Market Overview:

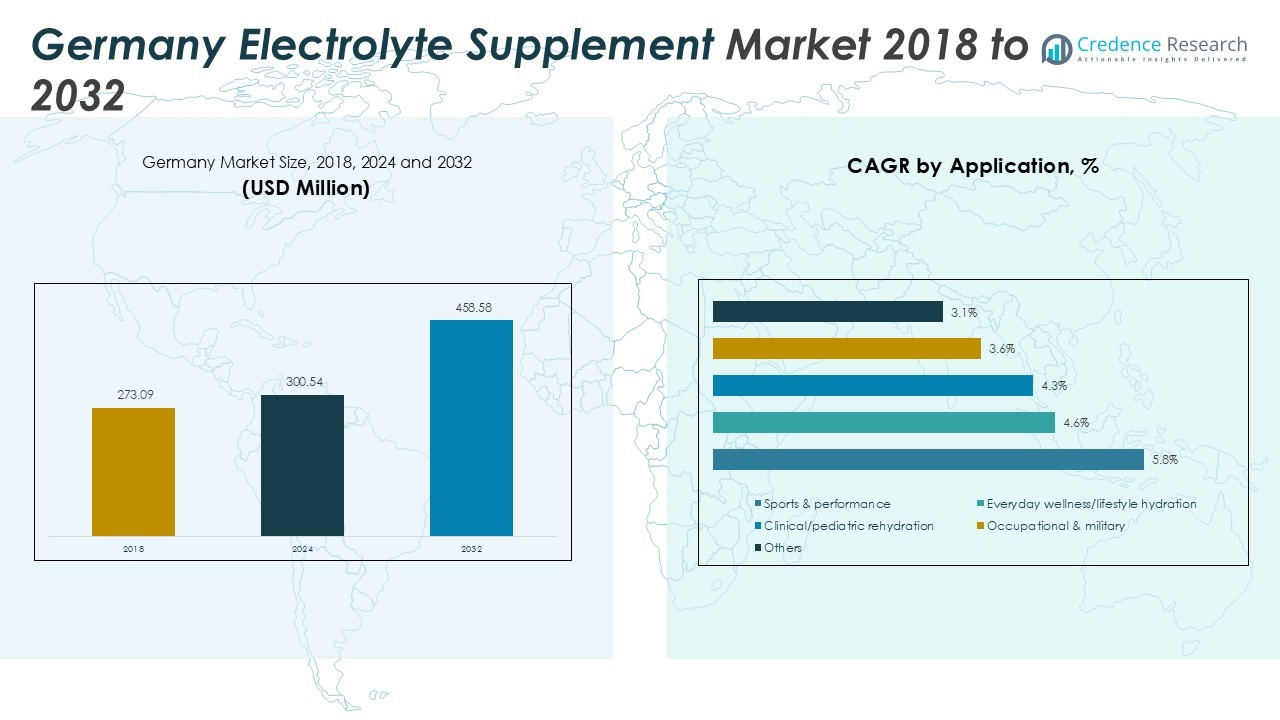

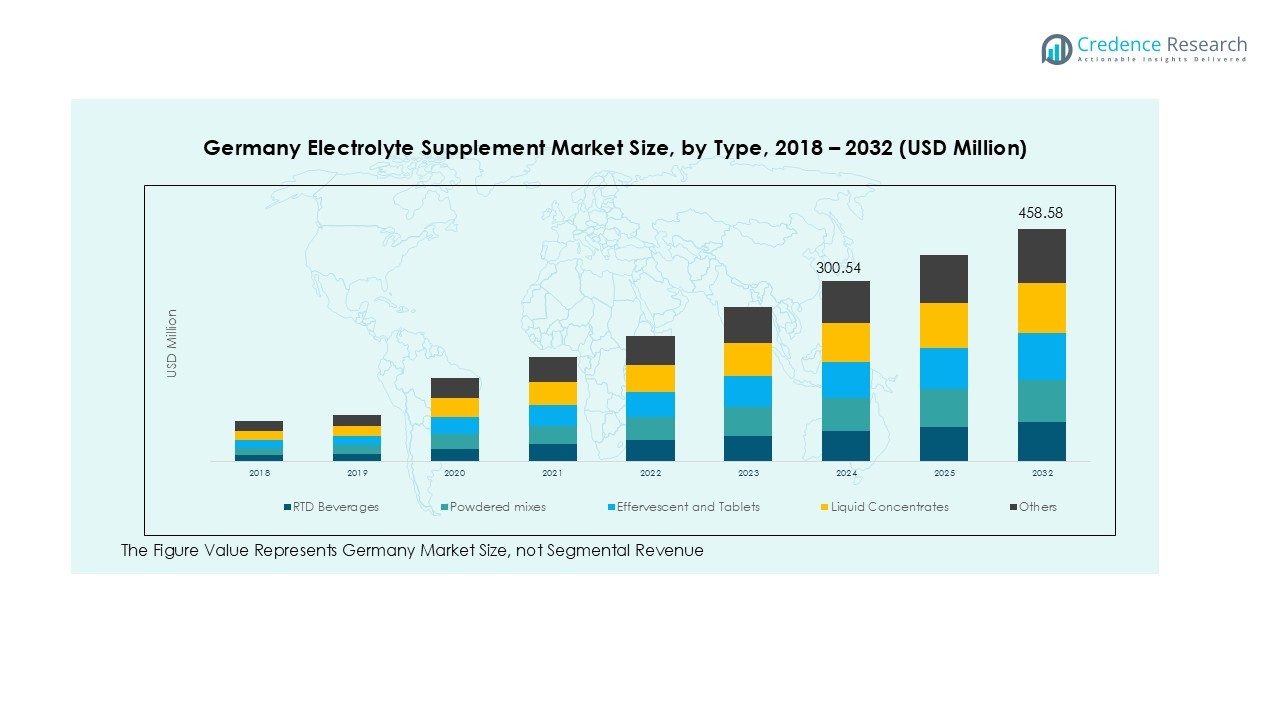

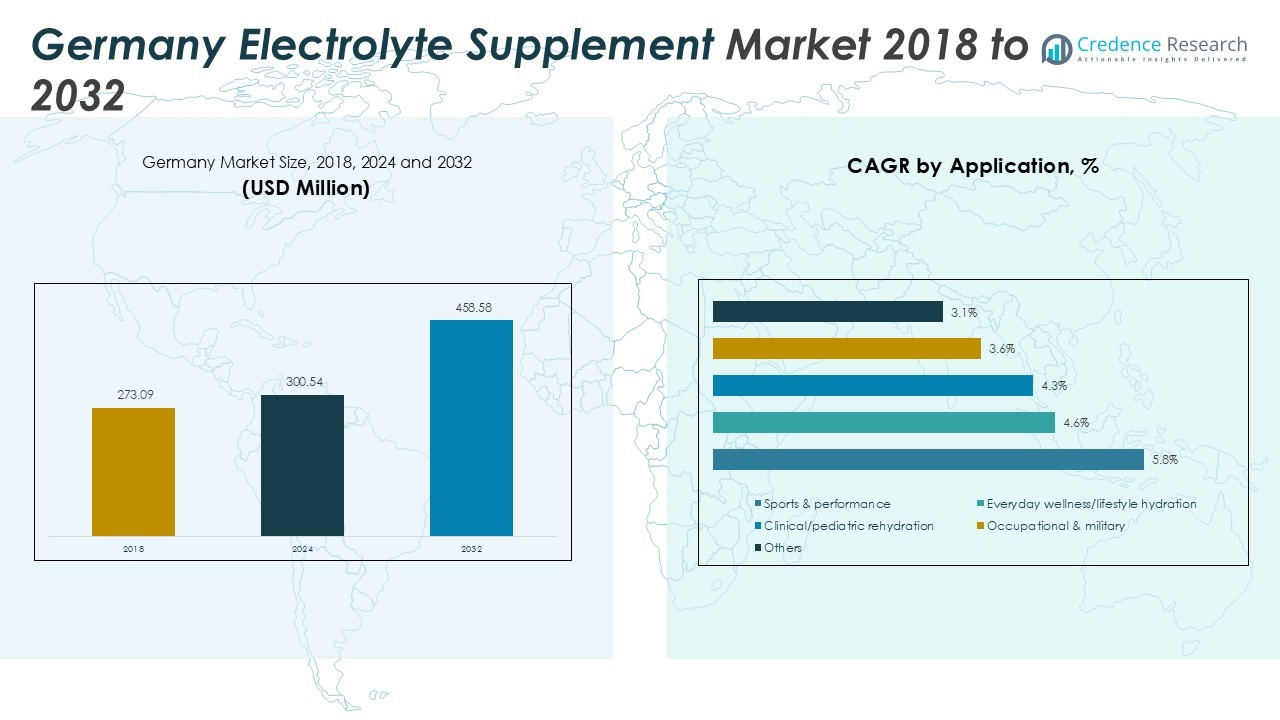

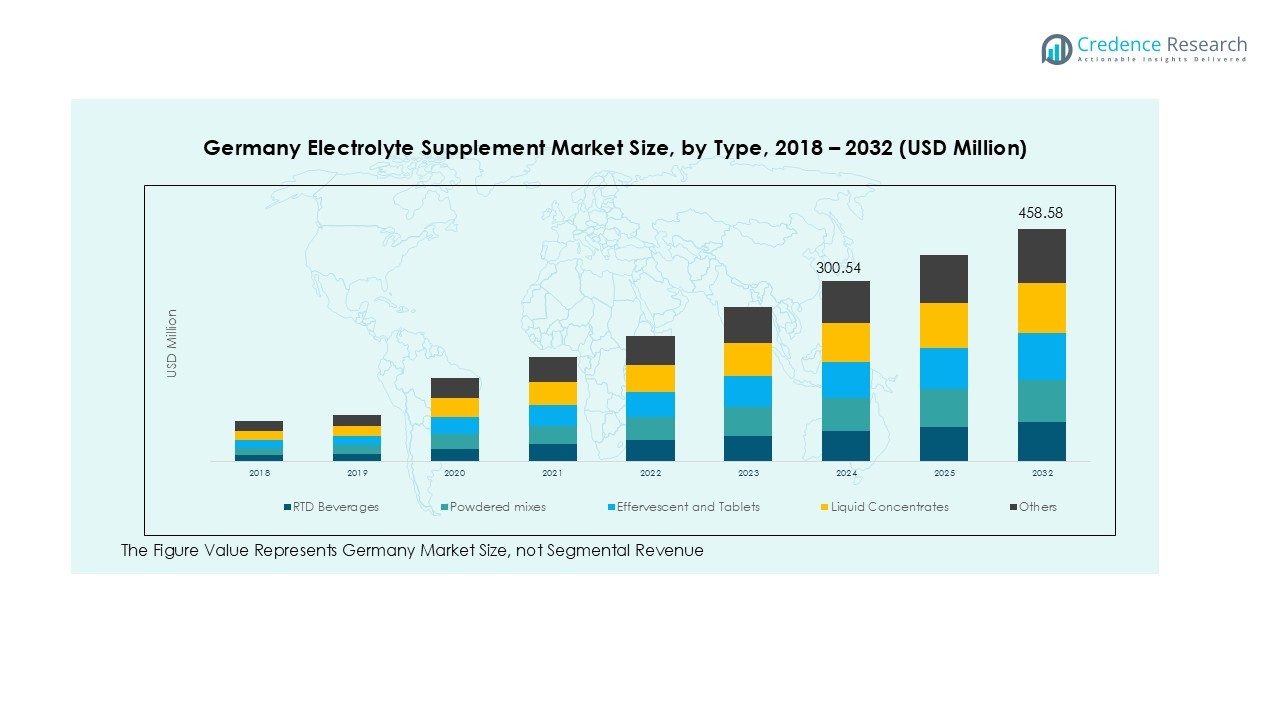

The Germany Electrolyte Supplement size was valued at USD 273.09 million in 2018 to USD 300.54 million in 2024 and is anticipated to reach USD 458.58 million by 2032, at a CAGR of 5.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Electrolyte Supplement Market Size 2024 |

USD 300.54 Million |

| Germany Electrolyte Supplement Market, CAGR |

5.42% |

| Germany Electrolyte Supplement Market Size 2032 |

USD 458.58 Million |

Key drivers of the market include the growing prevalence of dehydration, muscle cramps, and other health conditions that demand electrolyte supplementation. Furthermore, consumers are increasingly opting for natural and organic supplements, which align with the clean-label trend in the food and beverage industry. The shift towards healthier alternatives and functional foods has further accelerated the adoption of electrolyte supplements across various consumer demographics.

Regionally, the market is dominated by England, which holds the largest share due to a high concentration of fitness-conscious individuals and athletes. London, in particular, leads the market, supported by a large, active population. Other regions, such as Scotland and Wales, are also witnessing steady growth as the demand for fitness and wellness products continues to rise.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Electrolyte Supplement Market was valued at USD 273.09 million in 2018 and is expected to reach USD 458.58 million by 2032, growing at a CAGR of 5.42%.

- Rising health and fitness trends in Germany are driving demand for electrolyte supplements, especially among athletes and fitness enthusiasts seeking improved hydration and recovery.

- The increasing prevalence of dehydration and muscle cramps, particularly among active individuals, is significantly boosting the market for electrolyte supplements.

- Consumer preference for natural, clean-label products is accelerating market growth, as more people seek organic and chemical-free electrolyte supplements.

- The growing importance of online retail channels is expanding the reach of electrolyte supplements, making them more accessible to consumers across Germany.

- Competition from alternative hydration solutions such as water, sports drinks, and coconut water poses a challenge, requiring electrolyte brands to differentiate through innovation.

- England leads the market with 45% share, while Scotland, Wales, and urban areas like Munich, Berlin, and Hamburg contribute steadily to the market’s growth.

Market Drivers:

Rising Health Awareness and Fitness Trends

The Germany Electrolyte Supplement Market is benefiting from a growing awareness of health and wellness among consumers. A surge in fitness trends and the rising number of individuals engaging in physical activities are boosting the demand for electrolyte supplements. Athletes and fitness enthusiasts actively seek products that support hydration and performance, increasing the adoption of sports drinks and powders. This trend is supported by a broader focus on improving physical endurance and recovery post-exercise, fueling growth in the market.

- For instance, Precision Hydration’s PH 1000 electrolyte drink is technologically formulated with a high concentration of sodium, delivering 1,000mg of sodium per litre to match the amount lost by the average athlete in their sweat.

Increasing Prevalence of Dehydration and Muscle Cramps

The rising incidence of dehydration and muscle cramps is driving the demand for electrolyte supplements in Germany. These conditions often result from physical exertion, especially among athletes or individuals working in demanding environments. With a heightened awareness of the negative impacts of dehydration, consumers are turning to electrolyte supplements to replenish lost minerals and maintain proper fluid balance. This trend is contributing significantly to the market’s expansion, as consumers prioritize effective solutions for these health concerns.

Consumer Preference for Natural and Organic Products

There is a noticeable shift in consumer preference towards natural and organic products within the Germany Electrolyte Supplement Market. Consumers are increasingly drawn to clean-label supplements, free from artificial additives and preservatives. This demand aligns with broader global trends towards healthier, more sustainable food and beverage options. Suppliers are responding by offering electrolyte supplements that feature natural ingredients, which is further strengthening the market’s growth.

- For instance, the company Ancient + Brave offers its True Hydration product, which uses natural ingredients and provides 108mg of magnesium in a single serving.

Expanding Distribution Channels and Online Availability

The growing accessibility of electrolyte supplements through various distribution channels is another key driver for the market. Retailers are stocking a wide variety of electrolyte products, making them readily available to consumers. Furthermore, online platforms have expanded the reach of these products, allowing consumers to conveniently purchase supplements from the comfort of their homes. This expanded availability, coupled with increasing consumer education about the benefits of electrolyte supplementation, is driving further growth in the Germany Electrolyte Supplement Market.

Market Trends:

Increasing Demand for Convenient and On-the-Go Products

A notable trend in the Germany Electrolyte Supplement Market is the rising demand for convenient and portable products. Consumers are opting for electrolyte supplements that fit into their busy lifestyles, such as single-serve packets, effervescent tablets, and ready-to-drink beverages. These products cater to individuals who need hydration and electrolyte replenishment during or after physical activities, particularly athletes and fitness enthusiasts. With the growing focus on convenience, suppliers are continuously innovating to provide easily accessible options for consumers, making electrolyte supplementation more accessible in various settings, from gyms to outdoor activities.

- For instance, in March 2025, Electrolit expanded its premium hydration offerings with the launch of new multipacks, the company introduced a convenient 15-pack of its popular 12 oz ready-to-drink bottles to enhance portability for its customers.

Shift Towards Clean Label and Natural Ingredients

Another significant trend in the Germany Electrolyte Supplement Market is the shift toward clean-label products featuring natural ingredients. Consumers are increasingly seeking electrolyte supplements that are free from artificial additives, colors, and preservatives. This demand is driven by the broader consumer preference for healthier, more transparent food and beverage options. Brands are responding by offering products that highlight natural electrolytes such as coconut water, sea salt, and fruit extracts, which align with the rising consumer focus on natural and organic supplements. This trend not only caters to health-conscious consumers but also aligns with broader sustainability and wellness movements in the food and beverage industry.

- For instance, the European brand NoordCode provides an electrolyte mix that uses unrefined sea salt tested to be free of heavy metals and microplastics, delivering 1000mg of sodium in a single sugar-free serving.

Market Challenges Analysis:

Competition from Alternative Hydration Solutions

The Germany Electrolyte Supplement Market faces significant competition from alternative hydration solutions, such as plain water, sports drinks, and coconut water. Consumers often prefer these options, viewing them as simpler, more accessible ways to stay hydrated. This preference presents a challenge for electrolyte supplement brands, which must differentiate their products through superior benefits or innovative formulations. The rising trend of functional beverages, with added vitamins and minerals, further intensifies competition and puts pressure on electrolyte supplement brands to provide unique value propositions.

Regulatory and Quality Compliance Issues

Another challenge in the Germany Electrolyte Supplement Market is the need to comply with stringent regulations and quality standards. The German food and beverage industry is subject to strict regulations that govern product labeling, ingredient sourcing, and manufacturing practices. These regulations can increase operational costs and complicate market entry for new brands. Ensuring products meet the necessary health and safety standards while maintaining transparency in labeling can be resource-intensive for companies. Consequently, this can slow down innovation and hinder market growth, especially for smaller players.

Market Opportunities:

Growing Interest in Personalized and Targeted Products

The Germany Electrolyte Supplement Market presents opportunities for brands to develop personalized and targeted solutions for specific consumer needs. With increasing consumer awareness about health, there is a growing demand for products tailored to specific demographics, such as athletes, older adults, or individuals with specific health conditions like dehydration or muscle cramps. Brands can seize this opportunity by offering customized electrolyte supplements that address individual hydration needs. By incorporating advanced technologies like personalized nutrition or wearable health trackers, companies can further enhance product appeal and consumer engagement, driving market expansion.

Expansion of Online Sales Channels

There is a significant opportunity for the Germany Electrolyte Supplement Market to capitalize on the growing e-commerce sector. With increasing online shopping, more consumers are turning to digital platforms to purchase health and wellness products. This trend provides electrolyte supplement brands with a broader reach and direct access to consumers across the country. By investing in e-commerce strategies and offering convenient online shopping experiences, brands can tap into the growing demand for electrolyte products. Additionally, e-commerce allows for personalized marketing, helping brands target specific consumer segments more effectively.

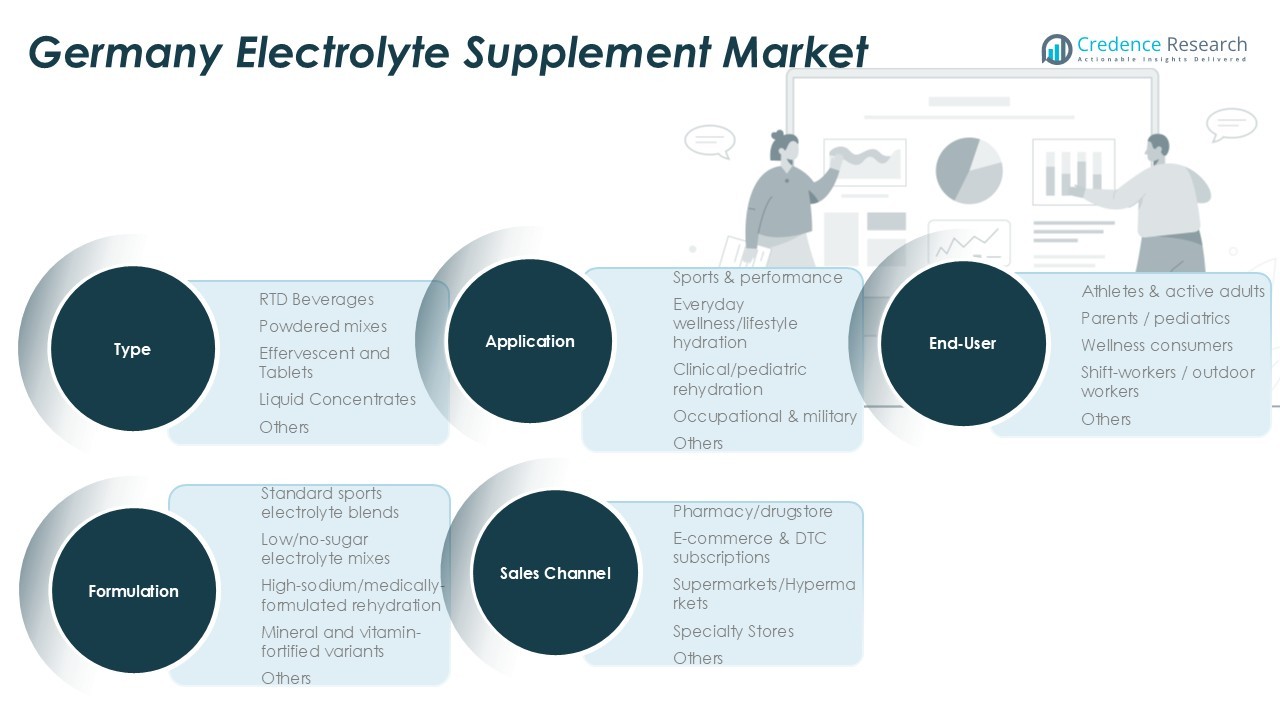

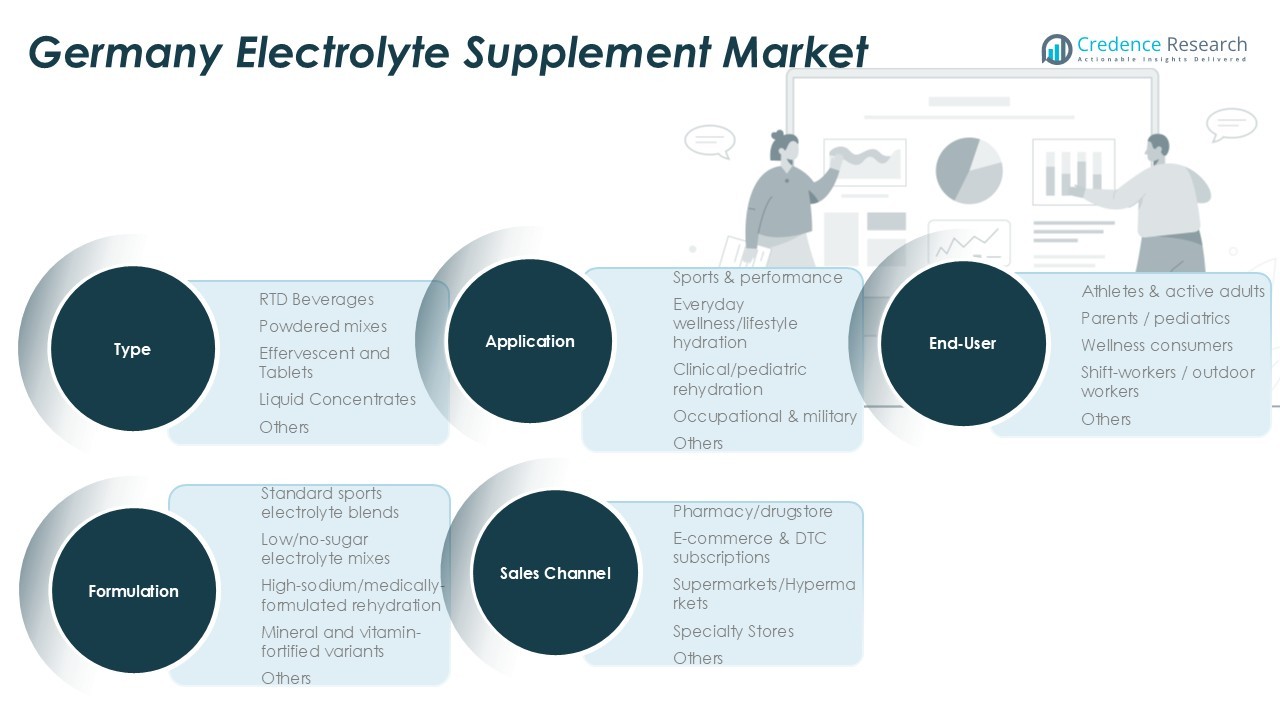

Market Segmentation Analysis:

By Type Segment

The Germany Electrolyte Supplement Market is divided into RTD beverages, powdered mixes, effervescent tablets, liquid concentrates, and others. RTD beverages hold the largest share due to their convenience and growing consumer preference for ready-to-consume hydration solutions. Powdered mixes also have a significant share, offering cost-effective and customizable options for hydration. Effervescent tablets and liquid concentrates target niche markets looking for specific rehydration products, adding diversity to the market’s offerings.

By Application Segment

The market is driven by several key applications, including sports and performance, everyday wellness/lifestyle hydration, clinical/pediatric rehydration, and occupational/military needs. Sports and performance products lead the market due to the rise in fitness trends in Germany. Everyday wellness hydration is growing as consumers prioritize general health. Clinical and pediatric rehydration products remain essential in medical settings, contributing to consistent demand. The occupational and military sector also plays a role, addressing the hydration needs of shift workers and personnel in high-demand environments.

- For instance, to address occupational hydration needs, Fluid Tactical offers electrolyte tablets originally designed for firefighters, with each tablet containing 320 mg of sodium to help prevent dehydration in demanding, high-heat environments.

By End-User Segment

The primary consumers in the Germany Electrolyte Supplement Market include athletes and active adults, who use supplements to maintain hydration and enhance performance. Wellness consumers are also a growing segment, focusing on health maintenance and disease prevention. Parents/pediatrics and shift-workers/outdoor workers form additional key segments, with each group having unique hydration requirements. These diverse end-users help expand the market’s reach across various demographic and occupational categories.

- For instance, the Cadence™ Electrolyte Drink is formulated to support athletes by delivering 500 mg of sodium in a single serving to help maintain fluid balance and proper muscle function during intense physical activity.

Segmentations:

By Type Segment:

- RTD Beverages

- Powdered Mixes

- Effervescent and Tablets

- Liquid Concentrates

- Others

By Application Segment:

- Sports & Performance

- Everyday Wellness/Lifestyle Hydration

- Clinical/Pediatric Rehydration

- Occupational & Military

- Others

By End-User Segment:

- Athletes & Active Adults

- Parents/Pediatrics

- Wellness Consumers

- Shift-Workers/Outdoor Workers

- Others

By Formulation Segment:

- Standard Sports Electrolyte Blends

- Low/No-Sugar Electrolyte Mixes

- High-Sodium/Medically-Formulated Rehydration

- Mineral and Vitamin-Fortified Variants

- Others

By Sales Channel Segment:

- Pharmacy/Drugstore

- E-Commerce & DTC Subscriptions

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Regional Analysis:

England Leads the Germany Electrolyte Supplement Market

England holds a 45% share in the Germany Electrolyte Supplement Market, driven by a large population of fitness-conscious individuals. The country’s active lifestyle culture supports a high demand for hydration and electrolyte products, particularly in major cities like London. The strong presence of sports events, gyms, and fitness centers further accelerates consumer engagement in health and fitness trends. This concentration of health-focused consumers positions England as the largest regional segment within the market.

Growth of the Germany Electrolyte Supplement Market in Scotland and Wales

Scotland and Wales account for 30% of the Germany Electrolyte Supplement Market. These regions have seen an increase in the adoption of healthier lifestyles and participation in physical activities, leading to a rise in demand for electrolyte supplements. Although these markets are smaller compared to England, the expanding consumer base in the fitness and wellness sector supports steady growth. The enhanced availability of products through retail and online channels is fueling further market development in both regions.

Urban Areas Fueling Market Expansion Across Germany

Urban areas in Germany, including Munich, Berlin, and Hamburg, contribute 25% to the total Germany Electrolyte Supplement Market. Increased consumer awareness of health and fitness in these cities is contributing to higher demand for electrolyte products. The trend toward healthier lifestyles continues to spread throughout major metropolitan areas, boosting product adoption. With greater accessibility through retail and e-commerce platforms, the Germany Electrolyte Supplement Market is expanding steadily across these urban centers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nestlé S.A.

- PepsiCo

- The Coca-Cola Company

- Abbott Laboratories

- Unilever PLC

- GlaxoSmithKline plc

- Otsuka Pharmaceutical Co., Ltd.

- Kent Corporation

- Stokely-Van Camp

- Roar Organic

- Purity Organic, LLC

- GNC Holdings, Inc.

- Osmo Nutrition

Competitive Analysis:

The Germany Electrolyte Supplement Market is highly competitive, with global leaders like Nestlé S.A., PepsiCo, and Unilever PLC dominating the landscape through strong brand recognition and extensive distribution networks. Regional players such as Orthomol Holding GmbH and Rocka Nutrition are carving out niches by focusing on organic and clean-label products. Emerging brands like Skratch Labs, Nuun Hydration, and GU Energy Labs emphasize functional benefits and sustainability to appeal to health-conscious consumers. Strategic moves like acquisitions, such as Unilever’s purchase of Liquid I.V., help companies expand their portfolios and market reach. This dynamic competition drives continuous innovation, particularly in product offerings tailored to specific consumer needs, including low-sugar, natural, and environmentally-friendly electrolyte solutions.

Recent Developments:

- In August 2025, Nestlé’s Coffee Mate brand partnered with the Harry Potter franchise to open the Honeydukes Cafe in Chicago.

- In June 2025, Nestlé announced the launch of an AI-powered internal service to generate product content for digital and e-commerce platforms.

- In June 2025, The Coca-Cola Company and Universal Music Group launched a new record label named Real Thing Records.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-User, Formulation, Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for electrolyte supplements in Germany will continue to rise due to increased health awareness and fitness trends.

- Consumers will increasingly prefer natural, organic, and clean-label products, reflecting broader global shifts toward sustainable and healthy living.

- The market will see a rise in personalized electrolyte supplement solutions, tailored to specific health needs and demographics.

- The growing prevalence of dehydration-related health issues, particularly among athletes and active adults, will drive product innovation.

- E-commerce and direct-to-consumer sales channels will expand, offering consumers easier access to a variety of products.

- Increasing product availability in pharmacies, supermarkets, and specialty stores will support the market’s growth across various regions.

- There will be a shift towards low-sugar and functional electrolyte blends that cater to health-conscious consumers.

- Strategic partnerships and acquisitions will play a critical role in expanding product portfolios and market reach.

- Occupational and military segments will see growth as hydration solutions become more crucial in demanding work environments.

- The market will witness increased focus on sustainable packaging and eco-friendly formulations, driven by consumer demand for environmentally responsible products.