Market Overview

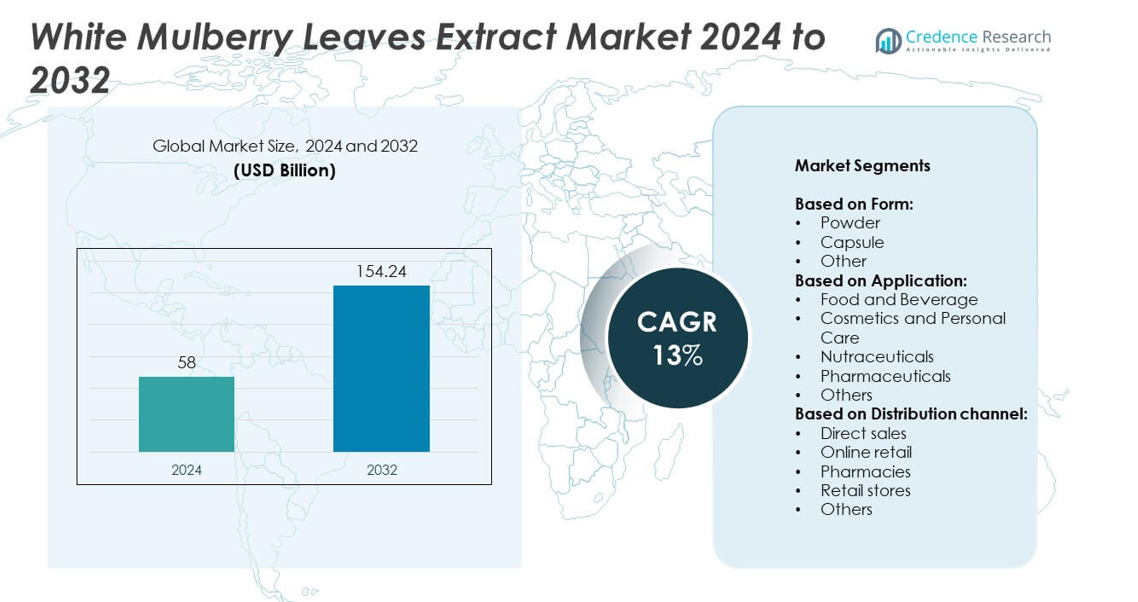

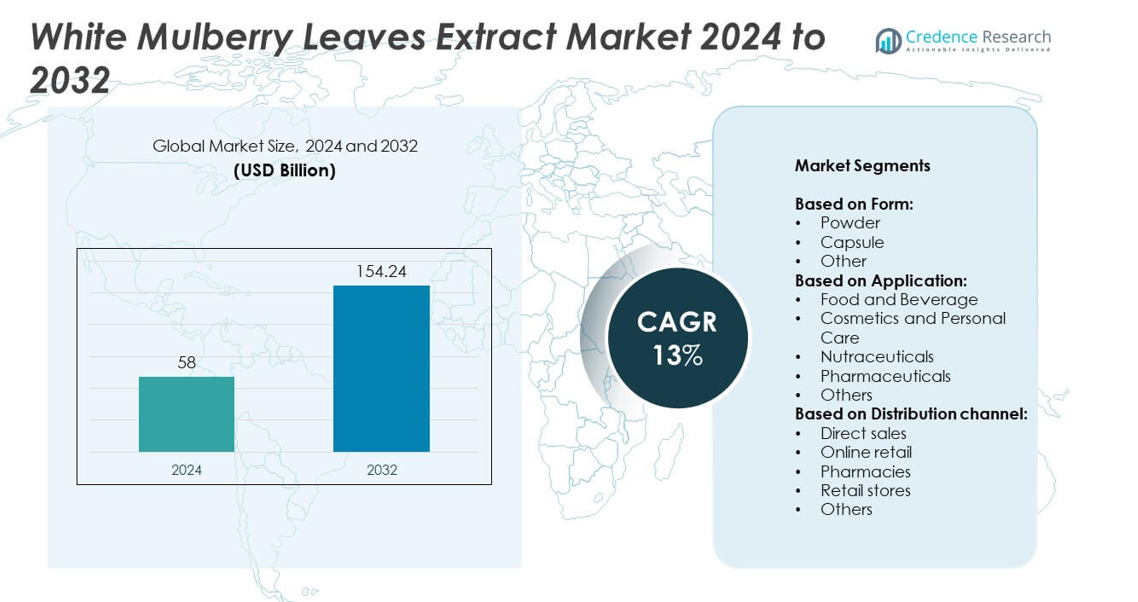

White Mulberry Leaves Extract market size was valued USD 58 Billion in 2024 and is anticipated to reach USD 154.24 Billion by 2032, at a CAGR of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| White Mulberry Leaves Extract Market Size 2024 |

USD 58 Billion |

| White Mulberry Leaves Extract Market, CAGR |

13% |

| White Mulberry Leaves Extract Market Size 2032 |

USD 154.24 Billion |

The White Mulberry Leaves Extract market is shaped by key players such as iHerb, LLC, Biotic Nature Products, Swanson Health Products, Phytotech Extracts Pvt Ltd, Shaanxi SCIGROUND Biotechnology Co., Ltd., Nutra Green, Undersun Biomedtech Corp., Kordel’s, NuVitality, and Nans Products. These companies focus on developing standardized, high-quality extracts for nutraceutical, food, and cosmetic applications. They invest in research and sustainable sourcing to ensure consistent bioactive content and global supply. North America led the market with a 36% share in 2024, supported by high consumer awareness and strong distribution networks, while Europe and Asia-Pacific followed with significant demand growth.

Market Insights

- The White Mulberry Leaves Extract market was valued at USD 58 Billion in 2024 and is projected to reach USD 154.24 Billion by 2032, growing at a CAGR of 13%.

- Rising demand for nutraceuticals and functional foods drives market growth, with powder form leading at over 55% share.

- Key trends include growing preference for organic, standardized extracts and expanding e-commerce channels for direct-to-consumer sales.

- The market is competitive, with global and regional players focusing on R&D, sustainable sourcing, and innovative formulations to strengthen market position.

- North America leads with 36% share, followed by Europe at 28% and Asia-Pacific at 25%, supported by rising health awareness and strong distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

Powder form dominated the White Mulberry Leaves Extract market with over 55% share in 2024. Its popularity is driven by versatility and ease of use in teas, functional beverages, and dietary supplements. Powder allows for better solubility, extended shelf life, and convenient bulk packaging for manufacturers. Rising demand for natural herbal products in Asia-Pacific and Europe further supports its growth. Capsule form is gaining momentum due to its precise dosage and convenience for health-conscious consumers, while other forms, including tinctures and tablets, remain niche but support specialized formulations in the nutraceutical sector.

- For instance, Xi’an Sost Biotech Co., Ltd., reported an annual production capacity of over 8,000 metric tons of various health ingredients. The company produces a wide range of ingredients, including fruit powders, herbal medicines, and vegetable powders. The global market for mulberry leaf powder was valued at $1.45 billion in 2024.

By Application

Nutraceuticals accounted for over 40% of the market share in 2024, emerging as the dominant application segment. Growing awareness of blood sugar regulation, weight management, and antioxidant benefits drives its adoption in dietary supplements. Increasing prevalence of lifestyle-related disorders such as diabetes boosts demand for functional health products. Food and beverage applications follow closely, with rising inclusion in herbal teas and fortified drinks. Cosmetics and personal care are expanding as mulberry extracts gain traction in skin-brightening and anti-aging products, while pharmaceuticals represent a smaller but steadily growing segment focused on herbal therapeutic formulations.

- For instance, Pharmavit, a pharmaceutical ingredients supplier based in Western Europe, explicitly lists its capacity as 7,000,000 kg per year on its website.

By Distribution Channel

Online retail led the market with more than 35% share in 2024, supported by the rapid growth of e-commerce platforms and direct-to-consumer brands. Rising internet penetration and convenience of home delivery boost online sales of herbal extracts and supplements. Direct sales channels also perform strongly, catering to bulk buyers in nutraceutical and beverage manufacturing. Pharmacies and retail stores hold steady demand as trusted offline options for health-conscious buyers. Other channels, including specialty health stores and herbal product distributors, continue to serve niche customers seeking personalized recommendations and locally sourced products.

Market Overview

Rising Demand for Natural Nutraceuticals

The increasing consumer preference for plant-based supplements is a major driver for the White Mulberry Leaves Extract market. Its proven benefits in blood sugar regulation and cholesterol management boost adoption in dietary supplements. The growing diabetic population worldwide, particularly in Asia-Pacific, supports consistent demand. Manufacturers are innovating with organic and standardized extracts to attract health-conscious consumers. This driver remains the most significant growth factor, pushing the extract into mainstream nutraceutical formulations and fueling continuous market expansion over the forecast period.

- For instance, iHerb announced it had fulfilled 37 million orders across 180 countries in 2024.

Expansion in Functional Food and Beverage Industry

Functional foods and beverages incorporating botanical ingredients are gaining popularity. White Mulberry Leaves Extract is increasingly used in herbal teas, fortified drinks, and meal replacement products due to its high antioxidant and flavonoid content. The rising focus on preventive health and wellness encourages consumers to choose products with added health benefits. Food and beverage manufacturers are also launching ready-to-drink teas and powders with mulberry extract, driving global product availability and market penetration. This trend is strongly supported by retail and e-commerce distribution networks.

- For instance, Sabinsa Corporation showcases a variety of ingredients for blood sugar management, including Silbinol®, sourced from Pterocarpus marsupium. In 2023, the parent company Sami-Sabinsa Group inaugurated its eighth manufacturing facility in Hassan, India. This new facility has an annual production capacity of 88 tons of active nutraceutical and pharmaceutical ingredients.

Growing Demand from Cosmetics & Personal Care

The cosmetics industry is adopting White Mulberry Leaves Extract for its skin-brightening and anti-aging properties. The extract inhibits melanin production, making it a popular ingredient in creams, serums, and facial masks targeting hyperpigmentation. Rising demand for natural, clean-label cosmetic products is driving increased formulation use. Major skincare brands are highlighting mulberry extracts as a key botanical ingredient, fueling growth in the premium and organic skincare segment. This driver is particularly strong in Asia-Pacific, where natural whitening products are highly sought after.

Key Trends & Opportunities

Shift Toward Organic and Standardized Extracts

There is a rising trend toward certified organic and standardized White Mulberry Leaves Extract, driven by consumer preference for clean-label and sustainable products. Brands are focusing on transparent sourcing and traceability to attract environmentally conscious buyers. This trend opens opportunities for suppliers to develop premium organic product lines and secure certifications that enhance credibility. It also aligns with regulatory compliance for natural health products, creating room for expansion in Europe and North America, where demand for certified herbal ingredients continues to grow.

- For instance, Phynova’s Reducose® underwent a double-blind randomized crossover trial with 37 participants to validate reductions in blood glucose and insulin responses at three doses (200 mg, 225 mg, 250 mg).

Growth of E-Commerce and Direct-to-Consumer Models

E-commerce platforms and direct-to-consumer brands present a strong growth opportunity for market participants. Online sales provide wider reach, product visibility, and access to niche health-conscious audiences. Subscription-based supplement models and personalized recommendations enhance customer retention. Digital marketing strategies and influencer-driven product promotions further accelerate demand. The convenience of online purchasing also allows smaller herbal product manufacturers to compete effectively, creating a dynamic and competitive online ecosystem that supports continuous growth in this market segment.

- For instance, UnderHerb’s standardized product (10:1 extract) with 1% DNJ requires about 1000 mg raw leaf equivalent to produce 100 mg standardized extract. (Because 10:1 means 10 times the leaf mass).

Key Challenges

Supply Chain Volatility and Raw Material Costs

Fluctuations in mulberry leaf availability due to seasonal variations and climate conditions pose a challenge for manufacturers. Inconsistent raw material supply impacts production planning and pricing stability. Rising costs for organic farming and sustainable sourcing add pressure on profit margins, especially for small-scale producers. Companies must invest in reliable supplier partnerships and cultivation programs to ensure consistent quality and mitigate the risk of supply shortages, which could otherwise disrupt market growth and product availability in key regions.

Regulatory Compliance and Quality Standardization

Varying global regulations on herbal ingredients create compliance challenges for market players. Lack of harmonized quality standards for botanical extracts complicates export and distribution processes. Manufacturers must ensure adherence to Good Manufacturing Practices (GMP) and conduct rigorous clinical validations to support health claims. Failure to meet regulatory requirements can result in product recalls or bans, harming brand reputation. This challenge highlights the need for industry-wide standardization and strong quality control mechanisms to build consumer trust and support long-term market growth.

Regional Analysis

North America

North America held the largest share of 36% in the White Mulberry Leaves Extract market in 2024. Rising awareness of herbal supplements and a strong focus on preventive healthcare are major growth factors. The United States leads demand due to a high prevalence of diabetes and obesity, driving the use of mulberry-based nutraceuticals and functional beverages. Expanding e-commerce sales channels and increasing product launches by supplement brands further strengthen market presence. Canada contributes steadily, supported by a growing preference for plant-based ingredients and natural wellness products, making the region a key revenue generator during the forecast period.

Europe

Europe accounted for 28% of the market share in 2024, supported by strong demand for organic and standardized herbal extracts. Countries such as Germany, the UK, and France are driving growth through rising adoption of natural dietary supplements and clean-label skincare formulations. Stringent regulatory frameworks encourage high-quality product development and certification, building consumer trust. Functional teas and herbal blends featuring mulberry extracts are gaining traction across the region. Increasing collaborations between nutraceutical manufacturers and retail chains, along with growing exports of European-certified botanical products, continue to boost market expansion across both Western and Eastern Europe.

Asia-Pacific

Asia-Pacific captured 25% share in the White Mulberry Leaves Extract market in 2024, with China, India, and Japan as major contributors. The region benefits from a long tradition of using mulberry leaves in herbal medicine, supporting widespread consumer acceptance. Rising health awareness and a growing middle-class population drive demand for dietary supplements and functional foods. Local manufacturers are investing in large-scale mulberry cultivation to meet rising domestic and export demand. Increasing presence of international supplement brands and expanding distribution through online platforms further enhance market penetration and create strong growth opportunities in the region.

Latin America

Latin America accounted for 7% share of the market in 2024, led by Brazil and Mexico. Growing interest in natural health products and herbal teas is driving consumption. Rising prevalence of lifestyle-related diseases, including diabetes and obesity, fuels demand for mulberry-based nutraceuticals. Local companies are introducing affordable supplement options to cater to the expanding health-conscious population. The region also benefits from supportive government initiatives promoting herbal product development. Despite challenges in regulatory harmonization, improving supply chains and increasing investments in functional food products are expected to boost market growth across major Latin American economies.

Middle East & Africa

Middle East & Africa represented 4% of the market share in 2024, with steady demand emerging from Gulf countries and South Africa. Growing interest in natural remedies and herbal supplements is driving sales, particularly among younger consumers seeking preventive health solutions. Expanding retail infrastructure and rising availability of international brands contribute to market growth. The cosmetics sector also supports demand, with mulberry extract gaining attention for skin-brightening formulations. Challenges such as limited local cultivation and higher product costs persist, but increasing awareness and urbanization are expected to unlock gradual growth opportunities across the region.

Market Segmentations:

By Form:

By Application:

- Food and Beverage

- Cosmetics and Personal Care

- Nutraceuticals

- Pharmaceuticals

- Others

By Distribution channel:

- Direct sales

- Online retail

- Pharmacies

- Retail stores

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The White Mulberry Leaves Extract market is highly competitive, with key players including iHerb, LLC, Biotic Nature Products, Swanson Health Products, Phytotech Extracts Pvt Ltd, Shaanxi SCIGROUND Biotechnology Co., Ltd., Nutra Green, Undersun Biomedtech Corp., Kordel’s, NuVitality, and Nans Products. The market features a mix of global supplement brands, botanical extract manufacturers, and nutraceutical suppliers focusing on product quality and formulation diversity. Companies emphasize research and development to create standardized extracts with higher bioactive content, supporting applications in nutraceuticals, functional beverages, and cosmetics. Strategic partnerships with online retail platforms and direct-to-consumer distribution channels are strengthening market reach. Several manufacturers are expanding cultivation and processing capacities to secure raw material supply and ensure consistent product availability. Innovation in clean-label, organic-certified, and vegan formulations is a key competitive differentiator, catering to rising demand for natural wellness solutions and helping companies maintain strong positions across major regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- iHerb, LLC

- Biotic Nature Products

- Swanson Health Products

- Phytotech Extracts Pvt Ltd

- Shaanxi SCIGROUND Biotechnology Co., Ltd.

- Nutra Green

- Undersun Biomedtech Corp.

- Kordel’s

- NuVitality

- Nans Products

Recent Developments

- In 2025, iHerb launched two new Terra Origin products, “Healthy Hydration+” and “Healthy Greens,” to its global customers, expanding their existing partnership and offering innovative solutions for wellness.

- In 2024, Swanson sells a range of white mulberry leaf products, including Mulberry Leaf Extract and a Cinnamon Gymnema Mulberry Complex, through retailers like iHerb.

- In 2022, Phynova Group Ltd and Ingredients Plus announced a distribution partnership for Reducose, for use in Supplement applications to customers in Oceania. Reducose is Phynova’s patented and clinically researched White Mulberry leaf extract that supports the significant lowering of post-meal blood sugar and insulin response and enabling food and beverage applications to become Low GI.

Report Coverage

The research report offers an in-depth analysis based on Form, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand from nutraceuticals driven by diabetes and obesity management.

- Functional food and beverage applications will expand with new product launches globally.

- Online retail will remain the fastest-growing channel with strong consumer adoption.

- Organic and standardized extracts will gain preference, boosting premium product sales.

- Cosmetic applications will rise with demand for natural skin-brightening solutions.

- Manufacturers will invest in sustainable mulberry cultivation to ensure raw material security.

- Asia-Pacific will witness the highest growth, supported by traditional herbal use.

- Strategic collaborations will increase between extract suppliers and supplement brands.

- Technological advancements will enhance extraction efficiency and bioactive concentration.

- Regulatory alignment and certifications will strengthen consumer trust and market acceptance.