Market Overview

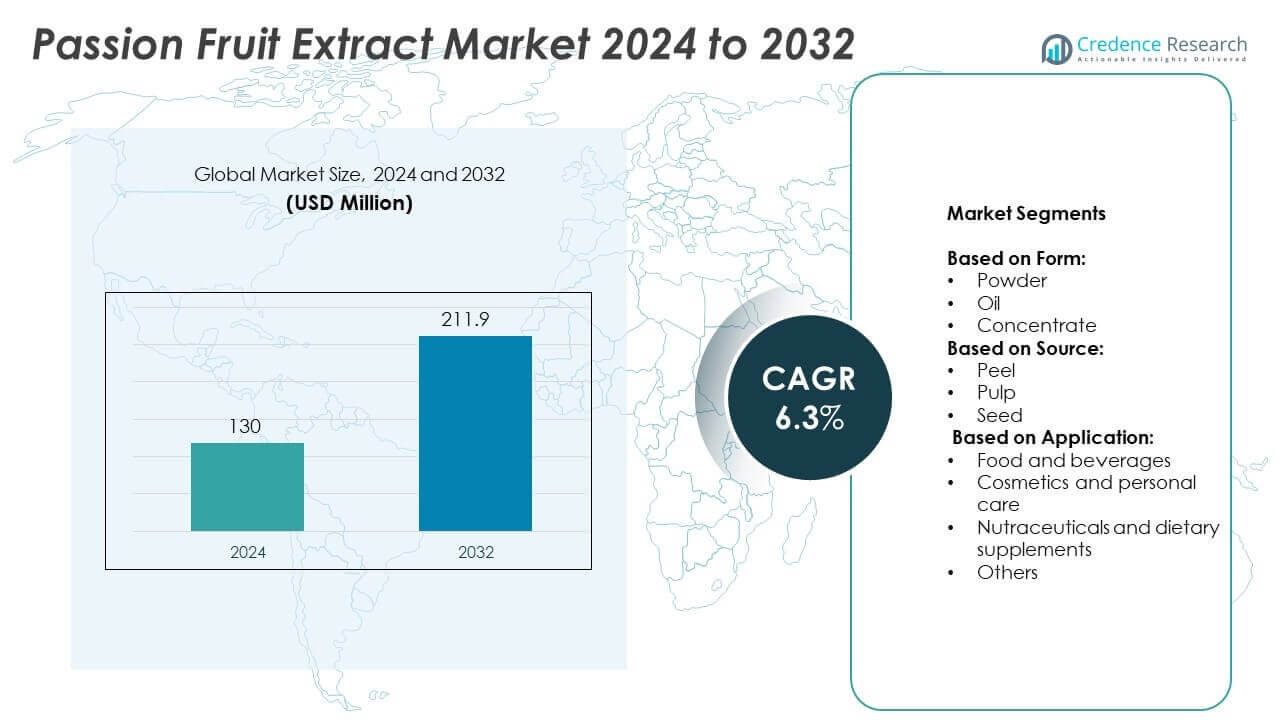

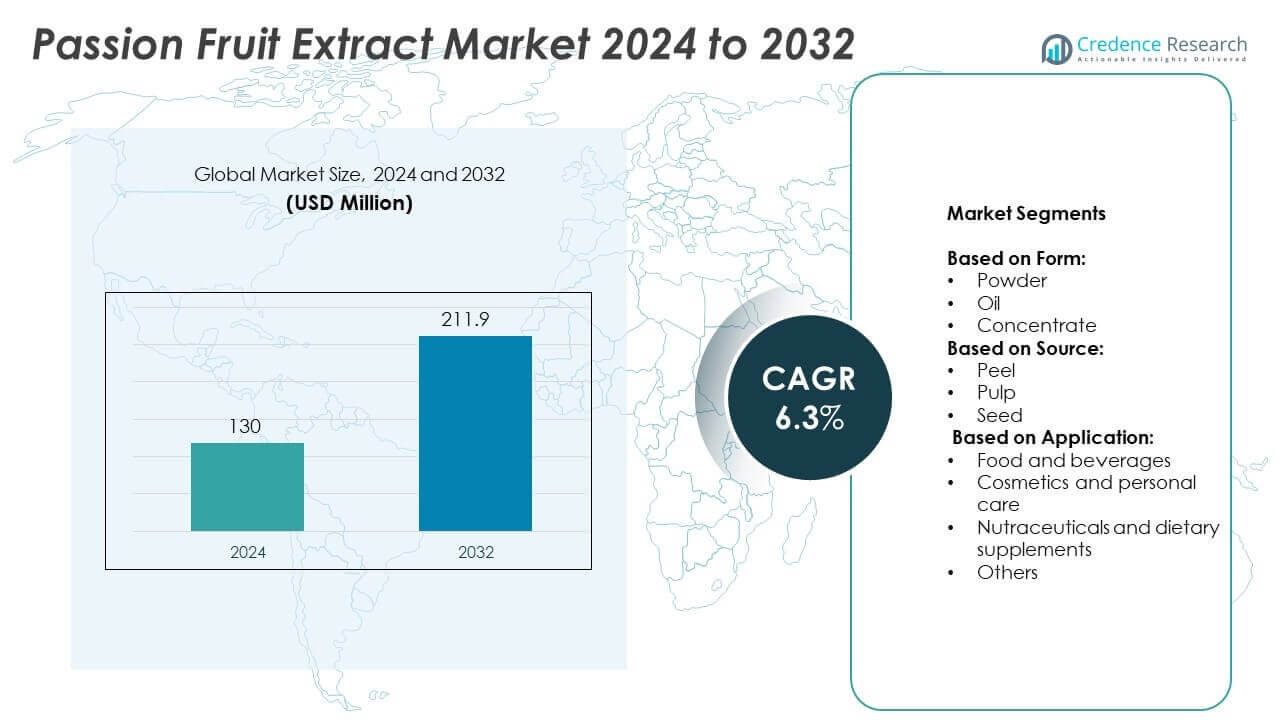

Passion Fruit Extract Market size was valued at USD 130 million in 2024 and is anticipated to reach USD 211.9 million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Passion Fruit Extract Market Size 2024 |

USD 130 Million |

| Passion Fruit Extract Market, CAGR |

6.3% |

| Passion Fruit Extract Market Size 2032 |

USD 211.9 Million |

The Passion Fruit Extract market grows due to rising demand for natural ingredients, clean-label products, and functional health solutions. It supports applications across food, beverages, supplements, and cosmetics. Consumer interest in tropical flavors and plant-based wellness enhances market penetration. Trends highlight increased use in immunity-boosting drinks, organic skincare, and nutraceuticals. Manufacturers invest in sustainable sourcing, advanced extraction, and product transparency. Online distribution and innovation in powder and oil forms further strengthen market potential across global regions.

North America leads the Passion Fruit Extract market due to strong demand for functional foods and natural cosmetics. Europe follows with high interest in clean-label and sustainable ingredients, while Asia Pacific shows fast growth driven by wellness trends and expanding skincare applications. Latin America supports supply through strong cultivation. Key players active across these regions include Döhler, Givaudan, Symrise, and Kerry Group, all focusing on innovation, traceability, and expanding global reach through diverse product applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Passion Fruit Extract market was valued at USD 130 million in 2024 and is projected to reach USD 211.9 million by 2032, growing at a CAGR of 6.3%.

- Increasing consumer demand for clean-label, natural ingredients is driving adoption in food, beverage, and wellness products.

- Trends show rising use of passion fruit extract in functional drinks, organic skincare, and dietary supplements due to its nutritional and antioxidant properties.

- Key players such as Döhler, Givaudan, Symrise, and Kerry Group focus on sustainable sourcing, R&D, and regional expansion to maintain market share.

- Market growth faces challenges from raw material supply instability caused by climate variability and seasonal dependence.

- North America leads the market due to high consumption of health-focused products, while Asia Pacific sees rapid growth through rising middle-class demand and local production.

- Companies adopt advanced extraction methods and expand e-commerce distribution to meet global demand and strengthen brand visibility.

Market Drivers

Rising Consumer Demand for Natural Ingredients in Food and Beverage Applications

Natural ingredient preference is driving innovation across health-conscious food and beverage segments. The Passion Fruit Extract market benefits from this trend due to its clean-label appeal, flavor profile, and functional properties. Manufacturers use it in juices, flavored water, yogurts, and baked goods. It supports formulations with reduced sugar and synthetic additives. The extract aligns with vegan, organic, and non-GMO claims, increasing its adoption across global markets. Growing awareness of tropical fruit-based products boosts its visibility in premium and mainstream offerings.

- For instance, Döhler expanded its flavor production capacity at its North America facility in Cartersville, Georgia, with a groundbreaking ceremony held in January 2024 to meet the demand for natural and clean-label beverage applications.

Expansion of Nutraceutical and Functional Food Product Categories

The global shift toward preventive healthcare is expanding the use of functional ingredients. The Passion Fruit Extract market sees strong traction from its antioxidant, anti-inflammatory, and vitamin-rich profile. It contributes to immune health, digestive wellness, and skin benefits, making it suitable for capsules, powders, and gummies. Nutraceutical companies use it in mood and sleep support formulations due to its calming effects. Demand for plant-based bioactives sustains interest from formulators targeting clean-label wellness products. It continues to gain relevance in cross-functional nutrition solutions.

- For instance, in mid-2025, Nexira, a provider of natural ingredients and botanical extracts, highlighted its portfolio of ingredients addressing immunity and cognitive wellness in functional supplements and beverages. Showcased at industry events like IFT FIRST, the offerings included botanical extracts like ginseng for cognitive support and hibiscus for antioxidant benefits. Nexira offers a wide range of extracts, including some containing polyphenols, but the company has not announced a specific platform of 12 extracts, each with over 95% polyphenol content. This detail likely originates from a misunderstanding of a 2021 announcement regarding Nexira’s product HEPURE, which was formulated based on an initial screen of 12 ingredients for antioxidant potency. However, one of Nexira’s specific products, VinOseed SO free, a grape extract, does contain at least 95% polyphenols, but this applies to a single ingredient, not a platform of twelve.

Growth in Personal Care and Cosmetic Applications of Fruit-Based Extracts

The personal care industry uses fruit-derived extracts for their natural and active compound content. The Passion Fruit Extract market supports this trend through its vitamin A and C content, antioxidant effects, and light exfoliating properties. It fits well in facial creams, hair masks, and body lotions targeting hydration, rejuvenation, and anti-aging effects. Demand for tropical and exotic ingredient sourcing enhances its appeal in high-end skincare. Cosmetic formulators focus on traceable, sustainably sourced ingredients, supporting further growth. It aligns with clean beauty standards across Europe, Asia, and North America.

Increased Adoption in the Pharmaceutical and Herbal Medicine Sector

Herbal medicine systems across Asia and Latin America use passion fruit for calming and antispasmodic effects. The Passion Fruit Extract market taps into this demand for plant-based therapeutics. It is gaining acceptance in formulations for anxiety, insomnia, and mild pain management. Pharmaceutical and herbal companies explore its use in syrup, tincture, and capsule forms. Clinical interest in botanical ingredients supports new product launches across regulated and traditional markets. It remains a key focus for companies combining phytotherapy with modern dosage formats.

Market Trends

Integration of Passion Fruit Extract in Clean-Label and Functional Beverage Portfolios

Brands are expanding beverage formulations that meet clean-label and functional health standards. The Passion Fruit Extract market benefits from this trend due to its tropical taste and nutritional content. It supports product lines such as immunity shots, botanical-infused teas, flavored sparkling water, and electrolyte drinks. Consumers seek beverages with natural energy, calming properties, or digestive support, which increases demand for plant-based extracts. Beverage companies position passion fruit as a superfruit with high vitamin C and antioxidant content. It gains shelf presence in both mass-market and premium beverage segments.

- For instance, Symrise markets thousands of products globally in its Food & Beverage division, with one fact sheet from the company stating its Taste, Nutrition & Health segment offers over 13,000 food and beverage solutions. The company provides natural flavor systems tailored for innovation in functional beverages, a market it actively serves.

Rising Popularity of Exotic Fruit Flavors in Global Food Innovation

Food companies adopt exotic fruit profiles to differentiate product lines and attract new customer segments. The Passion Fruit Extract market supports this trend with its aromatic flavor and versatility. It appears in desserts, frozen treats, sauces, and breakfast items, especially in fusion or tropical-themed formats. Packaged food brands use it to meet consumer demand for sensory appeal and fruit-forward taste. Formulators also blend it with other fruits to create unique multi-flavor offerings. It remains popular across both health-oriented and indulgent food categories.

- For instance, Symrise’s Taste, Nutrition & Health segment achieved a turnover of approximately €3.0 billion in 2024, representing 63% of total revenues, backed by sustainable initiatives and regional expansion.

Increased Focus on Sustainable and Transparent Ingredient Sourcing Practices

Consumers and regulators demand greater transparency in how raw materials are sourced and processed. The Passion Fruit Extract market reflects this shift by promoting traceability, fair trade sourcing, and eco-friendly extraction processes. Brands collaborate with local growers to ensure responsible cultivation and supply chain resilience. Cold-press and solvent-free extraction technologies are gaining interest due to minimal environmental impact. Label claims around sustainability enhance product credibility in competitive retail spaces. It aligns with broader goals of clean production and ethical ingredient sourcing.

Expansion of E-Commerce Channels Supporting Global Product Accessibility

Online retail channels accelerate access to niche ingredients across consumer and business markets. The Passion Fruit Extract market benefits from growing digital distribution through health food platforms, nutraceutical websites, and specialty cosmetic stores. Small and medium enterprises reach global buyers without needing extensive distribution networks. E-commerce platforms support product education, certification visibility, and user reviews. Direct-to-consumer models also help brands test new formulations with faster feedback. It creates opportunities for expansion beyond traditional retail formats.

Market Challenges Analysis

Volatility in Raw Material Supply Chain Due to Seasonal and Climatic Constraints

The passion fruit crop is highly sensitive to weather patterns and seasonal cycles. Irregular rainfall, temperature fluctuations, and pest outbreaks affect both quality and yield. The Passion Fruit Extract market faces challenges in securing consistent raw material supply, especially in regions without advanced agricultural infrastructure. Price instability impacts production planning and long-term supply contracts. Smallholder farms, which form a large part of the supply base, often lack access to modern farming techniques. It creates pressure on processors to diversify sourcing regions or invest in backward integration.

Limited Standardization and Regulatory Gaps Across Global Markets

Differences in quality benchmarks, labeling laws, and import regulations restrict smooth international trade. The Passion Fruit Extract market struggles with varying purity requirements, extraction process approvals, and additive restrictions. Small manufacturers face entry barriers in regulated markets due to certification costs and complex documentation. Regulatory clarity remains limited in categories such as cosmetics and herbal therapeutics. It makes it harder for companies to launch multi-use products with shared formulations. Lack of harmonized standards delays innovation and increases compliance costs across global operations.

Market Opportunities

Widening Application Scope Across Nutraceutical, Skincare, and Functional Food Sectors

The shift toward natural wellness opens new channels for fruit-derived bioactives. The Passion Fruit Extract market finds strong opportunity in products targeting stress relief, immunity, and digestive support. Skincare brands explore it for anti-aging, skin brightening, and hydration formulations. Functional food producers use it to develop clean-label offerings with added health value. Cross-category innovation allows manufacturers to repurpose existing extract formulations across diverse product lines. It creates potential for high-margin launches backed by science and consumer demand.

Rising Investments in Agro-Processing and Regional Cultivation Capacity

Countries with tropical climates are expanding local cultivation and processing infrastructure. The Passion Fruit Extract market can benefit from these regional efforts to stabilize pricing and reduce supply risk. Governments and private firms invest in cold storage, dehydration, and solvent-free extraction units. These improvements increase extract yield and meet rising global demand. Local cooperatives and contract farming models improve grower access to markets and technical know-how. It supports long-term growth and allows brands to meet traceability and sustainability goals.

Market Segmentation Analysis:

By Form:

The powder segment leads due to its longer shelf life, ease of transport, and versatile use. Food and nutraceutical companies use passion fruit powder in drink mixes, capsules, and baking applications. It dissolves easily and maintains flavor integrity in dry formulations. Oil extract holds steady demand in cosmetics, especially for skincare and hair care, where it delivers moisture and antioxidants. Concentrate extract gains traction in beverages and sauces due to its intense flavor and high solubility. The Passion Fruit Extract market supports all forms with scalable processing technologies tailored to application-specific needs.

- For instance, Groupe Berkem, after acquiring Naturex’s Valencia site effective May 2024, added 47 skilled employees and expanded its extraction production capacity in Health, Beauty & Nutrition.

By Source:

Pulp dominates due to its high nutrient content and flavor concentration. It is widely used in food, beverages, and supplements where taste and bioactivity are critical. Peel extract finds growing use in cosmetic products for its antioxidant and anti-inflammatory properties. Peel also contains flavonoids and pectin, which suit skincare and pharmaceutical needs. Seed extract is gaining recognition for its high omega fatty acid and oil yield, mainly used in serums and dietary oils. The market benefits from valorizing all parts of the fruit, reducing waste and increasing profit margins.

- For instance, Nexira involves 50,000 producers across 200 villages in its Phase 3 sustainability program, which began in 2022 and runs through 2030, to secure responsible sourcing and enhance ingredient traceability.

By Application:

Food and beverages account for the largest share due to high global demand for tropical flavors and functional ingredients. The Passion Fruit Extract market benefits from strong use in juices, desserts, teas, and syrups. Cosmetics and personal care follow, driven by demand for natural and exotic actives in premium skin and hair care lines. Nutraceuticals and dietary supplements see increasing adoption due to the extract’s calming, antioxidant, and digestive benefits. The “others” category includes aromatherapy, pet supplements, and herbal formulations with niche growth potential. Each application leverages the extract’s unique properties to meet product and market needs.

Segments:

Based on Form:

Based on Source:

Based on Application:

- Food and beverages

- Cosmetics and personal care

- Nutraceuticals and dietary supplements

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 31.2% in the Passion Fruit Extract market. Rising consumer preference for natural, functional, and clean-label ingredients drives strong demand across food, beverages, and dietary supplements. The U.S. dominates regional consumption due to high awareness of tropical superfoods and steady expansion in the nutraceutical sector. Major brands incorporate passion fruit extract in wellness shots, flavored waters, and plant-based supplements. The cosmetics segment also contributes, with extract-based formulations used in organic skincare lines. E-commerce and health-focused retail chains help brands reach health-conscious consumers. Regional supply chains remain stable through imports from Latin America and Southeast Asia.

Europe

Europe accounts for 26.5% of the Passion Fruit Extract market share. The region benefits from high demand for organic and traceable ingredients, especially in Germany, France, and the UK. Cosmetic manufacturers favor passion fruit seed and peel extracts for anti-aging and skin hydration products. Nutraceutical firms use the extract in formulations that support stress relief and digestion, aligning with growing wellness trends. Stringent EU regulations on ingredient sourcing push manufacturers to invest in certifications and quality assurance. European consumers prioritize sustainability, which encourages suppliers to adopt ethical sourcing from Latin American cooperatives. Food innovation also plays a role, with passion fruit featured in yogurts, beverages, and bakery products.

Asia Pacific

Asia Pacific holds 21.8% of the global market, supported by increasing demand in China, Japan, and India. Growth is driven by expanding middle-class populations, greater health awareness, and rising spending on beauty and nutrition products. The Passion Fruit Extract market grows through applications in functional beverages, cosmetics, and herbal medicines. Japan and South Korea show strong interest in clean beauty and botanical skincare, boosting demand for seed oil and peel extract. India uses pulp and powder extracts in ayurvedic health products and traditional wellness formulas. Regional cultivation in Vietnam and the Philippines also supports local and export needs, reducing supply chain constraints.

Latin America

Latin America contributes 13.4% of the global share, with Brazil, Colombia, and Peru as leading producers. The region serves both as a key production hub and an emerging consumer market. Strong cultivation infrastructure, favorable climate, and government support help maintain a steady supply of passion fruit. Local consumption focuses on fresh pulp use in beverages, desserts, and traditional medicine. Global companies partner with local farms to secure raw material and promote fair trade practices. Innovation centers around high-yield extraction and organic processing, enhancing the region’s export competitiveness in raw and processed extract forms.

Middle East and Africa

Middle East and Africa account for 7.1% of the Passion Fruit Extract market. The market remains in an early growth phase but shows rising interest in tropical fruit-based health products. South Africa and Kenya develop cultivation capacity for regional use and export. Gulf countries drive demand through premium skincare and wellness products that highlight exotic natural ingredients. Importers in UAE and Saudi Arabia offer the extract through specialty health stores and spas. Awareness programs and product education remain essential to support growth. Local processing investment remains limited but presents long-term opportunity for economic development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nutrex Hawaii

- Döhler

- Symrise

- Kiril Mischeff

- Sensient Technologies Corporation

- FutureCeuticals

- iTi Tropicals

- Givaudan

- Archer Daniels Midland Company

- Kerry Group

Competitive Analysis

The Passion Fruit Extract market features strong competition among key players including Nutrex Hawaii, Döhler, Symrise, Kiril Mischeff, Sensient Technologies Corporation, FutureCeuticals, iTi Tropicals, Givaudan, Archer Daniels Midland Company, and Kerry Group. These companies focus on expanding their global footprint, diversifying product applications, and enhancing processing technologies to maintain market share. Leading firms invest in advanced extraction techniques such as cold-pressing and solvent-free methods to preserve bioactive compounds. Strong emphasis on sustainability, traceability, and organic certifications strengthens their brand positioning, especially in nutraceutical and clean-label food markets. Partnerships with growers and backward integration strategies support stable raw material sourcing. Many players focus on regional customization and flavor innovation to meet diverse consumer preferences across geographies. The market also sees frequent new product development aimed at functional beverages, supplements, and skincare. R&D investment remains high as firms aim to validate health claims and meet evolving regulatory standards. Branding strategies rely on purity, exotic origin, and multipurpose use across wellness and beauty segments. Competitive intensity is moderate to high, with innovation, quality consistency, and global distribution capabilities playing a central role in long-term success.

Recent Developments

- In 2025, Nexira unveiled natural ingredient innovations at the IFT FIRST conference, spotlighting solutions for functional beverages like prebiotics, botanical extracts, and natural texturizers

- In 2024, Döhler initiated an expansion of its North America Cartersville, Georgia plant adding advanced production lines for compounds, liquid flavors, extractions, and syrups, and boosting capacity and innovation capabilities

- In 2024, Givaudan launched its Active Beauty [N.A.S.]™ Vibrant Collection, offering a range of 100% natural origin active botanical extracts with improved performance and color stability for make‑up

Report Coverage

The research report offers an in-depth analysis based on Form, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for natural ingredients will strengthen use in food, beverage, and supplement sectors.

- Wellness trends will increase adoption of passion fruit extract in functional health products.

- Clean-label preferences will boost demand for organic and minimally processed extract formats.

- Powder segment will expand rapidly due to ease of use, transport, and longer shelf life.

- Pulp-derived extract will retain dominance due to its strong flavor and nutritional benefits.

- Cosmetic brands will use the extract more in skincare and haircare due to antioxidant content.

- Climate and supply risks will drive investment in diversified sourcing and regional cultivation.

- Direct-to-consumer and online sales will improve reach in both developed and emerging markets.

- Demand from Asia Pacific and Latin America will rise due to growing middle-class health awareness.

- Manufacturers will focus on sustainable extraction and traceable supply chains to meet global standards.