| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) Market Size 2024 |

USD 1,547.18 million |

| North America Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) Market CAGR |

7.79% |

| North America Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) Market 2032 |

USD 2,806.10 million |

Market Overview

North America Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market size was valued at USD 1,547.18 million in 2024 and is anticipated to reach USD 2,806.10 million by 2032, at a CAGR of 7.73% during the forecast period (2024-2032).

The North America VNA and PACS market is driven by the increasing demand for efficient, interoperable healthcare solutions that streamline medical image management and improve patient care. The growing adoption of electronic health records (EHR) and the shift toward digital healthcare technologies are key factors driving the market. Additionally, advancements in cloud-based storage, along with the need for scalable and vendor-neutral solutions, are accelerating the growth of VNA. The rising prevalence of chronic diseases, an aging population, and the growing volume of medical imaging data further fuel the demand for robust PACS solutions. Furthermore, healthcare providers’ focus on enhancing diagnostic accuracy, reducing operational costs, and ensuring seamless data sharing across platforms are major market trends. As healthcare facilities seek to improve workflow efficiency and integrate multi-vendor systems, the adoption of VNA and PACS technologies is expected to expand significantly in the coming years.

The North America VNA and PACS market is characterized by significant geographical variation, with the U.S. leading the market due to its advanced healthcare infrastructure and adoption of digital health technologies. Canada follows with steady growth driven by government initiatives and a strong focus on interoperable healthcare solutions. Mexico, with its expanding healthcare sector, represents a growing opportunity for VNA and PACS adoption, especially as healthcare modernization continues. Key players in the market include GE Healthcare, IBM Watson Health, and Merge Healthcare (an IBM company), all of which provide advanced imaging solutions and healthcare IT systems. Other notable players include Carestream Health, Change Healthcare, McKesson Corporation, Intelerad Medical Systems, Sectra AB, Agfa HealthCare, and Ambra Health. These companies are at the forefront of technological innovation, offering a range of solutions that improve diagnostic capabilities, data management, and patient care across North America.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America VNA and PACS market was valued at USD 1,547.18 million in 2024 and is expected to reach USD 2,806.10 million by 2032, growing at a CAGR of 7.73% from 2024 to 2032.

- The Global VNA and PACS market was valued at USD 4,411.05 million in 2024 and is expected to reach USD 8,046.15 million by 2032, growing at a CAGR of 7.80% from 2024 to 2032.

- Growing adoption of digital healthcare solutions and electronic health records (EHR) is driving demand for VNA and PACS technologies.

- Cloud-based VNA and PACS solutions are gaining traction due to their scalability, cost-effectiveness, and flexibility.

- The integration of Artificial Intelligence (AI) and Machine Learning (ML) in medical imaging is improving diagnostic accuracy and automation.

- High initial implementation costs and data security concerns are key market restraints.

- The U.S. dominates the market, followed by Canada and Mexico, with significant growth opportunities in Mexico’s emerging healthcare sector.

- Key players include GE Healthcare, IBM Watson Health, Carestream Health, McKesson Corporation, and Sectra AB, competing on technology advancements and service offerings.

Report Scope

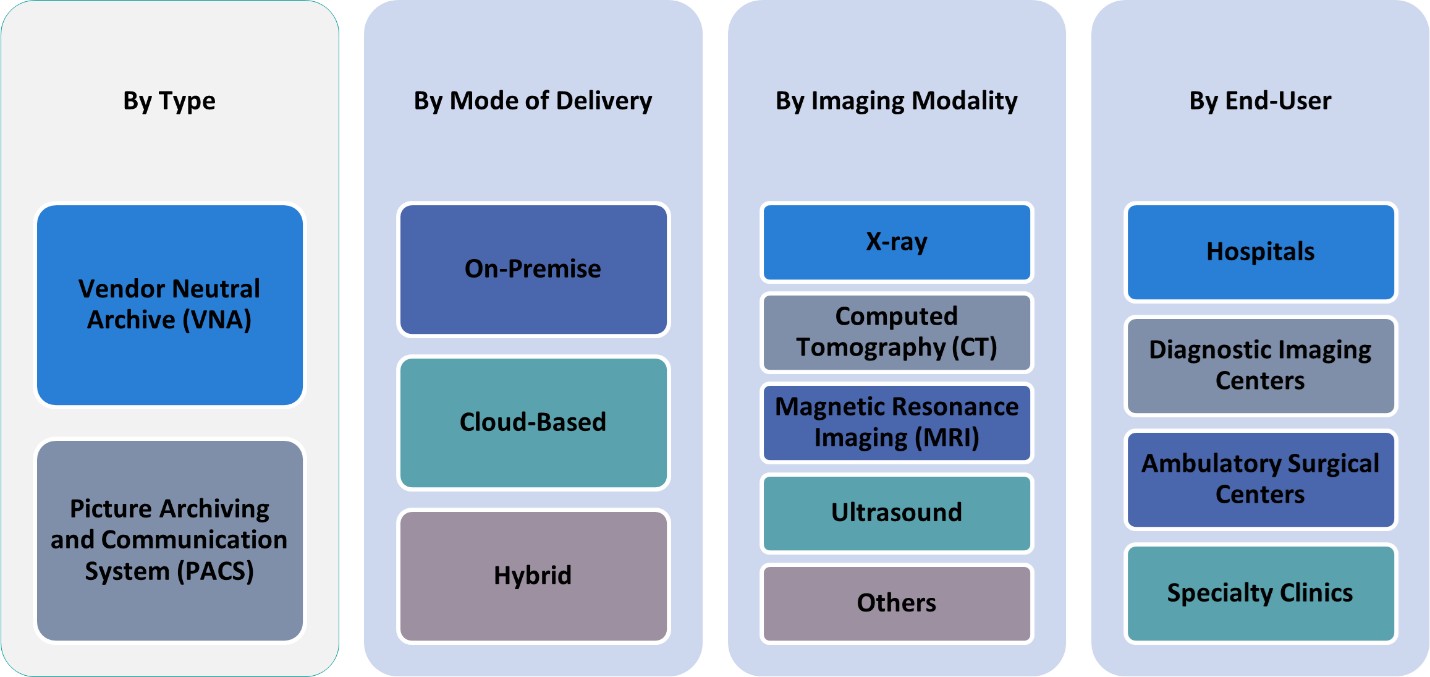

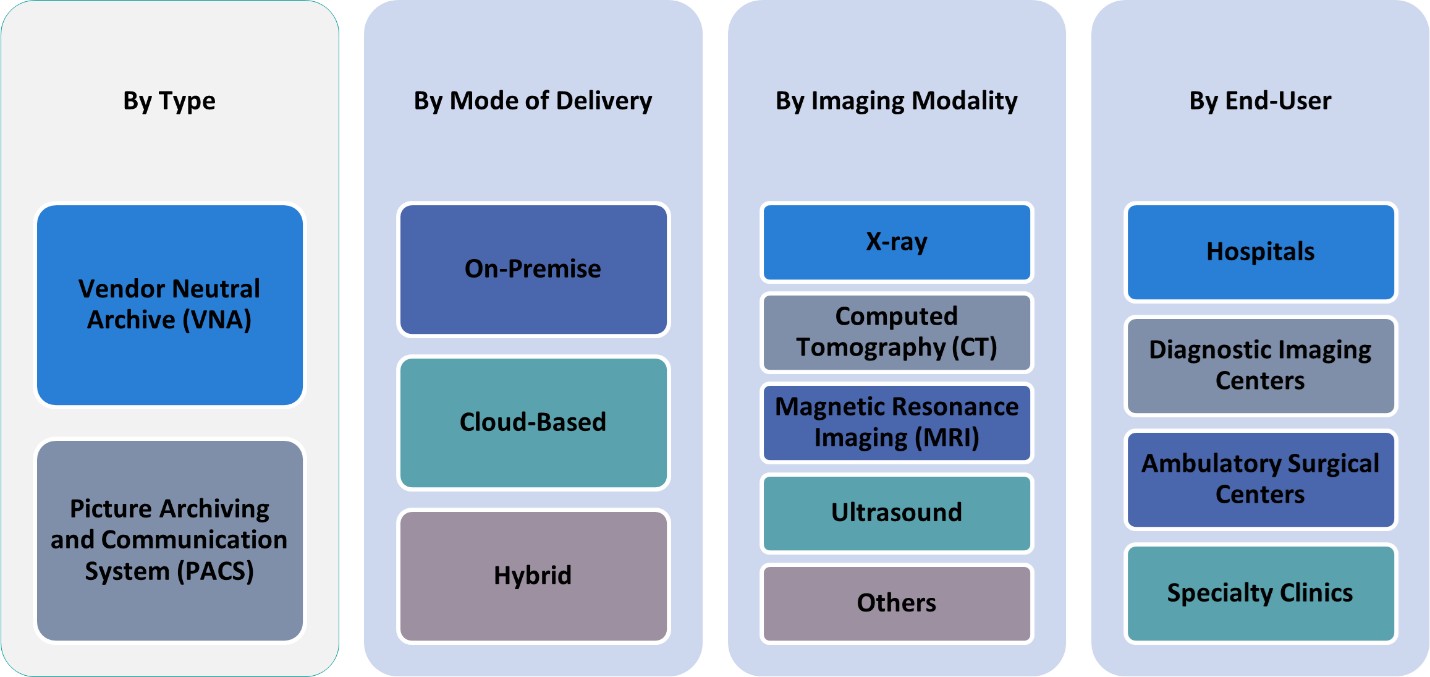

This report segments the North America Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) Market as follows:

Market Drivers

Focus on Operational Efficiency and Cost Reduction

Healthcare organizations are under constant pressure to improve operational efficiency and reduce costs. VNA and PACS systems contribute significantly to these objectives by streamlining image management workflows and reducing the need for physical storage infrastructure. Traditional imaging systems often lead to inefficiencies in managing, archiving, and retrieving images, resulting in higher operational costs. In contrast, VNA and PACS offer centralized, digital storage that simplifies data access and management, reducing time and resources spent on handling images. For instance, the U.S. Government Accountability Office (GAO) has identified opportunities to improve efficiency and reduce costs in healthcare IT systems, including PACS and VNA adoption. Additionally, these solutions improve diagnostic accuracy and reduce the likelihood of redundant imaging procedures, which can further reduce healthcare costs. As a result, healthcare providers are increasingly adopting VNA and PACS solutions to improve efficiency, cut costs, and enhance patient care, fueling the market’s growth in North America.

Growing Adoption of Digital Healthcare Technologies

The rapid adoption of digital healthcare technologies is a significant driver for the North America Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market. Healthcare organizations are increasingly shifting from paper-based systems to digital solutions for managing medical records and imaging data. The transition to Electronic Health Records (EHR) has created a strong demand for interoperable solutions that can efficiently store, retrieve, and manage medical images across different platforms. VNA and PACS are key components of this digital transformation, enabling seamless storage and sharing of imaging data while enhancing diagnostic capabilities. As healthcare providers move toward integrated digital ecosystems, the need for systems that support interoperability and data access across multiple devices and vendors continues to grow, further propelling the market.

Rising Prevalence of Chronic Diseases and Aging Population

The increasing prevalence of chronic diseases and the aging population are major factors driving the demand for advanced imaging solutions such as VNA and PACS in North America. Chronic conditions such as cardiovascular diseases, diabetes, and cancer require frequent medical imaging to monitor disease progression and guide treatment. As the elderly population grows, the need for diagnostic imaging services is expected to rise, increasing the volume of medical images generated. VNA and PACS systems help healthcare providers efficiently manage, store, and retrieve large quantities of imaging data, ensuring accurate and timely diagnoses. For instance, the Pan American Health Organization (PAHO) warns that rapid population aging has led to an increase in ill health and disabilities caused by noncommunicable diseases, urging countries to prepare their health systems. The growing demand for medical imaging to monitor these chronic conditions fuels the adoption of advanced VNA and PACS solutions, which can handle the growing workload associated with chronic disease management.

Advancements in Cloud-Based Solutions

The integration of cloud-based technologies into the healthcare sector is another major driver influencing the VNA and PACS market. Cloud-based PACS and VNA solutions offer significant advantages over traditional on-premise systems, including scalability, reduced infrastructure costs, and enhanced data security. With cloud storage, healthcare organizations can store large volumes of medical imaging data without the limitations of physical storage infrastructure. Additionally, cloud-based systems enable real-time access to images and patient data, improving workflow efficiency and collaboration among healthcare providers. As cloud computing continues to evolve and become more secure, healthcare institutions are increasingly adopting these solutions to manage imaging data, further driving the adoption of VNA and PACS technologies in the North American market.

Market Trends

Shift Towards Cloud-Based Solutions

One of the significant trends driving the North America VNA and PACS market is the increasing shift towards cloud-based solutions. Healthcare organizations are moving away from traditional on-premise systems to adopt cloud storage for managing medical images and patient data. For instance, government reforms such as the HITECH Act and ACA have encouraged the adoption of cloud-based PACS and VNA solutions to improve healthcare efficiency. Cloud-based VNA and PACS offer advantages such as scalability, reduced infrastructure costs, and greater flexibility. These solutions enable healthcare providers to access and share images securely across multiple locations and devices, enhancing collaboration and improving patient care. The cloud infrastructure also facilitates the storage of large volumes of medical imaging data without the constraints of physical storage, further encouraging the transition to cloud-based systems. As cloud technology continues to advance, it is expected that more healthcare institutions will opt for cloud-based VNA and PACS solutions, driving growth in the market.

Increasing Focus on Interoperability

Interoperability remains a crucial trend in the VNA and PACS market, driven by the need for seamless integration of imaging systems across different vendors, platforms, and healthcare systems. As healthcare providers strive to improve care coordination and streamline patient data sharing, they are increasingly adopting Vendor Neutral Archives (VNA) solutions that can bridge the gap between different imaging systems. For instance, North America is the largest market for VNA and PACS, with government incentives supporting data consolidation and exchange. VNA allows medical imaging data to be stored in a standardized format, enabling access regardless of the vendor of the imaging equipment. This trend towards interoperability not only improves operational efficiency but also enhances the quality of patient care by providing clinicians with a comprehensive view of patient history. The push for more interoperable solutions is gaining traction as healthcare systems move towards integrated, patient-centered care models.

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into VNA and PACS systems is an emerging trend that is revolutionizing the medical imaging sector. AI and ML technologies are being incorporated to automate the analysis of medical images, helping healthcare providers detect abnormalities and make more accurate diagnoses. These technologies enhance the efficiency of VNA and PACS systems by automating time-consuming tasks such as image classification and data processing. As AI and ML algorithms continue to evolve, their integration with VNA and PACS is expected to become more advanced, improving diagnostic accuracy and reducing the burden on radiologists and clinicians. This trend is shaping the future of medical imaging by making it more efficient, reliable, and data-driven.

Focus on Enhancing Patient Experience

Another growing trend in the VNA and PACS market is the increasing focus on enhancing the patient experience through improved imaging and quicker diagnosis. Healthcare organizations are adopting more advanced VNA and PACS solutions to improve workflow efficiency, reduce wait times, and enhance the accuracy of diagnoses. By providing clinicians with easy access to comprehensive and up-to-date medical imaging data, these systems enable faster decision-making and more personalized patient care. Additionally, the ability to store and retrieve medical images quickly supports faster diagnosis and treatment planning, which ultimately leads to a better patient experience. As patient satisfaction becomes an increasingly important metric for healthcare providers, the demand for VNA and PACS solutions that optimize workflow and improve care quality is expected to grow.

Market Challenges Analysis

High Implementation Costs

One of the primary challenges facing the North America Vendor Neutral Archives (VNA) and Picture Archiving and Communication Systems (PACS) market is the high initial cost of implementation. The setup of VNA and PACS solutions often requires significant investment in both software and hardware infrastructure. Healthcare organizations must account for the costs associated with system integration, data migration, training, and ongoing maintenance. Smaller healthcare facilities or those with limited budgets may struggle to justify the upfront costs of adopting these technologies, even though they offer long-term operational benefits. This financial barrier can delay or hinder the adoption of VNA and PACS solutions, particularly among smaller providers and rural healthcare systems. Consequently, high implementation costs remain a significant challenge for the widespread adoption of these systems across North America.

Data Security and Privacy Concerns

Another challenge for the VNA and PACS market is ensuring the security and privacy of sensitive patient data. As healthcare providers increasingly rely on digital solutions for managing imaging data, the risk of cyberattacks, data breaches, and unauthorized access to medical records grows. For instance, the U.S. Government Accountability Office (GAO) has identified cybersecurity risks in healthcare IT systems, emphasizing the need for stronger data protection measures. VNA and PACS systems store vast amounts of sensitive health information, making them prime targets for malicious activity. Healthcare organizations must comply with strict regulatory requirements, such as the Health Insurance Portability and Accountability Act (HIPAA), to ensure that patient data is protected. The complexity of securing these systems, especially when cloud-based solutions are involved, adds to the challenge. Additionally, concerns about data interoperability between different systems and vendors can further complicate the secure sharing of imaging data across platforms. Ensuring robust security measures while maintaining data privacy and regulatory compliance remains a key challenge for the VNA and PACS market.

Market Opportunities

The North America VNA and PACS market presents several key opportunities driven by ongoing healthcare digitalization and advancements in technology. One significant opportunity lies in the growing demand for cloud-based solutions, as healthcare providers increasingly seek scalable, cost-effective alternatives to traditional on-premise systems. Cloud-based VNA and PACS offer enhanced data storage, easier access to medical images, and the ability to seamlessly share imaging data across multiple healthcare facilities, improving care coordination. This shift to the cloud provides market players with the chance to develop more flexible and secure cloud-based systems that can cater to the evolving needs of healthcare organizations. Additionally, as the volume of medical imaging data continues to grow, there is a strong demand for solutions that offer efficient data management and streamlined workflows, providing opportunities for vendors to innovate and address these needs.

Another key market opportunity exists in the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies within VNA and PACS solutions. AI and ML can automate image analysis, improve diagnostic accuracy, and reduce the workload of healthcare professionals. Vendors that integrate these advanced technologies into their VNA and PACS offerings have the potential to enhance their value propositions, providing healthcare organizations with tools that not only manage images but also assist in diagnostic decision-making. Additionally, as healthcare providers focus on interoperability to ensure seamless data exchange between systems, there is an opportunity for VNA solutions to facilitate this integration by offering vendor-neutral and standardized formats for image storage. These opportunities highlight the potential for growth and innovation in the VNA and PACS market, as healthcare organizations continue to seek solutions that improve efficiency, accuracy, and patient care.

Market Segmentation Analysis:

By Type:

The North America VNA and PACS market is primarily segmented into two key types: Vendor Neutral Archive (VNA) and Picture Archiving and Communication System (PACS). VNA solutions are increasingly favored for their ability to store medical imaging data in a standardized, vendor-neutral format, enabling healthcare organizations to access and manage images regardless of the system or vendor that produced them. On the other hand, PACS is a more established solution that focuses on the storage, retrieval, and distribution of medical images for diagnostic purposes. PACS solutions enable radiologists and healthcare professionals to access images quickly and efficiently, enhancing diagnostic workflows. The PACS market continues to grow, particularly as healthcare providers upgrade their imaging infrastructure and integrate more advanced technologies such as AI for image analysis. While both VNA and PACS serve similar purposes, the key distinction lies in the flexibility offered by VNA and the specific functionality of PACS tailored to diagnostic imaging. Both segments are essential in modern healthcare facilities, with each meeting different but complementary needs.

By Mode of Delivery:

The VNA and PACS market is further segmented based on the mode of delivery, including on-premise, cloud-based, and hybrid solutions. On-premise solutions have traditionally been the dominant delivery method, where healthcare organizations host their VNA or PACS systems internally on their own servers. These solutions offer control over data management and security, but they come with higher upfront costs and require dedicated IT infrastructure and personnel for maintenance. Cloud-based VNA and PACS solutions eliminate the need for costly on-premise infrastructure and provide healthcare organizations with flexible storage and computing capabilities. This model also allows for seamless data sharing between institutions, improving collaboration and care coordination. The hybrid model, which combines both on-premise and cloud-based solutions, is also growing in popularity. It offers the best of both worlds, allowing organizations to store critical or sensitive data on-premise while utilizing the cloud for scalability and remote access. This trend reflects the growing need for healthcare providers to balance data security, compliance, and operational efficiency while adapting to evolving technological demands.

Segments:

Based on Type:

- Vendor Neutral Archive (VNA)

- Picture Archiving and Communication System (PACS)

Based on Mode of Delivery:

- On-Premise

- Cloud-Based

- Hybrid

Based on End- User:

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Specialty Clinics

Based on Imaging Modality:

- X-ray

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Ultrasound

- Others

Based on the Geography:

Regional Analysis

U.S.

The U.S. holds the largest market share in the region, accounting for approximately 75% of the total market. This dominance is driven by the country’s advanced healthcare infrastructure, widespread adoption of digital health solutions, and large healthcare expenditure. The increasing need for interoperable systems to manage large volumes of medical imaging data has led U.S. healthcare providers to adopt VNA and PACS solutions extensively. Additionally, the strong focus on healthcare digitization, coupled with significant investments in AI and cloud-based technologies, further propels market growth in the U.S.

Canada

Canada holds a smaller yet significant share of around 15% in the North American market for VNA and PACS. The country’s healthcare sector is characterized by a high degree of government involvement and a strong emphasis on public healthcare systems. In Canada, there is growing demand for interoperable healthcare solutions that can improve data sharing across provinces and healthcare facilities. As healthcare providers in Canada continue to adopt digital imaging systems, VNA and PACS are gaining traction to support patient-centered care and enhance diagnostic capabilities. The Canadian market is also benefiting from government initiatives promoting digital health solutions, driving the adoption of these technologies in both public and private sectors.

Mexico

Mexico, with its emerging healthcare infrastructure and expanding healthcare market, holds a smaller market share, approximately 10%, in the North American VNA and PACS market. While Mexico’s healthcare sector is still developing compared to its North American counterparts, the increasing adoption of digital health technologies and medical imaging solutions is a significant growth driver. Government investments in healthcare modernization, coupled with a growing private healthcare sector, are encouraging the adoption of VNA and PACS solutions. Mexico’s market is expected to experience robust growth as healthcare organizations seek more cost-effective, interoperable solutions to enhance diagnostic capabilities and improve patient care.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GE Healthcare

- IBM Watson Health

- Merge Healthcare (an IBM Company)

- Carestream Health

- Change Healthcare

- McKesson Corporation

- Intelerad Medical Systems

- Sectra AB

- Agfa HealthCare

- Ambra Health

Competitive Analysis

The North America VNA and PACS market is highly competitive, with several key players leading the innovation and development of imaging solutions. GE Healthcare, IBM Watson Health, Merge Healthcare (an IBM company), Carestream Health, Change Healthcare, McKesson Corporation, Intelerad Medical Systems, Sectra AB, Agfa HealthCare, and Ambra Health are the major players dominating the market. The competition is driven by technological advancements, including the adoption of cloud storage for more flexible and cost-effective data management. Companies are also working to improve the security and privacy of medical data, addressing growing concerns around cybersecurity and compliance with healthcare regulations like HIPAA. In addition to technological innovations, the competition in the market is influenced by the ability to offer seamless integration with existing healthcare systems and equipment. Key competitive factors include service reliability, system performance, and the ability to scale solutions to meet the demands of healthcare providers of all sizes, from small clinics to large hospitals. The market also sees increasing focus on providing tailored solutions that address specific needs in different healthcare sectors, such as radiology, cardiology, and oncology. Companies are investing in expanding their product offerings to enhance patient care and streamline healthcare workflows.

Recent Developments

- In March 2024, at the European Congress of Radiology in Vienna, Philips unveiled new hardware innovations, focusing on integrating artificial intelligence into their imaging solutions to enhance diagnostic accuracy and workflow efficiency.

- In February 2024, FUJIFILM Healthcare Americas Corporation announced that it’s Synapse VNA and Synapse Radiology PACS solutions (in Asia/Oceania) were ranked #1 in the 2024 Best in KLAS Awards: Software and Services. The recognition, based on insights from KLAS Research, highlights companies excelling in improving patient care through their software and services.

- In January 2024, RamSoft (Canada) launched imaging EMR solution, named OmegaAI. The solution is a cloud-native, serverless imaging EMR software platform that consolidates VNA, Enterprise Imaging, PACS, RIS, simplified image exchange/sharing, routing & storage, a zero-footprint (ZFP) viewer, unified worklist, radiology reporting, document management, peer, patient portal, and a real-time business intelligence and analytics solution.

- In November 2023, InsiteOne (US) announced to acquire BRIT Systems cloud native RIS/PACS/VNA solution to advance imaging workflows. This acquisition will continue to focus on developing cost-effective solutions that improve operational productivity while enhancing patient care.

- In July 2023, Fujifilm Sonosite joined the newly formed Medical Imaging Division under the Advanced Medical Technology Association (AdvaMed), collaborating with industry leaders to advance medical imaging technologies.

Market Concentration & Characteristics

The North America VNA and PACS market is moderately concentrated, with a few key players holding significant market share, while several smaller companies offer niche solutions. The market is characterized by intense competition driven by technological advancements, such as the integration of Artificial Intelligence (AI) and cloud-based storage solutions. Leading companies focus on delivering highly interoperable systems that can seamlessly integrate with existing healthcare infrastructures and enhance diagnostic accuracy. These solutions aim to streamline workflow, improve data accessibility, and support better decision-making across healthcare providers. Additionally, the market is witnessing a shift towards vendor-neutral systems, allowing for greater flexibility and reducing dependency on specific vendors. As healthcare organizations increasingly prioritize cost-effective and scalable solutions, the demand for cloud-based VNA and PACS systems is rising. The market’s characteristics also reflect a trend towards offering tailored solutions that meet the diverse needs of various healthcare sectors, ensuring personalized patient care and improved operational efficiency.

Report Coverage

The research report offers an in-depth analysis based on Type, Mode of Delivery, End-User, Imaging Modality and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of cloud-based VNA and PACS solutions is expected to increase as healthcare providers seek scalable, cost-effective, and flexible data management options.

- The integration of Artificial Intelligence (AI) and Machine Learning (ML) will continue to improve diagnostic accuracy and automate routine tasks in imaging systems.

- Demand for vendor-neutral systems will rise, allowing healthcare organizations to reduce dependency on specific vendors and achieve better data interoperability.

- The shift towards integrated healthcare ecosystems will drive further adoption of VNA and PACS solutions that offer seamless integration across multiple platforms.

- Healthcare organizations will increasingly focus on data security and privacy, prompting innovation in secure storage and compliance with regulations like HIPAA.

- The aging population in North America will contribute to the increased need for medical imaging solutions, driving market growth for VNA and PACS.

- Advancements in telemedicine and remote care will increase the demand for VNA and PACS solutions that support remote access to medical imaging data.

- The market will see continued development of hybrid systems that combine on-premise and cloud-based solutions to meet diverse healthcare needs.

- The growing emphasis on patient-centered care will drive the need for more efficient image-sharing capabilities across healthcare networks.

- As healthcare providers seek to optimize operational efficiency, VNA and PACS solutions will play a critical role in reducing costs and improving workflow productivity.