Market Overview:

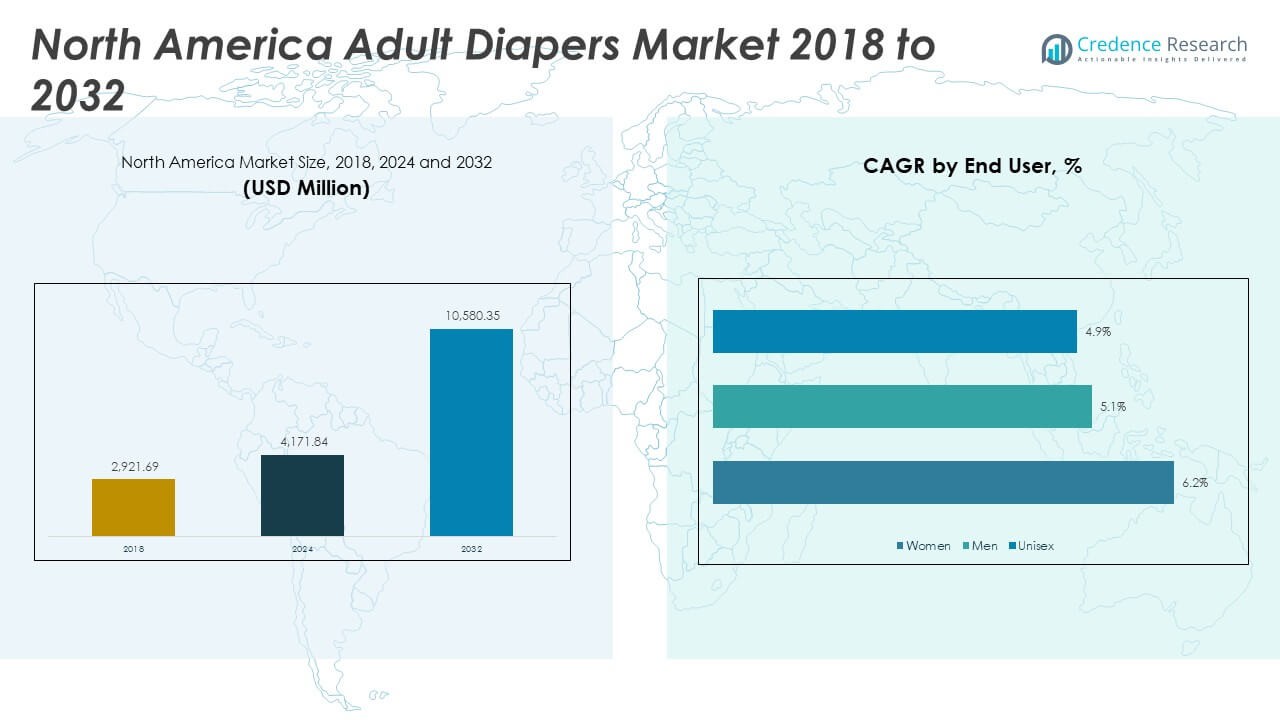

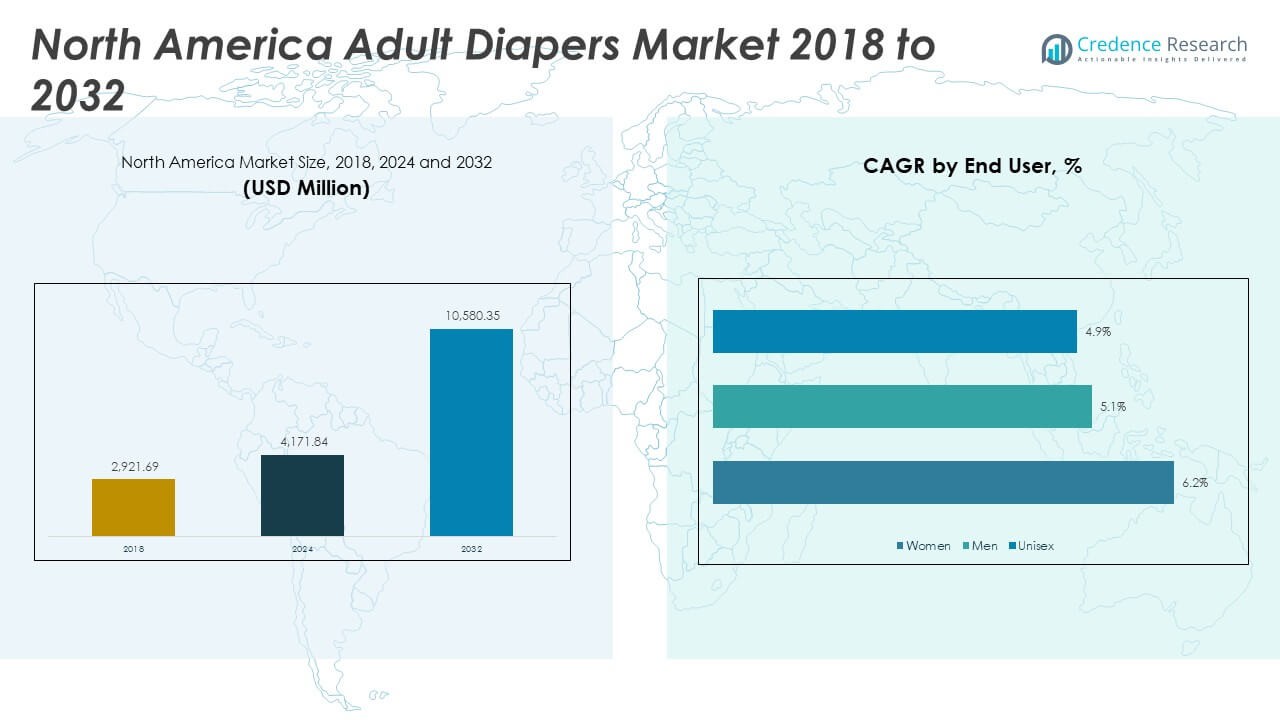

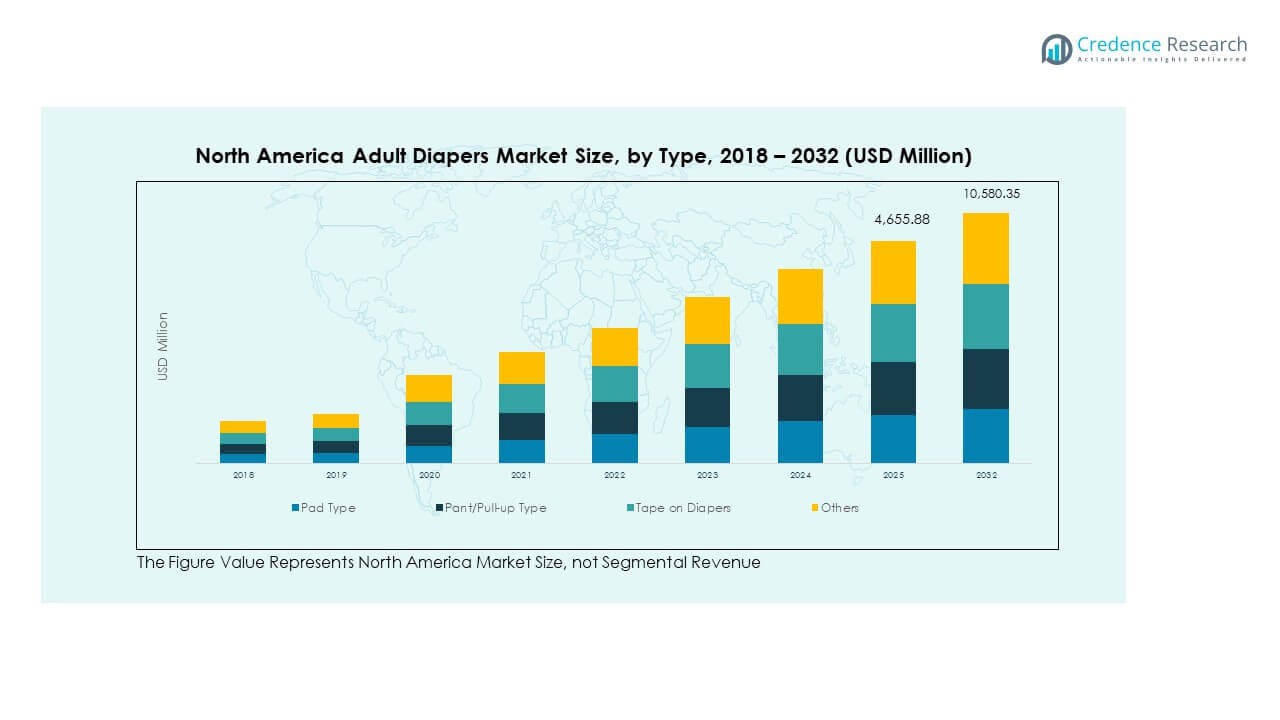

The North America Adult Diapers Market size was valued at USD 2,921.69 million in 2018 to USD 4,171.84 million in 2024 and is anticipated to reach USD 10,580.35 million by 2032, at a CAGR of 12.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Adult Diapers Market Size 2024 |

USD 4,171.84 Million |

| North America Adult Diapers Market, CAGR |

12.34% |

| North America Adult Diapers Market Size 2032 |

USD 10,580.35 Million |

The market is driven by rising aging populations, increased awareness of incontinence management, and improved healthcare infrastructure. Growing acceptance of adult diapers as lifestyle products rather than solely medical aids is also boosting demand. Manufacturers are innovating with discreet, comfortable, and eco-friendly products, catering to consumer preference for convenience and hygiene. Shifts in demographics, coupled with rising disposable incomes, support greater adoption across healthcare facilities and households. Retail and e-commerce channels further enhance accessibility, making adult diapers widely available across diverse consumer segments.

Regionally, the United States dominates the market, supported by its large elderly population, advanced healthcare systems, and strong retail networks. Canada shows steady growth, driven by expanding healthcare support programs and rising consumer awareness. Mexico is emerging as a potential growth market, backed by improving healthcare access, increasing disposable income, and changing attitudes toward elderly care. The regional landscape highlights a mature market in the U.S., steady expansion in Canada, and promising opportunities in Mexico, shaping a balanced growth outlook across North America.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Adult Diapers Market was valued at USD 2,921.69 million in 2018, reached USD 4,171.84 million in 2024, and is projected to hit USD 10,580.35 million by 2032, registering a CAGR of 12.34%.

- The United States led with about 65% share in 2024, driven by its large aging population, advanced healthcare infrastructure, and widespread retail penetration.

- Canada held around 20% share in 2024, supported by healthcare programs, rising awareness, and e-commerce expansion, while Mexico accounted for 15% with growing urbanization and disposable incomes.

- Mexico stands as the fastest-growing region within North America, fueled by cultural acceptance, expanding private healthcare facilities, and increasing consumer purchasing power.

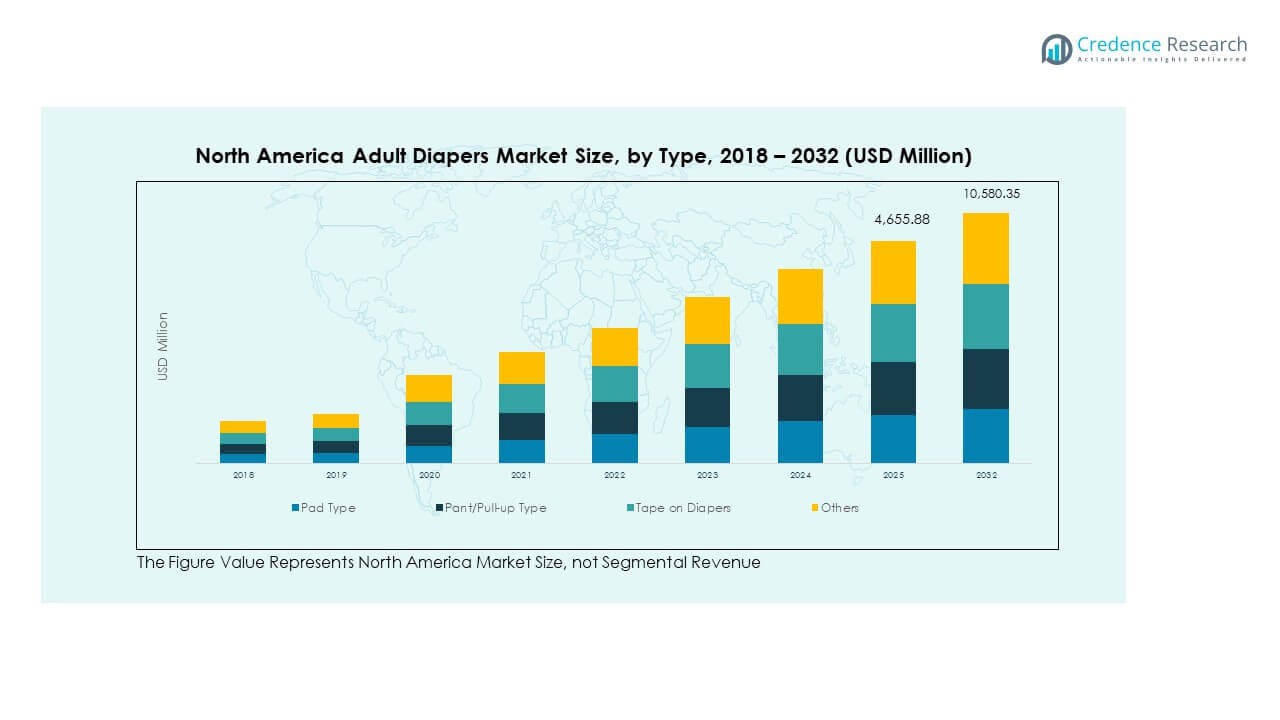

- By type, pad type dominated with the largest share of the market, while pant/pull-up type showed strong growth momentum, reflecting rising demand for discreet and comfort-focused incontinence solutions.

Market Drivers:

Growing Elderly Population and Rising Demand for Incontinence Care:

The North America Adult Diapers Market is strongly driven by the rapid increase in the elderly population across the region. Longer life expectancy and growing health concerns associated with aging create sustained demand for adult incontinence products. Healthcare institutions, nursing homes, and families are investing more in hygienic solutions for elderly care. Rising awareness regarding quality of life encourages greater adoption beyond clinical use. Brands focus on making products discreet and comfortable, which further normalizes usage among seniors. The cultural acceptance of these products is gradually improving across North America. It continues to strengthen market penetration and increase long-term demand.

- For instance, in the United States, adult incontinence products have been a major growth market, driven by demographic trends. The elderly population is projected to continue growing, with the population aged 65 and over expected to exceed 72 million by 2030. Additionally, over 53 million Americans provide unpaid care for adults, which boosts the demand for effective incontinence management products.

Increased Awareness and Shifting Perception Toward Lifestyle Products:

Awareness campaigns and educational initiatives by healthcare providers highlight the importance of incontinence management. The market is benefiting from shifting perceptions that position adult diapers as lifestyle aids rather than strictly medical necessities. Consumers show increasing comfort in purchasing these products in retail outlets and online platforms. The integration of wellness and hygiene branding strategies reduces social stigma and boosts confidence in usage. It helps normalize adult diapers as a standard hygiene product. Companies are leveraging media and digital channels to reach broader demographics. The North America Adult Diapers Market is witnessing faster growth from evolving attitudes that support broader acceptance.

- For instance, leading brands employ targeted marketing that emphasizes discreetness and comfort, aligning with consumer preference for products that integrate into daily life without stigma.

Product Innovation With Comfort, Discretion, and Sustainability Features:

Manufacturers are innovating with materials that ensure breathability, comfort, and odor control. Product lines include slim-fit designs and reusable options to meet consumer preferences. Innovations focus on blending functionality with discreet wear for daily activities. Companies invest in eco-friendly production practices to align with sustainability goals. It makes adoption more appealing to environmentally conscious buyers. These advancements encourage repeat purchases and stronger customer loyalty. Product innovation remains one of the strongest growth drivers for the regional market.

Expansion of Distribution Through Retail, E-Commerce, and Healthcare Networks:

Accessibility is a critical driver of adoption across the region. Supermarkets, pharmacies, and convenience stores have expanded shelf space for adult diapers. E-commerce platforms provide discreet purchasing options, improving adoption among hesitant buyers. Subscription services offer cost savings and convenience, boosting retention rates. Healthcare facilities support demand through large-scale procurement for patients. Partnerships between manufacturers and hospitals enhance product credibility and brand trust. The North America Adult Diapers Market benefits from this wide distribution reach. It creates consistent growth opportunities across diverse consumer segments.

Market Trends:

Integration of Smart Technology and Sensor-Based Adult Diapers:

The North America Adult Diapers Market is experiencing a rising trend in smart wearable technologies. Manufacturers are developing sensor-enabled diapers that detect moisture levels and alert caregivers. These innovations enhance patient comfort, reduce health risks, and optimize care. Nursing homes and hospitals are early adopters due to efficiency in staff workload. Home caregivers also find value in real-time monitoring tools. This technology-driven approach helps create differentiation in a competitive market. It shows how innovation is reshaping product categories beyond traditional hygiene.

- For instance, adult smart diapers with Bluetooth and sensor technology are gaining traction, especially in the U.S., where advanced healthcare infrastructure supports adoption. The smart diapers market includes sensor-enabled products that improve patient care and have made North America the top-performing region globally in this segment as of 2024.

Rising Popularity of Eco-Friendly and Biodegradable Product Lines:

Sustainability is influencing consumer purchasing decisions across hygiene products. Manufacturers are launching eco-friendly diapers with biodegradable materials and reduced plastic use. Growing environmental awareness pushes brands to invest in sustainable production processes. Eco-conscious consumers prefer these products even at premium pricing levels. It supports long-term loyalty and strengthens brand reputation. Companies focus on certifications and marketing strategies that emphasize green commitments. The North America Adult Diapers Market is adapting to this trend with strong traction in urban markets.

- For instance, TENA and Depend have introduced eco-friendly diaper lines incorporating biodegradable materials, and Drylock Technologies announced the world’s first compostable diaper made from 80-90% natural, plant-based materials, designed for institutional use such as hospitals and kindergartens.

Growing Customization and Personalization Across Product Segments:

Consumers increasingly prefer diapers designed to match specific lifestyle needs. Options include gender-specific designs, varying absorption levels, and flexible fits. This personalization ensures comfort, reduces stigma, and promotes frequent use. Brands are tailoring packaging and sizing for different demographics, including active adults. It improves customer satisfaction and strengthens product positioning in retail outlets. Customization strategies reflect a focus on consumer-centric growth. The trend signals a shift toward higher-value premium product offerings.

Emergence of Subscription Models and Digital Sales Channels:

Digital platforms are reshaping the sales approach for adult hygiene products. Subscription models provide convenience, discretion, and cost-effectiveness for recurring buyers. Retailers and e-commerce firms are expanding digital outreach campaigns to attract younger caregivers. Data analytics enable targeted marketing and predictive stocking strategies. It reduces stockouts and improves consumer trust in availability. Online reviews and influencer recommendations also encourage adoption. The North America Adult Diapers Market benefits from these digital innovations that accelerate product reach.

Market Challenges Analysis:

High Costs of Premium Products and Limited Affordability for Some Consumers:

The North America Adult Diapers Market faces challenges due to the high costs of advanced products. Premium diapers with comfort and sustainability features are often priced beyond the reach of budget-conscious consumers. Economic disparities across urban and rural populations create gaps in accessibility. Insurance and healthcare reimbursement programs may not always cover these products. It restricts broader penetration and impacts volume-driven growth. Retailers often struggle to balance premium inventory with affordable options. Pricing pressure is a significant challenge for sustaining inclusive adoption rates. Companies must navigate this balance to avoid losing price-sensitive buyers.

Social Stigma and Consumer Reluctance Despite Rising Awareness:

Cultural perceptions still limit full acceptance of adult diapers in some parts of North America. Despite awareness campaigns, social stigma prevents consumers from openly purchasing or discussing these products. Discretion in packaging and marketing helps, but barriers remain strong in rural or conservative markets. It creates reluctance among potential buyers, reducing overall adoption rates. Younger caregivers may hesitate to purchase due to embarrassment or fear of judgment. Manufacturers and retailers must continue to build awareness to overcome these psychological barriers. The North America Adult Diapers Market struggles with this challenge, slowing down broader market normalization.

Market Opportunities:

Expanding Home Healthcare Services and Demand for Convenient Solutions:

The North America Adult Diapers Market holds opportunities through rising demand for home healthcare. Families are managing incontinence care at home due to cost savings and personal comfort. The growing preference for convenience-based hygiene solutions creates strong product uptake. Subscription-based models offer ease and encourage consistent usage. It supports market expansion across both urban and suburban households. Companies investing in caregiver-focused solutions can secure long-term consumer loyalty. This opportunity aligns with demographic and cultural shifts in elderly care management.

Growth Potential in Emerging Markets Across Canada and Mexico:

Beyond the United States, emerging demand in Canada and Mexico offers growth prospects. These regions are experiencing lifestyle changes, rising disposable incomes, and expanding healthcare access. Cultural openness toward adopting adult hygiene products is also improving steadily. It positions Canada and Mexico as promising contributors to future regional growth. Localized marketing strategies can strengthen consumer engagement and drive adoption. The North America Adult Diapers Market benefits from these emerging opportunities that broaden its regional footprint. Companies can achieve stronger market balance by diversifying beyond the U.S. market.

Market Segmentation Analysis:

By Type

The North America Adult Diapers Market is segmented into pad type, pant/pull-up type, tape-on diapers, and others. Pad type products dominate due to ease of use and affordability, making them popular among healthcare facilities. Pant/pull-up diapers are gaining strong momentum for their discreet design and comfort, appealing to active users. Tape-on diapers remain significant in long-term care settings where caregivers play a key role. Other niche products serve specialized needs and contribute to diversification.

- For instance, the pad type segment accounted for the largest market share in 2024, holding approximately 51.8% to 57.13% of the market, primarily catering to moderate to heavy incontinence and often used with washable undergarments. Meanwhile, pant-style products are expected to grow rapidly, reflecting strong adoption for their convenience and resemblance to regular underwear. Tape-type remains a significant product type, especially in healthcare institutions for bedridden patients due to ease of changing and secure fit.

By End-User

Women form the leading consumer group, driven by higher prevalence of incontinence issues. Men represent a growing segment, supported by targeted product designs and awareness campaigns. The unisex category appeals to institutional buyers and caregivers, offering flexibility in procurement. It strengthens adoption across hospitals, nursing homes, and homecare facilities.

- For instance, the female segment accounted for over 57% of the cosmetics market revenue share in 2024, while in the broader apparel market, women’s apparel accounted for 47.44% of the market share. Unisex products are gaining rapid adoption, especially for uniforms in institutional settings, due to their versatility and potential for streamlined procurement and inventory management.

By Distribution Channel

Offline channels, including supermarkets, pharmacies, and convenience stores, hold a strong position due to established consumer trust and accessibility. E-commerce is expanding rapidly, offering discreet purchase options and subscription services that encourage repeat buying. The digital shift provides manufacturers with new opportunities for consumer engagement and brand differentiation. Both channels collectively support balanced market growth.

Segmentation:

By Type

- Pad Type

- Pant/Pull-up Type

- Tape-on Diapers

- Others

By End-User

By Distribution Channel

- E-Commerce

- Offline Channel

By Country

- United States (U.S.)

- Canada

- Mexico

Regional Analysis:

United States: Leading Market with Strong Healthcare Support

The United States dominates the North America Adult Diapers Market with over 65% share in 2024. Its large aging population and advanced healthcare infrastructure create consistent demand for incontinence products. Strong retail penetration across supermarkets, pharmacies, and online channels ensures product availability nationwide. Cultural acceptance of hygiene products is higher compared to neighboring countries, encouraging broader adoption. Manufacturers leverage the U.S. market for premium product launches, eco-friendly variants, and subscription models. It maintains leadership through innovation, strong distribution, and high consumer spending power.

Canada: Expanding Market Driven by Awareness and Access

Canada accounts for around 20% of the North America Adult Diapers Market share in 2024. Growth is supported by rising awareness of elderly care needs and improved healthcare access. Public health programs and subsidies in some provinces promote adoption of adult incontinence products. E-commerce platforms strengthen reach in both urban and semi-urban locations. Consumers show growing interest in eco-friendly and comfort-focused diaper designs. It demonstrates steady growth as awareness and cultural openness improve across the country.

Mexico: Emerging Growth Market with Rising Disposable Income

Mexico contributes close to 15% of the North America Adult Diapers Market in 2024. Demand is rising due to urbanization, lifestyle changes, and improving disposable income levels. Healthcare reforms and expanding private care facilities support greater product use. Social stigma remains a barrier, but targeted awareness campaigns are reducing hesitation among consumers. Offline retail remains dominant, while e-commerce adoption is gradually strengthening. It presents a strong growth opportunity as cultural acceptance improves and healthcare systems expand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The North America Adult Diapers Market is highly competitive, with global leaders and regional players focusing on innovation and expansion. Companies such as Kimberly-Clark, Procter & Gamble, Essity, and Ontex dominate through strong brand portfolios, advanced product designs, and extensive distribution networks. Smaller firms compete by offering eco-friendly, cost-effective, or specialized solutions targeting niche consumer groups. Intense rivalry encourages frequent product launches, promotional campaigns, and strategic collaborations with healthcare providers. It drives continuous improvement in product quality and accessibility. The competitive environment emphasizes sustainability, comfort, and discreet product use to capture wider acceptance.

Recent Developments:

- In 2025, Essity continued to emphasize growth through acquisitions and innovation in personal hygiene solutions, including adult incontinence products, despite facing soft demand in North America as of June 2025.

- In 2025, Kimberly-Clark Corporation announced a strategic transformation to enhance growth and profitability, focusing on innovation and sustainability. The company emphasized its ambition to become 100% natural forest-free across its product portfolio, reinforcing its leading position in adult incontinence products such as Depend® and Poise® as of March 2024.

- Ontex Group in July 2025 introduced lower-carbon bio-based superabsorbent polymers in its diaper products to reduce the carbon footprint while maintaining performance. Additionally, in September 2025, Ontex announced an expansion of its diaper and training pant size ranges for the U.S. market, offering sizes 3 through 7 for diaper pants and size 5T/6T for training pants starting in 2026.

- First Quality Enterprises signed a definitive agreement in September 2025 to acquire Henkel’s Retailer Brands business in North America, expanding its product portfolio to include detergents and fabric finishers alongside its existing adult diaper lines. This acquisition will create a new division called First Quality Home Care Products.

Report Coverage:

The research report offers an in-depth analysis based on type, end-user, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising aging populations will continue driving strong demand across healthcare and homecare settings.

- Growth of eco-friendly and biodegradable products will expand sustainability-focused market segments.

- Smart diaper technology adoption will increase in hospitals and eldercare facilities.

- E-commerce will strengthen due to consumer preference for privacy and subscription-based services.

- Cultural acceptance of adult diapers will widen, reducing stigma across North America.

- Product innovations focusing on comfort, odor control, and fit will enhance consumer trust.

- Canada and Mexico will emerge as faster-growing markets compared to the U.S. base.

- Healthcare partnerships will expand institutional adoption and strengthen brand credibility.

- Premium product launches will capture affluent and active senior demographics.

- Competitive intensity will encourage continuous innovation, marketing investments, and consumer engagement.