Market Overview

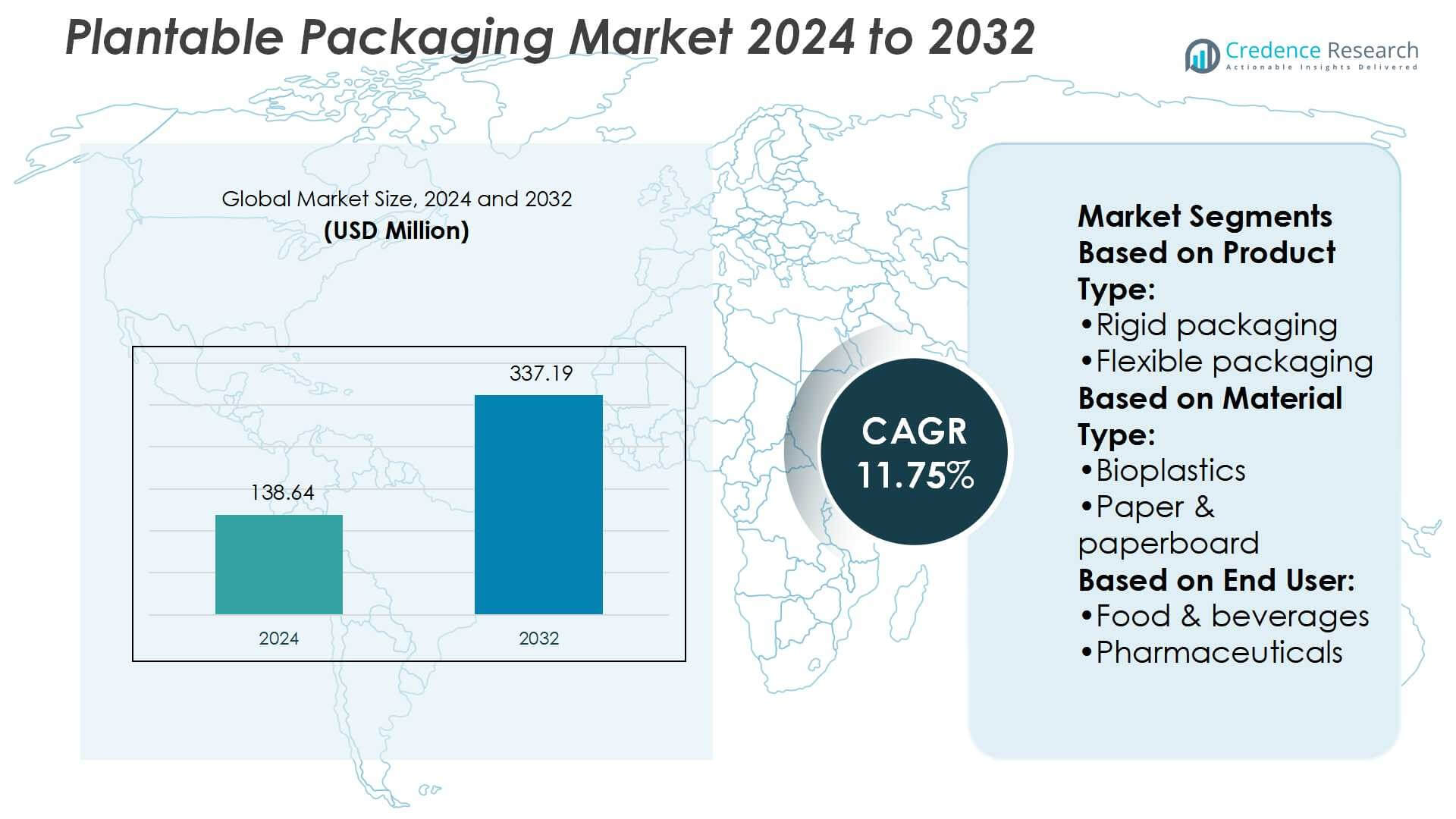

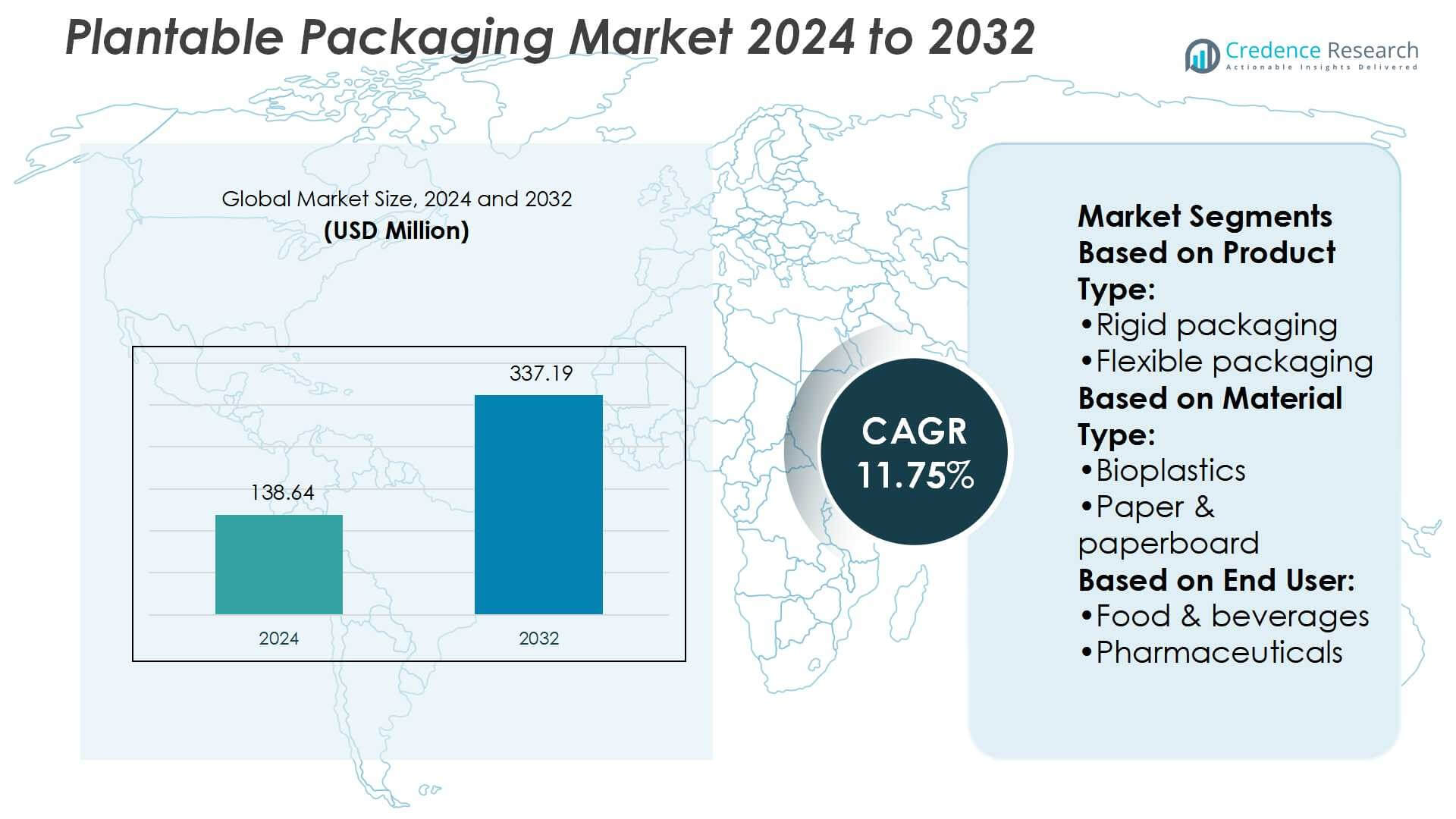

Plantable Packaging Market size was valued USD 138.64 million in 2024 and is anticipated to reach USD 337.19 million by 2032, at a CAGR of 11.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plantable Packaging Market Size 2024 |

USD 138.64 Million |

| Plantable Packaging Market, CAGR |

11.75% |

| Plantable Packaging Market Size 2032 |

USD 337.19 Million |

The plantable packaging market is shaped by prominent players including Amcor PLC, Mondi, Tetra Pak International SA, International Paper Company, DS Smith, Clearwater Paper Corporation, Kruger Inc., SmartSolve Industries, Hogör Plastik, and Riverside Paper Co. Inc. These companies focus on innovation in biodegradable materials, seed-infused designs, and recyclable paperboard solutions to strengthen market positioning. Strategic investments in research, partnerships, and eco-friendly product lines enable them to meet rising demand across food, pharmaceutical, and personal care sectors. Regionally, North America leads the market with a 34% share in 2024, supported by strict regulations, advanced recycling infrastructure, and high consumer preference for sustainable packaging solutions.

Market Insights

Market Insights

- The Plantable Packaging Market was valued at USD 138.64 million in 2024 and is projected to reach USD 337.19 million by 2032, growing at a CAGR of 11.75%.

- Rising demand for eco-friendly packaging in food and beverages, which holds the largest segment share, is a key driver supported by regulatory bans on single-use plastics.

- Market players focus on trends such as seed-infused designs, recyclable paperboard solutions, and bioplastic innovations to strengthen their competitive edge.

- High production costs and limited composting infrastructure remain major restraints, slowing adoption in cost-sensitive and underdeveloped markets.

- Regionally, North America leads with a 34% share in 2024, supported by advanced recycling systems, while Europe follows with strong adoption in premium cosmetics and food sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The plantable packaging market is segmented into rigid and flexible formats, with flexible packaging holding the dominant share of 62% in 2024. Flexible solutions are preferred for their lightweight structure, lower material use, and adaptability across multiple industries. Rising demand for eco-friendly pouches, wraps, and sachets in food and personal care sectors drives this growth. In contrast, rigid packaging maintains relevance in premium products requiring higher durability. However, cost efficiency, reduced carbon footprint, and easy customization continue to strengthen the market position of flexible packaging over the forecast period.

- For instance, SmartSolve Industries has developed a range of 100% water-soluble packaging films and papers that dissolve quickly in water when agitated, eliminating solid waste and ensuring rapid biodegradability for various single-use flexible applications.

By Material Type

Among materials, paper and paperboard dominate with 48% market share in 2024, driven by their recyclability, biodegradability, and strong regulatory acceptance. These materials offer excellent printability, enabling branding advantages, and are widely used in food and beverages. Bagasse and bamboo are gaining traction as renewable substitutes, appealing to sustainable packaging initiatives. Bioplastics show steady growth, supported by innovation in plant-derived polymers. Yet, paperboard’s balance of cost-effectiveness, strength, and consumer acceptance cements its leadership position in the plantable packaging market.

- For instance, Clearwater Paper Corporation operates facilities capable of producing approximately 820,000 tons of bleached paperboard annually to support sustainable packaging applications.

By End User

The food and beverages segment accounts for the largest share at 54% in 2024, driven by rising demand for sustainable packaging in dairy, bakery, and ready-to-eat products. Consumers increasingly prefer compostable and plant-based solutions to reduce plastic waste. Regulatory frameworks banning single-use plastics further support this segment’s leadership. Pharmaceuticals and personal care sectors are adopting plantable packaging for eco-friendly branding, while industrial use remains limited but promising. Strong consumer awareness and retailer initiatives in the food industry continue to anchor this segment’s dominance in the global market.

Key Growth Drivers

Rising Consumer Demand for Sustainable Packaging

Growing environmental awareness is driving consumers to prefer eco-friendly alternatives over traditional plastics. Plantable packaging addresses this need by offering compostable and biodegradable solutions that reduce landfill waste. Food and beverage companies are rapidly adopting plant-based packaging to align with customer expectations and brand positioning. Governments supporting single-use plastic bans further accelerate adoption. As sustainability becomes a key purchase factor, demand for plantable packaging strengthens across multiple industries, making it a significant growth driver in this market.

- For instance, Riverside Paper Co. offers double-wall corrugated boxes rated as “450 lb test” for one of its stock moving boxes (56 × 10 × 32 inches). The firm provides thousands of box sizes and many styles with custom-manufactured corrugated products tailored to specified needs.

Government Regulations and Plastic Bans

Stringent global regulations targeting plastic waste are propelling the demand for plantable packaging. Several countries have introduced bans on single-use plastics and implemented strict recycling targets, creating opportunities for biodegradable alternatives. Plantable packaging materials such as paperboard, bagasse, and bamboo meet these compliance requirements while offering cost efficiency. Incentives for sustainable manufacturing and eco-label certifications also promote adoption. Regulatory alignment across major markets positions plantable packaging as a compliant and future-ready solution, reinforcing its growth trajectory during the forecast period.

- For instance, DS Smith has replaced over 1.2 billion pieces of plastic via its plastic replacement initiative, including removing plastic from fruit and vegetable punnets, carriers, and shrink wrap, supported by more than 800 designers trained in Circular Design Metrics to assess recycled content, excess waste, and CO₂ emissions.

Innovation in Material Development

Continuous advancements in material science are enhancing the performance of plantable packaging. Manufacturers are investing in bioplastics, bamboo composites, and bagasse-based solutions that offer strength, durability, and moisture resistance. Improved printability and customization options support branding and consumer engagement. Research into compostable polymers and seed-infused packaging is expanding applications across food, pharmaceuticals, and personal care sectors. These innovations reduce reliance on conventional plastics while improving product appeal. As companies scale production of high-performing eco-materials, innovation becomes a central driver of market expansion.

Key Trends & Opportunities

Expansion in Food and Beverage Applications

The food and beverage sector remains the largest adopter of plantable packaging due to sustainability mandates and rising consumer demand. Flexible pouches, seed-infused wraps, and biodegradable containers are gaining popularity in bakery, dairy, and ready-to-eat products. Retailers and quick-service restaurants are embracing eco-friendly packaging to build brand loyalty and comply with regulations. The growing trend toward convenience foods further supports this opportunity, as companies seek packaging that balances sustainability, safety, and cost-effectiveness, strengthening the role of plantable packaging in mainstream food retail.

- For instance, Amcor has ensured that over 94% of its flexible packaging portfolio by area has a recycle-ready solution available, and that more than 95% of its rigid packaging by weight is recyclable in practice and at scale.

Emergence of Premium and Customizable Packaging

Plantable packaging is increasingly seen as a tool for brand differentiation. Companies are adopting seed-infused boxes, printed paperboard, and customized bamboo solutions to enhance consumer experiences. Premium personal care and cosmetic brands leverage plantable packaging for sustainability positioning and consumer engagement through “grow after use” concepts. Digital printing innovations allow personalization, seasonal designs, and small-batch runs that appeal to niche and luxury markets. This trend represents a strong opportunity for manufacturers to expand into high-margin segments with eco-friendly and creative packaging solutions.

- For instance, Mondi assessed 1,776 products using its in-house life-cycle tools, calculating 224 individual product carbon footprints.Mondi decreased its waste to landfill per production unit by 4%, contributing to an overall reduction of 46% relative to its baseline.

Key Challenges

High Production and Material Costs

The cost of producing plantable packaging remains higher than conventional plastics or paper alternatives. Bioplastics, bamboo, and bagasse materials often require specialized processing and infrastructure, raising manufacturing expenses. Small and medium enterprises face barriers in adopting these solutions due to limited capital and higher unit costs. While economies of scale may reduce prices in the long term, current cost challenges hinder widespread adoption. Competitive price pressure from traditional packaging formats continues to challenge the growth potential of plantable packaging in price-sensitive markets.

Limited Awareness and Infrastructure

Consumer and industry awareness about plantable packaging is still limited in several regions. Many markets lack the necessary composting or recycling infrastructure to fully realize the environmental benefits. Inadequate education on how to use or dispose of seed-infused packaging can reduce its effectiveness. Additionally, industrial buyers remain cautious about switching due to perceived risks around durability, supply chain availability, and scalability. Without robust awareness campaigns and supporting infrastructure, adoption rates of plantable packaging may grow slower than projected in certain geographies.

Regional Analysis

North America

North America accounts for 34% of the plantable packaging market in 2024, driven by strong regulatory frameworks and consumer preference for eco-friendly products. The United States leads adoption, supported by bans on single-use plastics and corporate sustainability initiatives. Food and beverage companies are the primary users, followed by personal care brands promoting eco-conscious packaging. Investment in bioplastics and advanced compostable materials further accelerates growth. Canada’s focus on circular economy policies also supports market expansion. With established infrastructure and high consumer awareness, North America remains a key revenue-generating region for plantable packaging solutions.

Europe

Europe holds 29% market share in 2024, reflecting the region’s stringent environmental regulations and leadership in sustainable packaging innovation. Countries such as Germany, France, and the U.K. are at the forefront, with strong adoption in both food packaging and premium cosmetics. The European Union’s Green Deal and directives targeting plastic reduction drive significant demand. Bagasse, paperboard, and bamboo-based materials are widely accepted due to high recycling rates. Brand owners increasingly use plantable packaging to align with eco-labeling and carbon neutrality goals. Europe’s policy-driven landscape positions it as a mature and innovation-driven market for plantable packaging.

Asia-Pacific

Asia-Pacific represents 24% of the global market in 2024, supported by rising consumer awareness and government-led initiatives against plastic waste. Countries like China, India, and Japan drive adoption, particularly in food and beverage sectors. India’s policies on single-use plastic bans create strong growth prospects for biodegradable alternatives. Increasing urbanization and e-commerce expansion fuel demand for lightweight, flexible packaging solutions. While infrastructure for large-scale composting is still developing, high population density and consumer shifts toward sustainable lifestyles make Asia-Pacific a fast-growing market. Manufacturers are also expanding local production capacity to meet regional sustainability requirements.

Latin America

Latin America accounts for 7% of the plantable packaging market in 2024, with growth driven by increasing environmental regulations and consumer interest in sustainable products. Brazil and Mexico lead adoption, supported by government campaigns against plastic pollution. The food and beverage industry, particularly fresh produce and beverages, is the main end-user segment. Despite limited infrastructure, rising eco-conscious consumer groups and regional startups are driving demand for plantable packaging. Challenges remain with cost and scalability, but growing alignment with global sustainability practices ensures steady adoption across Latin American markets in the coming years.

Middle East & Africa

The Middle East & Africa region holds a 6% market share in 2024, reflecting its early-stage adoption of sustainable packaging solutions. South Africa, the UAE, and Saudi Arabia show the strongest growth, driven by regulatory reforms and rising consumer preference for green products. The food and pharmaceutical industries are gradually adopting biodegradable and plantable packaging to align with sustainability commitments. Infrastructure challenges and higher costs remain barriers, but rising investments in eco-friendly materials present opportunities. With increasing awareness and government-led initiatives, the region is projected to register steady growth in plantable packaging adoption.

Market Segmentations:

By Product Type:

- Rigid packaging

- Flexible packaging

By Material Type:

- Bioplastics

- Paper & paperboard

By End User:

- Food & beverages

- Pharmaceuticals

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The plantable packaging market features a competitive landscape shaped by leading players such as SmartSolve Industries, Clearwater Paper Corporation, Kruger Inc., Hogör Plastik, Riverside Paper Co. Inc., DS Smith, Amcor PLC, International Paper Company, Tetra Pak International SA, and Mondi. The plantable packaging market is highly competitive, characterized by continuous innovation, sustainability-driven strategies, and expanding product portfolios. Companies are investing in research and development to enhance material performance, integrating bioplastics, bagasse, and bamboo into scalable solutions. The focus remains on creating packaging that balances durability, compostability, and cost-effectiveness while meeting regulatory standards on single-use plastics. Market participants also prioritize partnerships with food, pharmaceutical, and personal care brands to expand adoption. Increasing emphasis on circular economy practices and eco-label certifications is reshaping competitive strategies, with manufacturers seeking differentiation through premium designs, seed-infused concepts, and digital printing capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SmartSolve Industries

- Clearwater Paper Corporation

- Kruger Inc.

- Hogör Plastik

- Riverside Paper Co. Inc.

- DS Smith

- Amcor PLC

- International Paper Company

- Tetra Pak International SA

- Mondi

Recent Developments

- In July 2024, RootMaker partnered with sustainable packaging company Footprint to launch the eco-friendly BioPot, an air-pruning container aimed at eliminating traditional single-use plastic pots and enhancing plant growth while minimizing environmental impact.

- In June 2024, Xampla’s plant-based coating was supplied to Huhtamaki for takeaway packaging. Huhtamaki and 2M Group of Companies will apply Xampla’s plant-based Morro Coating polymer to a range of takeaway boxes in a new, multi-year supply deal set to help Huhtamaki transition into recyclable, compostable, and renewable packaging solutions.

- In June 2024, Mondi adopts a traceless’ plant-based coating to upscale it into the paper industry. In a partnership with Mondi, traceless hopes to scale its plant-based coating across the paper industry and combat the generation of unnecessary plastic packaging waste.

- In October 2023, the Green Tractor initiative launched a closed-loop packaging program, partnering with Agrii and FPS Flexibles to enable farmers to return used fertilizer and seed packaging for recycling, aiming to process 70% of farm plastic by 2030.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for sustainable packaging across industries.

- Flexible packaging formats will continue to dominate due to cost efficiency and adaptability.

- Paper and paperboard will remain the leading material supported by recycling infrastructure.

- Seed-infused packaging will gain popularity as brands focus on consumer engagement.

- Food and beverage applications will drive the largest share of adoption globally.

- Regulatory bans on single-use plastics will accelerate demand for biodegradable alternatives.

- Innovation in bioplastics and bamboo composites will improve durability and scalability.

- Premium and customizable packaging will emerge as a tool for brand differentiation.

- Developing regions will see faster growth with increasing sustainability awareness.

- Companies will strengthen market presence through collaborations and circular economy initiatives.

Market Insights

Market Insights