Market Overview

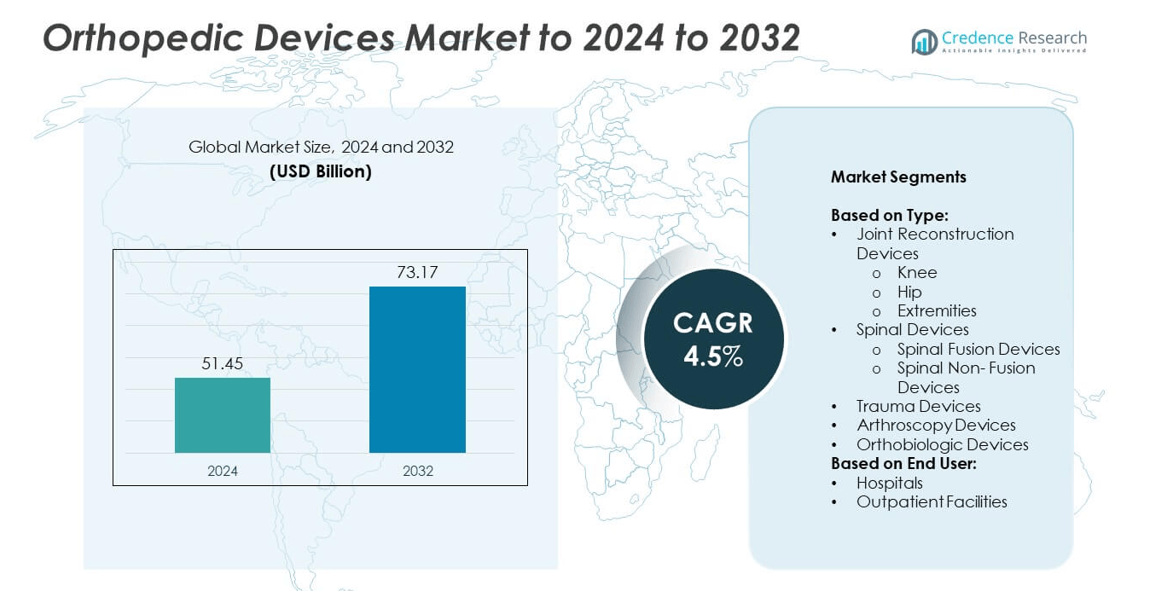

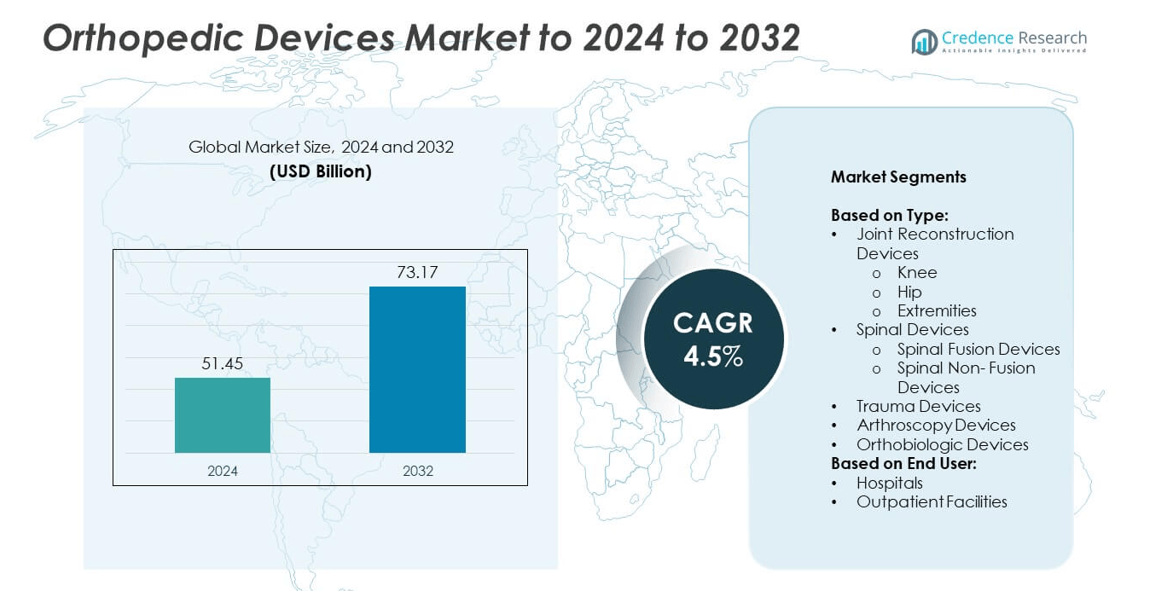

The Orthopedic Devices Market size was valued at USD 51.45 billion in 2024 and is anticipated to reach USD 73.17 billion by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Orthopedic Devices Market Size 2024 |

USD 51.45 billion |

| Orthopedic Devices Market , CAGR |

4.5% |

| Orthopedic Devices Market Size 2032 |

USD 73.17 billion |

The orthopedic devices market is led by major players including Medtronic, Stryker, Zimmer Biomet, Johnson & Johnson (DePuy Synthes), Smith+Nephew, Aesculap, Inc. – a B. Braun company, CONMED Corporation, Enovis, and NuVasive, Inc. (merged with Globus Medical). These companies maintain strong market presence through innovations in minimally invasive surgeries, robotics, orthobiologics, and patient-specific implants. North America emerged as the leading region in 2024, commanding 38% of the global share, supported by advanced healthcare infrastructure, high prevalence of musculoskeletal disorders, and favorable reimbursement systems. Europe followed with 29%, while Asia Pacific held 22%, driven by rapid healthcare expansion and rising patient demand.

Market Insights

- The orthopedic devices market was valued at USD 51.45 billion in 2024 and is projected to reach USD 73.17 billion by 2032, growing at a CAGR of 4.5% from 2025 to 2032.

- Growth is driven by rising cases of osteoarthritis, osteoporosis, and trauma injuries, alongside increasing demand for minimally invasive surgeries and personalized implants.

- Key trends include the integration of robotics and digital health, adoption of 3D-printed implants, and wider use of regenerative orthobiologics to improve patient outcomes.

- The market is competitive with players such as Medtronic, Stryker, Zimmer Biomet, Johnson & Johnson (DePuy Synthes), and Smith+Nephew investing in innovation, partnerships, and expansion strategies.

- North America led with 38% share in 2024, followed by Europe at 29% and Asia Pacific at 22%; joint reconstruction devices dominated product segments, with knee implants holding the largest share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The orthopedic devices market is segmented into joint reconstruction, spinal, trauma, arthroscopy, and orthobiologic devices. Among these, joint reconstruction devices dominate, led by knee implants, which held nearly 45% share in 2024. High prevalence of osteoarthritis, rising geriatric population, and growing demand for minimally invasive knee replacement drive this leadership. Spinal fusion devices also hold strong demand due to increasing degenerative spine disorders, while orthobiologics are gaining traction with advanced regenerative therapies. Innovations in biomaterials, 3D-printed implants, and navigation-assisted surgeries continue to strengthen adoption across these device categories.

- For instance, DePuy Synthes reported more than 1,000,000 ATTUNE Knee patients as of June 23, 2020.

By End User

Hospitals accounted for the largest share at about 65% in 2024, supported by advanced surgical infrastructure, skilled specialists, and comprehensive rehabilitation care. Complex joint replacements, spinal fusions, and trauma surgeries are largely performed in hospitals, keeping them dominant. Outpatient facilities are expanding due to cost-effective care, shorter recovery times, and rising adoption of minimally invasive orthopedic procedures. Advances in portable imaging, robotic-assisted tools, and same-day discharge models further support outpatient growth, but hospitals remain the primary hub for large-scale orthopedic interventions worldwide.

- For instance, Stryker confirmed over 1,500,000 Mako procedures globally by March 11, 2025.

Key Growth Drivers

Rising Prevalence of Musculoskeletal Disorders

The increasing incidence of musculoskeletal disorders such as osteoarthritis, osteoporosis, and degenerative spine diseases is a major growth driver for the orthopedic devices market. With an aging global population and higher life expectancy, the number of patients requiring joint replacements, spinal corrections, and trauma care continues to rise. According to the WHO, osteoarthritis alone affects hundreds of millions worldwide, creating strong demand for advanced implants. This rising patient base ensures consistent adoption of joint reconstruction and spinal devices, strengthening overall market expansion during the forecast period.

- For instance, in 2024, Intuitive Surgical reported nearly 2.7 million procedures performed using its robotic systems.

Advancements in Minimally Invasive Surgeries

Minimally invasive surgical techniques have transformed orthopedic care, offering reduced hospital stays, faster recovery, and lower complication risks. The adoption of advanced navigation systems, robotic-assisted tools, and enhanced imaging has improved precision in joint replacement and spine surgeries. These technological advancements drive strong demand for modern orthopedic devices tailored for minimally invasive approaches. Hospitals and outpatient centers alike are increasingly investing in such equipment, as patient preference shifts toward quicker recovery solutions. This trend strongly supports growth across joint reconstruction, arthroscopy, and spinal device categories worldwide.

- For instance, in 2018, before its acquisition by Medtronic, Mazor Robotics reported that more than 200 of its robotic systems, including both the Mazor X and its predecessor, the Renaissance, were in clinical use globally.

Growing Demand for Personalized Implants and Orthobiologics

Personalized orthopedic solutions, including 3D-printed implants and regenerative biologics, are becoming key drivers of the market. Customized implants improve fit, durability, and patient outcomes, while orthobiologics accelerate healing in trauma and reconstructive surgeries. Advances in biomaterials, bone graft substitutes, and stem cell therapies have expanded treatment options across orthopedic applications. Rising investments by device manufacturers in regenerative medicine and patient-specific implant technology are boosting adoption rates. This shift toward precision and personalized care is shaping the future of orthopedic treatment, creating long-term growth opportunities in the market.

Key Trends & Opportunities

Rise of Outpatient Orthopedic Procedures

Outpatient facilities are increasingly performing orthopedic surgeries, driven by minimally invasive techniques and advanced portable tools. Same-day discharge models reduce costs for patients and healthcare systems, making outpatient care more attractive. This trend is particularly strong in developed markets such as North America and Europe, where reimbursement systems support outpatient treatments. As technology improves efficiency, outpatient centers are expected to gain greater share in joint replacements and arthroscopy. This creates new opportunities for manufacturers offering cost-efficient, compact, and procedure-specific orthopedic devices.

- For instance, Xenco Medical claims its sterile-packaged composite polymer systems can save hospitals US$ 900 to US$ 1,100 per surgery by eliminating sterilization and reprocessing costs.

Integration of Digital Health and Robotics

Digital technologies and robotics are reshaping orthopedic procedures by enabling greater surgical precision and post-operative monitoring. Robotics-assisted knee and hip replacements ensure accurate alignment, reducing revision rates. Meanwhile, digital health platforms track patient recovery, enhance rehabilitation, and improve compliance. Companies are also integrating AI and navigation systems into devices to assist surgeons in complex cases. Growing adoption of such technologies opens significant opportunities for innovation and partnerships between medtech firms and digital health providers, positioning digital integration as a strong market trend.

- For instance, Globus Medical reports its ExcelsiusGPS system data show 98.8 % accuracy in pedicle screw placement in robot-assisted surgery.

Key Challenges

High Cost of Orthopedic Implants and Surgeries

One of the major challenges in the orthopedic devices market is the high cost associated with implants and surgical procedures. Advanced implants, robotic-assisted surgeries, and biologics often remain unaffordable for patients in low- and middle-income countries. Limited reimbursement coverage in several regions further restricts accessibility. This cost barrier slows adoption despite clinical benefits, particularly in emerging economies where demand for affordable solutions is rising. Manufacturers face pressure to balance innovation with affordability, which remains a persistent challenge for sustained global market penetration.

Regulatory and Clinical Approval Barriers

Strict regulatory frameworks and lengthy clinical approval processes often delay the launch of new orthopedic devices. Compliance with stringent safety and performance standards in the U.S., Europe, and other regions requires significant investment in clinical trials and documentation. Smaller companies, in particular, face hurdles in entering the market due to limited resources. In addition, recalls or post-market safety issues can damage brand reputation and limit growth potential. These regulatory challenges create bottlenecks for innovation, slowing the adoption of advanced orthopedic technologies worldwide.

Regional Analysis

North America

North America held the largest share of the orthopedic devices market in 2024, accounting for 38%. The region’s dominance is supported by advanced healthcare infrastructure, high adoption of minimally invasive surgeries, and strong presence of leading device manufacturers. Rising prevalence of arthritis and sports-related injuries continues to drive demand for joint reconstruction and arthroscopy devices. Favorable reimbursement policies and rapid integration of robotic-assisted surgeries further strengthen the market. The U.S. remains the largest contributor within the region, while Canada is experiencing steady growth due to increasing investments in orthopedic care.

Europe

Europe accounted for 29% share of the orthopedic devices market in 2024, supported by a growing geriatric population and a high burden of musculoskeletal conditions. Countries such as Germany, the U.K., and France drive demand through established healthcare systems and increased adoption of advanced implants. The region benefits from regulatory focus on innovative yet safe devices, boosting adoption of orthobiologics and minimally invasive solutions. Rising investments in outpatient surgery centers and favorable reimbursement frameworks enhance access to orthopedic treatments, positioning Europe as a strong market for technologically advanced solutions in joint and spine care.

Asia Pacific

Asia Pacific captured 22% of the orthopedic devices market in 2024, emerging as the fastest-growing region. Rapid urbanization, expanding healthcare infrastructure, and rising awareness about advanced orthopedic treatments fuel growth across China, India, and Japan. Increasing prevalence of osteoporosis and trauma injuries, coupled with rising medical tourism, drives adoption of implants and biologics. Governments are investing in cost-effective healthcare solutions, making advanced surgeries more accessible. Additionally, global manufacturers are expanding operations in the region to tap into large patient pools. This combination of high demand and expanding supply capabilities accelerates regional market expansion.

Latin America

Latin America represented 6% share of the orthopedic devices market in 2024, driven by increasing healthcare expenditure and gradual adoption of modern surgical techniques. Brazil and Mexico dominate the region due to higher investments in hospital infrastructure and growing middle-class access to advanced treatments. Rising cases of road traffic accidents and sports injuries boost the demand for trauma and arthroscopy devices. However, uneven reimbursement coverage and high costs remain barriers to wider adoption. Efforts to expand private healthcare and medical tourism are creating opportunities for manufacturers offering affordable orthopedic solutions tailored to local needs.

Middle East and Africa

The Middle East and Africa accounted for 5% of the orthopedic devices market in 2024, with growth led by countries such as Saudi Arabia, the UAE, and South Africa. Rising investments in healthcare modernization and medical tourism drive adoption of advanced joint replacement and spinal procedures. Increasing prevalence of obesity-related orthopedic conditions also supports market expansion. However, limited specialist availability and high implant costs restrict widespread adoption across several African nations. International players are increasingly partnering with local healthcare providers to improve access, creating opportunities for long-term growth in this emerging regional market.

Market Segmentations:

By Type:

- Joint Reconstruction Devices

- Spinal Devices

- Spinal Fusion Devices

- Spinal Non- Fusion Devices

- Trauma Devices

- Arthroscopy Devices

- Orthobiologic Devices

By End User:

- Hospitals

- Outpatient Facilities

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The orthopedic devices market is shaped by leading players such as NuVasive, Inc. (merged with Globus Medical), Smith+Nephew, Medtronic, Aesculap, Inc. – a B. Braun company, Enovis (formerly known as DJO), Zimmer Biomet, CONMED Corporation, Johnson & Johnson (DePuy Synthes), Stryker, and DePuy Synthes. These companies compete by focusing on innovation, expanding product portfolios, and enhancing global distribution networks. The landscape is defined by strong investments in minimally invasive surgical technologies, robotics, and digital integration. Strategic mergers and acquisitions strengthen market presence and broaden access to emerging regions. Continuous advancements in biomaterials, 3D printing, and regenerative biologics enhance product differentiation and improve patient outcomes. Players also emphasize value-based healthcare solutions, cost efficiency, and partnerships with hospitals and outpatient facilities to maintain market share. The competitive environment remains dynamic, with leading firms prioritizing technological leadership, geographic expansion, and tailored solutions to address diverse orthopedic needs worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NuVasive, Inc. (merged with Globus Medical)

- Smith+Nephew

- Medtronic

- Aesculap, Inc. – a B. Braun company

- Enovis (formerly known as DJO)

- Zimmer Biomet

- CONMED Corporation

- Johnson & Johnson (DePuy Synthes)

- Stryker

- DePuy Synthes

Recent Developments

- In 2025, Stryker Expanded Mako SmartRobotics for Shoulder: Showcased the next generation of its Mako SmartRobotics platform, expanding its application portfolio across hip, knee, spine, and notably, the introduction of shoulder procedures.

- In 2025, Zimmer Biomet entered into an agreement to acquire Monogram Technologies to integrate their semi- and fully autonomous robotic technologies, aiming to add differentiated capabilities to its ROSA® Robotics platform (e.g., CT-based, AI-navigated TKA).

- In 2025, Johnson & Johnson (DePuy Synthes) showcased the expansion of its digital surgery ecosystem, centered around the VELYS Robotic-Assisted Solution for Total Knee Arthroplasty, with a focus on increasing its use in Europe and other global markets.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising prevalence of musculoskeletal disorders.

- Joint reconstruction devices will remain the leading category, driven by knee and hip demand.

- Spinal devices will see strong growth with innovations in motion-preserving technologies.

- Orthobiologics adoption will increase as regenerative therapies gain wider clinical use.

- Outpatient facilities will capture higher share due to minimally invasive surgeries.

- Digital health integration and robotic-assisted surgeries will reshape orthopedic procedures.

- Emerging markets will offer significant opportunities with expanding healthcare access.

- Personalized implants and 3D printing will enhance patient-specific treatment outcomes.

- Cost challenges will encourage development of affordable orthopedic device solutions.

- Strategic partnerships will drive innovation and global market expansion.