Market Overview

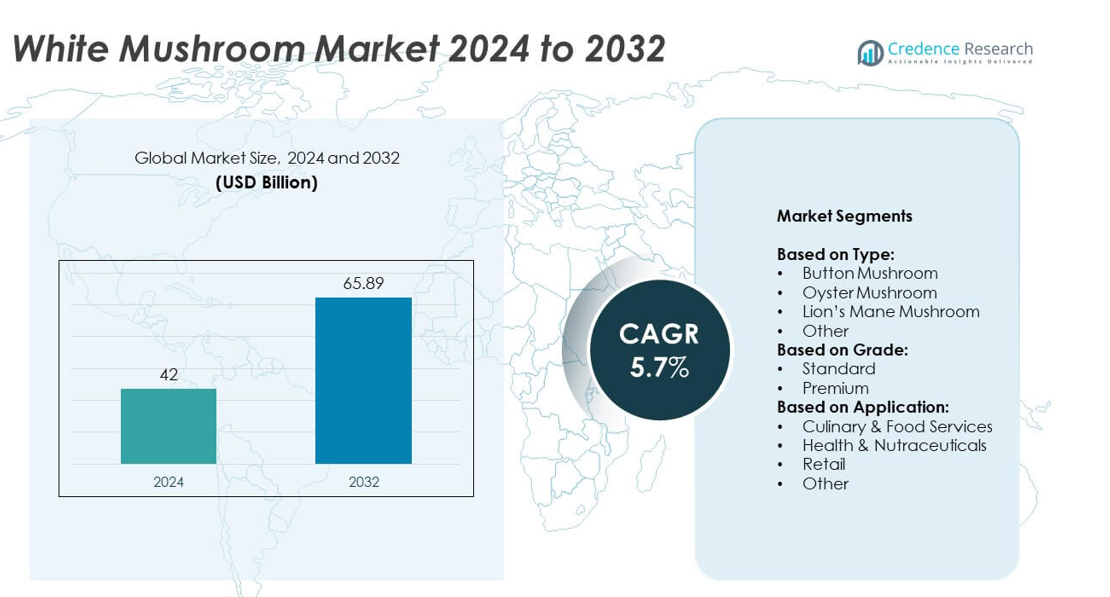

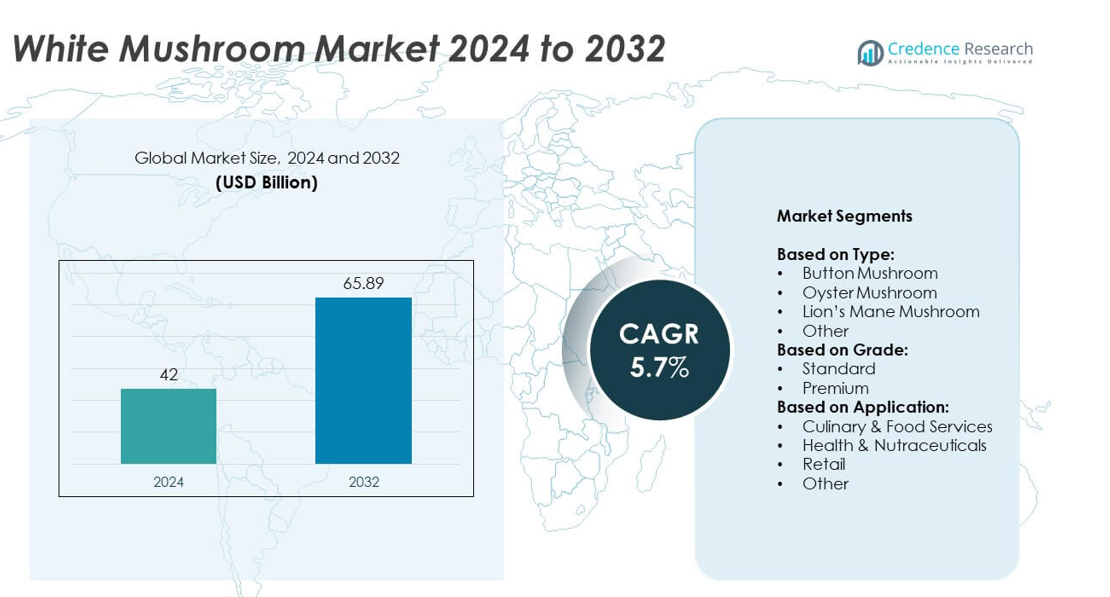

The White Mushroom market size was valued USD 42 Billion in 2024 and is anticipated to reach USD 65.89 Billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| White Mushroom Market Size 2024 |

USD 42 Billion |

| White Mushroom Market, CAGR |

5.7% |

| White Mushroom Market Size 2032 |

USD 65.89 Billion |

The white mushroom market is dominated by leading players such as Scelta, Monterey Mushrooms, Inc., GUAN’S MUSHROOM, Eurochamp, Phillips Mushroom Farms, Costa Group, Bonduelle Group, Greenyard, Prochamp, and Okechamp SA. These companies focus on large-scale production, climate-controlled cultivation, and sustainable farming practices to ensure consistent quality and year-round availability. Strategic partnerships with retailers, foodservice providers, and e-commerce platforms support their market presence and distribution efficiency. North America led the global market with a 38% share in 2024, driven by strong demand from the foodservice industry and retail channels. Europe followed with 29% share, supported by high per-capita mushroom consumption and preference for organic produce.

Market Insights

- The white mushroom market was valued at USD 42 Billion in 2024 and is projected to reach USD 65.89 Billion by 2032, growing at a CAGR of 5.7%.

- Rising adoption of plant-based diets, health awareness, and the expansion of the foodservice sector are key drivers boosting demand for white mushrooms.

- Trends include growing popularity of functional foods, premium and organic mushrooms, and wider online retail availability enhancing consumer access.

- The market is highly competitive with players focusing on production capacity expansion, sustainable farming, and partnerships with retailers and foodservice providers.

- North America led with 38% share in 2024, followed by Europe with 29% and Asia Pacific with 23%, while button mushroom held over 65% share among all types.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Button mushroom led the market with over 65% share in 2024, driven by its wide availability and cost-effectiveness. Its mild flavor and versatility make it the preferred choice in household cooking and large-scale food production. Oyster mushroom followed as the second-largest type, supported by its growing use in plant-based diets and specialty cuisines. Lion’s mane mushroom is gaining traction for its potential cognitive health benefits, boosting demand in nutraceutical applications. Rising consumer awareness of functional foods and the popularity of meat substitutes continue to strengthen demand across all mushroom types.

- For instance, Giorgi Mushrooms in Pennsylvania harvest over 40 kg per m² for white button mushrooms under optimized conditions using their standard compost protocols and controlled rooms.

By Grade

Standard grade mushrooms dominated the market, capturing more than 70% share in 2024. Their competitive pricing and suitability for mass-market retail and foodservice applications make them the primary choice for distributors. Premium grade mushrooms are expanding steadily, driven by demand from high-end restaurants and health-conscious consumers seeking superior quality. Growth in premiumization trends and organic product availability supports this segment’s momentum. Consumers increasingly associate premium mushrooms with better freshness, nutritional value, and sustainable farming practices, which encourages suppliers to invest in advanced cultivation technologies and certifications.

- For instance, Applied Food Sciences launched MycoThrive™ Lion’s Mane, certified organic, in a randomized placebo-controlled crossover trial; participants given 1,000 mg of the premium extract showed significant acute improvements in cognitive function compared to placebo.

By Application

Culinary and food services held the largest market share, exceeding 60% in 2024, fueled by strong demand from restaurants, quick-service chains, and processed food producers. White mushrooms are widely used in soups, sauces, pizzas, and ready-to-eat meals, supporting consistent bulk purchases. Health and nutraceutical applications are growing rapidly due to mushrooms’ bioactive compounds that support immunity and cognitive health. Retail sales continue to rise, boosted by e-commerce platforms and growing consumer preference for fresh, packaged produce. This multi-channel demand ensures robust consumption across household and commercial use cases.

Market Overview

Rising Demand for Plant-Based Diets

Growing adoption of plant-based diets is the leading driver for the white mushroom market. Consumers prefer mushrooms as a natural meat substitute due to their high protein and umami flavor. Button mushrooms, which hold the largest share, benefit most from this trend. Food manufacturers are incorporating mushrooms into burgers, snacks, and ready-to-eat meals, expanding market penetration. The rise of veganism, particularly in North America and Europe, is accelerating production volumes and innovation in mushroom-based product lines, creating steady revenue growth for producers and suppliers.

- For instance, MyForest Foods, an Ecovative spin-off, commissioned its “Swersey Silos” vertical farm in Green Island, New York, on July 25, 2022. This facility has the capacity to produce nearly 3 million pounds of oyster mushroom mycelium annually for its MyBacon product line, which is distributed to foodservice and retail channels. The company reported that this production volume is sufficient to produce about 1 million pounds of MyBacon per year.

Expansion of Foodservice Sector

The rapid growth of the foodservice industry strongly drives white mushroom consumption. Quick-service restaurants, pizzerias, and casual dining chains use mushrooms extensively in their menus. The demand for consistent, fresh supply boosts partnerships between growers and distributors. Culinary applications dominate with over 60% share, supported by urbanization and changing lifestyles. Increasing dining-out culture and rising disposable incomes further fuel demand. This driver enhances bulk orders, prompting producers to scale operations and invest in advanced cultivation technologies to meet foodservice industry quality standards.

- For instance, an oyster mushroom market report notes that in July 2024, Nammex launched ErgoGold™, a 1:1 extract of Golden Oyster Mushroom (Pleurotus citrinopileatus) with verified ergothioneine content.

Health and Nutritional Benefits

White mushrooms’ rich nutrient profile is a major growth driver, attracting health-conscious consumers worldwide. They are low in calories, high in vitamins, and support immune health. This driver particularly boosts the health and nutraceuticals segment, which is expanding steadily. Awareness campaigns highlighting mushrooms’ vitamin D content and bioactive compounds contribute to higher consumption. Government dietary guidelines in several countries encourage vegetable intake, indirectly supporting market growth. Producers are leveraging these benefits in marketing to position mushrooms as a superfood and expand their share in wellness-focused product categories.

Key Trends & Opportunities

Rising Popularity of Functional Foods

Functional food demand creates significant opportunities for mushroom producers. Lion’s mane mushrooms are gaining popularity for cognitive health support, driving product launches in supplements and fortified foods. Companies are developing mushroom powders, extracts, and beverages to capture health-conscious consumers. Online retail channels make functional mushroom products widely accessible, accelerating adoption. This trend supports diversification beyond culinary uses, opening higher-margin revenue streams. Manufacturers investing in research-backed health claims and product innovation are well-positioned to capitalize on this rapidly expanding market segment globally.

- For instance, in the AFS clinical trial, participants receiving 1,000 mg MycoThrive Lion’s Mane showed statistically significant improvements in working memory and attention vs placebo at 60 and 120 minutes post-dose.

Technological Advancements in Cultivation

Modern cultivation technologies offer opportunities to enhance yield, quality, and sustainability. Climate-controlled facilities, vertical farming systems, and automation reduce production risks and ensure year-round supply. These advancements allow producers to meet growing foodservice and retail demand consistently. Improved post-harvest handling and packaging solutions extend shelf life, reducing waste. This trend aligns with the premiumization movement, as consumers seek fresher, higher-quality mushrooms. Companies adopting precision farming and data-driven monitoring can optimize resource use, lower costs, and strengthen competitiveness in both developed and emerging markets.

- For instance, market analysis from 2023 indicated that AI-driven monitoring systems were utilized in 38% of modern mushroom cultivation facilities, which includes the use of Internet of Things (IoT) sensors and data analytics for precise climate control. These technologies were reported to enhance yields by an average of 12% and decrease the risk of contamination by 20%.

Key Challenges

Supply Chain Vulnerabilities

The mushroom market faces challenges from supply chain disruptions, which affect freshness and quality. Mushrooms are highly perishable and require efficient cold-chain logistics. Delays in transportation can lead to spoilage and financial losses for producers and retailers. Seasonal fluctuations in raw material availability also pressure prices and margins. This challenge is particularly critical for export-oriented suppliers who depend on reliable distribution networks. Companies must invest in advanced packaging, cold storage infrastructure, and regional production facilities to mitigate these risks and maintain consistent market supply.

High Production and Labor Costs

Mushroom cultivation involves significant investment in infrastructure, energy, and skilled labor. Maintaining controlled environments for optimal growth increases operating expenses. Labor shortages in key producing regions raise wages, affecting profitability. This challenge is more pronounced for premium-grade mushroom producers, who must ensure higher quality standards. Rising input costs such as compost, casing soil, and energy further impact margins. Producers are adopting mechanization and automation to reduce dependency on manual labor, but high initial setup costs remain a barrier, especially for small and mid-sized growers.

Regional Analysis

North America

North America held the largest share of the white mushroom market with 38% in 2024, supported by strong demand from the foodservice industry and retail chains. The United States remains the key consumer, driven by the popularity of button mushrooms in pizzas, salads, and ready-to-eat meals. Rising adoption of plant-based diets and growing interest in organic produce further support market expansion. Technological advancements in mushroom cultivation, including climate-controlled production, help meet year-round demand. Canada also contributes significantly, with increasing consumption in health-conscious households and expanding retail distribution networks that promote fresh and packaged mushroom availability.

Europe

Europe accounted for 29% of the market share in 2024, driven by high per-capita mushroom consumption and well-established distribution channels. Germany, the UK, and France are major contributors, with strong preferences for fresh button and specialty mushrooms. Government focus on sustainable agriculture and organic food production supports growth in premium segments. The culinary tradition of including mushrooms in soups, sauces, and meat dishes boosts steady demand. Investment in advanced production facilities across Poland and the Netherlands ensures reliable supply. The increasing trend of vegetarian diets in Western Europe further strengthens the region’s position in the global market.

Asia Pacific

Asia Pacific captured 23% of the market share in 2024, driven by rising urbanization, population growth, and expanding middle-class spending on healthy foods. China leads the region with large-scale production and consumption of mushrooms, while Japan and India are witnessing strong demand in retail and foodservice sectors. Traditional cuisines in these countries use mushrooms extensively, which sustains consumption levels. Growing awareness of nutritional benefits and the popularity of plant-based meals are key drivers. E-commerce growth further supports market expansion by improving access to fresh and packaged mushrooms in metropolitan and semi-urban areas across the region.

Latin America

Latin America represented 6% of the white mushroom market share in 2024, supported by increasing adoption in urban households and foodservice outlets. Brazil and Mexico are key markets, with rising disposable incomes driving higher consumption of fresh and processed mushrooms. Growing health awareness and Western dietary influences encourage greater use of mushrooms in home cooking. Expansion of supermarket and hypermarket chains improves accessibility and product visibility. Investment in local production facilities is helping reduce reliance on imports and ensure consistent supply. Rising culinary experimentation among younger consumers further strengthens growth prospects in the coming years.

Middle East & Africa

Middle East & Africa held 4% of the global market share in 2024, with gradual growth driven by increasing consumer awareness of healthy eating. Urban centers in the UAE, Saudi Arabia, and South Africa are leading markets, supported by the expansion of modern retail infrastructure. Demand is concentrated in premium hospitality sectors, including hotels and restaurants offering international cuisines. Limited local production poses a challenge, but investments in controlled-environment farming are emerging. Rising imports from Europe and Asia help meet demand, while health-conscious and vegetarian consumers are slowly contributing to increased household consumption of mushrooms.

Market Segmentations:

By Type:

- Button Mushroom

- Oyster Mushroom

- Lion’s Mane Mushroom

- Other

By Grade:

By Application:

- Culinary & Food Services

- Health & Nutraceuticals

- Retail

- Other

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The white mushroom market is led by key players such as Scelta, Monterey Mushrooms, Inc., GUAN’S MUSHROOM, Eurochamp, Phillips Mushroom Farms, Fujian Yuxing, Drinkwater Mushrooms, Metolius Valley Inc., Costa Group, Bonduelle Group, Okechamp SA, Greenyard, Prochamp, Shangai Fengke, and The Giorgi Companies, Inc. These companies focus on expanding production capacity and adopting advanced cultivation techniques to ensure year-round supply and consistent quality. Strategic investments in climate-controlled facilities and sustainable farming practices help improve efficiency and reduce losses. Many players are strengthening distribution networks to meet growing demand from retail, foodservice, and nutraceutical sectors. Partnerships with supermarkets and e-commerce platforms are boosting consumer access to fresh and packaged mushrooms. Product innovation, including organic and pre-sliced offerings, is a key focus to attract health-conscious buyers. Global players are also exploring international markets to expand their presence and secure a competitive edge in this rapidly growing industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Scelta

- Monterey Mushrooms, Inc.

- GUAN’S MUSHROOM

- Eurochamp

- Phillips Mushroom Farms

- Fujian Yuxing

- Drinkwater Mushrooms

- Metolius Valley Inc.

- Costa Group

- Bonduelle Group

- Okechamp SA

- Greenyard

- Prochamp

- Shangai Fengke

- The Giorgi Companies, Inc.

Recent Developments

- In 2025, Phillips Mushroom Farms began trials of new oyster varieties like Pink Oyster to refresh consumer interest and appeal.

- In 2025, Monterey Mushrooms introduced a new top-seal specialty mushroom line including shiitake, maitake, lion’s mane, and oyster varieties to broaden offerings beyond traditional types.

- In 2024, Scelta Mushrooms launched Fungible®, a clean-label fat replacer made from Dutch white button mushrooms that reduces fat content in both animal and plant-based products without sacrificing taste or texture.

Report Coverage

The research report offers an in-depth analysis based on Type, Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for white mushrooms will rise with growing adoption of plant-based diets worldwide.

- Foodservice sector expansion will continue driving bulk purchases and year-round supply needs.

- Retail sales will grow through supermarkets, hypermarkets, and online platforms offering fresh produce.

- Functional food and nutraceutical applications will create new revenue opportunities for producers.

- Organic and premium-grade mushrooms will gain popularity among health-conscious consumers.

- Investment in climate-controlled cultivation and automation will boost production efficiency.

- E-commerce growth will enhance accessibility and expand market reach in emerging regions.

- Sustainability initiatives will push producers toward eco-friendly farming and packaging solutions.

- Global trade and export opportunities will increase as demand rises in developing economies.

- Consolidation and partnerships among growers and distributors will strengthen market competitiveness.