Market Overview

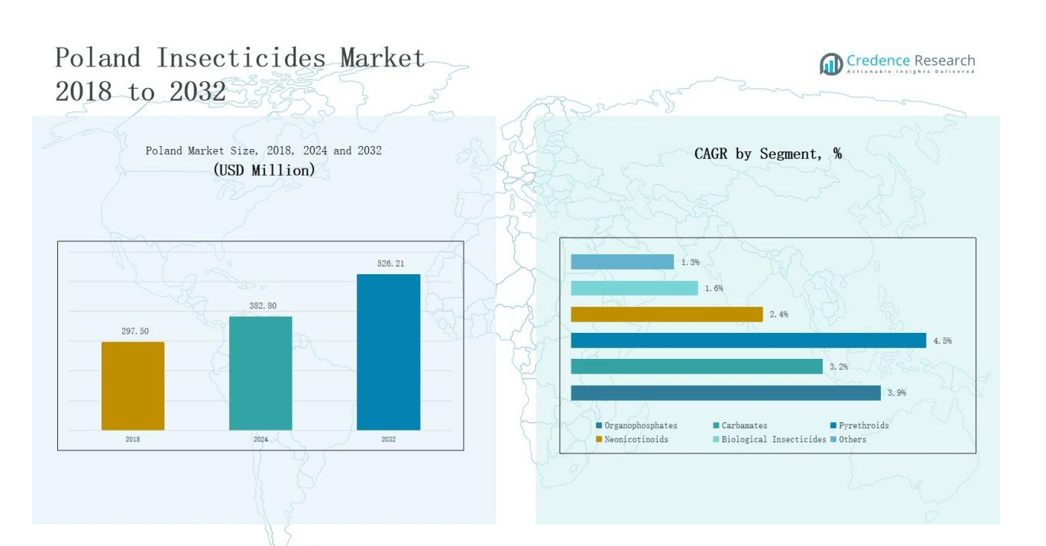

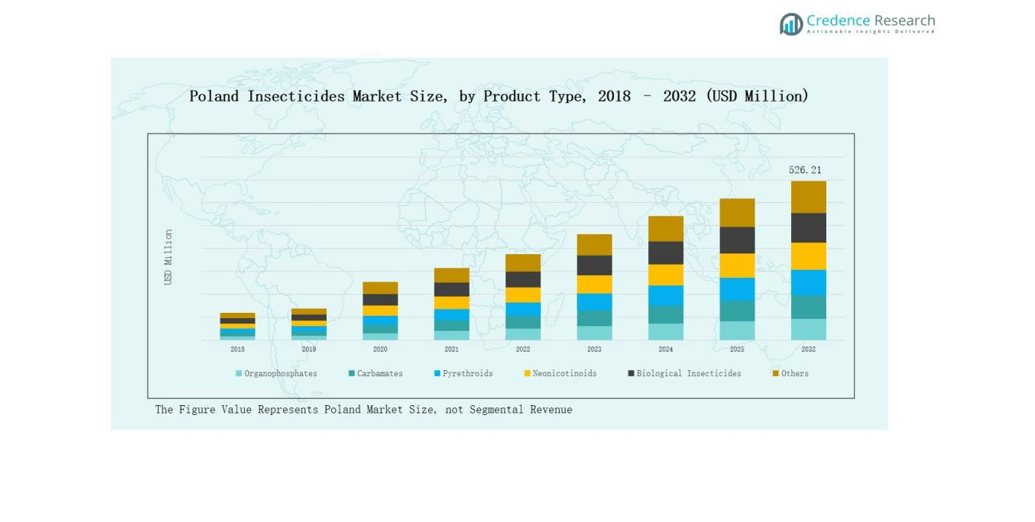

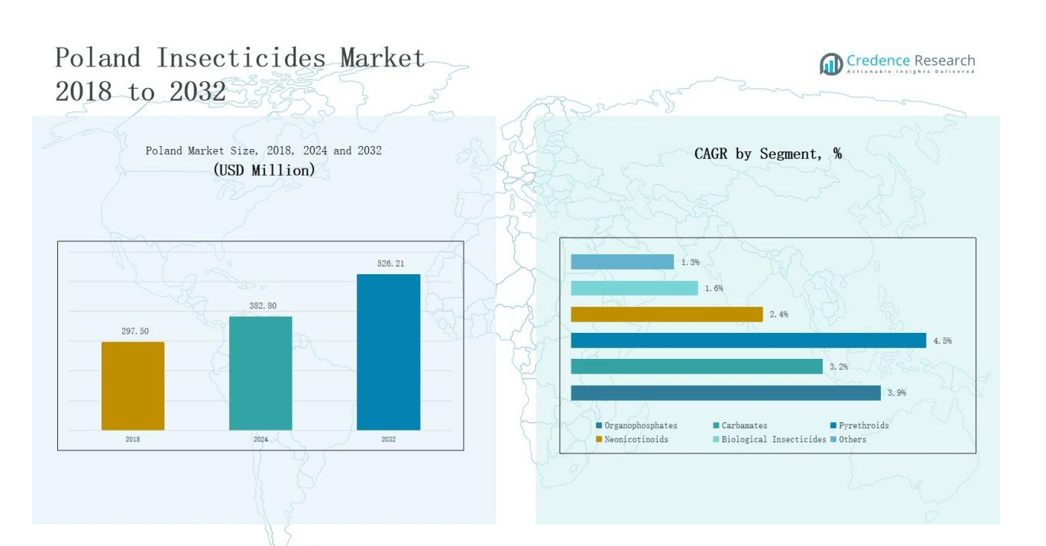

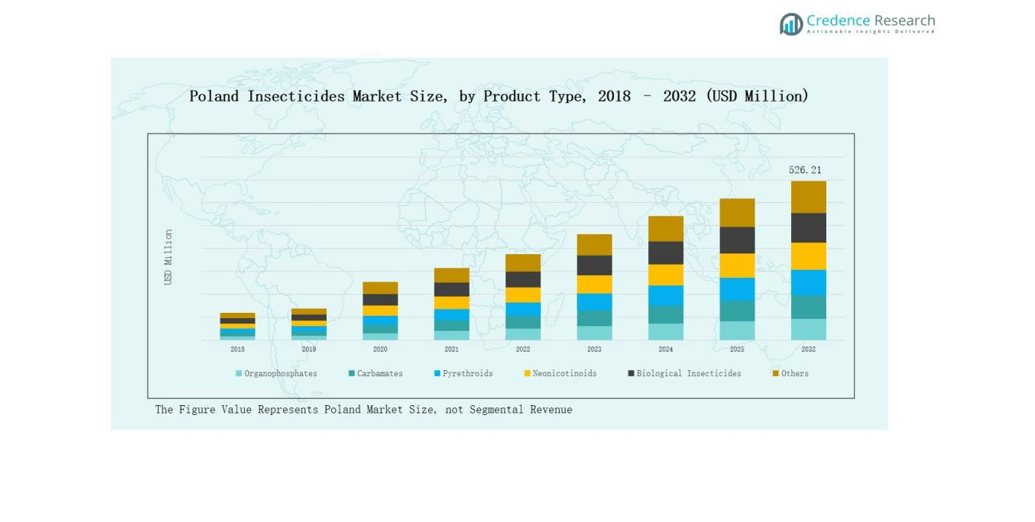

Poland Insecticides Market size was valued at USD 297.50 million in 2018 to USD 382.80 million in 2024 and is anticipated to reach USD 526.21 million by 2032, at a CAGR of 3.98% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Poland Insecticides Market Size 2024 |

USD 382.80 million |

| Poland Insecticides Market, CAGR |

3.98% |

| Poland Insecticides Market Size 2032 |

USD 526.21 million |

The Poland Insecticides Market is shaped by global and domestic leaders including Bayer AG, BASF Polska, Syngenta, FMC Corporation, ADAMA Agricultural Solutions, UPL Limited, Nufarm, Grupa Azoty, Koppert Biological Systems, and Chemirol. These companies strengthen their positions through broad product portfolios, innovation in eco-friendly formulations, and compliance with EU regulations. Multinationals drive competitiveness with advanced chemistries and seed treatments, while local firms focus on tailored solutions for Poland’s agricultural needs. Regionally, West Poland leads with 30% share, supported by large-scale industrialized farming, precision agriculture practices, and strong distribution infrastructure, making it the key revenue driver in the national market.

Market Insights

- The Poland Insecticides Market grew from USD 297.50 million in 2018 to USD 382.80 million in 2024 and will reach USD 526.21 million by 2032.

- Organophosphates lead with 34% share, while biological insecticides at 9% show the fastest growth due to sustainability policies and organic farming.

- Agriculture dominates with 62% share, followed by public health at 15%, forestry at 11%, turf and landscape at 7%, and others at 5%.

- West Poland leads with 30% share, supported by industrialized farming and precision agriculture, while South Poland follows with 28% driven by horticulture and fruit exports.

- Key players include Bayer AG, BASF Polska, Syngenta, FMC Corporation, ADAMA, UPL Limited, Nufarm, Grupa Azoty, Koppert Biological Systems, and Chemirol.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

In the Poland insecticides market, organophosphates lead with 34% share, driven by their widespread use in cereals and vegetables. Pyrethroids follow with 21%, supported by strong adoption in both agriculture and public health due to their low-dose effectiveness. Carbamates hold 16%, mainly in fruit and horticulture, while neonicotinoids capture 14%, sustained by seed treatment applications despite EU restrictions. Biological insecticides, with 9% share, show the fastest growth as sustainability policies and organic farming expand. Other chemistries account for 6%, serving niche uses in integrated pest management.

- For instance, Syngenta Poland reported strong farmer uptake of its Ampligo® 150 ZC pyrethroid-lambda-cyhalothrin mix for vegetable pest management, citing its effectiveness at low application doses.

By Application

By application, agriculture dominates with 62% share, reflecting Poland’s reliance on cereal and potato production. Public health ranks second at 15%, supported by mosquito and vector control programs favoring pyrethroids. Forestry holds 11%, driven by pest management in pine and spruce plantations, while turf and landscape contribute 7%, supported by demand from parks and urban green spaces. Other applications represent 5%, with steady use in food processing, warehousing, and household pest control.

- For instance, Biobest Group NV acquired a 60 % stake in Poland’s Biopartner sp z o.o. in 2022, enabling it to market bio-pesticide (including herbicide) solutions across Poland.

Market Overview

Rising Agricultural Production

Poland’s strong agricultural base, particularly in cereals, potatoes, and horticulture, drives steady insecticide demand. Farmers rely on chemical solutions to protect yields from soil and foliar pests, ensuring higher productivity. The expansion of commercial farms and greenhouse cultivation further boosts usage. Growing export demand for Polish crops strengthens pesticide application, as producers seek to meet both domestic and international quality standards. This ongoing reliance on crop protection products secures insecticides as a crucial input in Poland’s agricultural value chain.

EU Green Deal and IPM Adoption

The EU Green Deal and integrated pest management (IPM) policies are reshaping insecticide usage in Poland. Farmers are adopting safer, eco-friendly products to comply with EU sustainability targets. Biological insecticides and selective chemistries are gaining traction, supported by government incentives and industry guidance. Adoption of IPM practices reduces dependence on broad-spectrum chemicals while still addressing pest threats. This regulatory shift encourages innovation and opens growth opportunities for eco-conscious players. It is also accelerating a gradual replacement of conventional active ingredients with next-generation solutions.

- For instance, Syngenta announced PLINAZOLIN® technology in 2021, providing a novel mode of action (IRAC Group 30) to manage resistant and difficult-to-control pests in various crops.

Increasing Pest Resistance

Rising pest resistance to traditional chemistries is a major growth driver for innovation in Poland’s insecticides market. Farmers are seeking advanced formulations and new modes of action to maintain effectiveness against resistant species. This demand has encouraged companies to invest in R&D and expand product portfolios. Biological insecticides and rotation strategies are gaining attention as resistance management tools. The need for sustainable pest control solutions supports consistent demand, ensuring long-term market growth while improving farm resilience against evolving pest pressures.

- For instance, BASF launched Axalion®, a new insecticide in Europe designed with a novel mode of action to combat resistant sucking pests such as aphids and whiteflies.

Key Trends & Opportunities

Growth of Biological Insecticides

The biological insecticides segment is witnessing rapid adoption in Poland, supported by organic farming growth and consumer preference for residue-free produce. Government initiatives promoting eco-friendly agriculture create favorable conditions for their expansion. Horticulture growers, especially in greenhouse crops, are adopting biopesticides to meet export standards. The segment’s relatively low base ensures faster growth compared to chemical categories. This trend presents opportunities for both global and local players to expand portfolios with microbial, botanical, and pheromone-based solutions tailored to Polish crops.

- For instance, in June 2024, Bayer introduced its biological insecticide Vynyty Citrus a pheromone-based solution that controls citrus pests without chemical residues marking an expansion of its European biocontrol lineup.

Digital and Precision Farming Integration

Poland’s agricultural sector is gradually adopting digital and precision farming technologies, creating opportunities for advanced insecticide use. Data-driven tools, drones, and smart sprayers are improving application efficiency and reducing waste. Precision farming helps align insecticide use with IPM practices, lowering environmental impact while ensuring effectiveness. Technology-driven monitoring of pest outbreaks enables timely intervention, boosting adoption of premium formulations. This integration creates a pathway for companies to introduce innovative products that pair effectively with modern agricultural practices, supporting sustainable growth.

- For instance, John Deere introduced AI-enabled See & Spray™ technology in Central Europe, including Poland, which uses cameras to detect pests and apply insecticides only where needed, reducing chemical use by up to 77%.

Key Challenges

Stringent EU Regulations

Strict EU regulations on pesticide use present significant challenges for the Poland insecticides market. The ban or restriction of key active ingredients, particularly neonicotinoids, has limited farmers’ options. Compliance with maximum residue limits (MRLs) and sustainability standards increases pressure on manufacturers. Companies must invest in reformulations and eco-friendly alternatives to maintain market access. While regulations encourage innovation, they also raise development costs and lengthen approval timelines, creating barriers for both established players and new entrants in the competitive landscape.

Environmental and Health Concerns

Rising awareness of environmental and health risks linked to chemical insecticides challenges market growth. Public debates on pollinator safety, water contamination, and human exposure are leading to stronger resistance against chemical use. Consumer demand for safe and organic food pushes retailers and producers to adopt stricter standards. This pressure reduces the reliance on synthetic insecticides and encourages faster adoption of biological solutions. However, transitioning away from established chemicals can increase costs for farmers and disrupt established crop protection practices.

Price Volatility and Farmer Profitability

Price fluctuations in insecticides, driven by raw material costs and supply chain disruptions, create uncertainty for Polish farmers. Rising input costs reduce profitability, especially in small and medium-scale farms. Farmers often delay or reduce purchases during periods of high prices, impacting market stability. Dependence on imports for certain active ingredients further exposes the market to currency fluctuations. Ensuring cost-effective solutions while maintaining effectiveness remains a challenge for manufacturers and distributors operating in Poland’s competitive agricultural sector.

Regional Analysis

North Poland

North Poland accounts for 22% share of the Poland Insecticides Market in 2024. The region benefits from intensive cereal and potato farming, which drives strong demand for organophosphates and pyrethroids. Greenhouse vegetable cultivation is expanding, creating opportunities for biological insecticides. Farmers in this area increasingly adopt integrated pest management to align with EU sustainability targets. Distribution networks remain well-developed, ensuring timely availability of crop protection products. The region also shows steady adoption of seed treatments in row crops, which strengthens the role of neonicotinoids.

South Poland

South Poland holds 28% share, making it the largest regional market. The dominance comes from extensive horticulture and orchard production, where carbamates and biological insecticides are widely used. Fruit exports to the EU encourage adoption of residue-free solutions to meet stringent quality standards. Farmers are shifting towards sustainable alternatives to maintain competitiveness in export markets. Public health programs targeting vector control add further demand for pyrethroids. The combination of strong commercial farming and export-oriented production ensures the region’s leadership in market revenue.

East Poland

East Poland represents 20% share of the market, supported by traditional farming practices and expanding agro-cooperatives. Agriculture remains diverse, with cereals, vegetables, and rapeseed being the major crops requiring insecticide applications. Farmers continue to rely on conventional organophosphates, though biological solutions are slowly gaining recognition. The region faces challenges of smaller farm sizes, which limit large-scale adoption of advanced formulations. However, government-backed programs for rural development support the distribution of modern crop protection products. This ensures continued growth potential despite structural constraints.

West Poland

West Poland contributes 30% share, positioning it as a key driver of national market revenue. The region is highly industrialized in agriculture, with large-scale farms and advanced mechanization. Farmers favor pyrethroids and neonicotinoids due to their efficiency and compatibility with precision farming. It benefits from stronger infrastructure and supply chain integration, which supports timely product distribution. Adoption of digital technologies in pest monitoring is creating opportunities for premium insecticide solutions. West Poland remains central to innovation and high-value crop protection within the overall market.

Market Segmentations:

By Product Type

- Organophosphates

- Carbamates

- Pyrethroids

- Neonicotinoids

- Biological Insecticides

- Others

By Application

- Agriculture

- Forestry

- Turf & Landscape

- Public Health

- Others

By Region

- North Poland

- South Poland

- East Poland

- Western Poland

Competitive Landscape

The Poland Insecticides Market is highly competitive, with multinational corporations and strong domestic players shaping the landscape. Global leaders such as Bayer AG, BASF Polska, Syngenta, FMC Corporation, ADAMA, UPL Limited, and Nufarm maintain dominance through extensive product portfolios, advanced formulations, and compliance with strict EU regulations. Their investments in biological insecticides and integrated pest management solutions reflect a response to sustainability goals and growing demand for eco-friendly alternatives. Domestic firms, including Grupa Azoty, Chemirol, and Koppert Biological Systems, strengthen competition by offering tailored solutions for local crops and conditions. Price competitiveness, distribution reach, and regulatory adaptability remain central strategies. Companies also focus on partnerships with distributors and farmers’ cooperatives to expand market presence. Innovation in seed treatments, biopesticides, and precision application products enhances market differentiation. This combination of global expertise and local specialization ensures a dynamic and evolving competitive environment in Poland’s insecticides sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In May 2025, Synthos Agro launched Lipostar 090 EC, the first proliposomal-matrix fungicide in Poland. Developed with SyVento, the product enhances difenoconazole delivery, cutting application rates by up to 40 percent while supporting sustainable farming practices.

- In March 2025, Bayer introduced Plenexos, a novel ketoenol insecticide with systemic and flexible application options, featuring a plant-uptake mechanism that enhances pest control while supporting integrated pest management

- In August 2024, Pangaea Biosciences signed an exclusive distribution agreement with MILAGRO sp. z o.o. for its product Booster™ in Poland. This strategic move targets improved pest resistance control in oilseed rape, a key crop for the region.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biological insecticides will grow due to sustainability policies and consumer preferences.

- Farmers will adopt more integrated pest management practices to comply with EU standards.

- Neonicotinoid restrictions will encourage investment in alternative chemistries and safer solutions.

- Public health programs will continue driving demand for pyrethroids in vector control.

- Precision farming and digital tools will support efficient insecticide application.

- Export-oriented horticulture will push adoption of residue-free and eco-friendly products.

- Local companies will expand portfolios to compete with multinationals in niche segments.

- Partnerships between suppliers and farmer cooperatives will strengthen product accessibility.

- Regulatory pressure will accelerate reformulation of conventional insecticides.

- Rising pest resistance will stimulate research and development of innovative active ingredients.