Market Overview

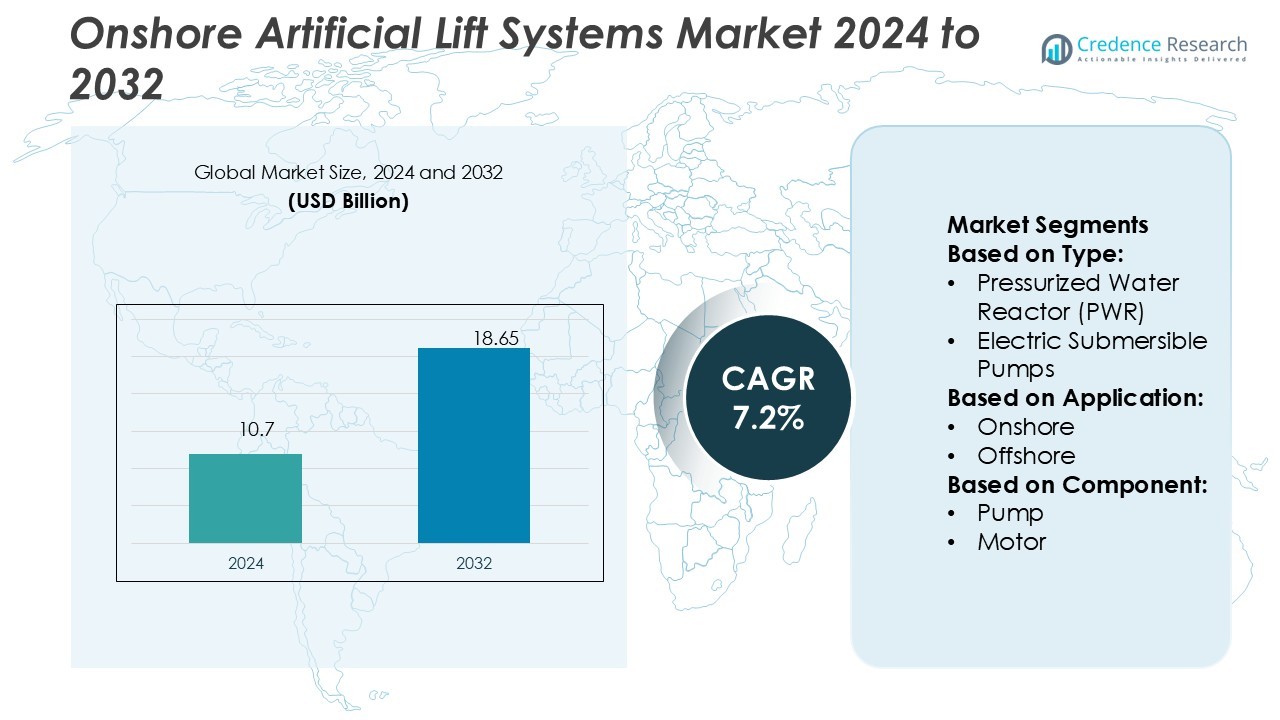

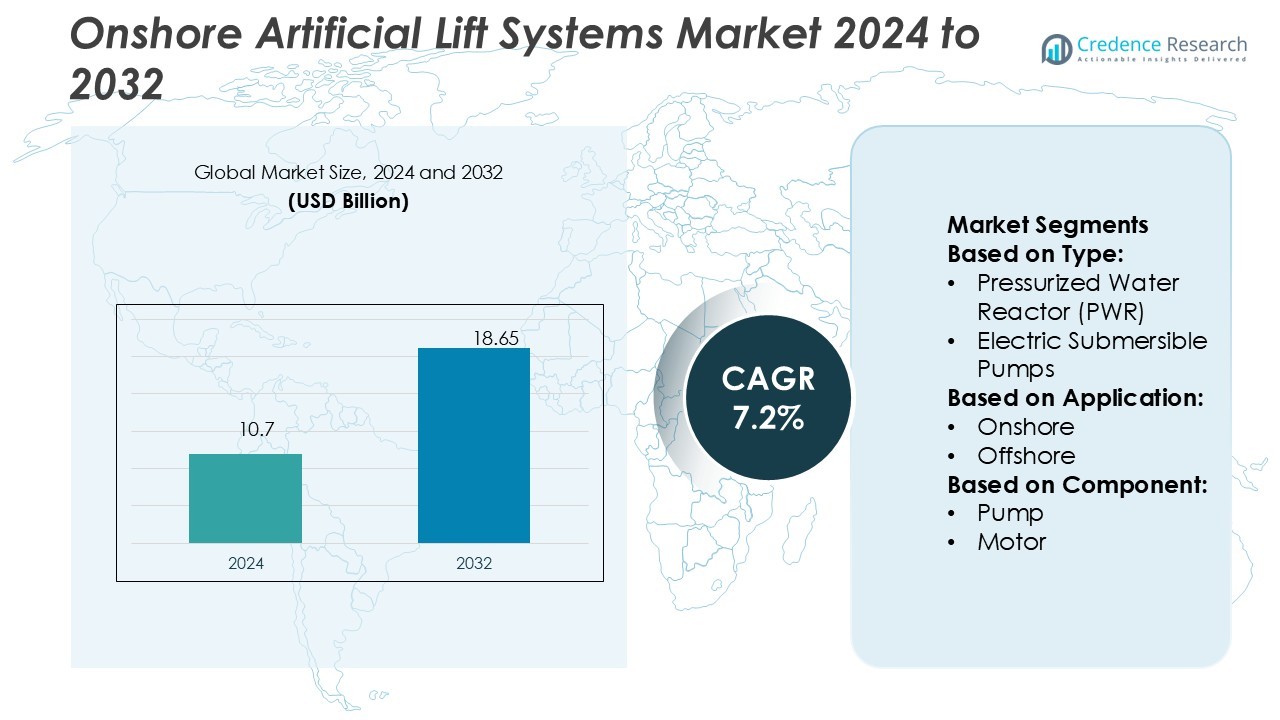

Onshore Artificial Lift Systems Market size was valued USD 10.7 billion in 2024 and is anticipated to reach USD 18.65 billion by 2032, at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Onshore Artificial Lift Systems Market Size 2024 |

USD 10.7 Billion |

| Onshore Artificial Lift Systems Market, CAGR |

7.2% |

| Onshore Artificial Lift Systems Market Size 2032 |

USD 18.65 Billion |

The onshore artificial lift systems market is shaped by leading players such as Canadian Advanced ESP, Halliburton, ELKAM ArtEfficial Lift, JJ Tech, Aker Solutions, Levare, NOV, Alkhorayef Petroleum, General Electric, and BCP Group. These companies compete through advanced pumping technologies, digital integration, and regional service expansions to support efficient oil recovery from mature and unconventional wells. North America leads the global market with a 37% share in 2024, driven by extensive shale production and widespread deployment of electric submersible pumps and progressing cavity pumps. The region’s strong investment in unconventional oilfields and continuous technology adoption reinforces its dominant position in the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Onshore Artificial Lift Systems Market was valued at USD 10.7 billion in 2024 and is projected to reach USD 18.65 billion by 2032, growing at a CAGR of 7.2% during the forecast period.

- Market growth is driven by rising demand from mature oilfields, expansion of shale production, and increasing adoption of advanced pumping systems like electric submersible pumps and progressing cavity pumps.

- Key trends include integration of digital technologies, automation, and energy-efficient designs, enabling real-time monitoring, reduced downtime, and improved cost efficiency.

- The competitive landscape features Canadian Advanced ESP, Halliburton, ELKAM ArtEfficial Lift, JJ Tech, Aker Solutions, Levare, NOV, Alkhorayef Petroleum, General Electric, and BCP Group, with companies focusing on technological innovation and regional service expansion.

- North America leads with a 37% market share in 2024, supported by strong shale oil production, while pumps account for 42% of the component segment, reinforcing their role as the dominant category.

Market Segmentation Analysis:

By Type

Electric Submersible Pumps (ESPs) dominate the onshore artificial lift systems market, holding a 38% share in 2024. Their strong position is supported by high efficiency in lifting large volumes of fluids from deeper wells. ESPs are widely used in mature oilfields where declining reservoir pressure requires reliable lifting solutions. Gas lift systems follow closely, favored in fields with high gas availability and flexibility for variable production rates. Progressing cavity pumps and jet pumps serve niche applications such as heavy oil recovery, while hydraulic pumping systems and plunger lifts remain in specialized use.

- For instance, Canadian Advanced ESP offers high-capacity ESP systems for demanding oil and gas environments. The company’s brochures mention high-volume pumping with ESP systems capable of producing capacities up to 100,000 bfpd and motors up to 1,500 HP, with even higher horsepower available in specific applications like geothermal.

By Application

Onshore applications account for 66% of the market share, making them the leading segment. Growth is fueled by the abundance of mature onshore fields requiring artificial lift solutions to sustain production. Lower development costs and faster project cycles compared to offshore exploration drive higher adoption. Offshore applications, while smaller in share, continue to grow due to increasing investments in deepwater and ultra-deepwater projects. Offshore adoption is particularly rising in regions with declining onshore reserves, where advanced lift systems extend field life and improve recovery rates.

- For instance, Halliburton and AIQ deployed the RoboWell AI-enabled autonomous well control in a gas lift field, cutting gas lift consumption by 30% and reducing well movements by half.

By Component

Pumps lead the component segment with a 42% market share in 2024, as they are the core element driving artificial lift performance. Their dominance is backed by continuous advancements in pump design, durability, and efficiency. Motors follow as the second-largest component, especially in ESP deployments where reliable power drives high-volume production. Cable systems and controllers represent critical supporting components, ensuring operational stability and real-time monitoring. The “Others” category, including seals and sensors, plays a growing role with digital integration, enhancing system automation and predictive maintenance capabilities.

Key Growth Drivers

Rising Demand from Mature Oilfields

Mature oilfields with declining reservoir pressure are the primary growth driver for onshore artificial lift systems. As conventional wells age, natural flow rates decrease, creating a need for efficient lifting solutions to sustain output. Electric submersible pumps and gas lift systems are increasingly deployed to maximize recovery. This trend is particularly strong in North America, the Middle East, and Russia, where a large number of mature fields require secondary production support. Demand for enhanced oil recovery further strengthens market reliance on advanced artificial lift technologies.

- For instance, JJ Tech’s Hydra-Cell T100 pump delivers 100 horsepower, while their Q155 and Q330 versions deliver 155 HP and 330 HP respectively, enabling surface drive pressures up to 5,000 psi.

Technological Advancements in Lift Systems

Continuous innovation in artificial lift technologies drives market growth by improving operational efficiency and reducing downtime. Manufacturers are integrating digital monitoring, predictive analytics, and automation into lift systems to optimize performance. Smart controllers and sensors enable real-time adjustments that lower energy consumption and extend equipment life. The development of high-capacity pumps suited for unconventional wells supports wider adoption. These advancements not only enhance oil recovery rates but also reduce maintenance costs, making artificial lift systems a more attractive investment for operators worldwide.

- For instance, Aker Solutions uses digital twins combining edge computing and advanced analytics, reducing engineering and fabrication man-hours by up to 20% via automation of routine tasks.

Expansion of Shale and Unconventional Oil Production

The growth of shale and unconventional oil production significantly boosts demand for artificial lift systems. Horizontal drilling and hydraulic fracturing techniques create wells with rapid production declines, requiring reliable lift solutions early in their life cycle. Progressing cavity pumps and ESPs are widely used in these settings to maintain output. North America, particularly the U.S., leads this trend with robust shale activities, while similar developments are emerging in Argentina and China. The ongoing push for energy security ensures steady investment in artificial lift technologies for unconventional resources.

Key Trends & Opportunities

Integration of Digital Technologies

Digitalization represents a key trend, with artificial lift systems increasingly equipped with IoT-enabled sensors, cloud connectivity, and predictive analytics. These technologies provide operators with real-time data, enabling proactive maintenance and minimizing failures. Advanced control systems optimize energy usage and improve pump performance, resulting in higher cost-efficiency. The move toward digital oilfields supports this adoption, presenting strong opportunities for service providers offering end-to-end monitoring solutions. As companies focus on reducing operational risks, digital integration creates a major opportunity for market expansion in onshore applications.

- For instance, Levare’s ProLift® software models multiphase flow and designs ESPs using actual fluid properties. The software is used to size pumps and select equipment for wells with vertical depths of up to 4,000 m, supporting optimal production and equipment selection.

Shift Toward Energy-Efficient Solutions

Energy efficiency is becoming a central priority for operators, driving adoption of systems that minimize power usage while maintaining output. ESPs with variable frequency drives and gas lift systems optimized for fluctuating production conditions illustrate this trend. Operators seek to reduce carbon emissions and operating costs, aligning with global sustainability goals. Manufacturers investing in greener technologies and energy-efficient designs position themselves competitively in the evolving market. This focus on efficiency not only enhances profitability but also creates opportunities to capture environmentally conscious investors and clients.

- For instance, NOV’s Novomet division lists variable speed drive units rated for currents of 160 A up to 800 A (0–200 Hz) and efficiencies near 0.97, helping ESP systems adapt to changing downhole conditions.

Growing Investments in Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and Africa offer significant opportunities for artificial lift system providers. Increasing oilfield development and rising domestic energy demand fuel adoption of these systems. Countries such as India and Brazil are expanding exploration and production activities, requiring modern lift solutions to support output growth. Lower-cost operations and government-backed initiatives in these regions further accelerate market penetration. Global players focusing on regional partnerships and localized manufacturing gain access to untapped reserves, strengthening long-term growth prospects in these fast-developing economies.

Key Challenges

High Operational and Maintenance Costs

Artificial lift systems, particularly ESPs, involve high capital and maintenance expenses, which challenge adoption in cost-sensitive markets. Frequent servicing, replacement of components, and energy consumption contribute significantly to operating costs. Smaller operators and projects with marginal profitability often hesitate to invest in advanced systems. Market players must balance efficiency with affordability to ensure widespread adoption. Developing cost-effective technologies and offering flexible service models will be critical to addressing this challenge and sustaining long-term market growth across varied oilfield settings.

Fluctuations in Crude Oil Prices

Volatile crude oil prices remain a significant challenge for the onshore artificial lift systems market. Price declines often lead operators to cut capital expenditure, delaying or reducing investment in lift technologies. This directly impacts system sales and service contracts, creating uncertainty for manufacturers and suppliers. Conversely, price spikes can drive short-term growth but also increase input costs, pressuring margins. The cyclical nature of the oil industry forces companies to adapt with resilient business strategies, diversifying revenue streams and focusing on regions with stable production activity.

Regional Analysis

North America

North America dominates the onshore artificial lift systems market with a 37% share in 2024. The region benefits from extensive shale oil and gas production, particularly in the U.S. Permian Basin, where declining reservoir pressure demands advanced lift solutions. Electric submersible pumps and progressing cavity pumps are widely adopted due to their ability to sustain high production rates in unconventional wells. Canada also contributes significantly, driven by heavy oil fields in Alberta that rely on thermal recovery and artificial lift. Continuous technological innovation and strong investments in shale projects reinforce the region’s leadership in the global market.

Europe

Europe accounts for 18% of the market share, supported by mature onshore fields in Russia, the UK, and Eastern Europe. The region focuses heavily on enhancing recovery rates from aging reservoirs, driving demand for efficient artificial lift systems. Gas lift and hydraulic pumping technologies are widely used due to field characteristics and availability of natural gas. Russia remains the largest contributor, with vast onshore oilfields requiring secondary recovery solutions. Additionally, stringent regulations on energy efficiency and carbon reduction encourage the adoption of optimized pumping systems. Ongoing investments in Eastern Europe strengthen regional growth despite plateauing production in Western Europe.

Asia-Pacific

Asia-Pacific holds a 24% market share, emerging as one of the fastest-growing regions for artificial lift systems. Key contributors include China and India, where rising energy demand and expanding exploration activities fuel adoption. In China, mature onshore fields such as Daqing rely heavily on progressing cavity pumps, while India’s growing oilfield development accelerates demand for ESPs and gas lift systems. Southeast Asia, including Indonesia, also supports growth through increasing recovery projects. Government-backed energy security initiatives and investments in domestic oil production drive regional expansion. The push for advanced technologies further positions Asia-Pacific as a high-potential growth hub.

Latin America

Latin America represents 6% of the global market, led by major oil-producing countries such as Brazil, Mexico, and Argentina. Argentina’s Vaca Muerta shale play is a major driver, requiring extensive artificial lift deployments to support unconventional production. Brazil and Mexico rely on artificial lift systems to sustain output in maturing onshore reservoirs. Progressing cavity pumps and jet pumps are particularly favored for heavy oil applications in Venezuela and Colombia. Regional adoption is supported by government-backed energy reforms and foreign investments in upstream projects. Although smaller in market share, Latin America presents strong long-term opportunities for artificial lift providers.

Middle East & Africa

The Middle East & Africa region commands a 15% share, with significant potential due to vast onshore reserves in Saudi Arabia, Iraq, and the UAE. While many fields still flow naturally, artificial lift systems are increasingly deployed in maturing reservoirs to sustain long-term production. Gas lift systems dominate, leveraging abundant gas resources, while ESPs are gaining traction in heavy oil projects. In Africa, Nigeria and Angola lead with enhanced oil recovery initiatives requiring artificial lift solutions. Regional market growth is supported by continued oilfield investments, energy diversification strategies, and partnerships with global oilfield service providers.

Market Segmentations:

By Type:

- Pressurized Water Reactor (PWR)

- Electric Submersible Pumps

By Application:

By Component:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The onshore artificial lift systems market players such as Canadian Advanced ESP, Halliburton, ELKAM ArtEfficial Lift, JJ Tech, Aker Solutions, Levare, NOV, Alkhorayef Petroleum, General Electric, and BCP Group. The onshore artificial lift systems market is highly competitive, driven by continuous innovation, expanding service capabilities, and increasing adoption of advanced technologies. Companies focus on enhancing product efficiency, integrating digital solutions, and developing energy-efficient systems to meet the growing demand for optimized oil recovery. Strategic initiatives such as mergers, acquisitions, and collaborations strengthen market positions and enable access to new regional opportunities. Additionally, providers invest in localized manufacturing and service networks to reduce operational costs and improve responsiveness. The competitive landscape is further shaped by the rising importance of sustainability, automation, and predictive maintenance in oilfield operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Canadian Advanced ESP

- Halliburton

- ELKAM ArtEfficial Lift

- JJ Tech

- Aker Solutions

- Levare

- NOV

- Alkhorayef Petroleum

- General Electric

- BCP Group

Recent Developments

- In July 2025, Schlumberger (SLB), a global multinational oilfield services company received regulatory clearance to close its ChampionX acquisition, creating the largest integrated production-optimization platform.

- In February 2025, Baker Hughes unveiled Hummingbird all-electric cementing units, SureCONTROL Plus interval valves, and all-electric subsea systems targeting lower emissions.

- In May 2024, ABB announced an agreement of acquisition of Siemens’ business of China. According to this agreement, ABB is planning to acquire smart home systems, peripheral home automation products, and wiring accessories, with the Siemens brand under a licensing agreement.

- In May 2024, Schneider Electric partnered with Crux to assist in buying 45X advanced manufacturing production from Silfab Solar, a North American company that develops, designs, and manufactures premium solar PV modules. The collaboration is expected to accelerate the development and expansion of solar energy manufacturing within the U.S.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as mature onshore fields increasingly require artificial lift solutions.

- Adoption of digital technologies will improve monitoring, efficiency, and predictive maintenance in lift systems.

- Energy-efficient solutions will gain priority as operators align with global sustainability targets.

- Shale and unconventional oil development will drive strong demand for ESPs and progressing cavity pumps.

- Emerging markets in Asia-Pacific, Latin America, and Africa will create new growth opportunities.

- Strategic partnerships and collaborations will strengthen regional service capabilities and technology access.

- Advanced automation and AI integration will enhance system reliability and lower downtime.

- Demand for cost-effective systems will increase as smaller operators seek affordable solutions.

- Heavy oil and unconventional reservoirs will accelerate use of progressing cavity and jet pumps.

- Volatile crude oil prices will continue to shape investment decisions in artificial lift systems.