Market Overview:

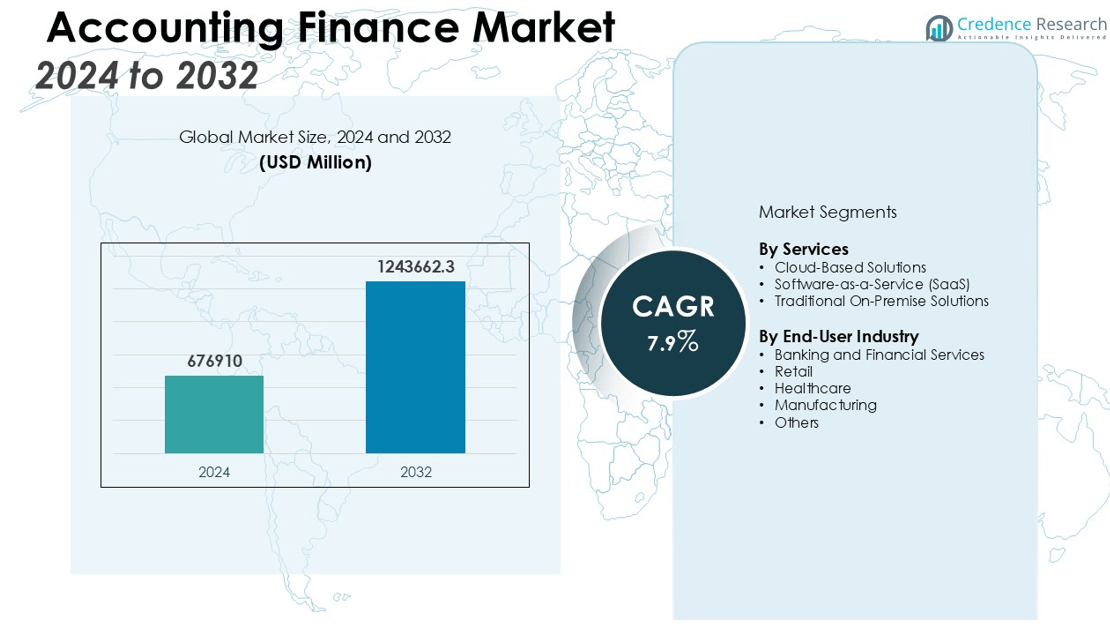

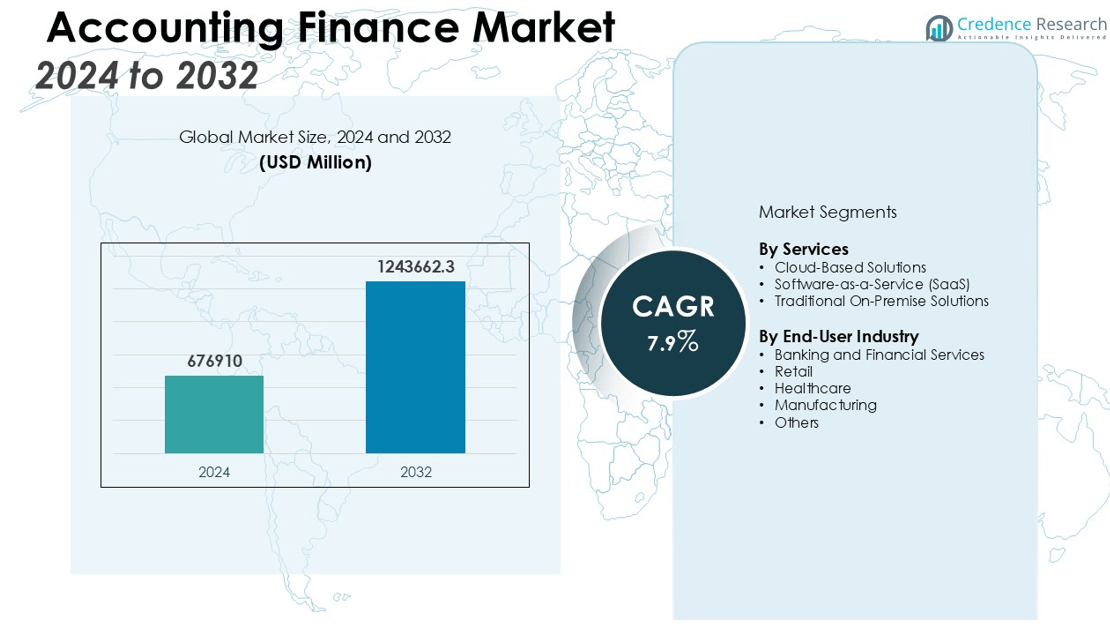

The Accounting Finance Market size was valued at USD 676910 million in 2024 and is anticipated to reach USD 1243662.3 million by 2032, at a CAGR of 7.9% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Accounting Finance Market Size 2024 |

USD 676910 million |

| Accounting Finance Market, CAGR |

7.9% |

| Accounting Finance Market Size 2032 |

USD 1243662.3 million |

Key drivers fueling the market include the growing need for cost-effective and scalable financial solutions. The integration of AI and automation technologies in accounting systems has enabled faster and more accurate financial analysis. Additionally, the growing demand for integrated financial solutions that address operational inefficiencies and regulatory concerns is contributing significantly to market growth. The increasing reliance on data-driven insights for decision-making in businesses is also propelling the market forward.

Regionally, North America holds the largest share of the market, driven by the high concentration of small and medium-sized enterprises (SMEs) and large corporations adopting advanced financial solutions. The United States, in particular, is a major contributor due to its early adoption of technology and significant investments in digital transformation. The Asia-Pacific region is expected to experience the highest growth rate, driven by rapid digitalization and increasing enterprise needs in emerging economies like India and China. Moreover, the rise of fintech startups in the region is further enhancing the demand for innovative financial management solutions.

Market Insights:

- The Accounting Finance Market was valued at USD 676,910 million in 2024 and is expected to reach USD 1,243,662.3 million by 2032.

- North America leads the market with a 40% share, driven by technological adoption and investments in digital transformation.

- The Asia-Pacific region holds 25% of the market share and is poised for the highest growth due to rapid digitalization and increasing enterprise needs.

- Cloud-based solutions are gaining traction, offering scalability, flexibility, and cost-efficiency for businesses, especially small and medium-sized enterprises (SMEs).

- The integration of AI and automation technologies is enhancing financial processes, reducing human error, and boosting operational efficiency.

- Regulatory compliance demands are rising, creating a need for automated financial solutions to keep up with evolving tax laws and reporting standards.

- Data security concerns are driving investments in advanced security measures, as businesses focus on protecting sensitive financial information stored on cloud platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Adoption of Cloud-Based Solutions

The Accounting Finance Market is experiencing significant growth due to the increasing shift towards cloud-based solutions. Cloud platforms offer businesses scalability, flexibility, and cost-efficiency, allowing companies to streamline their accounting processes and improve overall financial management. With cloud technologies, financial data becomes more accessible and secure, enabling organizations to collaborate and perform real-time analysis. These advantages are particularly beneficial for small and medium-sized enterprises (SMEs) that require affordable yet robust financial solutions.

- For instance, Intuit’s QuickBooks is a go-to enterprise resource planning system for small businesses, with more than 7 million online subscribers.

Integration of Artificial Intelligence and Automation

Automation and artificial intelligence (AI) are driving the Accounting Finance Market by enhancing the accuracy and speed of financial processes. AI-powered tools automate routine accounting tasks such as invoicing, bookkeeping, and reconciliation, reducing human error and freeing up valuable time for finance teams. These technologies provide advanced data analytics, allowing businesses to make data-driven decisions faster and with greater confidence. As a result, organizations can enhance productivity and achieve higher operational efficiency.

- For instance, after implementing UiPath’s AI and automation solutions for its global finance audit delivery process, a global professional services and audit company saved 54,000 hours of work annually.

Increased Regulatory Compliance Demands

The rising complexity of financial regulations is another key factor pushing the demand for advanced accounting solutions. Companies are under constant pressure to comply with evolving tax laws, reporting standards, and industry-specific regulations. This has increased the need for automated financial solutions that ensure compliance while reducing the risk of errors and penalties. The Accounting Finance Market benefits from this trend as organizations seek tools that streamline compliance processes and enhance reporting capabilities.

Demand for Integrated Financial Solutions

The Accounting Finance Market is fueled by the increasing demand for integrated financial solutions that address a variety of business needs. Modern financial platforms allow businesses to consolidate accounting, payroll, budgeting, and reporting functions into one unified system. These integrated solutions simplify management, improve accuracy, and provide businesses with better visibility into their financial operations, supporting more informed strategic decisions. As companies seek to optimize operations, the demand for such integrated solutions continues to rise.

Market Trends:

Shift Towards Automation and Artificial Intelligence in Financial Processes

The Accounting Finance Market is witnessing a strong trend towards automation and the integration of artificial intelligence (AI) technologies. AI-driven tools are increasingly used to automate manual tasks such as bookkeeping, reconciliation, and invoicing, allowing organizations to enhance productivity and minimize errors. Machine learning algorithms enable real-time data analysis, helping businesses make faster and more informed decisions. The demand for AI-powered financial solutions is growing, as they offer improved efficiency, accuracy, and scalability. Companies are adopting AI not only to automate routine tasks but also to gain deeper insights into their financial data, enabling predictive analytics for future financial planning.

- For instance, Cenlar FSB, a major mortgage sub-servicer, implemented intelligent automation for its wire processing operations. This move cut the processing time for a single wire down to just 16 seconds.

Cloud-Based Financial Solutions and Integration with Other Business Systems

Cloud technology continues to drive significant growth in the Accounting Finance Market. Businesses are increasingly turning to cloud-based platforms for their financial management needs due to their scalability, cost-effectiveness, and ease of integration with other enterprise systems. Cloud solutions allow seamless access to financial data from anywhere, enabling greater collaboration and enhancing decision-making. These platforms often integrate with enterprise resource planning (ERP) systems, human resources, and customer relationship management (CRM) software, further streamlining business operations. The trend towards cloud-based accounting solutions reflects a broader shift towards digital transformation in the finance sector, where businesses seek more efficient and adaptable ways to manage financial operations.

- For instance, QuickBooks Online has achieved remarkable scalability with 5.3 million users worldwide.

Market Challenges Analysis:

Data Security and Privacy Concerns

One of the significant challenges facing the Accounting Finance Market is the growing concern over data security and privacy. As financial data is increasingly stored and processed on cloud platforms, the risk of cyberattacks and data breaches has become a critical issue for businesses. Organizations must invest in advanced security protocols and comply with stringent regulations to protect sensitive financial information. The increasing frequency of data breaches and the evolving nature of cyber threats require constant monitoring and adaptation of security strategies. Businesses face the challenge of balancing convenience with robust data protection measures to ensure compliance with privacy laws and safeguard customer trust.

Adapting to Rapid Technological Changes

The rapid pace of technological advancements presents another challenge for the Accounting Finance Market. Businesses must continuously update their financial management systems to keep up with new technologies, including AI, blockchain, and machine learning. This constant need for system upgrades and staff training can be resource-intensive. Smaller organizations, in particular, struggle to implement and maintain advanced technologies due to budget constraints and limited expertise. Furthermore, integrating new technologies with legacy systems often presents compatibility issues, hindering seamless transitions. The challenge lies in adopting innovations while ensuring operational continuity and managing associated costs.

Market Opportunities:

Growth of Financial Automation Solutions in SMEs

The Accounting Finance Market presents significant opportunities driven by the growing adoption of financial automation solutions, particularly among small and medium-sized enterprises (SMEs). These businesses are increasingly seeking cost-effective and scalable financial tools to streamline accounting processes, reduce errors, and enhance operational efficiency. Automation reduces the need for manual data entry and minimizes human error, providing SMEs with more accurate financial insights and better compliance. As the demand for simplified financial management grows, there is a rising opportunity for software providers to offer tailored solutions for SMEs, allowing them to compete with larger enterprises in the global market.

Expansion of Cloud-Based Accounting Solutions

Another key opportunity in the Accounting Finance Market lies in the continued expansion of cloud-based accounting solutions. These platforms provide businesses with flexibility, accessibility, and enhanced data security, making them highly attractive to companies of all sizes. Cloud solutions enable organizations to manage their financial data from anywhere, improving collaboration and decision-making. The rapid digital transformation across industries further increases the demand for integrated cloud-based platforms, offering an opportunity for providers to innovate and expand their product offerings. As more businesses shift to cloud technologies, providers can capitalize on the need for seamless, secure, and scalable financial solutions.

Market Segmentation Analysis:

By Services

The Accounting Finance Market is segmented by services into cloud-based solutions, software-as-a-service (SaaS), and traditional on-premise solutions. Cloud-based services dominate the market due to their scalability, cost-effectiveness, and accessibility, allowing businesses to streamline financial management processes. SaaS offerings are gaining popularity as they offer flexibility, quick implementation, and lower upfront costs compared to traditional software. On-premise solutions continue to be preferred by larger enterprises due to their security, control, and customization capabilities. As digital transformation accelerates, cloud-based and SaaS solutions are expected to maintain strong growth, while on-premise services cater to organizations with specific data security requirements.

- For instance, after implementing the Sage Intacct SaaS accounting solution, the educational technology company GoGuardian reduced its monthly financial close process by 31 days.

By End-User Industry

The Accounting Finance Market is segmented by end-user industry into banking and financial services, retail, healthcare, manufacturing, and others. Banking and financial services lead the market, driven by the need for advanced financial management systems to handle complex transactions, regulatory compliance, and risk management. Retail and manufacturing sectors follow, as businesses in these industries increasingly adopt automated financial tools to manage inventory, supply chains, and large-scale transactions. Healthcare organizations also invest in financial software to ensure compliance with health-related regulations and manage large volumes of data. As industries continue to embrace automation, the demand for specialized accounting solutions tailored to each sector will remain strong, boosting growth across these segments.

- For instance, the global footwear brand Dr. Martens implemented Microsoft Dynamics 365 Finance to manage its complex operations, supporting its network of over 130 retail stores.

Segmentations:

By Services

- Cloud-Based Solutions

- Software-as-a-Service (SaaS)

- Traditional On-Premise Solutions

By End-User Industry

- Banking and Financial Services

- Retail

- Healthcare

- Manufacturing

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading with Technological Adoption

North America holds 40% of the market share in the Accounting Finance Market, driven by its advanced technological adoption. The region benefits from a high concentration of small, medium, and large enterprises that consistently invest in cloud-based and AI-driven accounting solutions. The United States, in particular, leads this growth with early adoption of digital financial systems and significant investments in digital transformation. The growing need for automation and enhanced data security fuels the market’s expansion in this region. With a robust infrastructure and a large number of technology providers, North America is expected to maintain its dominance in the market.

Europe: Strong Regulatory Environment and Innovation

Europe holds 30% of the market share in the Accounting Finance Market, driven by its strict regulatory framework and focus on sustainability and compliance. Financial institutions across countries like Germany, the UK, and France are increasingly adopting advanced financial technologies to meet stringent regulatory requirements. The European Union’s emphasis on digitalization and green finance initiatives contributes to the demand for modernized accounting systems. Businesses in the region are turning to cloud solutions to ensure operational efficiency and stay compliant with evolving laws. Europe’s combination of regulatory pressures and technological innovation offers substantial market opportunities.

Asia-Pacific: High Growth Potential Fueled by Digital Transformation

The Asia-Pacific region holds 25% of the market share in the Accounting Finance Market, propelled by rapid digitalization and the increasing need for automated financial solutions. Emerging economies, particularly in India and China, are making significant investments in technology adoption, spurring demand for modern financial systems. Cloud-based solutions and AI integration are gaining traction, especially among businesses aiming to streamline their financial processes. The region’s growing number of startups and SMEs further increases the demand for scalable financial solutions. Asia-Pacific’s strong growth potential positions it as a key area for future market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Clearbooks

- Bookkeeping Simplified

- BlackLine

- Sage 50cloud

- Crunch

- Stampli

- Check Inc. (now Mint Bills)

- MineralTree

- FreeAgent

- com.

Competitive Analysis:

The Accounting Finance Market is highly competitive, with numerous global and regional players vying for market share. Key companies, such as Intuit Inc., Sage Group, and Oracle Corporation, offer comprehensive accounting solutions that cater to businesses of various sizes. These players focus on continuous innovation, particularly in cloud-based and AI-driven financial management tools, to meet the growing demand for automation and scalability. Smaller, niche providers also contribute by offering specialized software tailored to specific industries or regions. As technology adoption accelerates, companies are investing heavily in research and development to enhance their product offerings, ensuring they remain competitive. Market leaders are focusing on partnerships and acquisitions to expand their capabilities and customer base. The competitive landscape remains dynamic as organizations push to stay ahead in delivering integrated, secure, and efficient accounting solutions to meet evolving customer needs.

Recent Developments:

- In July 2024, Sage announced a strengthened partnership with Microsoft, focusing on integrating Microsoft Azure OpenAI Service with Sage products.

- In September 2024, FreeAgent announced new integration partnerships with Buddy and XBert.

- In June 2025, FreeAgent expanded its payment solutions by launching GoCardless Instant Bank Pay feature and the AI-powered payment tool Success.

Market Concentration & Characteristics:

The Accounting Finance Market is moderately concentrated, with a few key players dominating the landscape, such as Intuit Inc., Oracle Corporation, and Sage Group. These established companies hold significant market share due to their broad range of cloud-based solutions and advanced automation capabilities. While large corporations lead, the market also features a growing number of niche players offering specialized financial software tailored to specific industries or regions. This diversity enhances the market’s competitiveness, as smaller firms innovate to address specific customer needs. The market is characterized by rapid technological advancements, with a strong emphasis on cloud integration, artificial intelligence, and data security. As businesses of all sizes increasingly adopt digital financial solutions, market characteristics continue to evolve, reflecting the demand for scalable, efficient, and secure financial management tools.

Report Coverage:

The research report offers an in-depth analysis based on Service, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Widespread adoption of artificial intelligence (AI) and automation, enhancing efficiency and enabling real-time financial analysis.

- Integration of large language models (LLMs) for advanced risk management and decision-making across asset classes.

- Shift towards advisory roles for accountants, emphasizing strategic decision-making over traditional bookkeeping.

- Increased demand for professionals skilled in financial planning and analysis (FP&A), driven by the need for strategic insights.

- Expansion of cloud-based accounting solutions, facilitating remote work and real-time collaboration.

- Growing emphasis on environmental, social, and governance (ESG) reporting, with accountants playing a pivotal role in sustainability initiatives.

- Rise of open finance frameworks, promoting secure data sharing and fostering innovation in financial services.

- Enhanced focus on cybersecurity, addressing emerging threats and ensuring data protection in financial systems.

- Increased private equity investments in accounting firms, accelerating growth and technological advancements.

- Integration of quantum computing in cybersecurity, strengthening defenses against potential threats in financial systems.