Market Overview:

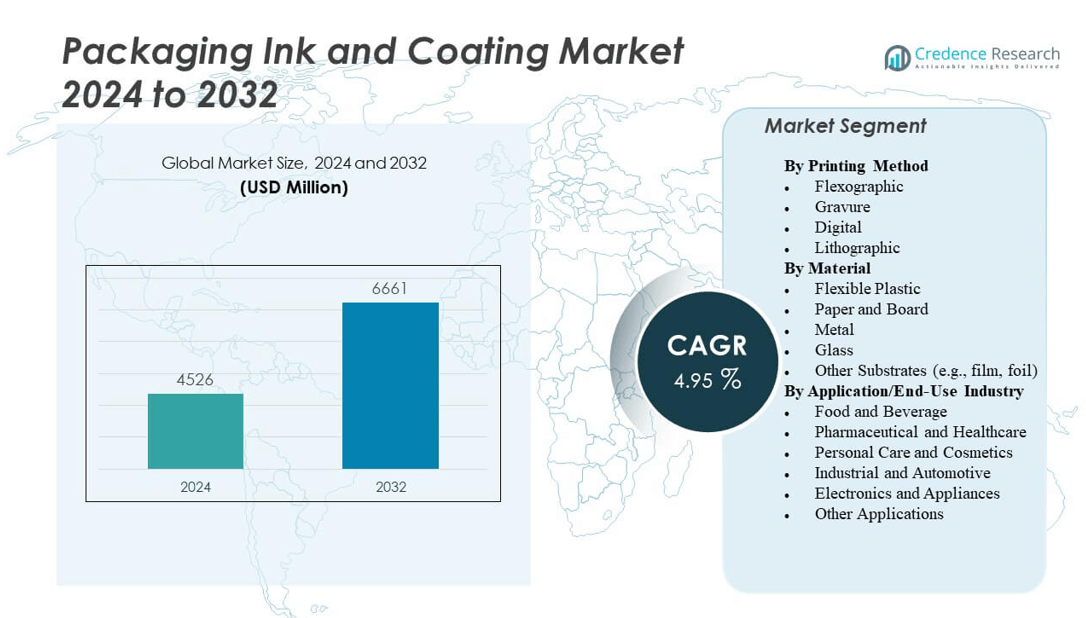

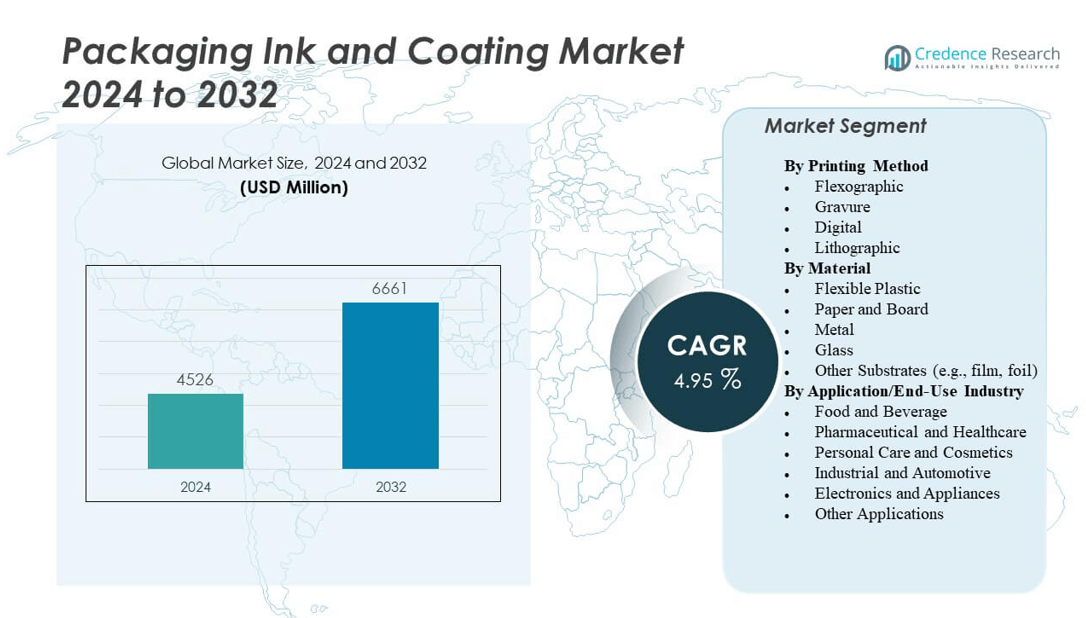

The Packaging Ink and Coating Market is projected to grow from USD 4526 million in 2024 to an estimated USD 6661 million by 2032, with a compound annual growth rate (CAGR) of 4.95% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Ink and Coating Market Size 2024 |

USD 4526 million |

| Packaging Ink and Coating Market, CAGR |

4.95% |

| Packaging Ink and Coating Market Size 2032 |

USD 6661 million |

Growth in the Packaging Ink and Coating Market is primarily driven by increasing demand for sustainable and visually appealing packaging across industries such as food and beverage, pharmaceuticals, and personal care. Brands are focusing on product differentiation and shelf appeal, which is accelerating the adoption of innovative ink and coating technologies. Moreover, regulations encouraging the use of low-VOC and biodegradable materials are pushing manufacturers to develop eco-friendly formulations. The rise of e-commerce has also created new packaging requirements that support protective and decorative printing solutions.

Geographically, Asia-Pacific leads the Packaging Ink and Coating Market due to its strong manufacturing base, high packaging consumption, and growing retail and e-commerce sectors, especially in China and India. North America and Europe follow closely, driven by innovation, sustainability goals, and stringent environmental standards. Meanwhile, Latin America and the Middle East & Africa are emerging as promising markets with expanding industrial activity, increasing urbanization, and growing consumer demand for packaged goods. These regions are witnessing infrastructure improvements and foreign investments that support the growth of printing and packaging industries.

Market Insights:

- The Packaging Ink and Coating Market was valued at USD 4526 million in 2024 and is projected to reach USD 6661 million by 2032, growing at a CAGR of 4.95%.

- Strong demand from the food and beverage industry drives growth, supported by the need for safe, visually appealing, and regulatory-compliant packaging.

- Expansion of e-commerce and retail packaging fuels the need for durable, print-stable inks and coatings that withstand handling and transit.

- Environmental concerns and VOC regulations push manufacturers toward water-based, bio-based, and UV-curable ink technologies.

- Volatility in raw material prices and global supply chain disruptions hinder consistent production and pricing stability.

- Asia Pacific leads the market with 41% share due to high packaging consumption and manufacturing capacity in countries like China and India.

- North America and Europe remain strong markets, with regulatory innovation and premium packaging trends shaping product development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Surge in Demand from Food and Beverage Packaging Applications

The growing global consumption of packaged food and beverages is a major factor fueling the Packaging Ink and Coating Market. Manufacturers are seeking advanced inks and coatings that enhance visual appeal and ensure product safety. Brands are increasingly customizing their packaging to attract consumer attention in retail environments. Food-grade coatings that resist moisture and maintain print quality are witnessing higher adoption. Regulatory emphasis on food safety is prompting the use of non-toxic, compliant packaging materials. The trend toward convenience food and single-serve packaging boosts demand for flexible packaging inks. It supports vibrant, long-lasting, and safe labeling. The Packaging Ink and Coating Market is experiencing strong growth due to its alignment with these industry shifts.

- For example, BASF’s JONCRYL HPB 1631‑A, launched in North America and Europe, is a water‑based copolymer emulsion that delivers a moisture vapor transmission rate (MVTR) barrier of just 7 g/m²/day—representing a 73% reduction compared to the 26 g/m²/day of conventional polyethylene‑extruded board

Expansion of E-commerce and Retail Packaging Needs

The rise in e-commerce sales has driven demand for robust and aesthetically pleasing packaging solutions. Retailers require inks and coatings that withstand logistics stress while retaining branding clarity. Coatings that enhance abrasion resistance and barrier properties are being integrated into shipping packages. Custom prints for promotions and returns are also becoming standard. Brands are investing in digitally printed packaging for agile marketing and regional customization. Ink systems compatible with variable data printing and short-run jobs are gaining traction. The Packaging Ink and Coating Market plays a critical role in supporting e-commerce packaging evolution. It continues to advance alongside retail fulfillment trends.

- For example, Ball Corporation’s Dynamark technology allows for individualization at scale, supporting agile promotion campaigns, regional customization, and robust branding on metal cans via digitally enabled, high-definition processes.

Growth in Sustainable and Eco-Friendly Packaging Initiatives

Growing environmental concerns are pushing industries to shift toward eco-friendly inks and coatings. Water-based and UV-curable inks are replacing solvent-based systems due to lower VOC emissions. Biodegradable coatings are gaining acceptance for use in paper-based packaging. Consumer pressure for recyclable and compostable materials is influencing packaging design. Regulatory frameworks in Europe and North America are guiding the transition to sustainable packaging components. Inks with natural pigments and reduced chemical content are being prioritized. The Packaging Ink and Coating Market is aligning with these goals by offering green alternatives without compromising performance. It enables manufacturers to meet environmental and compliance standards.

Technological Innovations in Functional Coatings and Smart Packaging

The evolution of smart packaging has led to the integration of functional inks and coatings. Thermochromic, photochromic, and moisture-sensitive inks enhance interactivity and monitoring. Anti-microbial and anti-fog coatings improve product protection and shelf stability. Inkjet and digital printing technologies are enabling greater design flexibility and personalization. Advanced coatings improve heat resistance and scuff protection in high-demand sectors like pharmaceuticals. Intelligent labeling using RFID and QR codes relies on compatible ink systems. The Packaging Ink and Coating Market is driving these innovations to meet the demand for next-generation packaging. It supports functionality beyond aesthetics by enabling interactive and protective layers.

Market Trends:

Shift Toward Minimalistic and Transparent Packaging Aesthetics

Minimalistic design preferences are reshaping the packaging landscape across multiple sectors. Clean layouts, subtle color palettes, and transparency are becoming mainstream. Inks that provide a soft matte finish or subtle gloss are in high demand. Transparent and clear packaging enhances product visibility, influencing purchase behavior. Brands prefer subdued and premium-looking designs to reflect product quality. Coatings that support clarity and anti-yellowing characteristics enable these trends. The Packaging Ink and Coating Market adapts to these visual preferences with tailored formulations. It contributes to creating clean, modern packaging aligned with evolving consumer tastes.

Growth of Digital Printing and Customization Capabilities

Digital printing technologies are increasingly used in packaging due to their agility and cost-efficiency for short runs. Customization at scale is enabling brand differentiation and regional targeting. Inks compatible with digital workflows must dry quickly and adhere to various substrates. Demand for variable data printing and just-in-time production continues to rise. Digital-compatible coatings that enhance adhesion and durability are gaining relevance. The Packaging Ink and Coating Market supports this shift by enabling high-resolution, fast-curing solutions. It plays a pivotal role in accelerating the digital transformation of packaging lines.

- For example, DuPont’s launch of the Artistri® PN1000 series represents a benchmark in digital inkjet technology, utilizing proprietary low-viscosity, water-based pigments for fast drying and compatibility with high-speed commercial packaging lines.

Adoption of Metallic and Special-Effect Finishes in Premium Packaging

Luxury brands and premium product lines are turning to metallic and textured finishes to enhance shelf presence. Metallic inks, pearlescent coatings, and tactile effects offer differentiation in competitive categories. These finishes communicate quality and sophistication without relying on excess material. Advances in formulation have made these inks more sustainable and print-compatible. The trend is extending into sectors like cosmetics, spirits, and specialty foods. UV and water-based metallic systems offer safer alternatives to solvent-heavy counterparts. The Packaging Ink and Coating Market is addressing this demand with innovative finishes that balance performance and appeal. It enables enhanced visual and sensory packaging impact.

Integration of Interactive and Smart Labeling Technologies

Interactive packaging elements are being integrated into mainstream product categories. Brands are embedding QR codes, NFC tags, and augmented reality triggers into labels and cartons. Inks must be compatible with printing processes that support these elements. Coatings are tailored to avoid signal interference or reflection issues. Consumer engagement through connected packaging is gaining traction in both developed and emerging markets. These innovations support traceability, authentication, and marketing interactivity. The Packaging Ink and Coating Market aligns with these requirements by offering adaptable and durable printing solutions. It enables integration of technology into packaging without compromising quality.

- For example, INX International Ink Co. and similar firms supply ink formulations designed for smart label compatibility, ensuring signal integrity and facilitating printing of data-embedded elements such as QR codes, RFID, or NFC tags without sacrificing print quality.

Market Challenges Analysis:

Volatile Raw Material Costs and Supply Chain Disruptions

Fluctuating prices of key raw materials such as solvents, pigments, and resins are affecting manufacturing costs. Disruptions in the global supply chain have resulted in unpredictable lead times and sourcing difficulties. Price instability can reduce profit margins for both ink manufacturers and packaging producers. Rising costs of oil-based derivatives impact solvent-based inks significantly. Alternative materials often require new formulations and testing protocols. Smaller manufacturers struggle to absorb or transfer these additional costs. The Packaging Ink and Coating Market must navigate these risks by securing resilient supply networks. It also demands ongoing R&D investments to identify cost-effective alternatives.

Stringent Regulatory Compliance and Environmental Standards

Compliance with regional and international regulations on VOC emissions and hazardous substances presents a significant challenge. Meeting diverse regulatory standards across markets requires complex formulation strategies. Manufacturers must invest in reformulating legacy products to align with REACH, FDA, and other frameworks. Certification and testing processes extend time to market and increase development costs. Non-compliance risks include product recalls, reputational damage, and legal penalties. Maintaining ink performance while eliminating restricted substances is a difficult balance. The Packaging Ink and Coating Market faces regulatory pressures that demand innovation and operational agility. It must stay ahead of evolving environmental expectations.

Market Opportunities:

Expansion Across Biodegradable and Compostable Packaging Formats

The transition to eco-conscious packaging opens new avenues for specialized inks and coatings. Biodegradable and compostable substrates require ink systems with compatible adhesion and degradation profiles. There is a growing need for water-based and vegetable-oil-based inks that meet compostability criteria. Start-ups and major FMCG brands alike are launching green packaging lines. These alternatives demand custom coatings that protect product integrity without hindering decomposition. The Packaging Ink and Coating Market is positioned to capitalize on this evolution. It can support innovation by offering compliant, high-performance options tailored for sustainable formats.

Rising Demand in Emerging Markets and Developing Economies

Urbanization, rising incomes, and expanding retail infrastructure are driving packaging growth in emerging markets. Countries in Asia, Africa, and Latin America are investing in modern supply chains and branded consumer goods. Local packaging producers seek affordable, versatile inks that work across flexible and rigid formats. Increasing digital adoption in these regions also fuels demand for customized labels and smart packaging features. Governments are encouraging domestic manufacturing and eco-friendly materials. The Packaging Ink and Coating Market has untapped potential in these high-growth regions. It can scale by offering adaptable solutions aligned with local manufacturing needs.

Market Segmentation Analysis:

The Packaging Ink and Coating Market is segmented by printing method, material, and end-use industry, reflecting the diverse range of packaging formats and functional requirements.

By printing method, Flexographic printing holds a dominant share due to its compatibility with high-speed operations and flexible materials. Gravure printing remains relevant for long-run, high-quality graphics, particularly in food packaging. Digital printing is expanding quickly, favored for short runs, customization, and variable data applications. Lithographic printing finds its niche in rigid packaging and labels, offering sharp image resolution.

- For example, Amcor utilizes gravure printing for high-volume flexible packaging applications, offering excellent image sharpness and consistent print quality. The company’s AmLite™ Ultra Recyclable laminate—a metal-free, high-barrier structure—supports sustainable packaging for food segments such as snacks and confectionery.

By material, flexible plastic leads the segment owing to its widespread use in flexible pouches and wraps, demanding ink systems that offer durability and elasticity. Paper and board follow, driven by the growth of sustainable packaging and increased regulatory push for recyclable substrates. Metal and glass substrates require specialized coatings for adhesion and corrosion resistance, particularly in beverage and pharmaceutical sectors. Other substrates like films and foils are gaining traction in premium and barrier-sensitive packaging.

- For example, Sealed Air’s CRYOVAC® shrink films are flexographically printable with up to 10 colors, delivering high clarity, gloss, and merchandising appeal on flexible pouch and wrap applications.

By applications, the food and beverage segment generates the highest demand, requiring safe, vibrant, and moisture-resistant inks and coatings. Pharmaceutical and healthcare packaging relies on compliance-driven formulations that ensure legibility, durability, and safety. Personal care and cosmetics favor high-gloss, decorative finishes to enhance shelf appeal. Industrial and automotive applications prioritize performance coatings for chemical resistance and longevity. Electronics and appliances demand precision printing for labeling and anti-static properties. It supports innovation across all these applications, meeting the evolving technical and regulatory needs of each sector within the Packaging Ink and Coating Market.

Segmentation:

By Printing Method

- Flexographic

- Gravure

- Digital

- Lithographic

By Material

- Flexible Plastic

- Paper and Board

- Metal

- Glass

- Other Substrates (e.g., film, foil)

By Application/End-Use Industry

- Food and Beverage

- Pharmaceutical and Healthcare

- Personal Care and Cosmetics

- Industrial and Automotive

- Electronics and Appliances

- Other Applications (e.g., flexible packaging, security printing)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific holds the largest share in the Packaging Ink and Coating Market, accounting for 41% of the global revenue. Strong demand from the food and beverage, pharmaceutical, and consumer goods sectors drives regional growth. Countries like China, India, and Japan are investing in advanced printing technologies and expanding packaging production capacity. Rapid urbanization and rising consumer spending habits are contributing to the increasing consumption of packaged goods. The region benefits from a cost-effective raw material supply chain and growing e-commerce penetration. It continues to attract investments from global players aiming to strengthen their local presence.

North America represents the second-largest market with a 27% share, driven by innovation and sustainability mandates. The U.S. leads regional growth due to its mature packaging industry and high adoption of digital and UV-curable inks. Strict environmental regulations are prompting the use of low-VOC and recyclable packaging solutions. Demand for premium, custom-printed packaging is strong across sectors such as cosmetics and personal care. Technological advancements and consumer preference for eco-conscious brands shape the market landscape. The Packaging Ink and Coating Market in North America focuses on product quality, regulatory compliance, and functional performance.

Europe accounts for 22% of the market share, supported by a strong focus on circular economy goals and environmental legislation. Germany, France, and the UK lead innovation in biodegradable and water-based ink solutions. The market is shaped by strict regulatory frameworks that govern packaging safety and emissions. Demand is rising for sustainable coatings that enable recycling and reduce packaging waste. Emerging technologies like smart labels and intelligent packaging solutions are gaining traction in the region. It reflects a high level of R&D investment and strategic partnerships within the Packaging Ink and Coating Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AkzoNobel N.V.

- PPG Industries Inc.

- Flint Group

- Siegwerk Druckfarben AG & Co. KGaA

- Toyo Ink SC Holdings Co., Ltd.

- ARKEMA S.A.

- ALTANA AG

- Valspar Corporation

- Dainichiseika Color & Chemicals Mfg. Co. Ltd.

- Sherwin-Williams Company

- BASF SE

- Nippon Paint Holdings Co., Ltd.

- Sakata INX

- ColorMatrix

- Evonik Industries AG

- INX International Ink Co.

Competitive Analysis:

The Packaging Ink and Coating Market features a highly competitive landscape, led by established global players such as AkzoNobel N.V., PPG Industries Inc., Flint Group, and Sun Chemical Corporation. These companies focus on technological innovation, sustainable product development, and strategic mergers to strengthen their market position. Regional players contribute by offering cost-effective and tailored solutions to niche applications. Companies actively invest in R&D to develop low-VOC, water-based, and UV-curable systems to meet evolving regulatory and customer demands. It sees steady consolidation, with large firms acquiring specialized ink manufacturers to expand their portfolios. Market participants compete on product performance, regulatory compliance, environmental impact, and print versatility.

Recent Developments:

- In February 2025, AkzoNobel N.V. launched an innovative waterborne wood coating called RUBBOL WF 3350, which features 20% bio-based content. This product increases the use of renewable raw materials in the wood coatings segment, aligning with the company’s sustainability commitments and offering both interior and exterior use backed by enhanced durability warranties.

- In December 2024, PPG Industries Inc. completed the sale of 100% of its architectural coatings business in the U.S. and Canada to American Industrial Partners for $550 million. This strategic move enables PPG to optimize its global portfolio and focus on regions where it holds market leadership in coatings, including packaging inks and coatings.

- In November 2024, Siegwerk Druckfarben AG & Co. KGaA expanded its CIRKIT product range, which consists of functional coatings to support recycling and reusable packaging, directly linked to innovations for the packaging ink and coating market. The establishment of a Circular Economy Coatings Business Unit further underscores its relevance to this market.

- In August 2023, Flint Group announced a strategic partnership with General Atlantic, a leading global growth investment firm. This partnership aims to accelerate Flint Group’s expansion and enhance its position in the packaging ink and coating sectors by leveraging the investor’s sector expertise and growth capital.

Market Concentration & Characteristics:

The Packaging Ink and Coating Market shows moderate to high market concentration, dominated by a few multinational companies with strong global supply chains. It is characterized by a high degree of product innovation, stringent regulatory adherence, and increasing demand for customized solutions. Entry barriers are moderate due to the need for compliance, advanced formulation capabilities, and technical expertise. Product differentiation and sustainability performance often determine competitive positioning. Strategic collaborations with packaging converters and end-users support long-term market presence. It continues to evolve with a focus on functionality, recyclability, and digital printing compatibility.

Report Coverage:

The research report offers an in-depth analysis based on printing method, material, and end-use industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will witness increased demand for eco-friendly inks and coatings driven by global sustainability initiatives.

- Growth in flexible packaging applications will support innovation in adhesion and print durability technologies.

- Digital printing advancements will continue to influence the development of quick-drying, high-resolution ink systems.

- Regulatory developments across regions will accelerate the shift toward water-based and low-VOC formulations.

- Rising e-commerce activity will fuel demand for abrasion-resistant and visually appealing packaging coatings.

- Smart packaging technologies will drive the adoption of inks compatible with interactive and trackable features.

- Investment in R&D will intensify, focusing on performance-enhancing additives and functional coatings.

- Expansion in emerging markets will open new opportunities for regional manufacturing and localized ink solutions.

- Consumer preference for minimalistic and transparent packaging will impact color palette and coating texture innovations.

- Strategic mergers and acquisitions will shape the competitive landscape, enabling portfolio diversification and market expansion.