Market Overview:

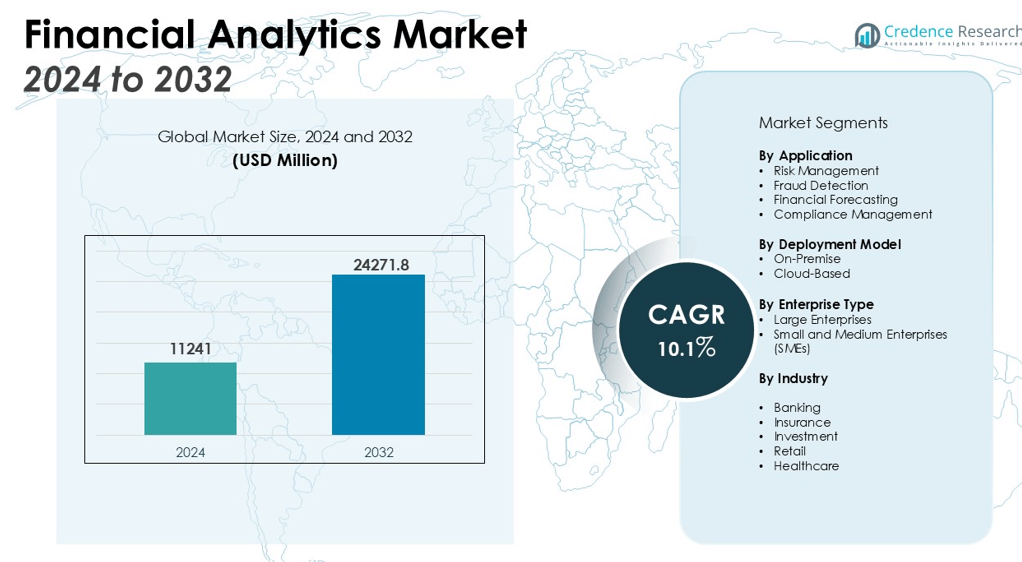

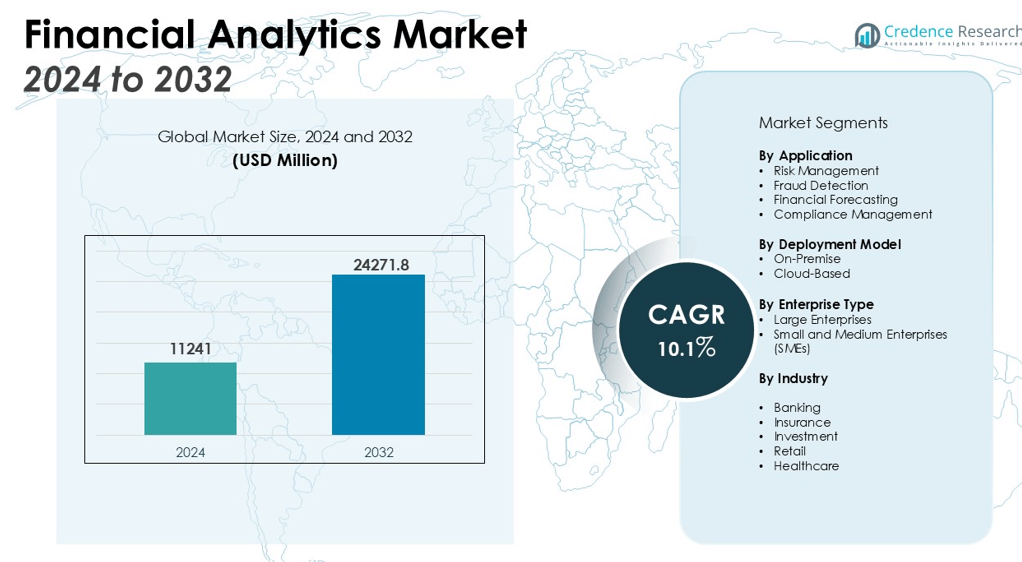

The Financial Analytics Market size was valued at USD 11241 million in 2024 and is anticipated to reach USD 24271.8 million by 2032, at a CAGR of 10.1% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Financial Analytics Market Size 2024 |

USD 11241 million |

| Financial Analytics Market, CAGR |

10.1% |

| Financial Analytics Market Size 2032 |

USD 24271.8 million |

Key drivers of the Financial Analytics Market include the rising adoption of advanced data analytics tools by financial institutions to improve operational efficiency, enhance risk management, and deliver personalized customer services. Additionally, the shift towards automated financial processes, coupled with the growing importance of data security and compliance, has spurred the market. Organizations are increasingly relying on financial analytics to identify growth opportunities, mitigate financial risks, and optimize investment strategies. The integration of artificial intelligence (AI) and machine learning (ML) is also playing a crucial role in accelerating these advancements, enabling more accurate predictions and insights.

Regionally, North America holds a dominant share in the financial analytics market, driven by the presence of leading financial institutions and a strong emphasis on technological innovation. Europe follows closely, with a robust demand for regulatory compliance and financial reporting solutions. The Asia Pacific region is expected to witness the highest growth rate, owing to the increasing digitalization of financial services and the rise of emerging economies like China and India. As the region strengthens its financial infrastructure, it is becoming a key player in shaping the future of financial analytics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Financial Analytics Market was valued at USD 11,241 million in 2024 and is expected to reach USD 24,271.8 million by 2032, growing at a CAGR of 10.1% during the forecast period.

- The rising adoption of advanced data analytics tools by financial institutions enhances operational efficiency, mitigates risks, and optimizes investment strategies.

- Increasing focus on risk management and regulatory compliance drives demand for financial analytics, helping institutions comply with regulations and manage financial risks.

- Automation in financial processes is transforming the market by streamlining operations, reducing errors, and improving decision-making efficiency.

- Growing concerns about data security and privacy are pushing financial institutions to invest in secure financial analytics tools to protect sensitive information.

- North America leads the Financial Analytics Market with a 40% share, driven by strong financial infrastructure, regulatory compliance, and high adoption of advanced technologies.

- Europe holds a 30% market share, driven by regulatory frameworks like MiFID II and PSD2, which spur the adoption of financial analytics for compliance and risk management.

Market Drivers:

Increasing Adoption of Advanced Data Analytics Tools by Financial Institutions

The Financial Analytics Market is experiencing significant growth due to the increasing adoption of advanced data analytics tools by financial institutions. These tools enable organizations to enhance operational efficiency by automating various processes, such as transaction monitoring and fraud detection. Financial institutions leverage these tools to gain deeper insights into customer behavior, market trends, and financial risks. By utilizing predictive analytics, these organizations can make more informed decisions, improve financial forecasting, and optimize their investment strategies. The demand for such tools is also driven by the need for real-time data analysis, which helps companies respond quickly to market fluctuations.

Growing Importance of Risk Management and Regulatory Compliance

Another key driver of the Financial Analytics Market is the rising importance of risk management and regulatory compliance. Financial institutions are increasingly relying on financial analytics to monitor and mitigate risks associated with market volatility, credit default, and liquidity. Compliance with stringent regulations is a priority for these institutions, particularly in the wake of financial crises. Financial analytics provide real-time reporting and monitoring capabilities, which help organizations comply with regulatory standards, such as the Dodd-Frank Act and Basel III. These solutions enable firms to identify potential regulatory breaches and address them proactively, avoiding fines and reputational damage.

- For instance, Standard Chartered achieved a 4x increase in its end-to-end risk model management speed through AI-driven automation, accelerating deployment and version control in its risk compliance systems in 2023.

Shift Toward Automated Financial Processes

The shift toward automated financial processes is transforming the Financial Analytics Market. Automation helps financial organizations reduce manual workloads, streamline operations, and enhance productivity. By automating processes such as financial reporting, data collection, and budgeting, organizations can minimize human error and accelerate decision-making. Automation also allows for better scalability, enabling financial institutions to handle increased volumes of transactions and data without significant cost increases. As automation becomes more integrated with financial analytics, organizations can achieve more accurate and timely insights, improving their overall performance.

- For instance, UiPath enabled a global professional services and audit company to automate 45 percent of its audit process, resulting in savings of 54,000 work hours annually, and delivering up to 85% accuracy improvement in financial report audits

Increased Demand for Data Security and Privacy

Data security and privacy concerns are driving the growth of the Financial Analytics Market. With the increasing volume of sensitive financial data being generated and shared, ensuring the confidentiality and security of this data has become critical. Financial analytics solutions provide advanced security measures, such as encryption and access control, to protect sensitive information from breaches. Regulatory requirements, such as the General Data Protection Regulation (GDPR), have further emphasized the importance of maintaining secure financial data. Organizations are investing in secure financial analytics tools to protect their data and ensure compliance with data protection laws, thus supporting market growth.

Market Trends:

Integration of Artificial Intelligence and Machine Learning in Financial Analytics

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is one of the key trends in the Financial Analytics Market. These technologies enable financial institutions to process large volumes of data and generate actionable insights with greater accuracy and speed. AI-powered tools enhance predictive capabilities, helping organizations forecast market movements, optimize asset allocations, and detect fraudulent activities. Machine learning models are increasingly being used for automated decision-making, risk assessment, and portfolio management. By leveraging these advanced technologies, financial institutions can achieve more personalized financial services and gain a competitive edge in the market.

- For instance, Feedzai’s AI-powered platform screened over 3.5billion financial transactions in real time for fraud detection at major banks in 2024.

Rise of Cloud-Based Financial Analytics Solutions

Cloud-based solutions are transforming the Financial Analytics Market by providing financial institutions with scalable and cost-effective alternatives to traditional on-premise systems. Cloud technology enables businesses to access real-time data and analytics from any location, ensuring enhanced flexibility and efficiency. Financial organizations are migrating to the cloud to improve collaboration, reduce infrastructure costs, and streamline their operations. Cloud-based financial analytics solutions allow institutions to easily scale their analytics capabilities without the need for significant capital investments in hardware. This trend is also driven by the increasing demand for faster, more accurate data processing and the ability to handle big data in real-time. As cloud adoption increases, it will continue to shape the future landscape of financial analytics.

- For instance, MineralTree’s real-time analytics and dashboards are being used by over 3,000 mid-market and mid-enterprise companies to reduce manual tasks in accounts payable automation, enhancing visibility and control for finance leaders in invoice and payment operations.

Market Challenges Analysis:

Data Privacy and Security Concerns in Financial Analytics

One of the significant challenges in the Financial Analytics Market is ensuring data privacy and security. Financial institutions handle large volumes of sensitive data, making them prime targets for cyberattacks. With the growing reliance on digital platforms for financial transactions, ensuring robust cybersecurity measures is critical. Financial analytics solutions must comply with stringent data protection regulations, such as GDPR and CCPA, to safeguard personal and financial information. Failure to address these concerns can lead to data breaches, legal penalties, and a loss of customer trust, hindering market growth.

Integration of Legacy Systems with Advanced Analytics Tools

The integration of legacy systems with modern financial analytics tools presents another challenge in the Financial Analytics Market. Many financial institutions still rely on outdated systems that may not be compatible with new, advanced analytics solutions. Upgrading these systems can be costly and time-consuming, creating a barrier to the adoption of newer technologies. Financial institutions must ensure seamless integration to fully leverage the benefits of financial analytics while maintaining system stability and performance. Overcoming these integration challenges is vital for maximizing the potential of financial analytics and ensuring efficient operations.

Market Opportunities:

Expansion of Financial Analytics in Emerging Markets

The growing adoption of financial analytics in emerging markets presents a significant opportunity for growth in the Financial Analytics Market. Countries in Asia Pacific, Latin America, and Africa are witnessing rapid digitalization, creating a demand for advanced analytics solutions. Financial institutions in these regions are increasingly recognizing the value of financial analytics for optimizing operations, improving risk management, and enhancing customer experiences. The rise of mobile banking and digital payments in these markets further fuels the demand for data-driven decision-making tools. As more businesses adopt financial analytics tools to stay competitive, the market is expected to see substantial growth in these regions.

Advancement of Predictive and Prescriptive Analytics Solutions

The increasing development of predictive and prescriptive analytics solutions provides a notable opportunity in the Financial Analytics Market. Financial institutions are focusing on tools that offer proactive insights, allowing them to predict future market trends and mitigate risks before they materialize. Predictive analytics can enhance investment strategies, while prescriptive analytics can provide actionable recommendations based on real-time data. These advanced capabilities allow organizations to make more informed decisions, optimize operations, and drive profitability. As the demand for smarter, data-driven strategies rises, financial analytics solutions equipped with predictive and prescriptive capabilities are becoming highly sought after.

Market Segmentation Analysis:

By Application

The market is driven by applications in risk management, fraud detection, financial forecasting, and compliance management. Financial institutions increasingly use analytics tools to assess and mitigate risks, enhance operational efficiency, and meet regulatory requirements. Risk management and fraud detection are particularly vital in banking, insurance, and investment sectors, where real-time data analysis helps prevent financial crimes and optimize strategies.

- For instance, a large German bank implemented a Grid-based risk management system that enabled risk calculation updates every 7 minutes, a substantial improvement over the previous twice-daily updates, supporting faster and more accurate portfolio risk decisions.

By Deployment Model

The Financial Analytics Market is categorized into on-premise and cloud-based deployment models. Cloud-based solutions are gaining popularity due to their scalability, cost-effectiveness, and the ability to access real-time data from anywhere. On-premise solutions, however, remain favored by large enterprises with strict data security requirements and regulatory obligations. Cloud adoption is accelerating in small to medium-sized enterprises (SMEs) and emerging markets due to reduced infrastructure costs and enhanced flexibility.

- For instance, a UAE-based fintech startup deployed a cloud analytics platform on Google Cloud, achieving 30-times faster financial reporting, which directly improved the performance of their digital payment operations.

By Enterprise Type

The market is divided into large enterprises and SMEs. Large enterprises are leading the market due to their complex financial structures and the need for advanced analytics to manage vast amounts of data. SMEs, however, are adopting financial analytics solutions at a faster pace, driven by increased digital transformation and the affordability of cloud-based analytics tools. Both enterprise types are leveraging these tools to optimize financial decision-making and improve customer services.

Segmentations:

By Application

- Risk Management

- Fraud Detection

- Financial Forecasting

- Compliance Management

By Deployment Model

By Enterprise Type

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Industry

- Banking

- Insurance

- Investment

- Retail

- Healthcare

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading in Financial Analytics Adoption

North America holds the largest market share in the Financial Analytics Market, accounting for 40% of global revenues. This dominance is driven by the region’s well-established financial infrastructure and high adoption of advanced technologies. The United States, in particular, leads with its strong financial institutions and emphasis on technology integration. Financial organizations prioritize real-time data analytics, AI, and machine learning to improve decision-making and optimize risk management. The region also focuses heavily on regulatory compliance and data security, further supporting the growing demand for financial analytics solutions.

Europe: Growing Demand for Compliance Solutions

Europe holds a significant market share of 30% in the Financial Analytics Market. The region’s robust regulatory framework drives the demand for financial analytics tools, as institutions seek solutions to comply with regulations like MiFID II and PSD2. Financial institutions in the United Kingdom, Germany, and France are adopting these technologies to improve risk management, operational efficiency, and data security. The increasing focus on transparency, sustainability, and consumer protection further fuels the adoption of advanced financial analytics solutions. The region’s emphasis on data privacy, particularly under GDPR, also contributes to its growing market presence.

Asia Pacific: Rapid Expansion Due to Digital Transformation

The Asia Pacific region commands 20% of the global Financial Analytics Market share and is expected to experience the fastest growth. The rapid digital transformation in countries like China, India, and Japan drives the demand for financial analytics solutions. The expansion of mobile banking, e-commerce, and digital payments in the region has led to an increased need for data-driven insights in financial decision-making. The adoption of cloud-based solutions and AI technologies is accelerating the region’s market growth. Financial institutions in Asia Pacific are leveraging these tools to enhance customer service, manage risks more effectively, and improve operational efficiencies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- IBM Corporation (U.S.)

- Accenture (Ireland)

- Alteryx (U.S.)

- Fractal Analytics Inc. (U.S.)

- S&P Globalx (U.S.)

- TABLEAU SOFTWARE, LLC (U.S.)

- Capgemini (France)

- Microsoft Corporation (U.S.)

- QlikTech International AB (U.S.)

- SAP SE (Germany)

Competitive Analysis:

The Financial Analytics Market is highly competitive, with several prominent players offering advanced analytics solutions. Key market leaders include IBM Corporation, Oracle Corporation, SAS Institute Inc., and FIS Global. These companies are at the forefront of providing AI-driven analytics, machine learning, and cloud-based solutions to financial institutions. They focus on enhancing risk management, operational efficiency, and regulatory compliance. New entrants are leveraging innovations in data security and predictive analytics to carve out a niche in the market. Partnerships and acquisitions are common strategies employed by major players to expand their market share and enhance product offerings. The market is also witnessing the growing influence of regional players, particularly in Asia Pacific, where financial digitalization is rapidly advancing. Companies are increasingly focusing on customer-specific solutions to differentiate themselves in this dynamic and evolving market, making competitive positioning crucial for long-term success.

Recent Developments:

- In July 2025, Alteryx announced a new development in its partnership with Evisions to enhance data analytics solutions for higher education.

- In May 2025, Qlik acquired the Qloud Cover Migration technology from Stretch Qonnect, providing customers with an enterprise-grade migration tool to support cloud adoption and analytics modernization.

- In May 2025, SAP announced a strategic partnership with Alibaba Group to accelerate digital transformation through advanced cloud and AI technologies, focusing initially on the Chinese market and planning global expansion.

Market Concentration & Characteristics:

The Financial Analytics Market is moderately concentrated, with a few large players dominating the space, including IBM, Oracle, SAS Institute, and FIS Global. These companies control a significant portion of the market, primarily due to their established reputation, comprehensive product offerings, and strong global presence. However, the market is also witnessing increased competition from smaller, innovative firms that provide specialized solutions tailored to specific financial needs. As the demand for cloud-based and AI-driven analytics grows, companies must focus on differentiation through technology advancements, customer service, and compliance offerings. Regional players are gaining traction in emerging markets, leveraging local expertise and customized solutions. This combination of established players and emerging innovators shapes a competitive landscape that is dynamic and evolving, where firms must continually adapt to meet the increasing demand for data-driven decision-making in the financial sector.

Report Coverage:

The research report offers an in-depth analysis based on Application, Deployment Model, Enterprise Type, Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Financial institutions will increasingly adopt AI and machine learning technologies to enhance predictive analytics and decision-making capabilities.

- The demand for real-time financial data analysis will continue to rise as organizations seek to improve operational efficiency and customer service.

- Cloud-based financial analytics solutions will dominate the market due to their cost-effectiveness, scalability, and flexibility for small to medium enterprises.

- Automation in financial processes will expand, reducing manual tasks and improving the speed and accuracy of financial reporting and analysis.

- Data security and privacy will remain a top priority, driving the development of advanced encryption and secure analytics solutions to meet compliance requirements.

- The rise of digital banking and mobile financial services will fuel the need for financial analytics solutions tailored to mobile platforms.

- Emerging markets in Asia Pacific, Africa, and Latin America will experience rapid growth as financial institutions adopt digital transformation strategies.

- Integration with blockchain technology will become more prevalent in financial analytics tools to enhance transparency and fraud prevention.

- Increased focus on sustainability and ESG (Environmental, Social, and Governance) factors will drive demand for analytics that support responsible investment strategies.

- The use of financial analytics for personalized customer experiences will expand as financial institutions strive to offer tailored products and services.