Market Overview

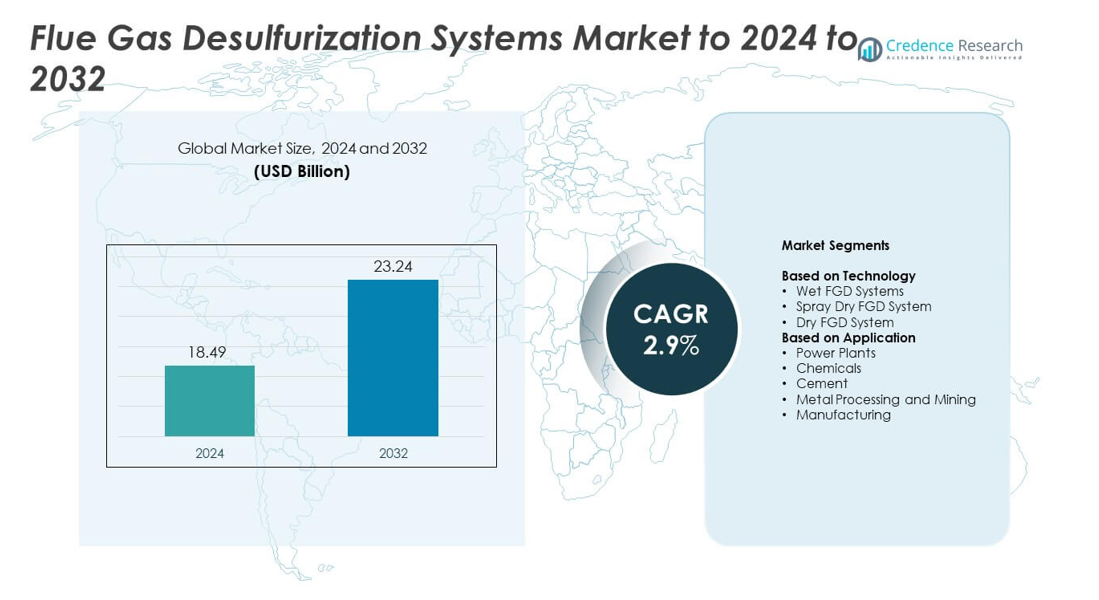

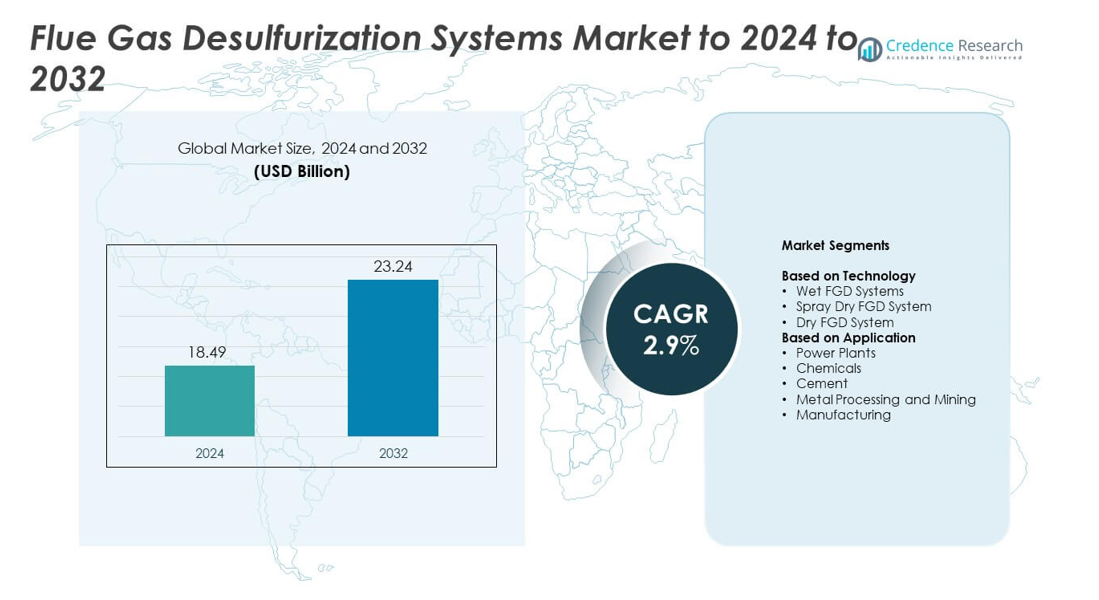

Flue Gas Desulfurization Systems Market size was valued USD 18.49 Billion in 2024 and is anticipated to reach USD 23.24 Billion by 2032, at a CAGR of 2.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flue Gas Desulfurization Systems Market Size 2024 |

USD 18.49 Billion |

| Flue Gas Desulfurization Systems Market, CAGR |

2.9% |

| Flue Gas Desulfurization Systems Market Size 2032 |

USD 23.24 Billion |

The Flue gas desulfurization systems market is led by key players including Mitsubishi Hitachi Power Systems Ltd (MHI), GEA Group Aktiengesellschaft, Babcock & Wilcox Enterprises Inc., Koch-Glitsch, GE Vernova, ANDRITZ AG, Thermax Ltd, Carmeuse, S.A. HAMON, and KraftPowercon. These companies maintain strong positions through advanced wet, dry, and hybrid FGD technologies designed to meet global emission standards. Continuous innovation, large-scale retrofit projects, and regional partnerships strengthen their competitiveness. Asia-Pacific dominates the market with a 36% share in 2024, driven by rising industrialization, strict environmental regulations, and extensive coal-fired power generation across China and India.

Market Insights

- The Flue gas desulfurization systems market was valued at USD 18.49 Billion in 2024 and is expected to reach USD 23.24 Billion by 2032, growing at a CAGR of 2.9%.

- Growth is driven by stricter emission control regulations and increasing adoption of desulfurization systems in coal-based power plants and heavy industries.

- The market is witnessing trends toward hybrid and modular FGD systems that reduce water and energy use while improving operational efficiency.

- Competition is strong with major players investing in technology upgrades, automation, and regional expansion to enhance global presence and meet compliance standards.

- Asia-Pacific leads the market with a 36% share, followed by North America at 28% and Europe at 25%, while the wet FGD system segment dominates with a 71% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Wet FGD systems dominate the Flue gas desulfurization systems market with a 71% share in 2024. These systems are preferred for their high SO₂ removal efficiency exceeding 95%, making them ideal for coal-fired power plants and large industrial facilities. The technology uses limestone or lime slurry to absorb sulfur oxides, offering reliable performance under high load operations. Demand for wet FGD systems is rising due to stricter emission control standards and the need for continuous compliance with environmental regulations across developed and emerging economies.

- For instance, The Babcock & Wilcox wet flue gas desulfurization (FGD) systems installed at DTE Energy’s Monroe Power Plant (formerly owned by Detroit Edison) were designed to achieve 97% SO₂ removal. The project involved adding one FGD system per unit for all four units (1–4).

By Application

Power plants represent the dominant application segment, holding a 64% market share in 2024. The segment’s leadership stems from the increasing global reliance on thermal power generation and the enforcement of emission norms such as the EU Industrial Emissions Directive and India’s CPCB guidelines. Utilities are investing heavily in FGD installations to reduce SO₂ emissions and extend the operational life of coal-based plants. The segment’s growth is also supported by government-backed retrofitting programs and the adoption of hybrid FGD technologies for cost-efficient compliance.

- For instance, the wet limestone-based Flue Gas Desulfurization (FGD) system for NTPC’s Vindhyachal Unit 13 (Stage V, 500 MW) was completed by GE Power in 2018 and was designed to cap SO₂ emissions below 200 mg/Nm³ with 90.6% removal efficiency.

Key Growth Drivers

Stringent Environmental Regulations

Global emission control policies are driving large-scale adoption of desulfurization systems. Governments across the U.S., Europe, China, and India have imposed strict SO₂ emission limits on coal-based power plants and heavy industries. Compliance with frameworks like the U.S. Clean Air Act and the EU Industrial Emissions Directive compels industries to install advanced FGD systems. This regulatory push remains the strongest growth driver as companies invest heavily in emission control retrofits to maintain operational licenses and reduce environmental penalties.

- For instance, Shanghai Electric supplied two 1,000 MW ultra-supercritical units at the Guodian Taizhou plant, underscoring continued thermal build-outs that typically require FGD systems.

Expansion of Thermal Power Generation

Despite the growth of renewable energy, coal-fired and oil-based power plants continue to dominate global electricity generation. Countries in Asia-Pacific, particularly China and India, are expanding capacity to meet rising energy demand. These plants require efficient emission control equipment, Flueing demand for FGD systems. Ongoing modernization and retrofitting of existing plants to meet new emission standards also contribute to market expansion, reinforcing the need for cost-effective and high-efficiency desulfurization technologies.

- For instance, Mitsubishi Heavy Industries’ Dry Confined Flow Scrubber (DCFS) was installed at TVA’s Paradise Unit 3 and was designed to treat 4,000,000 ACFM and remove over 98% of SO₂ with a single modular absorber. But, the entire Paradise Fossil Plant was retired by the Tennessee Valley Authority in 2020.

Increasing Industrialization and Urbanization

Rapid industrial growth in developing nations is boosting sulfur dioxide emissions from cement, metal, and chemical manufacturing units. Growing environmental awareness and stricter local air quality norms encourage these industries to deploy FGD systems. Urbanization has led to higher energy consumption and industrial output, particularly in Asia-Pacific and the Middle East. This trend strengthens the long-term demand for compact, adaptable desulfurization technologies suitable for non-utility sectors.

Key Trends and Opportunities

Rising Adoption of Hybrid and Modular Systems

Hybrid FGD systems combining wet and dry technologies are gaining traction due to operational flexibility and cost efficiency. These solutions allow industries to optimize performance based on varying flue gas compositions. Modular systems are also emerging as an opportunity for small and medium-scale industries, enabling faster installation and lower maintenance costs. Manufacturers are developing scalable designs to meet both environmental and economic requirements, broadening adoption across diverse industrial applications.

- For instance, Alstom/GE (NID) modular semi-dry systems demonstrate SO₂ removal up to 98%, with PM <5 mg/Nm³ and HCl ~2 mg/Nm³, enabling compact retrofits.

Shift Toward Low-Water and Energy-Efficient Technologies

Water scarcity and energy efficiency concerns are encouraging the development of advanced FGD systems with reduced resource consumption. Dry and semi-dry scrubbers, which minimize water use, are increasingly preferred in arid regions. Technological advancements such as smart process control and waste heat recovery integration further enhance system sustainability. This shift supports global efforts toward cleaner industrial operations and positions eco-efficient systems as a key opportunity for market players.

- For instance, ANDRITZ’s Novel Integrated Desulfurization (NID) semi-dry system can achieve up to 98% SO₂ removal and offers a significantly smaller footprint (up to 50% less) compared to a Spray Dryer Absorber (SDA).

Key Challenges

High Installation and Operating Costs

The substantial capital investment required for installing FGD systems remains a major barrier, particularly for small and medium industries. Ongoing costs related to energy use, reagent supply, and maintenance increase the financial burden. Many developing nations face funding limitations and delayed project approvals due to high upfront expenses. This challenge restrains market penetration, especially among sectors with narrow profit margins or limited government incentives.

Complex Waste Management and Byproduct Disposal

FGD operations produce byproducts such as gypsum and sludge, which require proper handling and disposal to avoid secondary pollution. Inadequate waste management infrastructure in several regions adds complexity to the process. The need for sustainable byproduct utilization, such as gypsum reuse in construction, is growing but remains underdeveloped. Without effective disposal or recycling frameworks, environmental and regulatory challenges may offset the benefits of emission reduction.

Regional Analysis

North America

North America holds a 28% share of the Flue gas desulfurization systems market in 2024. The region’s growth is driven by the strong regulatory framework of the U.S. Environmental Protection Agency and Canada’s Clean Air Regulatory Agenda. Upgrades in existing coal-fired and industrial plants, along with technological advancements in dry and hybrid FGD systems, strengthen regional adoption. Utilities are investing in modernization projects to meet low-emission targets, while growing interest in renewable integration drives demand for retrofitting solutions that improve operational efficiency and environmental compliance.

Europe

Europe accounts for 25% of the market share, supported by stringent environmental norms such as the Industrial Emissions Directive and the European Green Deal. Countries like Germany, the U.K., and Poland continue upgrading existing power and cement plants to maintain compliance with SO₂ emission limits. The region also witnesses an increasing shift toward dry and semi-dry desulfurization systems to reduce water usage. Continuous policy support and early technology adoption by industrial players sustain Europe’s position as a mature and stable market.

Asia-Pacific

Asia-Pacific dominates the global market with a 36% share in 2024. China and India are major contributors due to their high dependence on coal-fired power generation and expanding industrial sectors. Government-led emission control initiatives and large-scale retrofitting programs accelerate FGD installations across utilities and manufacturing plants. Rising urbanization and industrialization have intensified the need for advanced emission control technologies. The region’s dominance is further reinforced by local equipment manufacturing and cost-efficient installation services, driving significant long-term market growth.

Latin America

Latin America holds a 6% share of the global market, led by Brazil, Mexico, and Chile. Industrial expansion and tightening environmental standards are driving demand for FGD systems in cement, mining, and refining industries. Governments are promoting cleaner production technologies to manage urban air quality and industrial pollution. However, limited funding and delayed infrastructure investments slow adoption in some countries. Increasing participation from international technology providers and environmental policy reforms are expected to improve regional growth momentum.

Middle East and Africa

The Middle East and Africa account for a 5% share of the market, driven by growing industrialization and energy diversification efforts. Major economies such as Saudi Arabia, the UAE, and South Africa are investing in emission control technologies to align with global environmental targets. Power generation and metal processing sectors are the key end-users adopting FGD systems to meet regulatory requirements. While high initial costs hinder widespread deployment, rising awareness and strategic government initiatives are fostering gradual adoption across key industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Technology

- Wet FGD Systems

- Spray Dry FGD System

- Dry FGD System

By Application

- Power Plants

- Chemicals

- Cement

- Metal Processing and Mining

- Manufacturing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Flue gas desulfurization systems market is highly competitive, with major players such as Mitsubishi Hitachi Power Systems Ltd (MHI), GEA Group Aktiengesellschaft, Babcock & Wilcox Enterprises Inc., Koch-Glitsch, GE Vernova, ANDRITZ AG, Thermax Ltd, Carmeuse, S.A. HAMON, and KraftPowercon leading the global landscape. The competition centers on technology innovation, cost efficiency, and regulatory compliance. Companies focus on developing advanced wet, dry, and hybrid desulfurization technologies to meet diverse industrial emission standards. Strategic alliances, mergers, and large-scale project partnerships are expanding their global footprint. Continuous investment in digital automation and process optimization enhances operational reliability and energy efficiency. Many manufacturers are also localizing production and service networks to reduce installation costs and strengthen market presence across Asia-Pacific and the Middle East. The growing emphasis on eco-efficient designs and smart monitoring systems is shaping a technology-driven and sustainability-focused competitive environment.

Key Player Analysis

Recent Developments

- In 2025, GE Vernova introduced upgraded wet FGD systems equipped with its patented SulfiTrac™ sulfite analyzer designed to optimize the performance of wet FGD systems.

- In 2023, MHI Power India received an order to install wet limestone FGD systems at India’s Farakka Super Thermal Power Station, with a target completion date of 2025.

- In 2023, Thermax launched a new modular FGD system, designed for quick installation and high performance to meet stringent sulfur emission norms in emerging economies.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing retrofitting of coal-based power plants will sustain long-term demand for FGD systems.

- Advancements in hybrid and modular designs will improve operational efficiency and flexibility.

- Increasing industrialization in Asia-Pacific will drive strong market expansion across key sectors.

- Adoption of energy-efficient and low-water FGD technologies will rise due to sustainability goals.

- Government-backed emission control programs will boost installations in developing economies.

- Integration of digital monitoring and automation will enhance system reliability and maintenance.

- Rising use of gypsum byproducts in construction will promote circular economy practices.

- Manufacturers will focus on cost reduction through localized production and modular systems.

- Replacement of aging pollution control units will create steady demand in mature markets.

- Stricter global emission standards will continue reinforcing the importance of FGD system adoption.