Market Overview

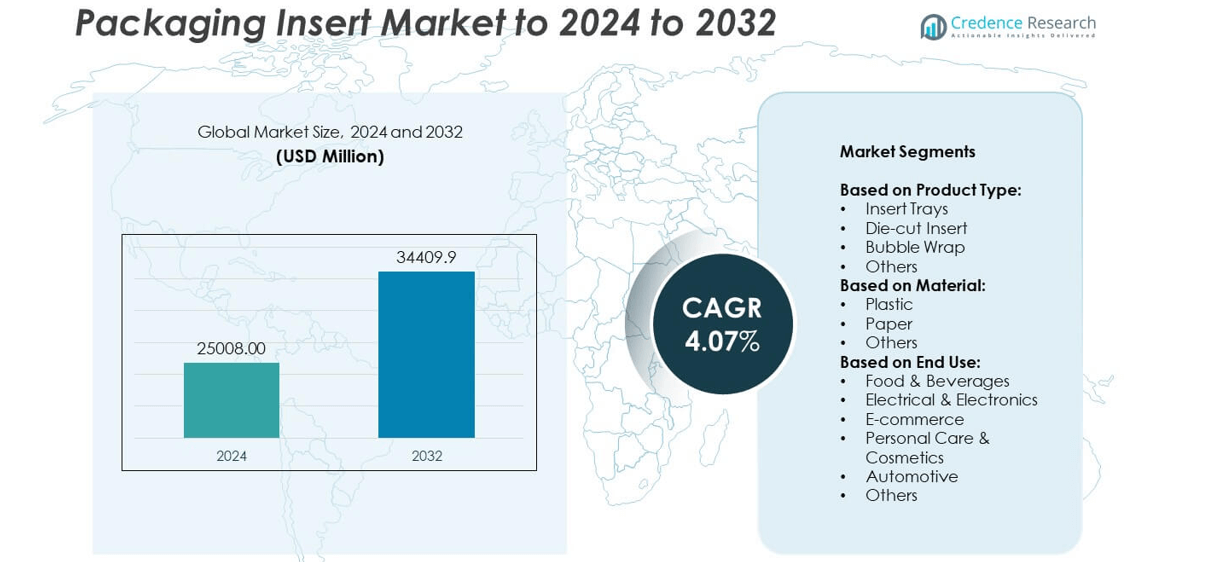

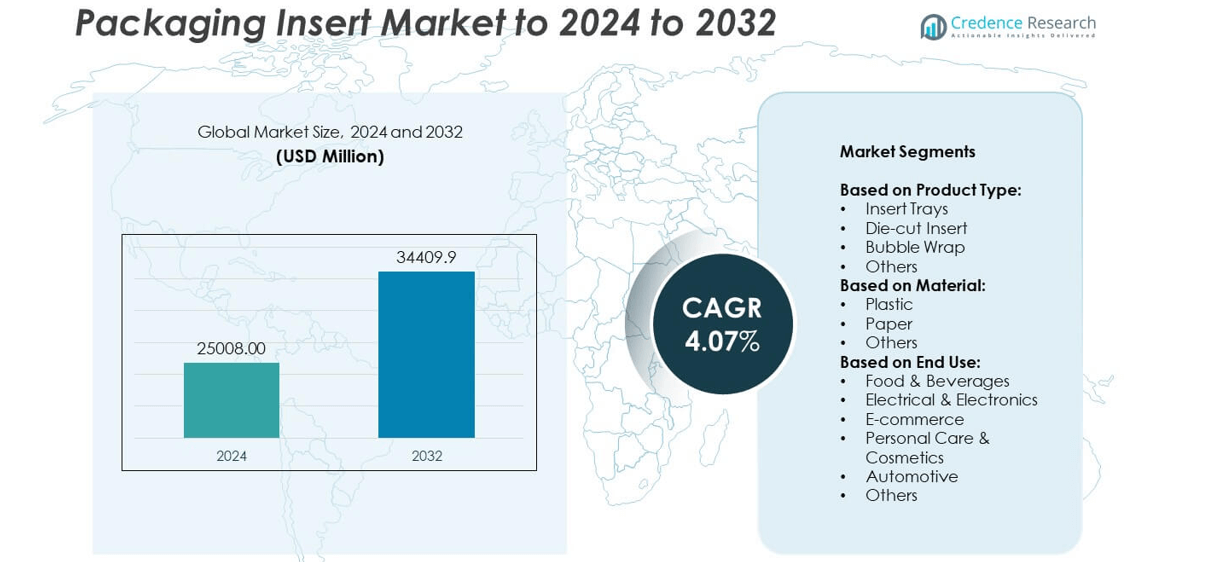

Packaging Insert Market size was valued at USD 25,008.00 million in 2024 and is anticipated to reach USD 34,409.9 million by 2032, at a CAGR of 4.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Insert Market Size 2024 |

USD 25,008.00 million |

| Packaging Insert Market, CAGR |

4.07% |

| Packaging Insert Market Size 2032 |

USD 34,409.9 million |

The packaging insert market is driven by key players such as Ranpak, Smurfit Kappa, Reflex Packaging Inc., DS Smith, EcoEnclose, Sonoco, Salazar Packaging, Index Packaging, Inc., Huhtamaki, Visipak, and Pregis. These companies focus on developing innovative, sustainable, and cost-efficient insert solutions to serve industries such as e-commerce, food and beverages, and electronics. Strategic investments in recyclable and biodegradable materials are gaining momentum as sustainability becomes a priority. Regionally, North America leads the market with about 35% share, supported by strong e-commerce growth and advanced packaging infrastructure, followed by Europe with 28% and Asia Pacific with 25% share.

Market Insights

- The packaging insert market was valued at USD 25,008.00 million in 2024 and is projected to reach USD 34,409.9 million by 2032, growing at a CAGR of 4.07%.

- Growth is fueled by e-commerce expansion, rising demand for product protection, and a shift toward sustainable packaging solutions across industries.

- Key trends include increasing use of customized inserts for branding, adoption of recyclable and bio-based materials, and growing demand for smart inserts with tracking features.

- The market is competitive with players focusing on innovation, automation, and strategic collaborations to expand global presence and meet sustainability goals.

- North America leads with 35% share, followed by Europe at 28% and Asia Pacific at 25%, while insert trays dominate the product segment with over 40% market share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Insert trays dominated the packaging insert market with over 40% share in 2024. Their high adoption is driven by their ability to securely hold products and reduce movement during transit. Insert trays are widely used in food, electronics, and personal care packaging due to their precise fit and protection. Die-cut inserts follow closely, supporting custom-shaped products and enhancing brand presentation. Bubble wrap continues to serve as a cost-effective protective solution, particularly in e-commerce shipping. Demand for sustainable and biodegradable insert trays is rising, pushing manufacturers to innovate with eco-friendly materials and designs.

- For instance, In 2024, Huhtamaki expanded its manufacturing of smooth molded fiber (SMF) lids to its Lurgan, Northern Ireland facility. This added to its existing molded fiber sites in Germany, the Netherlands, and the USA. Huhtamaki’s 2024 annual report detailed net sales of EUR 4.126 billion, a slight drop from 2023’s EUR 4.169 billion, while adjusted EBIT rose 6% to EUR 417 million and overall volumes saw a slight increase. By the end of 2024, the company operated 101 locations in 36 countries, employing approximately 18,000 professionals.

By Material

Plastic accounted for the largest share, holding around 55% of the packaging insert market in 2024. Its dominance stems from durability, flexibility, and superior cushioning properties that safeguard fragile goods. Plastic inserts are preferred in electronics, automotive, and food packaging due to moisture resistance and extended shelf life. Paper-based inserts are gaining momentum as sustainability concerns drive the shift toward recyclable and biodegradable materials. The “others” category includes foam and bio-based materials, which cater to niche segments. Increasing environmental regulations and consumer preference for green packaging are boosting investments in paper and compostable plastic alternatives.

- For instance, in May 2024, Smurfit Kappa inaugurated a new corrugated cardboard packaging plant in Guarne, Colombia, with an investment of over $50 million, to meet growing demand for sustainable packaging.

By End Use

Food & beverages led the market with nearly 30% share in 2024, fueled by the rising demand for protective packaging that maintains product integrity during transport. Insert trays and die-cut solutions are widely used for confectionery, ready-to-eat meals, and beverage bottles. E-commerce is the fastest-growing segment, supported by booming online shopping and the need for protective, lightweight inserts. Electronics and personal care industries also contribute significantly, using inserts for premium product presentation and damage prevention. Automotive end use continues to expand with custom inserts for spare parts, while sustainability initiatives are driving the adoption of recyclable solutions.

Market Overview

Rising E-commerce and Online Retail

The surge in e-commerce is the key growth driver for the packaging insert market. Growing demand for secure, attractive, and cost-effective packaging solutions is pushing companies to use insert trays, die-cut inserts, and bubble wraps. These solutions ensure product safety during long-distance shipping and enhance customer unboxing experience. Brands are investing in customized inserts to boost brand visibility and reduce return rates. The rapid growth of online retail platforms and increasing consumer preference for home delivery services continue to strengthen this driver across multiple regions.

- For instance, in 2024, Mondi launched and showcased numerous fiber-based packaging innovations at events like Fachpack, including its broad FunctionalBarrier Paper range, designed for various applications such as food and non-food contact packaging, that can be recycled in existing paper waste streams across Europe. The company also highlighted its TrayWrap solution, a secondary paper packaging that replaces plastic shrink film for bundling food and beverage products and is made from 100% kraft paper.

Focus on Product Protection and Damage Reduction

Product protection is a major growth driver as companies prioritize minimizing product damage and logistics losses. Packaging inserts offer cushioning, secure placement, and separation of items, which is essential for fragile goods in food, electronics, and personal care sectors. Industries are adopting specialized inserts to meet strict quality and safety standards while improving supply chain efficiency. Rising logistics costs are encouraging companies to invest in protective solutions to reduce returns and wastage. This trend supports the steady adoption of innovative insert materials and designs globally.

- For instance, in 2024, Sealed Air reported sales of $5.39 billion, a decrease of 1.8% compared to the previous year. The company’s global operations served customers in 117 countries and territories and employed approximately 16,400 individuals.

Shift Toward Sustainable Packaging

Sustainability is a key growth driver as consumers and regulators push for eco-friendly solutions. Brands are replacing single-use plastic inserts with recyclable paper, bio-based, and compostable materials. This shift is driven by regulations on plastic waste reduction and corporate sustainability targets. Companies are focusing on lightweight, recyclable inserts to minimize environmental impact and appeal to eco-conscious customers. This transition is also creating opportunities for material innovation and strengthening the market presence of sustainable packaging suppliers worldwide.

Key Trends & Opportunities

Customization and Branding Demand

A key trend is the rising demand for customized inserts that enhance product presentation and create brand identity. Personalized packaging inserts are being used to improve customer experience and increase brand recall. Companies are offering printed inserts with promotional messages, QR codes, or brand stories to engage customers. This trend is opening opportunities for packaging manufacturers to offer value-added services, including digital printing and design customization, catering to e-commerce brands and premium product manufacturers.

- For instance, in September 2022, WestRock announced the acquisition of an HP PageWide T1190 Press to expand its corrugated printing capabilities. The press was scheduled to be installed in 2023 to enable high-quality digital printing, including features like serialization to support brand engagement programs and traceability. In March 2024, WestRock was ranked among the top 200 U.S. companies on Fortune’s list of America’s Most Innovative Companies.

Growth of Smart and Innovative Inserts

Another major opportunity lies in the adoption of smart packaging inserts equipped with QR codes, RFID tags, or sensors. These features help track shipments, share product information, and improve transparency in the supply chain. Brands are exploring interactive packaging to engage tech-savvy customers and provide post-purchase support. Innovative inserts also include foldable or modular designs to reduce storage costs. The combination of technology and packaging functionality is expected to boost growth, particularly in electronics, healthcare, and luxury product segments.

- For instance, in January 2024, Sonoco announced the divestiture of its Protective Solutions business to Black Diamond Capital Management, LLC, for an estimated $80 million in cash. The transaction was completed in April 2024, within the originally projected first half of the year.

Key Challenges

High Raw Material and Production Costs

One of the key challenges is the rising cost of raw materials such as plastic resins and specialty paper. Price fluctuations increase production costs, impacting the profit margins of packaging manufacturers. Small and medium enterprises struggle to balance cost and quality while meeting customer expectations. Additionally, investments in eco-friendly materials and compliance with sustainability regulations add to overall expenses. Companies are exploring cost optimization strategies and bulk procurement to offset these challenges without compromising performance and design.

Environmental Regulations and Compliance

Stringent environmental regulations present a key challenge for market players, especially those dependent on plastic-based inserts. Governments worldwide are imposing bans and restrictions on single-use plastics, forcing manufacturers to switch to sustainable alternatives. Compliance with recycling, labeling, and waste management laws adds operational complexity and cost. Companies that fail to adopt eco-friendly solutions risk losing contracts from large retailers and e-commerce firms that have strict sustainability requirements. This challenge is driving a gradual industry shift toward greener materials and processes.

Regional Analysis

North America

North America held the largest share of around 35% of the packaging insert market in 2024. The region benefits from strong e-commerce growth, advanced retail infrastructure, and a high focus on product protection standards. Demand is supported by leading packaging manufacturers investing in sustainable and customized inserts to meet consumer preferences. The U.S. dominates the regional market, driven by high online shopping penetration and strict quality regulations. Growth in food and beverage packaging, along with innovation in protective solutions for electronics and personal care sectors, continues to strengthen market presence across North America during the forecast period.

Europe

Europe accounted for nearly 28% of the packaging insert market in 2024, supported by strong emphasis on sustainability and strict packaging regulations. Countries like Germany, France, and the U.K. are leading adopters of paper-based and recyclable insert solutions. Demand is rising from food, cosmetics, and premium product manufacturers focusing on eco-friendly packaging to meet EU directives. Technological advancements in lightweight inserts and growing e-commerce adoption are fueling market expansion. The region’s focus on circular economy practices and high investment in design innovation further drives adoption, making Europe a major contributor to global packaging insert market growth.

Asia Pacific

Asia Pacific captured around 25% market share in 2024, making it the fastest-growing region in the packaging insert market. Rapid industrialization, booming e-commerce, and expanding middle-class populations in China, India, and Southeast Asia drive demand. The region is witnessing rising investments in protective and low-cost packaging solutions to cater to growing consumption. Local manufacturers are increasingly adopting paper-based and bio-based inserts to meet sustainability goals. Strong demand from electronics, automotive, and food sectors further boosts growth. Government initiatives to promote domestic manufacturing and exports are creating significant opportunities for packaging insert producers in the region.

Latin America

Latin America represented about 7% of the packaging insert market in 2024, driven by growing adoption of protective packaging in food, personal care, and e-commerce sectors. Brazil and Mexico are the key contributors, supported by rising consumer spending and digital retail expansion. Manufacturers are increasingly offering cost-effective and customizable solutions to meet diverse industry needs. However, limited adoption of advanced packaging technology compared to developed markets slightly restricts growth. Sustainability initiatives and the shift toward recyclable packaging materials are gaining momentum, creating opportunities for innovation and partnerships with global packaging companies in the region.

Middle East & Africa

Middle East & Africa accounted for nearly 5% of the packaging insert market in 2024, with demand supported by growing retail infrastructure and increasing consumption of packaged goods. The UAE and Saudi Arabia lead the regional market due to rising e-commerce and premium product demand. The region is gradually adopting sustainable packaging practices as awareness of environmental impact grows. Growth is further driven by the expansion of the food, cosmetics, and pharmaceutical industries. Challenges include limited local manufacturing capacity and reliance on imports, but ongoing investments in production facilities are expected to improve supply chain efficiency.

Market Segmentations:

By Product Type:

- Insert Trays

- Die-cut Insert

- Bubble Wrap

- Others

By Material:

By End Use:

- Food & Beverages

- Electrical & Electronics

- E-commerce

- Personal Care & Cosmetics

- Automotive

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The packaging insert market is characterized by strong competition, with key players including Ranpak, Smurfit Kappa, Reflex Packaging Inc., DS Smith, EcoEnclose, Sonoco, Salazar Packaging, Index Packaging, Inc., Huhtamaki, Visipak, and Pregis. These companies focus on delivering innovative, sustainable, and cost-effective insert solutions to cater to growing demand from e-commerce, food, and electronics sectors. The market is witnessing high investment in recyclable and biodegradable materials as regulatory pressure and consumer demand for eco-friendly packaging rise. Players are also emphasizing design customization, lightweight solutions, and automation to improve efficiency and reduce logistics costs. Strategic collaborations, capacity expansions, and technological innovations are common approaches used to strengthen market share. Additionally, increasing adoption of smart packaging solutions with digital printing and branding features is reshaping competitive dynamics, encouraging continuous product development and differentiation among manufacturers to gain a competitive edge across global and regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ranpak

- Smurfit Kappa

- Reflex Packaging Inc.

- DS Smith

- EcoEnclose

- Sonoco

- Salazar Packaging

- Index Packaging, Inc.

- Huhtamaki

- Visipak

- Pregis

Recent Developments

- In 2025, Ranpak company expanded its automated product line, including the introduction of Pad’it!™, a system that automatically inserts paper pads into boxes to protect goods.

- In 2025, DS Smith At PharmaPack Europe, unveiled TailorTemp, a fully fiber-based, temperature-controlled packaging line for pharmaceuticals.

- In 2022, Pregis introduced Renew Zero, their first carbon-neutral protective packaging film, in Europe, which uses a 50/50 blend of post-consumer recycled content and certified renewable plant waste to reduce its environmental footprint.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by e-commerce expansion and online retail demand.

- Sustainable and recyclable inserts will gain wider adoption due to strict environmental regulations.

- Customization and branding on inserts will become a major differentiator for manufacturers.

- Smart inserts with QR codes and tracking features will grow in adoption for transparency.

- Demand from food and beverage and electronics sectors will remain strong during the forecast period.

- Asia Pacific will emerge as the fastest-growing region due to rising manufacturing and exports.

- Lightweight and cost-efficient designs will be prioritized to reduce shipping and logistics costs.

- Strategic partnerships and mergers will rise as players focus on expanding global presence.

- Technological innovations in materials and automation will improve production efficiency and output.

- Consumer preference for eco-friendly packaging will push innovation toward bio-based and compostable inserts.