| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Philippines Industrial Solvents Market Size 2024 |

USD 66.19 million |

| Philippines Industrial Solvents Market CAGR |

6.53% |

| Philippines Industrial Solvents Market Size 2032 |

USD 109.75 million |

Market Overview

Philippines Industrial Solvents market size was valued at USD 66.19 million in 2024 and is anticipated to reach USD 109.75 million by 2032, at a CAGR of 6.53% during the forecast period (2024-2032).

The Philippines industrial solvents market is driven by the growing demand from key end-use industries such as paints and coatings, adhesives, pharmaceuticals, and cleaning products. Rapid urbanization and infrastructure development are fueling the construction and automotive sectors, which in turn increase the need for solvent-based products. Additionally, the expanding manufacturing base and rise in consumer goods production contribute to solvent usage across various applications. The market is also witnessing a shift toward environmentally friendly and bio-based solvents, prompted by stricter environmental regulations and increasing awareness of sustainable practices. Technological advancements in solvent formulation are enhancing performance and safety, further boosting adoption. Moreover, foreign investments and government initiatives supporting industrial growth are strengthening the supply chain and enabling better access to raw materials. These factors collectively support steady market expansion and encourage innovation in solvent technologies tailored to local and regional needs.

The geographical landscape of the Philippines industrial solvents market is shaped by strong demand centers in Metro Manila, Cebu, Davao, and Northern Luzon, driven by industrial concentration, infrastructure development, and regional manufacturing growth. Metro Manila leads in consumption due to its dense industrial base and accessibility to international trade routes, while Cebu and Davao are emerging as key regional hubs fueled by expanding economic zones and investments in processing industries. Northern Luzon is witnessing growing industrial decentralization, encouraging solvent demand across diverse sectors. In terms of key players, the market features a mix of local and international companies, including the Philippines National Petroleum Corporation (CNPC), Formosa Plastics Corporation, Reliance Industries Limited, and Sinopec Group. Other notable participants such as Mitsubishi Chemical Holdings Corporation, Sumitomo Chemical, Toray Industries, LG Chem, Tata Chemicals, and SK Innovation contribute to a competitive landscape, offering a wide range of solvent products and focusing on innovation, sustainability, and strategic partnerships to strengthen market presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Philippines industrial solvents market was valued at USD 66.19 million in 2024 and is projected to reach USD 109.75 million by 2032, growing at a CAGR of 6.53% during the forecast period.

- The global industrial solvents market was valued at USD 34,660.50 million in 2024 and is expected to reach USD 60,647.79 million by 2032, growing at a CAGR of 7.24% during the forecast period (2024-2032).

- Growing demand from industries such as paints and coatings, pharmaceuticals, and automotive fuels market growth.

- Technological advancements and the shift toward eco-friendly and bio-based solvents are key market drivers.

- Increasing government focus on infrastructure development boosts solvent demand in the construction sector.

- The market is witnessing a rise in demand for specialty solvents tailored to niche applications such as pharmaceuticals and electronics.

- Key players such as CNPC, Reliance Industries, and Formosa Plastics are strengthening their market position through product diversification and strategic partnerships.

- Regional demand is led by Metro Manila, with emerging growth in Cebu, Davao, and Northern Luzon, driven by industrial expansion and logistics improvements.

Report Scope

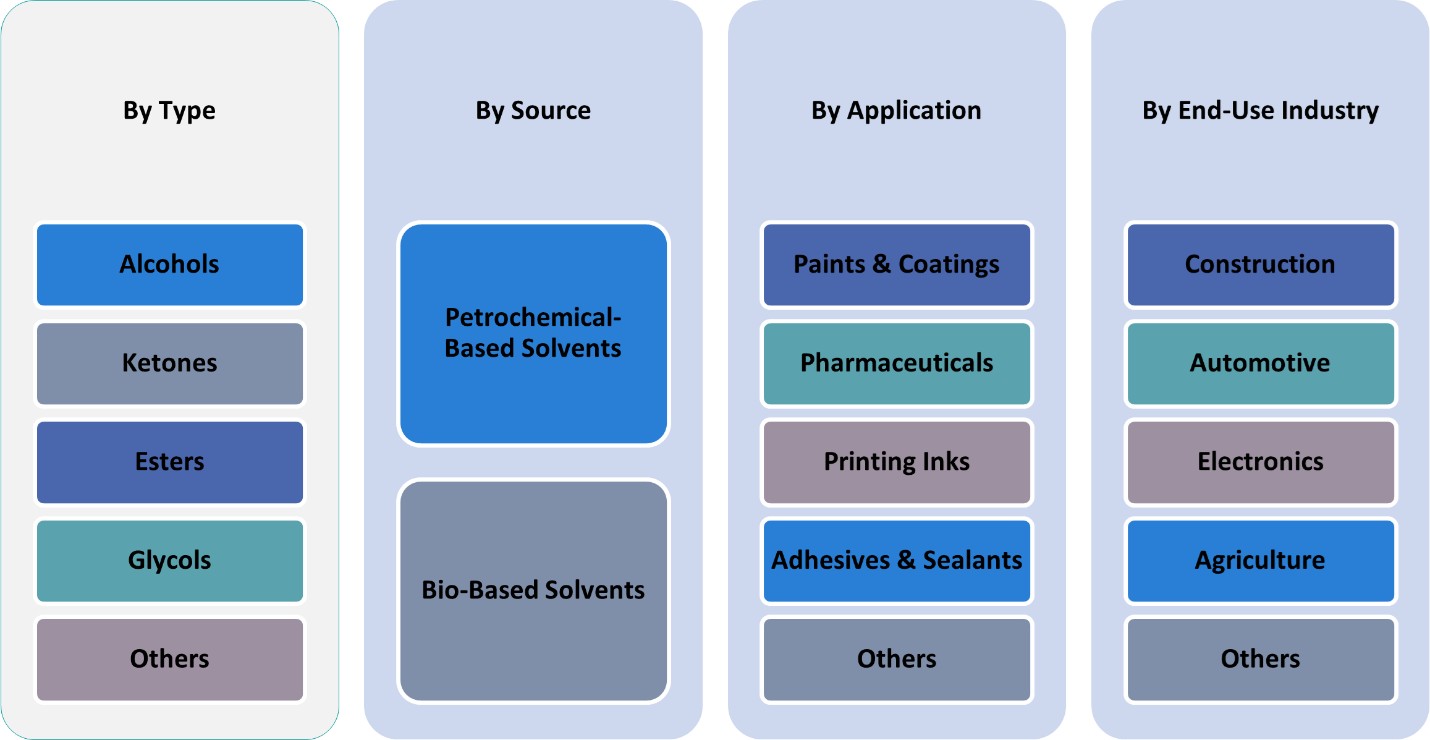

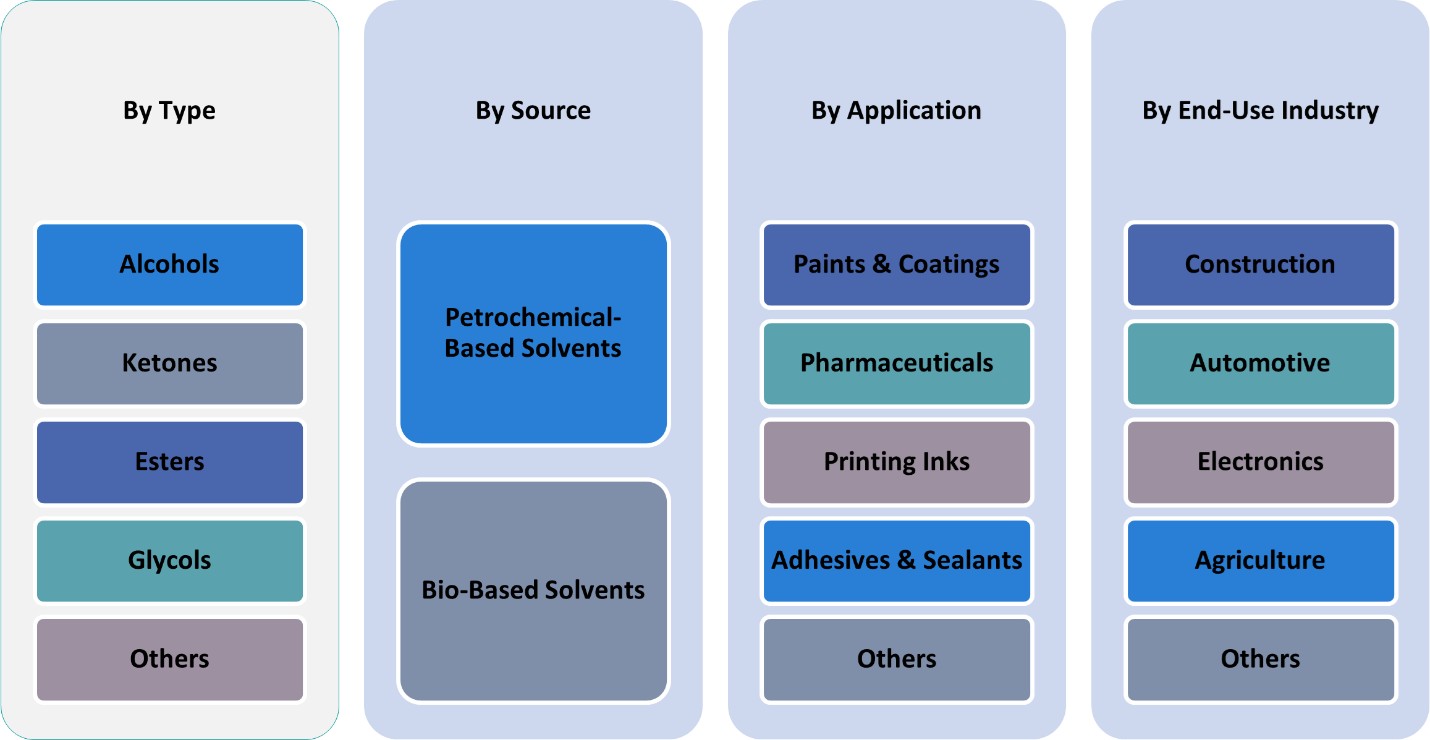

This report segments the Philippines Industrial Solvents market as follows:

Market Drivers

Growing Demand from End-Use Industries

The expansion of key end-use industries such as paints and coatings, adhesives, pharmaceuticals, and personal care is a primary driver of the industrial solvents market in the Philippines. For instance, according to the Philippine Statistics Authority (PSA), the manufacturing sector has shown steady growth, with increased production in chemical-based industries. As urbanization continues and the middle class grows, consumer demand for finished goods, including automobiles, electronics, and packaged products, has increased. These industries rely heavily on industrial solvents for manufacturing, cleaning, and processing operations. Solvents are critical in producing high-performance coatings, ink formulations, and adhesive systems, all of which see growing demand from both domestic and export markets. This trend positions industrial solvents as an essential input for various manufacturing chains, driving stable growth in the sector.

Infrastructure Development and Construction Boom

The Philippine government’s ongoing infrastructure initiatives, such as the “Build, Build, Build” program, have stimulated growth across construction-related sectors. For instance, the PSA’s Monthly Integrated Survey of Selected Statistics (MISSI) highlights increased production in construction materials, including sealants, waterproofing compounds, and coatings. Industrial solvents are vital in the production and application of construction materials such as sealants, waterproofing compounds, and coatings. The increased pace of road, bridge, housing, and commercial building construction has led to a surge in demand for these materials. Moreover, solvent-based paints and finishes are preferred in certain large-scale and high-performance applications, further bolstering consumption. With continued investments in real estate and infrastructure expected through 2032, the construction boom remains a significant growth engine for the industrial solvents market.

Rise of Manufacturing and Export Activities

The Philippines has seen robust growth in its manufacturing sector, driven by both domestic policies and foreign direct investment. Industrial solvents play a key role in manufacturing processes, from metal cleaning and degreasing to electronics assembly and textile production. As global brands expand operations or outsource to Philippine-based manufacturers, the demand for high-quality solvents increases. The country’s strategic location in Southeast Asia, combined with trade agreements and access to regional markets, positions it as a favorable manufacturing hub. This export-oriented growth not only elevates solvent consumption domestically but also encourages local solvent production and importation to meet quality and volume requirements.

Environmental Awareness and Shift to Green Solvents

A growing awareness of environmental impact and regulatory pressures has encouraged the shift toward eco-friendly and bio-based solvents. While traditional petroleum-based solvents remain dominant, there is rising demand for low-VOC (volatile organic compound) and biodegradable alternatives. This trend is supported by both government environmental policies and end-user preferences for sustainable practices. Industries are increasingly investing in research and development to adopt safer, greener formulations without compromising performance. Additionally, global sustainability standards for exports are pushing local manufacturers to incorporate environmentally compliant solvent technologies. This shift represents not only a market challenge but also an opportunity for innovation and product differentiation within the Philippines industrial solvents market.

Market Trends

Shift Towards Eco-Friendly and Bio-Based Solvents

The Philippines is experiencing a significant shift towards environmentally sustainable solvents, driven by stringent environmental regulations and growing awareness of green chemistry. For instance, according to a Pulse Asia survey, over 80% of Filipino consumers prefer eco-friendly products, indicating strong market support for sustainable solutions. Industries are increasingly adopting bio-based and low-VOC (volatile organic compound) solvents to reduce environmental impact and comply with regulatory standards. This trend is particularly evident in sectors such as paints and coatings, pharmaceuticals, and personal care products, where the demand for sustainable and biodegradable solvents is rising. The move towards eco-friendly solvents not only aligns with global sustainability goals but also opens new avenues for innovation in solvent formulations.

Technological Advancements in Solvent Recovery and Production

Technological innovations are playing a pivotal role in transforming the industrial solvents market in the Philippines. For instance, the Department of Science and Technology (DOST) has been actively promoting advancements in solvent recovery processes, such as distillation, filtration, and adsorption, enabling industries to recycle and reuse solvents, thereby reducing operational costs and environmental footprint. Additionally, the integration of digital technologies and automation in solvent production is enhancing efficiency, product quality, and safety. These technological strides are crucial for industries aiming to achieve sustainability targets and operational excellence.

Rising Demand for Specialty and High-Purity Solvents

The demand for specialty and high-purity solvents is on the rise in the Philippines, driven by the growing needs of industries such as pharmaceuticals, electronics, and biotechnology. These sectors require solvents with specific properties and high purity levels for applications like drug formulation, semiconductor manufacturing, and analytical testing. The increasing complexity of industrial processes and the emphasis on product quality are propelling the demand for tailored solvent solutions, encouraging manufacturers to invest in research and development to meet these specialized requirements.

Strategic Collaborations and Market Expansion Initiatives

To capitalize on emerging opportunities, companies in the Philippines are engaging in strategic collaborations, partnerships, and market expansion initiatives. These efforts aim to enhance product portfolios, technological capabilities, and market reach. By collaborating with global players and investing in local production facilities, companies are better positioned to meet the growing demand for industrial solvents across various sectors. Such strategic moves are instrumental in fostering innovation, ensuring supply chain resilience, and driving the overall growth of the industrial solvents market in the Philippines.

Market Challenges Analysis

Environmental Regulations and Compliance Pressure

One of the major challenges in the Philippines industrial solvents market is the increasing pressure from environmental regulations. For instance, the Department of Environment and Natural Resources (DENR) actively monitors industrial emissions through programs such as the Industrial Emission Monitoring Program (Bantay Tsimneya), which assesses compliance with air quality standards. As global and local authorities push for stricter emissions standards and reduced environmental impact, solvent manufacturers and end-users face the challenge of complying with evolving legal frameworks. Traditional solvents, particularly those derived from petroleum, are often associated with volatile organic compound (VOC) emissions and hazardous air pollutants (HAPs), which contribute to environmental degradation and health risks. To align with these standards, companies must invest heavily in reformulating products, upgrading production technologies, and enhancing waste management systems. This regulatory pressure can significantly increase operational costs and act as a barrier for small- to medium-sized enterprises that may lack the resources for rapid adaptation.

Raw Material Volatility and Supply Chain Constraints

Volatility in raw material prices and supply chain disruptions present another key obstacle to market stability and growth. Many solvents are petrochemical derivatives, making their pricing highly sensitive to fluctuations in global crude oil prices. This dependency exposes manufacturers to unpredictable cost structures, impacting profit margins and pricing strategies. Additionally, the Philippines, being an import-dependent nation for several industrial chemicals and raw materials, faces risks related to global shipping delays, import duties, and foreign exchange volatility. The COVID-19 pandemic, geopolitical tensions, and logistical bottlenecks have further underscored the vulnerability of global supply chains. These constraints can lead to inconsistent product availability, hinder production schedules, and strain relationships with downstream industries relying on timely solvent supply. Building more resilient local supply chains and diversifying sourcing strategies remain critical yet complex challenges for industry players.

Market Opportunities

The Philippines industrial solvents market presents promising opportunities driven by the country’s expanding industrial and manufacturing landscape. As key sectors such as automotive, construction, electronics, and packaging continue to grow, the demand for solvents used in adhesives, coatings, cleaning agents, and chemical processing is expected to rise steadily. The government’s support for infrastructure projects and the growing middle class are fueling consumption-driven industries, thereby increasing solvent usage across multiple applications. Additionally, foreign direct investments in manufacturing and industrial parks are contributing to the expansion of production capacity, which creates a ripple effect across the solvent supply chain. These developments provide local and international players with avenues to introduce a broader range of solvent products, enhance distribution networks, and establish long-term partnerships with end-user industries.

Moreover, there is a significant opportunity in the development and adoption of green and bio-based solvents as environmental regulations become more stringent and sustainability gains importance among consumers and businesses. Companies that innovate in low-VOC and eco-friendly formulations can gain a competitive edge, particularly in sectors such as pharmaceuticals, personal care, and food processing, where safety and compliance are critical. The growing awareness and demand for sustainable industrial practices open the door for new product lines that combine performance with environmental responsibility. Additionally, advancements in solvent recovery and recycling technologies present opportunities for companies to offer value-added services and improve resource efficiency. By focusing on technological innovation, product diversification, and regulatory alignment, market players in the Philippines can position themselves for long-term growth and resilience in the evolving industrial solvents landscape.

Market Segmentation Analysis:

By Type:

The industrial solvents market in the Philippines is segmented by type into alcohols, ketones, esters, glycols, and others. Among these, alcohols hold a significant market share due to their broad applicability, especially in cleaning agents, pharmaceuticals, and personal care products. Ethanol and isopropanol are particularly in demand for their effectiveness and lower toxicity. Ketones, such as acetone and methyl ethyl ketone (MEK), are widely used in the paints and coatings industry due to their rapid evaporation rates and strong solvency. Esters, including ethyl acetate and butyl acetate, are commonly used in printing inks and coatings, favored for their pleasant odor and moderate evaporation. Glycols, especially ethylene and propylene glycol, serve critical roles in the pharmaceutical and cosmetics sectors due to their hygroscopic and solvent properties. The “others” category includes hydrocarbons and chlorinated solvents, which are seeing declining use due to environmental concerns but remain relevant in specific industrial processes. Product innovation and environmental compliance are reshaping the preferences within each solvent type.

By Application:

Based on application, the industrial solvents market in the Philippines is segmented into paints & coatings, pharmaceuticals, printing inks, adhesives & sealants, and others. The paints and coatings segment is the dominant consumer of industrial solvents, driven by ongoing infrastructure development, housing projects, and automotive refinishing demand. Solvents in this segment enhance application properties and improve finish quality. Pharmaceuticals represent a high-growth area, with solvents used in drug formulation, sterilization, and extraction processes. The printing inks segment benefits from rising demand for packaging and labeling in the food and beverage industry, while adhesives and sealants use solvents to ensure proper bonding and durability in construction and consumer goods. The “others” segment includes agriculture, textiles, and industrial cleaning, where solvent demand is stable but niche. Each application sector contributes uniquely to overall solvent consumption, and as industrial output diversifies, so too will the demand for tailored solvent solutions across the Philippine market.

Segments:

Based on Type:

- Alcohols

- Ketones

- Esters

- Glycols

- Others

Based on Application:

- Paints & Coatings

- Pharmaceuticals

- Printing Inks

- Adhesives & Sealants

- Others

Based on End- Use:

- Construction

- Automotive

- Electronics

- Agriculture

- Others

Based on Source:

- Petrochemical-Based Solvents

- Bio-Based Solvents

Based on the Geography:

- Metro Manila

- Cebu

- Davao

- Northern Luzon

Regional Analysis

Metro Manila

Metro Manila holds the largest share of the Philippines industrial solvents market, accounting for approximately 42% of the total market. As the country’s primary economic and industrial hub, Metro Manila hosts a dense concentration of manufacturing facilities, including those in pharmaceuticals, paints and coatings, personal care products, and electronics. The high demand for industrial solvents in this region is driven by the presence of numerous production plants, research and development centers, and industrial zones. Additionally, Metro Manila’s well-established distribution networks, proximity to international ports, and accessibility to raw materials contribute to its dominant market position. The ongoing urban development and infrastructure upgrades further fuel the need for solvent-based construction materials and coatings, ensuring sustained solvent consumption in the region.

Cebu

Cebu accounts for approximately 21% of the Philippines industrial solvents market and serves as the key economic center in the Visayas region. The growing number of manufacturing and packaging industries, especially in the food and beverage sector, drives solvent usage in Cebu. The rise of export processing zones and increasing investments in industrial estates across the province are also contributing to market growth. In addition, Cebu’s strategic location and seaport access make it an ideal logistics and trade hub, supporting the importation and distribution of industrial solvents across the central Philippines. The region is witnessing a steady increase in solvent demand from small and medium-scale enterprises engaged in adhesive manufacturing, printing, and automotive repair, making it a vital contributor to the overall market.

Davao

Davao commands a market share of around 18% and is the leading industrial center in Mindanao. With agriculture and agri-processing industries playing a significant role in the region, solvents are used extensively in cleaning, processing, and packaging applications. Furthermore, the local government’s initiatives to attract more industrial and pharmaceutical investments have led to the expansion of manufacturing activities. Davao’s infrastructure improvements and rising demand for construction-related materials also support the growth of the paints and coatings segment. The solvent market in this region is poised for moderate but steady growth, especially with the planned development of industrial parks and special economic zones.

Northern Luzon

Northern Luzon represents approximately 19% of the total market share and is gaining momentum as a secondary industrial zone. The region benefits from increasing industrial decentralization, as businesses look beyond Metro Manila to expand operations. Northern Luzon has seen growth in automotive parts manufacturing, textiles, and agricultural processing—all of which utilize industrial solvents in various capacities. The region’s connectivity improvements, such as new expressways and expanded logistics infrastructure, support easier movement of raw materials and finished products. With ongoing industrial investment and rising regional demand, Northern Luzon is expected to play a growing role in shaping the future of the country’s industrial solvents market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Philippines National Petroleum Corporation (CNPC)

- Formosa Plastics Corporation

- Reliance Industries Limited

- Sinopec Group

- Mitsubishi Chemical Holdings Corporation

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- LG Chem Ltd.

- Tata Chemicals Ltd.

- SK Innovation Co., Ltd.

Competitive Analysis

The competitive landscape of the Philippines industrial solvents market is marked by both global and local players, each striving to capitalize on growing demand across various sectors. Leading players include Philippines National Petroleum Corporation (CNPC), Formosa Plastics Corporation, Reliance Industries Limited, Sinopec Group, Mitsubishi Chemical Holdings Corporation, Sumitomo Chemical Co., Ltd., Toray Industries, Inc., LG Chem Ltd., Tata Chemicals Ltd., and SK Innovation Co., Ltd. These companies are actively engaged in expanding their product portfolios, focusing on sustainable and bio-based solvent solutions to meet regulatory demands and consumer preferences. Companies are investing heavily in research and development to offer specialized solvent products that cater to niche industries, including pharmaceuticals, electronics, and high-performance coatings. Additionally, firms are expanding their regional presence through strategic partnerships and local manufacturing to capitalize on the growing demand in emerging markets like Cebu, Davao, and Northern Luzon. Strong distribution networks and logistical capabilities are crucial for ensuring timely product availability and maintaining customer loyalty. The increasing emphasis on sustainability and the circular economy is pushing market players to innovate, offering products that align with both environmental regulations and consumer preferences for greener solutions. Competition in the market is driven not only by product quality and pricing but also by a company’s ability to adapt to rapidly changing consumer and regulatory trends.

Recent Developments

- In April 2025, Eastman announced off-list price increases for several EOD (Ethylene Oxide Derivatives) solvents, including Eastman™ DB Solvent, effective April 7, 2025, reflecting ongoing cost and market pressures.

- In March 2025, BASF reported generating approximately €11 billion in 2024 sales from products launched in the past five years, driven by R&D focused on sustainability, biodegradable materials, and digital transformation. The company filed 1,159 new patents in 2024, with 45% targeting sustainability. R&D investment in 2024 was €2.1 billion, with a similar budget planned for 2025.

- In March and April 2025, Shell is restructuring its global chemicals business to boost profitability and reduce capital spending by 2030. This includes exploring strategic partnerships in the U.S., potentially closing some European assets, and selling existing assets like the Singapore refinery and chemical complex. The company aims to streamline operations, focus on core businesses, and improve returns for shareholders.

- In March 2025, BASF is expanding its production capacity for aminic antioxidants at its Puebla, Mexico site, targeting the growing demand for long-life lubricants. The project is set for completion in 2026.

- In March 2025, ExxonMobil announced a $100 million upgrade to its Baton Rouge, Louisiana plant to produce ultra-high-purity (99.999%) isopropyl alcohol (IPA) for the semiconductor industry by 2027.

- InMarch 2024, Dow announced plans to invest in new ethylene derivatives capacity-including carbonate solvents-on the U.S. Gulf Coast. This investment, supported by the U.S. Department of Energy, aims to supply carbonate solvents for lithium-ion batteries, supporting the domestic EV and energy storage market. The facility will capture over 90% of CO₂ from ethylene oxide production, aligning with sustainability goals.

Market Concentration & Characteristics

The Philippines industrial solvents market exhibits moderate concentration, with a mix of both local and international players competing for market share. The market is characterized by the presence of large multinational companies that offer a wide range of solvent products, leveraging their global supply chains, technological expertise, and strong distribution networks. However, local players also maintain a solid foothold, particularly in regional markets, due to their deep understanding of local industry needs and cost advantages. The market is highly competitive, with companies focusing on product innovation, including eco-friendly and bio-based solvents, to meet growing environmental and regulatory demands. Additionally, there is an increasing emphasis on specialty solvents tailored for specific applications such as pharmaceuticals, electronics, and adhesives. As a result, while competition remains fierce, opportunities exist for differentiation through sustainability, advanced product formulations, and strategic collaborations, driving ongoing market growth and diversification.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Philippines industrial solvents market is expected to continue growing due to rising demand from key sectors like paints and coatings, pharmaceuticals, and automotive.

- Increased government investments in infrastructure and construction projects will drive the demand for solvents in the construction industry.

- The shift toward sustainable, eco-friendly, and bio-based solvents will continue to shape product development and innovation.

- The demand for high-purity solvents in pharmaceuticals, biotechnology, and electronics will expand as these industries grow.

- Advances in solvent recovery and recycling technologies will provide cost-saving and environmental benefits to solvent users.

- Regional markets such as Cebu, Davao, and Northern Luzon will witness steady growth as industrial activities spread outside Metro Manila.

- Companies will focus on improving supply chain resilience and distribution networks to meet rising solvent demand in remote areas.

- Regulatory pressures on VOC emissions and environmental sustainability will push for further development of low-VOC and biodegradable solvents.

- Strategic partnerships and collaborations will remain crucial for expanding market reach and ensuring product differentiation.

- The growing adoption of automation and digital technologies in solvent production processes will enhance operational efficiency and product quality.