Market Overview

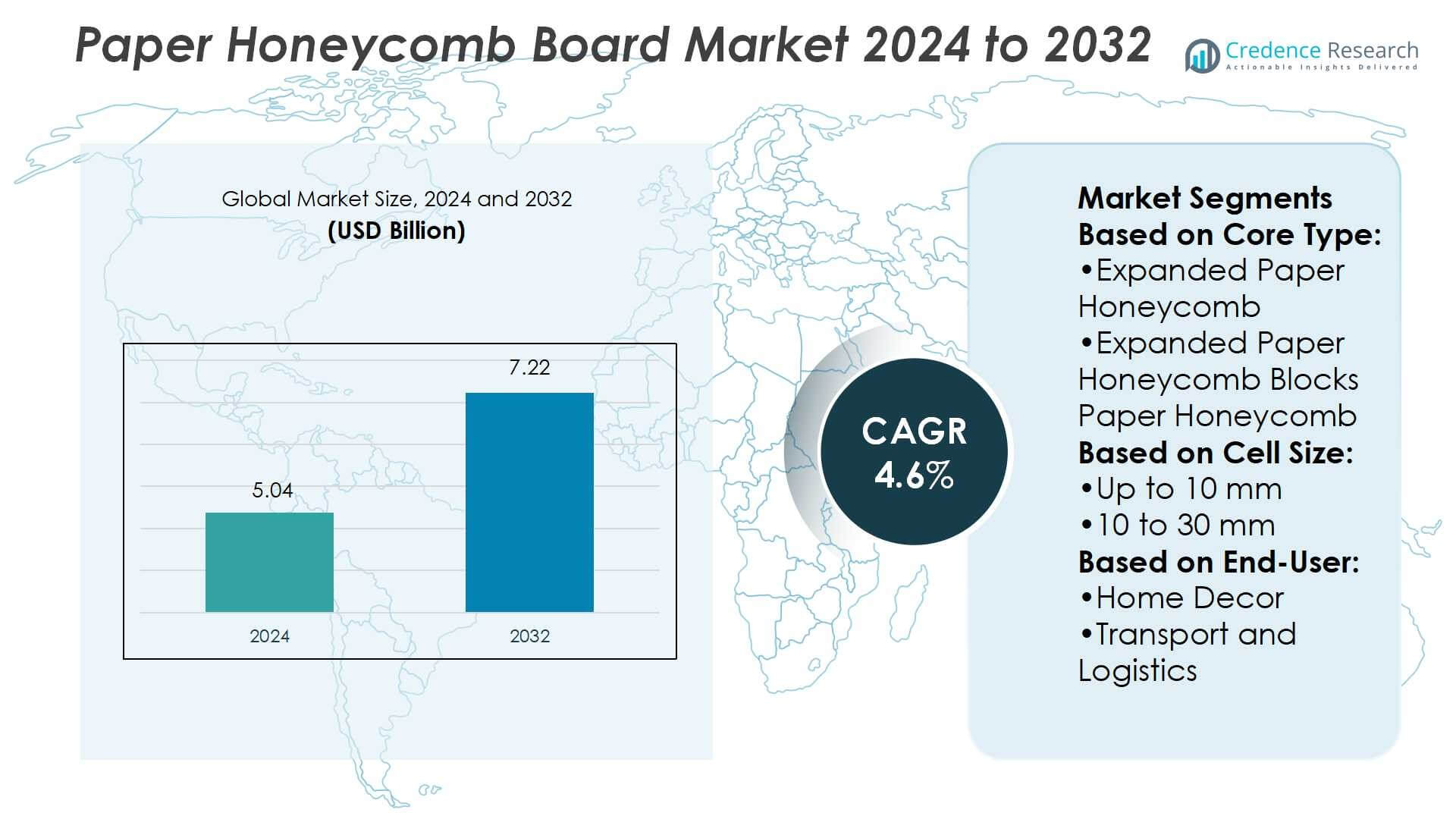

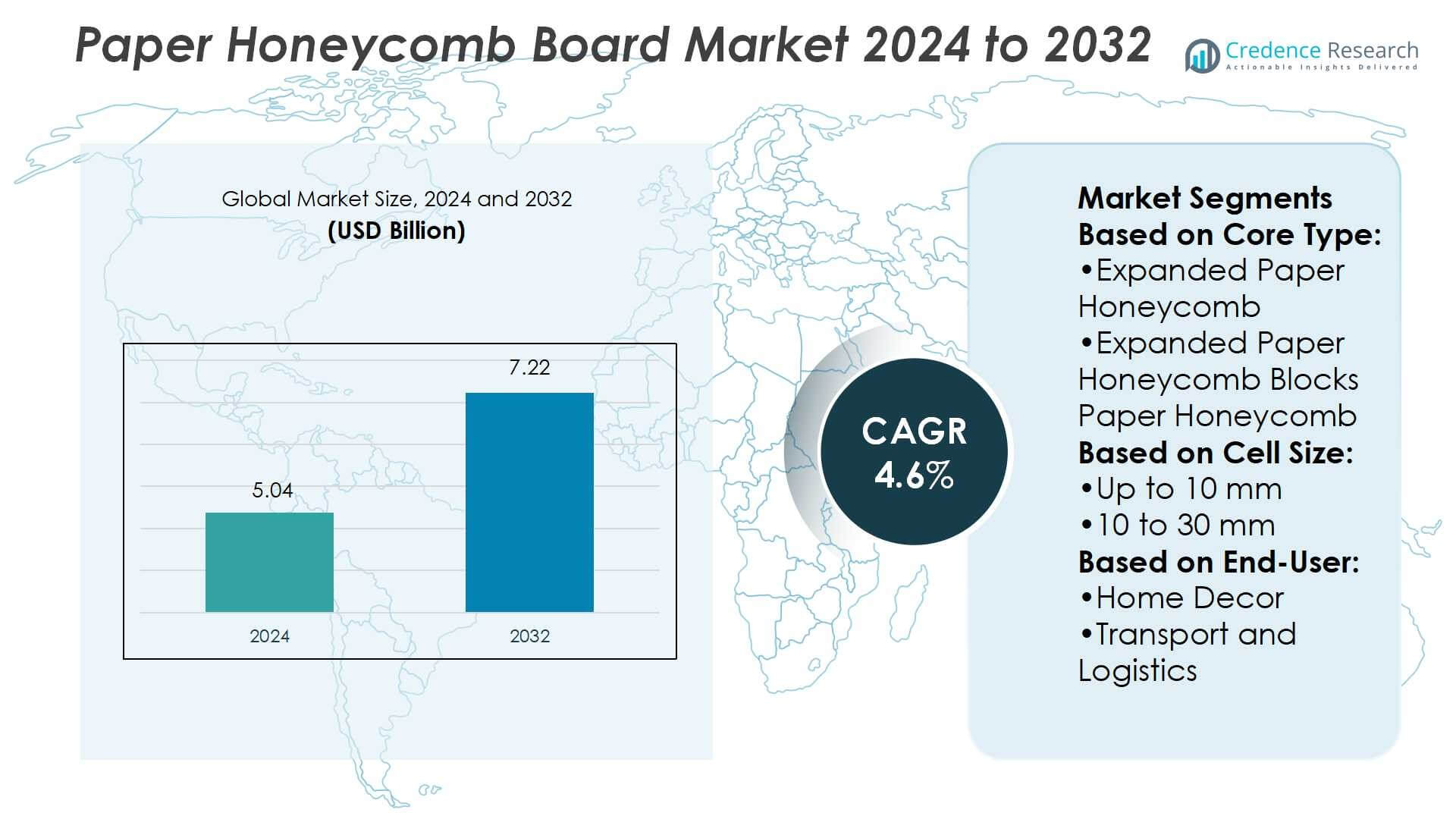

Paper Honeycomb Board Market size was valued at USD 5.04 billion in 2024 and is anticipated to reach USD 7.22 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Paper Honeycomb Board Market Size 2024 |

USD 5.04 Billion |

| Paper Honeycomb Board Market, CAGR |

4.6% |

| Paper Honeycomb Board Market Size 2032 |

USD 7.22 Billion |

The Paper Honeycomb Board Market grows with rising demand for sustainable, lightweight, and cost-efficient materials across packaging, construction, automotive, and furniture industries. Strong regulatory pressure and consumer preference for eco-friendly products drive adoption, while the expansion of e-commerce and logistics strengthens demand for protective packaging. The market also benefits from technological advancements that improve durability, moisture resistance, and customization. Trends highlight increasing integration in modular furniture, interiors, and automotive components, along with digital printing applications for branding and retail displays. Rapid industrialization in emerging economies and a global shift toward recyclable materials further reinforce long-term market growth potential.

The Paper Honeycomb Board Market shows strong geographical presence, with Europe holding the largest share, driven by strict sustainability regulations and advanced industrial adoption. North America follows with steady demand from packaging and logistics, while Asia Pacific emerges as the fastest-growing region due to urbanization and e-commerce expansion. Latin America and the Middle East & Africa present steady opportunities through rising industrial activities. Key players include Smurfit Kappa, DuPont, PCA Hexacomb, Honicel Netherland BV, Grigeo AB, and Sunrise MFG Inc.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Paper Honeycomb Board Market size was valued at USD 5.04 billion in 2024 and is expected to reach USD 7.22 billion by 2032, at a CAGR of 4.6%.

- Rising demand for sustainable, lightweight, and cost-efficient materials drives growth across packaging, automotive, construction, and furniture sectors.

- Increasing use in modular furniture, interiors, and digital printing applications shapes evolving market trends.

- Competitive landscape remains strong with companies focusing on innovation, durability, and eco-friendly product development.

- High sensitivity to moisture and competition from substitutes such as plastics and corrugated boards act as restraints.

- Europe leads the market share due to strict sustainability regulations, while Asia Pacific grows fastest with e-commerce and urbanization.

- North America shows steady adoption, and Latin America along with Middle East & Africa present emerging opportunities supported by industrial expansion.

Market Drivers

Rising Demand for Sustainable and Eco-Friendly Packaging Solutions

Sustainability drives growth in the Paper Honeycomb Board Market, with industries shifting away from plastics and non-recyclable materials. Brands adopt eco-friendly packaging to align with global environmental regulations and consumer expectations. Paper honeycomb board offers recyclability, lightweight design, and reduced carbon footprint compared to conventional options. The packaging industry increasingly integrates these boards into protective solutions for electronics, furniture, and consumer goods. It ensures both durability and compliance with sustainability goals. Regulatory pressure and consumer awareness strengthen adoption, making sustainability a central driver of market expansion.

- For instance, Sunrise offers a specific product line, the “SUNRISE SMALL CELL,” which has a compressive strength of 10 to 69 psi. The company notes that this figure is dependent on the specific product configuration.

Expansion of E-Commerce and Logistics Sector Strengthening Demand

The rapid growth of e-commerce and logistics accelerates the need for lightweight yet durable packaging. Paper honeycomb boards provide high compressive strength while keeping shipping weight low, reducing costs for businesses. Companies in furniture, automotive parts, and consumer electronics rely on it for protective packaging during transit. The material safeguards products while meeting efficiency requirements in supply chains. Online retail platforms benefit from lower damage rates when using honeycomb packaging. Rising parcel shipments across global markets continue to create steady demand. This sector expansion ensures consistent opportunities for market growth.

- For instance, Mex-Core produces paper honeycomb cores with paper grammage of 170 grams per square meter and cell sizes of 20 mm, achieving high compressive strength while using fire-rated paper and maintaining stable mechanical performance under humidity loads.

Growing Applications in Furniture and Construction Industries

The Paper Honeycomb Board Market benefits from rising usage in furniture manufacturing and construction. Furniture makers adopt these boards for tabletops, doors, and panels due to their strength-to-weight advantage. The boards provide design flexibility while reducing material costs compared to solid wood or composites. Construction firms increasingly use them for partitions, flooring, and lightweight structures. It supports energy-efficient building designs and improves installation efficiency. The rising need for affordable, durable, and sustainable materials fuels this adoption. Continuous innovation in production methods expands applications across both sectors.

Technological Advancements Enhancing Product Performance and Versatility

Advancements in production technology drive adoption of paper honeycomb boards across industries. Automation and improved adhesives increase board strength, moisture resistance, and customization options. Manufacturers introduce flame-retardant and water-resistant grades for use in demanding environments. It enhances product appeal in automotive interiors, industrial packaging, and modular furniture. Integration of digital printing also allows customization, supporting branding and marketing strategies. The capacity to deliver both functional and aesthetic benefits makes the product more versatile. Continuous technological development ensures long-term competitiveness of the market.

Market Trends

Increasing Shift Toward Lightweight and High-Strength Packaging Materials

The Paper Honeycomb Board Market witnesses a strong trend toward lightweight yet durable packaging solutions. Industries focus on reducing material weight without compromising strength or protection. Paper honeycomb boards deliver excellent load-bearing capacity while maintaining low density. Packaging suppliers adopt it widely for electronics, consumer goods, and fragile items. Logistics providers benefit from reduced transportation costs when using lightweight packaging. This trend aligns with cost efficiency and sustainability goals, creating lasting demand.

- For instance, Smurfit Kappa’s Hexacomb packaging achieves stacking strength up to 800 kPa while keeping board thicknesses manageable, and the company invested in machinery able to cut and score honeycomb material up to 45 mm thick, enabling stronger protection without bulk.

Rising Popularity in Modular Furniture and Interior Applications

Furniture and interior industries increasingly adopt paper honeycomb boards for innovative designs. The material’s strength-to-weight ratio supports durable yet lightweight products such as doors, panels, and partitions. It offers cost-effective alternatives to wood and other composites. Manufacturers integrate the boards into modular furniture that suits modern urban lifestyles. Growing demand for affordable, stylish, and eco-friendly furniture drives this trend forward. The Paper Honeycomb Board Market gains momentum from its versatile role in interiors.

- For instance, Honicel Netherlands produces “Continuous Paper Honeycomb” cores having cell sizes between 8 mm to 40 mm, thickness from 4 mm to 100 mm, paper weight from 100 g/m² to 250 g/m², and pressure strength up to 7.5 kg per square centimetre, which allows for interior panels that are both light yet able to withstand static load of multiple kilograms without deformation.

Advancements in Customization and Digital Printing Integration

A growing trend centers on the integration of digital printing and customization. Paper honeycomb boards allow high-quality prints for branding and marketing purposes. Manufacturers invest in printing technologies that enhance visual appeal and functional performance. It supports product differentiation in competitive markets such as retail displays and promotional packaging. Customizable features also attract sectors like automotive interiors and decorative panels. This trend reinforces the adaptability of honeycomb boards across diverse applications.

Expansion of Applications Across Construction and Automotive Industries

The construction and automotive industries steadily expand usage of paper honeycomb boards. Builders use the material in partitions, flooring systems, and lightweight walls to improve efficiency. Automakers integrate it into vehicle interiors for panels, shelves, and protective elements. It helps reduce overall weight and supports fuel efficiency targets in automotive design. Growing interest in sustainable construction materials reinforces its demand in the building sector. This expansion trend strengthens market penetration across heavy-use industries.

Market Challenges Analysis

Vulnerability to Moisture, Durability Concerns, and Limited Performance in Harsh Environments

The Paper Honeycomb Board Market faces challenges related to durability and environmental resistance. The material remains highly sensitive to moisture, which restricts its use in humid or wet conditions. Industries requiring long-term strength often prefer plastic or metal alternatives. It struggles to maintain performance in applications that demand resistance to heavy impacts, extreme temperatures, or chemicals. These limitations reduce its adoption in sectors such as heavy-duty construction or marine packaging. Manufacturers must invest in coatings, laminates, and treatment processes to overcome these weaknesses. Addressing durability concerns is critical for improving long-term competitiveness.

High Competition from Substitutes, Cost Constraints, and Complex Production Requirements

Competition from substitutes such as corrugated boards, plastics, and composites challenges the Paper Honeycomb Board Market. Many of these materials offer easier processing, higher strength, or lower costs in certain applications. Complex production methods and high-quality adhesive requirements increase manufacturing expenses for honeycomb boards. It limits competitiveness in price-sensitive industries like bulk packaging. Supply chain fluctuations in paper and raw materials also add cost instability. These challenges create pressure on manufacturers to optimize production efficiency while balancing quality standards. Overcoming these barriers requires both innovation and strategic cost management.

Market Opportunities

Expanding Scope in Sustainable Packaging and Eco-Friendly Manufacturing Practices

The Paper Honeycomb Board Market holds strong opportunities in sustainable packaging solutions. Rising global demand for recyclable and eco-friendly materials supports its adoption across industries. Companies seek packaging alternatives that reduce environmental impact while meeting regulatory standards. It provides high strength, lightweight design, and cost-effectiveness, making it suitable for protective packaging in electronics, appliances, and consumer goods. Growing consumer preference for green products strengthens its role in supply chains. The shift toward circular economy practices opens new avenues for large-scale use in packaging.

Growth Potential in Construction, Automotive, and Furniture Applications

The Paper Honeycomb Board Market presents growth opportunities in construction, automotive, and furniture industries. Builders require lightweight and cost-efficient materials for partitions, walls, and insulation applications. Automakers use honeycomb boards to reduce vehicle weight, supporting efficiency and emission targets. Furniture manufacturers benefit from its durability and design flexibility in modular furniture, doors, and panels. It offers scalability in both premium and mass-market products, expanding its commercial relevance. Rising demand in emerging economies further accelerates adoption in these sectors. The ability to deliver both functionality and sustainability makes it attractive across diverse applications.

Market Segmentation Analysis:

By Core Type

The Paper Honeycomb Board Market is segmented by core type, reflecting diverse applications and performance needs. Expanded paper honeycomb dominates due to its lightweight design and strong load-bearing capability, making it suitable for packaging and furniture. Expanded paper honeycomb blocks paper honeycomb finds use in protective packaging for heavy or fragile goods where structural strength is essential. Continuous paper honeycomb supports industries requiring large-scale panels for construction and automotive interiors. Others category includes specialized formats tailored for niche requirements. Each type caters to different end-users, supporting flexibility in both industrial and consumer applications.

- For instance, Hexcel manufactures a standard aluminum honeycomb core using a 1/8-inch cell size and a 5052 alloy. The specific strength properties of this material, including compressive and shear strength, are dependent on the foil gauge and density.

By Cell Size

Segmentation by cell size highlights performance variation based on application. Boards with up to 10 mm cell size are preferred in high-strength packaging where compact structures improve load resistance. The 10 to 30 mm range balances strength and cost-effectiveness, making it common in furniture, construction, and automotive uses. Above 30 mm cell size offers lightweight solutions for insulation and large decorative panels. It allows manufacturers to optimize material use while maintaining functional properties. This segmentation enables precise alignment of product characteristics with end-user demands.

- For instance, Grigeo AB produces honeycomb core with cell sizes ranging from 8 mm to 100 mm (±1.5 mm tolerance), width in the range of 600 mm to 2800 mm (±5 mm), and maintains moisture (humidity) not more than 10 % under ISO 187 standard conditions.

By End-User

By end-user, the Paper Honeycomb Board Market shows strong adoption across multiple industries. Home décor utilizes honeycomb boards in doors, panels, and partitions, where light weight and durability enhance design appeal. Transport and logistics rely on it for protective packaging that reduces shipping costs while preventing product damage. Automotive manufacturers use honeycomb boards for interior components, shelves, and panels to improve efficiency and reduce vehicle weight. Building and construction industries integrate the material into walls, flooring systems, and insulation, supporting sustainable and cost-effective projects. Others category covers diverse sectors such as exhibitions, signage, and specialty applications. Together, these end-user segments expand the reach of honeycomb boards across global markets.

Segments:

Based on Core Type:

- Expanded Paper Honeycomb

- Expanded Paper Honeycomb Blocks Paper Honeycomb

Based on Cell Size:

Based on End-User:

- Home Decor

- Transport and Logistics

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a market share of 27% in the Paper Honeycomb Board Market, driven by strong demand across packaging, logistics, and furniture industries. The United States leads adoption due to a robust e-commerce sector and rising consumer preference for sustainable packaging solutions. The region benefits from advanced manufacturing technologies that allow customization and high-quality production of honeycomb boards. Canada and Mexico also contribute significantly, with Mexico witnessing growth in logistics and automotive applications. Strict environmental regulations in the U.S. push companies to shift from plastics toward recyclable paper-based alternatives, fueling the use of honeycomb boards. It gains further momentum from large retail chains emphasizing sustainable packaging and eco-friendly supply chain practices. North America maintains steady growth as businesses prioritize cost efficiency, lightweight packaging, and compliance with sustainability standards.

Europe

Europe accounts for a market share of 32%, making it the leading regional contributor in the Paper Honeycomb Board Market. Germany, France, and the UK are key markets, supported by strong furniture and automotive industries. The region emphasizes sustainable materials in packaging and construction due to strict EU environmental policies. Automotive manufacturers in Germany integrate paper honeycomb boards into vehicle interiors to reduce weight and support emission targets. In Italy and Spain, rising demand for cost-efficient and lightweight construction materials expands adoption. Eastern Europe also contributes through growing packaging exports. It gains strength in Europe from widespread sustainability initiatives and innovations in recyclable materials. The region’s leadership stems from well-established regulatory frameworks and early adoption of eco-friendly alternatives across industries.

Asia Pacific

Asia Pacific holds a market share of 28%, making it the fastest-growing region in the Paper Honeycomb Board Market. China dominates production and consumption due to its expansive packaging, logistics, and furniture industries. India and Southeast Asian countries follow with rising demand in construction and automotive applications. Japan and South Korea emphasize premium applications in electronics packaging and automotive interiors. Rapid urbanization and growth in e-commerce drive strong demand for lightweight packaging solutions across the region. It also benefits from cost-effective manufacturing facilities and increasing export of honeycomb boards to Western markets. Asia Pacific continues to expand as global companies invest in local production units to meet growing demand.

Latin America

Latin America contributes 7% to the Paper Honeycomb Board Market, with Brazil and Argentina as primary markets. Brazil shows strong adoption in furniture, building materials, and transport packaging, supported by its large manufacturing base. Argentina demonstrates rising demand from logistics and consumer goods industries. The region’s growth is supported by increasing awareness of eco-friendly alternatives and government initiatives promoting sustainable materials. However, high competition from conventional packaging materials slows wider adoption. It gains traction as multinational companies expand operations in Latin America, boosting demand for honeycomb boards in packaging and industrial applications. Steady expansion is expected as local markets align with global sustainability goals.

Middle East and Africa

The Middle East and Africa together hold a market share of 6% in the Paper Honeycomb Board Market. GCC countries drive demand with rising logistics and construction projects, particularly in the UAE and Saudi Arabia. South Africa leads adoption within Africa, supported by expanding retail and packaging industries. Israel shows adoption in niche applications such as automotive and specialty packaging. Limited local manufacturing capacity poses challenges, but rising imports strengthen availability. It grows steadily due to demand for cost-efficient, durable, and eco-friendly packaging solutions. Infrastructure development and industrial expansion in these regions continue to open opportunities for wider adoption of honeycomb boards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sunrise MFG Inc.

- DuPont

- Greencore Packaging

- Hexagonas Mexicanos

- Smurfit Kappa

- Honicel Netherland BV

- Honecore

- PCA Hexacomb

- IPC Industrial Packaging Corporation

- Grigeo AB

Competitive Analysis

The Paper Honeycomb Board Market companies include Grigeo AB, IPC Industrial Packaging Corporation, Smurfit Kappa, Greencore Packaging, Honecore, Hexagonas Mexicanos, Sunrise MFG Inc., PCA Hexacomb, Honicel Netherland BV, and DuPont. The Paper Honeycomb Board Market remains highly competitive, with companies focusing on sustainability, product innovation, and operational efficiency to strengthen their positions. Market participants prioritize the development of lightweight, durable, and recyclable solutions that align with global sustainability goals and regulatory frameworks. Firms invest in advanced manufacturing processes, including digital printing and moisture-resistant treatments, to enhance product performance and broaden application areas. Strategic moves such as capacity expansion, partnerships, and geographic diversification play a vital role in gaining competitive advantage. Continuous innovation in design flexibility and customization further supports differentiation, allowing businesses to meet evolving demand across packaging, furniture, construction, and automotive industries.

Recent Developments

- In June 2024, Green Bay Packaging revealed its acquisition of SMC Packaging, a provider of packaging materials and corrugated boxes. This strategic acquisition aims to broadens Green Bay Packaging’s product lineup and fortify its market presence in the paper and paperboard packaging sector.

- In January 2024, Smurfit Kappa promoted its honeycomb Hexacomb solution in the automotive sector, emphasizing the industry’s need for sustainable packaging to transport sensitive components efficiently. By targeting the eco-conscious automotive sector, Smurfit Kappa strengthens its reputation as a leader in sustainable packaging solutions, differentiating itself from competitors and potentially capturing more market share in the industry.

- In January 2024, a quieter pickleball paddle was invented by an Oak Bay man to reduce noise by 50%. The shock-absorbing and water-resistant carbon honeycomb core material is common to standard paddles.

- In January 2024, China revealed a next-generation multi-target electronic welfare weapon design. The weapon design is a waveguide structure that is open-ended and honeycomb-like.

Report Coverage

The research report offers an in-depth analysis based on Core Type, Cell Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and recyclable materials will strengthen adoption across industries.

- Growth in e-commerce will boost the need for lightweight protective packaging.

- Furniture and interior applications will expand due to cost efficiency and design flexibility.

- Construction sector will increase usage in partitions, walls, and insulation systems.

- Automotive manufacturers will adopt honeycomb boards to reduce weight and improve efficiency.

- Technological advancements will enhance durability, moisture resistance, and customization.

- Digital printing integration will expand opportunities in branding and retail displays.

- Emerging economies will offer strong growth through industrialization and urban development.

- Strategic collaborations and capacity expansions will shape competitive dynamics.

- Sustainability regulations will continue to drive market penetration globally.