Market Overview:

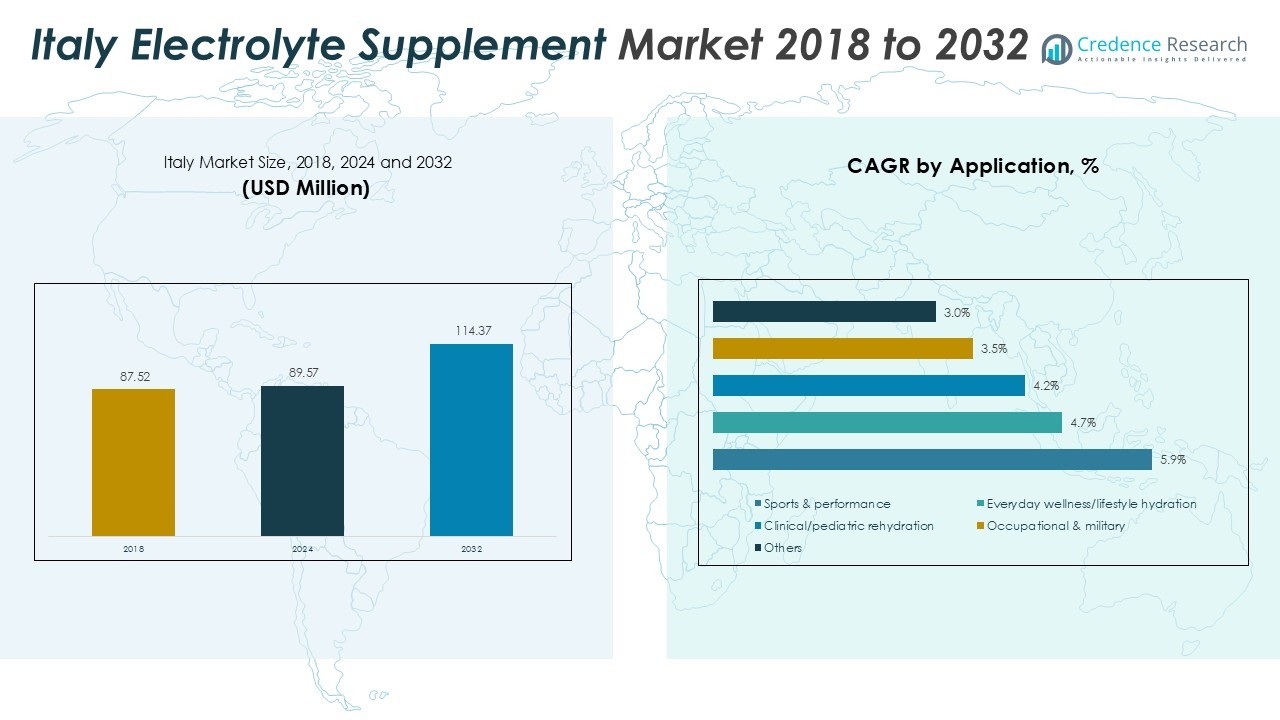

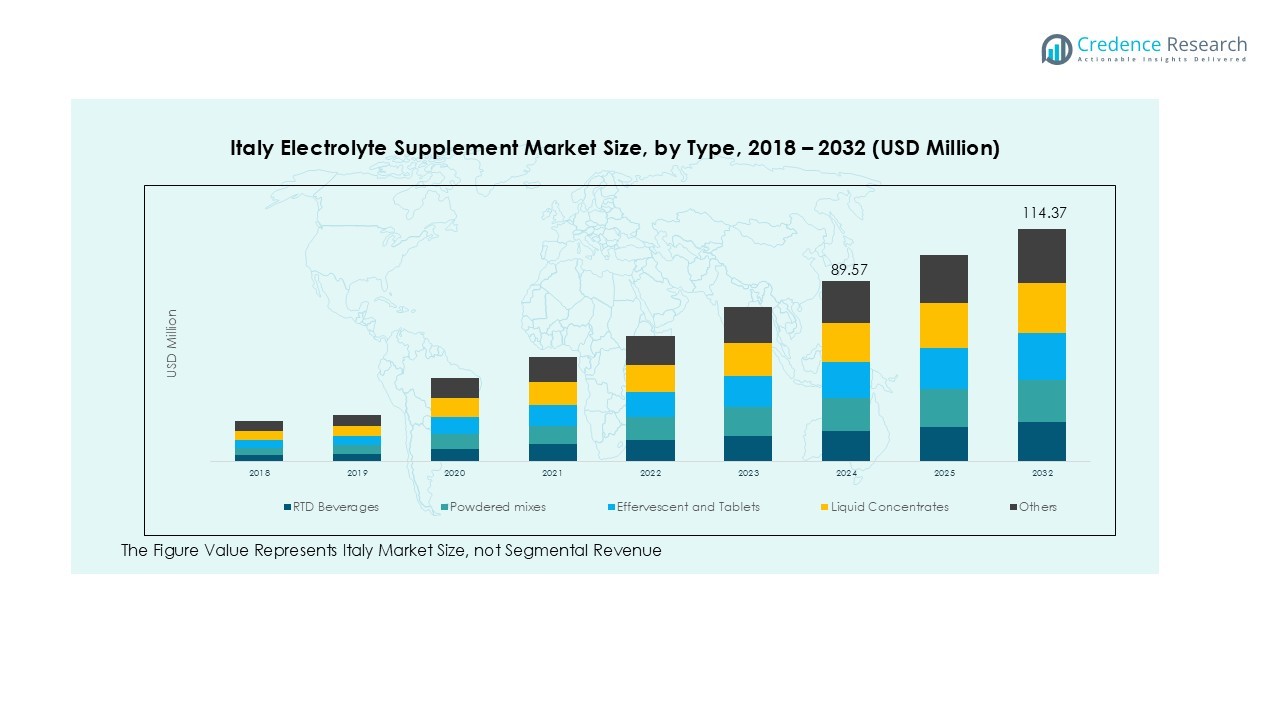

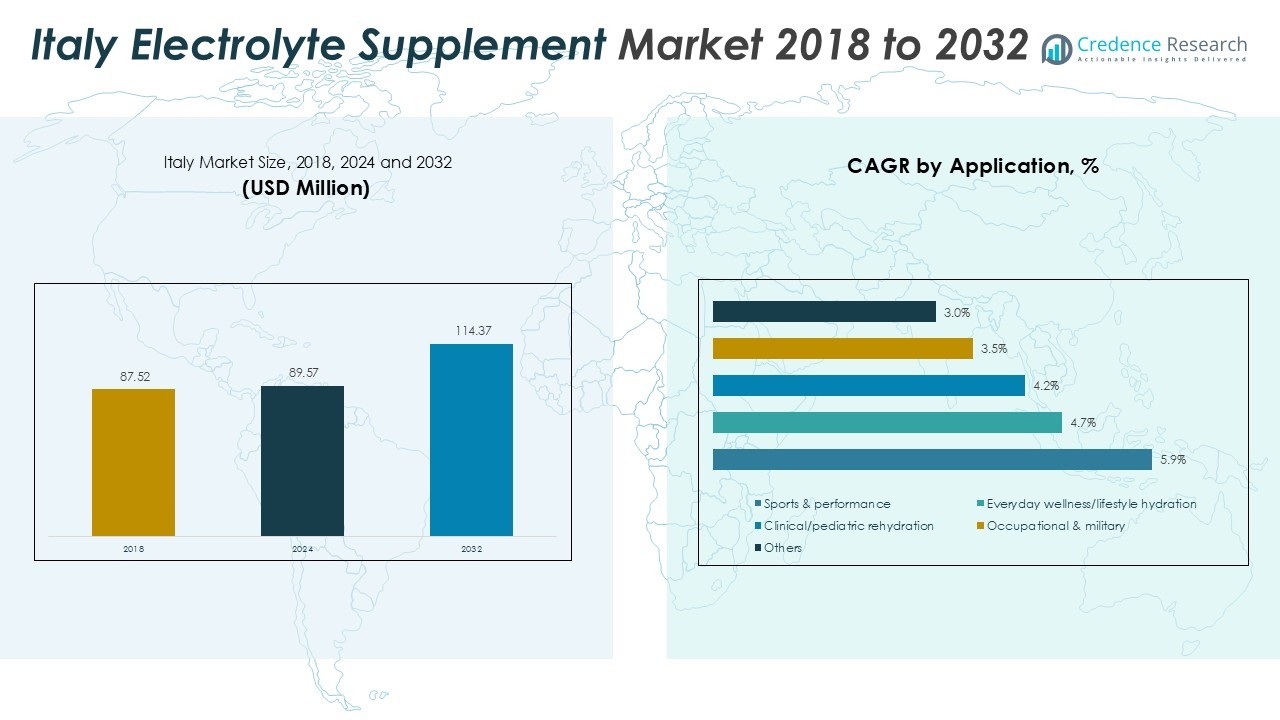

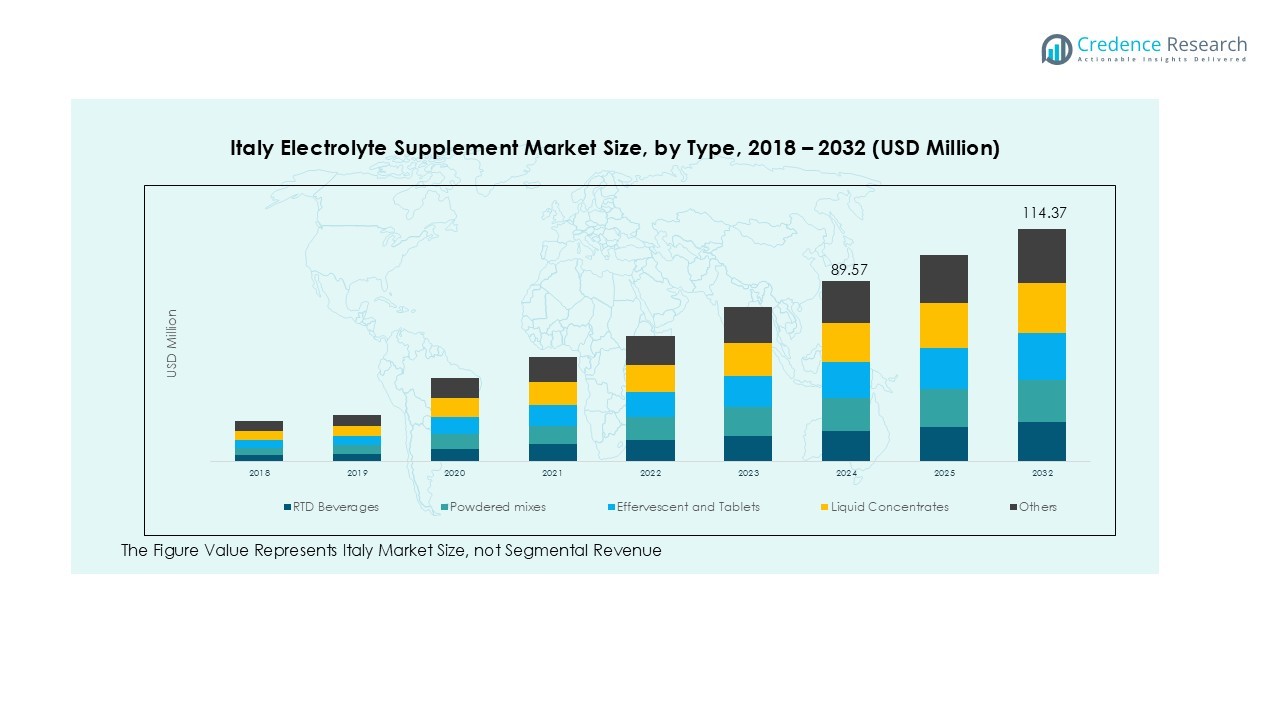

The Italy Electrolyte Supplement size was valued at USD 87.52 million in 2018 to USD 89.57 million in 2024 and is anticipated to reach USD 114.37 million by 2032, at a CAGR of 3.10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Electrolyte Supplement Market Size 2024 |

USD 2745.8 Million |

| Italy Electrolyte Supplement Market, CAGR |

14.80% |

| Italy Electrolyte Supplement Market Size 2032 |

USD 9509.24 Million |

The key drivers of this market include the growing prevalence of dehydration, muscle cramps, and related health conditions, which are fueling the need for electrolyte replenishment. Additionally, the shift towards natural and organic ingredients in supplements aligns with the increasing consumer preference for clean-label and functional food products. The rise in fitness activities, along with the adoption of sports drinks and powders, has further accelerated market demand, especially among athletes and fitness enthusiasts.

Regionally, the market is dominated by northern and central Italy, where sports and fitness culture is well-established. Major urban centers such as Milan, Rome, and Florence see the highest consumption of electrolyte supplements, driven by a health-conscious population. The demand in southern regions is also growing, with increasing consumer interest in wellness products and more accessible retail channels, including online platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Italy Electrolyte Supplement Market was valued at USD 87.52 million in 2018 and is expected to reach USD 114.37 million by 2032, growing at a CAGR of 3.10%.

- The growing prevalence of dehydration and muscle cramps, especially among athletes, drives the market for electrolyte replenishment products.

- There is a shift towards natural and organic electrolyte supplements, with increasing demand for clean-label products focusing on transparency and sustainability.

- Italy’s expanding fitness culture, with more fitness clubs and sports events, is boosting the consumption of electrolyte supplements.

- Northern Italy holds a 48% market share, driven by regions like Lombardy and Emilia-Romagna, with urban centers like Milan contributing to higher demand.

- Central Italy, including Tuscany and Lazio, accounts for 32% of the market share, with cities like Florence and Rome showing increased adoption.

- Northern Italy leads distribution channels with 50% of electrolyte products sold through online platforms and specialized stores.

Market Drivers:

Increasing Health Awareness and Demand for Fitness Products

The growing awareness about health and wellness is a major driver for the Italy Electrolyte Supplement Market. Italians are increasingly adopting healthier lifestyles, focusing on fitness and overall well-being. With a strong emphasis on physical activity and maintaining hydration, consumers are turning to electrolyte supplements to replenish vital minerals after exercise or during periods of dehydration. This shift towards fitness-oriented solutions has contributed to higher demand for products that support hydration, muscle recovery, and athletic performance.

- For instance, the Italian brand +Watt caters to this demand with its LIQUID ELECTROLYTE+ dietary supplement, the product is formulated to support mineral replenishment for health-conscious individuals, containing 0g of sugar per serving.

Rising Prevalence of Dehydration and Muscle Cramps

The increase in dehydration-related health issues, particularly in athletes and active individuals, is another driving factor for the market. Electrolyte supplements play a crucial role in addressing muscle cramps, fatigue, and dehydration. These conditions are commonly experienced after intense physical activity or during hot weather, which is frequent in certain regions of Italy. As more people seek solutions for these health concerns, the demand for electrolyte supplements continues to rise.

- For instance, IGH Naturals Inc. developed MAGNAK, an electrolyte mix with a technological formulation to address muscle cramps, the product delivers an optimal amount of 100mg of elemental magnesium in each serving to support muscle function during exertion.

Shift Towards Natural and Organic Products

Consumers in Italy are becoming more selective about the products they consume, with a growing preference for natural and organic options. The demand for clean-label products that are free from artificial additives is gaining momentum. The Italy Electrolyte Supplement Market is seeing significant growth as consumers opt for organic electrolyte supplements that offer better transparency regarding ingredients and sourcing. This trend is particularly prevalent among health-conscious individuals who prioritize sustainability and natural ingredients in their dietary choices.

Expansion of Fitness and Sports Culture

Italy’s expanding fitness and sports culture is fueling the growth of the electrolyte supplement market. The country has seen a rise in fitness clubs, outdoor activities, and sports events, which have contributed to higher consumption of electrolyte products. Electrolyte supplements are widely used by athletes, fitness enthusiasts, and individuals who engage in strenuous activities. The growing popularity of marathons, cycling, and other fitness events further drives the market’s expansion.

Market Trends:

Rising Popularity of Sports Drinks and Hydration Powders

The Italy Electrolyte Supplement Market is witnessing a significant rise in the popularity of sports drinks and hydration powders. These products are increasingly preferred due to their convenience and effectiveness in replenishing electrolytes during physical activity. Consumers are seeking products that can provide rapid hydration and muscle recovery after exercise, which has led to the widespread adoption of electrolyte-infused drinks and powders. The demand for ready-to-drink beverages and easy-to-use powders has expanded across gyms, fitness clubs, and retail outlets, making it more accessible to the average consumer. This trend aligns with Italy’s growing focus on fitness and athletic performance, where electrolyte supplements are seen as essential components for maintaining optimal hydration levels during workouts and daily activities.

- For instance, the Italian company Ferrero launched its Estathé beverage in a new, lightweight 330ml aluminum “Sleek” can.

Shift Towards Clean-Label and Natural Electrolyte Supplements

There is a clear shift in the Italian market towards clean-label and natural electrolyte supplements. Consumers are increasingly avoiding products with artificial additives, preservatives, and synthetic ingredients. This trend is especially prominent among health-conscious individuals who prioritize sustainability and natural sourcing. Brands are responding by offering electrolyte supplements with organic and naturally derived ingredients, providing transparency in sourcing and manufacturing processes. As the demand for natural and organic products grows, more brands are launching electrolyte supplements that cater to this preference, focusing on plant-based ingredients and eco-friendly packaging. The Italy Electrolyte Supplement Market is adapting to this trend by emphasizing clean-label formulations and appealing to consumers who value authenticity and sustainability in their supplement choices.

- For instance, in June 2025, the flavour house I.T.S. launched a new range of seven natural, clean-label flavours specifically formulated for hydration drinks.

Market Challenges Analysis:

High Competition and Market Saturation

The Italy Electrolyte Supplement Market faces challenges due to intense competition and market saturation. Numerous brands offer a wide range of products, leading to high market fragmentation. Many companies are competing for consumer attention, resulting in price wars and constant product innovation. The saturation of the market makes it difficult for new entrants to establish a strong brand presence. Consumers have a wide selection of electrolyte supplements to choose from, making it challenging for brands to differentiate their products. As a result, companies need to invest heavily in marketing and innovation to stand out in this competitive landscape.

Regulatory and Compliance Hurdles

Another significant challenge in the Italy Electrolyte Supplement Market is adhering to the country’s strict regulatory requirements. Italy, like the rest of the European Union, enforces stringent rules on food supplements, including electrolyte products. These regulations cover ingredient sourcing, labeling, and health claims, which can pose barriers for new brands entering the market. Ensuring compliance with all legal standards requires time and resources, especially as regulations evolve to keep pace with emerging trends. This adds complexity to the manufacturing and marketing processes for electrolyte supplement brands.

Market Opportunities:

Growth in Online Retail and E-commerce Channels

The Italy Electrolyte Supplement Market presents significant opportunities through the expansion of online retail and e-commerce channels. Consumers are increasingly turning to online platforms for convenience, offering brands a broader reach beyond traditional retail stores. E-commerce provides the flexibility to target niche segments such as athletes, fitness enthusiasts, and health-conscious individuals. Brands can capitalize on this trend by offering direct-to-consumer sales through e-commerce websites and online marketplaces. Leveraging digital marketing and influencer partnerships can further boost product visibility, driving growth in this growing segment of the market.

Expansion of Product Offerings and Innovation

There is ample opportunity for innovation within the Italy Electrolyte Supplement Market by expanding product offerings to cater to emerging consumer needs. Consumers are increasingly looking for customized solutions, such as supplements tailored for specific sports, dietary preferences, or health goals. Developing new formulations, such as plant-based or keto-friendly electrolyte supplements, could tap into these rising trends. Brands that focus on creating specialized products, whether for post-workout recovery or hydration during extreme sports, will likely see a surge in demand. This market’s potential for innovation presents an avenue for sustained growth and differentiation in an otherwise competitive environment.

Market Segmentation Analysis:

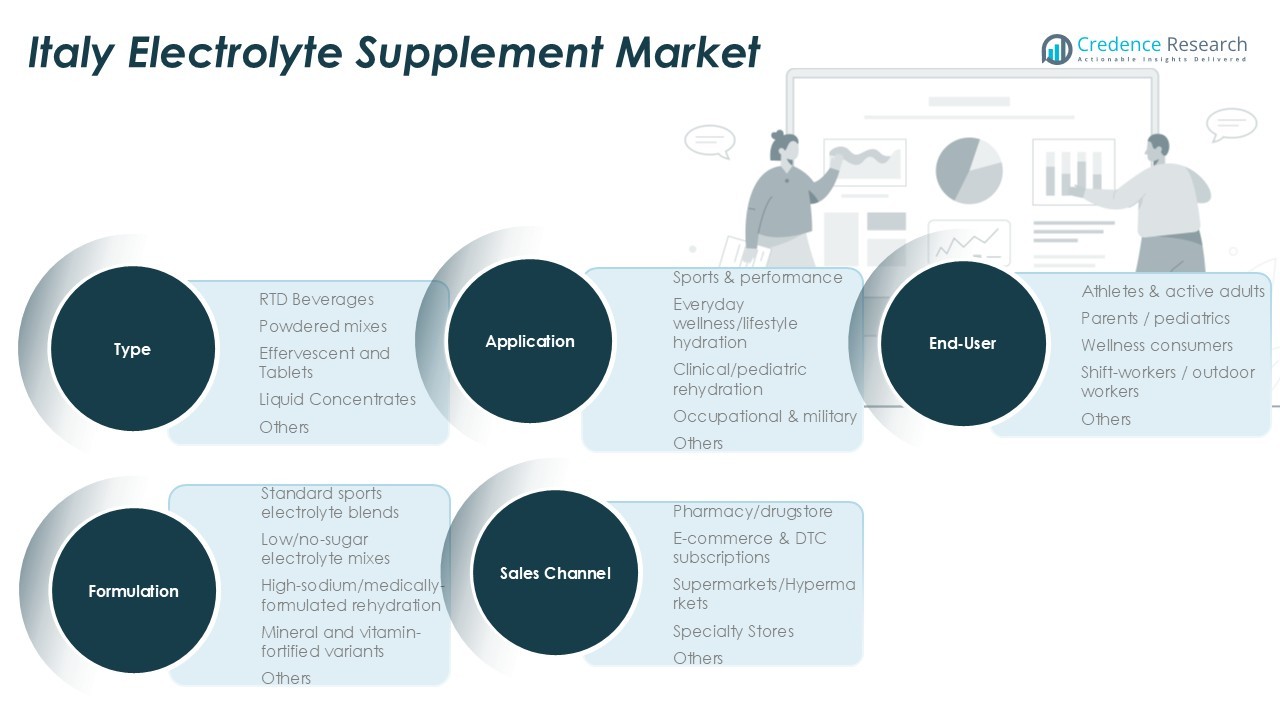

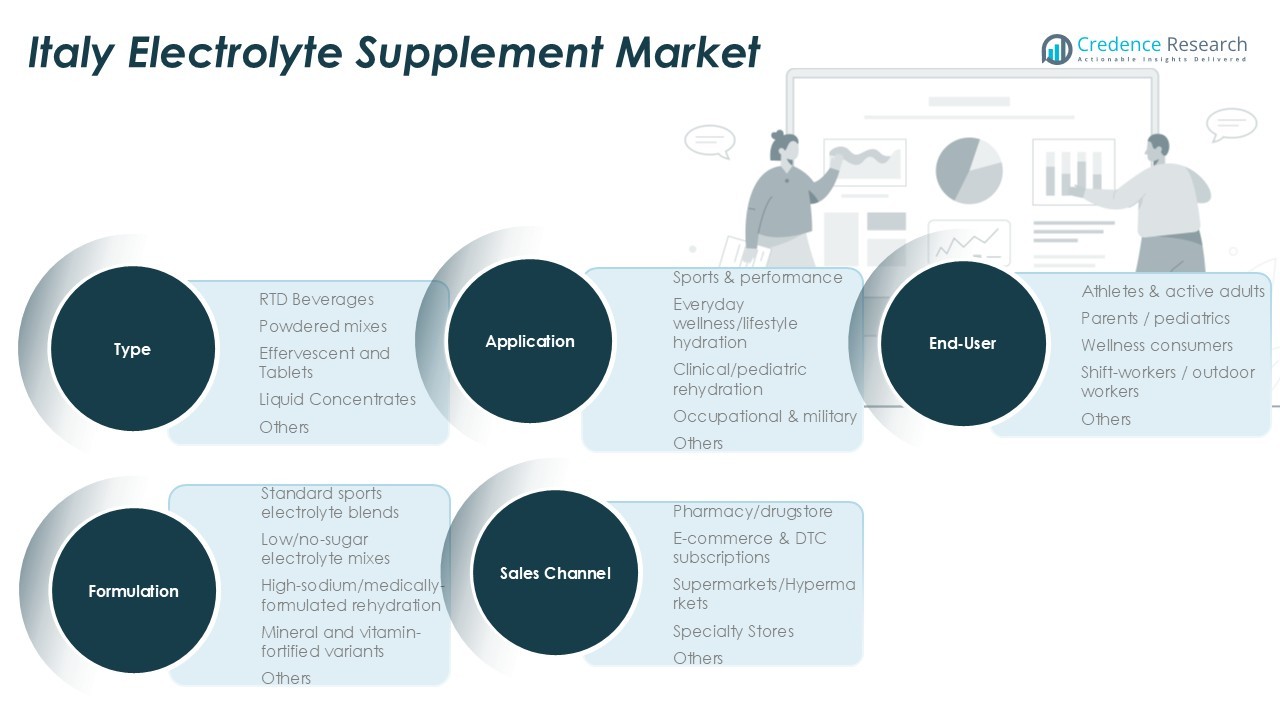

By Type Segment

The Italy Electrolyte Supplement Market is segmented by product type, with RTD beverages leading the market. These ready-to-consume drinks are preferred for their convenience and effectiveness, particularly among athletes and active individuals. Powdered mixes follow as a cost-effective and portable solution, while effervescent tablets and liquid concentrates cater to consumers looking for concentrated and easy-to-use supplements. Each type serves a distinct need, contributing to a well-rounded market.

- For instance, the brand Electrolit has developed a scientifically formulated ready-to-drink beverage that contains 6 essential ions, including magnesium, potassium, and calcium.

By Application Segment

In the application segment, sports & performance holds the largest share, as athletes and fitness enthusiasts rely heavily on electrolyte supplements for hydration and muscle recovery. Everyday wellness/lifestyle hydration is also growing in popularity, with consumers increasingly incorporating electrolyte supplements into their daily health routines. Clinical/pediatric rehydration is a vital, though smaller, segment, addressing medical needs, particularly for children. Occupational & military applications are growing, especially in high-exertion environments where hydration is critical.

By End-User Segment

In the end-user segment, athletes & active adults form the largest consumer group, driving the demand for electrolyte supplements. Wellness consumers, who prioritize overall health and hydration, represent an expanding market. Shift-workers and outdoor workers are emerging as a significant demographic, needing electrolyte solutions to combat dehydration caused by irregular schedules and outdoor conditions. Each end-user group contributes to the growing demand for electrolyte supplements in Italy.

- For instance, Maurten developed its Drink Mix 320 specifically for endurance athletes by utilizing a unique hydrogel technology.

Segmentations:

By Type Segment

- RTD Beverages

- Powdered Mixes

- Effervescent and Tablets

- Liquid Concentrates

- Others

By Application Segment

- Sports & Performance

- Everyday Wellness/Lifestyle Hydration

- Clinical/Pediatric Rehydration

- Occupational & Military

- Others

By End-User Segment

- Athletes & Active Adults

- Parents / Pediatrics

- Wellness Consumers

- Shift-Workers / Outdoor Workers

- Others

By Formulation Segment

- Standard Sports Electrolyte Blends

- Low/No-Sugar Electrolyte Mixes

- High-Sodium/Medically-Formulated Rehydration

- Mineral and Vitamin-Fortified Variants

- Others

By Sales Channel Segment

- Pharmacy/Drugstore

- E-commerce & DTC Subscriptions

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Regional Analysis:

Northern Italy: Market Leadership in Electrolyte Supplement Consumption

Northern Italy holds a 48% share of the electrolyte supplement market, particularly in regions like Lombardy and Emilia-Romagna. Milan, a major urban center, drives demand through its health-conscious population and active lifestyle. The presence of numerous fitness centers and sports events further boosts consumption. This region’s economic prosperity and focus on wellness significantly contribute to the market’s growth. Lombardy’s strong sports culture, with multiple marathons and cycling events, has led to a higher consumption of electrolyte products, particularly in metropolitan areas.

Central and Southern Italy: Emerging Markets with Growth Potential

Central Italy, including Tuscany and Lazio, accounts for 32% of the electrolyte supplement market share. Cities like Florence and Rome are increasingly adopting electrolyte supplements as consumer awareness of health and fitness rises. Southern Italy, including regions like Campania and Sicily, is also seeing an uptick in wellness product consumption, though at a slower pace compared to the north. The rise of fitness centers, outdoor activities, and sports events in cities like Rome is helping fuel local demand for electrolyte supplements, particularly among athletes and active individuals.

Regional Distribution Channels and Consumer Preferences

Northern Italy leads in online sales and specialized health stores, contributing to 50% of the distribution channels for electrolyte supplements. In contrast, central and southern regions rely more on traditional retail outlets, with central Italy accounting for 35% and southern regions contributing 15%. Consumer preferences vary across regions; northern consumers tend to opt for advanced formulations and premium brands, while southern consumers favor more affordable products. The demand for convenient and portable electrolyte powders is rising in regions with a high number of outdoor enthusiasts, such as Tuscany.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- PepsiCo

- The Coca-Cola Company

- Abbott Laboratories

- Nestlé S.A.

- Unilever PLC

- GlaxoSmithKline plc

- Otsuka Pharmaceutical Co., Ltd.

- GU Energy Labs

- Skratch Labs

- Ultima Health Products

- Hammer Nutrition

- SOS Hydration Inc.

- Tailwind Nutrition

Competitive Analysis:

The Italy Electrolyte Supplement Market is highly competitive, featuring a mix of global giants like PepsiCo, The Coca-Cola Company, and Nestlé S.A., which dominate the market through their extensive distribution networks and diverse product portfolios. These brands focus on RTD beverages and powdered mixes, meeting the growing demand for convenient hydration solutions. At the same time, local players like Ultima Health Products and GU Energy Labs are carving out a niche by offering natural and organic options, appealing to health-conscious consumers. These companies differentiate themselves through clean-label formulations and sustainability initiatives. The market is marked by continuous innovation, with brands frequently adapting to evolving consumer preferences, focusing on new flavors, packaging solutions, and ingredient transparency. This dynamic competition ensures constant product evolution to meet the diverse needs of Italian consumers.

Recent Developments:

- In July 2025, PepsiCo launched Pepsi® Prebiotic Cola, a new beverage containing prebiotic fiber, with an initial online release planned for fall 2025 and a broader retail rollout in early 2026.

- In September 2025, Unilever, along with PepsiCo, launched the STEP up for Agriculture initiative, a collaborative effort to promote and scale regenerative agriculture practices.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-User, Formulation and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Italy Electrolyte Supplement Market is expected to see steady growth as health-conscious consumers increasingly prioritize hydration and recovery.

- A growing awareness of the importance of electrolyte replenishment for athletes, active adults, and wellness consumers will drive further demand.

- Natural and organic electrolyte supplements are anticipated to gain more market share, as consumers shift towards clean-label, sustainable products.

- The demand for convenient, ready-to-drink beverages and portable powdered mixes will continue to rise, driven by the active lifestyles of Italians.

- Sports & performance applications will maintain a strong lead, particularly with Italy’s expanding sports culture and increased participation in fitness events.

- Everyday wellness hydration products will see a rise in consumption as consumers adopt healthier lifestyles and prioritize hydration throughout the day.

- Clinical and pediatric rehydration products will grow as health professionals emphasize hydration solutions for medical needs, particularly for children.

- Distribution channels will evolve, with online retail platforms and e-commerce subscriptions playing an increasingly prominent role in product sales.

- Regional variations in product preference and consumption will continue, with northern Italy showing the highest demand for premium, specialized electrolyte supplements.

- Innovations in flavor profiles, ingredient sourcing, and packaging are expected to shape the market, with brands constantly adapting to consumer preferences.