Market Overview

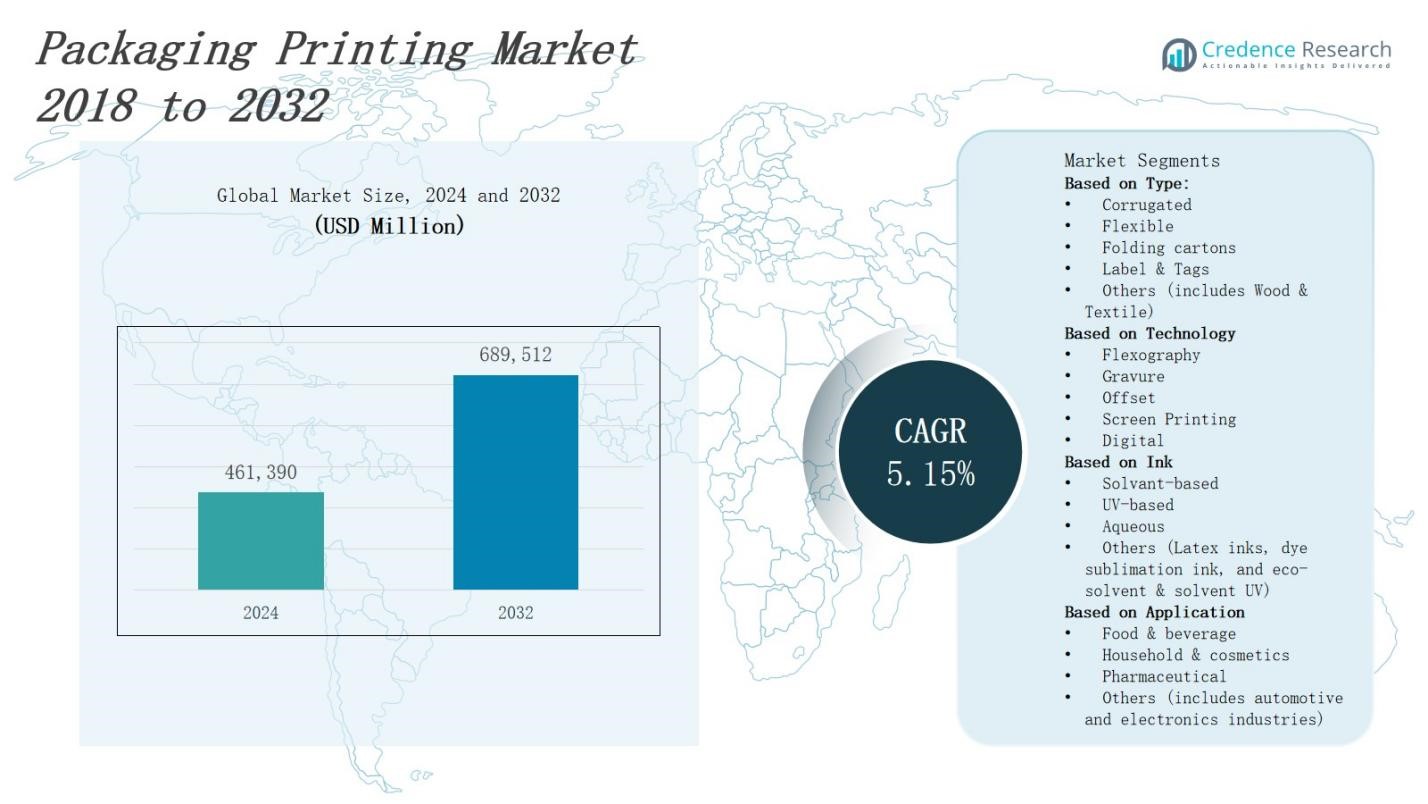

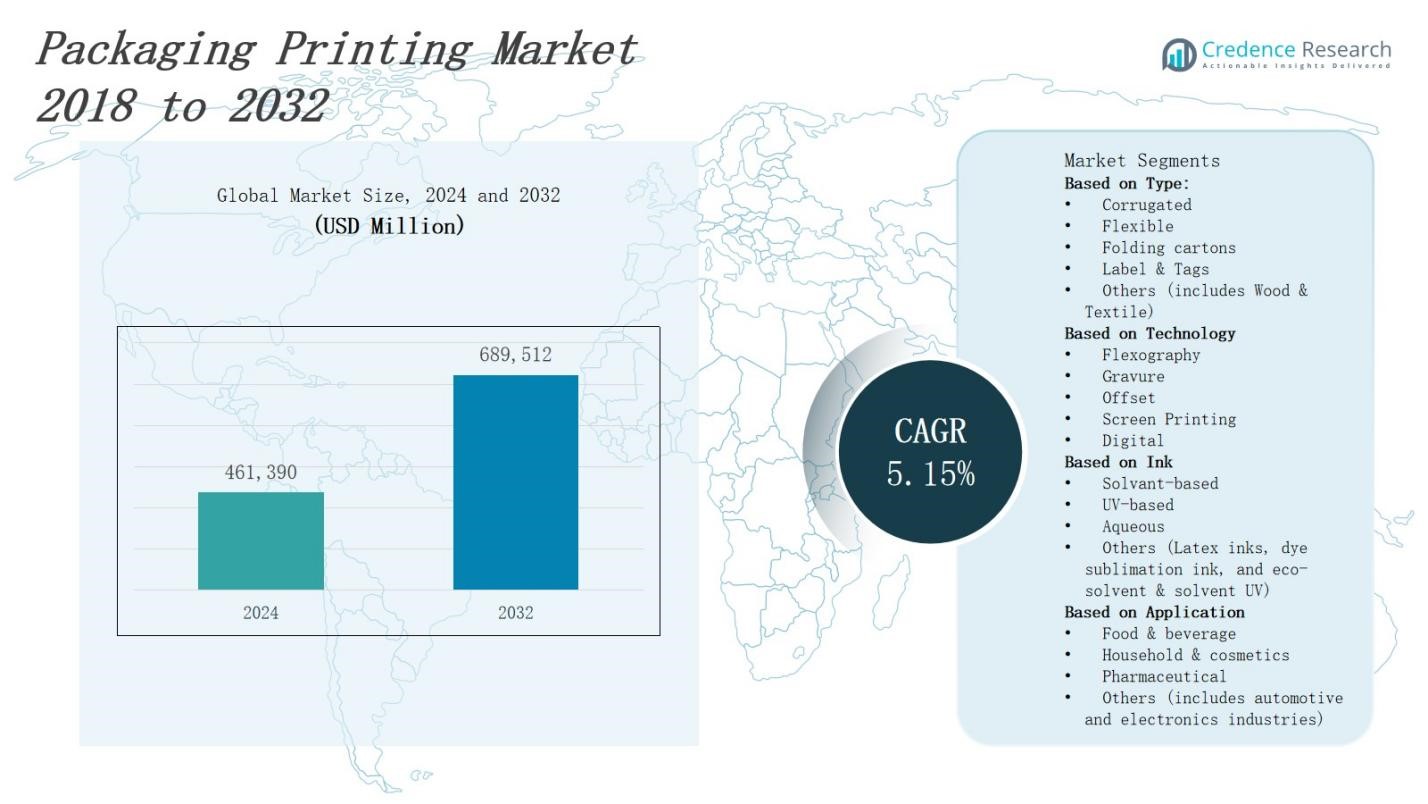

The Packaging Printing Market is projected to expand from USD 461,390 million in 2024 to USD 689,512 million by 2032, registering a CAGR of 5.15%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Printing Market Size 2024 |

USD 461,390 Million |

| Packaging Printing Market, CAGR |

5.15%. |

| Packaging Printing Market Size 2032 |

USD 689,512 Million |

Key drivers propelling the Packaging Printing Market include rising demand for sustainable and customizable packaging solutions, stringent regulations on labeling accuracy, and growth in e‑commerce packaging volumes. Technological advancements such as digital printing, narrow‑web presses, and UV‑curable inks enhance production efficiency and print quality. Brands leverage variable data printing to personalize packaging and improve consumer engagement. Trends in smart packaging—incorporating QR codes, NFC tags, and anti‑counterfeit features—gain traction across food, beverage, and pharmaceutical sectors. Growing emphasis on lightweight, eco‑friendly substrates drives innovation in recyclable and compostable materials. The convergence of print and digital workflows supports faster time‑to‑market and reduces waste.

North America, Europe, Asia Pacific, Latin America, Middle East & Africa drive the Packaging Printing Market. North America relies on digital press adoption by Amcor and Quad/Graphics, while Europe sees sustainable substrate innovation led by Mondi plc and Constantia Flexibles. Asia Pacific features high‑volume output from Toppan Printing and Sonoco Products Company. Latin America grows through flexible‑format solutions by Graphics Packaging Holding Company and WS Packaging Group. Middle East & Africa expands specialty printing services offered by Quantum Print and Packaging and Duncan Printing Group. It adapts to local demands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Packaging Printing Market will grow from USD 461,390 million in 2024 to USD 689,512 million by 2032, at a 5.15% CAGR.

- Brands drive demand for recyclable and compostable substrates to meet sustainability goals and strict labeling mandates.

- Digital presses, narrow‑web flexo systems and UV‑curable inks boost throughput and elevate print quality.

- Variable data printing enables personalized campaigns that enhance consumer engagement.

- Smart packaging features—QR codes, NFC tags and anti‑counterfeit marks—gain adoption in food, beverage and pharma.

- E‑commerce growth fuels demand for corrugated, flexible and retail‑ready formats with shorter lead times.

- The convergence of print and digital workflows reduces waste and accelerates time‑to‑market.

Market Drivers

Sustainable Packaging and Regulatory Compliance

Companies drive the Packaging Printing Market through increased focus on eco-friendly substrates and compliance with strict labeling mandates. It meets consumer demand for recyclable and compostable materials while satisfying government rules on product information. Brands adopt water-based and UV-curable inks to reduce environmental impact. Regulators enforce clear ingredient listings and safety warnings. Producers invest in life-cycle assessments to verify sustainability claims. Focus supports market growth.

- For instance, Printpack introduced PRESERVE™ COMPOSTABLE, a fully compostable, heat-sealable packaging film designed for food products, certified for both home and industrial composting standards.

Advanced Digital Printing Technologies and Customization

Digital inkjet presses and narrow-web flexographic systems drive efficiency in the Packaging Printing Market. They enable short runs, flexible design updates without plate changes. Variable data printing allows brands to personalize packaging for regional campaigns and limited editions. Printers embrace ultraviolet curing and hybrid presses to accelerate production cycles. Suppliers improve print resolution and cost per unit. Innovation delivers competitive advantage to packaging converters.

- For instance, HP’s Indigo 35K Digital Press enables brands to execute short-run folding carton jobs on demand, supporting frequent design changes and personalization for targeted campaigns.

E‑Commerce Expansion and Demand for Flexible Formats

Rapid growth in online retail fuels the Packaging Printing Market for corrugated, flexible and retail-ready packaging. It addresses variable order sizes and shifts packaging styles for seasonal promotions. Brands require lightweight substrates that cut transport costs. Shorter lead times prompt investment in automated finishing and inspection. Printers adopt metallic foils and textured coatings to enhance appeal. Focus reduces waste and boosts operational agility.

Security Features and Supply Chain Traceability

Integration of anti-counterfeit elements drives the Packaging Printing Market toward higher security standards. It embeds QR codes, NFC tags and tamper-evident seals into labels. Brands implement serialization and blockchain links to verify authenticity. Printers collaborate with technology providers to embed invisible inks and microtext. Consumer trust increases through real-time tracking via mobile applications. This security focus strengthens brand protection and supply chain integrity overall.

Market Trends

Digital Integration and Workflow Automation

Manufacturers implement cloud-based platforms to optimize press setup and quality control. It accelerates production cycles for the Packaging Printing Market and reduces manual interventions. Printers integrate inline sensors to monitor print parameters in real time. They standardize data exchange across prepress and finishing processes. Firms upgrade software to manage orders and track inventory. Investment in machine learning algorithms supports predictive maintenance and minimizes downtime.

- For instance, Packsize launched the PackNet Cloud Cube—a cloud-based platform that calculates precise package dimensions and optimal box sizes for every order, reducing waste and improving production efficiency by minimizing manual interventions.

Emergence of Smart Packaging and Traceability Solutions

Brands embed QR codes, RFID chips and invisible inks into labels to enhance consumer engagement. It transforms routine packaging into interactive platforms within the Packaging Printing Market. Printers collaborate with technology firms to integrate blockchain‑backed serialization. Labels feature temperature indicators and tamper‑evident seals to secure supply chains. Manufacturers deploy digital watermarks to authenticate products. Real‑time tracking enables rapid recalls and verifies origin at each distribution point.

- For instance, Nestlé deployed QR codes on its KitKat packaging in Japan, enabling consumers to scan the wrapper and send digital messages or access real-time product information, which increased consumer engagement.

Rise of Personalization and Short‑Run Production

Clients request custom designs and variable text for regional promotions and seasonal campaigns. The Packaging Printing Market meets demand for limited‑edition labels and flexible layouts. It handles orders as small as a few hundred units without cost penalties. Printers adopt hybrid presses that switch between digital and analog workflows on demand. Short‑set runs reduce waste and support just‑in‑time delivery. Automation software assigns unique codes to each package for targeted marketing.

Premiumization through Enhanced Finishing and Decoration

Brands apply metallic foils, soft‑touch coatings and embossed textures to elevate packaging presence. The Packaging Printing Market leverages specialty finishes to differentiate premium products. It integrates laser die‑cutting to create intricate shapes and windows. Printers use cold foil and matte varnishes to achieve tactile contrast. High‑resolution screening delivers crisp graphics on film and paper. Converters deploy inline inspection to ensure color consistency and finish integrity.

Market Challenges Analysis

Volatile Raw Material Costs and Supply Chain Disruptions

The Packaging Printing Market faces pressure from fluctuating prices of paper, ink and film substrates. It struggles to absorb sudden spikes in commodity costs without eroding margins. Global supply chain bottlenecks force converters to hold higher safety stocks and negotiate longer lead times. Printers contend with shortages of specialized coatings and additives that support premium finishes. They must balance cost containment with quality demands when suppliers impose minimum order quantities. This volatility compels firms to strengthen supplier relationships and explore alternative materials to maintain stable operations.

Regulatory Pressures and Technological Adoption Hurdles

Environmental regulations drive the Packaging Printing Market toward stricter waste management and recycling mandates. It must invest in compliant inks, substrates and finishing processes that meet evolving standards. Printers encounter high capital requirements for digital presses and automation systems that improve efficiency. Limited technical expertise hinders rapid deployment of workflow software and inline inspection tools. Brands demand traceability features such as serialization and tamper‑evident seals, increasing complexity in production. Companies must train staff on new technologies while managing upgrade costs within tight budgets.

Market Opportunities

Expansion of Eco‑Friendly and Sustainable Printing Solutions

Brands accelerate investment in recyclable substrates and water‑based inks to meet consumer and regulatory demands. The Packaging Printing Market benefits from growth in bio‑based films and compostable coatings that reduce environmental impact. It presents converters with a chance to develop closed‑loop systems and promote lifecycle transparency. Printers secure long‑term contracts by offering cradle‑to‑grave print audits and carbon‑neutral certifications. Suppliers introduce novel substrates made from agricultural waste to diversify material portfolios. Collaborative pilot programs enable rapid validation of sustainable workflows. This focus on green credentials drives revenue growth and strengthens brand loyalty.

Adoption of Smart Packaging and Digital Engagement Strategies

Demand for interactive labels featuring QR codes, NFC tags and augmented‑reality triggers generates new revenue streams. The Packaging Printing Market leverages digital printing platforms to deliver variable data campaigns at scale. It empowers brands to track products through blockchain‑based serialization and real‑time analytics. Printers partner with software vendors to integrate cloud‑based asset management and order‑fulfillment dashboards. Retailers reward suppliers offering personalized packaging for loyalty‑program engagement. Emerging micro‑print and invisible‑ink technologies open niche applications in luxury and pharmaceutical segments. This shift toward connected packaging deepens consumer engagement and unlocks aftermarket marketing opportunities.

Market Segmentation Analysis:

By Type

The Packaging Printing Market divides into corrugated, flexible, folding cartons, label & tags, and other formats. It depends on corrugated boards for sturdy retail packs and e‑commerce shipments. Flexible substrates suit pouches and sachets for food and personal care applications. Folding cartons serve pharmaceutical and cosmetic sectors with high‑quality graphics. Label & tags support branding across all packaged goods. Other materials include wood and textile for specialty uses.

- For instance, Amcor specializes in printing flexible substrates for food packaging, such as snack pouches, offering high barrier properties and customization to protect product freshness and meet consumer demands.

By Technology

The Packaging Printing Market employs flexography, gravure, offset, screen printing, and digital presses. It uses flexography for high‑speed runs on corrugated and flexible films. Gravure suits long runs that need fine detail and consistent ink laydown. Offset digital printing delivers precise color reproduction on folding cartons and labels. Screen printing provides thick ink layers for specialty coatings. Digital presses handle short runs and variable data without plates.

- For instance, Mark Andy Inc. uses flexography for high-speed printing on corrugated packaging and flexible films, achieving efficient production runs with consistent quality.

By Ink Type

The Packaging Printing Market includes solvent‑based, UV‑based, aqueous, and specialty inks. It leverages solvent‑based inks for durability on outdoor labels. UV‑based inks cure instantly under UV light, which increases line speeds and scratch resistance. Aqueous inks suit food contact and eco‑friendly workflows. Specialty inks cover latex, dye sublimation, eco‑solvent, and solvent UV formulations. Printers select ink according to substrate compatibility and regulatory requirements.

Segments:

Based on Type:

- Corrugated

- Flexible

- Folding cartons

- Label & Tags

- Others (includes Wood & Textile)

Based on Technology

- Flexography

- Gravure

- Offset

- Screen Printing

- Digital

Based on Ink

- Solvant-based

- UV-based

- Aqueous

- Others (Latex inks, dye sublimation ink, and eco-solvent & solvent UV)

Based on Application

- Food & beverage

- Household & cosmetics

- Pharmaceutical

- Others (includes automotive and electronics industries)

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The Packaging Printing Market in North America holds 20% share, driven by advanced manufacturing infrastructure and high e‑commerce volumes. It benefits from widespread adoption of digital presses that support just‑in‑time production. Brands demand variable data printing for personalized packaging campaigns. Sustainable materials gain traction under strict environmental regulations. Printers invest in inline quality control to reduce waste and improve throughput. Strong collaboration between converters and technology providers fuels innovation.

Europe

Europe captures 25% share of the Packaging Printing Market, supported by mature recycling systems and stringent labeling laws. It leads in compostable substrates and water‑based ink usage to meet regulatory requirements. Printers deploy narrow‑web flexographic systems for high‑quality folding cartons. Brands integrate QR codes and NFC tags for traceability across food and pharmaceutical supply chains. Investment in automation software enhances order management and inventory tracking. Cross‑border partnerships accelerate technology transfer.

Asia Pacific

Asia Pacific commands 35% share in the Packaging Printing Market, propelled by rapid industrialization and rising consumer demand. It leverages low‑cost manufacturing to execute large‑scale corrugated and flexible packaging projects. Printers scale hybrid presses to balance short runs with long‑run efficiencies. Local brands drive customization through vibrant graphic designs and specialty finishes. Government incentives promote sustainable ink formulations and renewable substrates. High population density supports growth in single‑serve and retail‑ready packaging formats.

Latin America

Latin America accounts for 10% share of the Packaging Printing Market, led by burgeoning food and beverage sectors in Brazil and Mexico. It upgrades gravure and offset presses to meet rising demand for folding cartons and labels. Printers secure cost advantages through regional raw‑material sourcing. Brands emphasize brand differentiation through metallic foils and embossed decorations. Supply chain modernization prompts investment in RFID‑enabled label production. Training programs enhance technical skills and operational efficiency.

Middle East & Africa

Middle East & Africa holds 10% share of the Packaging Printing Market, driven by growth in pharmaceutical and luxury goods exports. It relies on UV‑based inks for rapid curing and enhanced durability in arid climates. Printers adopt screen printing for specialty textiles and wood‑based packaging. Brands require tamper‑evident seals and serialization for product security. Investment in inline inspection systems ensures compliance with international standards. Government licensing reforms attract foreign converters and technology vendors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor Limited (Australia)

- Quad/Graphics (US)

- Mondi plc (Austria)

- WS Packaging Group (US)

- Sonoco Products Company (US)

- Toppan Printing Company (Japan)

- Graphics Packaging Holding Company (US)

- Constantia Flexibles (Austria)

- Duncan Printing Group (UK)

- Quantum Print and Packaging Limited (UK)

Competitive Analysis

Leading firms in the Packaging Printing Market compete through investments in digital press capacity, specialty inks and sustainable substrates. It intensifies competition around short‑run campaigns and personalization. Global players such as Amcor Limited, Mondi plc and Sonoco Products Company leverage distribution networks and integrated supply chains to secure high‑value contracts. Quad/Graphics and Toppan Printing Company expand digital printing footprints in North America and Asia, while Constantia Flexibles and Quantum Print and Packaging Limited concentrate on flexible packaging innovations. Private regional converters challenge incumbents by offering rapid turnaround and cost‑effective niche solutions. Companies pursue mergers and acquisitions to enhance technology portfolios and expand geographic reach. Strategic alliances with ink and substrate suppliers improve efficiency and reduce production costs. Emphasis on inline quality control, traceability and lifecycle transparency differentiates market participants. It maintains high entry barriers due to capital intensity and regulatory compliance.

Recent Developments

- In January 2025, International Paper acquired UK‑based DS Smith for $7.2 billion, expanding its recycled paper packaging and printing capabilities across North America and EMEA.

- On July 23, 2025, HEIDELBERG acquired Polar Mohr’s brand rights, technology, and IP, strengthening its position as a systems integrator in the packaging market.

- On April 1, 2025, Mondi plc completed the acquisition of Schumacher Packaging’s Western Europe assets, expanding its sustainable packaging portfolio and production capacity.

- On April 22, 2025, JUNG introduced a digital printing system for branded tissue paper and gift wrap, delivering high‑resolution graphics on paper substrates.

Market Concentration & Characteristics

The Packaging Printing Market exhibits moderate concentration, with global leaders capturing significant revenue through expansive production networks and technology investments. It relies on major players such as Amcor Limited and Mondi plc to set quality and sustainability benchmarks. It combines high capital requirements for digital and flexographic presses with regulatory compliance costs to create substantial entry barriers. It offers small and mid‑sized converters opportunities in niche segments like luxury finishes and regional packaging solutions. It demands continuous innovation in substrate development and ink chemistry to retain customer loyalty. It leverages strategic partnerships with ink and equipment suppliers to streamline supply chains. It emphasizes operational efficiency through inline inspection and automated workflows. It balances scale advantages against the agility of specialized providers in meeting customized orders. It maintains competitive intensity through mergers, acquisitions and technology licensing that reshape market dynamics.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Ink Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Brands adopt compostable and recycled substrates to meet consumer demands and strengthen environmental responsibility initiatives.

- Printers integrate QR codes and NFC tags into packaging to enable real‑time authentication and engagement.

- Companies leverage cloud‑based workflows and automation to streamline prepress operations and accelerate job management processes.

- Converters implement inline inspection systems to detect print defects immediately and maintain consistent quality standards.

- Manufacturers expand short‑run digital printing services to support customized campaigns and reduce material waste effectively.

- Firms secure strategic partnerships with ink and equipment suppliers to enhance capabilities and diversify offerings.

- Packaging producers invest in blockchain serialization to provide end‑to‑end traceability and strengthen supply chain transparency.

- Suppliers develop novel ink formulations that comply with environmental regulations and consistently improve print performance.

- Print shops implement agile operations to respond to market shifts and deliver value to brands.

- Industry players explore 3D printing prototypes to innovate packaging design and accelerate product development cycles.