Market Overview

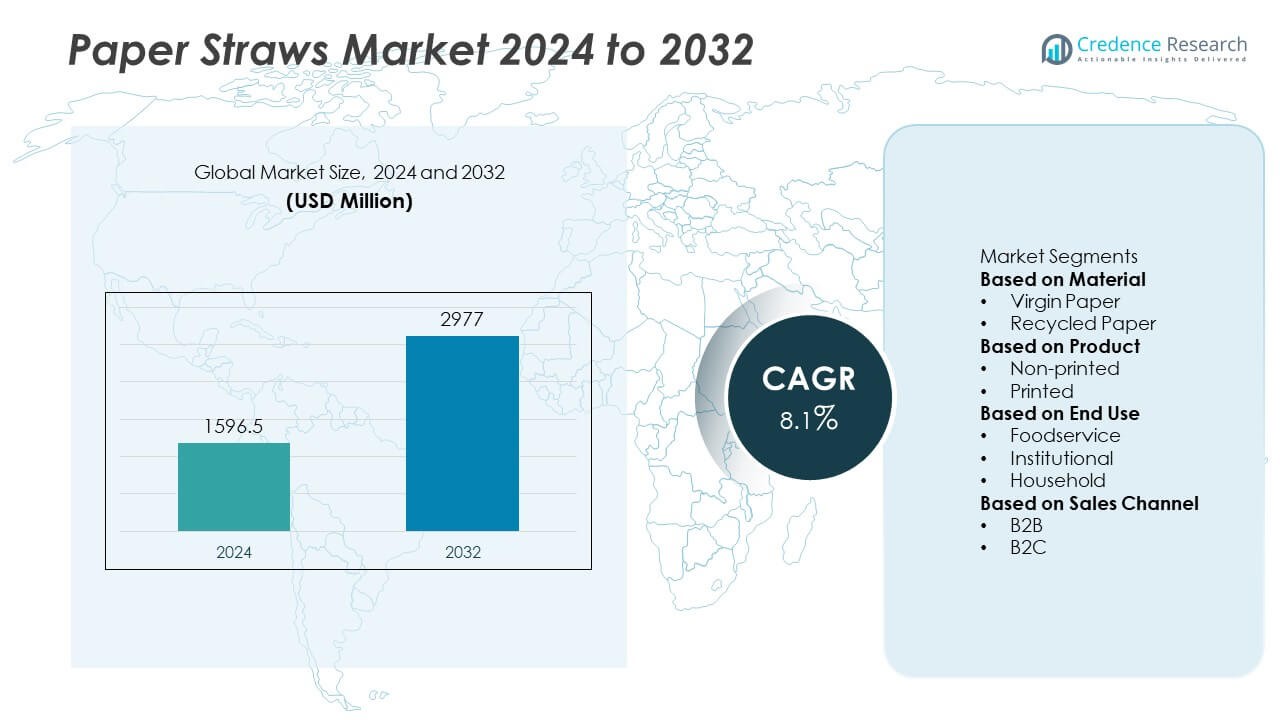

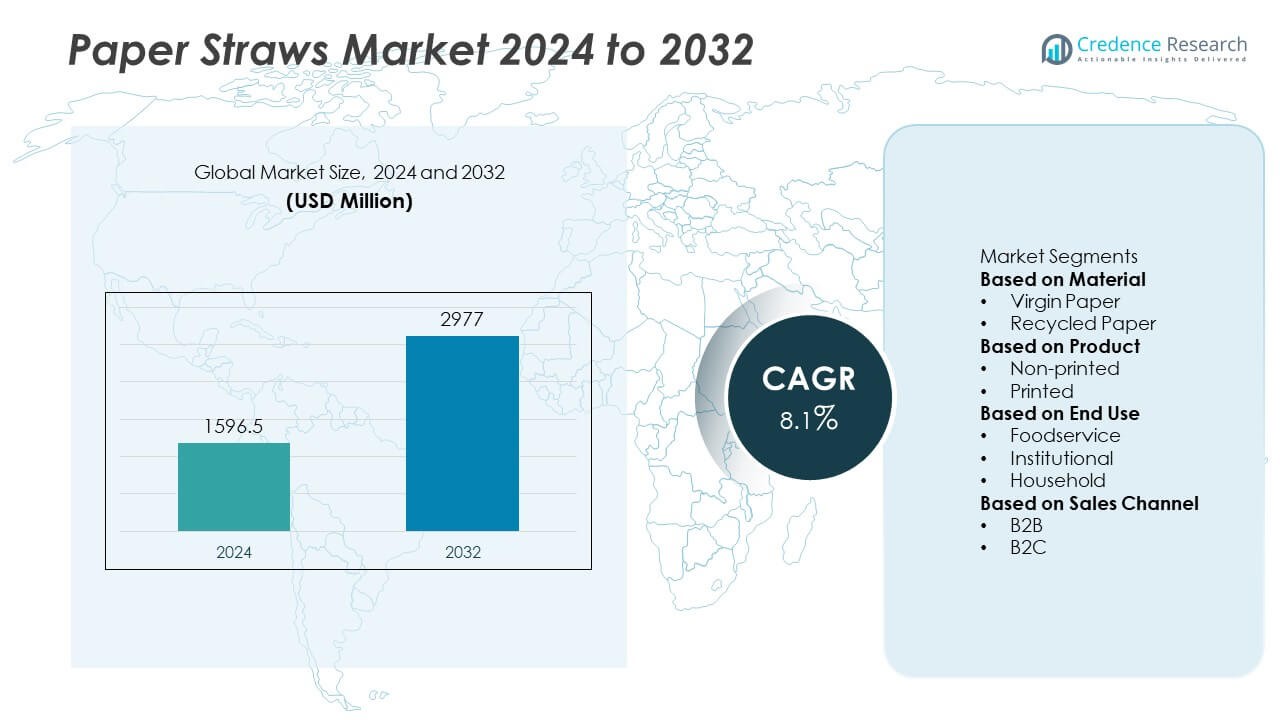

Paper Straws Market was valued at USD 1596.5 million in 2024 and is projected to reach USD 2977 million by 2032, growing at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Paper Straws Market Size 2024 |

USD 1596.5 Million |

| Paper Straws Market, CAGR |

8.1% |

| Paper Straws Market Size 2032 |

USD 2977 Million |

The Paper Straws Market grows on the back of stringent plastic bans, rising environmental awareness, and increasing demand for biodegradable alternatives in foodservice and hospitality sectors. Governments worldwide enforce regulations that encourage sustainable product adoption, while consumers actively choose eco-friendly options. Quick service restaurants and beverage brands integrate paper straws to align with corporate sustainability goals. Advances in material processing, alternative fiber sourcing, and moisture-resistant coatings enhance product performance and expand applications.

The Paper Straws Market has a strong global presence, with North America and Europe leading adoption due to strict regulatory frameworks and high consumer awareness, while Asia-Pacific experiences rapid growth driven by urbanization, expanding foodservice sectors, and rising environmental regulations. Latin America and the Middle East & Africa show emerging potential, supported by increasing tourism, hospitality expansion, and gradual implementation of plastic reduction policies. Key players shape market dynamics through product innovation, sustainable sourcing, and strategic partnerships. Huhtamaki Group focuses on advanced manufacturing and eco-friendly materials, BioPak emphasizes compostable and renewable solutions, and Hoffmaster Group, Inc. delivers a wide range of customized and durable designs for diverse applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Paper Straws Market was valued at USD 1,596.5 million in 2024 and is projected to reach USD 2,977 million by 2032, registering a CAGR of 8.1% during the forecast period.

- Global demand is supported by government regulations banning single-use plastics and rising environmental awareness, pushing adoption across foodservice, hospitality, and retail sectors.

- Trends include increased customization with printed branding, adoption of alternative fibers such as bamboo and bagasse, and improved moisture-resistant coatings to enhance product durability and appeal.

- Competitive activity is marked by innovation in design, expansion of production facilities, and strategic collaborations, with leading players such as Huhtamaki Group, BioPak, Hoffmaster Group, Inc., and Novolex driving technological and market advancements.

- Challenges include higher production costs compared to plastic alternatives and consumer concerns about durability in hot or long-duration beverage use, requiring continuous innovation in materials and coatings.

- North America and Europe lead adoption due to established regulatory frameworks and strong sustainability culture, while Asia-Pacific shows rapid growth driven by urbanization, regulatory adoption, and an expanding beverage industry.

- Latin America and the Middle East & Africa present emerging opportunities, supported by growing tourism, hospitality expansion, and the gradual enforcement of plastic reduction policies, creating scope for new entrants and regional manufacturing investments.

Market Drivers

Rising Environmental Regulations and Plastic Bans Driving Adoption

Governments worldwide enforce strict bans on single-use plastics to address pollution and marine waste. This regulatory landscape pushes foodservice providers, retailers, and beverage brands toward sustainable alternatives. The Paper Straws Market benefits from these mandates by gaining acceptance as a compliant product. Countries such as the UK, Canada, and India have already prohibited plastic straws in commercial use. Brands seek to maintain regulatory alignment while enhancing sustainability credentials. The shift supports rapid market penetration, especially in regions with high consumer awareness of environmental issues.

- For instance, Huhtamaki operates 79 manufacturing units globally, backed by approximately 17,700 employees, enabling it to scale compliant paper straw production swiftly under tightening regulations

Growing Consumer Demand for Sustainable and Eco-Friendly Products

Heightened awareness of plastic waste impacts leads consumers to choose biodegradable solutions. The Paper Straws Market meets this demand by offering renewable, compostable, and marine-safe products. It aligns with the preferences of environmentally conscious buyers in both developed and emerging economies. Food and beverage outlets leverage paper straws to strengthen eco-friendly branding and appeal to younger demographics. Rising media coverage of ocean plastic pollution accelerates this trend. The growing social pressure compels industry stakeholders to invest in sustainable product lines.

- For instance, UFlex introduced India’s first U-shaped paper straw production line in 2022, capable of manufacturing 2.4 billion paper straws annually, reflecting technological advancement and large-volume capacity in response to eco-driven demand

Expansion of Quick Service Restaurants and Beverage Chains Worldwide

The global growth of quick service restaurants and beverage franchises creates a significant opportunity. The Paper Straws Market gains from the sector’s high-volume demand for disposable yet eco-compliant drinking solutions. International brands standardize paper straw use to maintain brand image and meet varying regulations across markets. Seasonal promotions and high-frequency sales events further boost consumption levels. It positions paper straws as a standard accessory in fast-moving consumer environments. The trend extends across urban and semi-urban retail landscapes.

Innovation in Manufacturing and Product Performance Enhancement

Advancements in manufacturing improve the durability and moisture resistance of paper straws. The Paper Straws Market benefits from better raw material processing and coating technologies that extend usability without compromising biodegradability. It addresses prior concerns about sogginess and taste alteration, increasing consumer acceptance. Manufacturers explore new fiber blends and sustainable adhesives to enhance performance. High-speed production systems lower costs and improve supply reliability for large-scale contracts. Continuous innovation supports product differentiation in a competitive market.

Market Trends

Shift Toward Premium and Customizable Paper Straw Designs

Brands increasingly request paper straws that reflect their identity through colors, patterns, and printed logos. The Paper Straws Market responds with advanced printing techniques and food-safe inks to meet branding needs. It enables beverage chains and event organizers to enhance customer experience while promoting sustainability. High-quality finishes and embossed textures improve visual appeal and perceived value. Customization supports premium positioning in hospitality and specialty beverage segments. Demand for tailored products grows in corporate events, weddings, and promotional campaigns.

- For instance, Transcend Packaging engineered a 4.2 mm outer-diameter paper straw as a drop-in replacement for plastic and supports two-colour wrap printing with full straw logo application to meet premium branding

Rising Use of Sustainable and Alternative Fiber Sources

Manufacturers explore raw materials beyond conventional wood pulp to improve environmental performance. The Paper Straws Market incorporates fibers from bamboo, bagasse, and recycled paper to reduce reliance on virgin resources. It supports broader circular economy goals and appeals to environmentally aware consumers. Alternative fibers offer distinct textures and strength properties, enhancing product differentiation. Supply chain diversification also addresses potential disruptions in pulp availability. The trend aligns with brand commitments to reduce overall carbon footprint.

- For instance, Huhtamaki applies a blend of 50% grass fiber and 50% recycled paper in its molded fiber products – highlighting its material innovation approach that extends to fiber-based straws

Integration of Advanced Coatings for Enhanced Durability

Continuous improvements in coating technologies extend the functional life of paper straws in cold and hot beverages. The Paper Straws Market adopts plant-based and biodegradable coatings to maintain environmental compliance. It allows straws to resist softening for longer periods without altering taste. Coating innovation attracts premium beverage providers seeking reliable performance during extended consumption. Manufacturers invest in R&D to balance moisture resistance with full compostability. Enhanced coatings improve customer satisfaction and repeat purchase rates.

Growth of Online Retail and Direct-to-Consumer Channels

E-commerce platforms expand access to a wide range of paper straw products for both businesses and households. The Paper Straws Market leverages direct-to-consumer sales to tap into niche and bulk order segments. It benefits from subscription models that ensure consistent supply for cafés, bars, and home use. Online visibility allows small and mid-sized producers to reach global audiences without extensive distribution networks. Digital marketing highlights product sustainability and certifications, increasing consumer trust. The shift supports greater market diversity and competitive pricing.

Market Challenges Analysis

Higher Production Costs Compared to Plastic Alternatives

Paper straws involve more complex manufacturing processes and higher raw material costs than plastic counterparts. The Paper Straws Market faces pricing pressure, particularly in price-sensitive regions where affordability drives purchasing decisions. It requires investment in specialized machinery, high-quality pulp, and eco-compliant coatings, which raise overall production expenses. Transportation costs can also increase due to the heavier and bulkier nature of paper straws. Price competition from low-cost suppliers may challenge premium producers in maintaining market share. Businesses must balance sustainability goals with budget constraints to ensure long-term adoption.

Performance Limitations and Consumer Perception Issues

Despite advancements in technology, paper straws can still face durability concerns in certain applications. The Paper Straws Market works to overcome negative consumer perceptions related to sogginess, texture, and taste. It must address these concerns to ensure consistent acceptance across diverse beverage categories. Resistance to change among customers accustomed to plastic straws can slow adoption rates. Product failures during high-volume events or in hot beverages can impact brand image for both suppliers and users. Continued innovation in material composition and coating technology remains essential to compete effectively with alternative eco-friendly solutions.

Market Opportunities

Expansion Potential in Emerging Economies with Regulatory Support

Many developing nations are introducing plastic bans and promoting sustainable packaging policies. The Paper Straws Market can leverage this momentum to establish strong distribution networks in Asia, Latin America, and Africa. It benefits from growing urbanization, rising disposable incomes, and increased consumer awareness of environmental issues. Quick service restaurants, café chains, and hotels in these regions seek compliant solutions to meet new legal requirements. Local production facilities can reduce costs and improve supply reliability. Strategic partnerships with regional distributors can accelerate market penetration and brand recognition.

Product Diversification and Value-Added Offerings for Niche Segments

Rising demand for eco-friendly lifestyle products creates opportunities for specialized paper straw variants. The Paper Straws Market can expand into premium, flavored, or novelty designs to appeal to hospitality, events, and retail sectors. It can cater to niche categories such as children’s products, luxury beverage services, and themed promotions. Biodegradable coatings, unique textures, and printed branding can enhance market appeal. E-commerce platforms enable direct engagement with consumers seeking sustainable alternatives for home use. Developing multi-use and compostable variants can further differentiate offerings in competitive markets.

Market Segmentation Analysis:

By Material

Material selection plays a critical role in performance, sustainability, and cost structure. The Paper Straws Market primarily utilizes virgin paper, recycled paper, and specialty fiber blends to meet diverse requirements. Virgin paper remains dominant due to its consistent strength, smooth texture, and food safety compliance. Recycled paper gains traction in eco-conscious markets where reducing resource consumption is a priority. Specialty fibers such as bamboo or bagasse enhance durability and offer unique textures, appealing to premium and niche segments. It benefits from technological improvements in pulp processing and eco-friendly coatings that enhance performance without compromising biodegradability.

- For instance, BioPak manufactures its standard 3‑ply compostable straws with a total paper weight of 350 gsm, comprising layers of 135 gsm, 135 gsm, and 80 gsm, providing structural integrity without any plastic coating.

By Product

Product variations address different beverage types, brand positioning, and consumption environments. The Paper Straws Market includes standard straws, flexible straws, printed straws, and specialty designs such as jumbo or cocktail sizes. Standard straight straws remain the most widely used due to their versatility and low production cost. Flexible straws serve healthcare, hospitality, and convenience-driven applications where adjustability is valued. Printed straws provide branding opportunities for quick service restaurants, cafés, and events. Specialty designs support thick beverages, frozen drinks, and upscale presentation needs, expanding their role beyond everyday use. It enables producers to target specific consumer experiences while meeting regulatory compliance.

- For instance, Huhtamaki crafts its paper straws from 100% PEFC-certified virgin paper, individually wraps them in PEFC-certified kraft packaging, and produces the full line using purpose-built European machinery to meet food-grade safety standards including FDA and ISEGA certifications.

By End Use

End-use demand reflects the impact of sustainability regulations and shifting consumer expectations across sectors. The Paper Straws Market serves foodservice outlets, institutional buyers, household consumers, and specialty retail. Foodservice outlets, including quick service restaurants and beverage chains, account for the largest share due to high turnover and compliance requirements. Institutional buyers such as schools, hospitals, and corporate cafeterias adopt paper straws to align with sustainability policies. Household use rises with growing availability through supermarkets and online channels, often driven by eco-conscious purchasing decisions. Specialty retail leverages paper straws as part of curated eco-friendly product ranges, appealing to premium lifestyle buyers. It continues to expand its reach by adapting designs and supply strategies to diverse end-user priorities.

Segments:

Based on Material

- Virgin Paper

- Recycled Paper

Based on Product

Based on End Use

- Foodservice

- Institutional

- Household

Based on Sales Channel

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 28% of the global Paper Straws Market, supported by stringent plastic ban regulations and a strong culture of sustainability. The United States and Canada lead adoption due to early implementation of single-use plastic restrictions at both state and municipal levels. Large quick service restaurant chains have transitioned to paper straws as part of corporate environmental responsibility programs. It benefits from advanced manufacturing capabilities and widespread consumer acceptance of biodegradable alternatives. E-commerce channels further expand household adoption, with subscription services offering bulk paper straw deliveries. Continuous innovation in moisture-resistant coatings and specialty designs strengthens market competitiveness in this region.

Europe

Europe accounts for 32% of the Paper Straws Market, making it the largest regional contributor. The European Union’s Single-Use Plastics Directive has accelerated the shift toward biodegradable products across member states. The UK, Germany, France, and Italy have witnessed high compliance rates in foodservice and hospitality sectors. It gains traction from the region’s strong environmental awareness and high disposable incomes, which support demand for premium and custom-designed paper straws. The presence of established paper product manufacturers ensures efficient production and distribution. Collaborations between suppliers and beverage brands drive innovation in printed and specialty straws to meet evolving customer preferences.

Asia-Pacific

Asia-Pacific holds 24% of the Paper Straws Market, driven by rapid urbanization, expanding foodservice industries, and growing environmental regulations. Countries such as India, China, Australia, and Japan are implementing or tightening bans on plastic straws, boosting demand for sustainable alternatives. It benefits from a large population base and rising consumer awareness of marine pollution. The growth of bubble tea shops, smoothie bars, and quick service restaurants in Southeast Asia contributes significantly to consumption volumes. Local manufacturing investments help reduce costs and improve supply chain resilience. Product diversity, from jumbo straws to flexible and printed variants, enables brands to cater to the region’s varied beverage culture.

Latin America

Latin America represents 8% of the Paper Straws Market, with growth fueled by regulatory initiatives in countries like Chile, Brazil, and Mexico. Governments in these markets actively promote alternatives to single-use plastics, creating opportunities for domestic and international suppliers. It benefits from the rising presence of multinational beverage brands and fast-food chains in urban centers. Seasonal tourism in coastal areas increases demand for biodegradable straws to align with eco-friendly hospitality standards. Limited local production capacity in some countries drives imports, while emerging manufacturers focus on cost-effective solutions. The market is gradually adopting customized designs to cater to both commercial and retail buyers.

Middle East & Africa

The Middle East & Africa account for 8% of the Paper Straws Market, characterized by growing awareness of sustainability and early-stage regulatory adoption. The United Arab Emirates, Saudi Arabia, and South Africa are leading regional efforts to reduce plastic waste through voluntary and mandatory measures. It benefits from demand in luxury hospitality, tourism, and high-end dining, where eco-friendly practices enhance brand image. Limited domestic production results in reliance on imports from Europe and Asia-Pacific. Opportunities emerge in developing local manufacturing hubs to meet increasing demand from both institutional and retail segments. Gradual expansion of environmental education campaigns supports long-term consumption growth in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Paper Straws Market features leading players such as Huhtamaki Group, BioPak, Hoffmaster Group, Inc., Novolex, Footprint, Matrix Pack, Strawland, Jinhua Suyang Plastic Material Co., Ltd., Tetra Laval Group, and Transcend Packaging, each competing through innovation, sustainability initiatives, and strategic market expansion. These companies focus on improving product durability, adopting alternative fibers, and offering customized designs to meet brand and regulatory requirements. Huhtamaki Group leverages advanced coating technologies and a global production network, while BioPak emphasizes renewable and compostable materials for eco-conscious markets. Hoffmaster Group, Inc. builds its position with premium finishes and extensive distribution in North America, and Novolex integrates sustainable raw materials with high-volume manufacturing to serve major foodservice and retail clients. Footprint and Matrix Pack invest in high-speed production systems to improve scalability, while Strawland and Jinhua Suyang Plastic Material Co., Ltd. target competitive pricing for large-scale supply. Tetra Laval Group and Transcend Packaging focus on regulatory compliance, product innovation, and partnerships with beverage brands to strengthen their global presence.

Recent Developments

- In May 2025, Hoffmaster Group, Inc. announced the closure of its Fort Wayne paper straw manufacturing facility, impacting 53 employees. The layoffs will occur in two phases: the first in October and the second in November

- In March 2025, Footprint appointed Jim Kimbel as Chief Financial Officer, a strategic leadership update at strengthening the company’s financial management its sustainability initiatives and market expansion

- In August 2023, Transcend Packaging collaborated with Klüber Lubrication to produce paper straws free from mineral oil hydrocarbons, improving food safety. This partnership utilizes Klüberfood 4DC, a vegetable-based, food-grade lubricant, to eliminate mineral oil aromatic hydrocarbons (MOAH) and mineral oil saturated hydrocarbons (MOSH) from the manufacturing process

Market Concentration & Characteristics

The Paper Straws Market demonstrates moderate concentration, with a mix of global leaders and regional manufacturers competing through product quality, sustainability credentials, and pricing strategies. Large multinational companies such as Huhtamaki Group, BioPak, and Novolex hold significant influence due to their extensive production capacities, established client networks, and continuous investment in innovation. It benefits from a market environment shaped by regulatory enforcement, consumer preference for biodegradable alternatives, and rapid adoption by foodservice and hospitality sectors. The industry features high product substitutability within the eco-friendly segment, encouraging differentiation through design, durability, and custom branding. Entry barriers remain moderate, driven by the need for specialized manufacturing equipment, sustainable raw material sourcing, and compliance with international food safety standards. Regional players compete by offering cost-effective solutions and flexible production runs, while global brands focus on premium offerings and long-term contracts with major beverage and retail chains. The market continues to evolve through advancements in coatings, alternative fibers, and scalable manufacturing technologies.

Report Coverage

The research report offers an in-depth analysis based on Material, Product, End Use, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for paper straws will grow steadily with the enforcement of stricter single-use plastic bans across more countries.

- Adoption will rise in quick service restaurants, cafés, and beverage chains seeking to meet sustainability targets.

- Manufacturers will increase investment in advanced coatings to improve durability and user experience.

- Alternative fiber materials such as bamboo and bagasse will gain wider use to reduce reliance on virgin paper.

- Customization with printed designs and branding will become a standard offering for large-scale buyers.

- E-commerce and direct-to-consumer sales channels will expand reach to household consumers.

- Regional manufacturing facilities will increase to reduce logistics costs and enhance supply reliability.

- Competition will intensify with new entrants focusing on cost efficiency and product innovation.

- Partnerships between paper straw producers and beverage brands will strengthen product adoption in global markets.

- Continuous technological advancements will improve production speed, quality consistency, and environmental performance.