Market Overview:

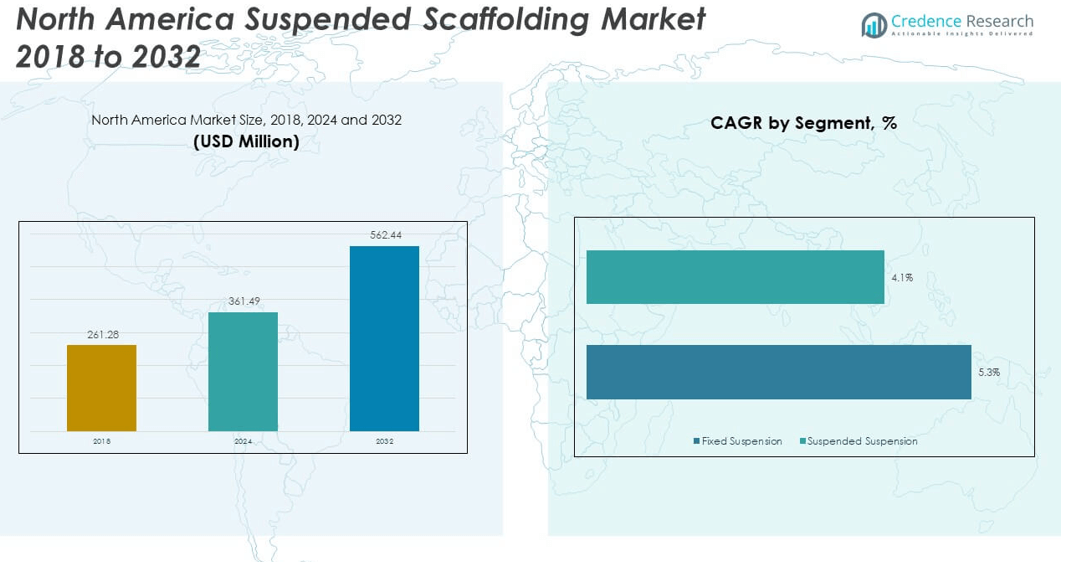

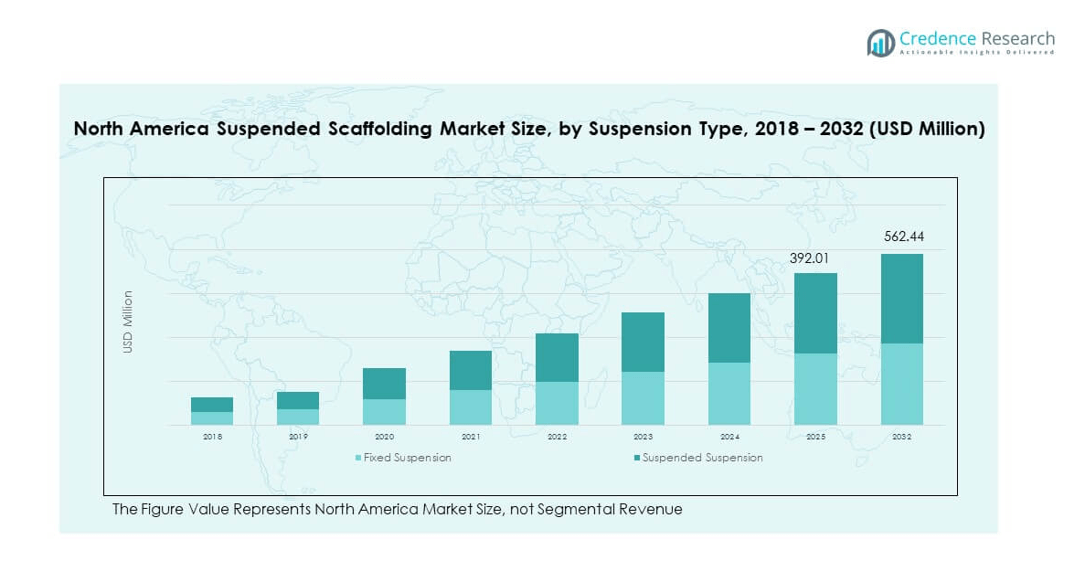

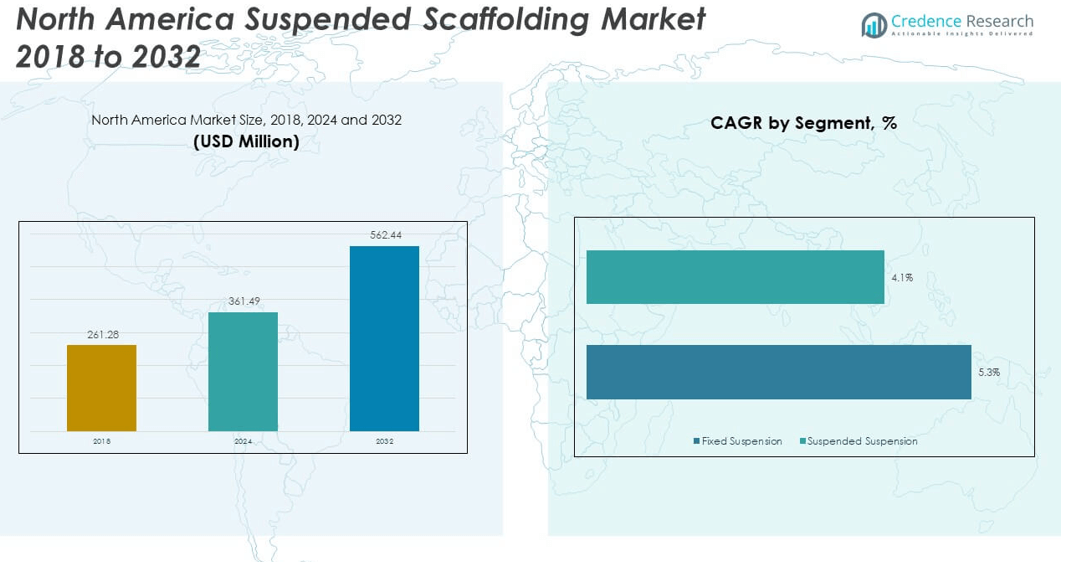

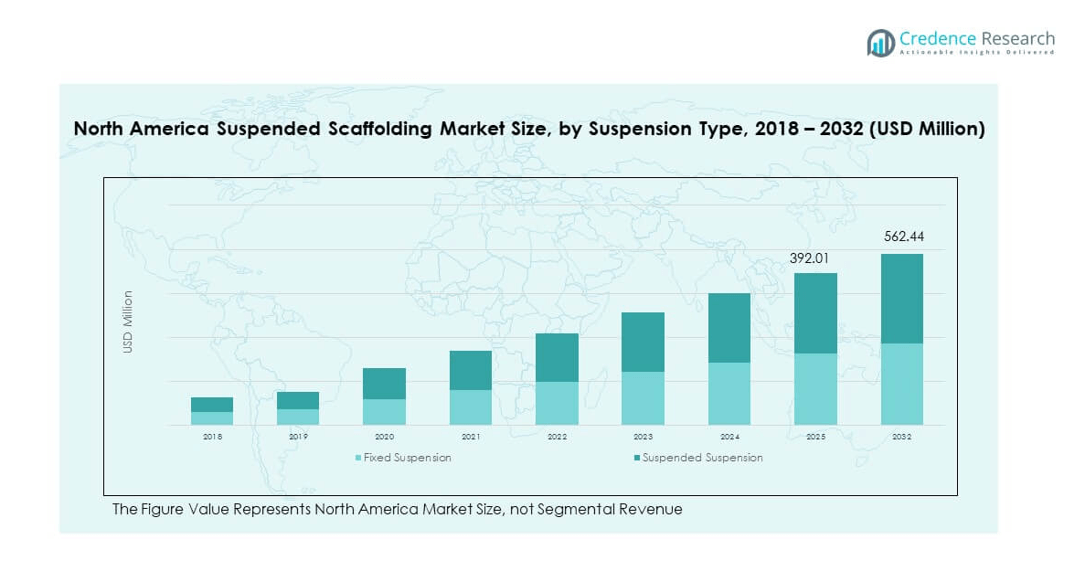

The North America Suspended Scaffolding Market size was valued at USD 261.28 million in 2018 to USD 361.49 million in 2024 and is anticipated to reach USD 562.44 million by 2032, at a CAGR of 5.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| INorth America Suspended Scaffolding Market Size 2024 |

USD 361.49 million |

| North America Suspended Scaffolding Market, CAGR |

5.30% |

| North America Suspended Scaffolding Market Size 2032 |

USD 562.44 million |

The North America Suspended Scaffolding Market is expanding steadily due to increased urban development, high-rise construction, and stringent safety regulations in the construction industry. Rising demand for renovation and maintenance of commercial and residential buildings also fuels market growth. Contractors and builders are adopting suspended scaffolding for its efficiency in vertical construction and facade work. Technological advancements such as motorized platforms and lightweight materials further drive the market, enabling quicker installations and improved worker safety. Government infrastructure investments and green building trends further enhance market demand across urban regions.

Geographically, the United States dominates the North America Suspended Scaffolding Market due to its mature construction industry, rising high-rise developments, and strong regulatory framework for worker safety. Major metropolitan areas like New York, Los Angeles, and Chicago continue to generate significant demand for suspended scaffolding in both new construction and restoration projects. Canada is emerging as a key market, supported by increasing infrastructure upgrades and sustainable urban planning initiatives in cities like Toronto and Vancouver. Mexico is witnessing moderate growth, driven by industrial expansion and the development of commercial complexes in urban centers.

Market Insights:

- The North America Suspended Scaffolding Market was valued at USD 361.49 million in 2024 and is projected to reach USD 562.44 million by 2032, growing at a CAGR of 5.30%.

- The Global Suspended Scaffolding Market size was valued at USD 882.70 million in 2018 to USD 1,240.25 million in 2024 and is anticipated to reach USD 1,921.79 million by 2032, at a CAGR of 5.24% during the forecast period.

- Urban high-rise construction and infrastructure redevelopment projects are significantly driving demand for suspended scaffolding systems.

- Strict safety regulations across the U.S. and Canada are pushing contractors to adopt OSHA-compliant and advanced access platforms.

- High initial investment and ongoing maintenance costs continue to challenge adoption among small and mid-sized contractors.

- The United States leads the North America Suspended Scaffolding Market, contributing nearly 74% of total regional revenue.

- Canada is emerging as a growth market due to its sustainable building initiatives and expanding urban infrastructure.

- Mexico shows potential in industrial and commercial zones, though adoption remains slower due to cost sensitivity and limited high-rise development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Urban Infrastructure Expansion and High-Rise Construction Demand Driving Equipment Adoption

The North America Suspended Scaffolding Market is witnessing steady growth due to extensive urban infrastructure development across major cities. Governments and private entities continue to invest in residential and commercial high-rise projects. The demand for vertical construction support solutions is increasing rapidly. Suspended scaffolding offers a flexible, cost-efficient, and safer alternative for building facades. Contractors are opting for it to reduce labor dependency and meet project deadlines efficiently. The rise in renovation and retrofitting of older structures also supports market growth. Urban renewal programs in major metros create consistent demand for suspended access systems.

- For example, Tractel Group offers modular suspended platforms including its Skysafe® range and powered tirak‑hoist systems used globally for access on high‑rise buildings and structures.

Stringent Safety Regulations Accelerating Uptake of Advanced Suspended Platforms

Strict safety codes enforced by OSHA and regional authorities are prompting construction firms to invest in compliant scaffolding systems. Companies in the North America Suspended Scaffolding Market are adopting products that offer advanced safety features. Features such as guardrails, anti-tilt mechanisms, and secure hoisting systems have become essential. These upgrades help reduce accident rates and enhance operational efficiency. Firms also prioritize worker protection to avoid legal liabilities and delays. This shift toward safer technologies is creating demand for standardized, high-quality systems. Regulatory alignment across states strengthens product deployment consistency.

Surge in Maintenance and Restoration Projects in Aging Urban Infrastructure

The growing need for restoration of aging bridges, industrial plants, and commercial towers fuels demand for suspended scaffolding. It provides ideal vertical access for projects involving exterior refurbishment. The North America Suspended Scaffolding Market benefits from frequent façade repairs, cleaning, and structural reinforcement. Large property owners and municipal agencies allocate recurring budgets for maintenance. Suspended systems are suitable for hard-to-reach areas and tall structures. Their ease of setup and mobility support restoration activities in limited spaces. Contractors favor such platforms for minimizing project disruption and maximizing access efficiency.

- For instance, Bee Access’s UP‑STAGE modular platform system is built entirely from aluminum and supports loads up to 2,000 lb (≈ 907 kg), depending on configuration. It offers fast assembly, high modular flexibility, and certification under OSHA and ANSI standards.

Adoption of Motorized Scaffolding for Operational Efficiency and Labor Optimization

Construction firms increasingly prefer motorized suspended scaffolding for faster execution and reduced labor needs. These systems enable precision positioning, remote control, and height adjustments without manual effort. The North America Suspended Scaffolding Market is seeing wider adoption of electric hoist-powered platforms. It helps companies save on labor costs while maintaining consistent safety standards. The demand is higher in large commercial and industrial projects where efficiency and scale are priorities. Integration of digital monitoring tools into motorized units also supports performance tracking. Firms are leveraging automation to improve productivity in vertical construction.

Market Trends:

Integration of IoT and Remote Monitoring Systems in Suspended Scaffolding Platforms

Technology-enabled suspended scaffolding platforms are gaining traction due to the growing importance of remote safety monitoring. Builders are integrating sensors and IoT modules to track system integrity and movement in real time. The North America Suspended Scaffolding Market is shifting toward data-driven operations. Remote diagnostics reduce downtime and help predict maintenance requirements. Cloud-based dashboards and wireless alerts offer operators better visibility into onsite risks. These advancements enable proactive safety measures and operational transparency. Tech-driven scaffolding is being deployed more frequently in mission-critical projects. Market players are investing in R&D for smart solutions.

- For instance, Sky Climber designs and supplies suspended access systems including platforms, hoists, and BMUs for complex infrastructure projects such as dams, museums, and power plants. Its solutions are engineered for safe access in high-risk, industrial environments.

Growth in Green Building Certifications Influencing Product Material Selection

Contractors are selecting scaffolding systems made with eco-friendly, recyclable materials to meet LEED and other sustainability standards. The North America Suspended Scaffolding Market is seeing preference for lightweight aluminum over steel. Reduced material weight enhances energy efficiency in transport and installation. Manufacturers are introducing modular components designed for multiple reuse cycles. Sustainable sourcing and circular product lifecycle goals are influencing procurement choices. Buyers consider environmental impact during bidding and planning stages. Corporate ESG initiatives drive market players to offer greener alternatives. This trend aligns scaffolding innovations with broader green construction goals.

Shift Toward Modular and Customizable Suspended Systems Across Projects

Customizable modular scaffolding designs are gaining market appeal for their flexibility across project types and sizes. Builders prefer solutions that adapt to varying façade geometries and elevation challenges. The North America Suspended Scaffolding Market is expanding with systems that allow easy extension or contraction. These platforms streamline logistics and reduce idle inventory. Quick installation and disassembly times help minimize labor downtime. Manufacturers offer customizable kits tailored to commercial, industrial, or infrastructure works. Modularity also supports cost-efficient multi-project deployment. The trend is pushing companies to redesign offerings for scalability and reusability.

- For example, ULMA Construction’s BRIO/Ringlok modular platform system delivers versatile, fast-to-assemble suspended and façade access solutions. It adapts efficiently to complex architectural designs in high-rises, bridges, and industrial facilities while maintaining strong safety standards and modular flexibility.

Rental Services and Full-Service Models Gaining Preference Over Equipment Ownership

The rising popularity of scaffold rental services reflects a broader shift in asset-light construction operations. Builders increasingly outsource equipment to reduce capital expenditure and storage burdens. The North America Suspended Scaffolding Market is evolving with providers offering end-to-end services. These include delivery, setup, inspection, dismantling, and safety training. Full-service models appeal to contractors working on short-term or varied projects. Rental agreements also offer access to the latest, safety-compliant platforms. Service providers differentiate offerings through availability, customization, and customer support. This trend is reshaping competition and pricing strategies across the region.

Market Challenges Analysis:

High Initial Investment and Ongoing Maintenance Expenses Restrict Broader Adoption

One of the key challenges facing the North America Suspended Scaffolding Market is the significant upfront cost of acquiring and installing advanced systems. Small to mid-sized contractors often lack the budget flexibility to invest in motorized or high-capacity units. In addition to procurement costs, these systems require frequent inspections, part replacements, and compliance checks. Equipment downtime for maintenance disrupts project schedules. Many firms find it difficult to balance between investing in innovation and maintaining profitability. This financial barrier slows the pace of adoption in price-sensitive segments. It also limits access to the latest safety features.

Labor Skill Shortages and Technical Training Gaps Impact Operational Efficiency

Operating suspended scaffolding systems requires specific technical know-how and certifications, which are not uniformly available across the workforce. The North America Suspended Scaffolding Market struggles with labor shortages, particularly in certified operators and safety supervisors. Training programs are regionally inconsistent and sometimes inaccessible to remote contractors. Improper use can lead to equipment damage, accidents, or regulatory violations. Companies often delay or avoid deploying complex systems due to workforce limitations. Retaining skilled workers and offering continued education becomes a recurring burden. This talent gap hampers growth potential and slows new technology integration.

Market Opportunities:

Rising Demand from Urban Redevelopment and Retrofit Projects across Aging Cities

Urban redevelopment initiatives across North America present significant opportunities for the suspended scaffolding industry. Municipalities are focused on restoring aging infrastructure and high-rise buildings. The North America Suspended Scaffolding Market stands to benefit from increased use in retrofitting, recladding, and façade reinforcement. Suspended systems offer safe access in densely populated areas with minimal disruption. Project timelines are tightening, which favors efficient scaffolding deployment. Building owners are also prioritizing worker safety and compliance, driving market uptake. This trend aligns with growing investment in sustainable urban renewal.

Expansion of Industrial and Utility Infrastructure Driving Specialized Scaffolding Needs

Ongoing expansion in the industrial and utility sectors is generating niche demands for suspended scaffolding. The North America Suspended Scaffolding Market is witnessing new use cases in oil refineries, power plants, and water treatment facilities. These environments require corrosion-resistant, adaptable, and high-load-capacity systems. Project contractors seek platforms capable of withstanding harsh conditions and complex geometries. Demand is expected to rise with federal infrastructure spending and energy transition projects. Specialized scaffolding firms can capitalize by offering tailored solutions and turnkey services.

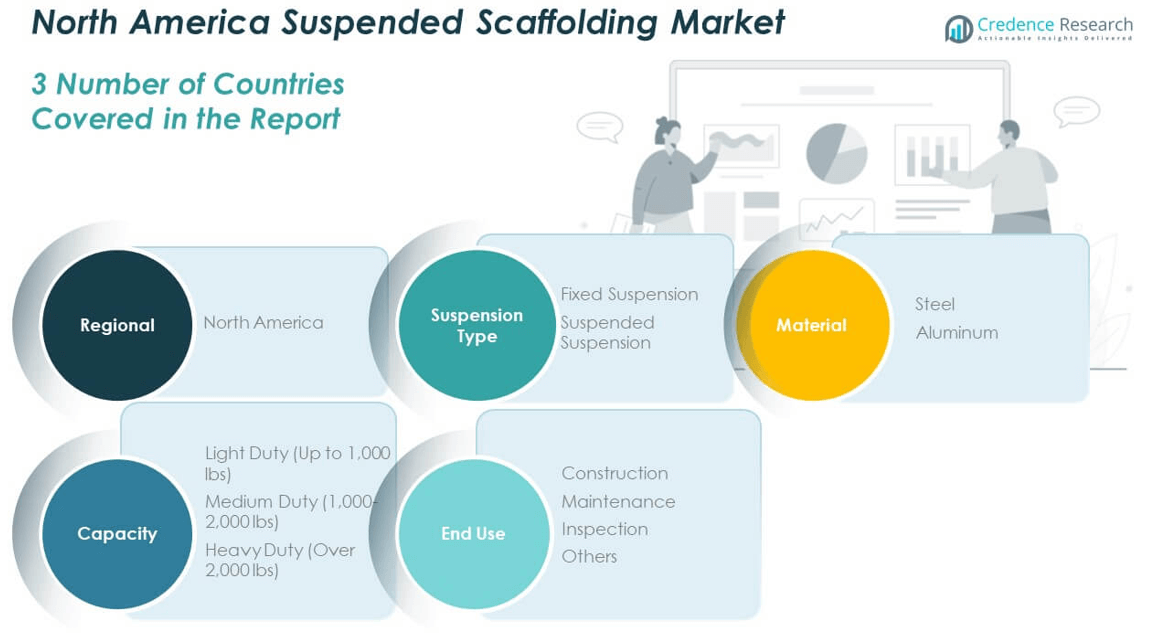

Market Segmentation Analysis:

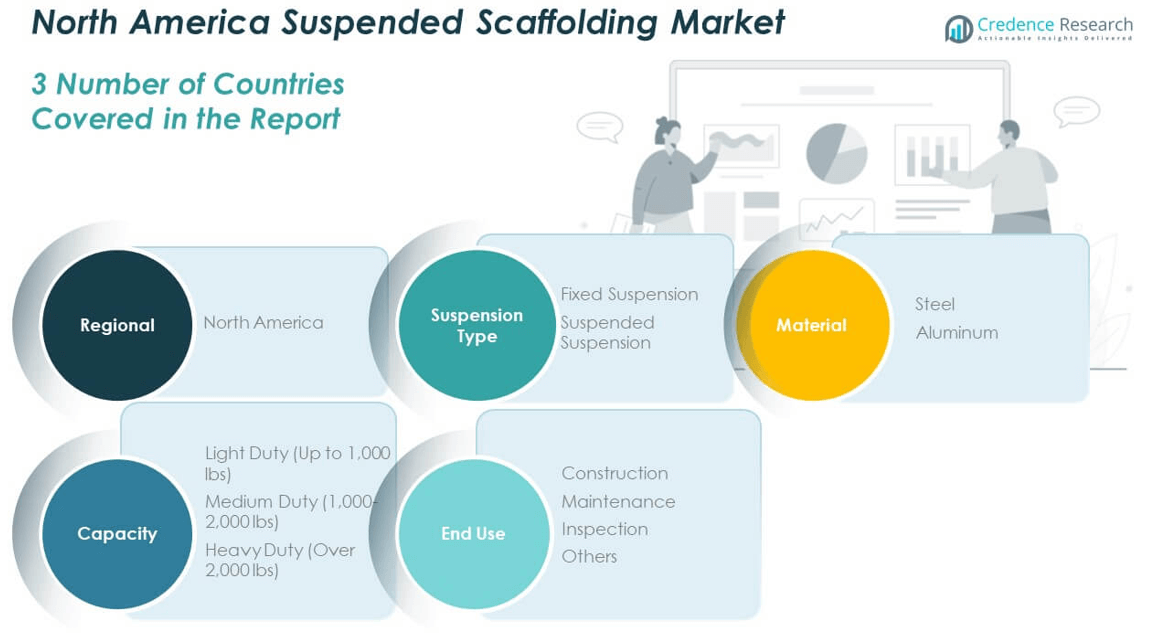

The North America Suspended Scaffolding Market is segmented

By suspension type into fixed suspension and suspended suspension. Suspended suspension systems hold a dominant position due to their adaptability in high-rise and complex façade work. Fixed suspension units are gaining interest for projects that require stationary platforms with stable elevation.

By material, steel scaffolding leads the market because of its strength and durability, especially in heavy-duty applications. Aluminum is growing steadily, driven by demand for lightweight, corrosion-resistant alternatives that offer easier handling and transport.

- For example, Layher’s Allround Steel Scaffolding has been deployed on industrial plant overhauls, supporting complex assemblies that must bear heavy loads and withstand harsh site conditions.

By capacity, the medium duty (1,000–2,000 lbs) segment accounts for the largest share due to its suitability for most commercial construction and maintenance projects. Heavy duty (over 2,000 lbs) scaffolding finds use in industrial sites and infrastructure projects, while light duty systems serve in short-duration or residential tasks.

- For heavy-duty staging, Bee Access offers the BISOMAC traction hoist series, where the BISOMAC 210 model supports loads up to 1,500 lb (≈ 680 kg) and reaches speeds around 33 ft/min (≈ 10 m/min).

By end use, the construction segment drives the majority of demand, supported by ongoing high-rise and commercial development. The maintenance segment follows closely, fueled by the need to refurbish aging structures in urban areas. Inspection activities are increasing in utility and energy sectors, while the others category covers niche applications like cleaning and façade upgrades. The North America Suspended Scaffolding Market benefits from strong demand across all segments, supported by safety regulations and modernization trends.

Segmentation:

By Suspension Type

- Fixed Suspension

- Suspended Suspension

By Material

By Capacity

- Light Duty (Up to 1,000 lbs)

- Medium Duty (1,000–2,000 lbs)

- Heavy Duty (Over 2,000 lbs)

By End Use

- Construction

- Maintenance

- Inspection

- Others

Regional Analysis:

The United States holds the largest share of the North America Suspended Scaffolding Market, accounting for nearly 74% of the regional revenue in 2024. It leads due to extensive high-rise construction, strict regulatory enforcement, and strong investments in commercial and infrastructure development. Major cities such as New York, Chicago, and Los Angeles drive demand with continuous building maintenance, retrofitting, and new urban projects. The adoption of motorized and smart scaffolding systems is gaining momentum across large-scale contractors and urban developers. The country’s emphasis on construction worker safety and operational efficiency continues to support technological advancements in suspended access platforms. The U.S. market remains highly competitive with established vendors offering both product innovation and rental services.

Canada contributes approximately 18% of the North America Suspended Scaffolding Market, with demand rising steadily across urban centers. Cities like Toronto, Vancouver, and Calgary are witnessing a surge in commercial and residential developments, boosting scaffolding requirements. Federal infrastructure investments and energy-efficient building regulations support market growth. Construction firms increasingly adopt modular and reusable scaffolding systems to align with sustainability goals. Canada’s labor safety compliance requirements drive contractors to invest in premium, certified equipment. The market is expanding with a mix of domestic manufacturers and cross-border supply partnerships. It shows potential for higher adoption of advanced platforms in upcoming large-scale projects.

Mexico holds the remaining 8% share in the North America Suspended Scaffolding Market, emerging as a growing player in the region. Industrial expansion and urbanization in cities such as Monterrey and Mexico City are stimulating demand. The market is driven by increasing construction activity in commercial real estate and manufacturing zones. While adoption of advanced systems remains limited, rental solutions are gaining popularity due to cost-effectiveness. Domestic and international vendors are exploring opportunities by offering basic but compliant scaffolding products. With the right regulatory improvements and skill development, Mexico could strengthen its role in the regional suspended scaffolding landscape. It continues to gain importance in cross-border construction supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BrandSafway

- United Rentals

- Sunbelt Rentals

- The Brock Group

- Mattison Scaffolding Ltd

- Brand Industrial Services, Inc.

- WernerCo

- ULMA Form Works, Inc.

- Penn Tool Co.

- Ver Sales, Inc.

Competitive Analysis:

The North America Suspended Scaffolding Market features a moderately competitive landscape with a mix of global leaders and regional players. Key companies such as Safway Group, Bee Access, Sky Climber, and Swing Staging dominate through strong distribution networks, advanced product offerings, and integrated service models. It is characterized by continuous innovation in motorized platforms, safety enhancements, and digital monitoring systems. Players differentiate themselves through rental solutions, custom engineering services, and rapid deployment capabilities. Strategic partnerships, mergers, and geographic expansions are common growth strategies. Companies prioritize compliance with OSHA and regional safety standards to maintain credibility. Competitive intensity remains high in urban construction zones and infrastructure maintenance contracts.

Recent Developments:

- In Jan 2024, BrandSafway introduced the new M2 Motorized Access System, which is designed as a cost-effective and time-saving alternative for access solutions on jobsites where traditional access is challenging. The launch highlights BrandSafway’s commitment to innovation and efficiency in North American construction environments.

- In March 2025, Mattison Scaffolding Ltd announced the renewal of its Veriforce CHAS Elite Accreditation and achieved Constructionline’s Gold Membership, reinforcing its commitment to maintaining high standards of compliance, safety, and quality in all scaffolding operations.

- In December 2024, Sunbelt Rentals signed a five-year partnership agreement with The Leukemia & Lymphoma Society (LLS), becoming the National Presenting Partner for LLS’s Student Visionaries philanthropic program. This partnership reflects Sunbelt’s corporate social responsibility within the North American market.

- In September 2024, Brand Industrial Services, also known as BrandSafway, made a significant acquisition by purchasing Covan’s Insulation Company. This move was aimed at enhancing BrandSafway’s suspended scaffolding and industrial access services in the southeastern United States.

Market Concentration & Characteristics:

The North America Suspended Scaffolding Market shows medium-to-high concentration, with a few dominant firms holding significant market share. It is driven by demand for high-performance, safety-compliant systems in commercial and industrial construction. Entry barriers include regulatory compliance, technical expertise, and capital investment. The market favors suppliers offering scalable solutions and strong after-sales support. Rental services and turnkey models gain traction, especially among small and mid-sized contractors. Growth remains concentrated in metropolitan areas and infrastructure-intensive zones. Vendors are investing in lightweight materials and modular product designs to increase operational flexibility. Industry players are also adopting digital tools to enhance safety monitoring and optimize equipment usage.

Report Coverage:

The research report offers an in-depth analysis based on Suspension Type, Material, Capacity and End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for suspended scaffolding will grow with rising urban redevelopment and high-rise construction across major metropolitan areas.

- Adoption of motorized and smart platforms will accelerate due to the need for improved safety, speed, and labor optimization.

- Rental-based scaffolding services are expected to dominate, driven by contractors seeking flexible, cost-efficient access solutions.

- Green construction initiatives will influence material choices, increasing preference for lightweight and recyclable scaffolding systems.

- Regulatory compliance will remain a critical factor, pushing manufacturers to develop OSHA-compliant and safety-certified platforms.

- Technological integration such as IoT-enabled monitoring and automated elevation control will enhance equipment functionality.

- Infrastructure investment in transport, utilities, and public buildings will continue to support long-term market growth.

- Canada and Mexico will emerge as important secondary markets, supported by urbanization and industrial expansion efforts.

- Customizable and modular scaffolding systems will gain popularity for their adaptability across diverse project scopes.

- Market competition will intensify as both regional and global players invest in product innovation and service diversification.