Market Overview:

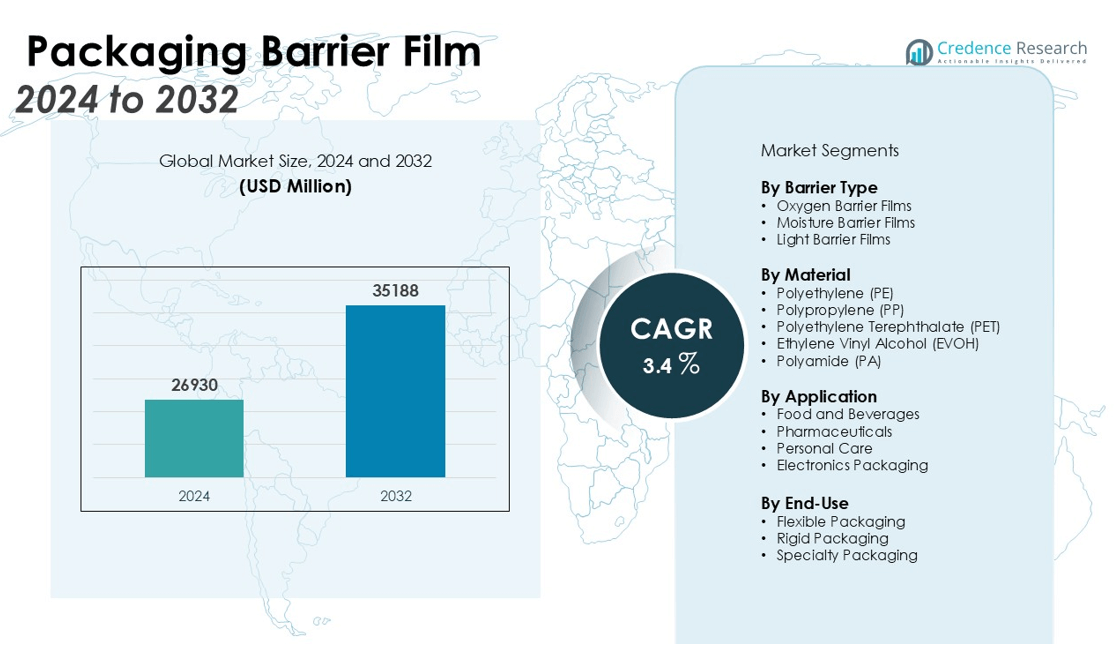

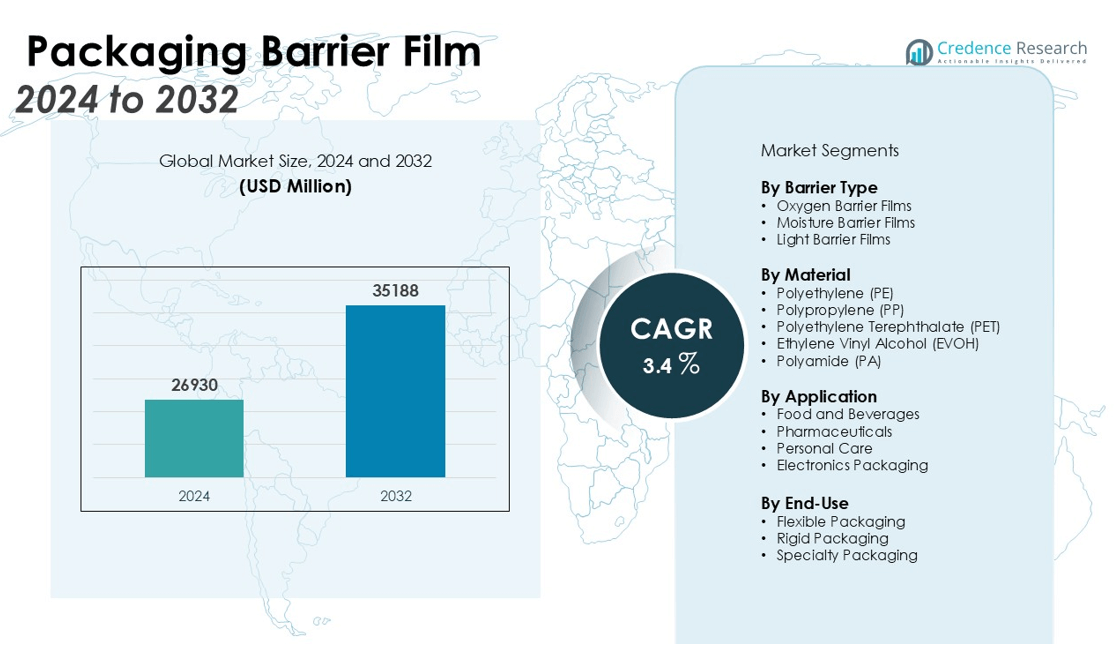

The Packaging Barrier Film Market size was valued at USD 26930 million in 2024 and is anticipated to reach USD 35188 million by 2032, at a CAGR of 3.4% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Barrier Film Market Size 2024 |

USD 26930 million |

| Packaging Barrier Film Market, CAGR |

3.4% |

| Packaging Barrier Film Market Size 2032 |

USD 35188 million |

Key drivers of the Packaging Barrier Film Market include the growing consumer demand for packaged food and beverages, rising health consciousness, and the need for sustainable, eco-friendly packaging solutions. The shift towards flexible packaging formats and the advancements in barrier film technologies, such as the development of multi-layer films, have further contributed to the market’s growth. Additionally, the rising adoption of barrier films in pharmaceuticals, electronics, and personal care sectors is expected to propel demand. The increasing focus on reducing food waste and enhancing product protection is also driving the market forward.

Regionally, North America holds the largest share of the Packaging Barrier Film Market, driven by the strong presence of key market players and high demand in the food and beverage industry. Europe follows closely, supported by stringent regulatory standards for food safety and sustainability. The Asia-Pacific region is expected to exhibit the highest growth rate, driven by rapid urbanization, industrialization, and increasing consumer preference for packaged goods in countries like China and India. Furthermore, the region’s expanding e-commerce sector is also contributing to the growing demand for advanced packaging solutions.

Market Insights:

- The Packaging Barrier Film Market was valued at USD 26,930 million in 2024 and is projected to reach USD 35,188 million by 2032, with a 3.4% CAGR during the forecast period.

- Key drivers include increasing consumer demand for packaged food and beverages, rising health consciousness, and a shift towards sustainable packaging solutions.

- Technological advancements, especially in multi-layer films, are enhancing product preservation, which fuels market growth.

- Adoption of barrier films in pharmaceuticals, personal care, and electronics sectors is driving additional demand.

- North America holds a 35% market share, with high demand from the food and beverage industry and stringent regulatory standards.

- Europe commands a 30% market share, driven by regulatory frameworks and growing demand for eco-friendly packaging solutions.

- The Asia-Pacific region, with a 25% share, is expected to exhibit the highest growth rate, supported by urbanization, increasing disposable incomes, and expanding e-commerce.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Packaged Food and Beverages

The increasing demand for packaged food and beverages is a key driver for the Packaging Barrier Film Market. With rising consumer preference for convenience, packaged foods provide extended shelf life and protection from contaminants. Packaging barrier films play a critical role in preserving the freshness, taste, and nutritional value of food products, which drives their adoption. The market sees significant demand from the ready-to-eat and on-the-go food sectors, which require high-quality, moisture-resistant packaging.

- For instance, Amcor’s retort high-barrier polyolefin film achieves oxygen barrier performance of less than 1cc/m²/day and moisture barrier below 1g/m²/day after retort processing, which matches the top performing non-recyclable PET barrier films and has been adopted in ready meal and snack packaging.

Focus on Health Consciousness and Food Safety

Heightened health awareness among consumers has led to a preference for products that are packaged in a way that preserves their nutritional integrity. Barrier films are crucial in preventing the exposure of food to oxygen, moisture, and light, all of which can degrade quality and nutrition. Packaging barrier films help retain vitamins, minerals, and flavor, which is essential for the growing health-conscious market. These films are increasingly used to package organic, fresh, and natural foods that require superior protection from environmental factors.

Sustainability and Eco-Friendly Packaging Solutions

There is a growing emphasis on sustainability in packaging materials, which is propelling the Packaging Barrier Film Market. Consumers and industries are focusing on eco-friendly, recyclable, and biodegradable packaging options. Barrier films made from recyclable materials like PET and PE are gaining traction due to their lower environmental impact. This trend aligns with global efforts to reduce plastic waste, further boosting the adoption of sustainable barrier film solutions in various sectors.

Technological Advancements in Packaging Materials

Technological innovations in the development of multi-layer barrier films have significantly improved the performance of packaging materials. These advancements enhance the protection of products by offering superior barrier properties such as moisture, oxygen, and aroma resistance. The continuous improvement of barrier films through better polymer combinations and manufacturing processes strengthens the packaging’s protective functions. This innovation is a key driver for the Packaging Barrier Film Market, as it meets the evolving demands of industries such as food and pharmaceuticals.

- For instance, Kuraray’s EVAL™ EVOH films enable a gas barrier equivalent to a 10-meter wall of LDPE with just 1mm thickness, providing robust oxygen and aroma resistance for food packaging.

Market Trends:

Rising Adoption of Flexible and Multi-Layer Barrier Films

One of the key trends in the Packaging Barrier Film Market is the increasing adoption of flexible and multi-layer films. These films offer superior protection compared to traditional materials, allowing for better resistance to moisture, oxygen, and light. They provide enhanced durability, lightweight packaging, and the ability to customize packaging formats, which is particularly beneficial for industries like food and beverages. The shift toward flexible packaging formats, including pouches, films, and bags, is gaining momentum due to their cost-effectiveness and ease of use. Multi-layer barrier films, which combine different polymers, are also becoming more popular for their ability to extend product shelf life while maintaining product quality. These innovations meet the growing consumer demand for convenient and safe packaging solutions.

- For instance, Dow has developed and commercialized barrier film structures that can be used in cheese packaging, enabling the preservation of natural cheese in packaging film for at least 60 days during aging, supporting both food safety and quality during ambient storage.

Sustainability and Eco-Friendly Innovations in Packaging Solutions

Sustainability is a prominent trend influencing the Packaging Barrier Film Market, with increasing demand for eco-friendly packaging solutions. Manufacturers are focusing on developing barrier films using recyclable, biodegradable, and compostable materials to reduce the environmental footprint. As environmental concerns grow, packaging companies are shifting away from traditional plastic materials towards alternative options like bio-based films and films with improved recyclability. Consumer preference for sustainable products is pushing brands to invest in packaging that aligns with green initiatives. The ongoing developments in eco-friendly barrier films contribute to the market’s growth, offering a balance between protecting products and reducing environmental impact.

- For instance, SP Group and Nurel Biopolymers have collaborated on a compostable multilayer film based on INZEA biopolymers that has high oxygen barrier properties and meets the OK compost INDUSTRIAL certification, completely biodegrading after 3 months according to EN 13432 and ASTM 6400 standards.

Market Challenges Analysis:

High Production Costs and Raw Material Prices

One of the significant challenges in the Packaging Barrier Film Market is the high production costs associated with these specialized films. Manufacturing multi-layer barrier films requires advanced technology and the use of premium raw materials, such as polyethylene (PE), polypropylene (PP), and ethylene vinyl alcohol (EVOH). These materials are often more expensive than traditional packaging options, which increases the overall cost of production. As the demand for high-performance barrier films grows, so does the pressure on manufacturers to balance cost-efficiency with product quality. The fluctuating prices of raw materials further complicate the pricing strategy for manufacturers, which could limit market growth, especially in cost-sensitive regions or industries.

Regulatory Challenges and Compliance Issues

The Packaging Barrier Film Market also faces regulatory challenges that can hinder its growth. The packaging industry is subject to stringent regulations related to food safety, environmental impact, and sustainability. Different regions have varying standards for packaging materials, which can complicate the global distribution of barrier films. For instance, some markets have strict requirements for the recyclability and biodegradability of packaging materials. Complying with these regulations requires significant investments in research, development, and certification, which may burden smaller manufacturers. These compliance challenges can slow down innovation and market penetration, particularly for emerging players in the industry.

Market Opportunities:

Growing Demand for Sustainable Packaging Solutions

The increasing global shift towards sustainability presents significant opportunities for the Packaging Barrier Film Market. Consumers and industries are prioritizing eco-friendly packaging solutions, driving demand for recyclable and biodegradable barrier films. Packaging manufacturers are investing in research and development to create sustainable alternatives that meet consumer preferences and environmental standards. The rising focus on reducing plastic waste and improving the recyclability of packaging materials provides a robust growth avenue for the market. With increasing awareness and regulatory pressure to adopt sustainable practices, barrier films that offer superior environmental benefits are well-positioned to capture market share in various sectors, including food and beverages, pharmaceuticals, and personal care.

Technological Advancements and Innovation in Barrier Film Solutions

Ongoing technological advancements in the Packaging Barrier Film Market present another growth opportunity. Innovations in multi-layer film technologies, such as the development of high-performance films with enhanced barrier properties, create new possibilities for various applications. Manufacturers are continuously improving the functionality of barrier films to offer better protection, longer shelf life, and more customization options. These advancements are particularly beneficial for industries like pharmaceuticals and electronics, where product integrity is critical. The integration of new materials and manufacturing processes can further enhance the performance of barrier films, creating opportunities for market expansion in both established and emerging industries.

Market Segmentation Analysis:

By Barrier Type

The market is classified into oxygen barrier, moisture barrier, and light barrier films. Oxygen barrier films dominate the market due to their essential role in preventing oxygen infiltration, which is critical for extending the shelf life of food and beverages. Moisture barrier films are also in high demand, especially for packaging applications that require protection from water and humidity. Light barrier films are gaining traction for their ability to protect sensitive products from UV light exposure, which can degrade quality.

- For instance, Vitex Systems’ Barix™ multilayer barrier coating provides more than 1,000 hours of protection for flexible display substrates at 60°C and 90% RH without UV degradation or performance drop.

By Material

The market is divided into polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and other materials such as ethylene vinyl alcohol (EVOH) and polyamide (PA). PET holds the largest share due to its excellent barrier properties, strength, and recyclability, making it a preferred choice for food and beverage packaging. PE and PP are commonly used in flexible packaging formats due to their cost-effectiveness and versatility, while EVOH is favored in high-performance applications where superior barrier properties are required.

- For instance, Dow and Procter & Gamble China collaborated on a mono-PE air capsule for e-commerce, with the design enabling a reduction of 40 kilograms in packaging weight for every 100 kilograms traditionally used.

By Application

Key applications of barrier films include food and beverages, pharmaceuticals, personal care, and electronics packaging. The food and beverage sector leads the market, as barrier films are crucial for preserving product quality and extending shelf life. The pharmaceuticals industry follows, as barrier films ensure the integrity and safety of medicines. The growing demand for e-commerce and consumer goods packaging has also driven the adoption of barrier films across various applications.

Segmentations:

By Barrier Type

- Oxygen Barrier Films

- Moisture Barrier Films

- Light Barrier Films

By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Ethylene Vinyl Alcohol (EVOH)

- Polyamide (PA)

By Application

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Electronics Packaging

By End-Use

- Flexible Packaging

- Rigid Packaging

- Specialty Packaging

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds a 35% share of the global Packaging Barrier Film Market. This dominance is attributed to the strong presence of key industry players and high demand from the food and beverage sector. The region’s well-established packaging industry, coupled with robust consumer demand for convenience and product quality, drives the need for advanced barrier films. Regulatory standards for food safety and packaging sustainability are also stricter in North America, encouraging the adoption of barrier films that meet these requirements. The presence of major manufacturing and packaging companies further contributes to North America’s leadership, with a growing trend toward sustainable packaging solutions that align with consumer preferences for eco-friendly products.

Europe

Europe commands a 30% share of the global Packaging Barrier Film Market, driven by stringent regulatory frameworks and a growing demand for sustainable packaging solutions. The European Union has set high standards for packaging materials, including recycling and waste reduction, which pushes manufacturers to adopt more advanced and eco-friendly packaging technologies. The food and beverage, pharmaceutical, and personal care sectors are significant contributors to the demand for barrier films, as they require high-performance materials to ensure product safety and quality. With increased consumer awareness of environmental issues, the European market is also seeing a rise in demand for recyclable and biodegradable barrier films.

Asia-Pacific

The Asia-Pacific region holds a 25% share of the global Packaging Barrier Film Market, expected to exhibit the highest growth rate during the forecast period. The region’s rapid urbanization, increasing disposable incomes, and growing consumer preference for packaged goods contribute to the rising demand for barrier films. China and India are key markets, where the food and beverage sector, in particular, is experiencing significant expansion. The growing e-commerce industry also fuels the need for packaging solutions that ensure product protection and long shelf life. With rising industrialization and an expanding middle class, the Asia-Pacific region presents substantial opportunities for packaging barrier film manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Linpac Packaging Ltd.

- Clondalkin Group Holdings B.V.

- Mondi Plc

- Ampac Holdings, LLC

- Schur Flexibles Holding GmbH

- Huhtamaki Oyj

- Uflex Ltd.

- Plastissimo Film Co., Ltd.

- Bischof & Klein GmbH

- Accredo Packaging, Inc.

- Winpak Ltd.

- Atlantis Pal Co. Ltd.

- Glenroy, Inc.

Competitive Analysis:

The Packaging Barrier Film Market is highly competitive, with several key players striving to enhance their market presence through technological advancements, product innovation, and strategic partnerships. Major companies such as Amcor Plc, Sealed Air Corporation, and Dow Inc. dominate the market due to their extensive product portfolios and strong research and development capabilities. These players focus on developing high-performance barrier films that offer superior protection against moisture, oxygen, and light, catering to the growing demand for food safety, pharmaceuticals, and sustainable packaging solutions. Smaller companies and emerging players are also gaining traction by offering customized, eco-friendly alternatives that meet regional consumer preferences and regulatory standards. Competitive strategies in the market include mergers and acquisitions, as well as expanding manufacturing capabilities to meet the rising demand for flexible and sustainable packaging. The increasing emphasis on reducing environmental impact also drives companies to adopt recyclable and biodegradable materials.

Recent Developments:

- In July 2024, Mondi entered a strategic partnership with CMC Packaging Automation, becoming the preferred kraft paper supplier for CMC’s advanced e-commerce packaging systems, with a focus on jointly developing sustainable on-demand paper-based packaging.

- In July 2025, Huhtamaki launched new compostable ice cream cups that are both home and industrially compostable and recyclable, made with certified paperboard and bio-based coatings while keeping plastic content below 10%.

- In November 2024, Winpak entered a strategic partnership with Advantek (for precision component packaging solutions) and collaborated with NOVA Chemicals to integrate post-consumer recycled polyethylene into Winpak’s flexible packaging, further supporting circular economy goals.

Market Concentration & Characteristics:

The Packaging Barrier Film Market is moderately concentrated, with a few major players commanding a significant share. Leading companies such as Amcor Plc, Sealed Air Corporation, and Dow Inc. hold a dominant position, leveraging advanced technology and extensive distribution networks to maintain market leadership. These companies invest heavily in research and development to create high-performance barrier films that meet diverse consumer demands, particularly in food, beverage, and pharmaceutical packaging. Smaller, regional players focus on specialized solutions, including eco-friendly and customizable barrier films, targeting niche markets. The market is characterized by strong competition, driven by ongoing product innovation, sustainability trends, and the increasing demand for flexible, high-quality packaging materials. The growing focus on environmentally friendly packaging solutions is reshaping the competitive landscape, with companies prioritizing recyclability and biodegradability to meet both consumer preferences and regulatory requirements.

Report Coverage:

The research report offers an in-depth analysis based on Barrier Type, Material, Application, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Packaging Barrier Film Market is expected to see continued growth due to the increasing demand for high-performance packaging solutions across various industries.

- Technological advancements in multi-layer and coextruded films are improving barrier properties, leading to better product preservation and extended shelf life.

- Sustainable packaging solutions, including recyclable and biodegradable films, are becoming more prevalent due to environmental concerns and regulatory pressures.

- The food and beverage sector will remain the largest application area, with consumers opting for flexible and convenient packaging formats.

- The pharmaceutical industry is rapidly adopting barrier films to ensure the integrity and safety of drugs and medical products.

- The Asia-Pacific region will experience the highest growth rate, driven by urbanization, rising disposable incomes, and expanding manufacturing capabilities in countries like China and India.

- North America and Europe will continue to lead the market, supported by stringent regulations and strong consumer demand for high-quality packaging solutions.

- The growth of e-commerce will increase demand for protective packaging solutions, ensuring product safety during transit and delivery.

- Key industry players are focused on expanding their product portfolios and market reach through strategic partnerships, mergers, and acquisitions.

- Research into smart and active packaging technologies will drive future innovation in the barrier film market, offering new solutions for packaging sustainability and functionality.