| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Water Pump Market Size 2023 |

USD 19,464.35 Million |

| North America Water Pump Market, CAGR |

4.13% |

| North America Water Pump Market Size 2032 |

USD 28,006.35 Million |

Market Overview:

North America Water Pump Market size was valued at USD 19,464.35 million in 2023 and is anticipated to reach USD 28,006.35 million by 2032, at a CAGR of 4.13% during the forecast period (2023-2032).

Several factors are propelling the expansion of the water pump market in North America. Notably, the agricultural sector’s increasing need for efficient irrigation solutions is a significant driver. Water pumps are essential for optimizing water usage, thereby enhancing crop yields and supporting sustainable farming practices. As water scarcity continues to be a concern, efficient irrigation systems are critical to maintaining productivity in agriculture. Additionally, the industrial sector’s demand for reliable water management systems, coupled with infrastructure modernization initiatives, is fueling market growth. Industries such as oil and gas, manufacturing, and chemical production require robust water pumps to ensure smooth operations and meet regulatory requirements. The adoption of energy-efficient and smart pump technologies is further accelerating this trend, as industries seek to reduce energy consumption and operational costs.

The United States dominates the North American water pump market, accounting for a substantial share due to its robust industrial base and significant agricultural activities. As the largest producer of crops in the region, the U.S. is a key driver for the demand for agricultural water pumps. The country’s significant urbanization and population growth further contribute to the demand for efficient water management systems. Canada follows closely, with growth driven by infrastructure development and a strong emphasis on sustainable water management practices. The Canadian government has prioritized improving water infrastructure, particularly in rural and remote areas, which is expected to boost the market for water pumps. Both countries are investing in modernizing water infrastructure, which includes upgrading existing systems and implementing advanced water treatment solutions. Technological innovations, such as smart pumps and remote monitoring, are expected to play a key role in this development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Water Pump Market was valued at USD 19,464.35 million in 2023 and is projected to reach USD 28,006.35 million by 2032, growing at a CAGR of 4.13%.

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- The agricultural sector drives significant demand for water pumps, as efficient irrigation systems are crucial to supporting sustainable farming and increasing crop yields.

- Industrial sectors such as oil and gas, manufacturing, and chemicals are propelling market growth by adopting robust water pumps for reliable water management and compliance with environmental regulations.

- Urbanization in North America is leading to increased demand for water pumps, as growing cities require upgraded water distribution, sewage treatment, and waste management systems.

- Government regulations promoting sustainability, water conservation, and energy efficiency are boosting the adoption of advanced, energy-efficient water pumps in industrial and municipal applications.

- The U.S. dominates the market due to its industrial base and agricultural activities, while Canada is growing rapidly, driven by investments in water infrastructure and sustainable management practices.

- Challenges include high initial costs of advanced pump systems, complex installation and maintenance requirements, and the need to comply with stringent environmental and regulatory standards.

Market Drivers:

The agricultural sector is a significant driver for the growth of the North American water pump market. With the increasing need for food production to meet the growing population and global demands, the need for efficient irrigation systems has become more critical. For instance, Franklin Electric has introduced high-efficiency pumps and automated systems specifically designed for agricultural irrigation, enabling farmers to optimize water usage and reduce operational costs. Water pumps are indispensable in optimizing water usage, ensuring crops receive the required moisture while reducing water wastage. As water scarcity continues to be a challenge in various regions, advanced water pump solutions are key to enhancing crop yields, supporting sustainable farming practices, and promoting resource efficiency. This trend is particularly evident in the U.S., where agriculture plays a vital role in the economy, further stimulating the demand for reliable and energy-efficient water pumps.

Industrial Demand for Water Pumps

The industrial sector is another key driver of the North American water pump market. Water pumps are essential in several industries, including oil and gas, manufacturing, and chemical production, for managing water resources in operations. For instance, Xylem has developed smart pump solutions for industrial applications that feature predictive maintenance and energy optimization, helping companies reduce downtime and operational costs. Industrial applications require reliable water pumps for processes such as cooling, water treatment, and waste management. As industries continue to grow and evolve, the demand for robust and efficient water pump solutions increases. Additionally, stricter environmental regulations and sustainability initiatives have led to the adoption of advanced water pumps that offer energy efficiency, enhanced performance, and reduced operational costs. The industrial sector’s push toward modernizing facilities and implementing state-of-the-art technology further accelerates the demand for high-quality water pumps.

Urbanization and Infrastructure Development

Urbanization across North America, particularly in the United States and Canada, has significantly contributed to the demand for water pumps. As cities expand, there is a growing need for reliable water distribution systems to cater to the needs of larger populations. The infrastructure development boom, which includes both new construction and the upgrading of existing systems, has spurred demand for water pumps to ensure efficient water distribution, sewage treatment, and waste management. Municipalities are investing in modernizing water infrastructure to improve operational efficiency and meet the increasing water demand. This urban growth and focus on upgrading infrastructure not only support the continued growth of the water pump market but also create new opportunities for technological advancements, such as the integration of smart pumps and remote monitoring solutions.

Government Regulations and Sustainability Initiatives

Government policies and regulations promoting sustainable water usage and energy efficiency are essential drivers of the North American water pump market. Governments across the region are introducing regulations that require industries and municipalities to adopt water-saving technologies and reduce energy consumption. These policies encourage the adoption of advanced water pump solutions that optimize energy use, minimize water wastage, and align with sustainability goals. In the United States, initiatives such as the Energy Star program have incentivized businesses and homeowners to invest in energy-efficient pumps. Similarly, Canada’s commitment to reducing carbon emissions and enhancing water conservation through legislation has propelled the demand for innovative, high-efficiency pumps. These regulatory efforts not only foster growth in the water pump market but also promote the development of new, environmentally friendly technologies to meet sustainability targets.

Market Trends:

Increasing Adoption of Smart Pumps

One of the key trends in the North American water pump market is the increasing adoption of smart pumps. These pumps integrate advanced sensors, automation, and remote monitoring systems to provide real-time performance data, enabling users to optimize water usage and detect potential issues early. For example, companies like Franklin Electric and Grundfos have expanded their product portfolios to include high-efficiency pumps and automated systems, responding to the demand for smarter water management solutions. Smart pumps offer improved energy efficiency, enhanced reliability, and the ability to integrate with other systems for better operational management. As industries and municipalities seek to improve water management practices and reduce operational costs, the demand for smart pumps is expected to continue growing. This trend is particularly notable in urban areas where large-scale water distribution and treatment systems require more efficient and scalable solutions to manage resources effectively.

Focus on Energy-Efficient Solutions

Another prominent trend in the North American water pump market is the growing focus on energy-efficient solutions. As energy costs rise and environmental concerns intensify, both businesses and governments are increasingly prioritizing the adoption of pumps that offer higher efficiency with lower energy consumption. Water pumps account for a significant portion of energy use in various industries, making energy-efficient pumps a key investment for companies aiming to reduce operational costs and meet sustainability targets. This trend is being fueled by technological advancements in pump design, such as variable speed drives and improved motor technologies, which allow pumps to adjust their output based on real-time demand, resulting in substantial energy savings. The continued push for sustainability in industrial processes and public infrastructure is expected to drive the demand for energy-efficient pumps in the coming years.

Growth in Water Treatment and Recycling Applications

The increasing focus on water treatment and recycling in North America is another driving trend in the water pump market. With rising concerns about water scarcity and pollution, there is a growing emphasis on recycling wastewater and improving water quality. Water pumps play a crucial role in these processes, facilitating the movement and treatment of water for reuse. Municipalities and industries are investing heavily in advanced water treatment facilities, including desalination and wastewater treatment plants, which rely on high-performance pumps to ensure the effectiveness of their operations. For instance, Canada’s water pump market is experiencing growth driven by investments in water treatment and infrastructure upgrades, with a strong commitment to adopting novel pump technologies that support efficient water management. The market for water pumps in the water treatment and recycling sectors is projected to experience robust growth as the demand for sustainable water solutions increases across the region.

Integration of IoT in Water Pump Systems

The integration of the Internet of Things (IoT) in water pump systems is also gaining traction in North America. IoT-enabled water pumps allow for remote monitoring, predictive maintenance, and real-time performance analytics. By connecting pumps to the cloud, operators can gather valuable data on pump health, water flow rates, and energy consumption, enabling them to make data-driven decisions. This trend is particularly beneficial for large-scale systems, such as municipal water treatment plants, which require constant monitoring to ensure operational efficiency and prevent costly downtime. IoT integration in water pump systems enhances their performance and opens up opportunities for greater automation, making it a crucial trend that is likely to shape the market in the coming years.

Market Challenges Analysis:

High Initial Costs

One of the significant restraints in the North American water pump market is the high initial cost of advanced water pump systems. While energy-efficient and smart pumps offer long-term savings, their upfront costs can be a barrier for many businesses and municipalities. The adoption of these advanced systems often requires significant capital investment, which may be prohibitive for smaller companies or local governments with limited budgets. This challenge is particularly pronounced in industries where cost control is critical, such as agriculture and small-scale manufacturing. The initial expense, combined with ongoing maintenance costs, can deter stakeholders from investing in modern water pump technologies.

Complex Installation and Maintenance Requirements

Another challenge facing the North American water pump market is the complex installation and maintenance requirements of certain water pump systems. While basic pumps are relatively simple to install, advanced pumps, such as those integrated with IoT or energy-efficient features, require specialized knowledge for both installation and maintenance. This can lead to longer lead times and higher service costs, especially in remote or rural areas where technical expertise may be limited. Additionally, the need for ongoing maintenance to ensure optimal performance can increase operational costs for industries that rely on these pumps continuously. These factors contribute to a reluctance to upgrade to more sophisticated water pump systems.

Regulatory and Environmental Compliance

The need to comply with strict regulatory standards is another challenge for the North American water pump market. Water pump systems, particularly in industrial applications, must meet various environmental and safety regulations set by local and federal authorities. For instance, water utilities in the United States must comply with evolving EPA regulations, such as the federal PFAS standards introduced in April 2024, which require utilities to upgrade equipment and recalibrate operational procedures within a five-year deadline. Navigating these regulations can be time-consuming and costly, especially for companies looking to adopt new technologies or expand existing operations. Furthermore, meeting sustainability standards for energy efficiency and water conservation often requires continuous investment in upgrades and monitoring, placing additional financial strain on businesses.

Market Fragmentation

The North American water pump market is highly fragmented, with a large number of players offering a variety of products ranging from low-cost, basic pumps to high-end, technologically advanced solutions. This fragmentation can make it challenging for customers to identify the best solution for their specific needs. Moreover, the competitive nature of the market may result in price-based competition, which can sometimes drive down profit margins for manufacturers and suppliers. This fragmentation, coupled with the fast pace of technological innovation, presents an ongoing challenge for market participants to stay competitive while maintaining profitability.

Market Opportunities:

The North American water pump market presents significant opportunities driven by the growing demand for sustainable water management solutions. As water scarcity and environmental concerns become more pressing, industries and municipalities are increasingly prioritizing water conservation and efficient resource management. This trend creates opportunities for manufacturers of energy-efficient and eco-friendly water pumps that can help address these challenges. Pumps with advanced features such as variable speed drives, energy recovery systems, and smart monitoring technologies are particularly well-positioned to capitalize on this demand. Additionally, government incentives and regulations promoting water conservation are expected to spur the adoption of these advanced pump solutions, creating growth opportunities in both urban and rural infrastructure projects.

Another promising opportunity in the North American water pump market lies in the growing emphasis on industrial water treatment and recycling. As industries across sectors such as manufacturing, oil and gas, and food processing face increasing pressure to reduce water consumption and recycle wastewater, the demand for high-performance water pumps is on the rise. Water pumps play a critical role in facilitating the movement and treatment of water in these processes, which are essential to achieving sustainability goals. With the expansion of water treatment plants and wastewater recycling facilities, there is ample room for innovation and the deployment of new technologies, presenting opportunities for companies to expand their product offerings in this rapidly evolving sector.

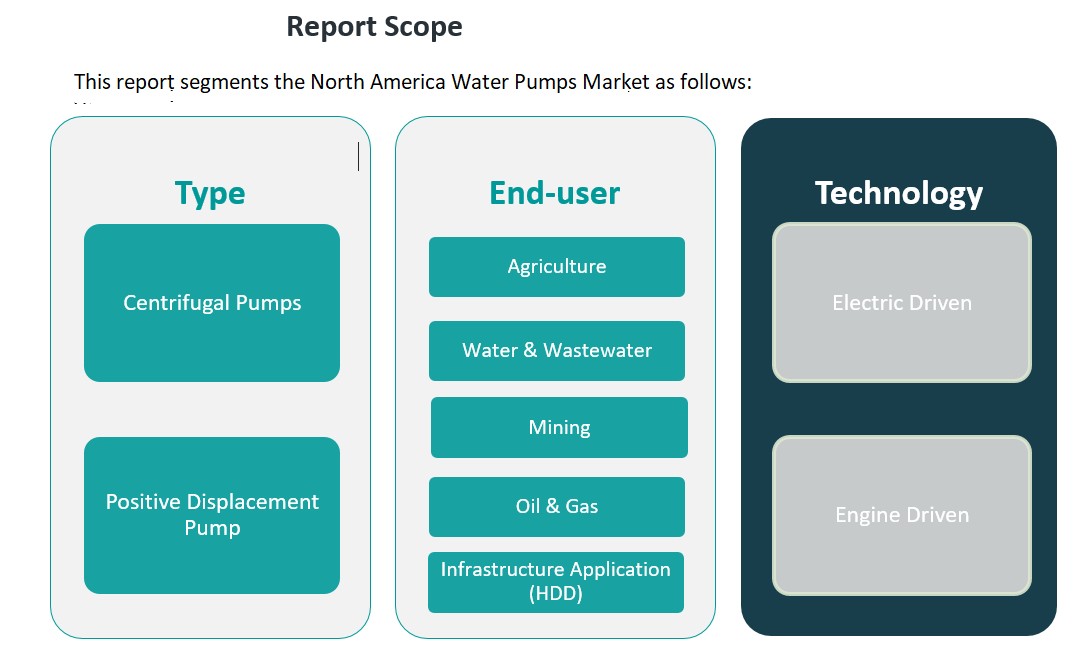

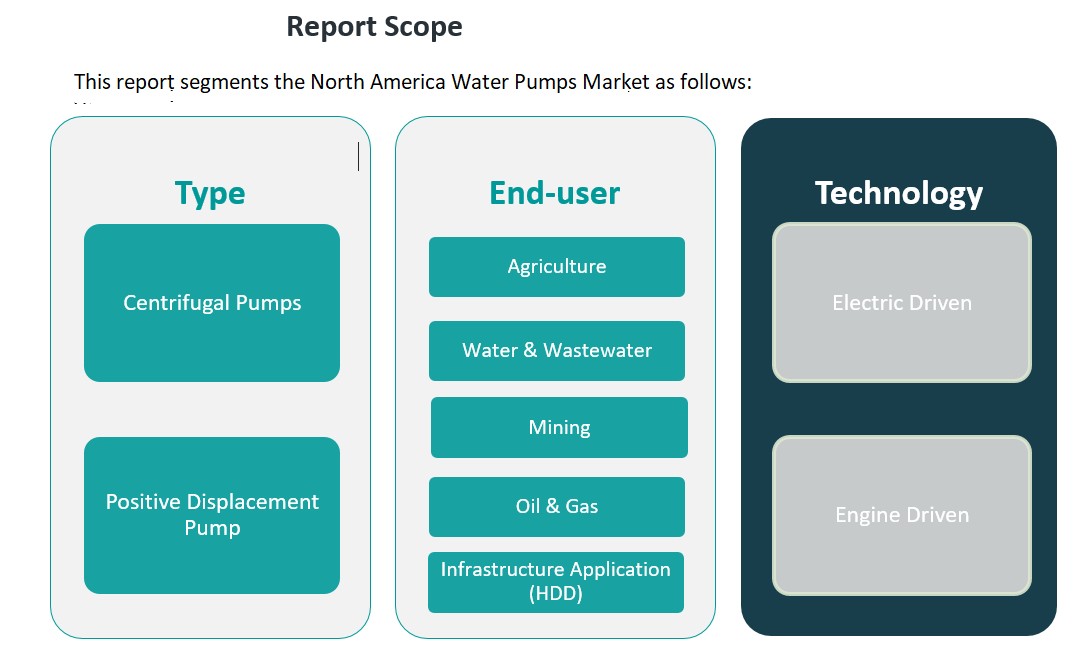

Market Segmentation Analysis:

The North American water pump market is segmented based on type, end-user applications, and technology, each contributing uniquely to the market’s growth.

By Type Segment

In the North American market, centrifugal pumps dominate, owing to their widespread use in various applications, including water supply and industrial processes. These pumps are favored for their efficiency in handling large volumes of liquid at lower pressures. Positive displacement pumps, however, are gaining traction in industries requiring precise fluid handling, such as oil and gas, as they deliver a constant flow regardless of system pressure. The versatility and application-specific advantages of both types contribute to the diverse market landscape.

By End-User Segment

The water pump market sees robust demand across multiple sectors. The agriculture segment leads, driven by the need for efficient irrigation systems to support large-scale farming. Water and wastewater treatment facilities also contribute significantly to market growth, as municipalities adopt advanced pumps for water management and recycling. Mining and oil & gas industries demand specialized, high-performance pumps for operations in harsh environments. Infrastructure applications, particularly in horizontal directional drilling (HDD), require pumps for fluid circulation and efficient construction operations, adding further to market demand.

By Technology Segment

Electric-driven pumps dominate the market due to their energy efficiency and lower operational costs. These pumps are increasingly preferred in urban and industrial water management systems. Engine-driven pumps, while less energy-efficient, are critical in remote areas or temporary applications where electrical power is unavailable. The versatility of both electric and engine-driven pumps in different settings drives the continued expansion of the market across sectors.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

The North American water pump market is primarily driven by demand in the United States and Canada, with each country contributing significantly to the overall market landscape. Both nations are focused on enhancing their water infrastructure and adopting energy-efficient solutions, driving the demand for advanced water pump technologies across various sectors.

United States

The United States holds the largest share of the North American water pump market, accounting for approximately 75% of the total market value. This dominant position is due to the country’s extensive industrial base, large-scale agricultural activities, and rapid urbanization. Water pumps are critical in numerous sectors, including agriculture, manufacturing, oil and gas, and municipal water systems. In the U.S., the agricultural sector is particularly significant, as efficient irrigation systems are essential for maintaining high crop yields in arid regions. Additionally, the U.S. has seen substantial investments in infrastructure, with municipalities upgrading water treatment plants and wastewater recycling systems, further driving the demand for water pumps. Technological innovations, such as the increasing use of smart pumps and energy-efficient solutions, also contribute to the market’s growth in the U.S.

Canada

Canada represents a growing segment of the North American water pump market, accounting for approximately 25% of the market share. The country’s market growth is driven by similar factors as the U.S., including agriculture, water treatment, and industrial applications. However, Canada’s focus on sustainability and resource conservation has accelerated the demand for advanced water pumps, particularly in urban areas. Canada’s commitment to improving water infrastructure in both rural and urban regions further fuels the need for reliable and efficient water pump solutions. The government’s focus on environmental regulations and energy efficiency standards has also contributed to the demand for advanced pumping systems that reduce energy consumption and minimize environmental impact.

Market Dynamics

Both countries within North America are investing heavily in modernizing their water infrastructure, focusing on reducing water wastage and improving energy efficiency. The rise of industrial automation and the integration of IoT-enabled water pump systems are key factors contributing to the region’s growth. Regional governments in both the U.S. and Canada are implementing regulations that promote energy-efficient water pump systems, offering incentives for adopting technologies that support water conservation and sustainability.

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation.

- ITT INC.

- EBARA CORPORATION

Competitive Analysis:

The North American water pump market is highly competitive, with numerous global and regional players operating across various segments. Key industry players include Xylem Inc., Grundfos, Flowserve Corporation, and Pentair PLC, all of which have a significant market presence due to their comprehensive product offerings, including centrifugal and positive displacement pumps. These companies focus on expanding their portfolios to meet the growing demand for energy-efficient, sustainable solutions. Additionally, local manufacturers and suppliers are leveraging technological advancements, such as the integration of IoT and smart pump systems, to differentiate themselves. The competitive landscape is marked by a focus on R&D to drive innovation in pump design and energy efficiency. Strategic partnerships, mergers, and acquisitions also play a crucial role in enhancing market positioning and broadening product offerings, particularly in the industrial and municipal water treatment sectors. Overall, competition remains fierce, with a focus on technological innovation and cost-effective solutions.

Recent Developments:

- In October 2024, Ingersoll Rand Inc.announced the acquisition of three companies: Air Power Systems Co., LLC (APSCO), Blutek s.r.l., and UT Pumps & Systems Private Limited, for a combined purchase price of approximately $135 million. These acquisitions are aimed at expanding Ingersoll Rand’s portfolio with high-pressure pump technologies and innovative solutions for mission-critical environments. APSCO, based in the United States, specializes in hydraulic and pneumatic products for specialty work trucks, while Blutek, based in Italy, focuses on compressed air and nitrogen generation systems. UT Pumps & Systems adds expertise in high-performance water pumping solutions. These acquisitions will strengthen Ingersoll Rand’s Industrial Technologies and Services segment.

- In May 2023, Xylem Inc.partnered with Tiba Manzalawi Group to launch the Xylem Egypt Plant, marking a significant milestone in local manufacturing for water pumps and systems. The facility produces Split-Case Centrifugal pumps and End-Suction pumps for irrigation, HVAC, and industrial applications. This initiative aims to address supply chain challenges by reducing reliance on imports and enhancing delivery efficiency while supporting Egypt’s economic growth through job creation. The plant also targets domestic and export markets, reinforcing Xylem’s commitment to sustainable manufacturing practices.

- In October 2022, EBARA Corporation completed its acquisition of Hayward Gordon L.P., a North American manufacturer of pumps and mixers. This acquisition enhanced EBARA’s product portfolio and strengthened its market presence in North America.

Market Concentration & Characteristics:

The North American water pump market is moderately concentrated, with several large multinational companies holding significant market shares. Key players such as Xylem Inc., Grundfos, Flowserve Corporation, and Pentair PLC dominate the market, leveraging their vast product portfolios and established distribution networks. While these industry giants lead in terms of market share, the market also features a growing number of regional and niche players offering specialized solutions for various sectors, including agriculture, water treatment, and industrial applications. The market is characterized by intense competition driven by technological innovation, particularly in energy-efficient and smart pump systems. Companies focus on improving performance, reducing environmental impact, and enhancing operational efficiency. Additionally, there is a strong emphasis on customer-specific solutions and tailored product offerings to cater to diverse end-user demands. The market’s competitive nature fosters continuous advancements in pump technologies, contributing to the ongoing growth of the sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North American water pump market will continue to grow due to increased demand in agriculture, industrial applications, and municipal water systems.

- Advancements in energy-efficient and smart pump technologies will drive future market growth, aligning with sustainability goals.

- The adoption of IoT-enabled pumps will rise, enabling real-time monitoring and predictive maintenance.

- Increasing investments in water infrastructure upgrades, especially in urban areas, will create sustained demand.

- Government regulations promoting water conservation and energy efficiency will support market expansion.

- The rise in wastewater treatment and recycling initiatives will boost the demand for specialized water pumps.

- The oil and gas industry will continue to drive growth due to the need for durable, high-performance pumps in harsh environments.

- Increased focus on sustainability will lead to a higher adoption of environmentally friendly and energy-saving pump solutions.

- The market will see a rise in regional players offering tailored, cost-effective solutions for niche applications.

- Technological innovations will fuel competition, with companies prioritizing automation, efficiency, and customization in their pump systems.