Market Overview:

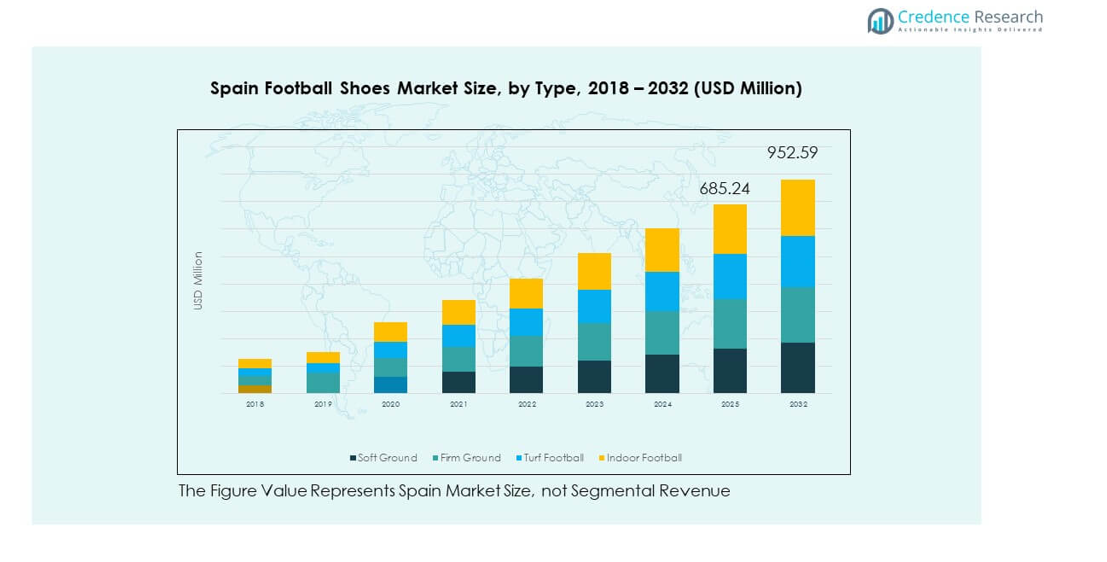

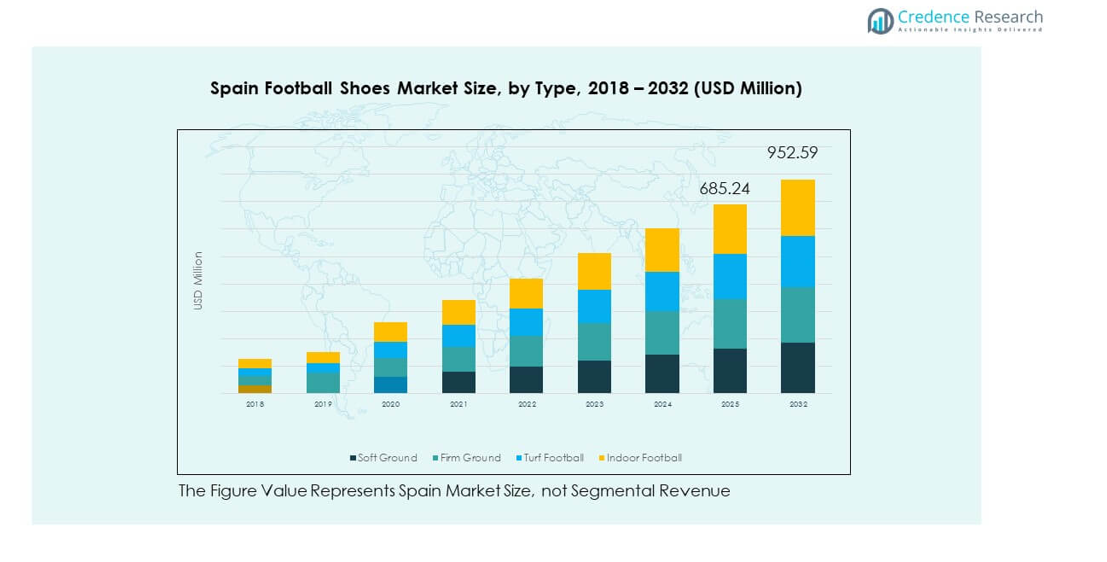

The Spain Football Shoes Market size was valued at USD 518.51 million in 2018 to USD 656.74 million in 2024 and is anticipated to reach USD 952.59 million by 2032, at a CAGR of 4.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Football Shoes Market Size 2024 |

USD 656.74 million |

| Spain Football Shoes Market, CAGR |

4.76% |

| Spain Football Shoes Market Size 2032 |

USD 952.59 million |

The market is driven by Spain’s deep-rooted football culture, supported by strong grassroots programs, elite academies, and the influence of La Liga clubs. Endorsements from professional players and strategic sponsorships by global brands boost visibility, while consumer demand rises for lightweight, performance-oriented designs. Retail expansion and the growth of online sales platforms enhance product accessibility, while innovation in stud configuration, cushioning, and material technologies ensure both professionals and recreational players invest in updated footwear.

Regionally, Central Spain leads growth, anchored by Madrid’s role as a hub for professional clubs and large-scale consumer demand. Northern Spain follows with strong adoption linked to established academies and high regional participation rates. Southern Spain is emerging as a fast-developing market, supported by grassroots tournaments, warm weather play conditions, and rising futsal adoption. The Spain Football Shoes Market reflects this regional balance, with established hubs ensuring stability while emerging areas contribute fresh growth momentum

Market Insights

- The Spain Football Shoes Market was valued at USD 518.51 million in 2018, reached USD 656.74 million in 2024, and is projected to hit USD 952.59 million by 2032, expanding at a CAGR of 4.76%.

- Central Spain led with 42% share in 2024 due to Madrid’s dominance and strong consumer demand, followed by Southern Spain at 30% from grassroots expansion, and Northern Spain at 28% supported by established academies.

- Southern Spain, holding 30% share, is the fastest-growing region, driven by futsal adoption, favorable climate for outdoor play, and expanding youth tournaments.

- By type, firm ground shoes accounted for 46% of the market, while soft ground held 22%, showing dominance of versatile products for natural and artificial pitches.

- Indoor football shoes represented 14% share, supported by Spain’s futsal culture, while turf football accounted for 18%, reflecting steady adoption in training and recreational facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Popularity of Football Culture Across All Demographics

Football continues to dominate Spanish sports culture, driving consistent demand for specialized footwear. Youth academies, schools, and amateur leagues are major sources of growth, supported by nationwide grassroots initiatives. La Liga clubs inspire both young and adult fans to buy performance-oriented shoes. Global brands actively endorse Spanish players, which further fuels aspirational purchases. Product launches tailored to local tastes create steady consumer interest. Companies focus on durability, lightweight design, and ankle support, aligning with player needs. The Spain Football Shoes Market gains traction through premium offerings and increased visibility of international tournaments. It benefits from strong consumer loyalty to both national and global football identities.

- For example, Nike launched the Phantom GX football boot in December 2022, featuring its proprietary Gripknit upper with a fingerprint-like texture coated in TPU to enhance ball control in both wet and dry conditions. The design was positioned as a major innovation in Nike’s football footwear line.

Expanding Retail Networks With Strong Online and Offline Presence

Retail networks in Spain strengthen distribution channels for football shoes, combining traditional outlets with digital platforms. Specialized sports stores remain popular for premium footwear, while supermarkets support mass demand. E-commerce growth widens accessibility, offering exclusive collections and customization options. Consumers find competitive pricing and delivery convenience appealing through online platforms. Brands improve digital engagement using campaigns and interactive shopping experiences. Retailers use flagship stores in key cities to build brand identity and showcase technology-driven designs. The Spain Football Shoes Market grows by linking physical availability with digital adoption. It benefits from retailers’ focus on both product reach and consumer experience.

Increasing Consumer Shift Toward Performance and Innovation

Players prioritize advanced technologies in football shoes to improve speed, traction, and stability. Lightweight synthetic uppers, engineered mesh, and 3D-printed outsoles address performance demands. Custom-fit collars and responsive cushioning enhance player comfort and safety during matches. Innovations in stud design optimize grip for Spain’s diverse playing surfaces. Consumers seek versatile options for natural grass, artificial turf, and indoor courts. Brands emphasize sustainability with recycled materials without compromising performance. The Spain Football Shoes Market progresses as buyers favor technically superior products. It shows steady acceptance of innovation-driven footwear that enhances both recreational and professional play.

- For example, Puma launched the ULTRA Ultimate football boot in 2023, featuring its advanced ULTRAWEAVE upper for reduced weight along with PWRTAPE support and a SPEEDPLATE outsole, engineered to enhance speed and traction. The boot was positioned as one of Puma’s lightest and most performance-focused designs.

Strong Influence of Youth Development Programs and Sponsorships

Football academies across Spain play a central role in boosting demand for shoes. Sponsorships from top clubs support visibility among younger generations. Local tournaments create opportunities for brands to showcase affordable yet reliable footwear. Youth-focused marketing campaigns highlight agility, speed, and comfort, resonating with emerging players. Training programs push participants to adopt footwear that mirrors professional standards. National pride in football success reinforces adoption of branded shoes. The Spain Football Shoes Market advances as youth involvement drives replacement cycles. It secures long-term growth by aligning with player development initiatives across regions.

Market Trends

Integration of Sustainability in Material Selection and Manufacturing

Sustainability gains importance across global footwear industries, with Spain showing similar trends. Recycled polyester, plant-based fabrics, and water-efficient processes are now part of new launches. Consumers welcome eco-conscious football shoes as environmental awareness strengthens. Major brands invest in circular models, collecting worn pairs for recycling. Product labeling highlights sustainability credentials to attract responsible buyers. Hybrid materials balance performance with lower ecological impact. The Spain Football Shoes Market evolves as consumers demand greener alternatives. It demonstrates how sustainability merges with advanced design to shape purchasing decisions.

- For example, Adidas confirmed through its sustainability communications and annual report that the majority of polyester used in its products is recycled, reinforcing its commitment to phasing out virgin polyester and advancing sustainable material adoption.

Growing Demand for Personalized and Limited-Edition Footwear Designs

Personalization emerges as a strong trend, enabling buyers to design shoes with unique details. Platforms allow players to select studs, materials, and graphics that fit personal style. Limited-edition releases build exclusivity and encourage quick adoption. Collectible football shoes tied to clubs or tournaments attract enthusiasts. Players prefer customized fits to match their positions and playstyle. Collaborations with athletes and designers enhance visibility of limited lines. The Spain Football Shoes Market reflects this trend through steady adoption of personalized footwear. It integrates exclusivity with performance, creating long-term consumer engagement.

- For example, Nike’s “Nike By You” platform enables consumers to personalize football shoes with choices such as colors, graphics, and materials, and it is promoted globally through Nike’s official customization channels.

Technological Enhancements in Digital Shopping and Consumer Engagement

Brands employ digital tools to improve the shopping journey in Spain. Augmented reality apps enable virtual try-ons, offering realistic views of fit and style. Artificial intelligence supports accurate size recommendations to reduce returns. E-commerce platforms integrate loyalty programs tied to football events. Social media campaigns promote direct engagement with young consumers. Interactive websites showcase performance metrics for new releases. The Spain Football Shoes Market adapts by combining digital innovation with physical availability. It strengthens consumer confidence through transparent, data-driven shopping experiences.

Adoption of Smart Football Shoes for Data and Performance Tracking

Smart technology adoption introduces a new segment of performance-enhancing shoes. Built-in sensors track metrics like distance, speed, and kick power during matches. Apps sync with devices to provide real-time feedback for players. Professional clubs encourage athletes to train with such footwear for analytics. Amateur players also adopt these products for improving performance. Brands develop user-friendly interfaces that highlight actionable insights. The Spain Football Shoes Market explores new growth paths through smart footwear integration. It shows readiness for the crossover between sports equipment and digital health monitoring.

Market Challenges Analysis

Intense Competition and Pressure on Pricing Strategies Across the Market

High competition between global and local brands creates pressure on pricing strategies. Established players dominate visibility, making it difficult for new entrants. Discount-driven promotions often reduce profit margins for sellers. Consumers demand both affordability and advanced features in shoes. Brands face challenges balancing technology investments with competitive prices. Retailers also struggle to differentiate products beyond pricing. The Spain Football Shoes Market remains competitive, forcing companies to innovate while controlling costs. It reflects an industry where value perception strongly influences buyer loyalty.

Volatile Consumer Preferences and Rapid Shifts in Design Expectations

Consumers in Spain show rapidly shifting footwear preferences, influenced by fashion and cultural icons. Frequent design changes force brands to speed up product cycles. Manufacturing flexibility becomes essential to meet sudden shifts in demand. Inventory mismanagement risks increase when consumer trends are unpredictable. Product recalls and excess stock hurt profitability. Footwear companies must anticipate trends before they peak to stay relevant. The Spain Football Shoes Market faces challenges maintaining consistent alignment with dynamic consumer behavior. It highlights the difficulty of balancing fashion with long-term product stability.

Market Opportunities

Expanding Scope of Female Participation and Emerging Youth Segments in Football

Female participation in football rises steadily in Spain, creating new demand channels. Women’s leagues gain recognition, boosting footwear adoption across all age groups. Brands design shoes tailored to female anatomy for better comfort and fit. Youth tournaments highlight the importance of accessible footwear for young players. Schools and academies adopt structured football programs that expand replacement cycles. Local endorsements by female athletes inspire more adoption among fans. The Spain Football Shoes Market benefits from this expanding demographic base. It builds long-term opportunities by capturing underserved segments.

Leveraging International Tournaments and Tourism for Market Growth Opportunities

International tournaments hosted in Spain create strong growth potential for footwear brands. Large sporting events attract tourists who purchase football shoes as memorabilia. Clubs leverage these events for exclusive product launches and promotions. Retailers use temporary stores and stadium outlets to boost sales. Cross-border sales increase when Spain becomes a hub for international fans. Marketing tied to tournaments enhances product visibility for global audiences. The Spain Football Shoes Market gains opportunities from its role in hosting global sports. It capitalizes on tourism-driven consumption during high-profile football events.

Market Segmentation Analysis

By type, firm ground shoes dominate demand due to their suitability across Spain’s natural grass pitches and artificial surfaces. Soft ground variants hold steady traction in professional settings where elite players require advanced stud systems for grip. Turf football shoes gain popularity with the expansion of training academies and recreational facilities. Indoor football shoes register consistent growth, reflecting Spain’s strong futsal culture and adoption in urban centers. The Spain Football Shoes Market benefits from the balance of professional-grade and recreational footwear types.

- For example, Adidas launched the X Crazyfast P+ in July 2023, featuring a redesigned AEROPLATE insert in the Speedframe outsole that was 5 grams lighter to enhance speed and traction. The boot debuted on professional pitches during the FIFA Women’s World Cup 2023.

By stud, rubber studs lead share due to their versatility and player safety across multi-surface use. Metal studs remain significant in elite competitions where players prioritize maximum traction on moist fields. Flat sole shoes expand with the growth of indoor football leagues and multi-purpose sports facilities. It shows a clear segmentation where stud preferences align with pitch conditions and competition levels.

- For example, Nike released the Tiempo Legend 10 in July 2023, featuring an engineered stud configuration that delivers consistent traction on firm natural grass and artificial turf. The design emphasizes reliable grip and stability, reinforcing the boot’s role as a versatile performance option.

By sales channel, retail channels remain a preferred option, supported by specialty sports stores and multi-brand outlets in urban hubs. E-commerce expands strongly, driven by customization features, online-exclusive releases, and improved delivery networks. Direct-to-consumer models grow steadily as brands strengthen engagement through flagship stores and digital platforms. It reflects how consumer behavior is shifting toward convenience while preserving in-store trial experiences.

Segmentation

By Type

- Soft Ground

- Firm Ground

- Turf Football

- Indoor Football

By Stud

- Metal Studs

- Rubber Studs

- Flat Sole

By Sales Channel

- Retail Channels

- E-commerce

- Direct to Consumer

Regional Analysis

Northern Spain

Northern Spain accounts for 28% of the Spain Football Shoes Market, supported by the presence of professional clubs and strong youth academies in regions such as Basque Country, Galicia, and Navarra. Local passion for football drives consistent footwear adoption across both amateur and semi-professional players. Retail penetration is high, with specialty sports stores and club-affiliated outlets serving consumer needs. Brands focus on product durability to match the region’s diverse playing conditions, including natural grass and artificial turf. Online sales expand reach in rural areas, making performance footwear more accessible. It maintains steady growth driven by regional loyalty and infrastructure.

Central Spain

Central Spain holds 42% of the market share, led by Madrid and surrounding provinces where football maintains strong cultural and professional influence. The presence of iconic clubs creates significant demand for premium football shoes. Youth academies and organized leagues expand the replacement cycle, ensuring steady sales. E-commerce adoption is strongest in urban centers, with consumers seeking both customization and quick delivery. Retail channels also thrive, supported by flagship stores of major brands. The Spain Football Shoes Market benefits from Central Spain’s dominance, positioning it as the largest subregion for revenue contribution.

Southern Spain

Southern Spain represents 30% of the market, with Andalusia and Valencia emerging as high-potential subregions due to rising grassroots initiatives. Warmer climates and frequent outdoor play environments encourage demand for versatile stud configurations. Local leagues and regional tournaments boost awareness of branded footwear among youth. Retail networks expand with both specialty stores and multi-brand chains targeting growing demand. Online shopping adoption continues to rise, supported by promotional campaigns tied to seasonal tournaments. It establishes Southern Spain as a fast-developing hub for both mid-range and premium football shoe segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nike Inc.

- Adidas AG

- Puma SE

- Umbro

- KELME

- Lotto Sport Italia

- New Balance

- Joma

- Skechers

- Sokito

- Other Key Players

Competitive Analysis

The Spain Football Shoes Market features strong competition between global brands and regional companies. Nike, Adidas, and Puma dominate share with aggressive marketing campaigns, sponsorships, and advanced product launches. Domestic players such as Joma and KELME strengthen their presence through affordable pricing and local endorsements. International brands focus on innovation, lightweight construction, and sustainability to differentiate their portfolios. Regional companies emphasize value-driven products tailored to grassroots and semi-professional players. It remains a highly competitive market where consumer loyalty, performance technology, and retail accessibility determine success. Strategic partnerships with clubs and academies further shape competitive positioning.

Recent Developments

- In July 2025, Puma launched the new Eclipse Pack, which includes the latest models Future 8 and Ultra 6 football boots. The Eclipse Pack stands out with a subtle midnight green colorway and technological updates to fit and branding, aiming to appeal both to elite players and grassroots participants in Spain’s vibrant football scene.

- In June 2025, Under Armour partnered with luxury car atelier Mansory and showcased the result with the Magnetico Elite 5 Boots during the FIFA Club World Cup, making headlines in Spanish football circles for blending automotive-inspired premium design with elite-level on-field functionality.

- In February 2025, Nike unveiled the Nike United Pack— a line of football boots designed collaboratively with six professional female footballers, including athletes from FC Barcelona and Chelsea FC. The pack, featuring Tiempo, Mercurial, and Phantom models, became available online and in select stores from February 5, 2025, reinforcing Nike’s presence in the football shoe segment for the Spanish and European markets.

- In January 2025, PUMA introduced the Unlimited football boots pack featuring the new FUTURE 8, ULTRA 5, and KING ULTIMATE models, aiming to strengthen its presence in Spain’s highly competitive football shoes segment with advanced performance technology for players at all levels.

Report Coverage

The research report offers an in-depth analysis based on Type, Stud and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Spain Football Shoes Market will expand steadily, supported by strong cultural attachment to football.

- Growth in female leagues and rising participation of women players will unlock new demand.

- Innovation in lightweight materials and enhanced stud configurations will shape product development.

- E-commerce channels will strengthen reach, offering customization and faster distribution options.

- Sustainability will become a decisive factor as brands invest in recycled and eco-friendly materials.

- Smart football shoes integrating sensors and analytics will attract performance-focused athletes.

- Collaborations with clubs and academies will enhance product visibility and influence purchase behavior.

- Retail flagship stores will grow in urban centers, showcasing premium lines and limited editions.

- Regional tournaments and youth development programs will maintain consistent replacement cycles.

- Domestic brands will compete with global leaders by leveraging affordability and local endorsements.