and renewable energy infrastructure ensures that the U.S. remains the largest consumer of quartz glass in the region.

Canada

Canada represented around 18% share of the North America quartz glass market in 2024. The country’s growing focus on renewable energy, particularly large-scale solar projects in Ontario and Alberta, boosts demand for quartz crucibles and photovoltaic applications. Canada’s life sciences sector also contributes, as quartz glass is widely used in laboratory equipment, medical devices, and analytical instruments. Rising investments in semiconductor research, though smaller in scale than the U.S., are adding to adoption. Government-led sustainability initiatives and clean energy incentives are further positioning Canada as an emerging growth hub for quartz glass in the region.

Mexico

Mexico accounted for nearly 12% share of the North America quartz glass market in 2024. The country is experiencing rising adoption in automotive electronics, industrial applications, and solar energy projects. Growing investment from multinational manufacturers setting up electronics and semiconductor assembly plants in Mexico drives quartz glass demand, particularly for tubes and plates. The medical and laboratory sector also shows steady consumption, supported by expanding pharmaceutical and diagnostic activities. Although the market size is smaller than in the U.S. and Canada, Mexico’s role is growing as it strengthens its position in regional supply chains and industrial manufacturing.

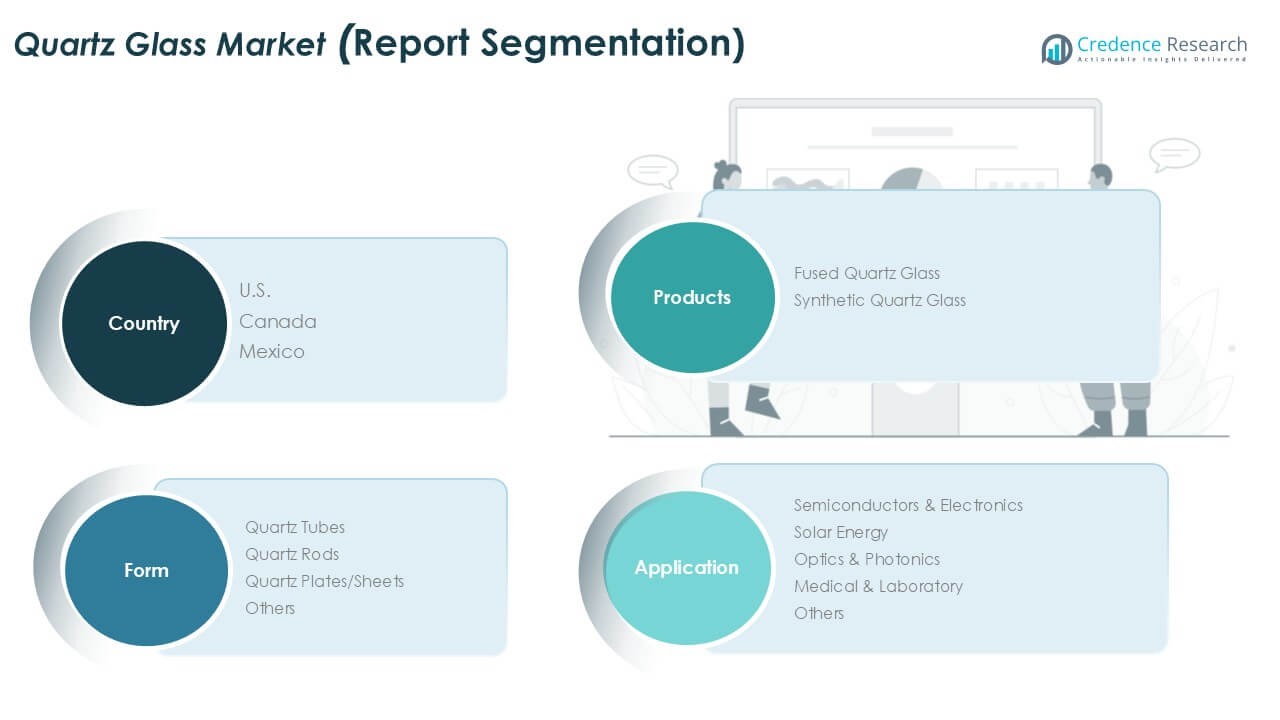

Market Segmentations:

By Product

- Fused Quartz Glass

- Synthetic Quartz Glass

By Application

- Semiconductors & Electronics

- Solar Energy

- Optics & Photonics

- Medical & Laboratory

- Others

By Form

- Quartz Tubes

- Quartz Rods

- Quartz Plates/Sheets

- Others

By Geography

- United States

- Canada

- Mexico

Competitive Landscape

The North America quartz glass market is characterized by the presence of global leaders and specialized regional manufacturers competing through product innovation, purity standards, and application-focused solutions. Major players such as Tosoh Quartz, Inc., Saint-Gobain S.A., and Heraeus Holding dominate the market with extensive portfolios covering fused and synthetic quartz glass for semiconductors, solar, and photonics. Companies like Precision Electronic Glass, Insaco Inc, and Swift Glass strengthen the regional base by supplying customized components for medical, laboratory, and industrial applications. Competitive strategies include capacity expansion, advanced fabrication technologies, and partnerships with semiconductor and solar energy firms to secure long-term contracts. Recent developments highlight growing investments in high-purity quartz production to meet stricter requirements in chip manufacturing and renewable energy systems. Niche players such as Sandfire Scientific and S & S Optical Company provide tailored solutions, ensuring strong competition across segments. The competitive landscape emphasizes innovation, supply chain reliability, and alignment with sustainability goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tosoh Quartz, Inc.

- Saint-Gobain S.A.

- Heraeus Holding

- Quartz Solutions

- Precision Electronic Glass

- Insaco Inc

- American Precision Glass Corp

- S & S Optical Company, Inc

- Shin-Etsu Quartz Products Co., Ltd

- Swift Glass

- Sandfire Scientific

- Other Key Players

Recent Developments

- In July 2025, QSIL inaugurated (opened) an expansion building at its ceramics site in Auma-Weidatal for the metallization process. While this is not directly quartz glass, it is part of its high-performance materials / production footprint.

- In March 2025, Heraeus (Heraeus Covantics) launches a new quartz manufacturing plant in Shenyang, China.The facility cost is ~600 million yuan (≈ USD 83.6 million). It focuses on high-purity and ultra-high-purity synthetic quartz products.

- In January 2025, Heraeus Covantics is formed (reorganization). Heraeus combined its high-performance materials units, Heraeus Conamic and Heraeus Comvance, into a new operating company under the name.

- In December 2024 / January 2025, QSIL GmbH Quarzschmelze Ilmenau is acquired by SCHOTT AG. Effective early 2025, SCHOTT acquired the quartz glass production facility in Ilmenau, Germany, including about 275 employees. The acquisition is seen as strategic for SCHOTT to bolster its semiconductor materials portfolio and ensure supply chain resilience.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with strong demand from semiconductor fabrication.

- Solar energy adoption will increase quartz glass use in photovoltaic applications.

- Medical and laboratory research growth will strengthen demand for high-purity quartz.

- Quartz tubes will continue to lead due to versatility in multiple industries.

- Synthetic quartz glass will gain share with rising demand for ultra-high purity.

- Photonics and optics applications will create new opportunities in defense and telecom.

- Advanced manufacturing technologies will improve precision and reduce production costs.

- Supply chain localization will become a focus to reduce import dependence.

- Sustainability initiatives will drive innovation in energy-efficient production processes.

- The United States will maintain dominance, while Canada and Mexico will expand faster.