Market Overview:

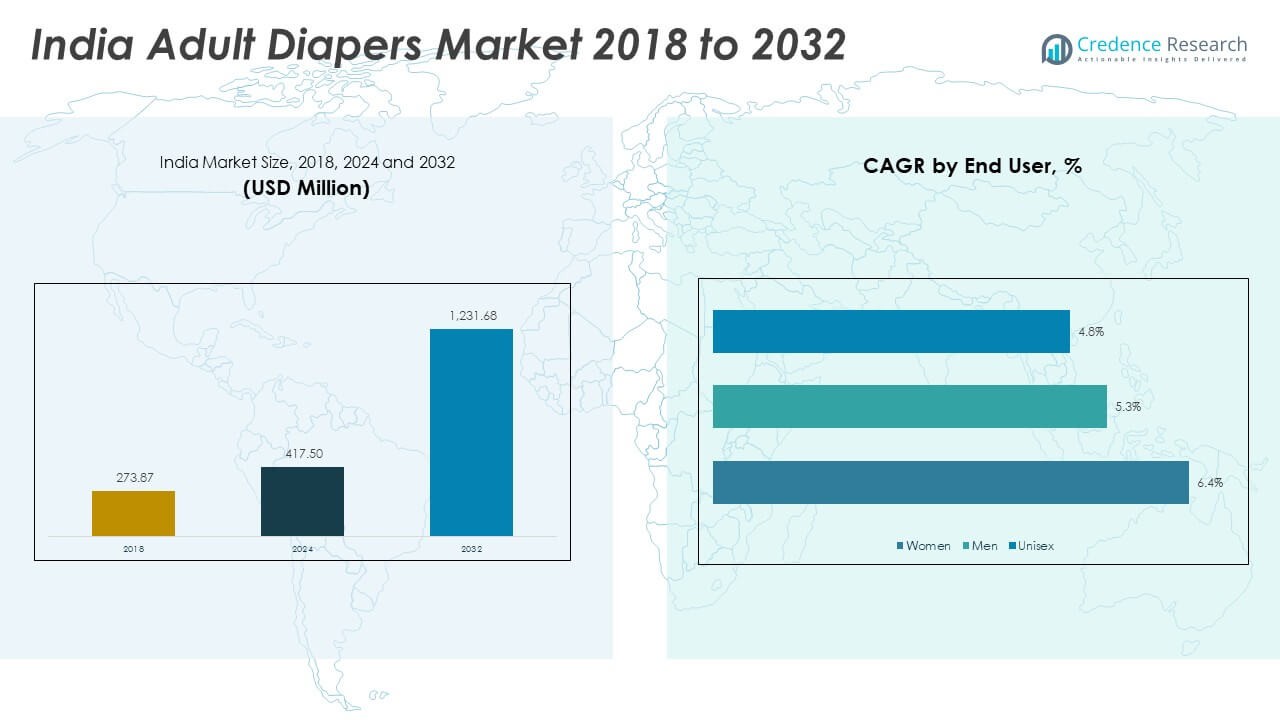

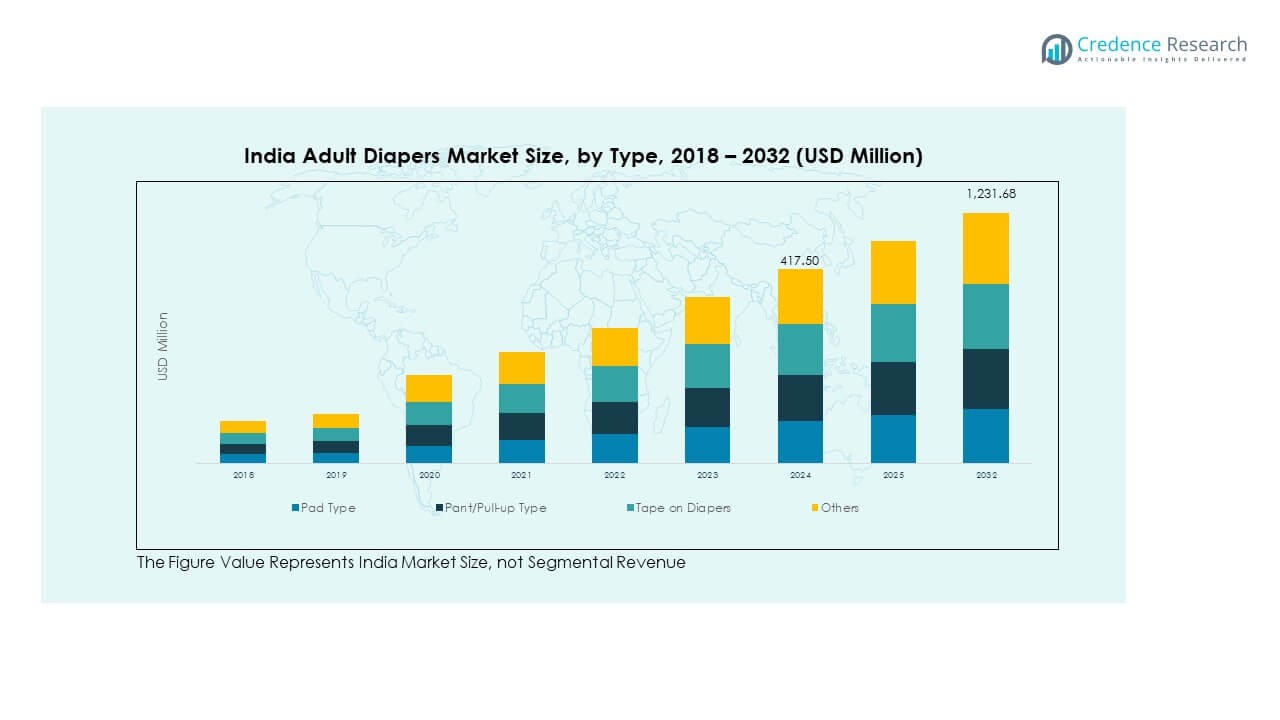

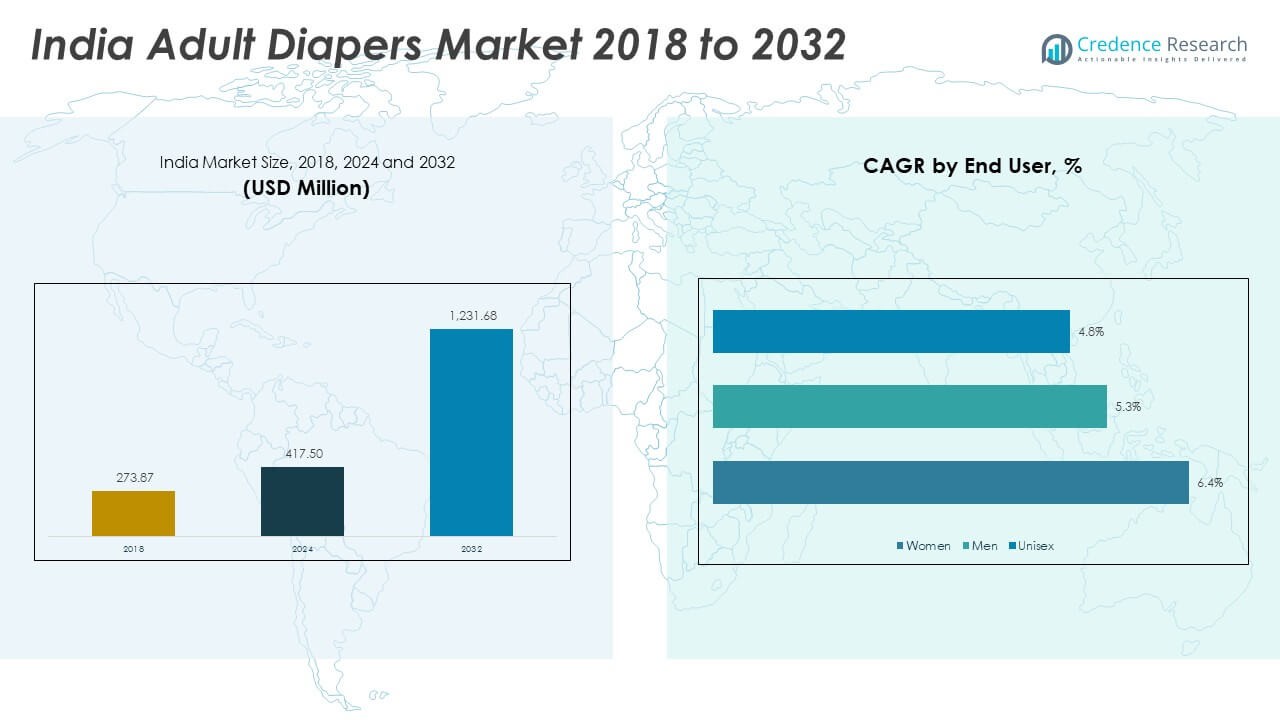

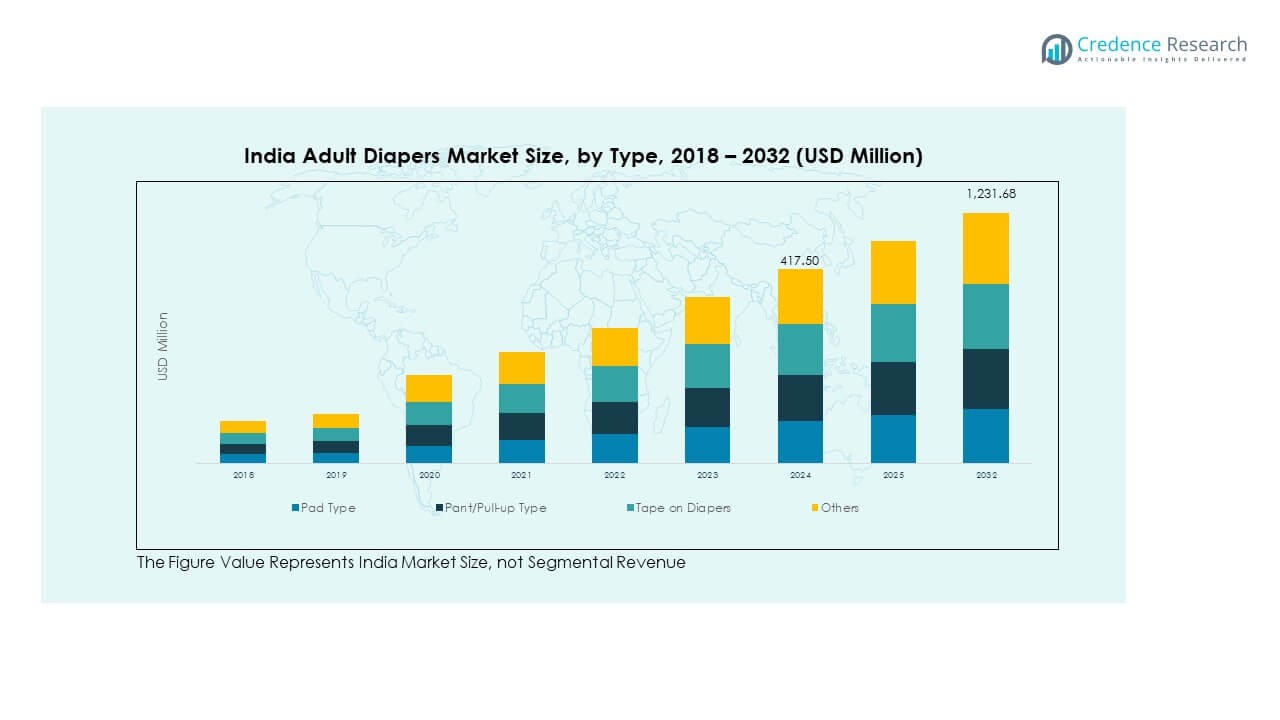

The India Adult Diapers Market size was valued at USD 273.87 million in 2018 to USD 417.50 million in 2024 and is anticipated to reach USD 1,231.68 million by 2032, at a CAGR of 14.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Adult Diapers Market Size 2024 |

USD 417.50 Million |

| India Adult Diapers Market, CAGR |

14.48% |

| India Adult Diapers Market Size 2032 |

USD 1,231.68 Million |

The market is experiencing strong growth due to rising awareness of elderly care, increasing cases of incontinence, and higher life expectancy. Growing urbanization, lifestyle changes, and improved access to healthcare products have also boosted demand. Manufacturers are focusing on product innovations such as skin-friendly materials, improved absorption capacity, and eco-friendly designs. The stigma around adult diaper use is reducing, leading to higher acceptance across both healthcare institutions and households. Expanding retail and e-commerce distribution further accelerates adoption.

Regionally, metropolitan areas and developed states dominate demand, supported by higher disposable incomes, better healthcare access, and greater awareness. Urban regions lead adoption due to lifestyle shifts and broader availability through organized retail and online platforms. Rural areas, though smaller in share, represent emerging growth opportunities driven by awareness campaigns and improving distribution networks. Increased government focus on elderly healthcare and the rapid rise in aging populations across key states ensure sustained market expansion across both established and developing regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The India Adult Diapers Market size was USD 273.87 million in 2018, reached USD 417.50 million in 2024, and is projected to hit USD 1,231.68 million by 2032, growing at a CAGR of 14.48%.

- North India led with 30% share in 2024, driven by urban demand and healthcare access; West India followed with 25%, supported by high incomes; South India held 28%, backed by strong hospital and institutional adoption.

- East and Central India, with 17% share in 2024, represent the fastest-growing region due to awareness campaigns, improving distribution, and untapped rural potential.

- Pant/Pull-up type accounted for the largest share in 2024, supported by ease of use, comfort, and discreet design, positioning it as the leading product type.

- Tape-on diapers held a notable share, driven by institutional demand from hospitals and elderly care facilities, while pad type products catered to cost-conscious users seeking lightweight options.

Market Drivers:

Rising Geriatric Population and Increasing Life Expectancy

The India Adult Diapers Market is significantly influenced by the country’s growing elderly population. A steady rise in life expectancy has led to a larger proportion of senior citizens requiring reliable incontinence solutions. With age-related health issues becoming more prevalent, demand for adult diapers has increased sharply. Families and caregivers view adult diapers as essential for enhancing comfort and hygiene in daily living. The healthcare sector actively promotes these products as part of geriatric care routines. Public health campaigns highlight awareness about incontinence, reducing hesitation among users. This demographic transformation forms one of the strongest drivers for the market’s growth.

- For instance, the Indian company Rotech Healthcare Private Limited manufactures the Lyfcare brand of adult diapers, which are designed with features like superior absorption technology and breathable fabric for comfort and fit. This serves the growing demand for adult incontinence products among India’s aging population.

Growing Awareness and Acceptance of Hygiene Products

The India Adult Diapers Market benefits from rising awareness regarding personal hygiene and comfort. Educational efforts by healthcare professionals and NGOs have reduced the stigma associated with adult diaper use. Increased exposure to global healthcare practices has encouraged urban populations to adopt these products. Hospital recommendations during post-surgical recovery or chronic illness further drive usage. Caregivers now consider adult diapers as necessary household items for managing elderly care. Acceptance across different socio-economic classes shows a gradual shift in attitudes. Expanding discussions around hygiene and dignity in aging strengthen product adoption across wider demographics.

- For instance, in mid-2023, ADbhoot’s Liberty Adult Diaper marketing campaign effectively reshaped societal perceptions, reaching over 300,000 consumers through healthcare collaborations emphasizing hygiene and independence.

Expansion of Retail and E-Commerce Distribution Networks

The India Adult Diapers Market is expanding through stronger retail channels and online platforms. Organized retail outlets stock a wide range of product options, creating greater visibility. Supermarkets, pharmacies, and specialty stores improve accessibility for caregivers and individuals. E-commerce platforms offer discreet purchase options with doorstep delivery, easing consumer hesitation. Promotional campaigns and subscription models enhance convenience for frequent buyers. Online reviews and product comparisons empower buyers to make informed decisions. This multi-channel distribution network strengthens demand by meeting consumer expectations of availability and privacy.

Product Innovations and Focus on Comfort and Sustainability

The India Adult Diapers Market is witnessing rapid innovation in product design and performance. Manufacturers are introducing skin-friendly materials and advanced absorption technologies. Products are being tailored to reduce odor, provide longer wear time, and improve fit. Eco-friendly alternatives are gaining attention, aligning with consumer demand for sustainable products. Brands highlight features such as breathable fabrics and adjustable sizes to increase comfort. These innovations improve consumer trust and expand the adoption base. Companies that invest in R&D continue to shape the competitive landscape by meeting evolving needs.

Market Trends:

Shifting Consumer Preferences Toward Premium and Customized Products

The India Adult Diapers Market is observing a steady shift toward premium product segments. Consumers increasingly prefer diapers offering higher absorption, better comfort, and discreet design. Customization based on fit, gender, and activity level has grown in demand. Younger caregivers are willing to pay more for products ensuring dignity and convenience. Market leaders introduce premium lines to capture this rising preference. Innovations such as ultra-thin designs and odor-locking layers attract urban buyers. This trend indicates a movement toward value-added offerings rather than basic products.

Integration of Technology in Product Development

The India Adult Diapers Market is incorporating smart features through technological integration. Some advanced products are designed with wetness indicators to alert caregivers. Sensors and connected applications are being explored for hospital and home care. These features improve monitoring and reduce the risk of infections among patients. Hospitals and nursing homes increasingly adopt such solutions for efficiency. Research on using biodegradable super-absorbent polymers supports both performance and sustainability. Technology-driven differentiation helps manufacturers maintain competitiveness in crowded markets. This trend highlights the merging of healthcare innovation with consumer hygiene products.

Marketing Strategies Targeting Urban and Semi-Urban Populations

The India Adult Diapers Market is experiencing aggressive marketing efforts in urban and semi-urban areas. Campaigns emphasize themes of dignity, independence, and convenience in daily living. Television and digital advertising play a key role in shaping consumer attitudes. Celebrities and healthcare experts often endorse products to reduce hesitation. Promotional activities in hospitals and wellness centers increase exposure.

Market Challenges Analysis:

High Cost of Premium Products and Limited Affordability

The India Adult Diapers Market faces challenges due to the high cost of premium products. Many consumers, especially in rural areas, find these products unaffordable. Price-sensitive buyers often rely on cheaper substitutes or restrict their usage. Manufacturers struggle to balance affordability with quality, impacting mass adoption. Hospitals and healthcare providers also face budget constraints, limiting large-scale procurement. While urban customers accept higher prices for comfort and discretion, rural markets demand cost-effective solutions. This price gap creates barriers to equitable adoption across regions.

Social Stigma and Lack of Awareness in Rural Areas

The India Adult Diapers Market encounters resistance in rural areas due to stigma and limited awareness. Many elderly individuals hesitate to adopt diapers, perceiving them as unnecessary or embarrassing. Cultural attitudes reinforce this resistance, especially among lower-income groups. Lack of targeted educational campaigns restricts product acceptance beyond urban hubs. Healthcare providers often underemphasize the role of adult diapers in long-term care. Distribution networks in remote areas also remain weak, reducing accessibility. Without overcoming social taboos, the market cannot fully expand its reach.

Market Opportunities:

Rising Healthcare Infrastructure and Institutional Adoption

The India Adult Diapers Market presents opportunities through expanding healthcare infrastructure and institutional usage. Hospitals, nursing homes, and elderly care facilities increasingly integrate adult diapers into patient management. Government focus on geriatric healthcare creates demand for bulk supply contracts. Organized care centers adopt these products to enhance patient comfort and reduce caregiver workload. The rising number of healthcare facilities in semi-urban areas broadens product penetration. Institutional adoption ensures stable demand and supports long-term market expansion strategies.

Untapped Potential in Rural and Semi-Urban Regions

The India Adult Diapers Market holds strong potential in rural and semi-urban regions. Awareness campaigns led by healthcare providers and NGOs can reduce stigma. Improved distribution networks and affordable product ranges can unlock these markets. Localized marketing tailored to cultural preferences may accelerate acceptance. E-commerce penetration into smaller towns creates access to discreet purchases. Brands that target these regions with affordable and culturally sensitive solutions can secure significant growth. This opportunity highlights the need for inclusive strategies across diverse Indian markets.

Market Segmentation Analysis:

By Type

The India Adult Diapers Market is segmented into pad type, pant/pull-up type, tape-on diapers, and others. Pant/pull-up type dominates demand due to ease of use, comfort, and discreet design. Hospitals and elderly care centers continue to rely on tape-on diapers for patients requiring assistance. Pad type finds traction among cost-conscious buyers and those preferring lightweight options. The “others” category includes hybrid formats gaining niche adoption. Manufacturers emphasize comfort, absorption, and fit to strengthen their type-based offerings.

- For instance, Paramount Surgimed Ltd was awarded BIS certification for disposable adult tape-on diapers in 2022, enhancing hospital adoption through assurance of quality standards.

By End-User

Women, men, and unisex categories define end-user segmentation. Women represent a major share due to higher life expectancy and greater incidence of incontinence. Men contribute steadily with growing awareness and adoption across urban centers. Unisex products address convenience for caregivers and healthcare providers, offering flexible solutions. Companies design gender-specific features to improve comfort and usage experience.

- For instance, BonBon India offers a variety of unisex adult diapers that are sold through online marketplaces and their website. These products are marketed with a focus on high absorption using features like super absorbent polymer and on skin comfort with hypoallergenic materials.

By Distribution Channel

E-commerce and offline channels drive distribution in this market. E-commerce is expanding rapidly with discreet delivery, product variety, and subscription models. Online platforms encourage adoption through targeted marketing and user reviews. Offline channels, including pharmacies, supermarkets, and specialty stores, remain crucial for accessibility and trust. It ensures product availability in both urban and semi-urban regions. The balance of online convenience and offline reach continues to shape consumer choices.

Segmentation:

- By Type

- Pad Type

- Pant/Pull-up Type

- Tape on Diapers

- Others

- By End-User

- By Distribution Channel

- E-Commerce

- Offline Channel

Regional Analysis:

North and West India: Established Demand Centers

The India Adult Diapers Market shows strong presence in North and West India, together holding nearly 55% share. North India leads with a high concentration of urban populations, advanced healthcare facilities, and rising geriatric demographics. States such as Delhi, Haryana, and Uttar Pradesh contribute significantly through organized retail and hospital demand. West India, including Maharashtra and Gujarat, benefits from higher disposable incomes and lifestyle awareness. Strong distribution networks and expanding e-commerce adoption support regional dominance. It continues to attract investments from leading brands due to consistent demand growth.

South India: Healthcare and Institutional Growth

South India contributes close to 28% share, supported by advanced healthcare infrastructure and institutional usage. Hospitals and nursing homes across states like Tamil Nadu, Karnataka, and Kerala integrate adult diapers into patient care. Awareness programs in healthcare settings reduce stigma and increase acceptance. High literacy levels support informed purchasing decisions, leading to faster adoption across segments. The region’s organized retail sector further promotes premium offerings. It represents a stable growth hub with strong acceptance across both genders and unisex products.

East and Central India: Emerging Growth Corridors

East and Central India together account for nearly 17% share, with demand steadily increasing. Rising awareness campaigns by healthcare providers and NGOs encourage adoption among elderly populations. Semi-urban and rural markets show potential due to improving distribution networks. Price sensitivity remains a challenge, pushing demand for affordable product variants. States such as West Bengal, Bihar, and Madhya Pradesh are witnessing gradual growth in acceptance. It is expected that continued awareness and affordable solutions will expand the adoption base in these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Kimberly-Clark Corporation

- Procter & Gamble Co.

- Unicharm Corporation (Sofy, Lifree)

- Nobel Hygiene Pvt. Ltd. (Friends Adult Diapers)

- Emami Ltd.

- Godrej Consumer Products Ltd.

- Essity Aktiebolag (TENA)

- Daio Paper Corporation

- Hengan International Group Company Limited

- DSG International Public Company Limited

Competitive Analysis:

The India Adult Diapers Market is highly competitive, shaped by both global multinationals and strong domestic players. Leading companies such as Kimberly-Clark, Procter & Gamble, and Unicharm dominate through brand strength and wide distribution. Domestic brands like Nobel Hygiene and Godrej Consumer Products add momentum with affordable and locally tailored products. It reflects a balance of premium and value-driven strategies across urban and semi-urban markets. Companies focus on innovation, skin-friendly materials, and targeted marketing to increase adoption. Expanding e-commerce platforms enhance visibility and customer reach. Competitive intensity continues to rise with sustained investments in product development and distribution.

Recent Developments:

- In February 2025, Unicharm Corporation announced the opening of a third manufacturing facility in India, located in Gujarat, with a $131 million investment. This facility will boost production capacity by 30% for disposable diapers, including adult diapers, expanding Unicharm’s footprint in the Indian market and creating approximately 1000 jobs.

Report Coverage:

The research report offers an in-depth analysis based on type, end-user, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising geriatric population will remain a primary growth catalyst.

- Awareness campaigns will reduce stigma and accelerate adoption.

- E-commerce will expand with discreet delivery and subscription models.

- Premium and gender-specific diapers will gain stronger acceptance.

- Hospitals and nursing homes will drive institutional demand.

- Product innovation will focus on skin health and eco-friendly materials.

- Urban regions will dominate, while semi-urban areas will show fast growth.

- Competitive intensity will rise with global and domestic brand rivalry.

- Partnerships with pharmacies and healthcare providers will expand distribution.

- Long-term growth will align with lifestyle changes and improved healthcare access.