Market Overview

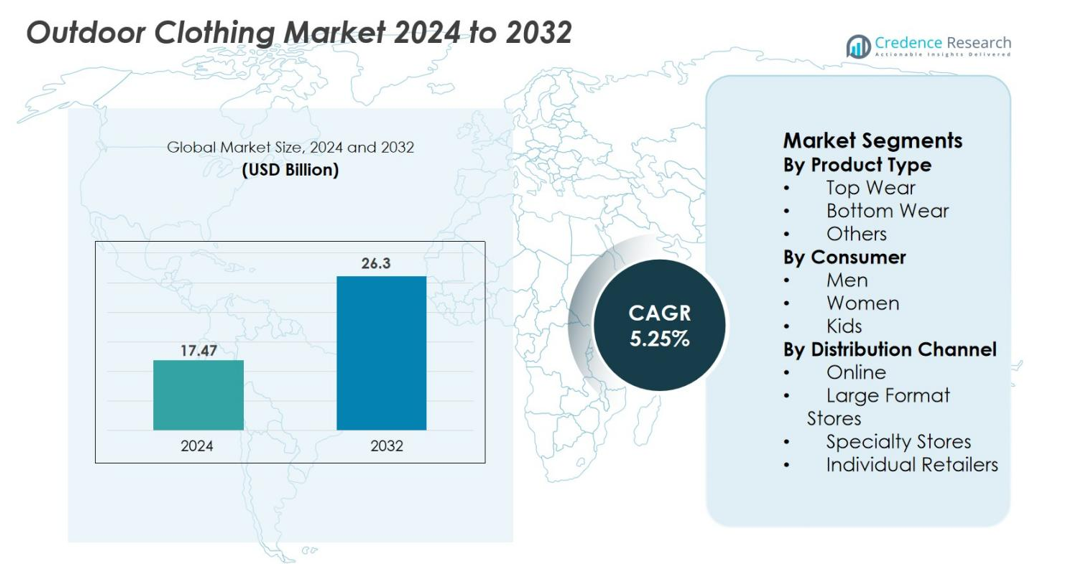

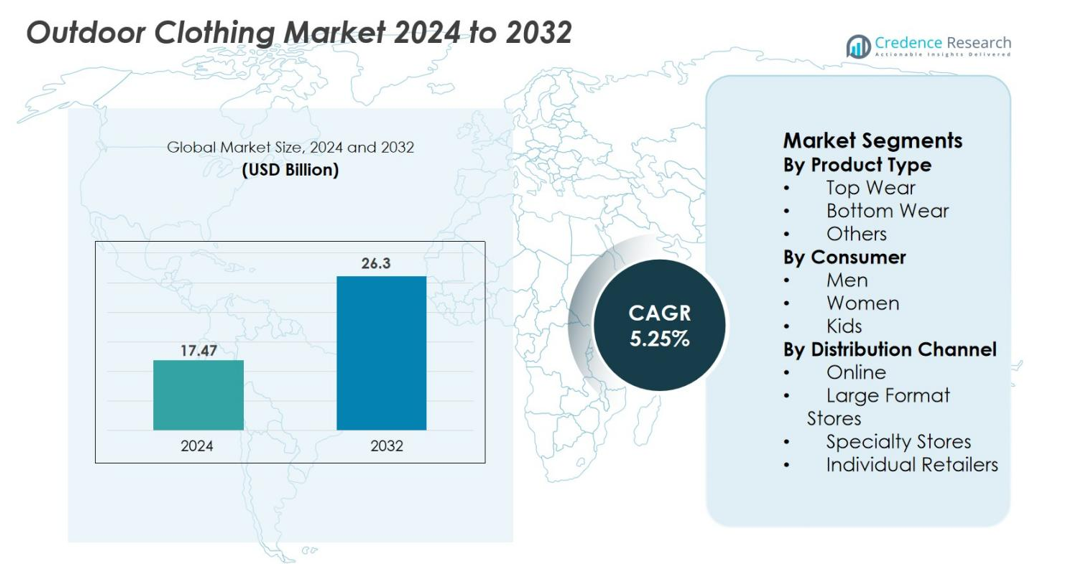

The Outdoor Clothing Market size was valued at USD 17.47 billion in 2024 and is anticipated to reach USD 26.3 billion by 2032, at a CAGR of 5.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Outdoor Clothing Market Size 2024 |

USD 17.47 billion |

| Outdoor Clothing Market, CAGR |

5.25% |

| Outdoor Clothing Market Size 2032 |

USD 26.3 billion |

The Outdoor Clothing Market features leading players such as VF Corporation, Columbia Sportswear Company, Patagonia, Inc., Adidas AG and Under Armour, Inc., which are driving innovation, sustainability and global brand exposure. VF Corporation alone holds around 14% of the market, and collectively these key players account for approximately 30% of market share, reflecting a moderately concentrated industry. Regionally, North America leads with a market share of about 35.88%, followed closely by Europe. These regions benefit from high disposable income, mature retail and e‑commerce infrastructures, and strong participation in outdoor activities, providing a robust foundation for growth and brand expansion.

Market Insights

- The Outdoor Clothing Market size is valued at USD 17.47 billion in 2024 and is expected to reach USD 26.3 billion by 2032, growing at a CAGR of 5.25% from 2025 to 2032.

- Increasing participation in outdoor recreational activities is a major driver, with more consumers seeking functional and high-performance apparel for activities like hiking and camping.

- Technological advancements in fabrics such as moisture-wicking, weather-resistant, and UV-protective materials are shaping market trends and driving consumer demand for innovative outdoor clothing.

- Price sensitivity in emerging markets and the rise of counterfeit products are key restraints impacting market growth and brand reputation, particularly in online retail.

- North America holds the largest market share at 35.88%, followed by Europe at 36%, with the Asia-Pacific region expected to witness the fastest growth, driven by rising incomes and outdoor tourism.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product Type

In the Outdoor Clothing Market, the Top Wear segment holds the largest share, accounting for 42.5% of the market in 2024. This dominance is driven by increasing demand for functional and stylish outdoor jackets, t-shirts, and hoodies. The segment benefits from consumer preferences for versatile, weather-resistant fabrics used in top wear, such as waterproof jackets and moisture-wicking layers, ideal for outdoor activities like hiking and camping. Bottom Wear and Other segments follow, capturing 35.3% and 22.2% shares, respectively, with growing innovation in lightweight, durable materials.

- For instance, Patagonia’s Nano Puff jacket uses 60-gram PrimaLoft Gold Insulation Eco, offering high warmth retention with minimal weight (284 grams for men’s medium).

By Consumer

The Men’s segment leads the Outdoor Clothing Market with a market share of 50.8% in 2024, driven by a growing inclination towards adventure sports and outdoor recreational activities among men. This segment benefits from the increasing popularity of performance-oriented activewear, especially in hiking, trekking, and skiing. Women’s outdoor clothing follows with a share of 35.4%, reflecting rising trends in active lifestyles and fashion-conscious outdoor wear. The Kids’ segment holds 13.8% of the market, as demand grows for high-quality, durable, and comfortable outdoor apparel for children.

- For instance, Patagonia’s Men’s R1 Air Hoody uses a 100% recycled polyester hollow-core yarn engineered to enhance airflow during high-output activities.

By Distribution Channel

The Online segment dominates the Outdoor Clothing Market, capturing 49.1% of the market share in 2024. The growth of e-commerce platforms is driven by consumer convenience and a broad range of product availability, with many brands offering direct-to-consumer services. Large Format Stores account for 30.2% of the market, providing a hands-on shopping experience for outdoor apparel enthusiasts. Specialty Stores and Individual Retailers represent smaller portions, with shares of 12.5% and 8.2%, respectively, as they cater to niche, high-quality outdoor apparel markets.

Key Growth Drivers

Increasing Participation in Outdoor Activities

The growing interest in outdoor recreational activities such as hiking, camping, and trekking is a major growth driver for the Outdoor Clothing Market. As consumers become more health-conscious and seek ways to connect with nature, the demand for functional and durable outdoor apparel has surged. This shift in lifestyle preferences, combined with a desire for high-performance gear, fuels the market’s expansion. The increasing number of outdoor events and tourism activities further amplifies the need for specialized clothing, driving continuous market growth.

- For instance, according to Strava’s 2023 activity report, users recorded over 2.1 billion outdoor activities worldwide, reflecting a significant growth in hiking and trail usage.

Technological Advancements in Fabrics

Innovation in fabric technology has significantly contributed to the growth of the Outdoor Clothing Market. The development of lightweight, weather-resistant, moisture-wicking, and UV-protective materials has boosted consumer confidence in outdoor apparel. As manufacturers introduce more advanced textiles that enhance performance and comfort, including breathable and temperature-regulating fabrics, outdoor clothing becomes more appealing for diverse conditions and environments. These advancements continue to cater to the specific needs of outdoor enthusiasts, driving demand for innovative, high-tech gear across the market.

- For instance, Gore-Tex Pro fabric used by Arc’teryx incorporates a 3-layer membrane engineered to withstand over 28,000 mm of water column pressure, offering extreme waterproof durability.

Rising E-commerce and Direct-to-Consumer Models

The rapid growth of e-commerce and direct-to-consumer sales channels has played a pivotal role in the expansion of the Outdoor Clothing Market. Online platforms provide consumers with a wide range of products and the convenience of shopping from home, driving increased sales. Brands are investing heavily in their digital presence and offering personalized experiences, including size guides and virtual try-ons, to meet growing consumer demand. This shift toward online retail is projected to continue dominating the market, enabling easier access to outdoor clothing across various demographics.

Key Trends & Opportunities

Sustainability and Eco-friendly Clothing

Sustainability has become a key trend in the Outdoor Clothing Market, with consumers increasingly demanding eco-friendly products. Brands are responding by using recycled materials, sustainable production processes, and reducing carbon footprints. This shift towards sustainability presents a significant opportunity for growth, as environmentally conscious consumers seek brands that align with their values. The growing popularity of eco-conscious outdoor apparel, such as jackets made from recycled plastic bottles and biodegradable fabrics, creates new opportunities for market players to attract eco-conscious consumers.

- For instance, Patagonia reports that 90% of its polyester clothing is made from recycled polyester, diverting over 27,000 metric tons of plastic waste from landfills since 1993.

Customization and Personalized Outdoor Gear

Personalized outdoor clothing is gaining popularity as consumers seek more individualized products that cater to specific needs, such as customized fit, design, or features. Advancements in technology enable outdoor brands to offer tailored experiences, from personalized sizing to adjustable components and unique style preferences. This trend creates opportunities for brands to differentiate themselves in a competitive market by offering customized outdoor gear that aligns with the active and adventurous lifestyles of their target audiences.

- For instance, 3DLOOK launched its “3D Body Scanning Lab” which collects over 1 million data‐points per scan (covering measurements, textures and positions) to enable advanced fit and sizing solutions for apparel brands.

Key Challenges

Price Sensitivity in Price-Conscious Markets

One of the main challenges in the Outdoor Clothing Market is price sensitivity, especially in emerging markets where consumers are more price-conscious. High-quality, performance-oriented outdoor apparel often comes with a premium price tag, which can deter potential buyers. As demand for affordable yet durable outdoor clothing rises, manufacturers face pressure to balance cost with quality. Competing on price without compromising on quality while maintaining profit margins remains a challenge for many players in the market.

Counterfeit Products and Brand Reputation

The rise of counterfeit products in the outdoor apparel sector poses a significant challenge to established brands. Imitation products often compromise quality and durability, negatively impacting consumer trust and brand reputation. As more counterfeit items flood online marketplaces and retail stores, consumers may struggle to distinguish between authentic and fake products. This can lead to reduced sales for legitimate brands and affect long-term growth. Combatting counterfeiting through improved quality control and stronger intellectual property protection measures remains an ongoing challenge for companies in the sector.

Regional Analysis

North America

In 2024, the Outdoor Clothing Market in North America accounted for approximately 35.88% of the global market share, making it the largest regional contributor. The region’s mature outdoor lifestyle, high disposable incomes, and strong participation in activities like hiking and camping support demand for premium technical apparel. Innovation in weather‑resistant fabrics and a robust online retail ecosystem further boost growth. Brands are focusing on sustainability initiatives and inclusive sizing to align with evolving consumer expectations, reinforcing the region’s leadership position.

Europe

Europe held an estimated market share of 36% in the global outdoor clothing sector in 2024, positioning it as a close second in regional contribution. The region benefits from strong alpine traditions, diverse climate conditions, and a high level of consumer interest in performance‑led and sustainable apparel. Urban‑outdoor crossover trends and stringent environmental regulations drive the adoption of recycled materials and circular design. Retailers and brands in Europe emphasise heritage outdoors credentials while adapting to evolving lifestyle demands in both northern and southern markets.

Asia‑Pacific

Asia‑Pacific captured around 20% of the global outdoor clothing market share in 2024 and is projected to deliver the fastest growth over the forecast period. The surge is driven by expanding middle‑class incomes, increased outdoor tourism and recreation, rapid urbanisation, and a strong shift to mobile‑first e‑commerce. Market entrants are tailoring product lines to local climates and cultural preferences, while leveraging partnerships with regional clubs and influencers. Brands investing in localisation of fit, climate‑specific fabrics, and omnichannel engagement are best positioned in this region’s rising market.

Latin America

The Latin American region currently contributes a smaller share of the outdoor clothing market, with market reports estimating near 5% of global share in 2024. Growth in this region is fueled by increasing outdoor adventure tourism, rising health‑ and fitness‑driven consumption, and expansion of branded retail through online channels. However, challenges such as lower per‑capita spend and infrastructural limitations temper speed of expansion. Targeted strategies that deliver value and durability in humid and varied tropical conditions present meaningful opportunities.

Middle East & Africa

In 2024, the Middle East & Africa region also accounted for approximately 5% of the global outdoor clothing market share. The region’s growth is propelled by adventure travel, tourism focused on desert and coastal outdoor experiences, and increasing participation in outdoor recreation. Localised needs such as UV‑protection fabrics, lightweight layering and seasonal resort apparel are gaining traction. Distribution relies heavily on curated specialist stores and e‑commerce frameworks, and brands focusing on climate‑relevant product innovation and region‑specific marketing are gaining ground in this emerging market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations

By Product Type

- Top Wear

- Bottom Wear

- Others

By Consumer

By Distribution Channel

- Online

- Large Format Stores

- Specialty Stores

- Individual Retailers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Outdoor Clothing Market features major key players such as VF Corporation, Columbia Sportswear Company, Patagonia, Inc., Adidas AG, and Under Armour, Inc., among others. These companies lead through diversified brand portfolios, global distribution networks, and a strong emphasis on innovation and sustainability. VF Corporation, for example, holds a market share of roughly 14% and actively expands through mergers and acquisitions, strengthening its position through brands like The North Face and Timberland. The market remains moderately fragmented, however, with the top players collectively accounting for around 30% of the total market, leaving ample room for niche and regional specialists. Competitive strategies focus on high‑performance fabrics, sustainability credentials, omnichannel retailing, and D2C models. Companies invest heavily in direct e‑commerce, rapid prototyping of weather‑resistant materials, and consumer engagement via social media. Collaboration with athletes and outdoor influencers has become a tactic to elevate brand credibility. Regional expansion into Asia‑Pacific and Latin America is accelerating, and partnerships with local outdoor clubs and eco‑initiatives serve to cultivate brand loyalty.

Key Player Analysis

Recent Developments

- In November 2025, Peak Performance (Sweden) launched the “R&D Helium Loop Anorak” in partnership with ALLIED Feather + Down, NetPlus and Resortecs, a circular-economy focused initiative to create a fully recyclable high-performance jacket.

- In November 2025, Klättermusen (Sweden) acquired its long-standing South Korean distributor AYL (established 2016) and established “Klättermusen Korea” to accelerate regional expansion.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Consumer, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand as global participation in outdoor and adventure‑based activities increases and drives demand for specialised apparel.

- Sustainability demands will push brands to adopt recycled and eco‑friendly materials more widely, thereby reshaping product portfolios in the market.

- Performance‑led innovation in fabrics (such as moisture‑wicking, weather‑proofing and temperature‑regulating textiles) will become a key differentiator for leading players.

- Online channels will increasingly dominate distribution, enabling direct‑to‑consumer models, faster market reach and global penetration by outdoor apparel brands.

- Growth in emerging regions such as Asia‑Pacific will outpace mature markets, as rising disposable incomes and outdoor tourism stimulate demand in these areas.

- Demand for lifestyle‑driven outdoor clothing (blending fashion and function) will drive collaborations between outdoor specialists and mainstream fashion brands.

- Multi‑channel retail strategies integrating physical stores, online platforms and mobile commerce will be critical for capturing consumer engagement and loyalty.

- Customisation and personalisation of outdoor wear (fit, features, region‑specific styles) will offer new value streams and competitive advantage for market entrants.

- Supply‑chain resilience and cost management will become increasingly important as raw‑material volatility and trade disruptions challenge margins across the industry.

- Brands that successfully combine high performance, ethical practices and appealing aesthetics will capture a larger share of the market as consumer expectations evolve.