Market overview

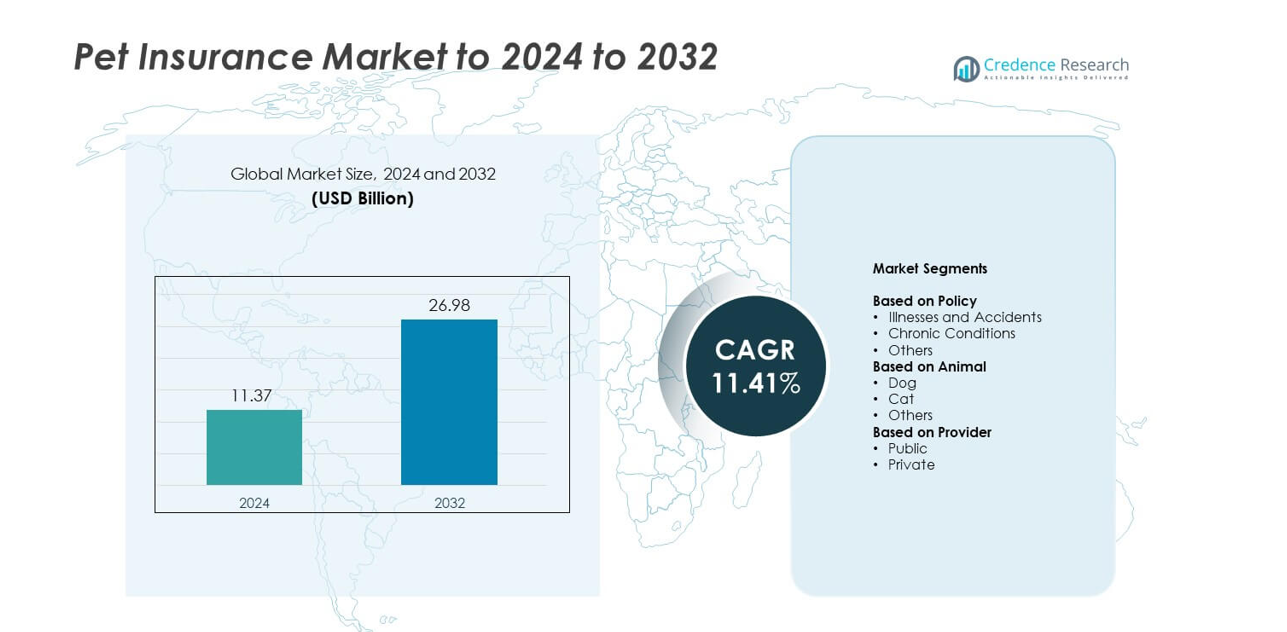

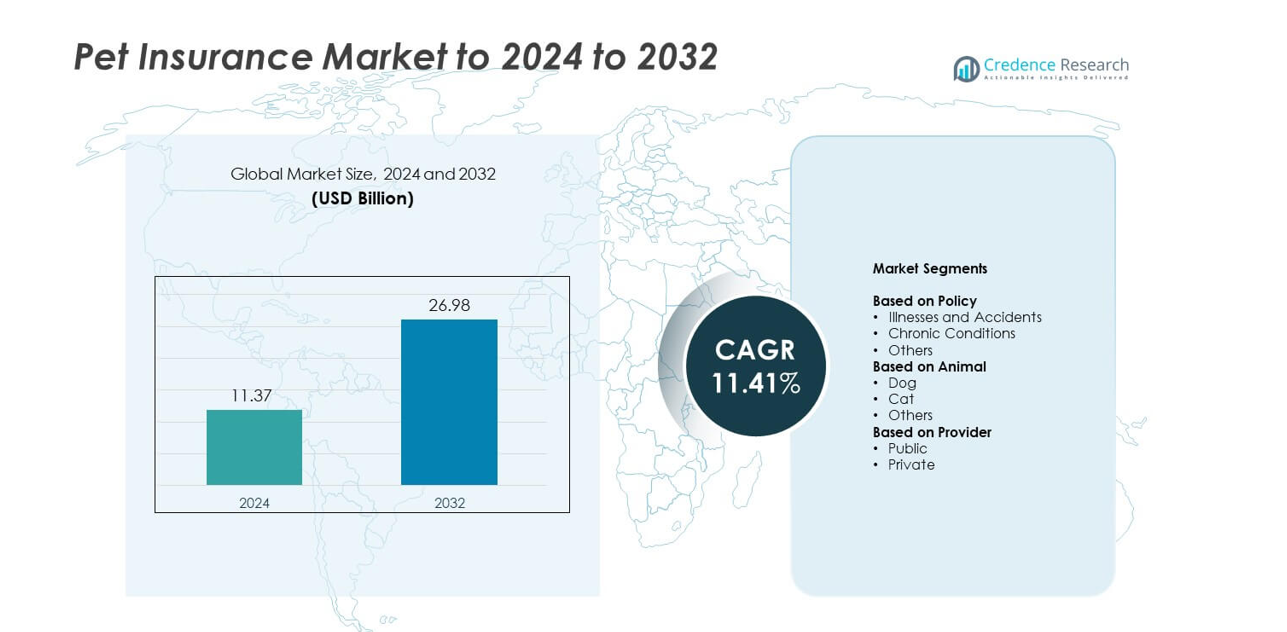

Pet insurance market size was valued at USD 11.37 billion in 2024 and is anticipated to reach USD 26.98 billion by 2032, at a CAGR of 11.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pet Insurance Market Size 2024 |

USD 11.37 billion |

| Pet Insurance Market, CAGR |

11.41% |

| Pet Insurance Market Size 2032 |

USD 26.98 billion |

Top players in the pet insurance market include Lemonade, PTZ Insurance Agency, Anicom Holdings Inc., Embrace Pet Insurance Agency LLC, Healthy Paws, Figo Pet Insurance LLC, Direct Line Insurance Group plc, dotsure.co.za, and Agria Pet Insurance Ltd. These companies strengthened their presence through digital claim platforms, flexible coverage options, and strong veterinary partnerships. North America remained the leading region in 2024 with about 52% share, driven by high veterinary costs and strong adoption of comprehensive policies. Europe followed with nearly 31% share due to mature insurance systems and high awareness, while Asia Pacific demonstrated rising potential with growing pet ownership.

Market Insights

- The pet insurance market reached USD 11.37 billion in 2024 and is projected to hit USD 26.98 billion by 2032, growing at a CAGR of 11.41%.

- Growth is driven by rising veterinary costs, higher pet humanization, and strong demand for comprehensive illnesses and accidents policies, which held about 71% share in 2024.

- Digital claim systems, tele-vet integration, and wellness-based products shaped major trends, while flexible coverage for dogs—representing nearly 78% share—supported sustained expansion.

- Competition intensified as major insurers improved automation, pricing models, and partnerships with veterinary clinics, although high claim ratios and limited awareness in developing regions remained restraints.

- North America led the market with about 52% share in 2024, followed by Europe at nearly 31%, Asia Pacific at 11%, Latin America at 4%, and Middle East & Africa at 2%, reflecting strong uptake in mature regions and rising opportunities in emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Policy

Illnesses and accidents led the pet insurance market in 2024 with about 71% share. This category dominated because it covers high-cost treatments such as surgeries, trauma care, and major illnesses that pet owners often cannot manage out-of-pocket. Strong growth came from rising veterinary expenses and higher adoption of comprehensive plans. Chronic conditions and other policy types expanded as insurers added flexible coverage options, yet illnesses and accidents stayed ahead due to broad protection and strong appeal among first-time policy buyers.

- For instance, Trupanion processed its one-millionth veterinary invoice in late November 2019.

By Animal

Dog insurance held the largest share in 2024 with nearly 78% of the market. Dog owners generated strong demand because dogs require more frequent medical care, vaccinations, and emergency treatment compared to other pets. Increasing ownership of large and premium dog breeds further pushed claim volumes and policy uptake. Cat and other animal segments grew at a steady pace, yet dog insurance remained dominant due to higher spending patterns and wider product availability across major insurers.

- For instance, in the spring of 2024, Nationwide, the largest pet insurer in the U.S., announced it was dropping coverage for approximately 100,000 pets due to rising veterinary care costs.

By Provider

Private providers dominated the market in 2024 with about 82% share. Their lead grew due to strong product innovation, fast claim processing, and widespread digital enrollment. Private companies introduced multi-layered plans, wellness add-ons, and direct-vet payment models that appealed to cost-conscious owners. Public providers served niche groups with basic coverage options, but private firms stayed ahead because they offered broader networks, flexible premiums, and advanced customer service platforms.

Key Growth Drivers

Rising veterinary care costs

Veterinary treatment costs increased sharply, driving more pet owners to seek financial protection. Higher spending on diagnostics, advanced surgeries, and specialist care pushed families toward structured coverage plans. Growing awareness of unexpected medical expenses strengthened policy adoption across urban households. This trend supported steady expansion as owners relied on insurance to manage long-term healthcare spending.

- For instance, the cost of veterinary services for urban consumers in the U.S. rose 7.1 % in April 2024 compared with the same month a year earlier.

Increasing pet ownership and humanization

Pet adoption grew, and families treated animals more like dependents, boosting spending on health and wellness. Owners focused on preventive care and long-term well-being, which increased the appeal of insurance plans. Urban lifestyles, smaller households, and higher disposable income accelerated this shift. As pets gained emotional and social importance, owners became more willing to invest in their medical protection.

- For instance, Anicom Holdings (Japan) reported subscriber numbers exceeding 294,000 as of December 2007.

Expansion of customized insurance plans

Flexible coverage options encouraged more buyers to enter the market. Providers introduced wellness add-ons, breed-specific plans, accident-only packages, and chronic condition coverage to match diverse needs. Digital enrollment, faster claims, and transparent pricing improved customer trust. Tailored plans supported first-time buyers and increased retention across existing policyholders.

Key Trends & Opportunities

Growth of digital platforms and tele-veterinary tools

Online enrollment, app-based claim uploads, and digital policy management expanded rapidly. Insurers partnered with tele-vet platforms to offer video consultations and remote health guidance. This integration reduced service delays and improved customer engagement. The shift created new opportunities for low-cost plans and instant claim settlements.

- For instance, Embrace Pet Insurance’s AI platform Apollo had processed almost 250,000 claims between its launch in June 2022 and March 2023, automating document handling, data extraction, and routine claim adjudication.

Rising demand for wellness and preventive care coverage

Pet owners sought broader wellness benefits including vaccinations, dental care, and routine checkups. Insurers used this trend to upsell preventive-focused packages. The move improved long-term policy retention and allowed companies to diversify revenue. As wellness culture strengthened, demand for proactive care plans continued to rise.

- For instance, Embrace stated it covered 92 % of submitted claims in 2023.

Opportunities in emerging markets

Developing regions with growing middle-income populations showed strong potential. Awareness campaigns, affordable premiums, and simplified products attracted first-time buyers. Expanding veterinary networks and rising pet adoption further supported growth. Insurers gained room to scale through partnerships with clinics and animal welfare groups.

Key Challenges

Low awareness and limited penetration

Many households still lacked knowledge about pet insurance coverage and eligibility. Misunderstanding of policy benefits and concerns about premium costs reduced adoption. Limited marketing outreach in semi-urban and rural areas slowed expansion. This awareness gap remained a major obstacle for insurers seeking mass-market growth.

High claim ratios and pricing pressure

Frequent claims, costly treatments, and rising pet medical inflation created financial pressure for insurers. Managing payouts while maintaining affordable premiums became difficult. Companies faced challenges balancing coverage depth with profitability. These factors increased risk and reduced flexibility for long-term pricing strategies.

Regional Analysis

North America

North America held the largest share in the pet insurance market in 2024 with about 52%. The region benefited from high veterinary costs, strong pet humanization, and wide availability of comprehensive insurance plans. Large insurers expanded digital claim systems and wellness-based coverage, which improved customer adoption. The United States led demand due to rising spending on advanced treatments and higher awareness among dog and cat owners. Canada also grew steadily as more clinics partnered with private providers to promote coverage. Strong policy flexibility and higher disposable income supported continued dominance.

Europe

Europe accounted for nearly 31% of the market in 2024, supported by mature insurance systems and strong regulation around pet welfare. The United Kingdom, Sweden, and Germany remained key contributors, driven by high enrollment rates and long-standing acceptance of preventive care plans. Veterinary networks partnered with insurers to offer combined packages that attracted a broad customer base. Growth strengthened as households increased spending on chronic condition management and routine checkups. Rising adoption of digital policy platforms further expanded penetration across Western and Northern Europe.

Asia Pacific

Asia Pacific held around 11% of the market in 2024 and showed strong future potential. Rapid urbanization, growing pet adoption, and rising middle-income households supported demand. Markets such as Japan, Australia, and South Korea saw notable expansion due to higher awareness and structured coverage options. Emerging economies recorded growth as insurers launched simplified policies with lower premiums. Increasing veterinary clinic modernization and digital claim tools helped strengthen regional interest. The region remained underpenetrated but continued its upward trajectory with expanding education efforts.

Latin America

Latin America captured about 4% of the market in 2024, driven by increasing pet ownership and rising veterinary expenses in major countries such as Brazil, Mexico, and Argentina. Awareness levels improved as insurers partnered with clinics and retail channels to promote basic accident and illness plans. Economic constraints slowed growth in some areas, yet affordable premium models helped widen adoption. Digital enrollment and community-based education supported steady expansion. The region remained in an early stage but showed meaningful traction among younger urban pet owners.

Middle East & Africa

Middle East & Africa held nearly 2% of the market in 2024, reflecting early adoption and limited coverage availability in several countries. Growth improved as veterinary infrastructure strengthened in the UAE, South Africa, and Saudi Arabia. Higher-income households showed rising interest in protection plans, especially for dogs and premium breeds. Limited awareness and fewer provider options restricted broader uptake, yet new digital platforms supported gradual market expansion. As pet ownership grows and veterinary care modernizes, the region continues to show long-term development potential.

Market Segmentations:

By Policy

- Illnesses and Accidents

- Chronic Conditions

- Others

By Animal

By Provider

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the pet insurance market features key players such as Lemonade, PTZ Insurance Agency, Anicom Holdings Inc., Embrace Pet Insurance Agency LLC, Healthy Paws, Figo Pet Insurance LLC, Direct Line Insurance Group plc, dotsure.co.za, and Agria Pet Insurance Ltd. Competition intensified as companies expanded digital enrollment, enhanced claim automation, and strengthened direct partnerships with veterinary networks. Providers focused on flexible pricing models, broader wellness packages, and faster reimbursement systems to improve customer retention. New insurers entered with app-based platforms, which increased pressure on established brands to innovate. Companies also invested in data analytics to refine risk assessment and improve premium accuracy. Growing demand for comprehensive illness and accident coverage further encouraged firms to introduce multi-tier plans for different pet breeds and ages. As consumer expectations shifted toward transparency and convenience, insurers responded with simplified policy structures and stronger service integration across digital channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lemonade

- PTZ Insurance Agency

- Anicom Holdings Inc.

- Embrace Pet Insurance Agency LLC

- Healthy Paws

- Figo Pet Insurance LLC

- Direct Line Insurance Group plc

- co.za

- Agria Pet Insurance Ltd.

Recent Developments

- In 2025, Healthy Paws, a Chubb Company, announced a partnership with PetSmart to make pet insurance more accessible to pet owners.

- In 2025, Lemonade’s pet insurance is available in approximately 41 states and Washington, D.C..

- In June 2022, Embrace Pet Insurance: Launched a proprietary AI solution for claims processing to modernize and speed up the claims experience.

Report Coverage

The research report offers an in-depth analysis based on Policy, Animal, Provider and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as more owners seek protection from rising veterinary costs.

- Digital claim platforms will expand and make policy management faster and easier.

- Wellness and preventive care plans will gain stronger adoption across urban households.

- Personalized policies for breed-specific and age-specific needs will increase demand.

- Tele-vet integrations will enhance policy value and support routine health guidance.

- Private insurers will widen market reach through broader clinic partnerships.

- Awareness campaigns will boost penetration in underdeveloped regions.

- Premium stability will improve as insurers refine pricing models and risk control.

- Emerging markets will show faster growth due to rising pet adoption and income levels.

- Customer retention will strengthen as insurers add flexible add-ons and loyalty benefits.