Market Overview:

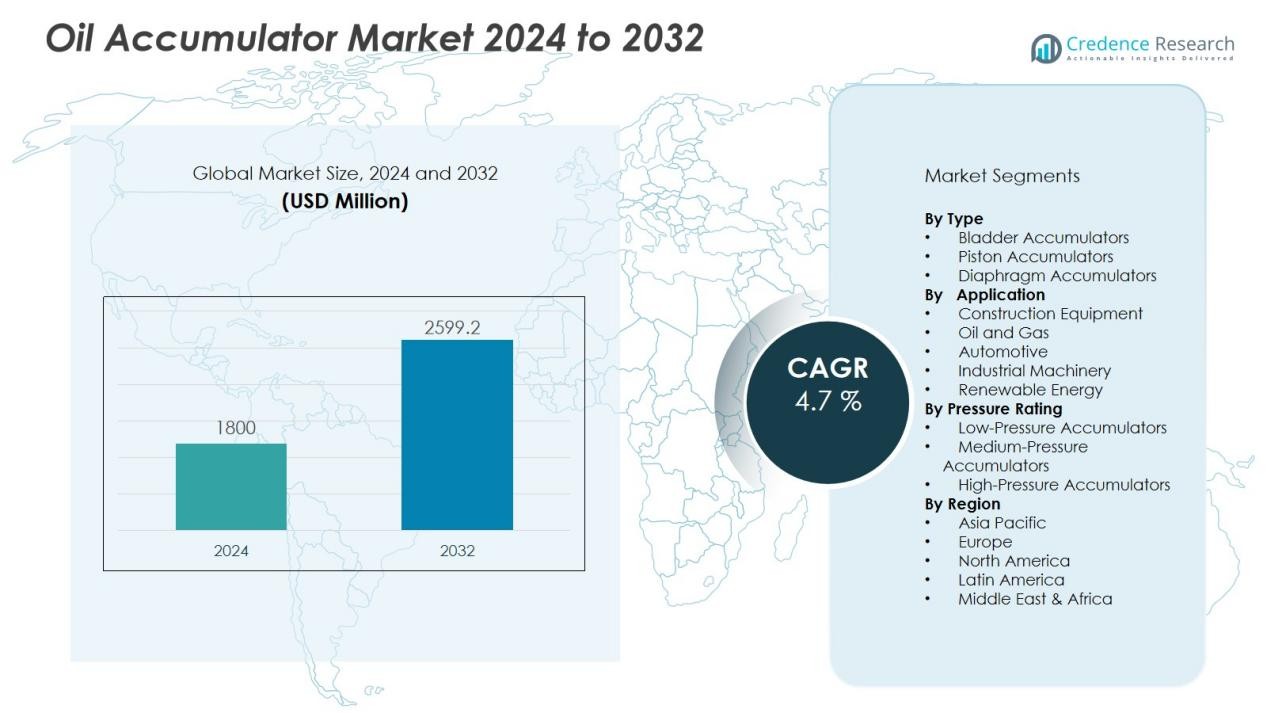

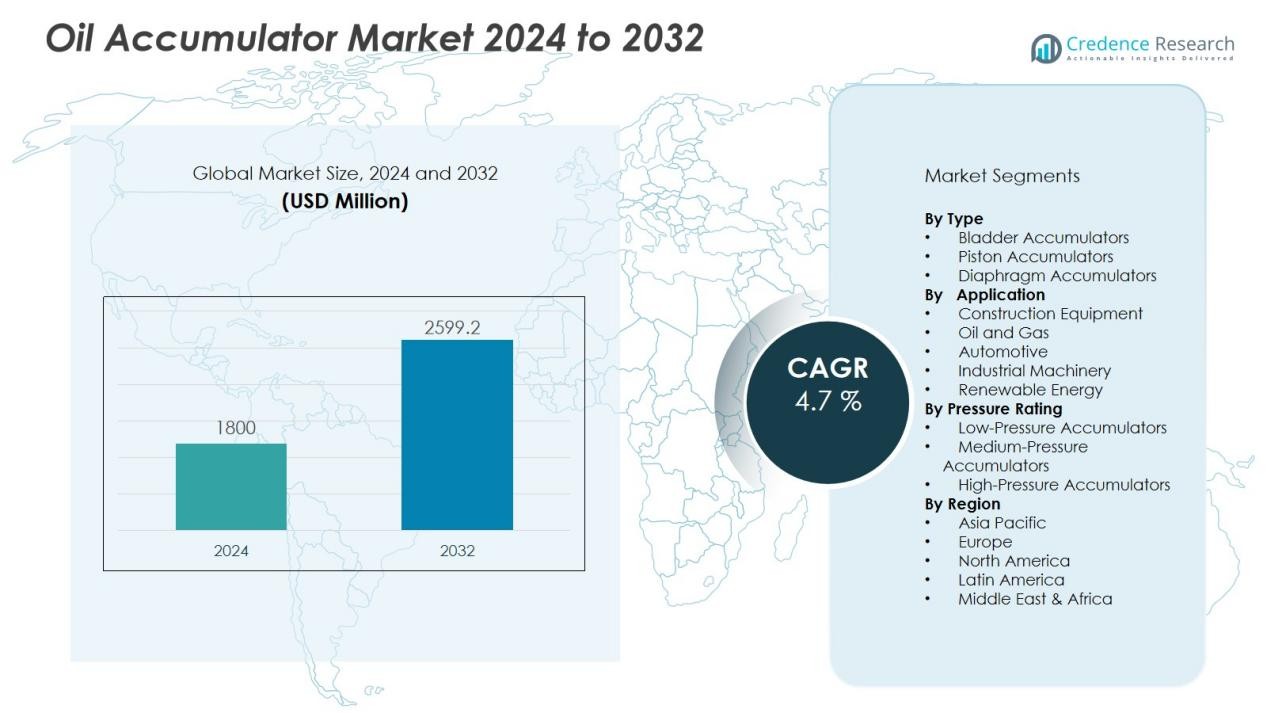

The Oil accumulator market size was valued at USD 1800 million in 2024 and is anticipated to reach USD 2599.2 million by 2032, at a CAGR of 4.7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oil Accumulator Market Size 2024 |

USD 1800 Million |

| Oil Accumulator Market, CAGR |

4.7% |

| Oil Accumulator Market Size 2032 |

USD 2599.2 Million |

Key drivers include the widespread use of oil accumulators in stabilizing pressure, reducing pulsation, and ensuring energy storage in hydraulic systems. Industries such as construction, mining, and oil & gas rely on accumulators to enhance equipment performance and extend system lifespan. Expanding applications in renewable energy projects and automotive hydraulics further contribute to long-term growth.

Regionally, Asia Pacific leads the oil accumulator market due to rapid industrialization, infrastructure projects, and the strong presence of manufacturing hubs in China and India. North America and Europe maintain steady demand, driven by advanced industrial bases, energy efficiency regulations, and adoption in automotive systems. Emerging economies in Latin America and the Middle East & Africa are witnessing rising investments in oil & gas exploration and heavy machinery, creating new opportunities for market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The oil accumulator market was valued at USD 1,800 million in 2024 and will reach USD 2,599.2 million by 2032, growing at a CAGR of 4.7%.

- Demand rises with the growing use of oil accumulators in stabilizing pressure, reducing pulsation, and ensuring energy storage in hydraulic systems.

- Industries including mining, construction, and oil & gas depend on accumulators to enhance equipment performance and extend operational lifespan.

- The market benefits from renewable energy adoption and automotive hydraulics, where accumulators improve safety and efficiency.

- High maintenance needs, risks of system failures, and rising material costs remain major challenges for long-term growth.

- Asia Pacific leads with 38% market share, supported by industrialization, infrastructure projects, and manufacturing growth in China and India.

- North America holds 27% and Europe 22%, while Latin America (7%) and Middle East & Africa (6%) emerge with new opportunities from oil exploration and industrial investments.

Market Drivers:

Rising Demand from Hydraulic Systems in Industrial Applications:

The oil accumulator market benefits from the growing reliance on hydraulic systems across industries. These systems require reliable components to stabilize pressure, reduce pulsation, and ensure uninterrupted operation. Oil accumulators play a vital role by storing and releasing energy when needed, improving efficiency. Industries such as mining, construction, and manufacturing drive strong demand for these solutions.

- For instance, Bosch Rexroth’s HAD28-250-2X diaphragm accumulator delivers a nominal volume of exactly 2.8 liters at 250 bar, ensuring uninterrupted pressure stabilization in heavy-duty mining equipment.

Increasing Focus on Energy Efficiency and Equipment Longevity:

Companies invest in oil accumulators to reduce energy waste and extend machinery lifespan. The technology helps lower wear and tear on hydraulic pumps by balancing pressure fluctuations. It also ensures smoother system performance, leading to reduced maintenance costs. The oil accumulator market gains traction from industries seeking sustainable, long-term operational benefits.

- For instance, Caterpillar’s 336EH hydraulic hybrid excavator demonstrates 25% fuel savings through accumulator-assisted energy recovery during swing operations.

Expanding Role in Oil and Gas Exploration Activities:

The oil accumulator market finds strong opportunities within oil and gas exploration projects. Offshore and onshore drilling operations require dependable energy storage and pressure control solutions. Accumulators provide safety and reliability under extreme conditions, supporting uninterrupted drilling performance. Rising investments in exploration activities continue to strengthen demand for advanced accumulator systems.

Growing Adoption in Automotive and Renewable Energy Sectors:

The oil accumulator market also benefits from expansion in automotive hydraulics and renewable energy projects. Automakers use accumulators in suspension and braking systems to improve performance and safety. Renewable energy plants deploy them in turbines and hydraulic systems to stabilize pressure. It supports broader industry goals of efficiency and reliability, creating steady growth opportunities.

Market Trends:

Integration of Smart Monitoring and Advanced Materials in Accumulator Design:

The oil accumulator market is witnessing a shift toward smart technologies and advanced materials. Manufacturers are introducing accumulators with integrated sensors to track pressure, temperature, and fluid levels in real time. This innovation supports predictive maintenance, reduces downtime, and extends equipment life. Composite and lightweight materials are also being adopted to improve performance and durability while reducing overall system weight. The use of eco-friendly materials aligns with sustainability goals and regulatory requirements. It reflects the market’s drive toward combining operational efficiency with environmental responsibility.

- For Instance, Parker Hannifin’s Smart Accumulator integrates a pressure sensor with an accuracy of 0.1 bar, enabling continuous real-time diagnostics for predictive maintenance without added system weight.

Expanding Applications Across Emerging Industries and Renewable Energy Projects:

The oil accumulator market is gaining traction in sectors beyond traditional industries. Automotive companies are using accumulators in hybrid and electric vehicles to enhance energy recovery and braking systems. Renewable energy projects, including wind and hydro plants, adopt accumulators to stabilize pressure and store hydraulic energy. Industrial automation and robotics also provide new areas for accumulator integration, driven by the need for precise and reliable fluid power systems. Growing focus on safety standards and energy efficiency supports broader adoption across applications. It highlights the market’s transition into a more diversified and innovation-driven phase.

- For instance, Eckert et al. (2022) demonstrated that using hydraulic accumulators in electro-hydraulic hybrid electric vehicles helped mitigate battery aging and provided a peak power buffer with high power density, significantly optimizing powertrain performance with a lithium iron phosphate battery capacity of 101.5 kWh.

Market Challenges Analysis:

High Maintenance Requirements and Risk of System Failures:

The oil accumulator market faces challenges linked to maintenance and operational risks. Accumulators require periodic inspection, repair, and replacement of components such as seals and bladders to ensure reliability. Failure to maintain them can lead to system breakdowns, costly downtime, and safety concerns. Industries that operate in harsh conditions, such as oil and gas, face higher risks of failures. It creates a barrier for companies seeking to minimize operational disruptions. These issues highlight the importance of advanced designs and improved durability.

Regulatory Pressures and Rising Material Costs:

The oil accumulator market must also address strict environmental and safety regulations. Compliance with international standards for hydraulic systems often increases design complexity and production costs. Rising prices of raw materials, such as steel and composites, add further strain on manufacturers. It reduces profit margins and limits the ability of smaller firms to compete with global players. Rapid industrialization in emerging markets intensifies the pressure on supply chains. Meeting both cost efficiency and regulatory requirements remains a key challenge for industry participants.

Market Opportunities:

Expansion in Renewable Energy and Sustainable Industrial Practices

The oil accumulator market holds strong opportunities in renewable energy and sustainable industries. Wind and hydro power plants deploy accumulators to stabilize hydraulic systems and store energy efficiently. Growing investments in clean energy projects across Asia, Europe, and North America create favorable demand. Manufacturers can also benefit from designing eco-friendly accumulators that align with global sustainability goals. It opens doors for companies offering lightweight, durable, and recyclable solutions. The trend supports long-term adoption across multiple green energy applications.

Rising Demand from Emerging Economies and Automation Growth

The oil accumulator market benefits from rapid industrialization in emerging economies such as India, Brazil, and Southeast Asia. Expanding construction, mining, and manufacturing sectors in these regions require reliable hydraulic systems. Increasing adoption of industrial automation and robotics further boosts accumulator applications. It provides opportunities for suppliers to deliver compact, high-performance models tailored to advanced systems. Growing infrastructure investments strengthen demand for reliable energy storage and pressure control solutions. These factors create a strong growth path for both established players and new entrants.

Market Segmentation Analysis:

By Type:

The oil accumulator market is segmented into bladder, piston, and diaphragm types. Bladder accumulators dominate due to their reliability, compact design, and suitability for high-frequency operations. Piston accumulators are widely used in applications requiring large volume capacity and higher pressure handling. Diaphragm accumulators find demand in mobile hydraulics and smaller systems where space efficiency is critical. It shows that product selection depends on specific operational needs, durability, and cost efficiency.

- For instance, Eaton’s diaphragm accumulators feature compact designs with operating pressures up to 250 bar and volumes as low as 0.5 liters, ideal for space-constrained mobile hydraulic systems, based on Eaton’s verified product brochures accessible online.

By Application:

The oil accumulator market serves applications such as construction equipment, oil and gas, automotive, industrial machinery, and renewable energy. Construction and mining sectors account for strong adoption due to heavy use of hydraulic systems. Oil and gas operations deploy accumulators to ensure safety and stable energy supply under extreme conditions. Automotive applications expand through integration in braking and suspension systems, particularly in hybrid vehicles. Industrial automation and renewable energy further enhance the demand across diverse end-user industries.

By Pressure Rating:

The oil accumulator market is categorized into low-pressure, medium-pressure, and high-pressure segments. Low-pressure accumulators are suitable for energy storage and auxiliary functions in light machinery. Medium-pressure accumulators gain adoption in manufacturing and automotive applications requiring balanced performance. High-pressure accumulators dominate oil and gas and heavy-duty equipment where safety and reliability are critical. It highlights the importance of pressure-specific solutions to meet industry demands and performance standards.

For instance, Hydac’s high-pressure diaphragm accumulators function effectively at pressures up to 500 bar, ensuring safety compliance and consistent performance in offshore drilling rigs.

Segmentations:

By Type:

- Bladder Accumulators

- Piston Accumulators

- Diaphragm Accumulators

By Application:

- Construction Equipment

- Oil and Gas

- Automotive

- Industrial Machinery

- Renewable Energy

By Pressure Rating:

- Low-Pressure Accumulators

- Medium-Pressure Accumulators

- High-Pressure Accumulators

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

Asia Pacific:

Asia Pacific holds 38% market share in the oil accumulator market in 2024. It is the leading region supported by rapid industrialization, infrastructure expansion, and manufacturing growth in China, India, and Southeast Asia. Rising investments in construction, mining, and renewable energy projects strengthen regional adoption. Hydraulic systems in heavy machinery and industrial equipment drive continuous demand. Government initiatives supporting industrial automation and energy efficiency also contribute to market growth. The strong presence of local and global manufacturers enhances competitiveness and supply chain resilience.

North America and Europe:

North America accounts for 27% market share in the oil accumulator market, while Europe represents 22%. Both regions benefit from advanced industrial bases, well-established automotive sectors, and strong regulatory frameworks promoting efficiency. The oil and gas industry in North America creates consistent demand for hydraulic energy storage solutions. Europe’s emphasis on sustainability and adoption of eco-friendly designs supports innovation. Industrial automation and robotics applications further expand regional opportunities. It reflects a mature yet innovation-driven market environment supported by continuous technological progress.

Latin America and Middle East & Africa:

Latin America secures 7% market share in the oil accumulator market, with the Middle East & Africa holding 6%. Both regions show steady progress through growing investments in oil exploration, mining, and infrastructure projects. Expansion of manufacturing bases in Brazil, Mexico, and GCC countries creates favorable demand. The adoption of accumulators in energy projects and heavy machinery continues to rise. Governments in these regions invest heavily in industrial development and energy diversification. It positions both markets as promising growth areas supported by rising demand for advanced hydraulic solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Hydac

- Eaton

- Parker Hannifin

- Freudenberg

- Nippon Accumulator

- Bosch Rexroth

- Technetics Group

- Enerflex

- Stauff

- Aventics

- Mactronic

- Yuken Kogyo

- Casappa

- HydraForce

- Atos

Competitive Analysis:

The oil accumulator market is highly competitive with global and regional players driving innovation and expansion. Key companies include Hydac, Eaton, Parker Hannifin, Freudenberg, Nippon Accumulator, Bosch Rexroth, Technetics Group, Enerflex, Stauff, and Aventics. These firms focus on product differentiation, advanced materials, and integration of smart monitoring technologies to strengthen their positions. It relies on continuous R&D investments to improve performance, durability, and compliance with regulatory standards. Partnerships and collaborations with end-use industries support market penetration across construction, oil and gas, automotive, and renewable energy sectors. Many players expand their global presence through strategic acquisitions and regional manufacturing hubs. It highlights a competitive environment where innovation, cost efficiency, and customization remain decisive success factors.

Recent Developments:

- In April 2025, Hydac showcased innovations in hydraulics, sensor technology, and thermal management at bauma 2025 in Munich, highlighting technologies for electrified construction machinery and automation systems such as the EcoSwitch for energy-efficient electro-hydraulic supply.

- In March 2025, Eaton announced its acquisition agreement with Fibrebond Corporation, a builder of modular power enclosures for data centers and utilities, and unveiled advanced smart power management solutions at Elecrama 2025 in India.

- In July 2025, Parker Hannifin announced the $1 billion acquisition of Curtis Instruments, signaling a strategic shift toward electrification.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Pressure Rating and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The oil accumulator market will advance with rising demand for efficient hydraulic systems across industries.

- Manufacturers will focus on integrating smart monitoring technologies for predictive maintenance and improved safety.

- Lightweight composites and eco-friendly materials will gain traction in accumulator production to meet sustainability goals.

- Growing use of accumulators in renewable energy projects such as wind and hydro power will drive adoption.

- The automotive sector will expand accumulator applications in suspension, braking, and hybrid energy recovery systems.

- Emerging economies will strengthen demand through large-scale infrastructure projects, mining activities, and manufacturing growth.

- Oil and gas exploration will continue to rely on accumulators for pressure control and operational safety.

- Automation in factories and robotics will create new opportunities for compact and high-performance accumulators.

- Regulatory compliance will shape design innovations, pushing manufacturers toward safer and more durable solutions.

- Partnerships, capacity expansions, and technological upgrades will define competitive strategies to meet global demand.