Market Overview

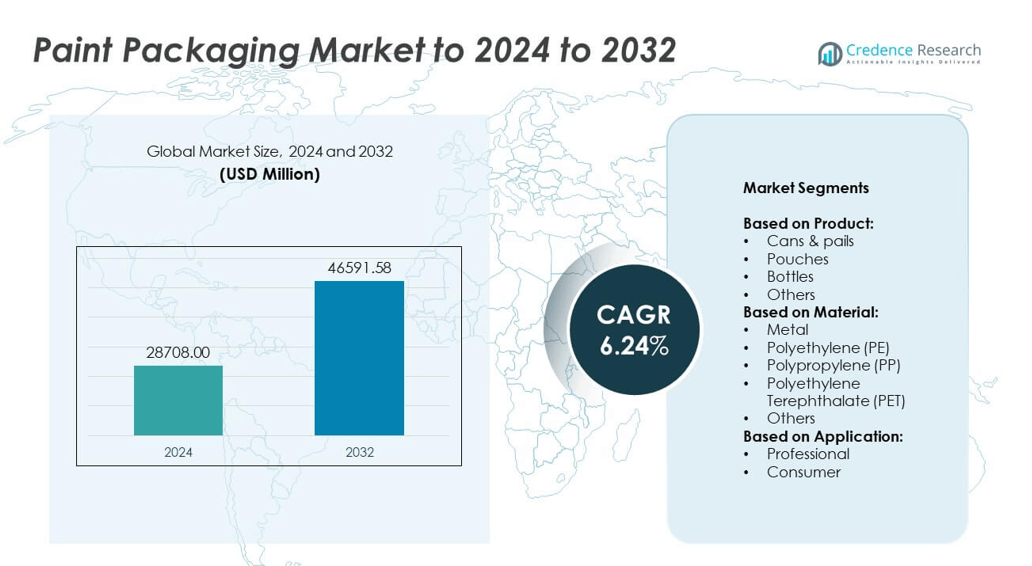

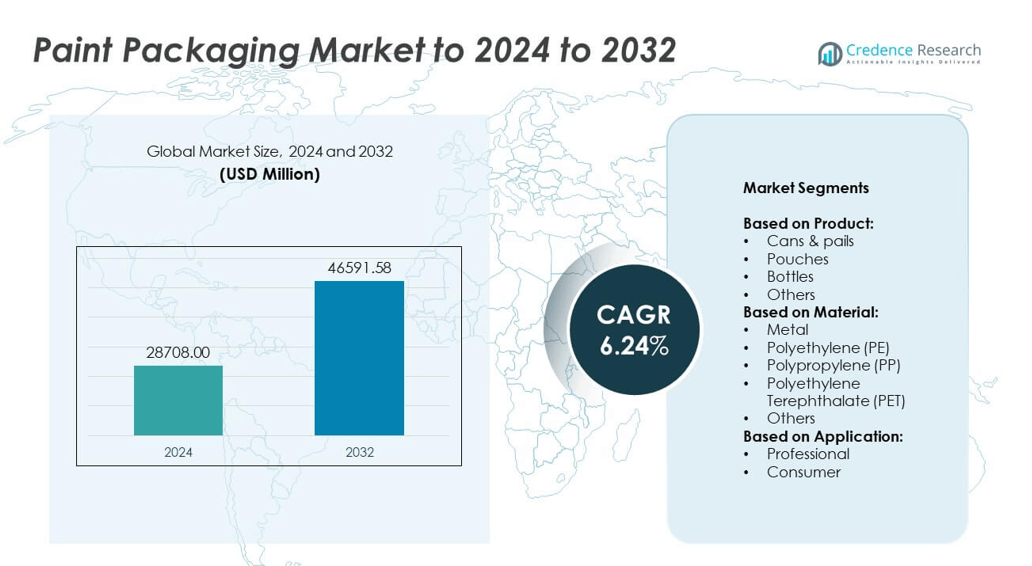

Paint Packaging Market size was valued USD 28,708.00 Million in 2024 and is anticipated to reach USD 46,591.58 Million by 2032, at a CAGR of 6.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Paint Packaging Market Size 2024 |

USD 28,708.00 Million |

| Paint Packaging Market, CAGR |

6.24% |

| Paint Packaging Market Size 2032 |

USD 46,591.58 Million |

The paint packaging market is shaped by key players such as Sherwin-Williams, Moldtek Packaging Ltd., PPG Industries, CL Smith, Crown, BASF, BWAY Corporation, Amcor plc, RPC Superfos, Ball Corporation, and Greif. These companies focus on innovation, sustainable packaging solutions, and lightweight designs to enhance functionality and reduce environmental impact. Strategic collaborations, product launches, and capacity expansions help them maintain competitiveness and expand their global reach. North America leads the market with around 35% share, supported by strong construction activities and high adoption of premium paint products. Europe follows with nearly 28% share, driven by strict sustainability regulations and renovation projects, while Asia Pacific holds 25% share, fueled by rapid urbanization and infrastructure development.

Market Insights

- The paint packaging market was valued at USD 28,708.00 million in 2024 and is projected to reach USD 46,591.58 million by 2032, growing at a CAGR of 6.24%.

- Rising construction, renovation activities, and growing DIY culture are driving demand for durable, innovative, and sustainable paint packaging formats.

- Trends include adoption of smart packaging, lightweight materials, and increased use of recyclable PE, PP, and PET formats for water-based paints.

- Competition is strong, with players focusing on product innovation, tamper-proof designs, and eco-friendly solutions to gain market presence.

- North America leads with 35% share, followed by Europe at 28% and Asia Pacific at 25%, while cans and pails dominate product share with over 45% in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Cans and pails dominated the paint packaging market in 2024 with over 45% share. Their dominance stems from their ability to provide superior protection against leakage and contamination. These containers are preferred by professional painters and industrial users for large-volume paint storage and transport. Pouches are gaining traction in eco-friendly and small-scale applications due to reduced material usage. Bottles serve niche uses such as specialty paints and DIY kits. Growth is driven by demand for durable, tamper-proof, and recyclable packaging that maintains paint quality over extended storage periods.

- For instance, PPG Industries is a manufacturer of paints, coatings, and specialty materials. In its 2024 annual report, the company stated that net sales were $15.8 billion and that it operates and innovates in more than 70 countries, employing approximately 46,000 individuals.

By Material

Metal accounted for the largest share of over 40% in 2024, driven by its superior barrier properties and durability. Metal packaging ensures extended shelf life and is preferred for solvent-based and industrial-grade paints. Polyethylene (PE) and polypropylene (PP) follow closely, supported by their lightweight, cost-effectiveness, and suitability for water-based paints. PET is emerging in consumer-focused products due to its transparency and recyclability. Increasing sustainability focus is pushing manufacturers to adopt recyclable materials, while rising demand for water-based and eco-friendly paints continues to expand the use of plastic packaging formats.

- For instance, Crown Holdings, a leading manufacturer of metal packaging, reported total beverage can volume of 82 billion cans in 2024, representing 67% of the company’s revenue. Crown’s product portfolio also includes metal food and aerosol containers, metal closures, and specialty packaging, which contain solvent-based and other types of paints and coatings.

By Application

Professional applications led the market with more than 55% share in 2024, reflecting strong demand from commercial construction and industrial projects. Professionals prefer robust metal cans and pails for bulk paint storage and easy handling on job sites. The consumer segment is growing steadily, driven by DIY culture, home renovation trends, and the availability of convenient packaging formats like pouches and bottles. The rise of e-commerce distribution for paints also supports consumer-focused packaging growth. Market expansion is supported by increasing construction activities, urbanization, and demand for high-performance coatings in residential and commercial spaces.

Market Overview

Rising Construction and Renovation Activities

The growth of global construction and renovation projects is the primary driver for paint packaging demand. Expanding urban infrastructure, housing projects, and commercial developments are increasing paint consumption, leading to higher packaging requirements. Cans and pails remain the preferred choice for professional use due to their durability and bulk capacity. Emerging economies such as India, China, and Brazil contribute significantly to this rise. Increased government spending on infrastructure and urbanization further accelerates the demand for paint packaging across residential, commercial, and industrial sectors worldwide.

- For instance, for the financial year ending in March 2024, Asian Paints reported a consolidated net profit of Rs 5,460.23 crore and a consolidated total income of Rs 36,182.69 crore, thereby crossing the Rs 35,000 crore milestone. The company’s combined Decorative and Industrial coatings businesses delivered a 10% volume growth for the year. Additionally, Asian Paints has stated that it has over 169,000 retail touchpoints across India.

Shift Toward Sustainable Packaging

Growing environmental awareness is driving demand for recyclable and eco-friendly paint packaging solutions. Manufacturers are focusing on lightweight materials, metal recyclability, and biodegradable alternatives to reduce environmental impact. Polyethylene and PET formats are gaining traction for water-based paints due to their lower carbon footprint and reusability. Brands are investing in circular economy initiatives, offering take-back programs for used containers. This shift aligns with regulatory pressures and consumer preference for sustainable products, positioning green packaging as a key factor shaping competitive differentiation in the paint packaging industry.

- For instance, in 2024, Nippon Paint China experienced a 12.9% year-on-year revenue increase, reaching 545.2 billion yen. The company’s Traditional Urban Core (TUC) business, which includes retail sales, saw revenue growth, particularly in third- to sixth-tier cities, as the company focused on expanding its market share in these areas.

Growth of DIY Culture and E-commerce

The rise of DIY home improvement projects and e-commerce distribution is boosting consumer-focused packaging demand. Smaller packaging formats such as pouches and bottles are increasingly popular for convenient handling and easy application. Online sales channels encourage the need for tamper-proof, durable packaging that ensures safe transport and storage. This trend is particularly strong in developed markets like North America and Europe, where consumers engage in frequent home renovations. Manufacturers are introducing attractive, easy-to-use packaging to enhance shelf appeal and meet the needs of retail and digital customers.

Key Trends & Opportunities

Adoption of Smart and Functional Packaging

Smart packaging technologies are emerging as a key trend in the paint packaging market. QR codes, tamper-evident seals, and digital tracking solutions are being integrated to improve consumer engagement and product authenticity. Functional designs such as easy-pour spouts and resealable lids enhance user experience and reduce wastage. This innovation is creating opportunities for premiumization, particularly in professional and consumer segments. Brands adopting smart packaging gain a competitive edge by improving convenience and building trust through traceability and safety features in an increasingly tech-savvy market.

- For instance, in 2024, AkzoNobel continued to focus on its circular economy initiatives, which included increasing the percentage of recycled content in its plastic packaging in its Decorative Paints business in Europe to 43% on average. This figure is part of a range of PCR content in individual packs from 25%–90%. The company is on track to meet its target of using at least 50% recycled plastic content in this packaging by 2025.

Increased Demand for Water-Based Paints

The transition from solvent-based to water-based paints is driving packaging innovation. Water-based paints require compatible plastic materials such as PE and PP that resist moisture absorption and maintain product integrity. This shift is generating opportunities for manufacturers to develop lightweight, recyclable packaging that supports sustainability goals. Regulatory restrictions on volatile organic compounds (VOCs) are further accelerating this change. The trend benefits companies investing in eco-friendly solutions, enabling them to capture a growing share of environmentally conscious consumers and meet tightening compliance requirements across multiple regions.

- For instance, in its 2024 annual report, Jotun reported setting new records with a total operating revenue of NOK 34,206 million, an increase of 7% from the previous year, driven primarily by volume growth across all segments.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in raw material prices, particularly metals and polymers, remain a major challenge for paint packaging manufacturers. Rising costs of steel, aluminum, and resins affect profit margins and force companies to adjust pricing strategies. These cost pressures are particularly significant for small and mid-sized manufacturers with limited ability to absorb price volatility. Global supply chain disruptions and energy price fluctuations also add uncertainty. Companies are focusing on material optimization, lightweighting, and alternative sourcing strategies to mitigate risks and stabilize production costs in a competitive market.

Regulatory Compliance and Waste Management

Strict regulations related to packaging waste and environmental impact create compliance challenges for industry players. Governments are imposing extended producer responsibility (EPR) programs, forcing manufacturers to collect, recycle, or dispose of used packaging. This increases operational costs and requires investment in recycling infrastructure and closed-loop systems. Non-compliance can lead to penalties and brand reputation damage. The challenge is more acute in regions with advanced regulations, such as Europe, where circular economy directives demand rapid adaptation. Companies must innovate sustainable packaging solutions while maintaining cost efficiency.

Regional Analysis

North America

North America held the largest share of around 35% in the paint packaging market in 2024. The region benefits from strong construction activity, high renovation spending, and a mature DIY culture. Demand for metal cans and pails remains strong, particularly in professional applications, supported by strict quality and safety standards. The presence of leading paint manufacturers and packaging innovators drives product development and adoption of sustainable solutions. Increasing focus on recyclable and lightweight materials also contributes to market growth. E-commerce growth and premiumization trends further support the expansion of consumer-friendly and tamper-proof paint packaging formats.

Europe

Europe accounted for nearly 28% of the market share in 2024, driven by sustainability regulations and high demand for eco-friendly packaging. The region has a strong focus on circular economy initiatives, pushing manufacturers to adopt recyclable and reusable materials. Demand is supported by renovation projects and energy-efficient building upgrades under EU green initiatives. Metal packaging is widely used, while PET and PE formats are growing with the shift toward water-based paints. The presence of major packaging producers and strict compliance standards fosters innovation in design and functionality, creating opportunities for premium and environmentally responsible solutions.

Asia Pacific

Asia Pacific captured around 25% of the market share in 2024 and is the fastest-growing region. Rapid urbanization, infrastructure development, and rising disposable incomes are boosting paint consumption across residential and commercial sectors. Countries such as China, India, and Southeast Asian nations are witnessing high construction activity, increasing the demand for bulk packaging formats. Local manufacturers are focusing on cost-effective, lightweight materials to serve growing middle-class consumers. Government initiatives supporting housing development and smart city projects further drive growth. The region also shows rising interest in sustainable packaging solutions, creating opportunities for recyclable and affordable product innovations.

Latin America

Latin America held about 7% of the paint packaging market share in 2024, driven by steady growth in residential construction and infrastructure upgrades. Brazil and Mexico are the key contributors, with increasing renovation projects and demand for decorative paints supporting packaging sales. Metal cans remain dominant, but flexible pouches are gaining traction in cost-sensitive markets. Economic recovery and urban population growth are boosting consumption across mid-range housing sectors. Local manufacturers are focusing on affordability and durability, while global players are introducing innovative packaging solutions to capture the growing demand for functional and sustainable paint packaging options.

Middle East & Africa

Middle East & Africa accounted for roughly 5% market share in 2024, with growth supported by ongoing infrastructure projects and commercial development. Countries like the UAE and Saudi Arabia are investing heavily in large-scale construction, creating demand for bulk paint packaging. Metal pails dominate professional use, while PET and PE bottles are slowly gaining popularity in consumer applications. The region is seeing gradual adoption of sustainable packaging solutions as environmental awareness rises. Economic diversification initiatives and urban expansion are expected to drive further market growth, supported by increased imports of high-quality paints and advanced packaging formats.

Market Segmentations:

By Product:

- Cans & pails

- Pouches

- Bottles

- Others

By Material:

- Metal

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Others

By Application:

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the paint packaging market include Sherwin-Williams, Moldtek Packaging Ltd., PPG Industries, CL Smith, Crown, Kian Joo Can Factory, BASF, BWAY Corporation, Amcor plc, RPC Superfos, Ball Corporation, and Greif. The market is highly competitive, with companies focusing on product innovation, sustainable materials, and cost optimization to strengthen their market position. Manufacturers are investing in advanced packaging designs, such as tamper-evident lids and lightweight containers, to enhance consumer convenience and meet regulatory standards. The shift toward recyclable and eco-friendly packaging is pushing players to adopt circular economy practices. Strategic partnerships, acquisitions, and capacity expansions are common approaches to increase geographic presence and serve diverse customer needs. The growing influence of e-commerce and rising consumer expectations for durable and user-friendly packaging are encouraging companies to develop packaging that improves shelf appeal and reduces product waste.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sherwin-Williams

- Moldtek Packaging Ltd.

- PPG Industries

- CL Smith

- Crown

- Kian Joo Can Factory

- BASF

- BWAY Corporation

- Amcor plc

- RPC Superfos

- Ball Corporation

- Greif

Recent Developments

- In 2025, BASF Coatings launched its biomass-balanced refinish coatings in North America, expanding its sustainable portfolio to the region after previous launches in Europe and Asia.

- In 2023, Sherwin-Williams published a white paper detailing the critical role coatings play in the future of sustainable packaging, particularly for the European food, beverage, and household goods markets.

- In 2023, PPG Industries company introduced PFAS-alternative coatings, such as PPG FUSION® PRO non-stick coating for cookware and bakeware, made without intentionally added PFAS chemicals.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, driven by rising construction and renovation activities worldwide.

- Demand for sustainable and recyclable packaging will increase due to stricter environmental regulations.

- Metal cans and pails will continue leading, but flexible pouches will gain faster adoption.

- Digital printing and smart packaging solutions will enhance product labeling and consumer engagement.

- Growth in water-based paints will boost demand for compatible plastic packaging formats.

- E-commerce expansion will push development of tamper-proof and durable packaging formats.

- Emerging economies will witness strong demand from rapid urbanization and infrastructure projects.

- Companies will invest in lightweight designs to optimize logistics and reduce material use.

- Strategic partnerships and acquisitions will expand production capacity and global reach.

- Focus on circular economy practices will shape product innovation and waste management solutions.