| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pet Toys Market Size 2024 |

USD 9,133.14 million |

| Pet Toys Market, CAGR |

6.95% |

| Pet Toys Market, Size 2032 |

USD 15,631.15 million |

Market Overview

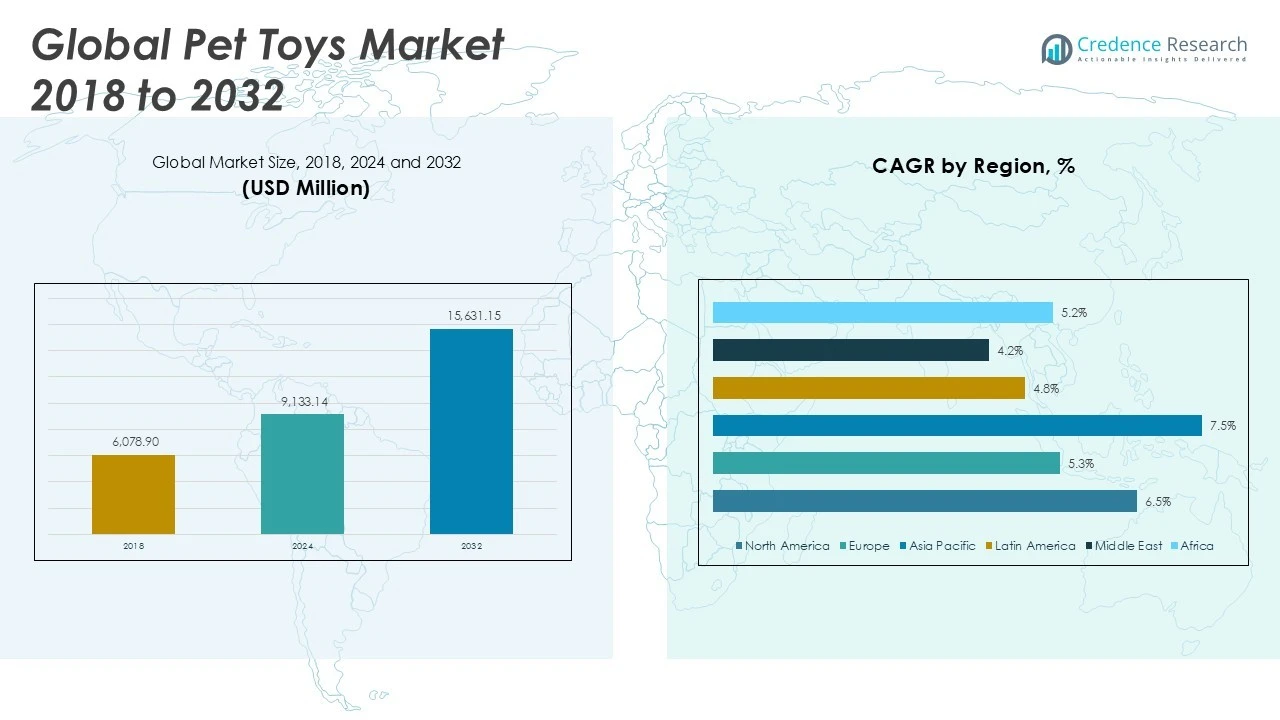

Global Pet Toys Market size was valued at USD 6,078.90 million in 2018 to USD 9,133.14 million in 2024 and is anticipated to reach USD 15,631.15 million by 2032, at a CAGR of 6.95% during the forecast period.

The Global Pet Toys Market demonstrates steady growth driven by rising pet ownership, increasing humanization of pets, and heightened awareness of pet health and well-being. Consumers prioritize engaging and interactive toys that promote physical activity, mental stimulation, and emotional comfort for their pets, boosting demand for innovative and durable products. The market benefits from the surge in e-commerce platforms, which broaden product accessibility and offer a diverse range of options. Growing preference for eco-friendly and sustainable materials further influences purchasing decisions, prompting manufacturers to introduce biodegradable and non-toxic toys. Urbanization and changing lifestyles contribute to higher expenditure on premium pet products, while advances in technology enable the development of smart, connected toys with features such as treat dispensers, sensors, and mobile app integration. Together, these factors and trends support the ongoing expansion and diversification of the pet toys market, making it a dynamic segment within the global pet industry.

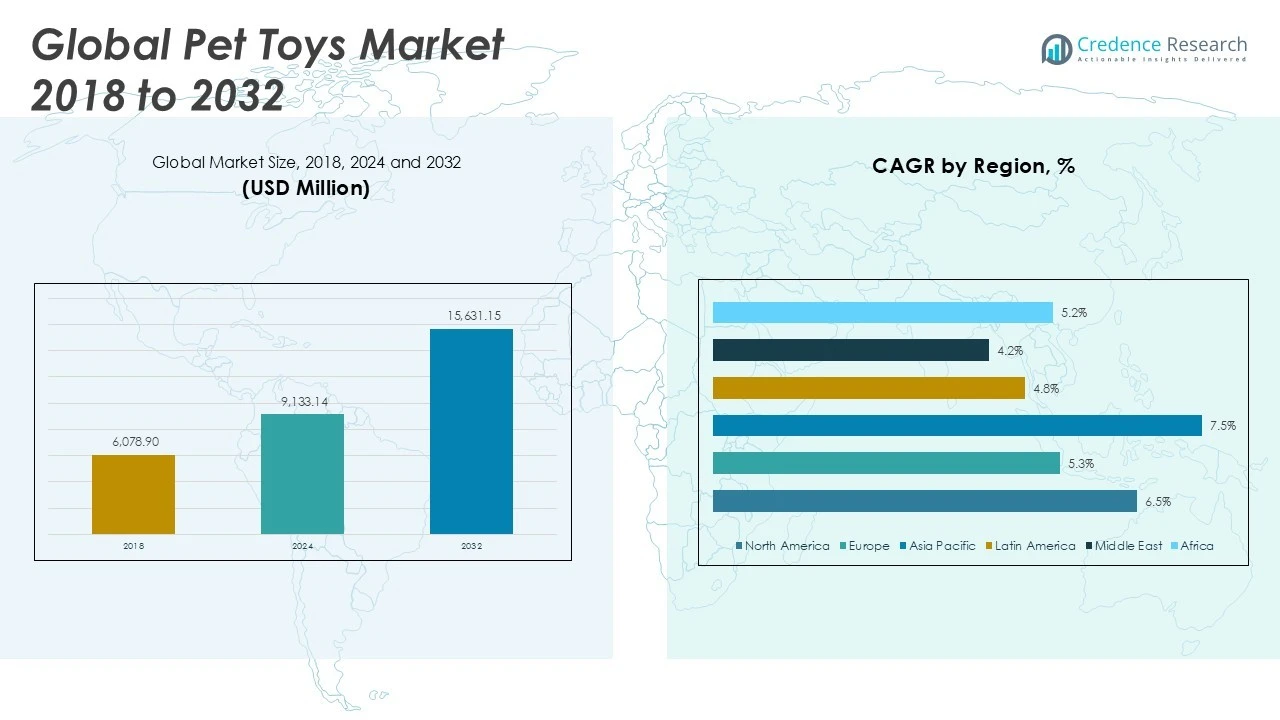

The Global Pet Toys Market demonstrates significant geographical diversity, with North America, Europe, and Asia Pacific emerging as leading regions due to robust pet ownership rates, evolving consumer preferences, and expanding retail infrastructure. North America leads with high adoption of premium and innovative toys, while Europe emphasizes sustainable and high-quality products that align with strict safety standards. Asia Pacific shows rapid growth, fueled by urbanization and rising disposable incomes in countries like China, Japan, and India. Latin America and the Middle East & Africa are gradually gaining momentum with improving economic conditions and growing awareness of pet wellness. Key players shaping the competitive landscape include Coastal Pet Products, Inc., Cosmic Pet, Honest Pet Products, Jolly Pets, Petmate, and ZippyPaws. These companies focus on innovation, quality, and product differentiation to maintain a strong market presence globally.

Market Insights

- The Global Pet Toys Market is projected to grow from USD 9,133.14 million in 2024 to USD 15,631.15 million by 2032, reflecting a CAGR of 6.95% during the forecast period.

- Rising pet ownership rates and the humanization of pets drive increased demand for innovative and engaging toys worldwide.

- Trends highlight the growing popularity of eco-friendly, sustainable, and technologically advanced toys, including interactive and smart pet products.

- Key players focus on product differentiation, expanding their portfolios with durable, safe, and multi-functional toys to address changing consumer preferences.

- Intense competition and the presence of counterfeit or low-quality products pose challenges for established brands, impacting profitability and consumer trust.

- North America and Europe remain leading markets, benefiting from robust retail infrastructure, premium product demand, and heightened awareness of pet wellness.

- Asia Pacific shows the fastest growth, driven by rising disposable incomes, urbanization, and expanding e-commerce, while Latin America, the Middle East, and Africa continue to gain traction with increasing pet adoption and retail development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Pet Ownership and Humanization Drive Market Demand

The Global Pet Toys Market gains significant momentum from the increasing rate of pet adoption across developed and emerging economies. Households view pets as family members, leading to higher investment in their well-being and entertainment. Consumers seek to enrich the lives of their pets with quality toys that support physical health and emotional comfort. Pet owners recognize the importance of interactive play in reducing anxiety and promoting exercise, prompting a consistent demand for new products. Urban lifestyles contribute to more single-person and nuclear families, where pets provide companionship and emotional support. It positions pet toys not just as luxury items but as essentials for responsible pet care.

- For instance, the American Pet Products Association (APPA) reported that 70% of U.S. households owned a pet in 2023, reflecting a steady rise in pet adoption rates.

Product Innovation and Premiumization Shape Consumer Choices

The Global Pet Toys Market benefits from a strong focus on product innovation and premiumization. Manufacturers develop toys that offer multifunctional benefits, such as dental care, cognitive stimulation, and physical activity. Companies use advanced materials and ergonomic designs to improve durability and safety, catering to the preferences of discerning pet owners. Smart toys with integrated technology, including sensors and mobile app connectivity, respond to consumer interest in tech-enabled pet care solutions. Premium and specialized toys address niche demands, such as for senior pets or those with specific health needs. This trend drives differentiation in a competitive market landscape.

- For instance, premium pet toys designed for senior pets and those with specific health needs are seeing increased adoption, particularly in North America and Europe.

Sustainability and Eco-Friendly Materials Influence Purchasing Decisions

The growing awareness of environmental sustainability shapes the product landscape in the Global Pet Toys Market. Consumers show preference for eco-friendly, biodegradable, and non-toxic toys made from natural or recycled materials. Brands invest in green product development to align with global sustainability goals and changing consumer expectations. Regulatory frameworks in various regions encourage the adoption of safer and environmentally responsible manufacturing practices. Marketing strategies highlight the environmental benefits of sustainable pet toys, strengthening brand loyalty and attracting a conscious customer base. It encourages ongoing innovation and accountability within the industry.

E-Commerce Expansion and Omnichannel Strategies Broaden Market Reach

The rise of e-commerce platforms and omnichannel retailing supports the robust growth of the Global Pet Toys Market. Online channels enable consumers to access a wide range of products, compare features, and read reviews before making purchasing decisions. Brands leverage digital marketing and influencer partnerships to boost visibility and engage new customer segments. E-commerce also facilitates personalized product recommendations and subscription-based sales models, enhancing convenience and customer retention. The integration of traditional and digital retail strengthens distribution networks, ensuring timely delivery and expanding geographic reach. It establishes a dynamic, customer-centric marketplace that drives sustained market expansion.

Market Trends

Integration of Smart Technology and Interactive Features

The Global Pet Toys Market sees a strong trend toward the integration of smart technology and interactive features in product design. Consumers value toys that provide real-time engagement and adapt to pets’ needs through motion sensors, remote controls, and app connectivity. Manufacturers develop toys that dispense treats, respond to touch, or track pet activity, enhancing the interactive experience for both pets and owners. Technology-driven products address the demand for mental stimulation and physical activity, which aligns with the broader movement toward holistic pet wellness. Smart toys enable pet owners to interact with their animals remotely, supporting modern lifestyles that often involve long work hours or travel. This trend pushes manufacturers to invest in research and development to bring innovative, tech-enabled solutions to market.

- For instance, smart pet toys with AI-driven features and mobile app connectivity are gaining traction, with demand for tech-enabled pet care solutions rising significantly.

Sustainable and Eco-Friendly Toy Offerings Gain Traction

The Global Pet Toys Market experiences growing demand for sustainable and eco-friendly toys, reflecting increased environmental consciousness among pet owners. Brands prioritize biodegradable, non-toxic, and recycled materials, responding to both consumer preferences and evolving regulatory standards. Product packaging also shifts toward minimalistic and recyclable options, reinforcing the commitment to sustainability. Marketing efforts highlight the environmental credentials of products, building trust with eco-conscious buyers. The use of plant-based fibers, natural rubber, and upcycled fabrics further diversifies sustainable product lines. Companies differentiate their offerings by focusing on transparency in sourcing and ethical manufacturing practices, driving long-term loyalty and market differentiation.

- For instance, eco-friendly pet toys made from organic cotton, hemp, and recycled materials are gaining popularity due to their non-toxic and biodegradable properties.

Rise of Customization and Personalization in Pet Toys

Customization and personalization represent a prominent trend in the Global Pet Toys Market, as pet owners seek toys tailored to their animals’ specific needs and preferences. Brands introduce customizable options, such as toys with adjustable difficulty levels, personalized colors, or engravings. The market caters to different pet breeds, sizes, and life stages with specialized designs, ensuring a targeted approach to pet wellness and entertainment. Online platforms facilitate the customization process, enabling consumers to design and order bespoke toys with ease. Customization not only enhances user satisfaction but also supports higher price points, boosting profitability for manufacturers. This trend strengthens the bond between pets and owners, making toys a unique extension of pet care routines.

Growth of Premium, Health-Focused, and Therapeutic Toys

The Global Pet Toys Market witnesses a shift toward premium and health-focused toy categories, reflecting pet owners’ growing attention to overall pet well-being. Companies introduce toys that promote dental hygiene, relieve anxiety, or address specific behavioral issues, integrating therapeutic benefits into traditional play products. Materials with antibacterial properties and innovative textures cater to health and safety concerns. Functional toys that offer enrichment and stress relief appeal to owners seeking to improve their pets’ quality of life. Brands partner with veterinarians and pet wellness experts to develop science-backed products, further enhancing credibility and value. It ensures the continued evolution of the market to meet changing consumer expectations and pet care standards.

Market Challenges Analysis

Quality Control and Product Safety Remain Key Concerns

The Global Pet Toys Market faces significant challenges related to quality control and product safety. Manufacturers must comply with strict safety standards to prevent risks such as choking hazards, toxic material exposure, or physical injury. Variations in regional regulations create complexity for global brands, requiring continuous monitoring and adaptation. Counterfeit and low-quality products in online marketplaces erode consumer trust and present legal risks for reputable manufacturers. It requires ongoing investment in research, testing, and certification processes to uphold brand reputation and ensure pet safety. Failure to meet regulatory or consumer expectations can lead to product recalls and long-term reputational damage.

- For instance, regulatory bodies such as the U.S. Consumer Product Safety Commission and the European Safety Standards enforce strict guidelines on pet toy safety, requiring continuous testing and certification.

Intense Competition and Price Sensitivity Impact Profitability

Intense competition and price sensitivity present ongoing challenges in the Global Pet Toys Market. Numerous established and emerging brands compete for market share, leading to frequent price wars and reduced margins. The proliferation of generic or private label products intensifies downward pressure on prices, while increasing raw material and production costs threaten overall profitability. It forces companies to balance innovation and cost-effectiveness while delivering value to discerning customers. Fluctuations in supply chain reliability and logistics further complicate cost management and timely delivery. Companies must invest in differentiation and brand building to sustain growth and remain competitive in a saturated market landscape.

Market Opportunities

Innovation in Smart and Interactive Toys Drives Market Expansion

The Global Pet Toys Market holds substantial opportunities through innovation in smart and interactive toys. Consumers seek products that incorporate technology to enhance pet engagement, monitor activity, and support behavioral training. Companies can leverage advancements in sensors, artificial intelligence, and mobile connectivity to develop toys that appeal to tech-savvy pet owners. It opens avenues for product differentiation and premium pricing in a competitive environment. Collaborations with veterinarians and pet behavior specialists enable the creation of toys with demonstrated health benefits, meeting the rising demand for holistic pet care solutions. Brands that invest in user experience and connected features can secure long-term customer loyalty and market leadership.

Sustainable and Customizable Solutions Attract New Consumer Segments

The shift toward sustainable and customizable solutions presents growth opportunities for the Global Pet Toys Market. Eco-friendly materials and ethically sourced components appeal to environmentally conscious consumers, supporting broader sustainability goals. Offering customizable toys tailored to specific breeds, life stages, or preferences enables brands to tap into niche markets and strengthen consumer relationships. Digital platforms facilitate personalized shopping experiences, allowing customers to design unique products for their pets. It positions brands to capture value in premium and specialty segments, fostering differentiation in a crowded marketplace. Companies that embrace sustainability and personalization are well-placed to drive future market growth.

Market Segmentation Analysis:

By Type:

The market primarily caters to dogs and cats, with a smaller share occupied by toys designed for other pets such as birds, rabbits, and small mammals. Dog toys account for a significant portion of overall demand, driven by the popularity of fetch, chew, and interactive toys that support physical activity and dental health. Cat toys emphasize sensory stimulation and engagement, including soft, plush, and interactive options that mimic prey-like movements.

By Product:

In terms of product segmentation, chew toys, interactive toys, soft toys, plush toys, and fetch toys dominate the market landscape. Chew and fetch toys remain popular for their durability and health benefits, especially among dog owners. Interactive toys see rising demand due to their role in mental stimulation and behavioral training for both cats and dogs. Soft and plush toys appeal to pet owners seeking comfort-oriented products that foster bonding and reduce anxiety.

By Distribution Channel:

The distribution channel segment highlights the shift toward modern retail and e-commerce. Hypermarkets and supermarkets provide convenient access and broad assortments, while specialty pet stores offer expert advice and a curated selection. The online segment grows rapidly, driven by ease of comparison, extensive product variety, and direct-to-consumer sales models. It enables brands to reach a wider audience and respond swiftly to changing consumer preferences, reinforcing the dynamic nature of the Global Pet Toys Market.

Segments:

Based on Type:

Based on Product:

- Chew Toys

- Interactive Toys

- Soft Toys

- Plush Toys

- Fetch Toys

- Others

Based on Distribution Channel:

- Hypermarkets & Supermarkets

- Specialty Pet Stores

- Online

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Pet Toys Market

North America pet toys market grew from USD 2,201.99 million in 2018 to USD 3,266.92 million in 2024 and is projected to reach USD 5,610.00 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.5%. North America is holding a 35% market share. High pet ownership, growing focus on pet wellness, and strong e-commerce infrastructure drive robust demand. The region benefits from innovation in premium and interactive toys, as well as an increasing trend of pet humanization. Canada supports regional growth with rising adoption rates and an expanding network of specialty pet retailers. Leading brands prioritize product safety, sustainability, and advanced technology, reinforcing North America’s leadership position in the global market.

Europe Pet Toys Market

Europe pet toys market grew from USD 1,254.32 million in 2018 to USD 1,791.13 million in 2024 and is projected to reach USD 2,815.37 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.3%. Europe is holding a 25% market share. The United Kingdom, Germany, and France lead market performance, driven by consumer preference for sustainable, high-quality toys and rigorous safety standards. The region features a well-established network of specialty retailers and a rapidly growing online sales channel. Urbanization and the rising number of single-person households stimulate demand for a broad array of pet toys. European brands respond with innovation, eco-friendly materials, and personalized product offerings to meet sophisticated consumer expectations.

Asia Pacific Pet Toys Market

Asia Pacific pet toys market grew from USD 1,942.21 million in 2018 to USD 3,065.40 million in 2024 and is projected to reach USD 5,678.41 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.5%. Asia Pacific is holding a 20% market share. China, Japan, and India are the primary contributors to regional growth, fueled by urbanization, rising disposable income, and evolving attitudes toward pet care. The proliferation of e-commerce platforms accelerates access to diverse product ranges and supports the rise of both local and international brands. Younger consumers drive demand for innovative, affordable, and tech-enabled toys. The region remains a dynamic marketplace, continually adapting to shifting lifestyle trends and pet ownership patterns.

Latin America Pet Toys Market

Latin America pet toys market grew from USD 279.63 million in 2018 to USD 414.76 million in 2024 and is projected to reach USD 626.07 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.8%. Latin America is holding 8% market share, with Brazil and Mexico leading regional demand. Expanding middle-class populations, increasing pet adoption, and growing awareness of pet wellness support market growth. The transition from traditional retail to specialty pet stores and digital sales channels creates opportunities for both global and regional brands. Consumers show growing interest in health-oriented, interactive, and comfort-focused toys, reflecting broader changes in pet care culture. Latin America’s market continues to mature, marked by strategic investments and product diversification.

The Middle East Pet Toys Market

The Middle East pet toys market grew from USD 172.26 million in 2018 to USD 236.83 million in 2024 and is projected to reach USD 342.81 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.2%. The Middle East is holding 3% market share, driven by rising pet ownership in countries such as the UAE and Saudi Arabia. Demand increases for premium and imported pet toys, supported by expanding retail infrastructure and greater awareness of pet health. Local distributors and international brands focus on urban centers, offering a mix of high-quality, innovative, and culturally appropriate products. The market sees growth in both specialty stores and online platforms, catering to the preferences of an affluent and discerning customer base.

Africa Pet Toys Market

Africa pet toys market grew from USD 228.50 million in 2018 to USD 358.11 million in 2024 and is projected to reach USD 558.49 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.2%. Africa is holding a 2% market share. South Africa and Nigeria lead market activity, where urbanization, economic development, and improved access to retail channels stimulate demand. Consumers increasingly seek durable, affordable, and safe toys as pet ownership becomes more widespread. Regional growth remains supported by greater product accessibility and entry of international brands. Africa’s market shows potential for further expansion as awareness of pet wellness and specialty products grows across key urban centers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Benebone LLC

- Coastal Pet Products, Inc.

- Cosmic Pet

- Ethical Products, Inc.

- Fluff and Tuff, Inc.

- Honest Pet Products

- Jolly Pets

- Petmate

- Petsport USA, Inc.

- ZippyPaws

Competitive Analysis

The competitive landscape of the Global Pet Toys Market is characterized by the presence of several established and innovative players, including Benebone LLC, Coastal Pet Products, Inc., Cosmic Pet, Ethical Products, Inc., Fluff and Tuff, Inc., Honest Pet Products, Jolly Pets, Petmate, Petsport USA, Inc., and ZippyPaws. These companies actively focus on expanding their product portfolios with durable, safe, and multi-functional toys that cater to evolving consumer preferences. Leading players invest in research and development to launch interactive, eco-friendly, and technology-enabled products that set new industry standards for quality and safety. Strategic collaborations with retailers and e-commerce platforms help them increase brand visibility and expand their global reach. Pricing strategies, product innovation, and distinctive branding play critical roles in differentiating their offerings in a highly competitive market. Key players also prioritize sustainability by introducing biodegradable materials and ethical manufacturing practices, strengthening their appeal to environmentally conscious consumers. Despite facing intense competition and price pressures from generic brands, these market leaders maintain a strong presence through continuous innovation, targeted marketing, and a commitment to pet health and safety, positioning themselves for long-term growth and customer loyalty in the global marketplace.

Recent Developments

- In April 2025, Coastal Pet highlighted its commitment to sustainability with an expanded range of eco-friendly cat toys, grooming tools, and restraints, aligning with Earth Day and growing consumer demand for environmentally conscious products.

- In March 2025, Benebone launched its first interactive natural rubber dog toy line, the Benebone Bounce series. This collection includes five toys-a Bone, Ball, Tug, slow-feeding Cone, and treat-dispensing Pawbler-expanding Benebone’s portfolio beyond chews into fetch, tug, and treat-dispensing toys. The line emphasizes durability and paw-friendly design, with a distinctive yellow-green color for visibility. Distribution includes Tractor Supply, specialty pet stores, and online channels.

- In January 2025, Jolly Pets released its “Top 10 Dog Toys of 2024,” featuring popular items like the Jolly Soccer Ball, Tug-n-Toss, Romp-N-Roll, Jolly Egg, and Knot-N-Chew. These toys focus on durability, interactivity, and enrichment, with many designed for both land and water play. The company continues to innovate and expand its product line, as highlighted during the Global Pet Expo 2025 in Orlando.

- In March 2024, Ethical Products entered a licensing agreement with KFC to develop and market a line of KFC-themed dog and cat toys. The KFC Paw Licking collection will include soft puzzles, plush, nylon, rope, and rubber toys for dogs, and catnip-scented toys for cats. The line will debut at SuperZoo Las Vegas and ship to retailers in January 2025.

Market Concentration & Characteristics

The Global Pet Toys Market exhibits a moderate to high level of market concentration, with several leading players dominating the competitive landscape through extensive product portfolios, strong brand recognition, and wide distribution networks. It features a diverse range of products, from traditional chew and fetch toys to advanced interactive and smart toys, catering to various pet needs and owner preferences. The market values innovation, safety, and quality, encouraging companies to invest in new materials and technology to differentiate their offerings. Consumer demand for sustainable, eco-friendly, and health-oriented products continues to shape market characteristics, prompting brands to prioritize ethical sourcing and environmentally responsible manufacturing. The presence of both global and regional players ensures a dynamic environment, with frequent new product launches and strategic partnerships reinforcing competitive intensity. It relies on omnichannel distribution, leveraging specialty stores, supermarkets, and online platforms to reach a broad customer base and adapt to changing shopping behaviors

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Global Pet Toys Market is projected to grow steadily, driven by increasing pet ownership and the humanization of pets.

- Demand for eco-friendly and sustainable pet toys is rising as consumers become more environmentally conscious.

- Technological advancements are leading to the development of smart and interactive pet toys, enhancing pet engagement.

- Online retail channels are expanding, offering consumers a wider variety of pet toys and convenient shopping experiences.

- Emerging markets in Asia-Pacific and Latin America are witnessing significant growth due to rising disposable incomes and urbanization.

- Manufacturers are focusing on product innovation to meet the diverse needs of pets and their owners.

- The popularity of subscription-based pet toy services is increasing, providing regular and curated toy selections for pets.

- Health and wellness trends are influencing the design of pet toys that promote physical activity and mental stimulation.

- Collaborations between pet toy manufacturers and veterinary professionals are enhancing product credibility and effectiveness.

- The market is becoming more competitive, with both established companies and new entrants striving to capture market share through unique offerings.