Market Overview:

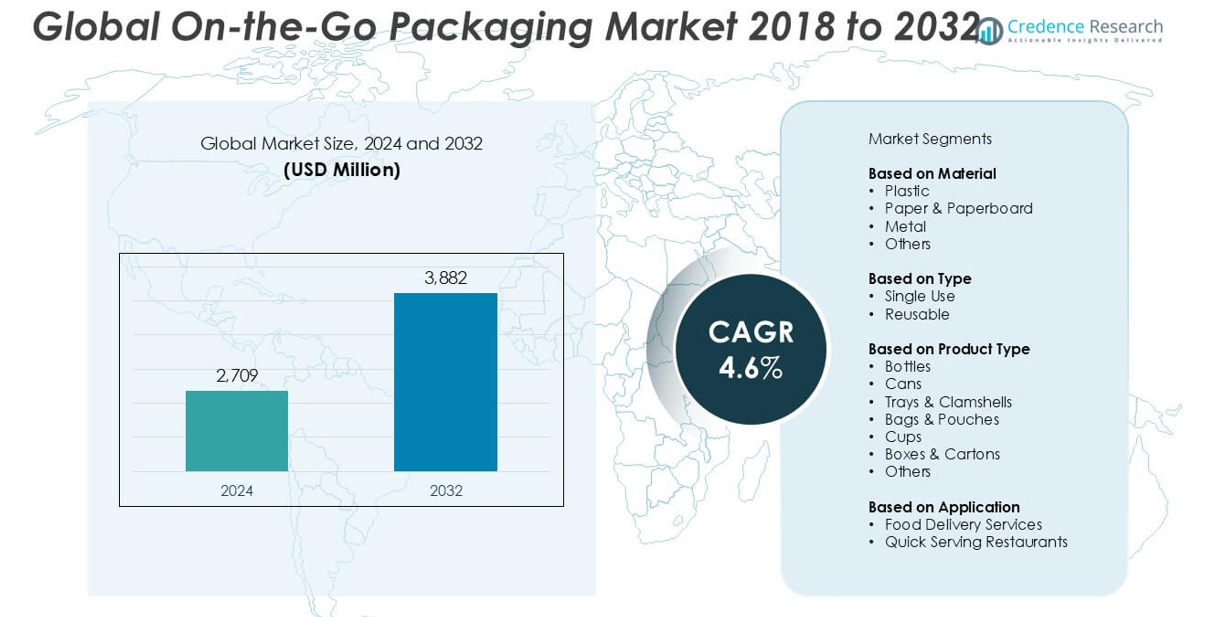

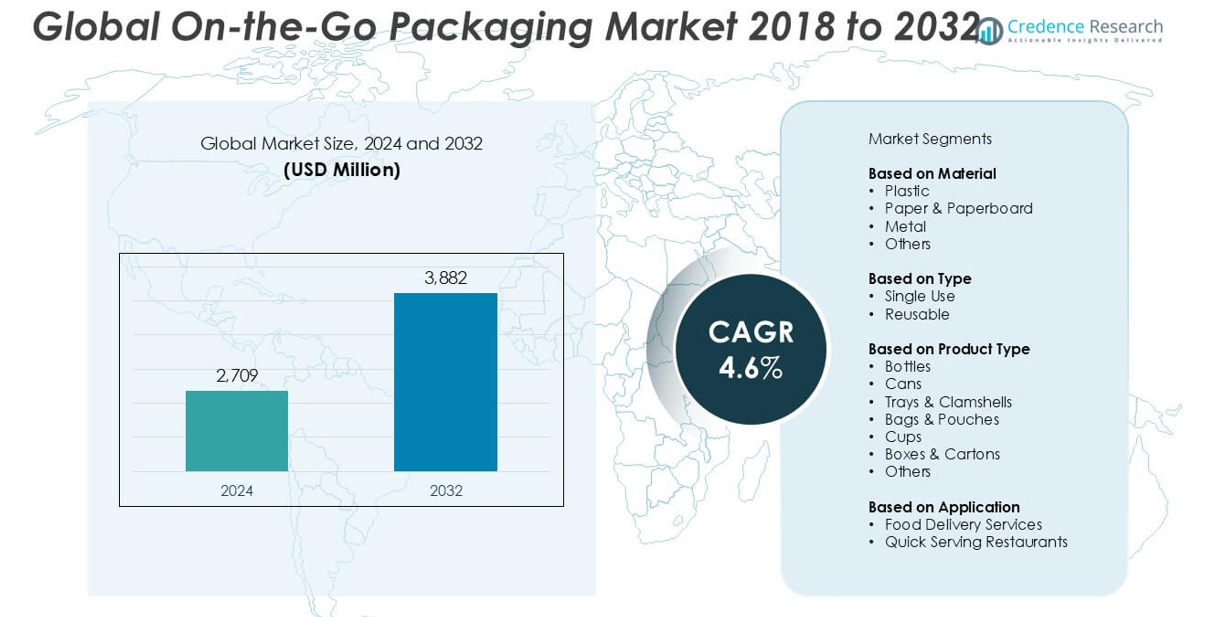

The On-the-Go Breakfast Packaging market size was valued at USD 1,440 million in 2024 and is anticipated to reach USD 2,063 million by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| On-the-Go Breakfast Packaging Market Size 2024 |

USD 1,440 million |

| On-the-Go Breakfast Packaging Market, CAGR |

4.6% |

| On-the-Go Breakfast Packaging Market Size 2032 |

USD 2,063 million |

The On-the-Go Breakfast Packaging market is dominated by leading players such as Amcor plc, Mondi, Berry Global Inc., Sonoco Products Company, Ball Corporation, and Constantia Flexibles. These companies maintain a competitive edge through innovations in lightweight, recyclable, and biodegradable packaging solutions tailored for mobility and convenience. North America emerged as the leading regional market in 2024, holding a market share of 35%, driven by high consumer demand for portable breakfast products and strong retail infrastructure. Europe followed with a 27% share, supported by eco-conscious consumer behavior and regulatory pressure promoting sustainable packaging. Key players continue to expand their global footprint through strategic partnerships and product advancements.

Market Insights

- The On-the-Go Breakfast Packaging market was valued at USD 1,440 million in 2024 and is projected to reach USD 2,063 million by 2032, growing at a CAGR of 4.6% during the forecast period.

- Rising demand for convenient, ready-to-eat breakfast options among urban consumers and working professionals is a key growth driver, supported by lifestyle changes and increasing product availability in retail and e-commerce channels.

- The cold breakfast packaging segment held the largest share at over 40% in 2024, while plastic-based materials dominated the material segment with around 45% share due to their cost-effectiveness and functional performance.

- North America led the global market with a 35% share, followed by Europe (27%) and Asia Pacific (22%), driven by strong retail networks, sustainability initiatives, and rising urbanization respectively.

- Environmental concerns over plastic waste, high costs of sustainable materials, and logistical complexities remain key restraints for market players across developing and developed regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the On-the-Go Breakfast Packaging market, Cold Breakfast Packaging held the dominant share in 2024, accounting for over 40% of the market. This segment’s growth is driven by the rising demand for ready-to-eat products such as yogurt cups, cereal bars, and smoothies, especially among working professionals and students seeking quick meal solutions. The convenience, longer shelf life, and minimal heating requirements of cold breakfast items contribute to their popularity. Additionally, innovations in packaging for portability and freshness preservation continue to support the segment’s expansion across both retail and food service channels.

- For instance, Amcor plc developed its AmLite Ultra Recyclable cold-seal flow pack, specifically used by a global yogurt brand in 2023, enabling the brand to reduce packaging weight by 12 grams per pack, while maintaining product integrity and portability for refrigerated breakfast items.

By Material:

Plastic-based packaging emerged as the leading material type in the On-the-Go Breakfast Packaging market, capturing a significant market share of approximately 45% in 2024. Its dominance is attributed to its lightweight nature, cost-effectiveness, and versatility in shaping and sealing breakfast items for portability and freshness. Despite growing concerns over environmental sustainability, plastic-based materials remain widely used, particularly in frozen and cold breakfast packaging. However, increasing adoption of biodegradable and paper-based alternatives, driven by regulatory pressure and consumer preferences for eco-friendly solutions, is gradually influencing the material landscape.

- For instance, Berry Global Inc. introduced its HPP (High-Pressure Processing) compatible polypropylene containers in 2022, enabling up to 70 cycles per minute in form-fill-seal lines, meeting durability and efficiency standards required by frozen breakfast packaging without compromising recyclability.

By End Use:

The Retail segment led the market by end use, accounting for nearly 50% of the total market share in 2024. The dominance of retail is fueled by the growing consumer trend toward purchasing ready-to-consume breakfast items from supermarkets, convenience stores, and grab-and-go counters. Increased urbanization, busier lifestyles, and rising health awareness have boosted retail demand for portable, nutritious breakfast options. Food manufacturers continue to introduce innovative packaging formats to appeal to health-conscious and time-constrained consumers, strengthening the retail segment’s position in the global on-the-go breakfast packaging market.

Market Overview

Rising Demand for Convenient Meal Solutions

The growing preference for convenient and time-saving food options among urban consumers is a primary driver for the On-the-Go Breakfast Packaging market. As busy lifestyles and long working hours limit time for traditional meal preparation, consumers increasingly turn to pre-packaged breakfast products that are portable, easy to consume, and require minimal or no preparation. This shift is particularly prominent among young professionals and students, driving the demand for functional, resealable, and travel-friendly packaging formats designed specifically for breakfast consumption.

- For instance, Sonoco Products Company partnered with General Mills to launch customized microwaveable containers for breakfast bowls, featuring dual-layer thermoforming technology that reduces prep time to under 90 seconds, while ensuring heat resistance up to 121°C, meeting food-grade packaging standards for hot-fill products.

Expansion of Organized Retail and E-commerce Channels

The rapid expansion of organized retail outlets, supermarkets, and online grocery platforms has enhanced product accessibility and visibility, boosting sales of on-the-go breakfast items. Retailers increasingly stock a variety of breakfast solutions packaged in user-friendly formats, while e-commerce platforms offer convenience through home delivery and subscription models. The availability of diverse product choices, coupled with strategic shelf placements and online promotions, has significantly contributed to the increased adoption of breakfast packaging solutions tailored to mobile consumption habits.

For instance, Mondi developed its FlexiBag Recyclable stand-up pouches, now used by a major European breakfast bar manufacturer, with distribution across 12,000 retail stores and e-commerce sites.

Innovation in Sustainable Packaging Materials

Sustainability concerns and changing consumer expectations are fueling innovations in eco-friendly packaging materials. Brands are investing in biodegradable, recyclable, and compostable packaging solutions to reduce their environmental footprint and align with evolving regulatory standards. These innovations not only appeal to environmentally conscious consumers but also offer a competitive edge to manufacturers in a crowded marketplace. The shift towards green packaging solutions, such as paper-based wraps, compostable trays, and bioplastics, is accelerating adoption across the on-the-go breakfast segment.

Key Trends & Opportunities

Technological Integration in Smart Packaging

Emerging technologies in smart packaging, such as freshness indicators, QR codes for nutritional information, and tamper-evident seals, are gaining traction in the on-the-go breakfast space. These innovations enhance consumer trust, product traceability, and engagement. As competition intensifies, smart packaging is expected to create new opportunities by offering enhanced functionality, data-driven marketing insights, and improved supply chain monitoring. Brands investing in such technologies are likely to benefit from increased customer loyalty and regulatory compliance.

- For instance, Constantia Flexibles integrated NFC (Near Field Communication) tags into its flexible breakfast sachets for a European brand in 2023, enabling over 200,000 unique digital interactions via smartphone scanning.

Health-Conscious Product Offerings with Functional Packaging

The rise in health awareness has spurred demand for nutritious, portion-controlled breakfast items such as high-protein bars, low-fat yogurts, and organic cereals. Packaging manufacturers are responding by designing portion packs and transparent containers that highlight freshness and health attributes. This trend offers opportunities for brands to position their products as both health-friendly and time-efficient, especially in urban and health-conscious demographics. Functional packaging that supports portion control and resealability is becoming increasingly important in product differentiation.

Key Challenges

Environmental Concerns over Plastic Waste

Despite the convenience and cost-effectiveness of plastic packaging, rising environmental concerns and stringent regulations on single-use plastics pose a significant challenge for market players. Consumers and regulators are increasingly pressuring companies to minimize plastic use and adopt sustainable alternatives. However, transitioning to biodegradable or recyclable materials often involves higher costs and supply chain adjustments, creating resistance among price-sensitive manufacturers. Addressing this challenge requires a balance between functionality, sustainability, and cost-efficiency.

- For instance, DS Smith developed Greencoat®, a 100% recyclable, moisture-resistant coated cardboard used by a U.S. breakfast sandwich supplier. This innovation replaced plastic-laminated trays in 1.5 million meal kits annually, helping eliminate 80 metric tons of plastic waste while maintaining the same stacking strength and shelf life for chilled items.

Price Sensitivity and Cost Pressures

Fluctuating raw material prices and the higher costs associated with sustainable packaging solutions can strain profit margins, particularly for small and mid-sized manufacturers. Many consumers in emerging markets remain price-sensitive, limiting the scope for premium-priced eco-friendly packaging formats. This cost-sensitive environment challenges companies to deliver value while maintaining product appeal and affordability. Efficient sourcing, economies of scale, and innovation in low-cost sustainable materials will be critical in overcoming this constraint.

Logistical and Storage Limitations

On-the-go breakfast items often require specific storage conditions such as refrigeration or moisture protection, which can complicate logistics and inventory management. Maintaining product integrity across supply chains—especially in hot and humid regions—demands packaging with barrier properties and durability. These requirements increase packaging complexity and cost, posing logistical challenges for distribution, especially in remote or underdeveloped markets. Companies must invest in robust, cost-effective packaging designs that ensure shelf stability without compromising sustainability goals.

Regional Analysis

North America

North America held the largest share of the On-the-Go Breakfast Packaging market in 2024, accounting for approximately 35% of global revenue. The region’s strong market presence is driven by busy lifestyles, high demand for convenient food options, and widespread availability of packaged breakfast products across retail and foodservice sectors. The U.S. leads regional consumption, supported by innovation in single-serve, recyclable, and resealable packaging. The growing preference for healthier, portion-controlled breakfast items continues to fuel product innovation. Additionally, rising sustainability awareness is prompting manufacturers to invest in eco-friendly packaging materials to maintain consumer engagement and regulatory compliance.

- For instance, 3M introduced its Scotch™ Secure Seal Packaging Tape 3768P to a major breakfast meal kit distributor, improving box closure speed by 15 cartons per minute across three high-speed packing lines, reducing packaging downtime in fulfillment centers across the U.S. and Canada.

Europe

Europe captured nearly 27% of the global On-the-Go Breakfast Packaging market in 2024, driven by growing consumer preference for sustainable and health-conscious products. Countries such as Germany, the UK, and France are witnessing a surge in demand for eco-friendly packaging, with paper-based and biodegradable options gaining traction. The region benefits from a well-established retail infrastructure and increasing adoption of plant-based and organic breakfast products, particularly among the urban population. Stringent environmental regulations are pushing manufacturers toward recyclable materials, creating opportunities for innovation. The trend toward functional and minimalistic packaging designs is also shaping consumer preferences across the European market.

- For instance, ProAmpac collaborated with a German breakfast muesli brand to deliver QuadFlex® recyclable pouches that reduced storage footprint by 42 pallets annually, while enabling high-resolution surface printing that maintained brand integrity across eight EU countries with multilingual content.

Asia Pacific

Asia Pacific accounted for around 22% of the global On-the-Go Breakfast Packaging market in 2024 and is expected to witness the fastest growth during the forecast period. Rapid urbanization, rising disposable incomes, and the growing influence of Western dietary habits are driving demand for convenient breakfast options. Markets such as China, Japan, and India are experiencing significant traction due to expanding working-class populations and the proliferation of retail and convenience stores. The region’s increasing focus on product portability and smart packaging solutions supports market expansion. However, regional disparities in infrastructure and environmental regulations may influence material choices and adoption rates.

Latin America

Latin America held an estimated 8% share of the global On-the-Go Breakfast Packaging market in 2024, supported by gradual shifts in consumer lifestyles and growing urbanization. Brazil and Mexico dominate regional demand, driven by increased participation of women in the workforce and the popularity of portable, ready-to-eat breakfast formats. Retail modernization and growing interest in healthier breakfast alternatives are encouraging innovation in packaging materials and formats. However, price sensitivity and underdeveloped supply chains remain challenges for widespread adoption of advanced and sustainable packaging solutions. Local manufacturers are gradually adapting to changing preferences, especially in urban areas and metropolitan centers.

Middle East & Africa

The Middle East & Africa (MEA) accounted for approximately 6% of the global On-the-Go Breakfast Packaging market in 2024. The region is experiencing moderate growth, driven by urban expansion, changing dietary habits, and increasing availability of packaged food products. The UAE and South Africa are key contributors, supported by a growing expatriate population and demand for Western-style breakfast options. However, market development remains limited by infrastructure gaps and lower per capita consumption of packaged foods. Despite this, rising investment in retail and foodservice industries, along with growing consumer exposure to global trends, is gradually improving adoption of modern breakfast packaging solutions.

Market Segmentations:

By Type

- Hot Breakfast Packaging

- Cold Breakfast Packaging

- Frozen Breakfast Packaging

By Material

- Paper-based

- Plastic-based

- Metal-based

- Glass-based

- Biodegradable

By End Use

- Food Service

- Retail

- E-commerce

By Distribution Channel

- Direct-to-Store

- Wholesalers/Distributors

- Online Retailers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the On-the-Go Breakfast Packaging market is characterized by the presence of several global and regional players focusing on innovation, sustainability, and strategic expansion. Key companies such as Amcor plc, Mondi, Berry Global Inc., and Sonoco Products Company dominate the market with diverse product portfolios and strong distribution networks. These players are actively investing in sustainable packaging solutions, including biodegradable and recyclable materials, to align with evolving regulatory requirements and consumer preferences. Strategic collaborations, mergers, and acquisitions are commonly employed to enhance technological capabilities and broaden market reach. For instance, companies are partnering with food brands to co-develop customized, functional packaging formats that enhance convenience and shelf appeal. Additionally, regional players are gaining traction by offering cost-effective, locally adapted solutions, intensifying market competition. Innovation in smart packaging and material science continues to play a critical role in gaining competitive advantage, as companies aim to balance performance, sustainability, and affordability in their offerings.

- For instance, Alcoa Corporation supplied aluminum foil laminates for heat-sealed breakfast bar wrappers used by a U.S. health-food brand, producing over 60 million units in 2023 with improved barrier protection and 30% thinner gauge material than previous versions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Berry Global Inc. (U.S.)

- Mondi (U.K.)

- Ardagh Group S.A. (Luxembourg)

- Sonoco Products Company (U.S.)

- DS Smith (U.K.)

- Alcoa Corporation (U.S.)

- CKS Packaging (U.S.)

- Amcor plc (Australia)

- WINPAK LTD. (Canada)

- DuPont (U.S.)

- Graham Packaging (U.S.)

- Bemis Manufacturing Company (U.S.)

- ProAmpac (U.S.)

- Constantia Flexibles (Austria)

- 3M (U.S.)

- Ball Corporation (U.S.)

- Crown Packaging Corp. (U.S.)

Recent Developments

- In March 2024, Shanghai Sunwise Chemical Co., Ltd expanded its global reach by actively participating in major international trade exhibitions, including Colombiaplast in Bogotá, CPHI Europe in Milan, CPHI China in Shanghai, and Khimia in Moscow. These efforts underline the company’s commitment to strengthening its global footprint and increasing its international customer base.

- In April 2023, Tyson partnered with Amcor Plc to unveil an innovative mono-material flexible film packaging for its Jimmy Dean egg bites and frittatas, enabling drop-off recycling while maintaining functionality similar to traditional multilayer materials. This collaboration demonstrates a strong push toward sustainable packaging solutions in the food industry.

- In March 2023, Central Drug House Private Limited witnessed outstanding financial performance, reporting a revenue growth of nearly 39.89% and a profit increase of 101.17% for the fiscal year. This financial leap reflects the company’s successful strategic direction and operational efficiency in a competitive market.

- In 2023, Tetra Pak launched a new range of aseptic carton packaging with a bio-based cap and closure, reducing the use of fossil-based plastics and enhancing the recyclability of the packaging.

Market Concentration & Characteristics

The On-the-Go Breakfast Packaging Market exhibits a moderately concentrated structure, with a mix of global and regional players competing on innovation, material sustainability, and product design. It features strong brand presence from major companies such as Amcor, Mondi, and Berry Global, supported by extensive distribution networks and partnerships with leading food brands. It serves a demand-driven environment shaped by shifting consumer lifestyles, rapid urbanization, and preference for convenience-focused food solutions. Market participants focus on functional packaging attributes such as portability, resealability, and portion control. Regulatory pressure and environmental concerns influence material choices, encouraging a shift toward biodegradable and recyclable options. Emerging economies offer significant growth opportunities due to rising disposable income and changing eating habits. Price sensitivity in these regions pushes manufacturers to optimize cost without compromising functionality. Innovation in packaging formats remains critical, with investments targeting lightweight materials, enhanced shelf appeal, and extended product freshness. Online retail and food delivery services contribute to demand for durable and secure packaging formats, further shaping product development strategies.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for convenient and time-saving breakfast solutions will continue to drive growth in the on-the-go breakfast packaging market.

- Manufacturers will increasingly invest in sustainable packaging materials such as biodegradable and recyclable options.

- Smart packaging technologies with features like QR codes and freshness indicators will gain wider adoption.

- Innovation in lightweight and resealable packaging formats will enhance portability and user convenience.

- Retail and e-commerce channels will remain key distribution drivers, offering broader market access.

- Growing health awareness will lead to increased packaging for portion-controlled and nutritious breakfast products.

- Asia Pacific is expected to witness rapid expansion due to urbanization and lifestyle changes.

- Stringent environmental regulations will push companies to redesign packaging for improved sustainability.

- Collaborations between food manufacturers and packaging firms will boost customized packaging development.

- Increased automation in packaging production will improve efficiency and lower operational costs.