Market Overview:

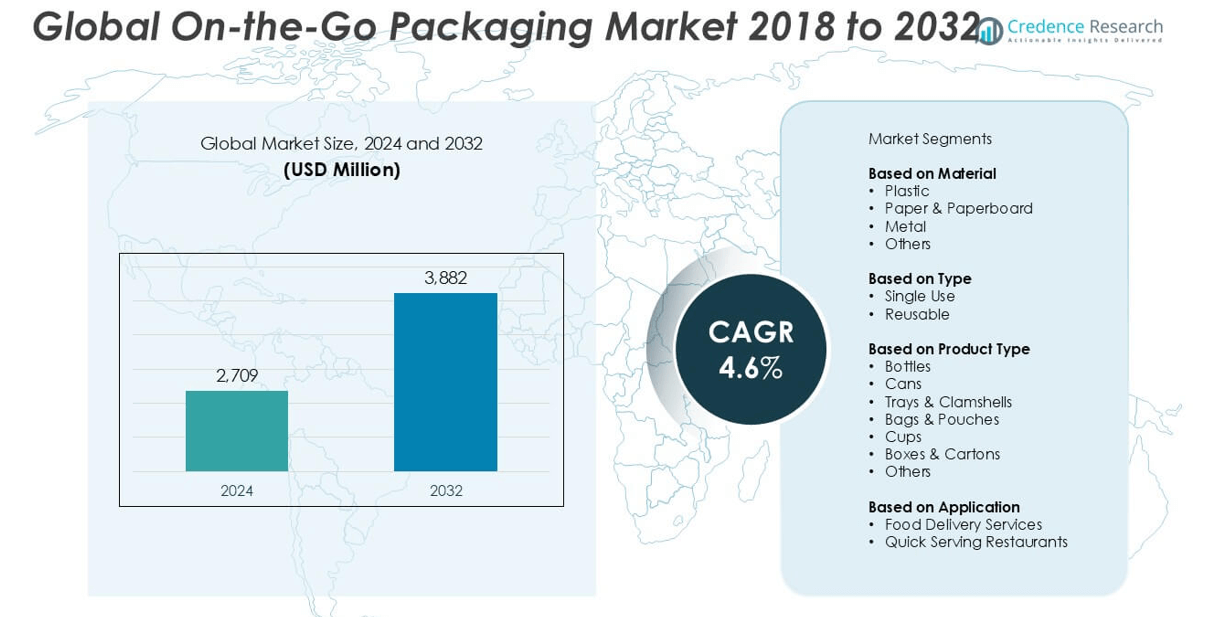

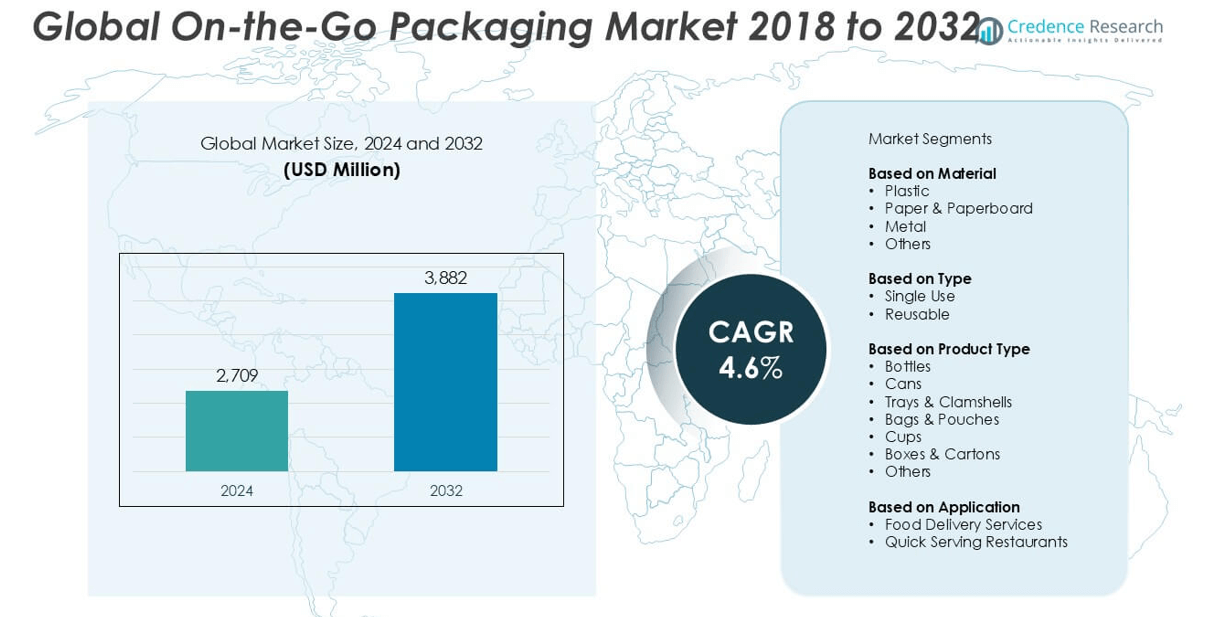

The On-the-Go Packaging Market size was valued at USD 2,709 million in 2024 and is anticipated to reach USD 3,882 million by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| On-the-Go Packaging MarketSize 2024 |

USD 2,709 million |

| On-the-Go Packaging Market, CAGR |

4.6% |

| On-the-Go Packaging Market Size 2032 |

USD 3,882 million |

The On-the-Go Packaging market is dominated by key players such as Amcor Plc, Huhtamaki Inc., Tetra Pak, Sealed Air Corporation, WestRock Company, Mondi Group, and Berry Global Inc., all of which focus on developing sustainable, lightweight, and functional packaging solutions. These companies leverage advanced material technologies and strategic partnerships to strengthen their global presence. North America emerged as the leading region in 2024, holding approximately 32% of the global market share, driven by a mature food delivery ecosystem and high demand for convenience packaging. Europe and Asia Pacific followed, fueled by regulatory support for eco-friendly packaging and growing urban populations, respectively.

Market Insights

- The On-the-Go Packaging market was valued at USD 2,709 million in 2024 and is projected to reach USD 3,882 million by 2032, growing at a CAGR of 4.6% during the forecast period.

- The market is primarily driven by rising consumer demand for convenience and ready-to-eat meals, supported by the growth of food delivery services and quick-service restaurants worldwide.

- Sustainability is a key trend, with increasing adoption of paper & paperboard materials as alternatives to plastic, alongside innovation in reusable packaging and smart packaging technologies.

- Key players such as Amcor Plc, Huhtamaki Inc., and WestRock Company dominate the market, focusing on eco-friendly materials and strategic partnerships to maintain competitiveness.

- Regionally, North America leads with a 32% share, followed by Europe (27%) and Asia Pacific (25%); segment-wise, plastic remains the dominant material, while bags & pouches lead among product types due to their lightweight and versatile nature.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

In the On-the-Go Packaging market, plastic emerged as the dominant material segment in 2024, accounting for the largest market share due to its lightweight nature, durability, and cost-effectiveness. Its versatility in molding into various packaging forms, such as bottles, trays, and pouches, makes it highly preferred across industries. However, growing environmental concerns and regulatory pressures are gradually increasing the demand for sustainable alternatives like paper & paperboard. This sub-segment is gaining momentum, supported by rising consumer awareness about eco-friendly packaging and increased adoption by food service providers seeking recyclable or compostable options.

- For instance, Huhtamaki invested €10 million in its facility in Alf, Germany, to boost the production of paper-based food packaging products, with a new capacity to produce up to 3 billion paper straws annually.

By Type

The single-use segment held the leading market share in 2024, driven by the increasing demand for convenience and hygiene, especially in urban areas with busy lifestyles. Single-use packaging is widely used across fast food chains, delivery services, and retail outlets for its practicality and disposability. Despite the environmental drawbacks, its dominance persists due to affordability and widespread acceptance. Meanwhile, the reusable segment is gaining traction, particularly in environmentally conscious regions. The shift towards circular economy practices and government incentives promoting waste reduction are expected to accelerate the growth of reusable packaging over the forecast period.

- For instance, Loop—a circular shopping platform supported by TerraCycle and used by companies like Nestlé and Unilever—launched reusable packaging pilots in over 10 countries, with Carrefour in France deploying over 100 reusable product SKUs across its stores.

By Product Type

Among product types, bags & pouches accounted for the largest market share in 2024, owing to their lightweight structure, flexibility, and cost-efficiency in transporting a variety of food and beverage items. These formats are extensively used in meal kits, snacks, and ready-to-eat products. Cups and trays & clamshells also represent significant portions of the market, particularly in beverage packaging and fast-food applications. The growing trend of customization and branding on packaging further supports the demand for these products. Innovations in resealable and tamper-evident designs continue to boost the adoption of functional

Market Overview

Rising Demand for Convenience and Ready-to-Eat Products

The increasing pace of urbanization and busy consumer lifestyles have significantly boosted the demand for convenient, portable, and ready-to-eat food products, which in turn fuels the on-the-go packaging market. Consumers increasingly prefer lightweight and easy-to-handle packaging solutions that support mobility and reduce meal preparation time. This shift in consumption behavior, especially among the working population and younger demographics, has driven quick-service restaurants and food delivery platforms to adopt efficient packaging formats, thereby propelling growth in this sector.

- For instance, McDonald’s serves more than 69 million customers daily and introduced fiber-based lids and strawless cup designs in over 1,200 outlets across Europe to reduce reliance on plastic packaging.

Expansion of Food Delivery and E-commerce Services

The rapid proliferation of food delivery services and the rise of e-commerce platforms have emerged as major growth enablers for the on-the-go packaging market. Packaging plays a crucial role in ensuring product safety, maintaining temperature, and enhancing the customer experience during transit. As food delivery apps and online grocery platforms gain popularity, the need for packaging that supports fast handling, spill prevention, and brand presentation continues to rise, prompting manufacturers to invest in functional and visually appealing packaging solutions.

- For instance, Zomato completed over 1.8 billion food deliveries in 2023, which led to the deployment of thermally insulated, tamper-proof packaging across its top 50 urban markets in India, enhancing both brand perception and delivery integrity.

Technological Advancements in Packaging Materials

Innovations in packaging technologies and material science have led to the development of lightweight, durable, and sustainable on-the-go packaging solutions. Advanced materials with better barrier properties, recyclability, and enhanced shelf-life preservation are becoming increasingly common. These innovations not only address environmental concerns but also meet evolving consumer expectations for product safety and convenience. Such advancements enable brands to differentiate their offerings while complying with regulatory standards, thus driving the adoption of next-generation packaging in competitive markets.

Key Trends & Opportunities

Shift Toward Sustainable and Eco-Friendly Packaging

Sustainability is becoming a core focus area across the packaging industry, with consumers and regulators pushing for reduced plastic use and improved recyclability. The on-the-go packaging market is witnessing a transition toward paper-based, compostable, and biodegradable alternatives that align with circular economy principles. Companies are investing in green packaging solutions and adopting recyclable materials to meet environmental goals and gain consumer trust. This trend opens new growth avenues for manufacturers offering eco-conscious packaging innovations that appeal to environmentally aware customers.

- For instance, Amcor developed its AmLite Ultra Recyclable product line, which replaced traditional multi-layer plastic with a polyolefin-based structure, enabling more than 100 million packaging units annually to be fully recyclable.

Customization and Smart Packaging Integration

The growing demand for personalized and tech-enabled packaging is creating fresh opportunities in the on-the-go segment. Brands are leveraging custom designs, QR codes, and interactive elements to enhance consumer engagement and differentiate products on retail shelves. Smart packaging technologies, including temperature indicators and freshness sensors, are also being explored to ensure product quality and safety, particularly in food delivery applications. These innovations enhance functionality and branding, positioning packaging as a strategic tool in the competitive consumer goods landscape.

- For instance, Tetra Pak integrated QR code-based digital traceability on over 500 million cartons in China, enabling end-to-end product tracking, consumer interaction, and supply chain transparency in real-time.

Key Challenges

Environmental Concerns and Regulatory Compliance

The extensive use of single-use plastics in on-the-go packaging raises serious environmental concerns and has triggered stringent regulations across regions. Governments are imposing bans, taxes, and recycling mandates to reduce plastic waste, challenging manufacturers to shift toward sustainable alternatives without compromising cost or functionality. Adapting to these evolving standards demands significant investment in R&D and supply chain modifications, posing a challenge for both small players and established brands in maintaining profitability and compliance.

High Cost of Sustainable Packaging Alternatives

While eco-friendly materials offer environmental benefits, their high production and sourcing costs remain a significant hurdle for widespread adoption. Compared to conventional plastics, sustainable options such as biodegradable films or molded fiber are often more expensive, limiting their use among price-sensitive businesses. These cost barriers may deter smaller companies from transitioning quickly, creating a disparity in market adoption and affecting the pace of overall industry transformation toward greener practices.

Supply Chain Disruptions and Raw Material Volatility

The on-the-go packaging market is vulnerable to supply chain disruptions and fluctuations in raw material availability and prices. Events such as geopolitical tensions, pandemics, and shipping delays can impact material sourcing and lead to production bottlenecks. Additionally, price volatility of key inputs like plastic resins or paper pulp directly influences manufacturing costs, putting pressure on profit margins. Ensuring consistent supply and cost stability remains a critical challenge for packaging providers aiming to maintain delivery timelines and service reliability.

Regional Analysis

North America

North America held a significant share of the On-the-Go Packaging market in 2024, accounting for approximately 32% of the global revenue. The region benefits from a well-established food delivery ecosystem, strong presence of quick-service restaurants, and a high demand for convenient meal solutions. Consumers’ fast-paced lifestyles and growing health consciousness have fueled the adoption of functional and portable packaging options. Moreover, major players in the U.S. and Canada are investing in sustainable and recyclable materials, aligning with evolving environmental regulations. Continued innovation in packaging technologies is expected to further strengthen North America’s dominance over the forecast period.

Europe

Europe captured around 27% of the global On-the-Go Packaging market in 2024, driven by the region’s stringent environmental regulations and increasing consumer preference for eco-friendly packaging. Countries such as Germany, the UK, and France are leading the demand for biodegradable and recyclable packaging alternatives, encouraging manufacturers to innovate with paperboard and reusable formats. The growing popularity of ready-to-eat meals and healthy snack options among working professionals is boosting demand for practical packaging formats. Europe’s strong emphasis on circular economy practices and government-led sustainability initiatives are expected to further influence market trends and shape future growth.

Asia Pacific

Asia Pacific accounted for approximately 25% of the On-the-Go Packaging market in 2024, with rapid urbanization, rising disposable incomes, and an expanding middle class contributing to strong market growth. Countries like China, India, and Japan are witnessing a surge in online food delivery and retail sales, driving the need for convenient, lightweight packaging solutions. Additionally, the increasing penetration of fast-food chains and evolving consumer dietary habits support market expansion. Though plastic remains the dominant material, there is growing interest in sustainable alternatives. The region’s large population and accelerating digitalization offer lucrative opportunities for packaging innovation and scalability.

Latin America

Latin America held a modest 9% share in the global On-the-Go Packaging market in 2024, with growth driven by increasing urbanization, rising food delivery adoption, and expanding retail networks. Brazil and Mexico are key contributors, with a growing consumer base demanding convenient food and beverage options. While plastic packaging remains prevalent due to cost advantages, there is a gradual shift toward more eco-conscious materials. Economic development and greater investment in foodservice infrastructure are expected to enhance packaging demand. However, limited awareness around sustainable packaging and fluctuating economic conditions may pose challenges to accelerated market penetration.

Middle East & Africa (MEA)

The Middle East & Africa region accounted for around 7% of the global On-the-Go Packaging market in 2024. Market growth is supported by an expanding young population, increasing urbanization, and rising consumption of fast food and beverages. Gulf countries like the UAE and Saudi Arabia are witnessing steady demand due to a growing number of quick-service restaurants and international food chains. The demand for portable, tamper-proof, and visually appealing packaging is growing. While current reliance on plastic remains high, government initiatives toward sustainability are prompting gradual adoption of alternative materials, paving the way for moderate but steady market growth.

Market Segmentations:

By Material

- Plastic

- Paper & Paperboard

- Metal

- Others

By Type

By Product Type

- Bottles

- Cans

- Trays & Clamshells

- Bags & Pouches

- Cups

- Boxes & Cartons

- Others

By Application

- Food Delivery Services

- Quick Serving Restaurants

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the On-the-Go Packaging market is characterized by the presence of several global and regional players focusing on innovation, sustainability, and strategic expansion. Key companies such as Amcor Plc, Huhtamaki Inc., Tetra Pak, Sealed Air Corporation, and WestRock Company dominate the market through extensive product portfolios and strong distribution networks. These players are actively investing in the development of eco-friendly and recyclable packaging solutions to meet rising consumer demand for sustainable alternatives. Mergers, acquisitions, and partnerships are common strategies used to enhance market reach and technological capabilities. Meanwhile, regional companies are leveraging cost-effective manufacturing and localized supply chains to gain market share, particularly in emerging economies. Continuous R&D and customization of packaging formats tailored to diverse applications—ranging from food delivery to retail beverages—remain critical to gaining a competitive edge. The market is expected to witness increased competition as consumer preferences shift towards lightweight, functional, and environmentally responsible packaging options.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huhtamaki Inc. (Finland)

- Glenroy, Inc. (U.S.)

- Sealed Air Corporation (U.S.)

- SIG Group (Switzerland)

- Winpak LTD. (Canada)

- Tetra Pak (Switzerland)

- WestRock Company (U.S.)

- Constantia Flexibles (Austria)

- Amcor Plc (Switzerland)

- Graphic Packaging International, LLC (U.S.)

- Stora Enso (Finland)

- Impact Consumer Products Group (U.S.)

- Berry Global Inc. (U.S.)

- Sonoco Products Company (U.S.)

- Mondi Group (U.K.)

Recent Developments

- In July 2024, Berry Global Group, Inc., and Abel & Cole entered a partnership for supplying bottles for its Club Zero Refillable Milk delivery service. Before being recycled, the new PP (polypropylene) bottles can be refilled up to 16 times.

- In April 2024, Leading Vietnamese dairy company Nutifood opted for on-the-go SIG DomeMini carton bottle, one of SIG’s latest packaging innovations. The small-size carton pack would offer Vietnam consumers the sustainability benefits of a carton pack and the convenience of a plastic bottle.

- In February 2024, Amcor entered a partnership with Cheer Pack North America, a leading manufacturer of spouted pouch packaging, and Stonyfield Organic, the country’s leading organic yogurt maker, for the rollout of the first all-polyethylene (PE) spouted pouch.

- In February 2024, Smurfit Kappa announced an investment of USD 59 million in a bag-in-box plant located in Alicante, Spain. This investment is set to strengthen the sustainability of both the plant’s operations and its product portfolio.

- In November 2023, Westrock, a leading sustainable paper and packaging solutions provider, and Liberty Coca-Cola Beverages, a local Coca-Cola bottler serving New Jersey, Philadelphia, and New York City, collaborated for the implementation of a paperboard carrier replacing plastic rings for its multipack bottled beverages.

Market Concentration & Characteristics

The On-the-Go Packaging Market features a moderately concentrated structure, with a mix of global leaders and regional players competing across various segments. Key participants focus on product differentiation, sustainable materials, and lightweight designs to capture consumer interest and meet regulatory standards. It reflects strong demand in urbanized regions, where busy lifestyles and food delivery services drive consumption. Large firms such as Amcor Plc, Huhtamaki Inc., and Tetra Pak leverage advanced manufacturing capabilities and broad distribution networks to maintain market presence. Regional manufacturers cater to cost-sensitive markets with localized solutions and agile production. It continues to evolve through innovation, eco-friendly material adoption, and responsiveness to consumer convenience preferences.

Report Coverage

The research report offers an in-depth analysis based on Material, Type, Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising demand for convenient and portable food and beverage packaging.

- Sustainable packaging solutions will gain traction as environmental regulations become stricter globally.

- Innovation in biodegradable and compostable materials will reshape packaging formats and consumer preferences.

- The growth of e-commerce and food delivery platforms will continue to boost demand for tamper-proof and spill-resistant packaging.

- Single-use packaging will remain dominant, but reusable alternatives will expand with increasing sustainability awareness.

- Customization and branding on packaging will become more prominent to enhance consumer engagement.

- Asia Pacific will emerge as a key growth region due to rising urbanization and expanding middle-class populations.

- Investments in smart packaging technologies will increase, enhancing product tracking, safety, and freshness indicators.

- Manufacturers will focus on lightweight and cost-effective designs to improve logistics and reduce carbon footprints.

- Strategic partnerships and acquisitions will drive market expansion and portfolio diversification across regions.