Market Overview

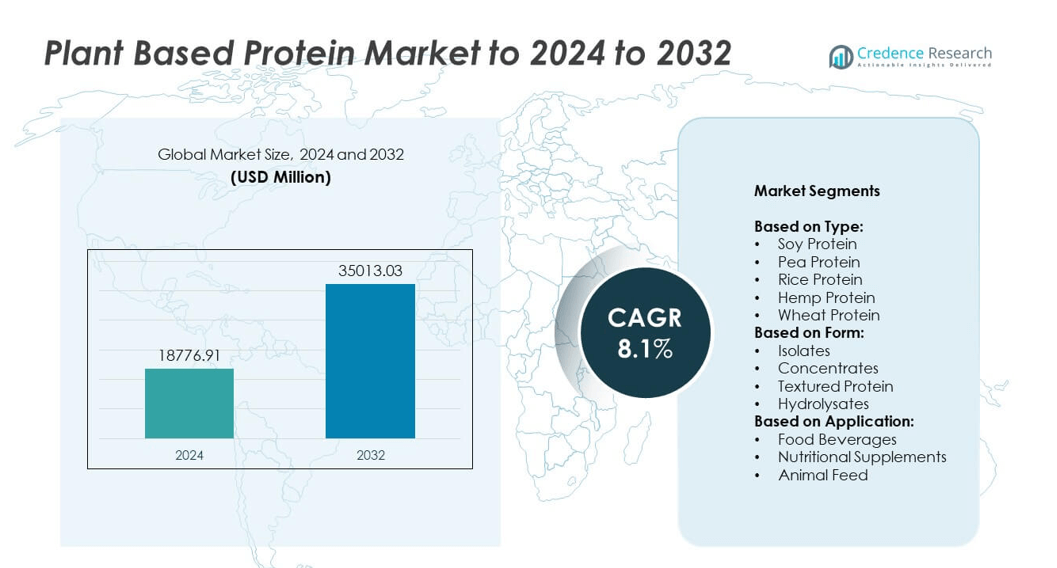

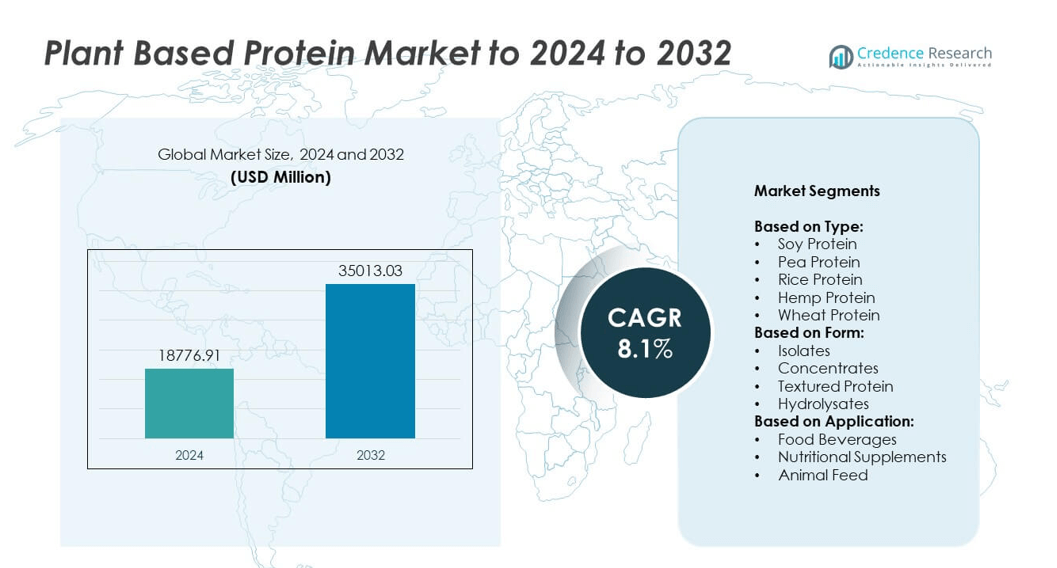

Plant Based Protein Market size was valued at USD 18,776.91 million in 2024 and is anticipated to reach USD 35,013.03 million by 2032, at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plant Based Protein Market Size 2024 |

USD 18,776.91 million |

| Plant Based Protein Market, CAGR |

8.1% |

| Plant Based Protein Market Size 2032 |

USD 35,013.03 million |

The plant-based protein market features leading players such as Nestle, Cargill, Pulse Canada, Beyond Meat, Quorn Foods, Unilever, ADM, Impossible Foods, DuPont, Soja Protein, Kraft Heinz, MGP Ingredients, Friendly Farms, Pea Protein Association, and Oatly. These companies focus on expanding product portfolios, improving taste and texture, and scaling production to meet growing demand. Strategic collaborations, acquisitions, and investment in sustainable sourcing strengthen their market position. North America leads the market with over 38% share, driven by strong consumer adoption, product innovation, and retail availability, followed by Europe and Asia Pacific with significant growth potential.

Market Insights

- The plant-based protein market was valued at USD 18,776.91 million in 2024 and is projected to reach USD 35,013.03 million by 2032, growing at a CAGR of 8.1%.

- Growth is driven by rising health awareness, demand for sustainable protein sources, and shifting consumer preference toward meat alternatives.

- Key trends include innovation in protein isolates, textured protein for meat analogs, and increasing clean-label and allergen-free product launches.

- The market is highly competitive with global players focusing on R&D, strategic partnerships, and capacity expansion to strengthen their market presence.

- North America leads with over 38% share, followed by Europe at 30% and Asia Pacific at 22%, while soy protein dominates by type with over 40% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Soy protein dominated the plant-based protein market in 2024, capturing over 40% share due to its high protein content, wide availability, and cost-effectiveness. Soy protein is extensively used in meat analogs, dairy alternatives, and functional foods, supported by its complete amino acid profile and favorable digestibility. Pea protein is growing rapidly, driven by rising demand for allergen-free and non-GMO options. Rice and hemp proteins are niche but gaining traction in sports nutrition and clean-label products. Wheat protein maintains steady demand in bakery applications, particularly in Europe and Asia.

- For instance, Roquette opened a 200,000-square-foot pea protein plant in Portage la Prairie, Manitoba, in November 2021. The facility was reported to have an annual processing capacity of 125,000 tons of yellow peas. This plant, combined with Roquette’s existing facility in France, brought the company’s total annual pea processing capacity to 250,000 tons.

By Form

Protein isolates accounted for the largest share, holding more than 45% of the market in 2024. Their dominance is driven by high purity levels, superior solubility, and application versatility in beverages, nutritional supplements, and meat alternatives. Protein concentrates follow closely, supported by cost efficiency and moderate protein levels suitable for bakery and snack formulations. Textured protein is gaining demand as a key ingredient for plant-based meat products, offering meat-like texture and chewiness. Hydrolysates serve niche segments, including sports nutrition and medical foods, where faster absorption and digestibility are required.

- For instance, in May 2022, Cargill announced it would build a new soybean processing plant in Pemiscot County, Missouri, with an annual capacity of 1.7 million metric tons. The company also operates numerous other soybean processing facilities globally, including an expanded plant in Sidney, Ohio, which helps serve the food sector

By Application

Food and beverages led the plant-based protein market, contributing over 55% share in 2024. Growth is supported by strong consumer demand for meat alternatives, dairy substitutes, and protein-enriched snacks. Nutritional supplements represent the second-largest segment, fueled by rising interest in sports nutrition and functional health products. The animal feed segment is growing steadily as plant-based proteins are adopted as sustainable and cost-effective alternatives to soymeal and fishmeal. The increasing shift toward flexitarian diets and rising investments from food manufacturers are expected to further strengthen the food and beverage segment.

Market Overview

Rising Health and Wellness Awareness

Growing consumer focus on health and wellness is the primary growth driver, contributing significantly to market expansion. Consumers increasingly seek plant-based proteins for their benefits in weight management, heart health, and overall nutrition. The shift from animal-based to plant-based diets is driven by concerns over cholesterol, lactose intolerance, and sustainability. This trend is supported by social media influence and the growing availability of fortified and functional products. Food companies are investing heavily in R&D to create high-quality plant protein offerings, strengthening market penetration.

- For instance, the Crespel & Deiters Group processes approximately 380,000 metric tons of wheat annually at its headquarters in Ibbenbüren, Germany. This volume of wheat is separated into multiple components, including wheat starches and wheat proteins. These ingredients are then used in a wide variety of food, feed, and technical applications, including for the bakery and confectionery sectors.

Sustainability and Ethical Consumption

Environmental concerns and ethical considerations are major drivers in the plant-based protein market. Consumers are choosing sustainable food sources to reduce carbon footprint, conserve resources, and support animal welfare. Plant-based proteins offer lower greenhouse gas emissions and reduced water use compared to animal protein production. This shift aligns with global initiatives for net-zero emissions and sustainable agriculture. Leading brands are focusing on transparent supply chains and eco-friendly production practices to appeal to conscious buyers and regulatory bodies, further accelerating market adoption worldwide.

- For instance, Perfect Day’s life-cycle assessment shows its animal-free whey protein uses 96-99% less blue water than conventional bovine milk protein.

Expanding Product Portfolio and Innovation

Innovation in product formulation and processing technology is a crucial driver for market growth. Companies are launching diverse plant-based protein solutions with improved taste, texture, and nutritional profile to meet consumer preferences. The development of functional beverages, protein-rich snacks, and meat alternatives is fueling demand across demographics. Collaborations between food tech companies and manufacturers are enhancing scalability and affordability. The entry of major FMCG players and retailers into the market is broadening availability and consumer reach, thereby driving consistent growth in this competitive segment.

Key Trends & Opportunities

Rising Flexitarian and Vegan Population

The growing flexitarian and vegan population presents a significant opportunity for the market. Consumers are adopting partial or complete plant-based diets, encouraging demand for innovative protein solutions. Restaurants and retailers are expanding plant-based menus to capture this trend. Startups and established brands are targeting this audience with clean-label, allergen-free, and fortified offerings. The trend is especially strong among millennials and Gen Z, who value health, sustainability, and ethical choices. This demographic shift is expected to sustain market growth in the coming years.

- For instance, in October 2023, Benson Hill announced it would sell its soy crushing facility in Seymour, Indiana, to White River Soy Processing for approximately $36 million in gross proceeds.

Technological Advancements in Protein Extraction

Advances in protein extraction and processing technology are unlocking opportunities for improved product quality and variety. Techniques such as wet fractionation, enzymatic hydrolysis, and precision fermentation are enhancing protein purity, texture, and flavor. These advancements enable manufacturers to create products that closely mimic animal-based protein taste and functionality. This innovation is key to increasing consumer acceptance and repeat purchases. Technology-driven efficiency also lowers production costs, making plant-based proteins more affordable and competitive in mainstream markets.

- For instance, Nectar’s “Taste of the Industry 2025” report, which evaluated 122 plant-based products with over 2,600 omnivores in blind taste tests, found that on average, only 30% of respondents rated a plant-based product as “like very much” or “like,” compared to 68% for conventional meat.

Key Challenges

High Production Costs and Price Sensitivity

High production costs remain a challenge, limiting affordability and consumer adoption in price-sensitive regions. Advanced processing methods, sourcing of high-quality raw materials, and product fortification increase costs. While demand is growing, plant-based proteins are still priced higher than conventional animal proteins. This price gap can deter mass-market penetration, particularly in developing economies. Manufacturers are focusing on scaling production, optimizing supply chains, and using cost-efficient technologies to reduce prices and appeal to a broader consumer base over the forecast period.

Taste and Texture Limitations

Taste and texture challenges continue to hinder wider acceptance of plant-based proteins. Consumers often find plant protein products lacking the flavor or mouthfeel of animal-based alternatives. This issue is especially relevant in meat and dairy replacement categories, where sensory experience is critical. Ongoing R&D is focused on improving flavor masking, enhancing texture, and creating more authentic eating experiences. Companies that successfully address these challenges are likely to capture stronger market share and drive consumer loyalty, supporting long-term growth.

Regional Analysis

North America

North America held the largest share of over 38% in the plant-based protein market in 2024. The region’s dominance is driven by high adoption of meat alternatives, strong presence of major players, and rising health-conscious consumers. The U.S. leads demand with robust retail availability, product innovation, and government support for sustainable protein production. Canada is also witnessing steady growth, supported by clean-label trends and expanding vegan population. Growing investments in food technology and the presence of large-scale manufacturing facilities are expected to maintain North America’s leading position throughout the forecast period.

Europe

Europe accounted for around 30% of the plant-based protein market in 2024. Demand is supported by strict sustainability regulations, strong vegetarian culture, and innovation in plant-based dairy and meat products. Countries like Germany, the UK, and France lead consumption, driven by health awareness and climate-conscious food choices. The European Union’s focus on reducing meat consumption to cut carbon emissions is further boosting plant-based adoption. Continuous product launches and expansion of private-label offerings in retail are fueling growth. The region is expected to maintain steady expansion with rising consumer preference for high-quality, allergen-free protein sources.

Asia Pacific

Asia Pacific captured nearly 22% share of the plant-based protein market in 2024 and is the fastest-growing region. Rising disposable incomes, urbanization, and growing awareness about plant-based diets are driving demand. China and India dominate the market, with increasing investments in local production and distribution networks. Japan and South Korea contribute significantly due to their focus on functional foods and innovative protein beverages. The region benefits from a large vegetarian population and government initiatives promoting alternative proteins for food security. Expanding e-commerce channels and partnerships with global brands are further strengthening regional market growth.

Latin America

Latin America held approximately 6% share of the plant-based protein market in 2024. Growth is supported by increasing awareness of healthy eating and rising popularity of vegetarian and vegan diets. Brazil and Mexico lead the region, driven by expanding food processing industries and adoption of plant protein in beverages and snacks. Rising demand from younger populations and government initiatives for promoting sustainable agriculture are key contributors. However, price sensitivity and limited product availability in rural areas remain challenges. Expanding retail distribution and product innovation are expected to boost market penetration across Latin America in the coming years.

Middle East and Africa

The Middle East and Africa accounted for around 4% of the plant-based protein market in 2024. Demand is gradually increasing due to urbanization, growing health awareness, and adoption of plant-based diets among younger populations. South Africa and the UAE are leading markets, supported by rising investments in retail and foodservice sectors. The region faces challenges from high prices and limited awareness in rural areas but presents strong potential with growing interest in protein-fortified foods. Companies are focusing on expanding distribution networks and introducing affordable product lines to capture untapped opportunities and accelerate regional market growth.

Market Segmentations:

By Type:

- Soy Protein

- Pea Protein

- Rice Protein

- Hemp Protein

- Wheat Protein

By Form:

- Isolates

- Concentrates

- Textured Protein

- Hydrolysates

By Application:

- Food Beverages

- Nutritional Supplements

- Animal Feed

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the plant-based protein market features key players such as Nestle, Cargill, Pulse Canada, Beyond Meat, Quorn Foods, Unilever, ADM, Impossible Foods, DuPont, Soja Protein, Kraft Heinz, MGP Ingredients, Friendly Farms, Pea Protein Association, and Oatly. These companies compete through product innovation, strategic partnerships, and investments in research and development to enhance taste, texture, and nutritional quality of plant-based protein products. Market participants are expanding production capacities and strengthening distribution networks to meet growing global demand. Many are focusing on sustainable sourcing and clean-label offerings to align with consumer preferences. Mergers, acquisitions, and collaborations with food-tech firms are common strategies to broaden portfolios and accelerate innovation. Players are also investing in marketing campaigns to educate consumers and build brand loyalty. The competitive intensity is expected to remain high, driving continuous product improvements and supporting market expansion across diverse end-use segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nestle

- Cargill

- Pulse Canada

- Beyond Meat

- Quorn Foods

- Unilever

- ADM

- Impossible Foods

- DuPont

- Soja Protein

- Kraft Heinz

- MGP Ingredients

- Friendly Farms

- Pea Protein Association

- Oatly

Recent Developments

- In 2024, Beyond Meat introduced its Beyond Sun Sausage lineup, made from yellow peas, brown rice, red lentils, and faba beans.

- In 2024, Impossible Foods rebranded to emphasize a “meatier, taste-first” approach to compete with traditional meat products directly.

- In 2023, Archer Daniels Midland (ADM) partnered with food technology company Marel to establish an alternative protein innovation center in the Netherlands.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising demand for plant-based diets.

- Product innovation will focus on improving taste, texture, and nutritional profiles.

- Adoption will expand in emerging economies with growing health-conscious populations.

- Investments in sustainable sourcing and production will strengthen industry reputation.

- Food manufacturers will introduce more clean-label and allergen-free protein options.

- Retail and e-commerce channels will play a key role in product availability.

- Collaborations between food tech firms and producers will accelerate product development.

- Flexitarian diets will remain a major driver of market expansion worldwide.

- Competitive intensity will increase, encouraging cost optimization and pricing strategies.

- Continuous R&D will create opportunities in functional foods and new applications.