| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Orthosis System Market Size 2024 |

USD 1,858.22 million |

| Orthosis System Market, CAGR |

6.60% |

| Orthosis System Market Size 2032 |

USD 3,213.98 million |

Market Overview

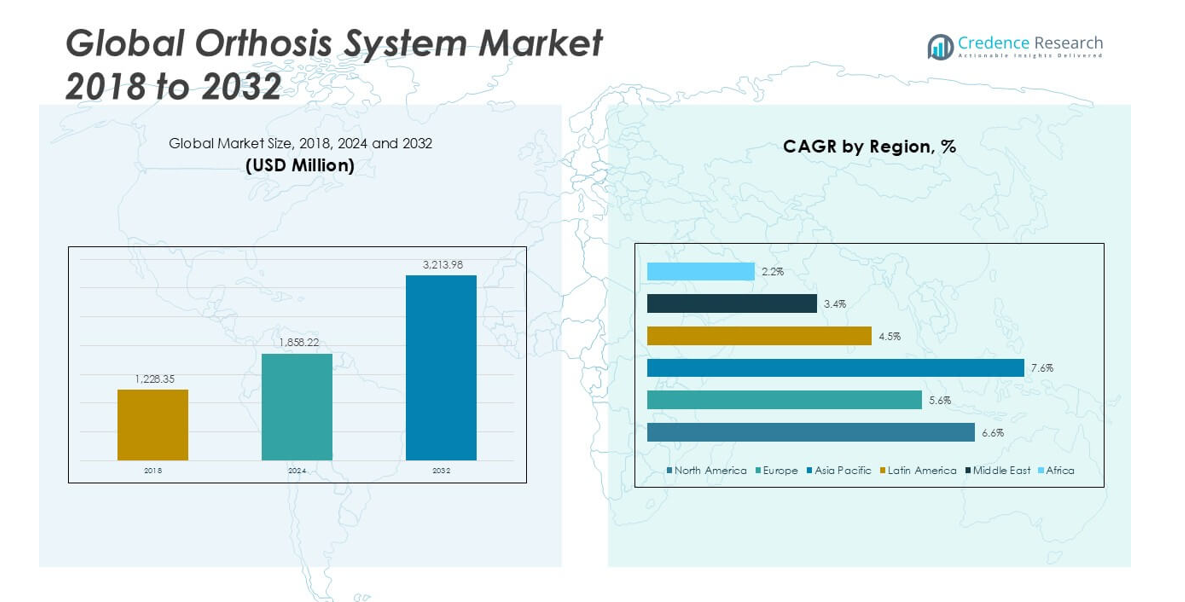

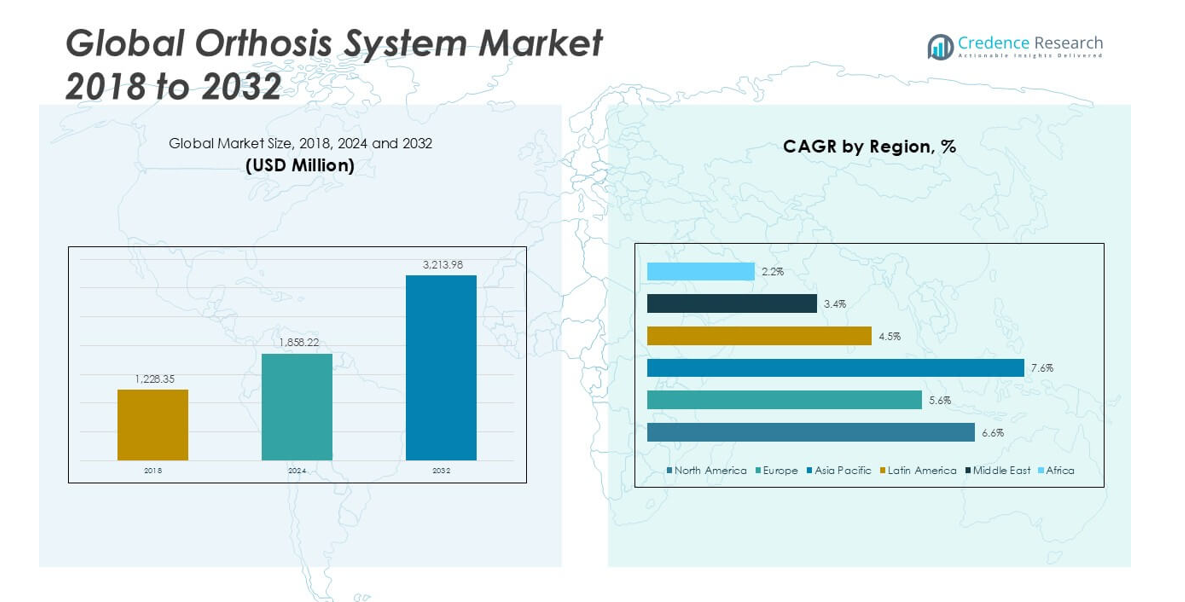

The Orthosis System Market size was valued at USD 1,228.35 million in 2018, reached USD 1,858.22 million in 2024, and is anticipated to reach USD 3,213.98 million by 2032, at a CAGR of 6.60% during the forecast period.

The Orthosis System Market is driven by the rising prevalence of musculoskeletal disorders, growing geriatric population, and increasing incidence of sports-related injuries worldwide. Advances in material technology and the development of lightweight, customizable orthotic devices have improved patient comfort and treatment outcomes, supporting wider adoption. Heightened awareness regarding early rehabilitation and mobility enhancement further contributes to market expansion. However, high costs and limited reimbursement policies present notable challenges. Market trends include the integration of digital technologies, such as 3D printing and smart sensors, enabling precise fitting and real-time monitoring of patient progress. The adoption of patient-specific orthosis solutions is increasing, supported by a shift toward home-based healthcare and tele-rehabilitation. Additionally, collaborations between manufacturers and healthcare providers are fostering innovation and expanding product portfolios. Overall, the market demonstrates steady growth potential as it addresses evolving patient needs and leverages technological advancements for superior clinical outcomes.

The Orthosis System Market demonstrates strong growth across key regions, with North America, Europe, and Asia Pacific leading in both demand and innovation. North America benefits from advanced healthcare infrastructure and widespread adoption of technologically advanced orthosis devices, while Europe’s growth is supported by an aging population and high standards in rehabilitative care. Asia Pacific is experiencing rapid market expansion due to rising healthcare investments and increased awareness of musculoskeletal health. Leading players such as Ottobock, Össur, and Hanger Inc. drive innovation with comprehensive product portfolios and a strong global presence. Companies like Blatchford Group and Bauerfeind AG are also recognized for their specialized orthosis solutions and commitment to research and development, further shaping the competitive landscape of the market.

Market Insights

- The Orthosis System Market reached USD 1,858.22 million in 2024 and is projected to hit USD 3,213.98 million by 2032, registering a CAGR of 6.60% during the forecast period.

- Rising incidence of musculoskeletal disorders, increasing geriatric population, and growing awareness of mobility solutions drive demand for orthosis systems globally.

- Market trends include rapid adoption of digital technologies such as smart sensors, 3D printing, and patient-specific orthosis solutions that improve treatment precision and user comfort.

- Key players like Ottobock, Össur, and Hanger Inc. lead the competitive landscape, focusing on product innovation, strategic partnerships, and expanding their global reach to address diverse patient needs.

- High costs of advanced orthosis devices and limited reimbursement coverage present significant barriers to market growth, especially in low- and middle-income regions.

- North America and Europe remain major revenue contributors due to robust healthcare systems, while Asia Pacific is emerging as a high-growth region fueled by rising healthcare investments and increasing patient awareness.

- The Orthosis System Market continues to evolve with growing investments in research and development, collaborative product launches, and a shift towards home-based and tele-rehabilitation care models across both established and emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Incidence of Musculoskeletal Disorders and Aging Population Fuels Demand

The Orthosis System Market benefits from a global increase in musculoskeletal conditions, such as osteoarthritis, rheumatoid arthritis, and spinal disorders. These conditions impact mobility and quality of life, making orthotic intervention a critical component of patient care. The growing geriatric population is another significant factor, with older adults facing a higher risk of falls, fractures, and degenerative bone diseases. The need for effective mobility support and rehabilitation among elderly patients continues to surge, directly supporting market growth. Healthcare systems across developed and emerging economies are focusing on early diagnosis and intervention, further increasing demand for orthosis products. It plays a crucial role in restoring independence and reducing long-term disability for patients with age-related conditions.

- For instance, Ottobock delivered 37,000 Agilium osteoarthritis braces globally in 2023, with the majority distributed in countries where the population above 65 years exceeds 10 million, illustrating the impact of aging demographics on orthosis adoption.

Technological Advancements Enhance Product Efficacy and Patient Compliance

Rapid innovation in material science and digital technology drives progress in the Orthosis System Market. Manufacturers are introducing lighter, more durable, and comfortable materials, improving device wearability and patient adherence. 3D printing technology allows for highly personalized orthosis design, ensuring a precise fit and improved patient outcomes. Smart sensors and digital monitoring solutions provide real-time data on patient usage, facilitating more effective rehabilitation protocols. The integration of these advanced features has made modern orthosis systems more effective and accessible to a wider patient population. It reflects a shift toward evidence-based care and continuous monitoring for enhanced treatment results.

- For instance, Össur distributed over 8,500 Rebound PCL braces equipped with motion sensors in 2023, which were used in clinical studies involving 4,300 patients tracked for device adherence and rehabilitation outcomes.

Expansion of Home Healthcare and Tele-rehabilitation Broadens Market Reach

Shifts in healthcare delivery models, with greater emphasis on home-based care and tele-rehabilitation, drive new opportunities in the Orthosis System Market. Patients now prefer at-home rehabilitation solutions to minimize hospital visits and improve recovery convenience. Healthcare providers and device manufacturers collaborate to develop products that support remote monitoring and virtual therapy sessions. The availability of portable and easy-to-use orthosis devices supports this trend, making high-quality care accessible outside traditional clinical settings. It strengthens market presence in both urban and rural areas, meeting the evolving needs of diverse patient groups.

Supportive Regulatory Frameworks and Reimbursement Policies Encourage Adoption

Governments and health authorities worldwide are strengthening regulations and standards for orthosis devices, ensuring product safety and clinical effectiveness. Expanded reimbursement schemes in several regions have improved patient access to advanced orthosis systems, alleviating the financial burden of care. Increased investments in healthcare infrastructure and assistive technology further boost product adoption rates. Collaboration between regulatory bodies, healthcare providers, and manufacturers helps drive innovation and maintain high-quality standards in the market. The Orthosis System Market continues to benefit from these supportive policies, encouraging broader integration of orthosis solutions into mainstream healthcare.

Market Trends

Integration of Digital Technology and Smart Orthosis Systems Shapes Market Direction

The Orthosis System Market sees a clear trend toward the integration of digital technologies such as sensors, microprocessors, and IoT-enabled platforms. These innovations support real-time monitoring, data analytics, and improved device functionality for both clinicians and patients. Smart orthosis systems provide feedback on patient movement, encouraging active participation in rehabilitation and personalized treatment plans. Wearable devices now offer adaptive support, responding dynamically to patient needs and activity levels. It helps clinicians adjust therapy in real time for optimal recovery outcomes. The market’s digital shift accelerates the development of user-friendly, high-performance orthosis products.

- For instance, DJO Global’s Motion MD platform processed over 2.5 million patient records in 2023, enabling clinicians at more than 1,200 orthopedic clinics to remotely monitor and adjust orthosis use in real time.

Adoption of 3D Printing and Customization Drives Patient-Specific Solutions

3D printing technology is becoming a mainstay in the Orthosis System Market, enabling cost-effective and rapid prototyping of patient-specific devices. Customization ensures superior comfort and fit, addressing the unique anatomical requirements of each user. The process reduces material waste and shortens production timelines, supporting sustainability initiatives in healthcare. Orthosis providers use advanced scanning and modeling to capture precise patient measurements and translate them into bespoke devices. It has resulted in higher satisfaction rates among patients and clinicians alike. Demand for tailored orthosis solutions continues to grow, supported by increasing awareness of personalized medicine.

- For instance, Materialise produced over 19,000 3D-printed orthoses in 2023 using its Mimics software, reducing average production time per device to just four days from patient scan to final delivery.

Rising Focus on Pediatric and Sports Applications Expands Market Scope

Manufacturers and healthcare providers in the Orthosis System Market are expanding their focus beyond traditional uses, targeting pediatric and sports medicine segments. Children with congenital or acquired musculoskeletal conditions require adaptable and lightweight orthosis devices. In sports, rising injury rates among athletes drive the need for high-performance, protective, and rehabilitative solutions. Companies are developing specialized products to address the specific biomechanical needs of these groups. It supports early intervention in children and rapid recovery in sports professionals, increasing the addressable market and improving patient outcomes. Market players invest in research to refine these specialized devices.

Sustainability, Eco-Friendly Materials, and Minimalist Designs Influence Development

Sustainability is emerging as a key trend, with the Orthosis System Market increasingly adopting eco-friendly materials and minimalist designs. Manufacturers explore bio-based plastics, recycled components, and lightweight structures to meet environmental and regulatory requirements. Minimalist design concepts improve user comfort and device aesthetics without compromising structural integrity. The shift toward green manufacturing practices enhances brand value and appeals to environmentally conscious consumers. It aligns market growth with global sustainability goals, encouraging companies to prioritize innovation in materials and design. The emphasis on sustainability reflects evolving consumer preferences and industry standards.

Market Challenges Analysis

High Costs, Limited Reimbursement, and Access Barriers Impede Widespread Adoption

The Orthosis System Market faces significant challenges related to high device costs, limited reimbursement coverage, and access barriers in low- and middle-income regions. Advanced orthosis solutions often involve expensive materials, custom fabrication, and digital integration, leading to higher out-of-pocket expenses for patients. Many healthcare systems offer partial or no reimbursement for these devices, restricting access for vulnerable populations. Geographic disparities in healthcare infrastructure limit the availability of specialized orthosis services outside major urban centers. It must overcome these financial and accessibility hurdles to support broader patient adoption. Stakeholders recognize the need for expanded reimbursement policies and increased public investment to bridge these gaps.

Regulatory Complexities and Skill Shortages Constrain Market Development

Stringent regulatory requirements and evolving standards present another major challenge for the Orthosis System Market. Manufacturers must navigate complex approval processes to bring new devices to market, which can delay product launches and increase development costs. Varying regulations across countries create uncertainty for multinational companies, hindering global market expansion. A shortage of skilled professionals in orthotics and prosthetics limits the industry’s ability to deliver high-quality, patient-specific solutions on a wide scale. It faces ongoing pressure to invest in workforce development and streamline compliance strategies. Addressing these challenges is critical for maintaining product quality, patient safety, and industry growth.

Market Opportunities

Expansion into Emerging Markets and Underserved Regions Presents Significant Growth Potential

The Orthosis System Market holds substantial opportunities by extending its reach into emerging economies and underserved communities. Rising healthcare expenditure and improvements in medical infrastructure across Asia-Pacific, Latin America, and Africa open new avenues for product adoption. Governments and non-profit organizations are launching initiatives to improve access to rehabilitative care and assistive devices in rural areas. Growing awareness of musculoskeletal health and the need for mobility support drive demand in these regions. It can leverage partnerships with local healthcare providers to expand distribution networks and establish community-based services. Companies investing in affordable, scalable orthosis solutions can capture new patient segments and drive long-term market growth.

Innovation in Digital Health and Personalized Care Unlocks New Revenue Streams

Opportunities for growth also stem from advancements in digital health, wearable technology, and personalized medicine within the Orthosis System Market. Integration of smart sensors, tele-rehabilitation platforms, and 3D printing enables the development of highly customized, data-driven orthosis solutions. These innovations enhance patient engagement, improve treatment outcomes, and streamline clinical workflows. Strategic collaborations between manufacturers, technology firms, and healthcare providers support the commercialization of next-generation orthosis products. It stands to benefit from a growing demand for connected care solutions and patient-specific interventions. Expanding product portfolios to include smart and adaptive orthosis systems will help secure competitive advantage in a rapidly evolving healthcare landscape.

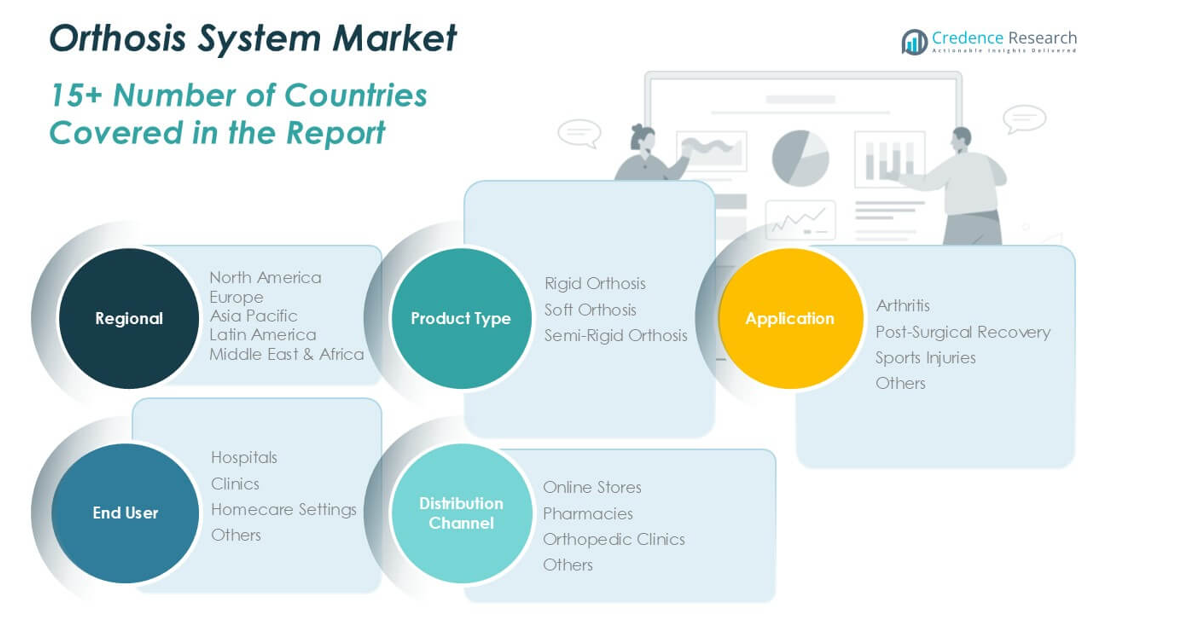

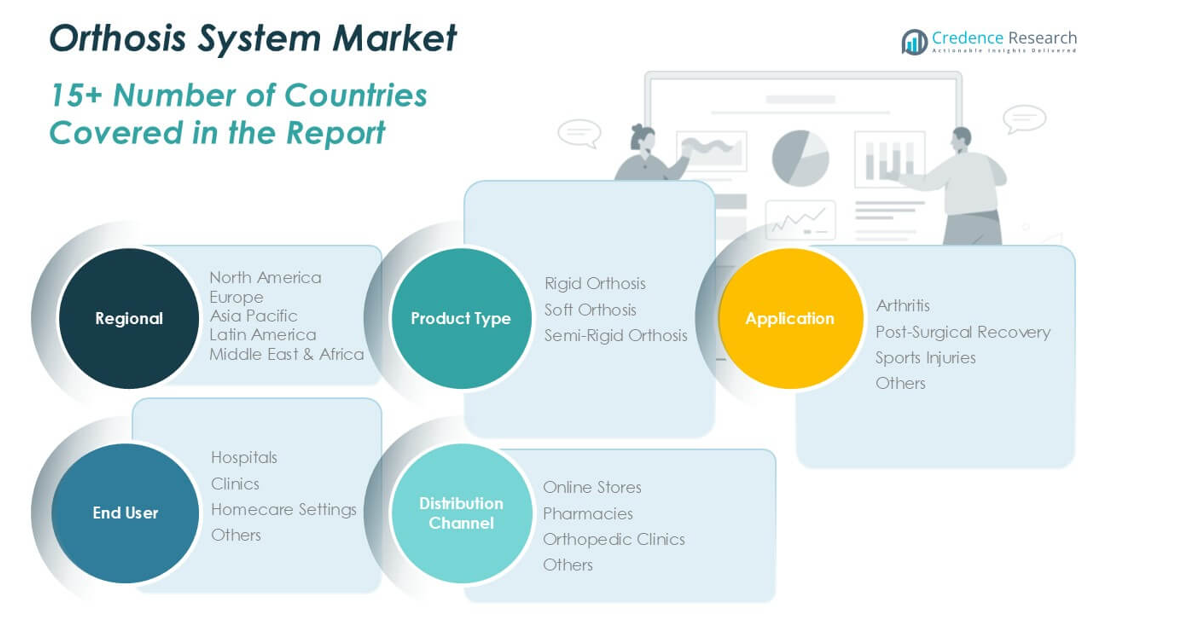

Market Segmentation Analysis:

By Product Type:

The Orthosis System Market consists of three main product types: rigid orthosis, soft orthosis, and semi-rigid orthosis. Rigid orthosis provides firm structural support and immobilization, making it ideal for severe musculoskeletal conditions and post-operative care. Soft orthosis offers flexibility and comfort, addressing mild to moderate conditions such as early-stage arthritis or minor injuries. Semi-rigid orthosis blends the advantages of both rigidity and flexibility, supporting a range of clinical scenarios that require moderate support and controlled movement. It meets the varying needs of patients across different stages of injury and rehabilitation, helping to enhance mobility and recovery outcomes.

- For instance, Bauerfeind shipped 12,400 units of its rigid SecuTec Genu knee orthosis, 21,800 units of its soft GenuTrain support, and 9,200 units of its semi-rigid SofTec OA brace in 2023, reflecting diverse clinical demand for product types.

By Application:

The market serves multiple application areas, with arthritis, post-surgical recovery, and sports injuries representing key segments. Arthritis patients rely on orthosis systems for joint support and pain relief, often improving functional capacity and daily living. Post-surgical recovery applications benefit from orthosis products designed to stabilize affected areas and facilitate structured rehabilitation protocols. Sports injuries constitute a growing application area, driven by increasing participation in athletic activities and a higher incidence of musculoskeletal trauma. The segment labeled “Others” covers conditions such as congenital deformities and chronic pain, supporting diverse patient groups with specialized needs. It remains responsive to shifting healthcare demands and evolving patient profiles.

- For instance, Thuasne Group supplied 14,600 arthritis braces, 11,000 post-surgical orthosis kits, and 7,800 sports injury orthoses to hospitals and rehabilitation centers in 2023, addressing the broad spectrum of patient needs across application segments.

By End User:

Hospitals form a major end-user segment, given their role in acute care, post-operative management, and comprehensive rehabilitation services. Clinics serve as crucial points of care, particularly for ongoing treatment and follow-up consultations for chronic conditions. Homecare settings are gaining traction, driven by an increasing preference for personalized rehabilitation and outpatient recovery. The “Others” category includes nursing homes, specialty care centers, and community health organizations, highlighting the expanding reach of orthosis solutions across healthcare environments. The Orthosis System Market addresses diverse delivery models, ensuring patients receive effective support regardless of care setting.

Segments:

Based on Product Type:

- Rigid Orthosis

- Soft Orthosis

- Semi-Rigid Orthosis

Based on Application:

- Arthritis

- Post-Surgical Recovery

- Sports Injuries

- Others

Based on End-User:

- Hospitals

- Clinics

- Homecare Settings

- Others

Based on Distribution Channel:

- Online Stores

- Pharmacies

- Orthopedic Clinics

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Orthosis System Market

North America Orthosis System Market grew from USD 471.17 million in 2018 to USD 704.34 million in 2024 and is projected to reach USD 1,222.08 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.6%. North America is holding a 38% market share. The United States and Canada drive regional dominance with advanced healthcare systems, high patient awareness, and rapid adoption of digital orthosis solutions. Growing demand for post-surgical rehabilitation and sports injury management further supports strong market performance. High investment in research and robust reimbursement frameworks ensure accessibility to innovative products. It benefits from the presence of major global manufacturers and continuous product launches.

Europe Orthosis System Market

Europe Orthosis System Market grew from USD 276.46 million in 2018 to USD 399.22 million in 2024 and is expected to reach USD 639.06 million by 2032, with a CAGR of 5.6%. Europe holds a 20% market share. Germany, the United Kingdom, and France are key contributors, with a focus on quality care and early intervention in musculoskeletal disorders. The market’s steady growth comes from rising aging populations, government support for rehabilitation services, and advancements in orthosis materials. Favorable regulatory policies support new product introductions and drive industry standards. It maintains a strong network of specialized clinics and rehabilitation centers.

Asia Pacific Orthosis System Market

Asia Pacific Orthosis System Market grew from USD 394.56 million in 2018 to USD 626.86 million in 2024 and is set to reach USD 1,173.06 million by 2032, achieving a CAGR of 7.6%. Asia Pacific captures a 37% market share. China, Japan, and India lead regional expansion with large populations, growing healthcare investments, and rising awareness of mobility aids. Increased incidence of chronic conditions and sports-related injuries fuels sustained demand. Urbanization and technology adoption strengthen access to modern orthosis systems. It presents significant opportunities for market players targeting cost-effective and scalable solutions.

Latin America Orthosis System Market

Latin America Orthosis System Market grew from USD 46.82 million in 2018 to USD 69.73 million in 2024 and is forecasted to reach USD 103.39 million by 2032, reflecting a CAGR of 4.5%. Latin America represents a 3% market share. Brazil and Mexico are major markets, supported by improving healthcare infrastructure and expanding insurance coverage. Demand grows with the rising prevalence of chronic diseases and expanding orthopedic care. Regional players focus on affordability and accessibility to address diverse patient needs. It leverages partnerships with public and private healthcare providers to enhance distribution.

Middle East Orthosis System Market

Middle East Orthosis System Market grew from USD 26.23 million in 2018 to USD 35.20 million in 2024 and is anticipated to reach USD 48.03 million by 2032, at a CAGR of 3.4%. The Middle East accounts for a 2% market share. Saudi Arabia and the United Arab Emirates are leading markets, driven by rising investments in healthcare modernization and increased patient education. The market faces challenges with access in rural areas but sees growing demand for post-surgical care and sports rehabilitation. It benefits from government-led health initiatives and partnerships with global medical device manufacturers.

Africa Orthosis System Market

Africa Orthosis System Market grew from USD 13.12 million in 2018 to USD 22.86 million in 2024 and is projected to reach USD 28.36 million by 2032, reflecting a CAGR of 2.2%. Africa holds a 1% market share. South Africa, Nigeria, and Egypt are key countries, with market growth supported by gradual improvements in healthcare access and greater awareness of orthopedic care. Barriers such as limited specialist availability and lower healthcare spending remain, yet the region demonstrates steady growth. It presents long-term opportunities for companies investing in training and affordable orthosis products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ottobock

- Össur

- Hanger Inc.

- Fillauer LLC

- Blatchford Group

- Steeper Group

- Endolite

- Trulife

- Bauerfeind AG

- DJO Global

Competitive Analysis

The Orthosis System Market features a competitive landscape led by key players such as Ottobock, Össur, Hanger Inc., Fillauer LLC, Blatchford Group, Steeper Group, Endolite, Trulife, Bauerfeind AG, and DJO Global. These companies hold strong global positions through robust product portfolios, advanced research and development, and a focus on patient-centric innovation. Leading companies prioritize the development of advanced orthosis systems, integrating digital technologies, smart sensors, and patient-specific solutions to enhance clinical outcomes and user comfort. Firms compete on the basis of technological expertise, product reliability, and a wide range of customizable options tailored to individual patient needs. Expanding global distribution networks and partnerships with hospitals, clinics, and rehabilitation centers support broader market reach and improved access to care. The competitive landscape is also influenced by the pursuit of regulatory approvals and adherence to international quality standards, ensuring product safety and performance. Organizations in this sector often engage in mergers, acquisitions, and strategic alliances to accelerate innovation and diversify product portfolios. This intense focus on technological advancement and patient-centered design continues to drive the evolution of the market and sustain its long-term growth trajectory.

Recent Developments

- In March 2024, the USA Army Medical Research and Development Command announced the adoption of the FastCast spray foam cast for rehabilitation exoskeletons. This innovation allows for rapid immobilization of injured limbs, enhancing mobility and recovery for injured Warfighters in combat situations, addressing limitations of traditional splints.

- In November, 2024, the Department of Empowerment of Persons with Disabilities (DEPwD) launched a nationwide awareness campaign on prosthetic and orthotic devices for the Divyangjan community. Following International Prosthetics and Orthotics Day, the initiative aims to enhance mobility and quality of life through various programs across India.

- In October, 2024, Imaginarium announced the successful use of its customized 3D printed orthotic device in aiding the recovery of 15-year-old Anamta Ahmad, the youngest recipient of a shoulder-level hand transplant. This innovative device enhances post-surgery care, offering precise customization and comfort, significantly improving the recovery process.

- In February, 2024, Hanger Inc. announced the acquisition of Fillauer, a global manufacturer in the orthotic and prosthetic (O&P) industry. This strategic move aims to enhance Hanger’s O&P ecosystem by integrating Fillauer’s manufacturing capabilities in the USA and Europe. Hanger, with its extensive network of clinics and commitment to patient care, looks to leverage this acquisition to improve outcomes in the O&P field.

- In May, 2024, Polish startup Wimba announced a partnership with Intrauma to advance veterinary orthotics using HP’s Multi Jet Fusion 3D printing technology. This collaboration aims to enhance orthopedic interventions for pets by providing custom-fit, lightweight orthotic devices.

- In October 2023, Hanger, Inc., a prominent provider of Orthotic and Prosthetic (O&P) patient care services and solutions, announced the successful completion of its acquisition by Patient Square Capital, a leading healthcare-focused investment firm.

Market Concentration & Characteristics

The Orthosis System Market exhibits moderate to high market concentration, with a handful of established global players commanding a significant share of total revenue. It features a landscape defined by robust technological innovation, frequent new product introductions, and strong focus on research and development. Companies differentiate themselves through product quality, technological advancements, and their ability to deliver customized solutions tailored to various patient needs. The market demonstrates strong regulatory oversight, driving adherence to stringent quality and safety standards across regions. It reflects high barriers to entry due to the requirement for specialized expertise, advanced manufacturing capabilities, and ongoing compliance with international certifications. Market characteristics include an increasing emphasis on digital health integration, rising adoption of patient-specific orthoses, and the expansion of distribution networks to both traditional clinical environments and homecare settings. The Orthosis System Market continues to adapt to evolving clinical demands, supporting its long-term growth and the advancement of rehabilitative care.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market growth will accelerate through integration of wearable sensors and real-time data analytics into orthosis devices.

- Manufacturers will increase investments in 3D printing to offer fully customized orthosis solutions.

- Home-based rehabilitation and telehealth usage will expand access to orthosis care outside clinical settings.

- Demand will rise for pediatric and sports-specific orthosis solutions designed to meet unique biomechanical requirements.

- Eco-friendly and bio-based materials will gain prominence in orthosis device design and production.

- Collaboration between technology firms and orthosis manufacturers will accelerate digital health innovations.

- Regulatory frameworks will evolve to support faster approvals of smart and adaptive orthosis systems.

- Market players will pursue strategic partnerships and acquisitions to expand global distribution networks.

- Growing awareness of preventive and early intervention orthosis solutions will support market penetration in emerging regions.

- Workforce training and digital skill development will become a priority to support orthosis technology deployment.